Messari:探索链上历史和当前的收益率

原文翻译:Terry,胡子观币

探索链上历史和当前的收益率

· 资本往往会追随激励,而追踪不同生态系统中的收益率或年化收益率是衡量资本激励的最佳指标。

· 从历史上看,生态系统内收益率的激增可以预示未来资本流入该生态系统。当收益和底层资产是像稳定币这样的高价值资产时,这一点尤其正确。

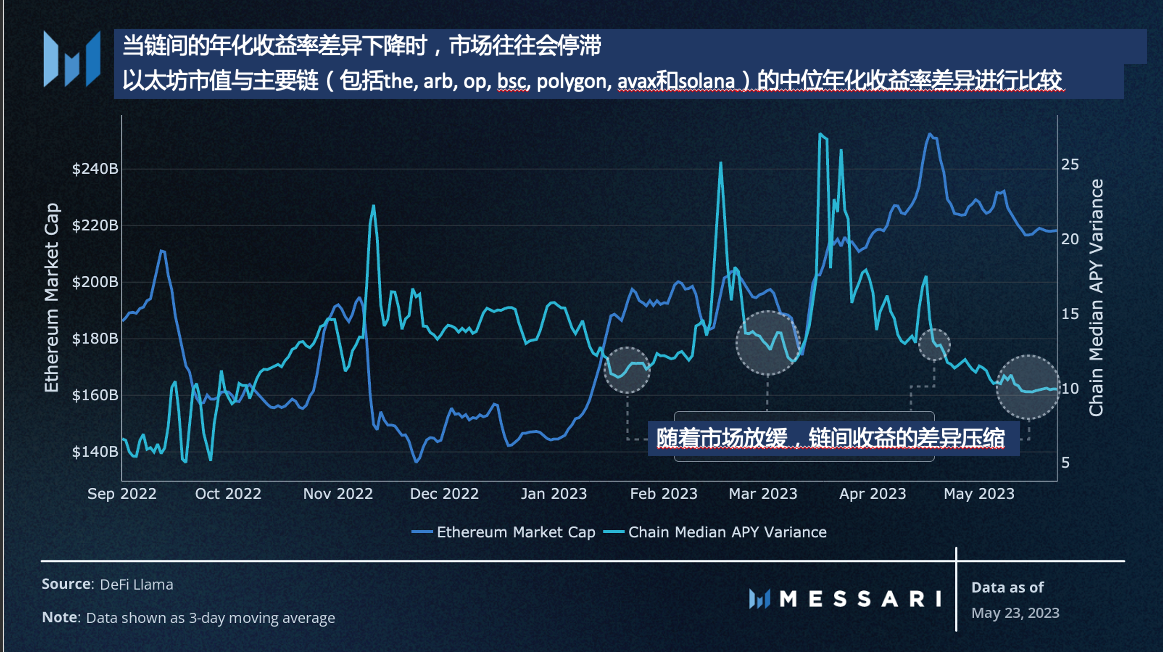

· 当前的收益环境正在看到主要生态系统的收益率趋于一致,因为主导的第二层交易叙事正在消退。这种明显的资本叙事的缺乏在历史上常常与更广泛市场的停滞或下滑相吻合。

· 监测未来在顶级和新兴生态系统内的收益率激增,可以指示市场何时准备再次集中资本流动。

就像分子自然地从高浓度区域流向低浓度区域一样,资本也从饱和的低收益区域流向新的高收益机会。年化收益率作为一种激励度量,如果大于当前的利率,将吸引资本流入投资池,直到收益饱和回到市场水平(假设风险相当)。

这种效应在加密货币中得到体现,因为资本转向新的池子、协议或链,这些链以更大的用户活动(费用收入)或激励计划(代币奖励)驱动更高的收益。

因此,衡量协议或整个链的相对年化收益率可以提供一个信号,表明资本是否将流入其池子。随着投资的增加,如果流动性估值倍数保持不变,那么预期协议或链生态系统的相应市值会增加。此外,赚取收益的简单市场机制可以推动积极的价格行动,因为在赚取收益之前可能需要购买特定的代币,就像在 DEX 流动性提供者对中的情况一样。回顾过去一年,可以看到收益率信号价格上涨的这种动态在一些经历了显著正面价格行动的顶级链中得到体现。

历史收益影响

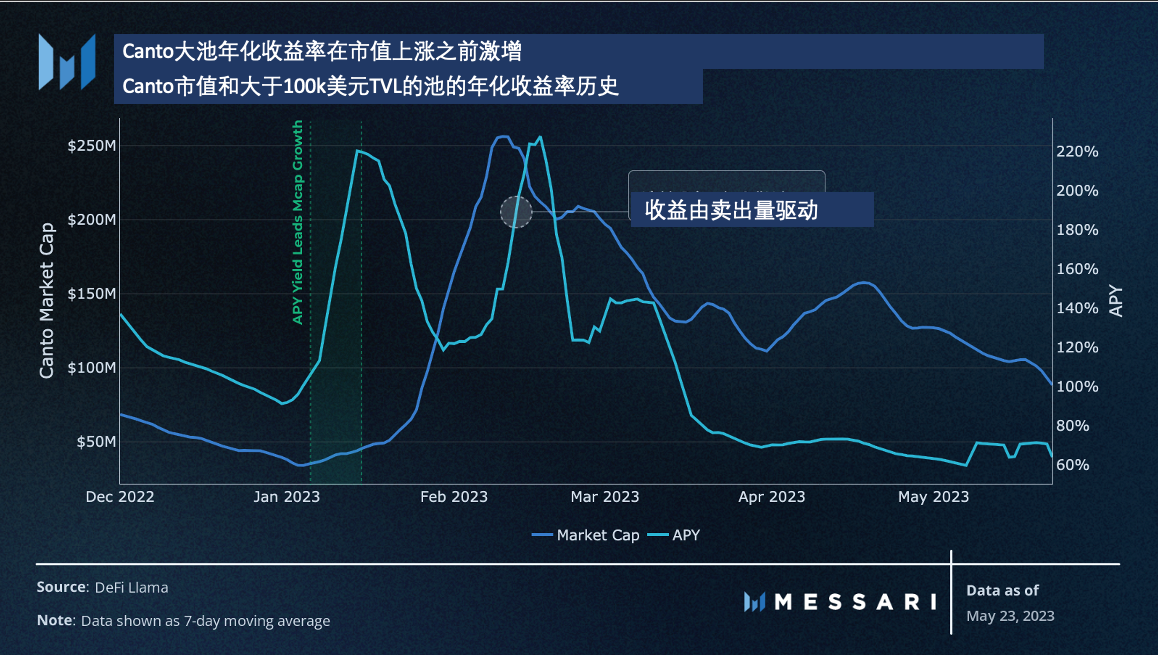

在 2023 年 2 月,Canto 的本地代币大约增长了 5 倍,因为用户们争相抢购高收益和可能的新叙事。在价格大幅上涨之前,链上最大的池子中的收益率出现了大幅上升。

链上的中位数收益率的上升是由 DEX LP 对 CANTO 资产的驱动,比如 ETH-CANTO 对。然而,与此同时,稳定币货币市场池和 DEX LP 对,如 NOTE-USDC(NOTE 是 Canto 上的本地 CDP 稳定币),产生了 20-30% 的年化收益率,并构成了链上以近 8500 万美元的总价值为最大的池。20-30% 的年化收益率大约是领先链上稳定币收益率中位数的 5 到 10 倍,这对资本赚取近乎无风险的回报起到了重要的激励作用。

虽然在价格跟随收益增长之前大约有 1 个月的领先时间,但在其他更受欢迎的链上并非如此。Canto 作为一个新的基于 Cosmos 的链,比传统的链在风险曲线上更远,因此,用户倾向于少付前期注意力,并在做尽职调查时反应较慢。

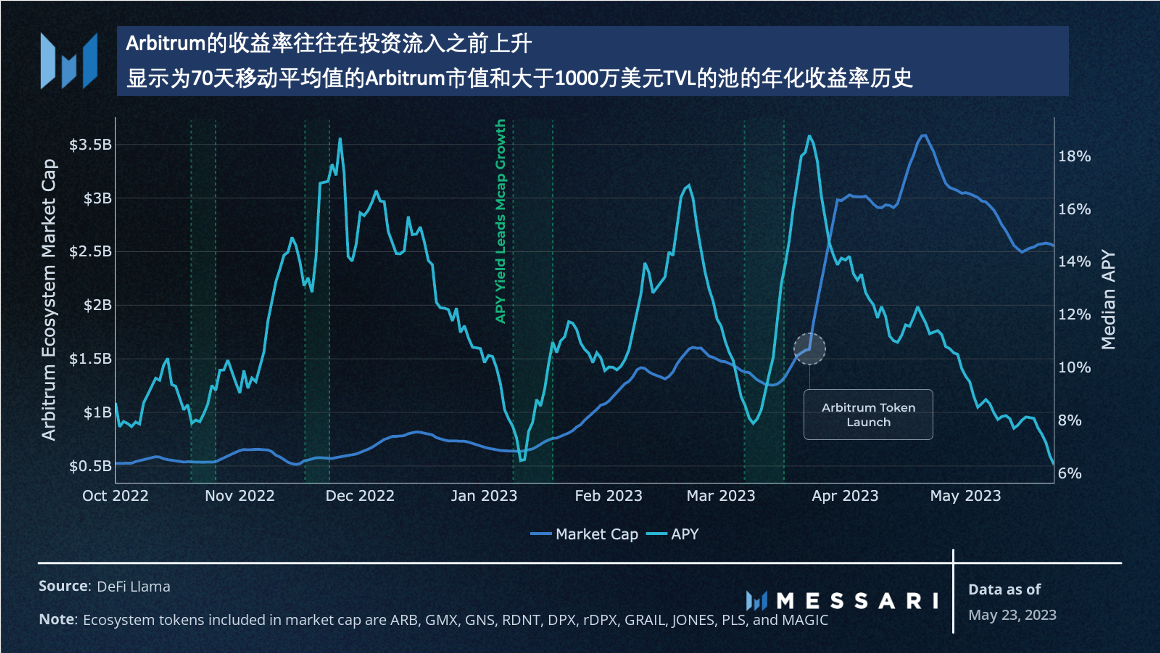

在像 Arbitrum 这样的流行链上,收益率和生态系统市值增长之间也有类似的领先关系,尽管由于与更广泛的市场条件的相关性更大,这种关系更为压缩和嘈杂。

与 Canto 类似,像 WETH-USDC 这样的主要 DEX LP 对在 Arbitrum 的收益率激增期间推动了最高的收益。然而,GMX 的抵押池是链上最大和最受欢迎的收益来源。在 2022 年 10 月至今的突出激增期间,GLP 池及其衍生品的年化收益率在 20-50% 之间,尽管用户可以向池中存入稳定币,但这是以 ETH 计价的。鉴于这个池的结构具有有机和可靠的收益来源,它吸引了大量的资本流入 Arbitrum,随后提振了生态系统资产的集体市值。

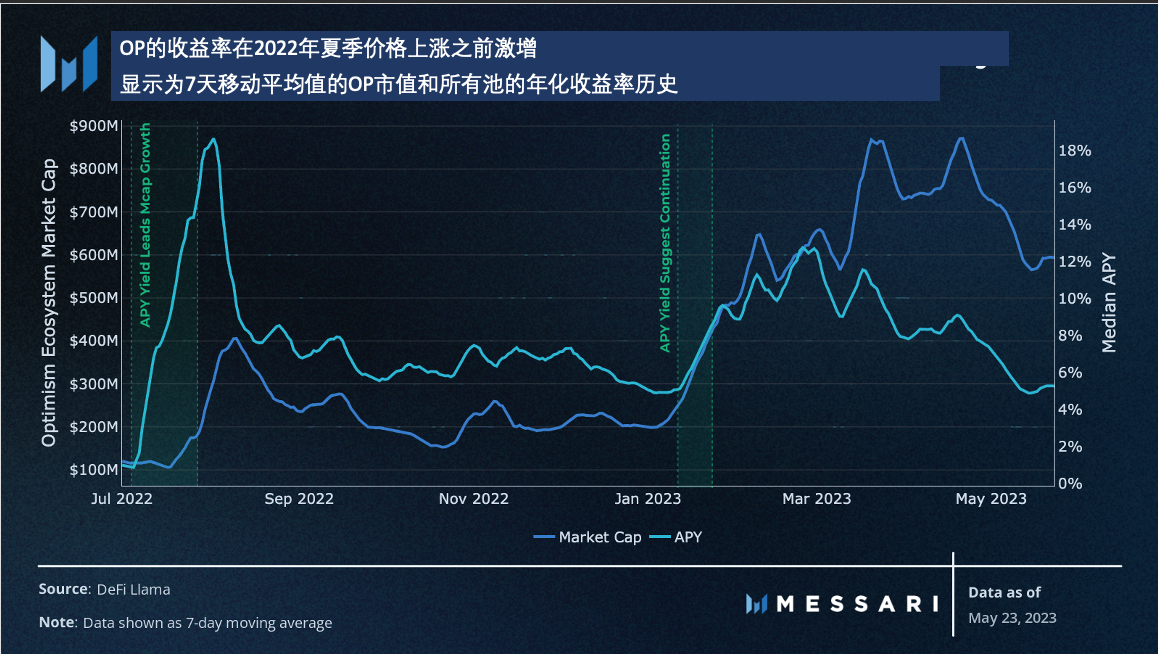

一个具有高收益的大稳定币池是吸引大量资本流入的关键组成部分,因为相对低风险、高回报与市场和暂时性损失风险的回报相比,是非常令人向往的。例如,Optimism 在 2022 年夏天在其稳定币池中经历了初始的收益率激增,但之后未能看到尖锐的收益增长,这将信号潜在的资本流入。

与独立吸引人的池子,如仅稳定币池不同,Optimism 的高收益率大部分在 DEX 池中,这些池要么有暂时性损失,要么有以相对不受欢迎的资产计价的激励。因此,收益率与更广泛的市场表现高度相关,对新资本缺乏吸引力。因此,当评估当前的收益环境以寻找潜在的资本转移时,人们应该监控的不仅仅是收益率的激增,还有那些能够提供无关联回报的大规模(高 TVL 水平)的收益机会。

当前收益环境

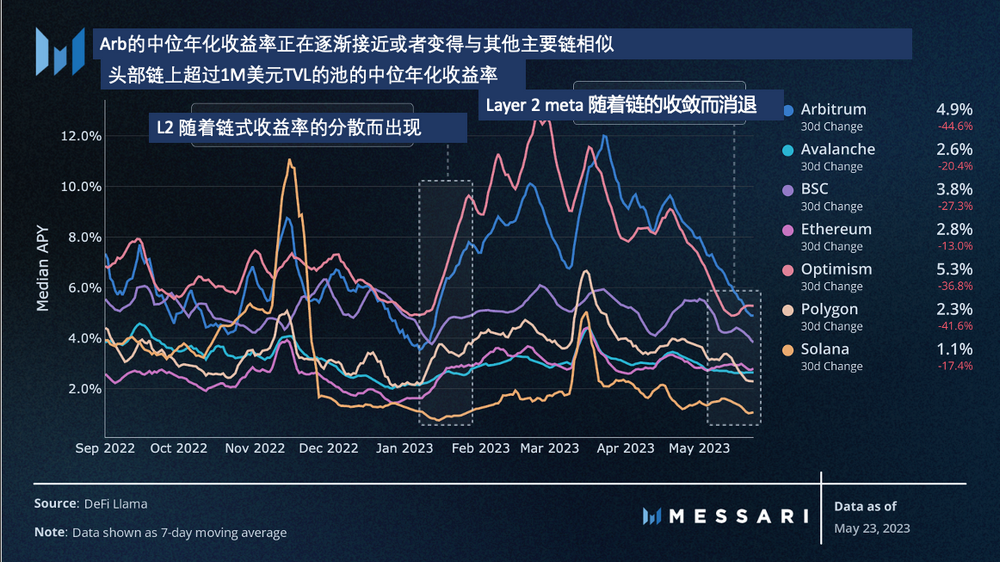

最近,主要链上的中位年化收益率在过去 90 天内下降了 30% ,现在的聚合中位数为 3.4% 。在这段时间里,主要链的收益率在一段时间内,二层链的中位收益率大约是市场其余部分的两倍到三倍后,收敛了。

当主要链的收益率收敛到更均匀的分布时,这表明市场缺乏一个元或主导叙事来引导资本流动。没有一个共识点,价格往往缺乏上升动力,因为出价在单一资产或生态系统中的集中程度不足以导致显著的正面价格行动(在熊市中,可用资本较低时,这一点尤其正确)。

查看历史数据,当主要链上的中位收益率的差异减小时,我们看到市场停滞甚至纠正,因为资本流动无引导。

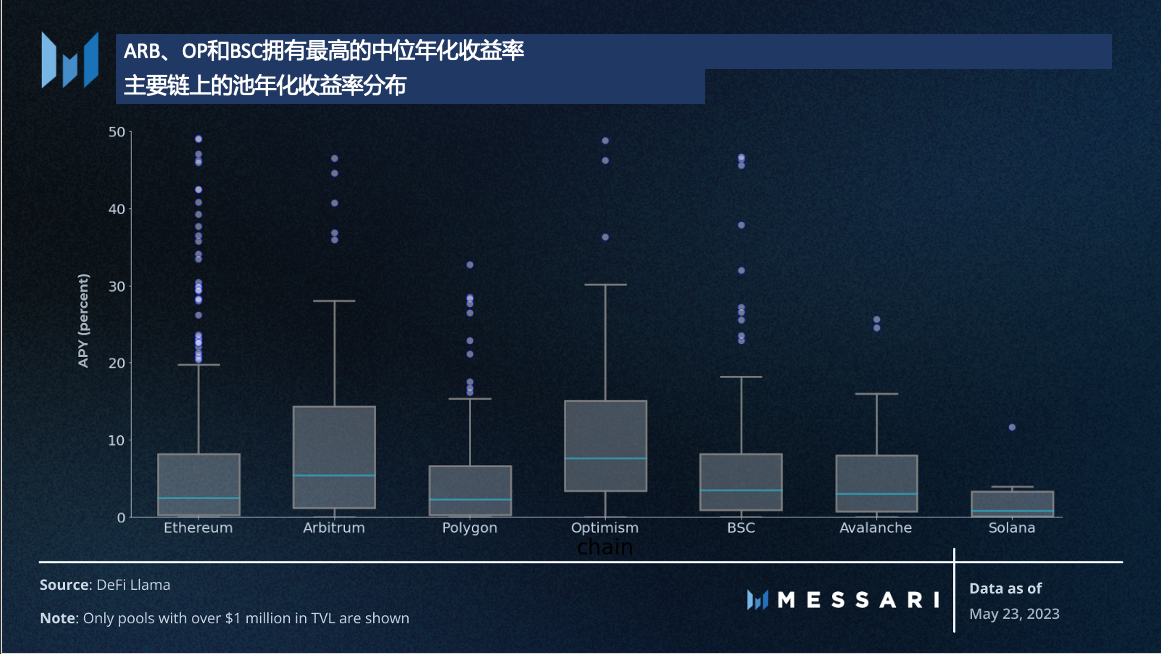

目前,随着链间收益率的差异收敛,历史模式会建议在新的收益机会出现之前,暂时停止资本分配,这将表现为特定链或协议上收益率的激增,如上述历史部分所示。然而,这并不意味着在主要链上没有收益机会。通过查看主要链的池收益分布,以太坊、Arbitrum、Optimism 和币安上有一些池子有高规模的回报。

这些链上当前收益环境的微妙之处在于,它们缺乏一致的回报,或者带来了市场(价格)风险或暂时性损失风险。分解顶级生态系统的本地收益环境:

· 以太坊:目前收益最高的池子是为梗币的 DEX LP 对,这些币带有极高的市场风险,其中代币的底价可能会崩溃,使得高收益变得毫无意义。除了梗币对,超过 1000 万美元 TVL 和 15% 回报的池子要么是更传统的 DEX 对,带有暂时性损失,要么是大量激励的池子。

· Arbitrum:除了主要的 DEX LP 对,如 WETH-USDC 之外,GMX 的 GLP 的衍生品仍然是 Arbitrum 上收益最高的机会。GLP 目前的回报大约是 10% ,而其在 Pendle 和 Jones DAO 等协议上的衍生品使用带来了 16-20% 的回报,其中包含了激励和风险。

· Optimism:尽管对于超过 100 万美元 TVL 的池子,Optimism 有最高的中位年化收益率,但 Optimism 只有 8 个超过 1000 万美元的池子的收益率超过 5% 。这些池子的绝大多数是 Velodrome 上的稳定币或抵押衍生对,这些对比较少有有机的使用,意味着大部分的收益来自协议激励,这些激励以相对不受欢迎的 Velodrome 资产计价,而不是本地 ETH 或稳定币。

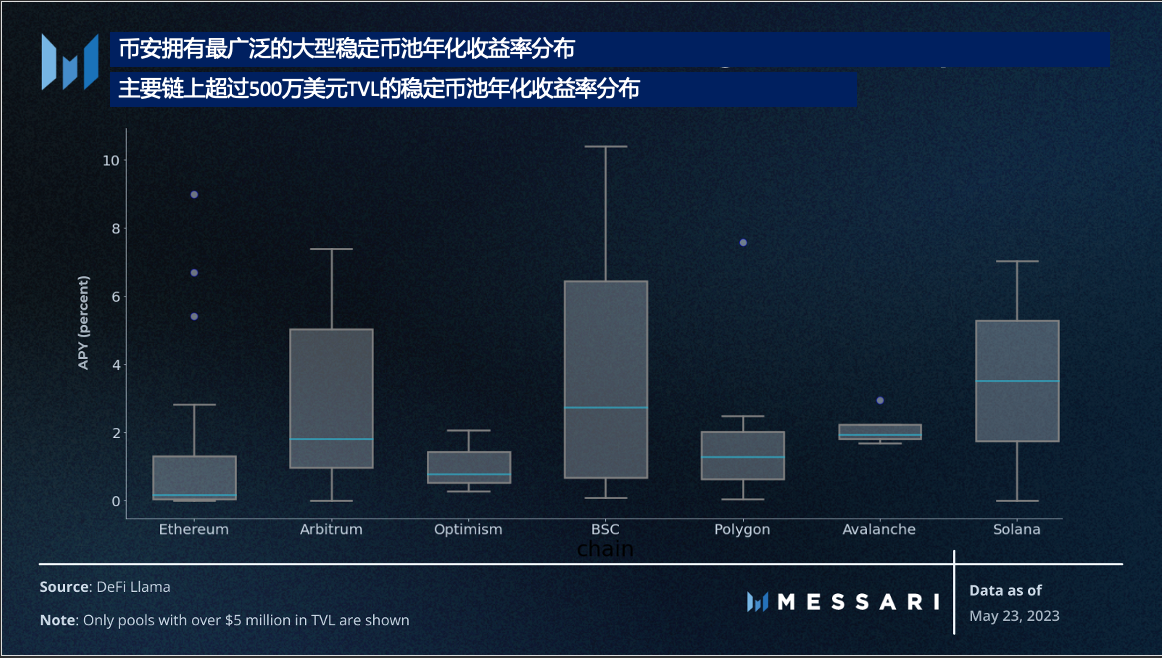

· 币安:在目前赚取链上收益的四个主要场所中,币安智能链有一些最高的、较低风险的收益。例如,PancakeSwap 的 USDT-BUSD 对的收益率近乎 13% 。将链间的池分布仅限于大型稳定币池,说明了币安上更大的稳定币机会。

最后的想法

收益是交易活动或激励的衍生物,是资本的引导激励。随着顶级链上的中位收益率的收敛,这表明市场缺乏一个主导的交易叙事,历史上这种情况常常伴随着停滞或下跌的价格行动。没有明确的激励来引导资本流动,资本会被广泛分散,由于缺乏集中,导致向上的波动性减少。

从历史上看,生态系统内的大价格移动都是由生态系统内的收益机会激增预示的。除非在特定的生态系统内有新的活动爆发或协议激励,否则历史数据模式会暗示市场停滞。

然而,随着时间的推移,监控领先的链和新兴生态系统的收益分布可能会在未来指示活动可能流向何处。