项目损失用户承担?稳定币USD+一夜七折

7 月 25 日晚间,zkSync 上 TVL 最高的借贷协议 EraLend 突遭黑客攻击。黑客通过操纵预言机的价格,从 EraLend 的 USDC 池获取了约 276 万美元资金,其他资金池未受影响。事件发生后,EraLend 暂停止所有池子的借款(Borrow),以及 USDC 池和 SyncSwap LP 池的存款(Supply)功能。

在这次攻击事件中,受害的不仅是 EraLend 用户,还引发了连锁反应。稳定币 USD+持有者也蒙受了损失。

USD+是谁?

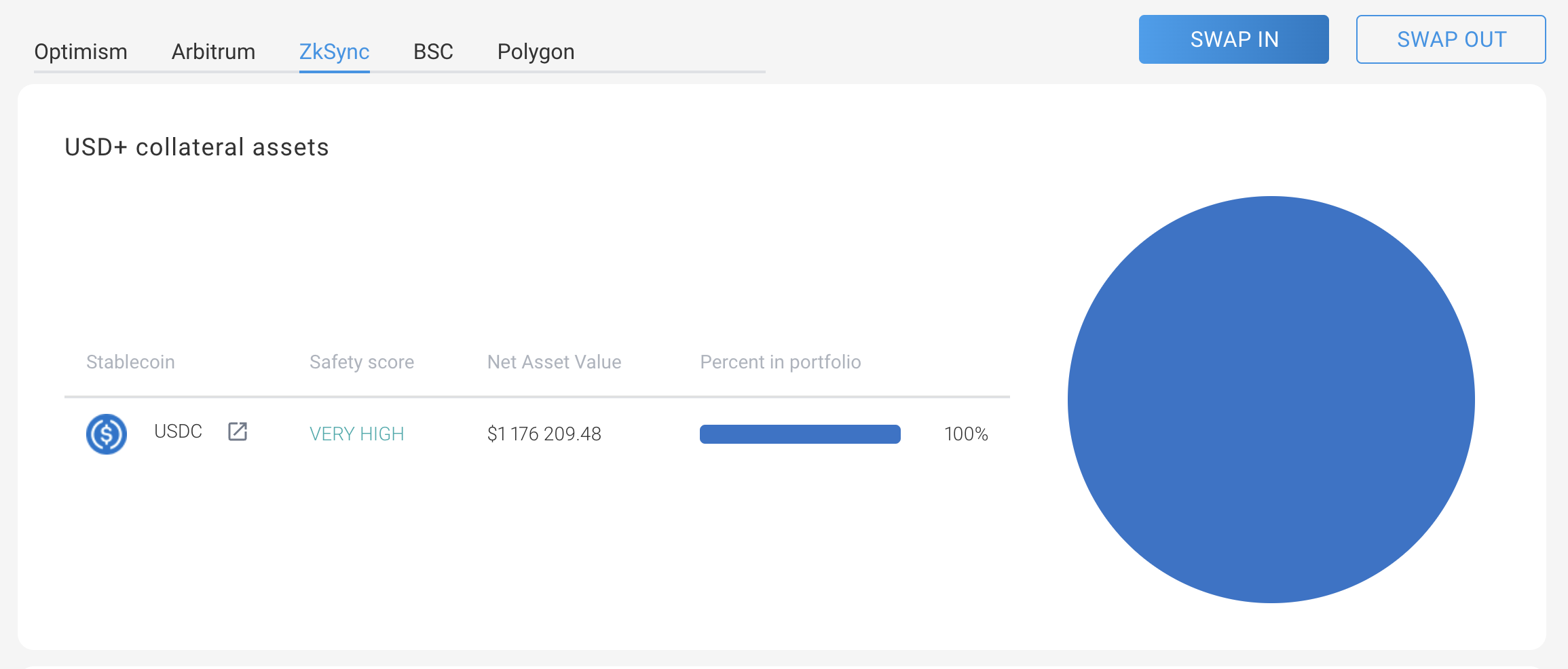

USD+是由 overnight.fi 发行的一款在 OP、Arb、zkSync 等多链均有部署的稳定币产品。与常见的稳定币依托于法币储备有所不同,该产品并不与法币直接产生联系,而是与 USDC 1: 1 挂钩。

(USD+的资产储备)

而 USD+另一个吸引人的特性在于,该稳定币持有即可获得收益。项目方将储备资产投资于多项 DeFi 协议。因此该产品可理解 DeFi 世界中的货币市场基金,USD+可产生 1% ~ 5% 的收益率,利润将会进行每日分配。

官方文档的介绍表示,使用 USD+的好处如下:可避免深入的市场研究和频繁交易、参与众多 DeFi 协议的使用、无需质押即可获取收益。此外,官方还在文档中专门作出声明:“请注意,您将承担 USD+抵押品中所有协议的风险。”

若一切运转良好(如项目方所预期的那样),那么用户可拥有一个完全在链上执行、去中心化、持有即可生息的稳定币资产。这一切听上去似乎非常美好。然而天不遂人愿,EraLend 的安全事件让 USD+走上了另一个方向。

城门失火,殃及池鱼

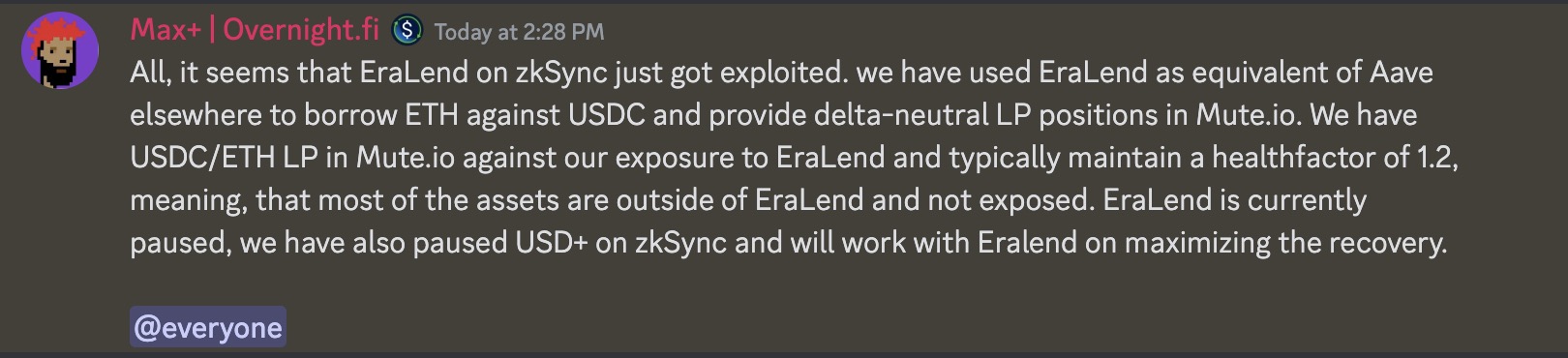

为何持有 USD+用户即可获得收益?因为该项目的储备资产包括大量 DeFi 资产。而不幸的是,其中也包括了 EraLend 存款。

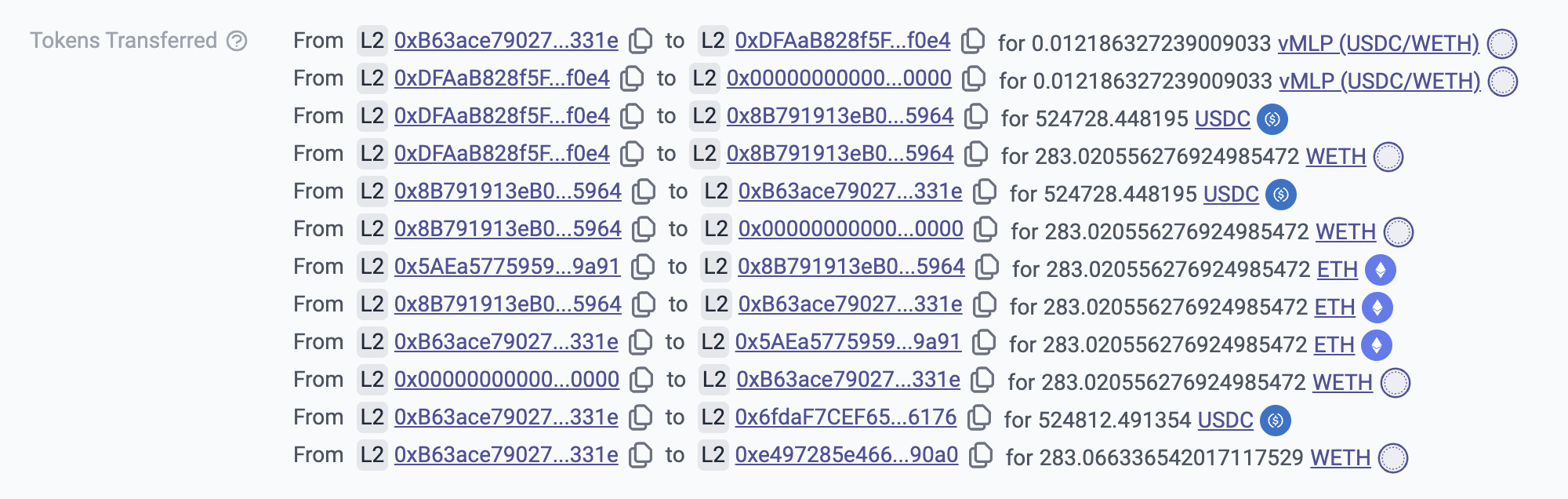

官方表示,USD+储备资产被存入 EraLend,并以此作为抵押借入 ETH。将二者组成 USDC/ETH LP,并在 mute.io 获取收益。事情发生后,约 283 枚 ETH 和 52 万枚 USDC 已被从 LP 对中所提取。

(链上操作记录)

官方表示,由于该项目组 LP 贷出了大量 ETH,因此在 EraLend 上的净资产敞口并不大(官方的用词为“敞口已被抵消”)。但该项目仍然面临了一部分的稳定币损失。

到目前为,Overnight 官方尚未在社交媒体上披露本次安全事件中的具体损失。但可根据 Overnight 持有的敞口进行估算,Overnight.fi 在 EraLend 持有 786, 162 美元,并借入约 283.0596 ETH(524, 509 美元)。这导致潜在的最大损失为 261, 652 美元。约 26.1 万美元,目前 USD+的供应量为 3, 330, 769 枚,因此潜在损失约为市值的 7.86% 。

rebase 是如何夺走用户资产的?

在损失发生后,Overnight 团队的处理引发了所有用户的不满。

团队表示,将对USD+进行“rebase”,以此来恢复其币价稳定。但对于如何进行 rebase 缺并未在推特中进行详细说明。

通过多方用户评论和社区的操作我们才最终得知,所谓的 rebase,即将现在的 USD+按照储备价值重新铸造为数量更少的 USD+。即让用户买单来弥补本次事件的损失。

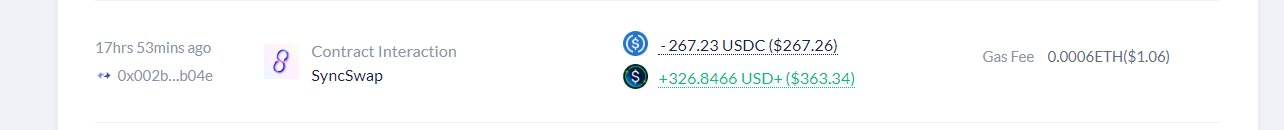

同为 SyncSwap 生态的另一DEX 项目 SyncSwap 则贴心的为广大用户进行了说明。USD+团队将为 USD+持有者和流动性提供者拍摄快照,以用于在将来补偿用户受影响的资金,但只有那些提款的人才会被包含在快照中。若用户进行取款,即会被进行“rebase”,即直接缩减余额。

推特用户@Jue 0123 将自己的 USD+进行了提款。但他惊讶地发现, 326 枚 USD+仅能兑换 267 枚 USDC。

在官方推特下,用户都对此怨声载道。直言,“你们偷走了我的钱!”

团队操作:不负责任、删除公告

除对资产损失处理糟糕之外,对本次事件的公关态度也同样糟糕。

在公布了 rebase 之后,Overnight 官方推特开始进入了“灌水”模式,疯狂发送了多条推文。目前已经很难在官推前几屏内刷到安全事件相关的推文。

此外,官方表示“您可以在我们的 Discord 上找到更多详细信息。”但官方披露本次安全进展的Discord 公告已无法打开。

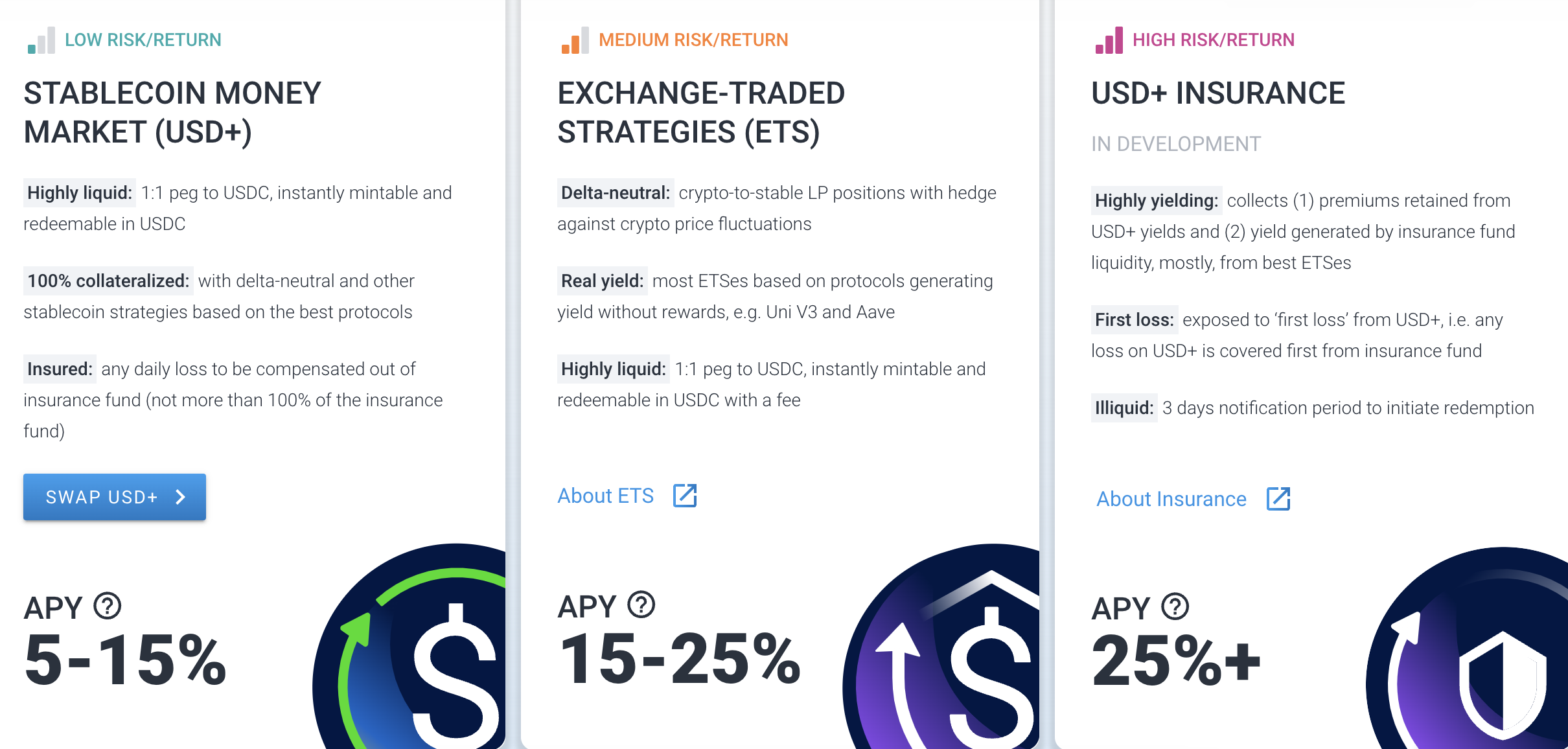

在 Overnight 官网中,我们可以从明显位置看到 Overnight 的三个产品:USD+、ETS、USD+保险。

USD+明确写明该产品已被保险保护,“任何损失都将从保险基金中获得赔偿”。而 USD+保险则注明:该产品从USD+收益中收取一部分作为保费,USD+的损失首先由保险基金支付。

而实际上,不仅 USD+的安全机制设计完全失灵。其保险机制并未产生任何作用,一系列后续处理操作更是令人大跌眼镜。

更离谱的是,Overnight.fi 官网公布了九位团队成员信息,并称有着 Google、Facebook 等互联网就职经历。Odaily 星球日报根据官网公布的 Linkedin(领英)链接查询,上述 9 人全部查无此人。整个项目可谓疑云重重。

在链上世界,Code is law,但没有任何项目方的单方面承诺是值得信任的。Odaily 星球日报提示广大用户注意资产安全。