一览Cosmos流动性质押生态:ATOM流动性质押仅占质押量的1.15%

原文作者:蒋海波,PANews

以太坊的质押从 2020 年 11 月开始,直至最近的上海升级才开通赎回功能,随着质押率的上升,质押收益率也在不断下降。截至 4 月 26 日,OKLink 显示,当前整体质押率为 14.54% ,质押的年化收益率为 3.92% 。最大的 LSD 协议 Lido 显示,在加上 MEV 等收益的情况下,过去 7 天通过 Lido 质押 ETH 的 APR 为 5.1% 。

与此同时,一些质押收益率较高的公链可能也值得关注,如 Cosmos。Staking Rewards 数据显示,目前 Cosmos Hub(ATOM)的市值为 33 亿美元,质押市值 23 亿美元,质押收益率 21.92% 。

ATOM 质押率接近 70% ,收益来自区块奖励和交易费费用

ATOM 高达 21.92% 的质押收益率在主要的公链原生代币中几乎是最高的,但是根据通胀调整后的收益率(质押收益率-通胀率)只有 3.58% ,也就意味着 ATOM 的通胀非常高。在这种情况下,如果不进行质押,那么代币持有人的权益将随着时间的推移被大量稀释。

根据 Cosmos 的规则,ATOM 的质押收益主要来自于以下两个方面。

1、区块奖励。这一部分由 Cosmos 的链上参数决定,包括预期每年铸造的代币数量和预期的区块时间,决定了每个区块铸造多少代币作为奖励。根据 Cosmos 的规则,ATOM 每年的通胀率在 7% ~ 20% 之间,旨在将质押率维持在 67% 。如果质押的 ATOM 占总量不足 67% ,通胀率将以每年 13% 的速度增长,直至 20% 。如果质押的 ATOM 占总量超过 67% ,通胀率将以每年 13% 的速度降低,直至 7% 。截至 4 月 26 日,ATOM 的质押比例为 69.75% ,那么 ATOM 的通胀率应该在下降过程中。需要注意,虽然链上参数会指导平均出块时间,但实际运行中出块时间有所差异,这也将使实际的区块奖励和预期可能不完全相等。

2、交易费用。这部分是指包括 Cosmos Hub 中的交易费用,交易费用带来的质押 APR 将随着网络的使用情况变化。如果验证器产生的是高手续费区块,那么奖励也会高于低手续费区块。

ATOM 的高通胀对仅持有代币而不进行质押的用户非常不利。2022 年 9 月,Cosmos 开发商 Tendermint 在 Cosmoverse 大会上发布ATOM 2.0 版本的白皮书,但随后 Cosmos 论坛ATOM 2.0 :Cosmos Hub 新愿景的提案被拒绝。在代币经济学方面,该提案希望在 36 个月的时间里逐步减少 ATOM 的发行量,并铸造代币补贴 Cosmos Hub Treasury。说明团队有意减少 ATOM 的通胀,但尚未有能够落实的方案。

4 种流动性质押方案介绍

由于 ATOM 的质押退出需要等待 21 天,那么可以随时通过交易换回原生资产的流动性质押方案就显得尤为重要,Cosmos 中也出现了多个流动性质押项目。Cosmos 可以“一健发链”,也造成生态较为分散,几乎都在不同的公链上。

Stride

Stride 是专为流动性质押而创建的区块链,目前已支持 Cosmos 生态 ATOM、OSMO、JUNO、STARS、EVMOS、LUNA、INJ 的流动性质押,并计划支持所有与 IBC v3兼容的 Cosmos 生态。为了方便用户进行操作,Stride 可以在没有原生代币 STRD 作为 Gas 费的情况下发起质押。以下是 Stride 的相关数据。

TVL:目前 Stride 的 TVL 为 2983 万美元,主要为 2150 万美元的 ATOM。

LSD:stToken,奖励积累在代币中。

收费: 10% 。

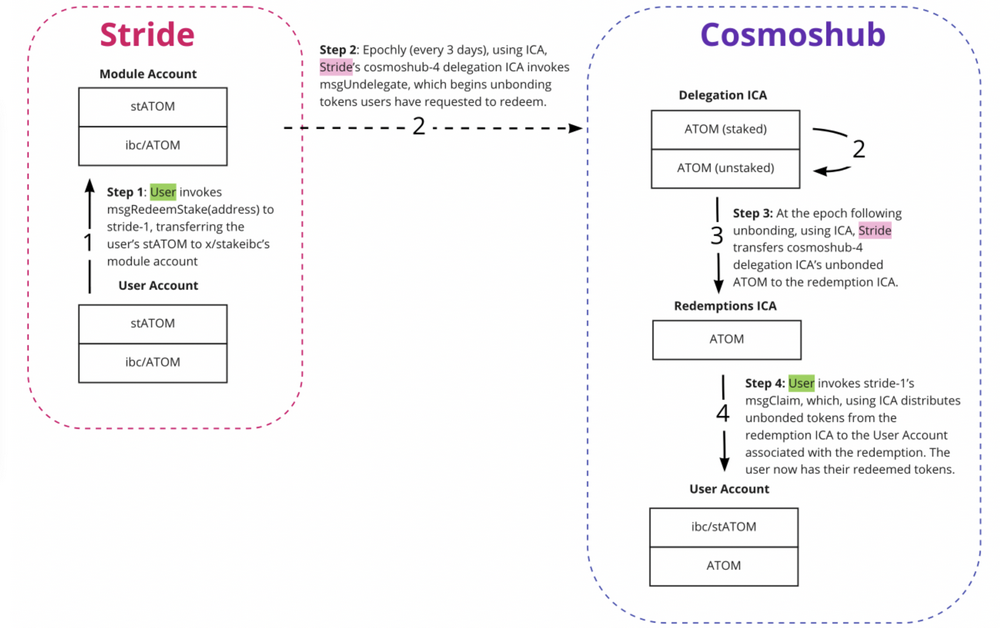

赎回方式:在 Osmosis 等 DEX 上卖出或等待 21 ~ 25 天。由于 Cosmos 的取消质押(Unbonding)需要 21 天,且规定不能在 21 天内 Unbonding 超过 7 次,因此 Stride 每 4 天执行一次 Unbonding 操作。

流动性和激励措施:Stride 这条链目前仅用于提供流动性质押服务,并没有配套的 DEX 等基础设施,因此需要在 Osmosis 或其它链的 DEX 上提供流动性。stATOM 的主要流动性在 Osmosis 上,stATOM/ATOM 交易对的流动性为 2394 万美元,APR 为 27.3% ,挖矿奖励以 STRD 和 stATOM(Stride 将一部分 STRD 提前兑换成了 stATOM)的方式发放。

pSTAKE Finance

pSTAKE 由 Persistence 开发,ATOM 的质押也发生在 Persistence 这条链上,pSTAKE 和 Persistence 都发行有自己的原生代币。根据 DefiLlama 的数据,Persistence 链上只有 pSTAKE 和 Dexter(一个 DEX)两个项目,而 Dexter 也仅支持 Persistence 的原生代币 XPRT、ATOM 与 pSTAKE 的质押衍生品 stkATOM 这三种代币的交易。

支持资产:ATOM、BNB、ETH。

TVL: 569 万美元,包括 312 万美元的 ATOM 和 258 万美元的 BNB,ETH 的质押现已暂停。

LSD:stkASSETs。

收费: 5% 。

赎回方式:有立即赎回选项,但流动性不多。

流动性和激励措施:在 Dexter 上 stkATOM/ATOM 交易对的流动性为 101 万美元,APR 44.87% ;在 Osmosis 上 stkATOM/ATOM 交易对的流动性为 104 万美元,APR 39.56% 。

Quicksilver

Quicksilver 也是单独的一条链,上面没有其它生态。通过 Quicksilver 质押可以自己选择委托的验证者,同时保留资金的治理权。

支持资产:Cosmos 生态中的 ATOM、OSMO、REGEN、STARS 的质押。

TVL: 186 万美元,其中的 ATOM 价值 116 万美元。

LSD:qAsset。

收费: 3.5% 。

赎回方式:只能交易卖出,暂时不允许赎回。

流动性:在 Osmosis 上无流动性,Canto 链上 Velocimeter 中 stATOM/qATOM 交易对的流动性约为 9000 美元,APR 29% 。

Stafi

Stafi 支持多种公链原生代币的流动性质押,并非特地为 Cosmos 而做。在 Cosmos 上,通过 Stafi Hub 这条链完成 ATOM 的流动性质押。

支持资产:ETH、ATOM、MATIC、BNB、FIS、SOL、IRIS、HUAHUA。

TVL: 3442 万美元,主要为 3260 万美元 ETH,质押的 ATOM 价值 71.9 万美元。

LSD:rToken。

收费: 5% 。

赎回方式:交易卖出。

流动性:在 Stafi Hub 的 rDEX 中,rATOM/ATOM 交易对有 50.8 万美元的流动性,但流动性挖矿已结束。

小结

目前 Cosmos 生态中的四个流动性质押协议 Stride、pSTAKE、Quicksilver、Stafi Hub 均有自己的链,质押的 ATOM 价值分别为 2150 万美元、 312 万美元、 116 万美元、 71.9 万美元。通过流动性质押的 ATOM 只占质押 ATOM 的 1.15% ,与以太坊上 Lido 自身就占 ETH 总质押量的 30% 相比,ATOM 的流动性质押还有很大的增长空间,这可能也是因为 Cosmos 生态的 DeFi 发展较落后,流动性代币缺乏应用场景。

几个 ATOM 的流动性质押方案都比较类似,都自动将收益复投,并将价值累积到发行的 LSD 代币中。根据目前的情况,Stride 已成为目前 Cosmos 生态 LSD 赛道的龙头,质押量远超其它项目,且业务聚焦于 Cosmos 生态的质押。但 Stride 目前的质押量也比较少,未来还可能面临 Lido 等新玩家的竞争。