拆解Optimism当前境况:生态发展与OP Stack的未来

原文作者:雨中狂睡

接下来我将通过两个维度的视角来拆解一下 OP 当前的境况。

生态&项目

OP Stack 的未来

生态&项目

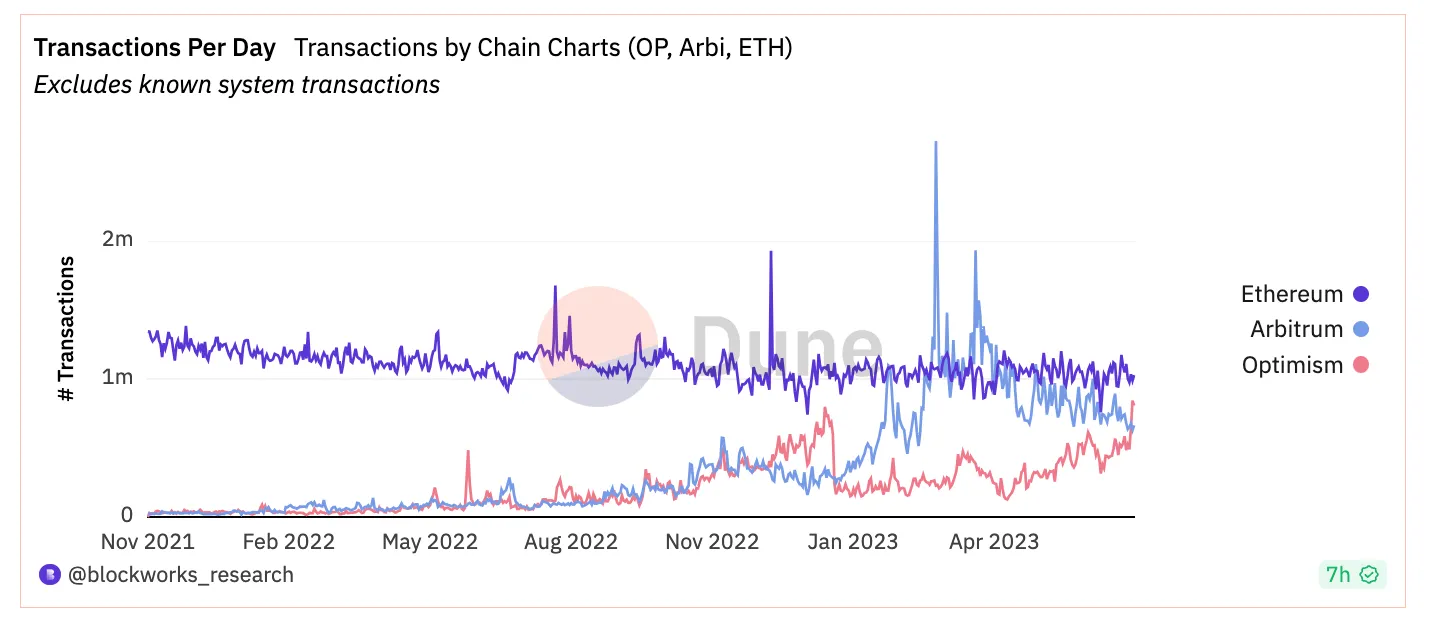

截止到目前,从数据的角度来看,Arbitrum 依然是 Layer 2 龙头,OP 在生态方面依旧处于劣势。但随着 OP Stack 的广受采用,OP 在最近获得了更多市场关注(Basechain、Worldcoin)——即使解锁不断,但 OP 的总体市值一直是在增长的。

值得一提的是,如今 OP 在日均交易数量上已经超过了 Arbitrum,一种吸血 Arbitrum 的态势。

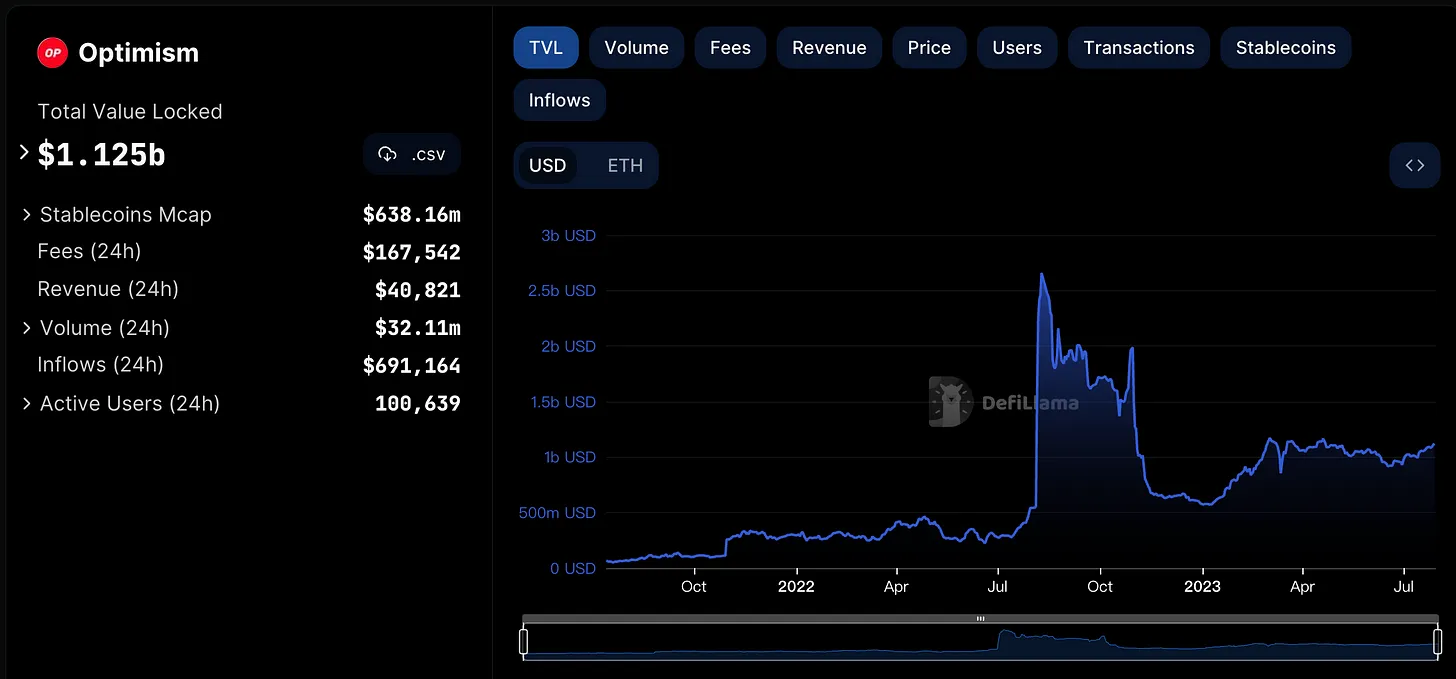

TVL 同样有一个向上的趋势。

OP 头部协议 Velo 是一个采用 ve 3, 3 架构的 DEX,之前一直不温不火是因为 OP 链上的原生资产不多,远逊于 Arbitrum(GMX、Magic、Dopex、Pendle 等等)。ve 3, 3 要吸引足够多的协议参与才能启动飞轮,一条链上的原生资产越多越强大,这条链上的 ve 3, 3 就会越强大。

原生资产多且强大-用户采用率高(挖矿+交易需求)-需要更深的流动性降低磨损-ve 33 符合低流动性采购成本-增加 ve 33 代币的排放价值和 bribe 收益-正向飞轮

就当前情况来看,OP 生态发展还有很长的一条路要走。但我们也可以看到,已经出现很多围绕 Velo 构建的协议,比如 Extra Finance 和 Exactly Protocol。

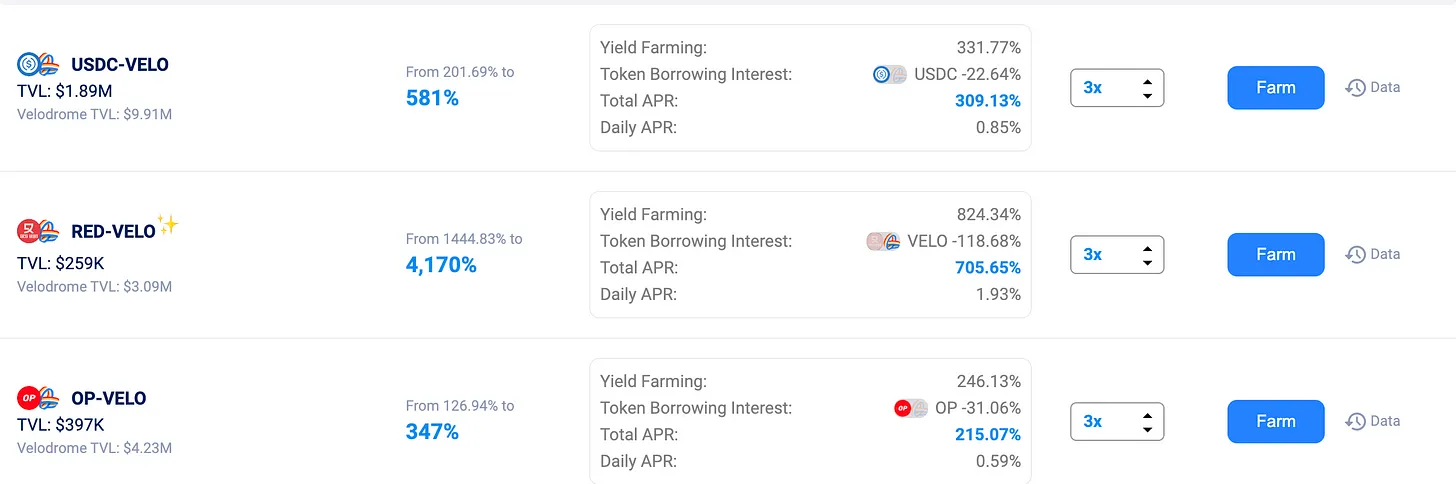

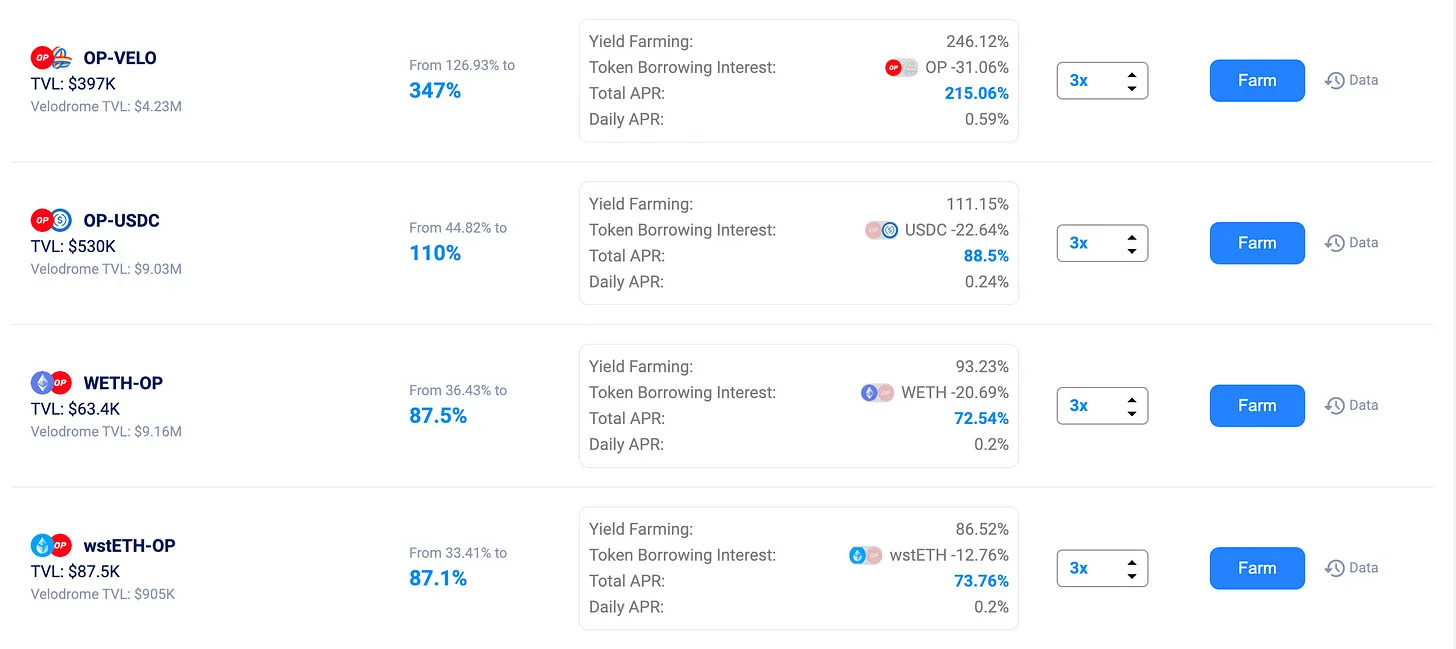

Extra 本身是一个借贷协议,但协议自带 UI/UX 支持用户通过协议加杠杆参与 Velo DEX 的流动性挖矿,到现在为止协议依然在提供着较高的流动性收益。高额的 LP 收益减缓了用户持有 $VELO 时所面临的 Token 排放(另一种方式是锁定 VE 吃贿赂收益)。目前其 TVL 是 19 M,是 OP 最近增长最快的协议。

Exactly 是一个为用户提供资产浮动/固定利率的协议,目前 TVL 是 82 M。如今 Exactly 的原生 Token $EXA 已经在 Velo 上部署了流动池,并通过贿赂提升了 LP 奖励。

Extra 和 Exactly 是与 Velo 协议交互的两个方向,前者是通过借贷的方式为 LP 加杠杆,后者是通过建立流动池来为 veVELO Holder 提供更多的贿赂。

Exactly 的行为代表着 OP 链上原生协议对于流动性的需求,和 ve 3, 3 DEX Velo 对其需求的满足。而 Extra 则是放大了 OP 链上的财富效应,吸引更多人进入 OP 链上。

他们代表了两种不同方面的催化剂,Velo 是受益者,生态也是受益者。我们从 Velo 的 Fee and Incentive Rewards 的增长中也可以看到,Velo 在 OP 生态的逐步增长中获得了更多的红利,如果由 OP Stack 带来的更多市场关注和情绪可以持续的话,Velo 也会获得对应的增长。

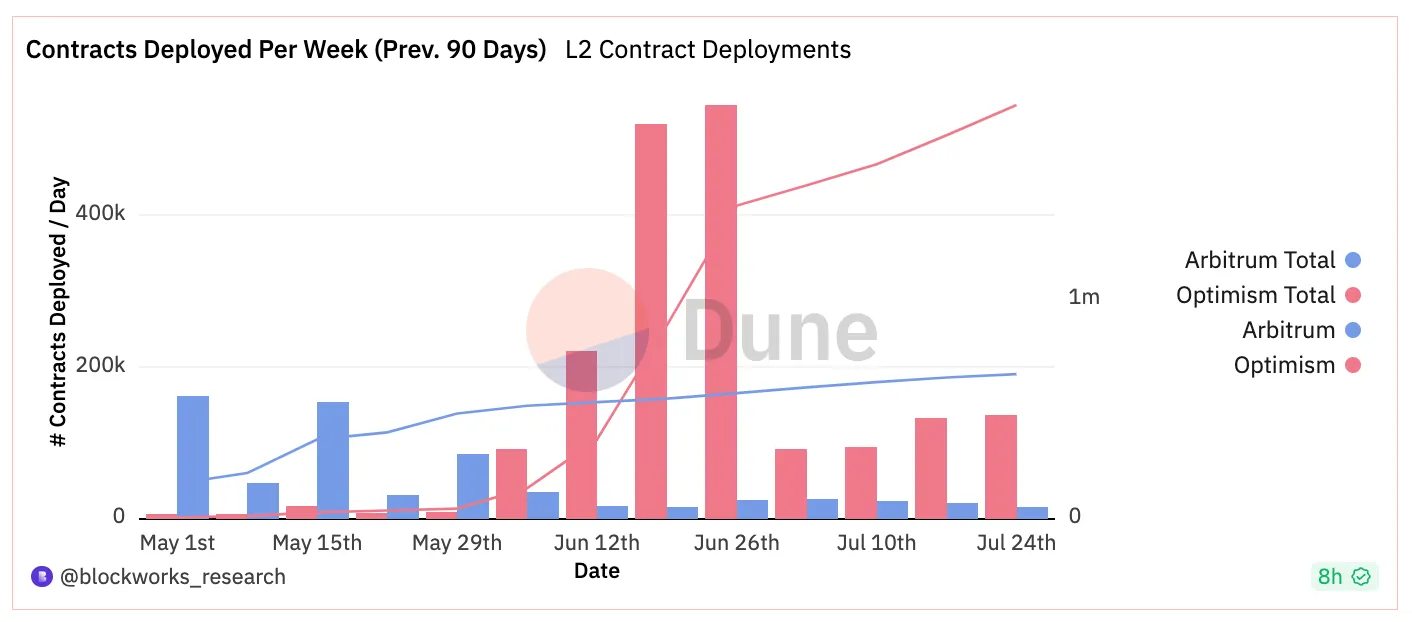

另外一个 OP 生态正在迅速增长的佐证是:最近 90 天内 OP 的合约部署量变化。所以在最近的半年,OP 生态应该会跑出来一些表现不错的协议。

另外一个 TVL 表现较好的原生协议是 Sonne Finance。它是一个借贷协议,目前 TVL 是 107 M。

而 Synthetix 是一个多链合成资产协议,大家已经很熟悉了,多余的我就不详细介绍了。不过它与 GMX 的区别在于,GMX 的 GLP 为 Arbitrum 生态提供了一个强大的生息资产乐高,各类协议都可以基于其上构建,从而产生一个正向的 GLP 飞轮。而 Synthetix 的 sUSD 并没有此类优势,甚至要承担共同债务。SNX 质押者是协议流动性的提供者,他们的收益来源于通胀和费用收入,因此 SNX 的市值也决定了 SNX 协议流动性的上限——他们将于Q4的v3将解决这个问题。

Synthetix 的优势在于它和 Velo 一样,为部署于 OP 的协议提供了一个强大的产品乐高。可惜的是它们没能像 GMX/GLP 那样为 OP 引入一个强大的生息资产乐高。

对于 OP 生态而言,这部分的空缺是一个潜在的增长机会。

OP Stack 的未来

我们现在可以看到,OP Stack 已经获得了较多的采用。Coinbase 等机构的品牌认证给予了 OP Stack 很好的品牌背书。因此,我们其实不用担心 OP Stack 后续的采用和发展。它的主要威胁来源于 zkRollup 的威胁,但从目前的情况来看,zkRollup 还远未到成熟的阶段,OP Stack 也已经开始了 ZKP 技术的拓展。

另外一点值得关注的是,采用 OP Stack 的链条能否反哺到 OP 上。Basechain 之前的说法是,会把一部分的收入反哺给 Optimism Collective。这对于 OP 而言是一件好事,国库拥有收入来源意味着「能力」,「能力」会更多的体现在币价上。如果更多的链条效仿 Basechain 的操作,会为 Optimism Collective 提供更多的「能力」。

显然 OP 团队也已经意识到 OP Stack 的这个「能力」,在 7 月 25 日的时候发布了 Law of Chain 提案,旨在为所有采用 OP Stack 的链条启动共享治理模型和排序器。这和此前 Cosmos 建立共享安全的模型异曲同工。Law of Chain 本质上希望将「收入反哺」这个模式规范化。而这个提案的实施也会为 Optimism Collective 带来更多的收益。

以上就是我对于 OP 的见解,而在未来我个人也将会积极参与到 OP 的生态当中。