Bankless:Optimistic Rollup的繁荣与困境

原文标题:《Ethereum's Ticking Time Bomb?》

原文作者:Jack Inabinet

原文编译:Kate, Marsbit

在过去的几年里,以太坊的第二层网络实现了巨大的增长,尤其是像 Arbitrum 和 Optimism 这样的 Optimistic Rollups。价值正在向它们转移,但它们是否增长得太大、太快了?

——Bankless 团队

Optimistic Rollup 从来不是悲观主义者的。自今年年初以来,Ethereum 的两个主要 Optimistic Rollup 组合 Arbitrum 和 Optimism 的 TVL 分别攀升了 108% 和 52% ,令人印象深刻。

但是,尽管有这些好处,Optimistic Rollup 并不是以太坊扩容的最终目标。虽然它们在 TVL 方面不断增长,并帮助巩固了 L2 作为以太坊生态系统不可或缺的组成部分,但随着它们的不断成功,对 Optimistic Rollup 的核心安全组件进行黑天鹅攻击的可能性只会增加。

今天,我们将解释为什么 Optimistic Rollup ( 尽管它们很受欢迎 ) 仍然容易被利用,探索零知识解决方案来减轻所有这些问题,并回到 DAO 黑客来解释为什么以太坊可能不会简单地摆脱困境。另一个主要漏洞。

Optimistic 的弱点

顾名思义,Optimistic rollup 乐观地假设运营商向以太坊发布的 rollup 状态是正确的,除非另有证明,并从加密「欺诈证明」中获得其安全性。

今天,Arbitrum 是唯一一个具有有效欺诈证明的主要 L2,目前只有被许可的参与者才能证明其状态是不正确的。如果参与者对链的状态有争议,rollup 协议将启动一个防欺诈证明计算,这是挑战者和 rollup 之间的一种链上对话形式,以确定状态是否有效。否则,交易状态改变被恢复,哈希被重置为可证明正确的状态根。Optimistic rollup 围绕着 7 天的标准挑战期,这给了善意的参与者足够的时间来质疑数据汇总的状态。

然而,Optimistic rollup 的安全性基于两个核心假设:

1. 在无效状态的情况下,有人提交欺诈证明

关于假设一,我们可以合理地预期,一个诚实的参与者会通过尝试发布欺诈证据来挑战无效状态。

2. 底层 L1 仍然是抗审查的

以太坊的抗审查特性当然值得称赞。例如,当区块已满时,EIP-1559 会以指数方式增加基本费用 ( 交易费用的一部分 )。从理论上讲,这应该禁止参与者通过垃圾邮件交易对 L1 进行 DDos 攻击,以防止欺诈证据的发布,因为攻击所需的 gas 成本将很快超过在 7 天挑战期结束之前积累的价值。

来源:推特

不幸的是,即使在假设的未来世界中,所有 Optimistic rollps 都有无需许可的欺诈证明,一个令人担忧的攻击向量仍然存在。尽管不太可能,但仍然有可能阻止欺诈证据的发布,同时通过验证者勾结来规避 EIP-1559 指数级增长的 gas 费。

竞争各方必须能够在 L1 级别提交欺诈证明,因为 rollup 协议将没有任何挑战解释为对其状态的隐含同意。由于在 L1 处串通而产生的欺诈证明的潜在审查会使第 2 点无效,从而使 rollup 的安全承诺无效。

来源:推特

不可避免的选择

虽然他们 Optimistic 的对应方案更容易实现,并且在今天的以太坊 L2 领域占据主导地位,但 zkRollup 可能会破坏当前的范式,提供即时确认、更快的终局性、更高的吞吐量和原生隐私。

与用欺诈证明来争论不正确的 rollup 状态不同,这类 rollup 选择了有效性证明,这是一种链下计算的形式,可以验证 rollup 操作者提交的交易的正确性,并证明 rollup 的正确性,而无需透露状态本身。

虽然密码学上很复杂,但这种证明设计意味着发布的状态将始终反映 L2 的正确状态,并且意味着 zkRollup 仅依赖于以太坊的抗审查特性,而不是安全性,就像 Optimistic rollup 在其欺诈证明方案下所做的那样。

其中一些 zkRollup 已经进入了主网,它们的快速采用显示了对建立在以太坊之上的零知识扩展解决方案的需求。

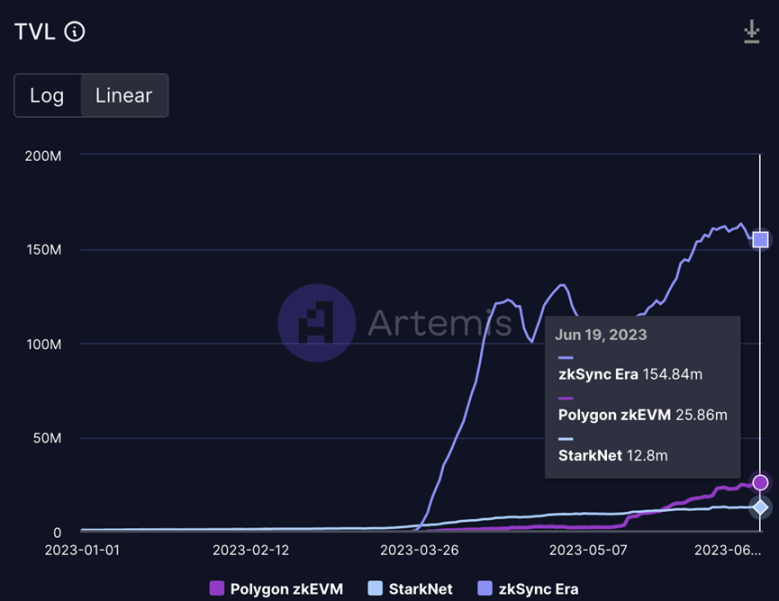

领先的是 zkSync Era,它在用户和 TVL 方面都有最积极的流入 ( 很大程度上是由于空投的猜测 ),自 3 月底部署到主网以来,它的 TVL 已经积累了令人震惊的 1.55 亿美元。

来源:Artemis

不可否认的是,竞争对手们一直在努力争取类似的成功,从 4 月初开始,Starknet 和 Polygon 的 zkEVM 都看到了大量的 TVL 流入。

就在昨天,Polygon Labs 提议对现有的 Polygon PoS 链进行升级,在这个过程中,围绕什么是「rollup」的讨论进一步陷入了混乱。

来源:推特

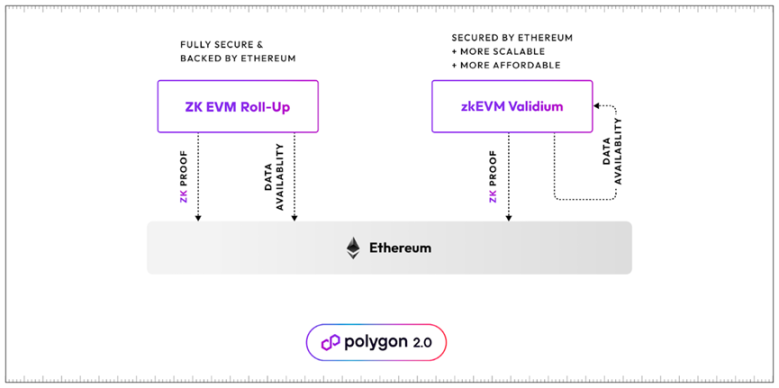

然而,一个关键的区别是,将上面突出显示的 zkRollup ( 包括 Polygon 的 zkEVM Rollup) 与零知识有效性 ( 似乎是 Polygon PoS 链的未来 ) 分开。

向以太坊发布有效性或「zk」证明确实保证了 Polygon PoS 状态转换的正确性,但用户仍将依赖 MATIC 网络来保持有效性的数据可用性和功能。

来源:Polygon Labs

虽然这种方法无疑将削减交易费用并提高可扩展性,但通过将数据可用性外包到以太坊之外,为 Polygon PoS 提出的「有效性」愿景将不会继承以太坊支持的完整安全包和可用于真正的 zkRollup 的活跃性。

DAO 黑客

在考虑未来任何潜在的黑天鹅事件时,回顾历史是有帮助的。以太坊上线不到一年,这个新生的生态系统就被迫面对一个灾难性的事件:DAO 黑客攻击。

DAO 于 2016 年 4 月启动,并通过赋予代币持有者前所未有的投票权,在短短四周的形成期内筹集了 1.5 亿美元。不幸的是,他们在筹款方面取得的前所未有的成功是短暂的,一个攻击者使用了重入攻击,耗尽了 DAO 控制的几乎所有 ETH。

尽管白帽黑客组织「罗宾汉」尽了最大的努力来追回这些资金,但攻击者仍然留下了 4000 万美元的 ETH,相当于当时流通的以太币供应量的 5% 。在混乱的后果中,以太人达到了最终的重置按钮:不规则的状态改变!

虽然以太坊经常采用协调硬分叉来实现协议升级,正如在 Merge 和 Shapella 期间所看到的那样,但清理 DAO 黑客攻击需要额外的步骤。这次硬分叉不仅修复了导致 DAO 崩溃的漏洞,还将所有被黑客攻击的资金归还给了它们的合法所有者。

回滚 DAO 黑客攻击是一个有争议的决定,其中大部分阻力来自比特币支持者,他们认为不规则的状态链会降低以太坊网络的可信度,并规避区块链不变性的整个前提。最终,专业硬分叉者赢得了这场战斗,这一壮举之所以成为可能,是因为人们担心黑客大量集中的以太币 ( 5% ) 会让人们同样难以认真对待网络。

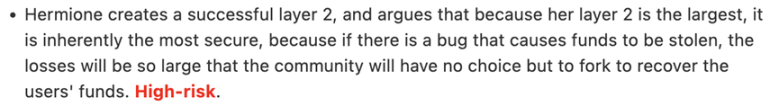

如果 rollup 被利用,就会要求进行这样的重置——而且有充分的理由,因为它之前很好地解决了问题——但现在还不要交叉手指,这次没有人会来拯救你的加密项目。

硬分叉的决定并不是轻易做出的,使用它来操纵账户余额确实损害了区块链技术的价值主张。实现类似硬分叉的请求在提案炼狱中陷入了停滞,比如 EIP-867( 旨在标准化资金回收请求 ) 和 EIP-999( 旨在撤销 513 k ETH Parity Wallet 灾难 )。

以太坊魔术师 Vitalik Buterin 最近在他的文章「不要超载以太坊的共识」中对任何可能的回滚节点发出了严厉的谴责,他认为脆弱的社会共识会造成链分裂的高风险,并且在成熟的社区中应该谨慎使用硬分叉。

虽然这篇文章主要讨论了再质押对社会共识造成的危险,但 Vitalik 明确指出,rollup 可能依赖以太坊来分叉和回收资金,这是一种高风险的共识应用,因此可能导致链分裂。

除非我们看到以太坊社区的守卫发生了根本性的变化,否则我们不太可能看到另一个 DAO 式的不规则状态变化来掩盖 rollup 漏洞。

TL;DR

说实话,我们仍然处于以太坊扩容之旅的早期阶段!

Optimistic rollup 代表了开发人员迄今为止扩展以太坊的最佳尝试,但它们仍然容易受到攻击,并且攻击面只会随着它们的日益成功而扩大。然而,面对以太坊的社会共识可能无法拯救被利用的 Optimistic rollup 的现实,寻求替代的扩展解决方案势在必行。

虽然今天的缺点很明显,但不可避免的是,进一步的时间和发展将使各种 zkRollup 和类似 rollup 扩展方法背后的团队能够完善他们的解决方案,从而解决以太坊当前的扩展挑战。