LSD MAP2.0:多维度解读LSD赛道发展情况

原文作者:waynezhang.eth

上次LSDFi Map 发布后,我们的预测的产品大部分都已经出现,比如 LST 支持的稳定币(R,TAI,USDL 等),veToken 引发的 Governance War(Pendle War)等。但也有很多出乎意料的数据与发现。本文将整理可查大部分 LSD 相关项目并提出问题,思考与行动指南。

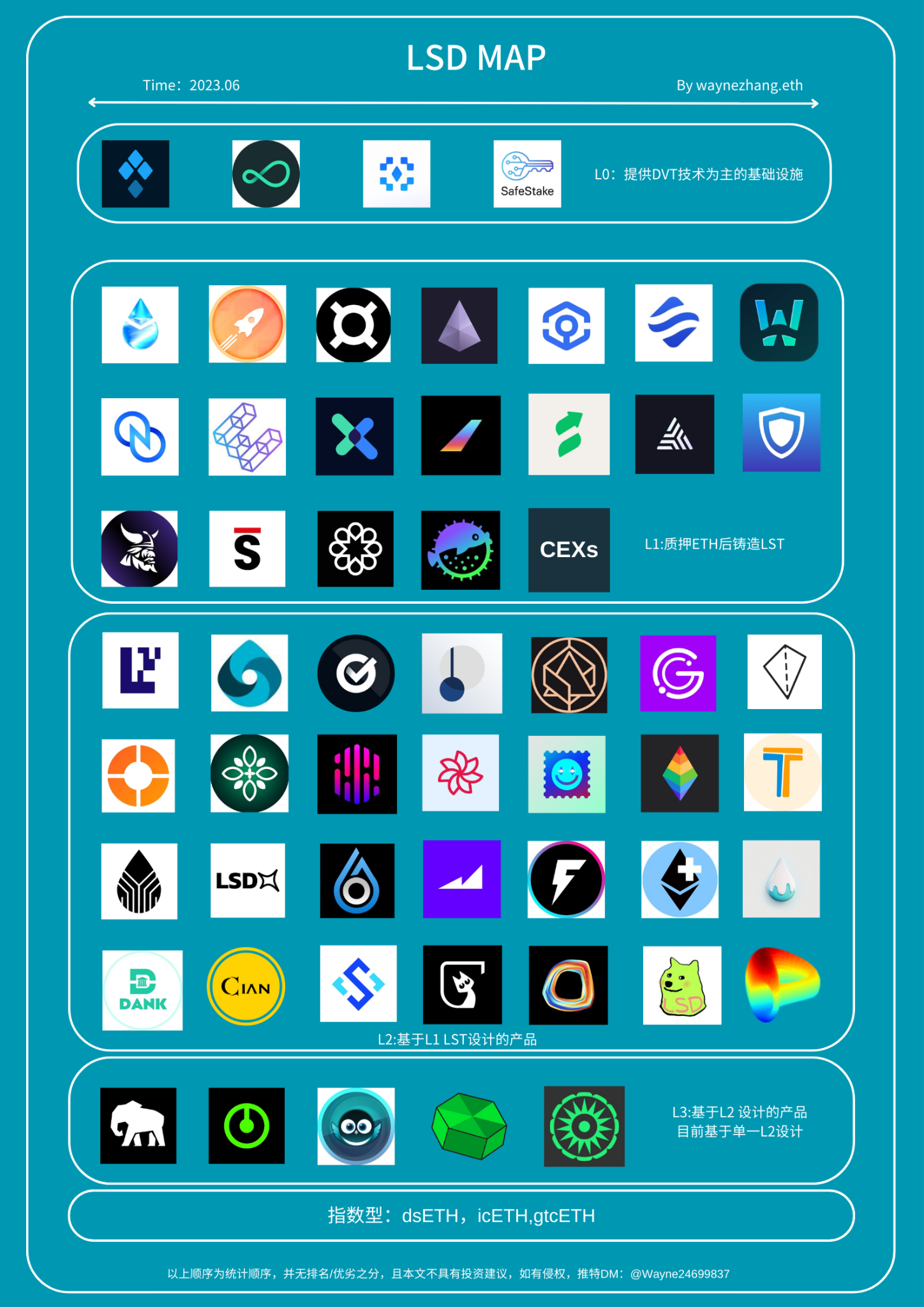

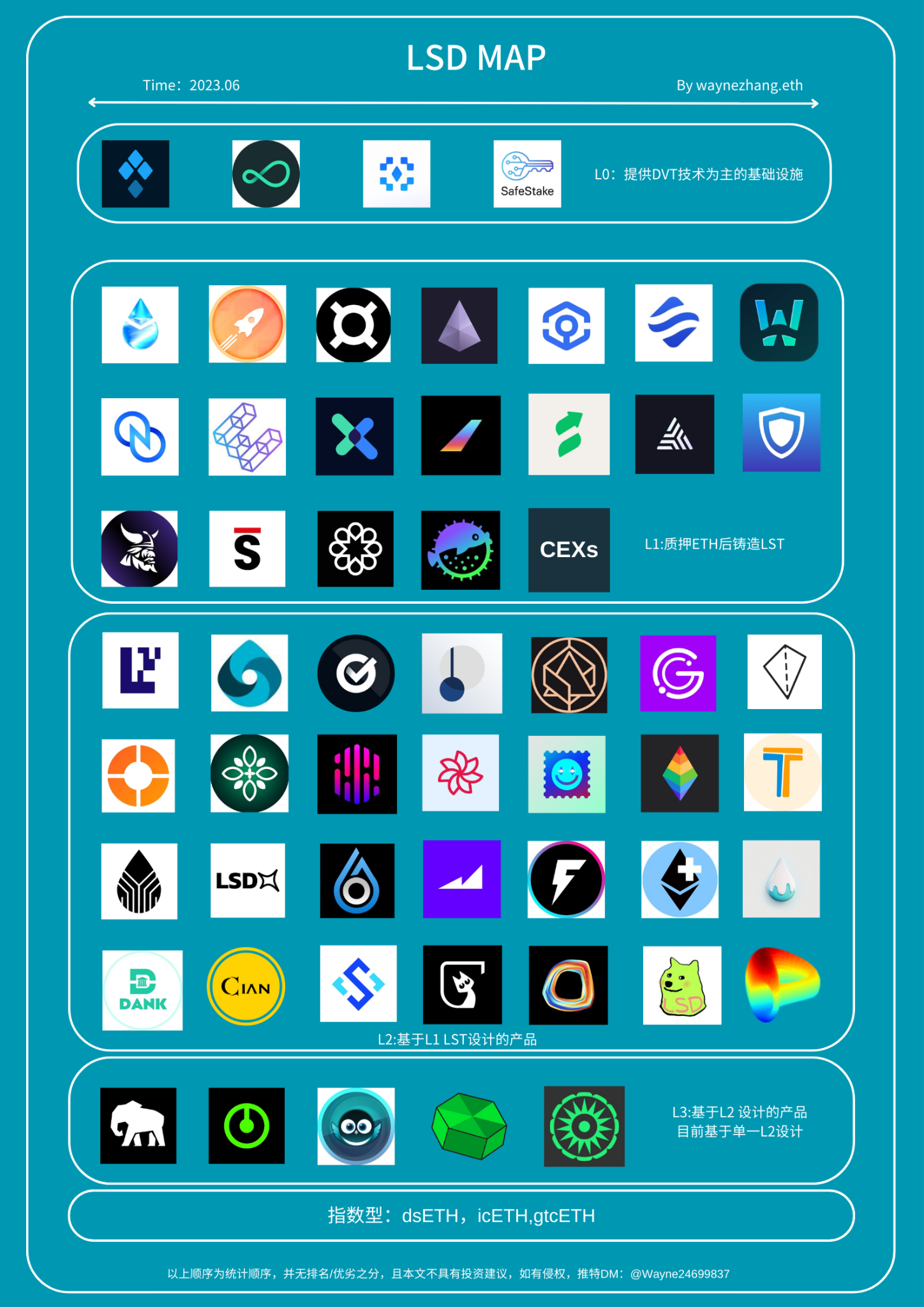

首先是整理好的 LSD MAP 2.0 ,如下图。详细的数据部分及主观评价部分,请见个人整理Google Sheet。

格局

LSD 赛道已经形成初步格局。若以层级划分,SSV Network,Obol Labs 等 DVT 技术服务商可视为L0。DVT 技术可以使验证器更稳定、更安全行使签名责任。作为层级首个发行代币的项目,SSV Network 在品牌知名度方面占据先发优势。

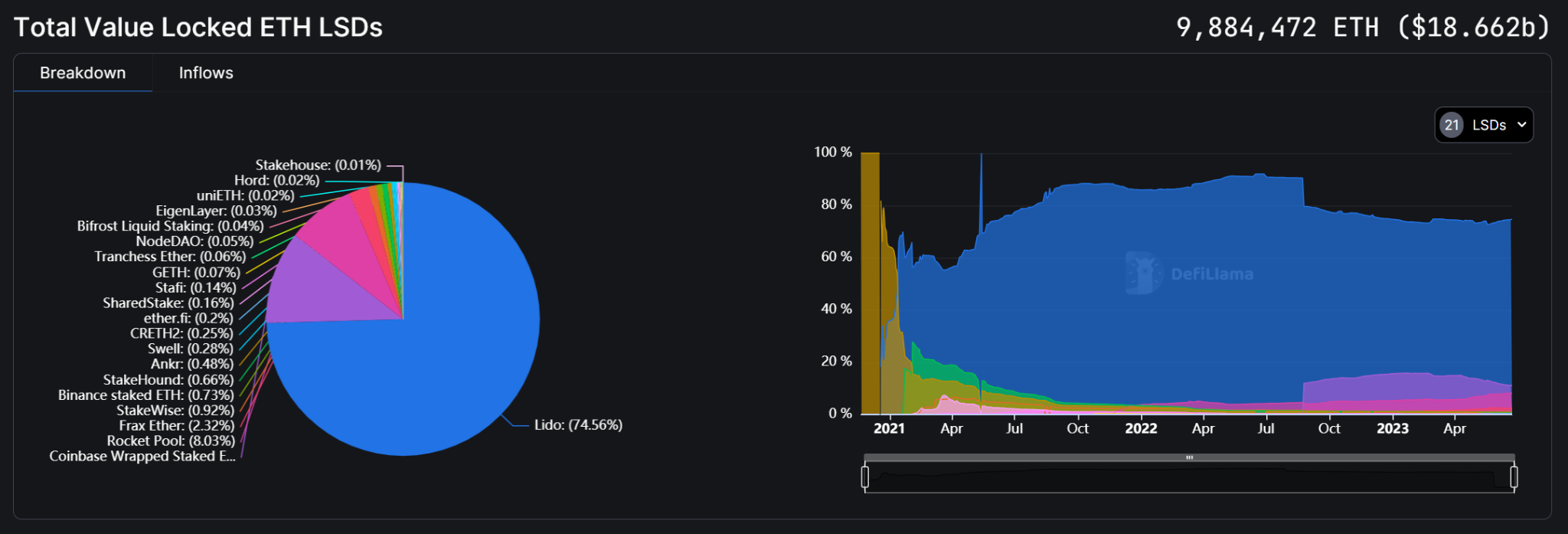

Lido、Ankr、Coinbase 等 LST 发行商则可视为L1。L1主要是佣金模式,用户主要获益点来自 ETH 的 POS 收入。上海升级之后,根据统计数据,L1层级项目数竟远多于于接下来的L2层级,超出第一版 MAP 预测,但经调查发现, 20% 以上正在测试网阶段。根据Defilama数据,Lido 占据流动性质押份额的 74.45% 。Lido 与 Rocket Pool 占 82.5% 左右,以 Coinbase 为首的中心化交易所发行的 LST 占流动性质押比例 12% 以上,留给其他去中心化质押的空间狭隘。此层级中一些参与项目是多链 LST 发行商来分一杯羹,但事实上,以太坊 LSD 玩法与其他公链略有不同,除了占据先发优势的 Ankr 之外,暂未见过其它成绩优异的项目。

TVL 份额图(来源:DeFillama,时间: 2023.6.23 )

基于 LST 设计出的固收类产品,稳定币,收益聚合等占据L3层级,也就是大家常说的 LSDFi。在这一层级,数量最多的是基于 LST 的稳定币,都是将 LST 列为质押品行列,几乎都支持其他稳定币和 ETH/WETH 等。借贷,杠杠化项目较少,这类项目的缺少直接导致收益聚合类项目、结构化策略类项目数量暂时较少。类似 Yearn 的收益池,Shield 利用期权的结构化产品,Pendle 的固收产品的出现与发展将进一步推进收益聚合类项目、结构化策略类项目出现;利用自身 Token 补贴提高质押收益率的项目在上海升级之后无论 Token 还是 TVL 下跌迅速。

某 APY 过千项目上海升级后价格走势图

L2层级让人看到了团队的重要性,部分项目半路出家进入 LSD 赛道取得了不错成绩。固收、期权、收益聚合、稳定币、合成资产等赛道的部分项目获得成绩后也不禁让人思考他们跟他们同赛产品进入 LSDFi 的可能性。市场流动性不足,上海升级前后,ETH 作为 TOP 2 加密货币,在熊市也能带来很强的流动性,又有多少团队把握住了机会?周期将至,牛市在望,流动性增强后,其他生息资产又是否可以借鉴 ETH,开发出一些类产品?

某固收协议借助 LSD 产品实现 Token 1 0x涨幅

本文采用基于L2建立的产品作为L3的定义。引发的 Pendle War 的 StakeDAO,Equilibria,Penpie 符合基于L3定义;自动复投0x Acid 的 AcidTrip;还有简化 unshETH 操作、提高收益的 gUSHer;可以看出主流还是 veToken 引发的治理权争夺。本层级有很大想象空间,不止L2工具和聚合治理类型项目。比如多L2产品的L3,聚合策略的前端。

在 Eigenlayer 中 ,个人 ETH 持有者将 ETH、stETH 质押给质押服务商,让服务商分配的节点运营商参与 Eigenlayer 协议、验证节点直接参与 Eigenlayer、或通过委托,委托其他运营商帮忙管理。各类中间件、数据可用性层等支付一定的报酬(项目方 token、手续费等)获得收益。实际上是利用 ETH 质押原理,但没有生产 LST,反而可以进行 LST(目前支持 rETH, stETH, cbETH)的质押,所以记入L2层级。

指数型产品以 Index Coop 推出的三个 LST 指数为主,成分中 LST 种类较少。

整体来看

【 1 】L0是最具有技术壁垒的,但要注意代币的实际效用

【 2 】L1中龙头出现,除内部或者系统性风险,时间、空间条件已经不允许有新晋 TOP 3 ,新秀会有。

【 3 】L2中很大一部分不具有护城河,考验团队和 BD 能力更多。基于 LST 的基础性 DeFi 策略项目越多,L2越繁华。

【 4 】L3市值/流动性受限于L2产品发展程度,且有很大的想象空间,需要一定时间发展。

数据 & 趋势

质押率

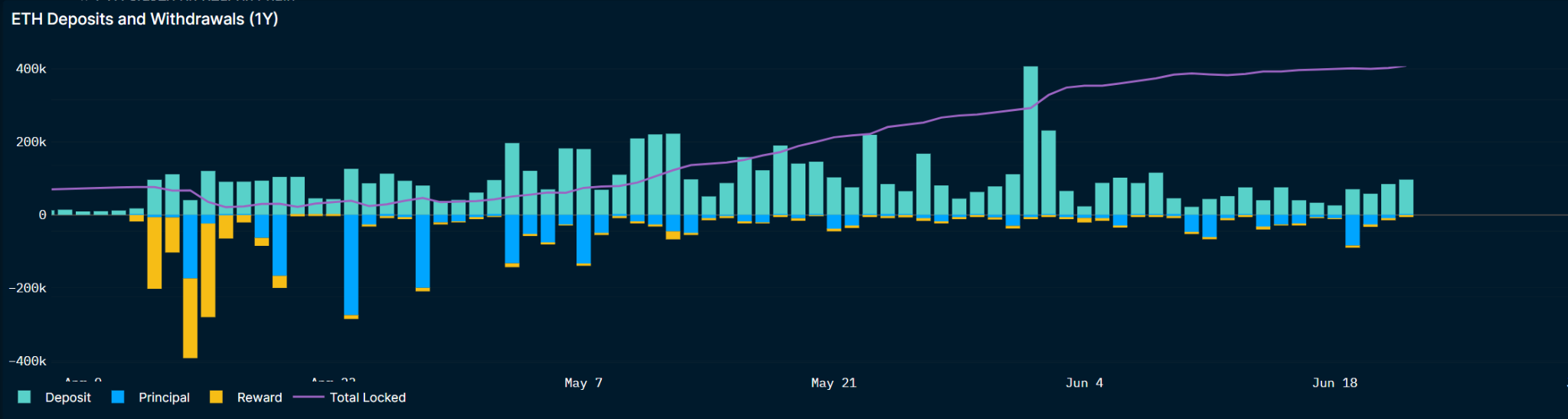

在上海升级前,预测结果是一波推出之后回暖进行第二波质押率下跌,但结果并非如此,在上海升级后,接触质押的最大的两波一次是质押奖励收取然后继续质押,一波是本金(主要来源于 CEX)解除质押,随后开始稳步上升,五月中旬质押量突破 20 M,六月突破 16% 。

ETH 质押与接触质押/质押总量图(来源:Nansen,时间: 2023.06.23 )

对于市场上将 ETH 质押率与其他公链对比的意见,笔者持强烈质押态度。在 MAP 1.0 ,笔者也曾预测稳定会在 25% 左右,理由及判断依据如下:

理由一:ETH 的去中心化程度

ETH 的筹码分散度不同于某些高质押率的”VC 链”和“联盟链”,很多链上的 Token 不得不质押,盘子大,玩家少,抛售等于崩盘。

ETH 大户持币(有交易所和桥地址)与地址数量变化图(来源:非小号,时间: 2023.06.23 )

理由二:实用性

作为目前最活跃的公链,ETH 可谓是以太坊的金铲子,使用 ETH 可以参与 DeFi,GameFi,NFT,同时在参与链上项目时会涉及到 ETH 计价的交易,ETH Gas,除稳定币外,ETH 在链上活动使用频率上是当之无愧的第一。在使用场景上也是佼佼者。

理由三:外部扩展性

L2的出现与繁荣,多链化时代的到来,ETH 也将作为多个生态中的主流资产,进一步分散代币,降低了集中到以太坊质押的趋势,当然我们会在下一节看到跨链质押以太坊的协议分析,将进一步探索跨链质押给 LSD 生态带来的影响。

理由四:合规

众所周知,加密货币是传统金融及各国监管关注的重点,很多 ETF 中,BTC 之后就是 ETH 份额最大,二级基金中 ETH 也一般占据份额 Top 5 。随着加密 ETF/加密二级基金的增多,有人提出二级基金以及 ETF 会将 Token 一步质押的说法,但合规问题很难解决,就算会利用质押提高收益,直接找 StakeFish 的安全性更高,法律性风险更小。

价格因素也可能影响质押率,一年后到来的减半周期如果点燃牛市情绪,在 altcoin 上涨之时,是否会大量 ETH 质押者会选择抛售获益 ETH 并购买新的热点币种及热点需要进一步观察。

质押 ETH 购买价格分布图(来源:Nansen,时间: 2023.06.23 )

LSDFi 无疑是会促进质押率提高,质押产生的 LST 能够进入多种项目赚取多份收益减少机会成本,甚至还能赚取超额收益。而现在的L2层级还没有出现能承载大量 ETH 的项目,L1中很多 LST 并未在L2中使用,所以笔者认为L2仍有巨大投资机会。

中心化质押与去中心化质押

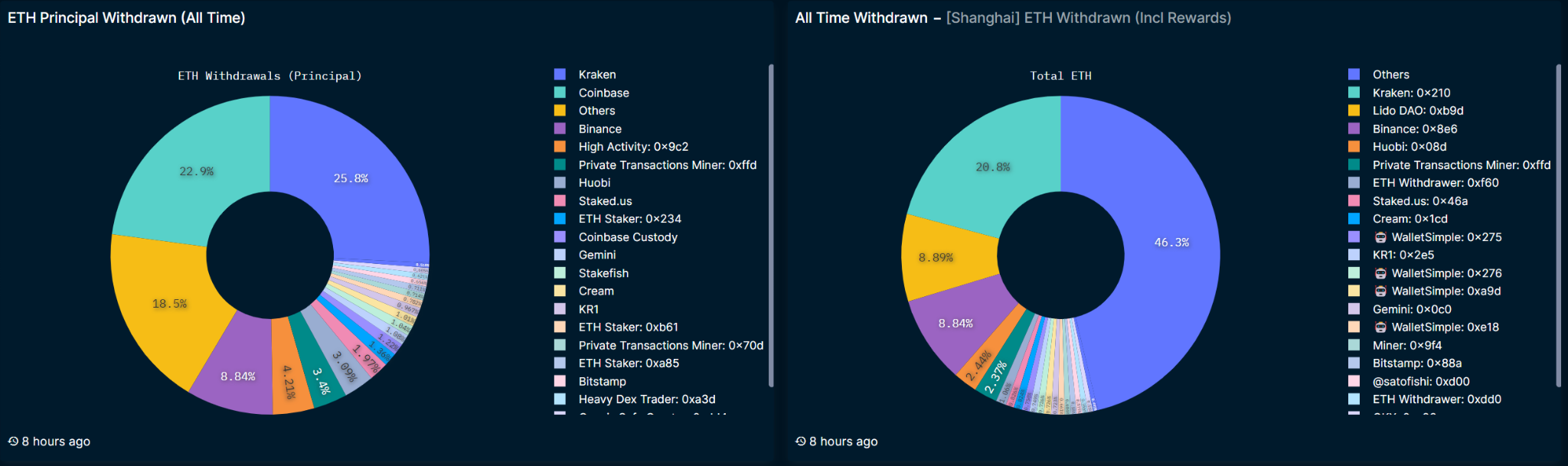

根据Nansen的数据进行粗略计算,去中心化质押平台质押比率不足 40% ,CEX 占比约为 20% ,剩余绝大多数 ETH 为节点质押和 Solo Staking。在上海升级之后,撤离本金最多的还是 CEX,占比达到 57.74% 。由于 Lido 占据总质押份额的 31.8% ,容易产生去中心化平台中心化,L2中出现了平衡配比 LST 的项目,通过将收益奖励按照比例分配来促进参与者获得更多小型平台的 LST 来获取奖励。

ETH 质押情况(来源:Nansen,时间: 2023.06.23 )

L1平台中也有很多利用 DVT 技术等让自己更加去中心化的,但从理性人角度分析,质押者第一优先考虑是安全性,第二是收益,Lido,Rocket Pool 的 LST 几乎适用于全部L2层级的 LSDFi 项目,且暂无安全事件出现。Lido 依赖 ETH 质押龙头地位获得收入与市场份额,作为既得利益者,中心化之后伤害以太坊也会伤害自己根本利益。当然内部风险以及类似于监管这种外部性风险是每一个L1平台需要注意的风险。

上海升级后 ETH 本金/奖励解决质押图表(来源:Nansen,时间: 2023.06.23 )

所以笔者继续看好 Top 3 龙头地位,但认为去中心化作为加密的天然属性,L1多样化是不可避免的趋势,L1中也出现了很多兼顾去中心化,安全性,低门槛的L1产品。但部分优质产品也无法摆脱代币效用问题。

收益率

不考虑安全性的因素下,高收益率以及收益持续性是 LSD 相关最为两个重要因素,关于高收益率,质押者需要依靠自己风险承担能力参与,在很多L2项目早期推出时,LST 直接质押收益在 Token 补贴下能达到 3 位数,LP 更是能达到 4 位数,但价格波动剧烈,挖提卖不可避免。目前部分项目采取的积分奖励模式以及质押获取空投对用户留存和代币价格影响最小。

质押者在提高收益率可以参考 DeFi 乐高常见玩法,考虑一下几种方法:

1.选择使用场景多/合作方多的 LST

2.通过杠杠增加资金效率

3.参与L2产品(部分L2产品有L3可以多重套娃)

4.参与新项目的 IDO 或者奖励活动(安全性低,但回报可观)

采用两层套娃基本可以将质押收益率提高到 10% 以上,读者可根据自己风险设计适合自己的策略。

在调研后发现,能够保持可持续性的项目基本具备一个特点:收益率不高,很多都是依靠自己的 Token 或者其他项目 Token(比如 Frax 利用 Curve)进行了一定的补贴,如果说 ETH→LST 部分的收益是基础,来源于以太坊质押奖励,那么 LST 为基础的L2和L3的收益来自哪里呢?

在调研后,总结为:

【 1 】Token 激励:自身 Token 补贴/其他方代币补贴

【 2 】借贷费用:部分稳定币

【 3 】LP 流动性池费用

【 4 】衍生品对冲

【 5 】Eigenlayer 向服务商收费补贴质押节点

【 6 】产品交易费用/佣金

……

从收入来源的稳定性基本可以判断L2/L3收益的稳定性,只有【 1 】、【 4 】、【 6 】方法能再符合高收益的性质,而【 4 】和【 6 】在操作上有很强的不确定性,所以【 1 】目前及未来很长一段时间都是主流方法,但在具体使用过程中存在很大细节差异。但项目想长期生存,采用【 1 】方法需要采取优秀的 Tokenomics。

个人认为优质的项目应该是真实收益+应用场景+好的 Tokenomics 的结合,目前L2层级已经出现了 PENDLE 为首的真实收益类+veToken 类项目,基本符合以上条件。

L2 的 LSD

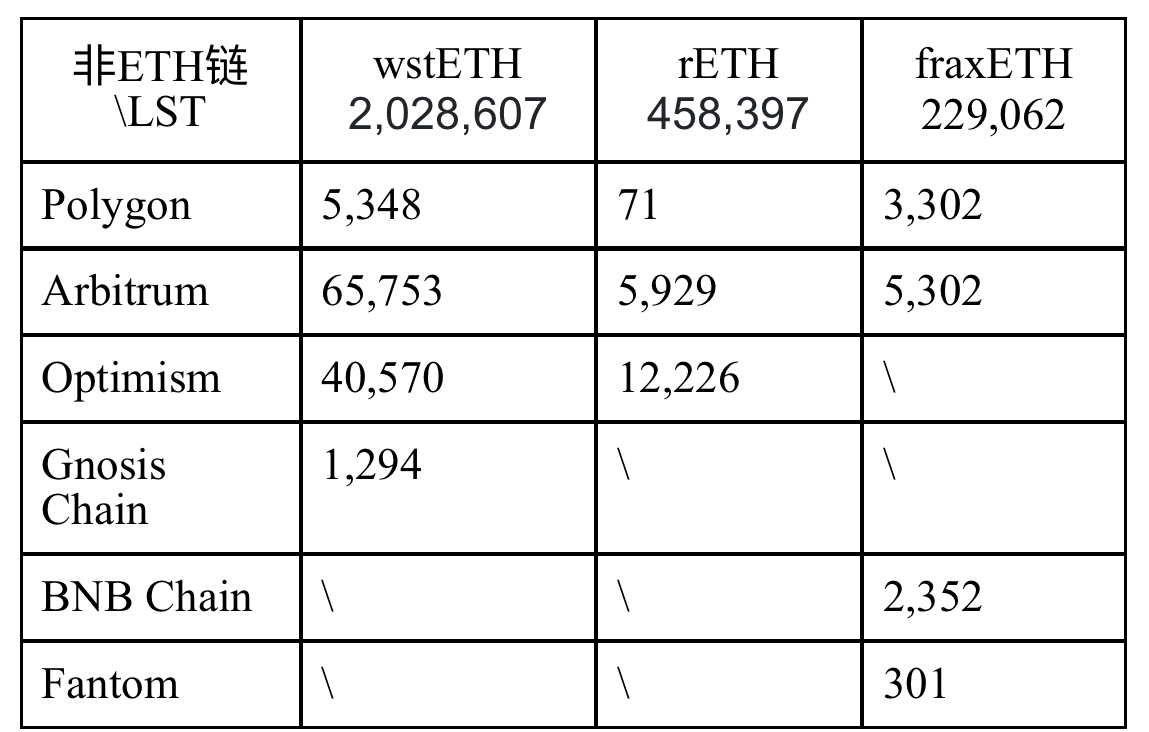

从表格中我们可以看到很多项目在L2层进行了部署,以 Top 3 去中心化质押 LST:wstETH、rETH、fraxETH 为统计。

Top 3 去中心化质押 LST 在不同链上的数量(来源:coingecko 提供过的区块链浏览器)

从总量来看 Arbitrum 上数量最多,调研结果中在 Arbitrum 上建立L2层级产品的也是最多的。Optimism 尽管 LST 数量不少,但单独为 LST 建立的项目远少于提供流动性池的 DeFi 项目数量。L2上的交易费用更低,能更快的发生交易,从持有者数量来看也在不断增多,所以有理由看好在 Layer 2 上发展的L2,越早部署,越有机会抢占L2的 LST 的流动性。

用户分级

不同的用户对于质押的需求不同,但基本要素有安全性,收益率,去中心化程度、代币经济学,UI/UX,易使用性等。

目前L0级别因为 Token 发行晚,技术壁垒高,VC 早期投资多,数目较少;L1层级,龙头出现,很多鲸鱼/大户也基本将 ETH 质押在L1层级,并参与L2;L2层级有来自各方的淘金者,但从L1 TVL 和L2 TVL 来看,以 Lido 的 stETH 为例,总量7.383 M,LSDFi 中可统计数量质押约为150 K左右,L2中还有很大市场空间。

(建议更为详细的数据追踪,此处数据复杂度过高,分析时进行了简化)

每个因素对于不同资金量用户的吸引程度/留存成度不同,笔者认为未来L1层级与L2出现的新秀将充分把握各个要素。

【 1 】安全性:团队人员及内部管理,审计,资金托管等

【 2 】收益率:高低之分,持久,收益品种多样化

【 3 】去中心化程度:托管方式,DVT 技术,Token 集中程度

【 4 】代币经济学:能否保证效用同时供需平衡甚至需不应求

【 5 】UI/UX:能否具有清晰简洁的页面以及用户门槛如何

【 6 】易使用性:产品的用途是否可以清晰告诉用户

项目推介

项目基本信息已放置在Google Sheet,请根据自身风险偏好进行配置

以笔者个人为例,笔者资金量较少,个人策略追求高收益,仅参与了 1 个L1龙头/L1新秀,剩余为L2真实收益项目以及L3项目,并少量参与新项目发售。

(以上不构成财务建议)

总结

大度 LSD 项目都以 LSD Summer 为口号,对标 DeFi Summer。从以上分析来看,对标基本不可能,但 Summer 是有的。追溯源头,整个的 LSD 生态都是基于 POS 代币币本位,这也代表 LSDFi 用户是需要了解Web3,且大多数为链上项目,代币也没有上交易所,收益为币本位,也就意味着参与 LSD 的是Web3具有一定经验的用户,参与者仅为Web3这个小用户群体的一小部分。外部用户进入极为有限。

且熊市流动性一直匮乏,DeFi Summer 时没有 NFT 与 GameFi、BRC 20 等,现在的流动性进入加密市场,先要被各个赛道瓜分,LSD 在 DeFi 赛道的细分赛道虽属热点赛道,但也无法获得大部分 DeFi 流动性。所以除了热点炒作,真正的 Summer 可能与牛市共同到来。

因为篇幅原因,没有介绍其中一些比较亮眼的项目,他们有些通过极强的合作能力丰富自身产品,有些预期 LSD 热点爆发,半路出家,并交出亮眼成绩。这直接证明了团队的重要性。同质化严重的L1与L2赛道既需要技术的创新也需要项目团队的努力。坎昆升级在即,牛市周期即将到来,是否又可以设计新的产品,或者针对不同资产设计产品,可能是很多项目需要考虑的问题。

各层级中均有跨层级的产品出现,这可能是未来的趋势,抢占本层级份额后利用优势发展其他层级也是业务扩展的选择,同时扩展至 Layer、 2 似乎仍然是一个合适选择,很多项目已经在计划开发中,期待他们的出现。

作为质押者和投资者,面对丰富的产品,个人建议首先要认识到自己的风险偏好,然后选择安全性较高(关注量较多,没出过安全事故等)的产品构建策略,最近已经出现了 Rug 项目,骗子项目,需要提高警惕。

声明:本文所提到的所有项目均不具备投资建议,且本人持有部分项目 Token,存在利益关系,且分析具有一定主观性。