LD Capital:深入解析Grayscale信托,五折买ETH机会还是陷阱?

摘要

2023 年加密市场从去年的深熊里大幅反弹,很多人可能还未来的及‘上车’,此时对比资产净值(NAV)仍有 5 折左右折价的 Grayscale 信托份额显得格外有吸引力;

基于以太坊 Web3 核心基础设施的地位,我们看好 Grayscale 信托产品矩阵中 Ethereum Trust (ETHE) 在未来潜在牛市中的反弹表现;

ETHE 历史上曾长期溢价或折价,产生正溢价的原因包括,申购有锁定期、产品可触达性高于 ETH 现货,相比自己保管私钥的成本 ETHE 更适合传统金融领域机构和小白散户投资;

目前长期折价的原因主要与该产品无法直接赎回、类似封闭基金的产品结构有关,此外,套利机会的限制、大型投机者的被迫平仓、机会成本的折现、竞争性产品的冲击也是原因;

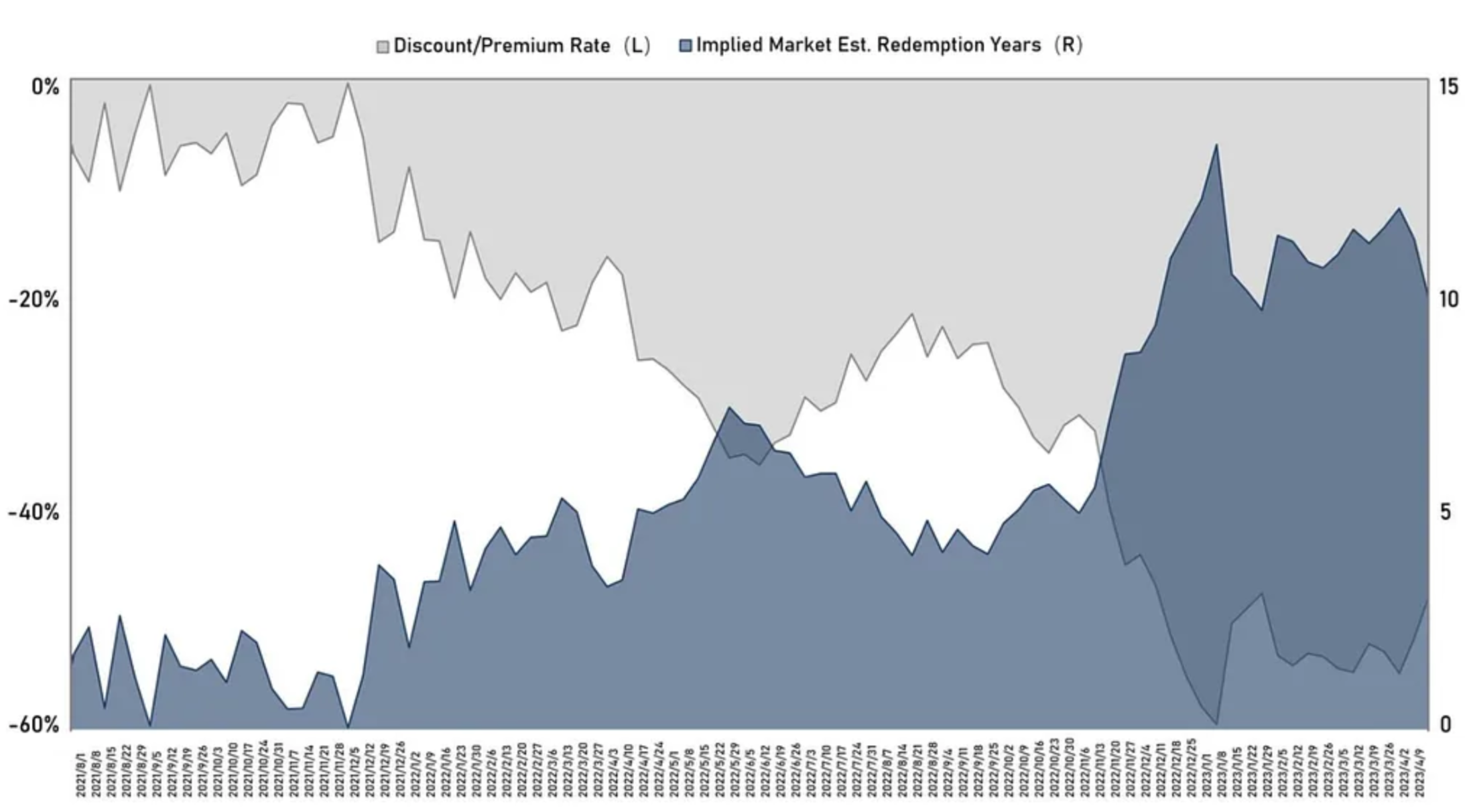

2021 年中负溢价趋势形成以后市场对 ETHE 恢复平价的时间预期越来越长,经我们测算,在去年底一度超过了 14 年,如今回落到 10 年左右。我们认为这一预期仍然过长,待乐观预期来临之际这一隐含恢复时间可能回落至 2 年以下较为合理;

有七种情况可以导致折价收窄甚至消失:包括开放赎回 ETH 现货(分为赎回获得 SEC 豁免以及 ETF 转换申请通过两种情况)、获得赎回豁免、产品解散清算、Grayscale 自行回购、套利策略的发展和市场信心的提升、机会成本的下降有助于折价修复;

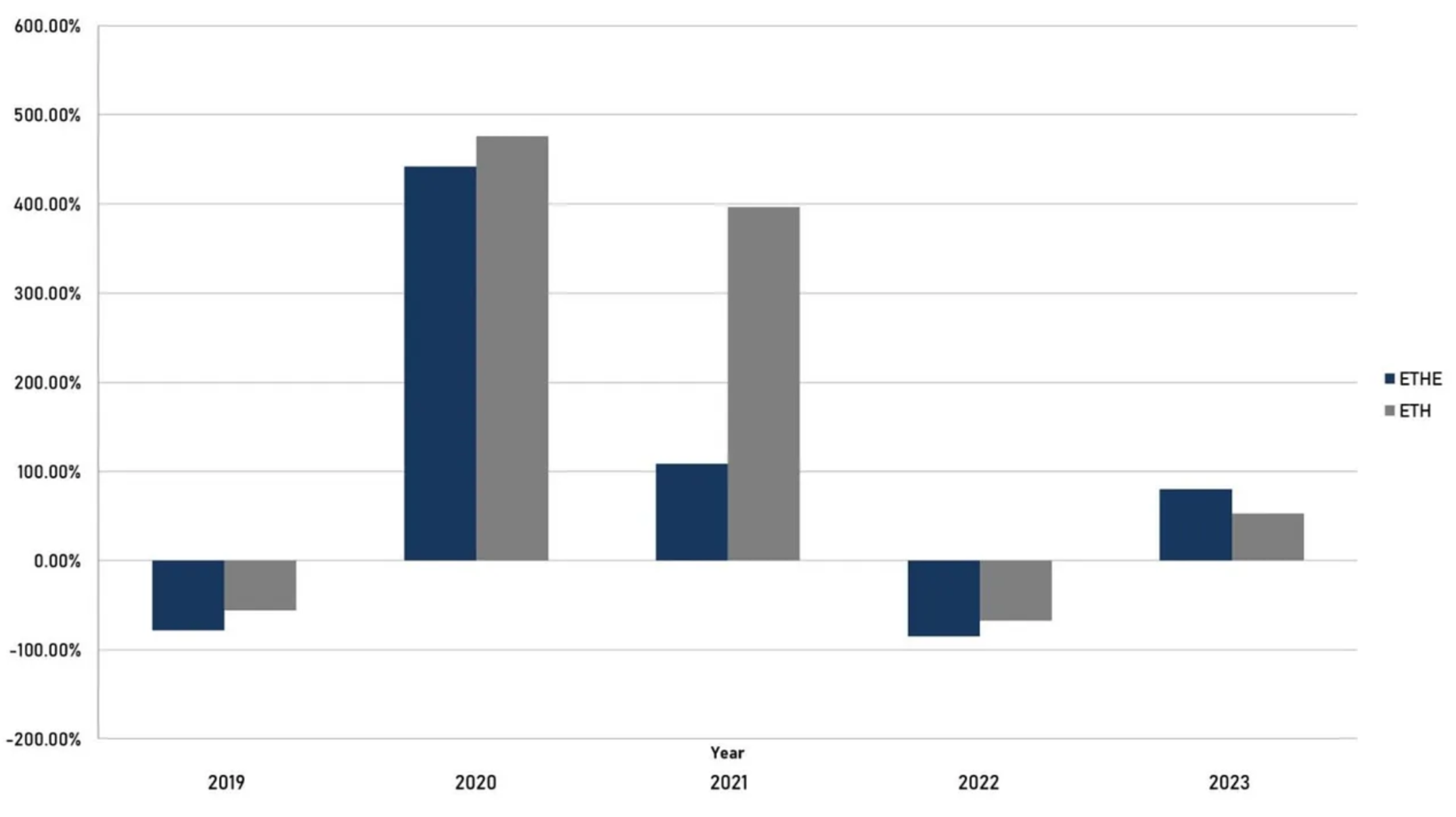

自 2019 年 ETHE 诞生以来,该产品还尚未经历完整的“周期”。我们认为一个完整的周期应遵循 溢价→平价→折价→平价→溢价的循环,目前 ETHE 产品只走完了一半的周期,我们认为假若押注潜在的牛市,则 ETHE 具有更好的弹性,年初以来 ETHE 涨幅是 ETH 的 1.7 倍证明了这一点;

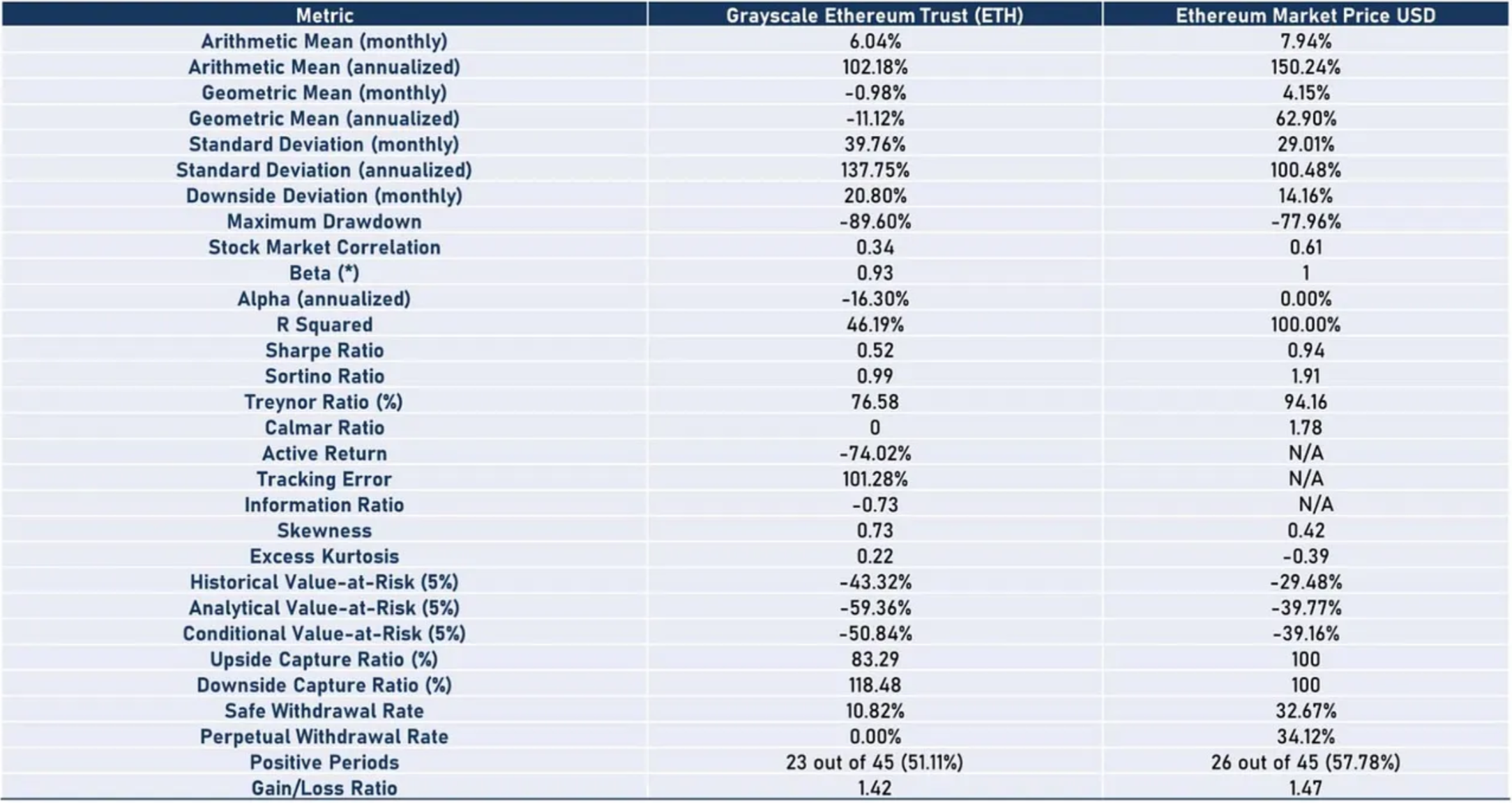

但历史数据测算显示 ETHE 的风险回报比不佳,如表 1 可见 ETHE 几乎在所有方面相较于 ETH/USD 表现较弱。意味着如果准备长期持有 ETHE 可能要做一些针对性的收益增强策略,否则如果牛市不能快速到来的话其表现有弱于大盘的风险。

综述

在 2023 年,加密货币市场再次成为投资者关注的焦点,BTC 和 ETH 的涨幅冠绝全球大类资产。然而,许多投资者仍然未能从熊市思维中恢复,未能及时把握这一投资机会。但在 Grayscale 信托旗下的 GBTC 和 ETHE 产品中,投资者仍可获得近五折的折价买入机会。

因为我们认为,以太坊网络(ETH)未来将是主流 Web 3 应用的核心基础设施,除了和 BTC 一样可以承接传统资金外溢,还将拥有 Web 3 生态应用带来的α,所以本文将特别关注 Grayscale 信托产品 ETHE 的折价现象和潜在投资价值,并详细讨论这一现象可能的缩减甚至消失的情景,以及适合专业投资者加入加密市场的理由。此外,我们还将分析这款产品的法律结构及潜在风险。

Grayscale Bitcoin Trust 早在 2013 年 9 月便推出,在法律上被指定为授信人信托(grantor trust)创建信托的人(授信人)是信托中资产和财产的所有者,保留对信托内资产的完全控制权,这在实际目的上类似于封闭式基金。在这种特殊结构下,它允许投资者通过购买受益权来间接拥有信托基金中的资产。与封闭式基金类似,授信人信托通常不允许投资者在任意时间赎回其持有的股份。

Grayscale Ethereum Trust (ETHE)(以前称为 Ethereum Investment Trust)(“信托”)是特拉华州的法定信托,成立于 2017 年 12 月 13 日,于 2019 年 7 月上市交易,采用了和 GBTC 相同的信托结构。

采用信托结构的好处是,由于该信托不会在任何交易所交易、购买、出售以太坊或其衍生品,所以可以避免受到相应监管机构的管辖,便于产品尽快发行,尽管 ETH 到底归属 CFTC 还是 SEC 管辖至今也尚未明确。

首先简要看一下 ETHE 和 ETH 的主要区别:

投资方式不同

ETHE 是上市信托基金,受美国证监会(SEC)监管,便于机构管理资产负债表;ETHE 通过一般证券户口交易,比加密货币交易所更为简易和便宜;ETHE 能够成为个人退休金账户(IRA) 及 401(K)(美国退休福利计划),享受投资税收优惠;不用学习如何管理加密货币电子钱包,无需担心因自己的原因不慎遗失私钥或钱包遭黑客攻击等风险;

供应量不同

ETH 的总供应量没有上限,而 ETHE 的供应量则取决于 Grayscale 的发行计划;

市场需求不同

由于 ETHE 是一种投资产品,它的市场需求和 ETH 有所不同。一些机构投资者和个人投资者可能更愿意投资 ETHE,而普通的数字货币交易者可能更愿意交易 ETH;

其它

ETHE 投资人暂时无法向 Grayscale 赎回底层 ETH 资产或等值美元;ETHE 每年收取 2.5% 资产净值的管理费;ETHE 不能参与 DeFi 挖矿等链上行为。

主题 1 :为何会产生严重折价?

理论上 ETHE 价格应该围绕 ETH 持仓价值上下波动,但实际上它的二级价格表现并非完全贴市,自 ETHE 2019 年上市以来,历史上曾经长时间维持着对 ETH 的正溢价, 2019 年上市之初一度超过 1000% 。自 2021 年 2 月后 ETHE 进入负溢价模式,并持续至今。

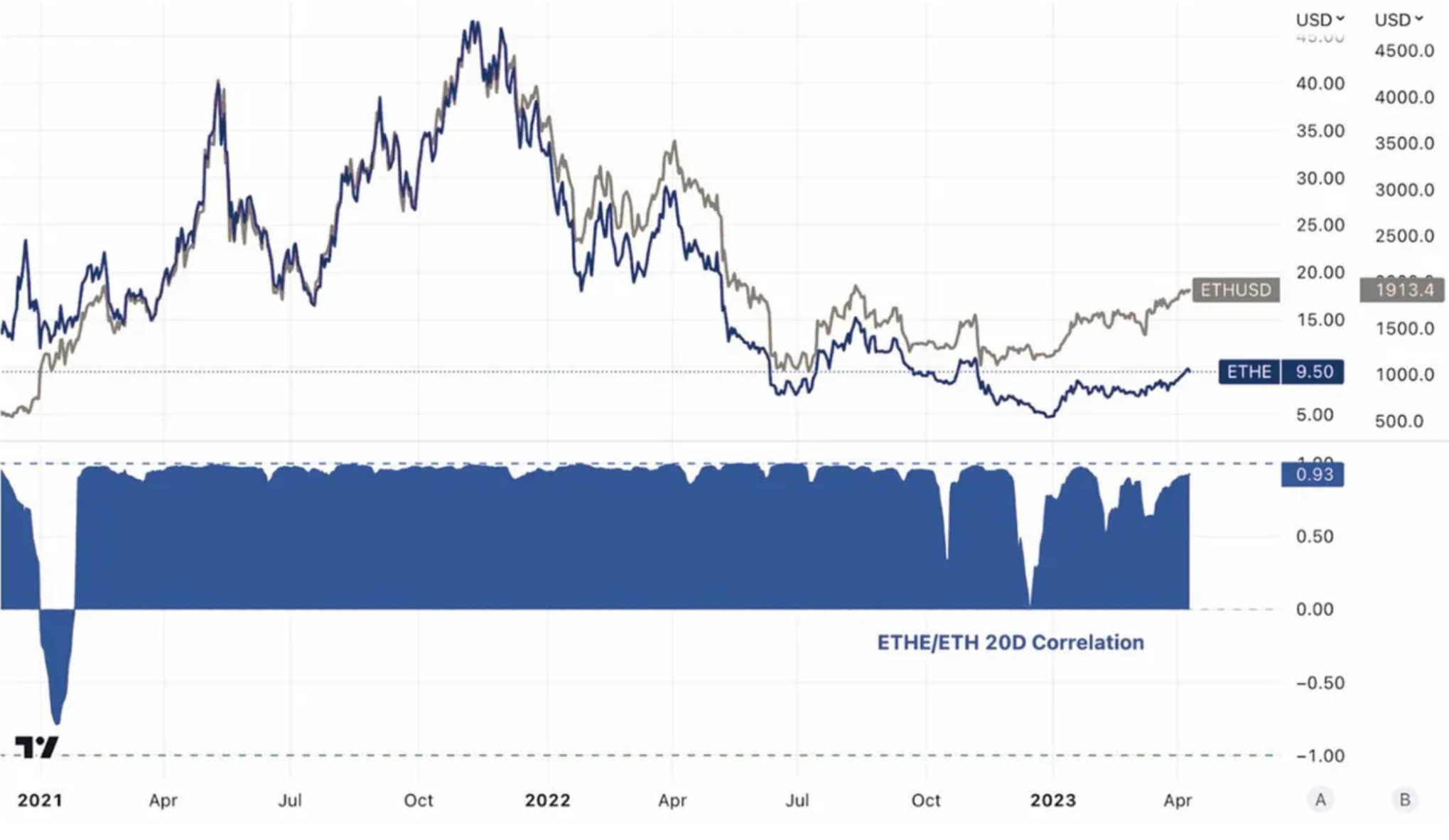

图 1 :历史 ETHE 折溢价与 ETH 价格走势

来源:Graysacle, Trend Research

Grayscale 的加密信托份额类似封闭基金,这导致了其市场供应量在早期非常有限。其次,由于加密货币市场的不成熟,许多投资者并不知道如何购买和存储加密货币,因此可以在美股券商平台直接购买的 Grayscale 的加密信托基金被买出了溢价。

可以看到,ETHE 历史上溢价绝对值在 2019 年 6 月 21 日达到最高,直至 2021 年 2 月首次出现负溢价前,ETHE 都以较高的溢价在二级市场上交易, 2021 年 2 月后,市场处于牛市,伴随更多可追踪比特币/以太坊价格的指数产品推出,投资者可选择的投资方式增多,ETHE 开始以相对 NAV 更为平价的价格在二级市场上交易。

2021 年 6 月 29 日,GBTC 申请转为 ETF 被 SEC 驳回,仅一小时后 Grayscale 起诉 SEC,这影响 ETHE 折价进一步放大。2021 年中~ 2022 年底,随着数字货币市场整体见顶走弱,期间以三箭资本(3AC)和 BlockFi 等几家已宣告失败的加密公司为首的大型投机者因为杠杆过高或财务吃紧需要被迫出售基金份额,即便当时市场折价,他们无法等待,这同样进一步扩大了 ETHE 的折价。

图 2 : 2021 年初首次出现负溢价以来的折价/溢价变化情况 Vs. ETH 价格走势

来源:Tradingview, Trend Research

图 3 :ETHE 和 ETH 价格的相关性在大部分时间里都非常高

来源:Tradingview, Trend Research

总结来说,产生负溢价/正溢价背后原因为 Grayscale ETHE Trust 无法直接赎回的基金产品结构,产生正溢价的原因包括,产品可触达性高于 ETH 现货,相比自己保管私钥的成本 ETHE 更适合传统金融领域机构和小白散户投资;资产负债表入账处理、税收优势以及帮助投资者绕过合规相关问题;产生负溢价的原因包括无法直接申赎回的基金结构、套利机会的限制、机会成本的折现、竞争性产品的冲击四大原因有关,将在下文重点介绍。

1、无法直接申赎回的基金结构

根据法律文件只有 Grayscale 授权的参与者(Authorized Participants,简称 AP)可以直接向 Grayscale 购买和赎回 ETH。AP 需要满足一定的资格要求和监管要求,包括必须是注册经纪商或交易商,并且必须符合特定的监管标准。根据规则,该信托份额每 100 股为一组,AP 每次申购至少一组,并且只能用 ETH 现货兑换。

目前为止,AP 只有两家。在 2022 年 10 月 3 日此之前,DCG 旗下的 Genesis Global Trading, Inc. 是唯一的 AP;2022 年 10 月 3 日后,Grayscale Securities 取而代之成为了该信托的另一家唯一 AP。

所以,也可以理解成 Grayscale 自己扮演了 primary dealer 的角色,而其它投资人只能购买从他们手中流出的份额。所以尽管一些机构可能可以以一级市场的原价申购 ETHE 但从规则上来说,他们并非直接申购人,亦无权要求赎回。至于为什么这些机构要这么做可能有两个主要原因,一是看到二级市场溢价时的套利机会,二是把 Grayscale 当做托管机构避免自己管理私钥的风险和成本。

目前,信托基金没有运营股份赎回计划,因此 AP 和其客户也无法通过信托基金赎回股份。因此,参与者无法利用二级市场价格偏离信托 ETH 资产持仓每股净值时所产生的套利机会,这导致出现折价时价差难以恢复。若可以直接申赎,则市场参与者可以二级市场低价购买信托份额再从基金中赎回价值更高的 ETH,推动折价收窄。

2、套利机会的限制

由于无法直接申赎,带来了套利机会的限制,这点牛市存 ETHE 存在正溢价时阻碍并不明显,而熊市出现负溢价时则更加显著。

在传统 ETF 市场中, 当对 ETF 的需求增加或减少与资产净值相比的市场价格导致溢价或折价错误定价时,就会出现套利机会。 这种错误定价往往会通过套利快速自行纠正。

套利有两种主要模式,一是针对可以快速申购赎回的 ETF 份额和标的资产之间的基础套利,二是针对无法快速申购赎回的 CTA 策略套利:

基础套利

在溢价的情况下,投资者将通过向基金公司申购 ETF 份额并随后在二级市场卖出进行套利; 这将降低 ETF 的需求/价格。

在折价的情况下,二级市场购买 ETF 并在基金公司赎回更高的价值进行套利; 这将增加 ETF 份额的需求/价格。

CTA 策略套利

针对难以及时申购或赎回的 ETF,则可以使用押注 ETF 底层资产和 ETF 份额之间价差回归。当出溢价到某种程度时做多底层资产,做空 ETF 份额;当折价到某种程度时,做空底层资产,做多 ETF 份额。

该种策略的实施空间受到价值收敛通道的影响,在 ETHE 的案例里,由于价值回归主要依赖监管的判断,而不是市场参与者的某种确定的操作(例如申赎),所以不确定性较高,导致市场可以容忍的价差也较大。

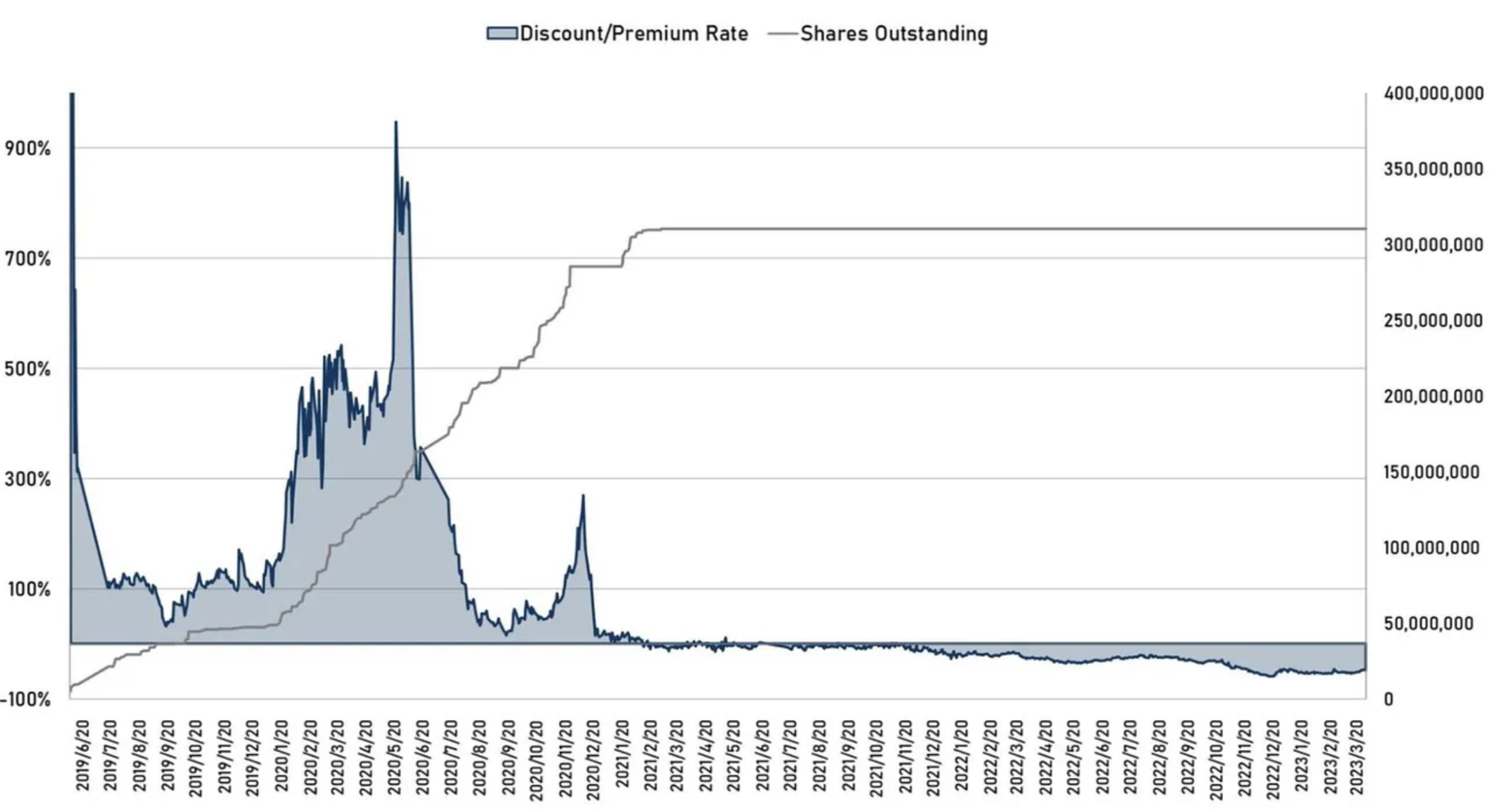

图 4 :ETHE 历史折价溢价率 Vs. 流通份额数量

来源:Graysacle, Trend Research

从上图可以看到,在溢价缩窄以后,2021 年春天以后,正向基础套利不复存在,新增的信托份额申购也停止了。

传统市场中也有一个经典的类似无法申赎的封闭基金的案例。这就是股神巴菲特的 Berkshire Hathaway 的股票,作为一家投资公司,其股票价格可能受到其投资组合中持有的公司股权价格波动的影响,但普通投资人无法要求 Berkshire Hathaway 兑付其名下的资产,也无法随时申购该公司的新股。

但过去几十年中,Berkshire Hathaway 的股票一直以高于其净资产价值的溢价交易,这主要得益于公司创始人沃伦·巴菲特的成功投资记录和市场地位。然而,在某些时期,公司股票的溢价水平可能会下降,反映出市场对公司的看法发生了变化。

例如, 2020 年 3 月,Berkshire Hathaway 的股票曾经下跌了约 30% ,导致公司股票交易价格出现了较大的折价。这个折价可能主要反映了市场对 COVID-19 大流行的担忧以及 Berkshire Hathaway 在旅游、航空、金融等受到疫情影响的行业中的暴露程度。

回到 ETHE 的案例,ETHE 在一级申购后要持有最少 6 个月后才可以在二级市场上流通,因此,正溢价的基础套利路径是存在的只是需要更长的时间。但 ETHE 在 2021 年 2 月首次出现负溢价后,投资者在一级市场的申购行为几乎停滞,这显然是因为负溢价基础套利需要赎回支持,而 Grayscale 开放该计划的时间表不明。所以,在 ETHE 的投资策略对比持有现货并无更多优势的情况下,其封闭份额很难像 Berkshire Hathaway 的股票一样重返溢价。

其次,随着数字货币市场整体见顶走弱,机构抛售方面,三箭资本(3AC)和 BlockFi 等几家已宣告失败的加密公司为首的大型投机者之前从 GBTC、ETHE 巨幅溢价中进行基础套利赚钱,进行了大量申购-等待 6 个月卖出的操作,随后因为杠杆过高或财务吃紧需要被迫出售基金份额,即便当时市场折价,他们无法等待。例如,已经公开的信息中可以看到今年早些时候 DCG 由于财务问题,被迫半价出售约 25% ETHE 持仓,放大 ETHE 负溢价空间。

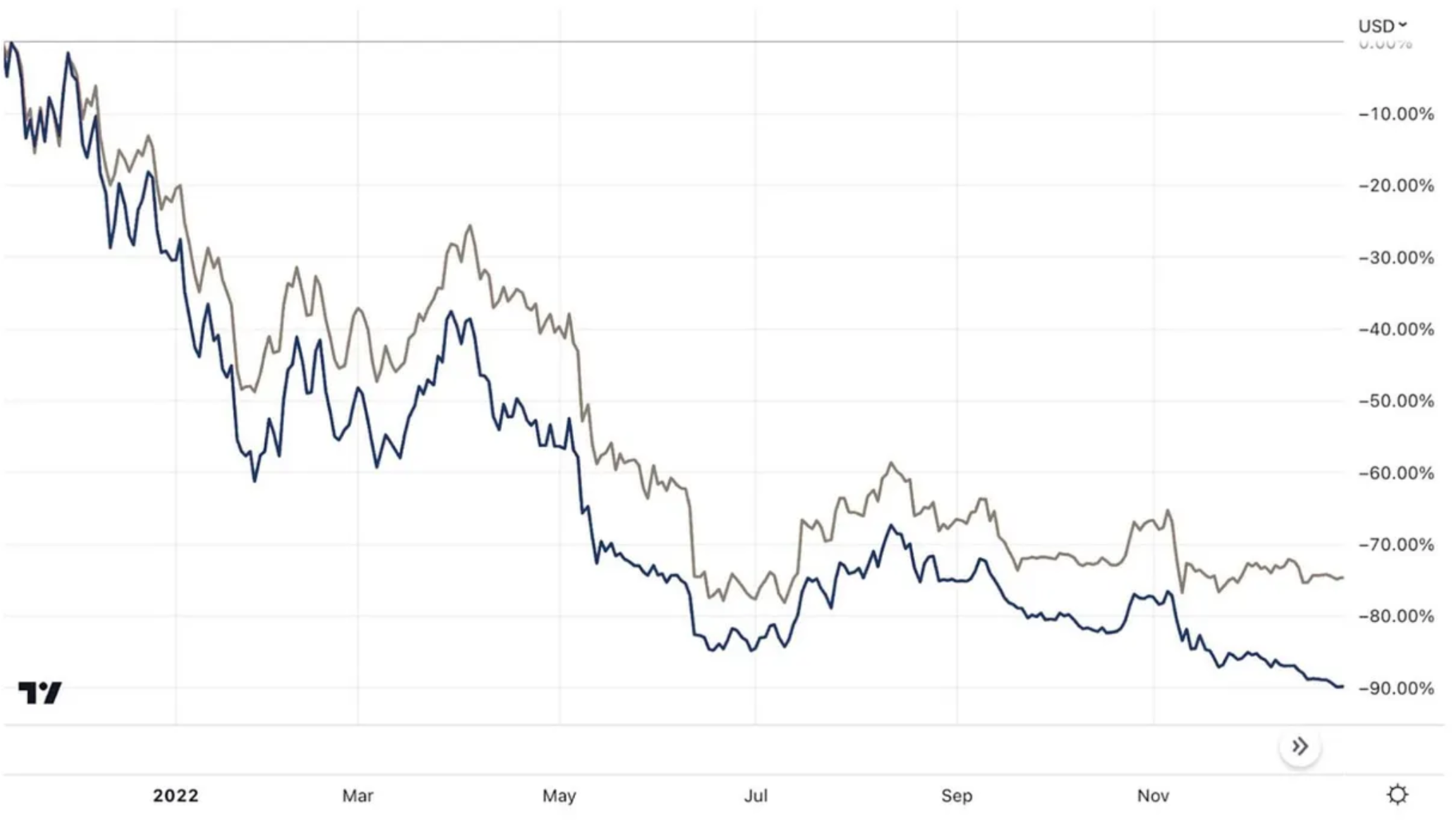

图 5 :ETHE 和 ETH 2021 年中高点到 2022 年底低点的表现对比:

来源:Tradingview, Trend Research

3、机会成本的折现

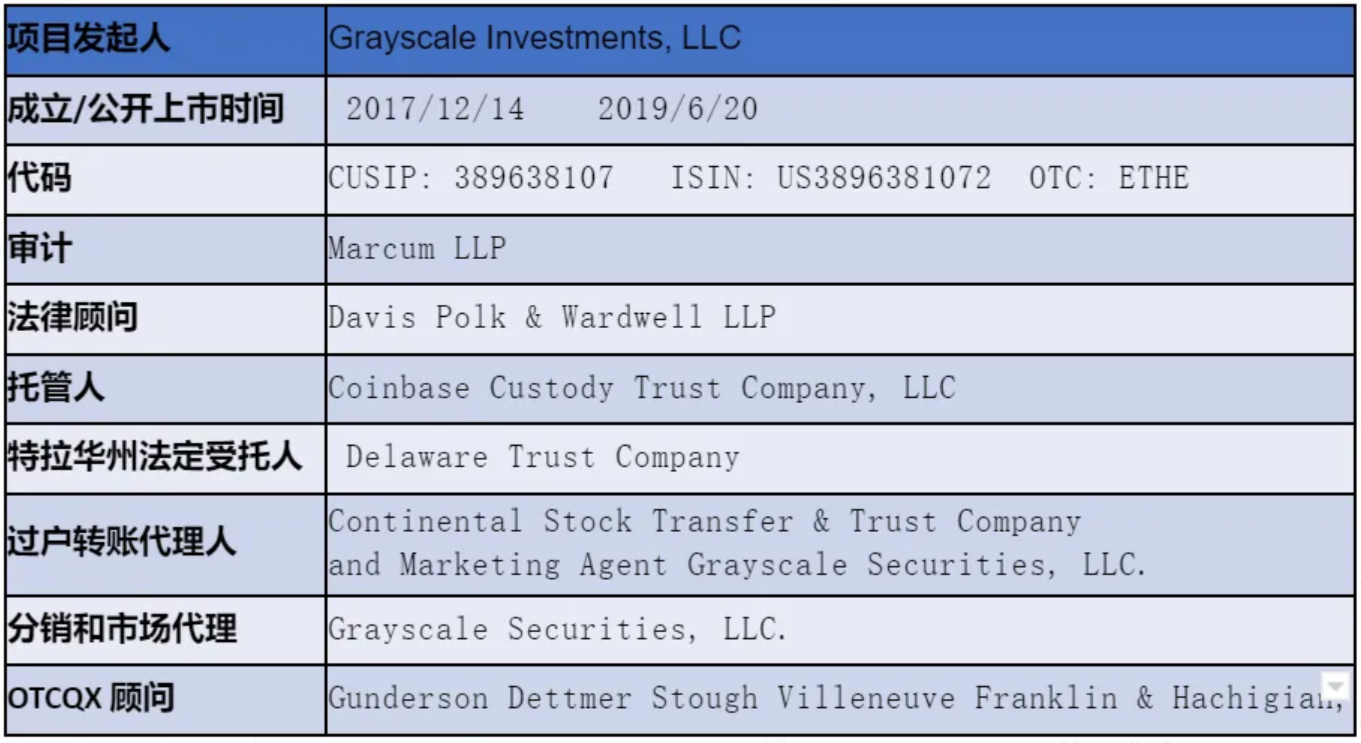

表 1 :ETHE 相关法律/财务信息(As of March 31, 2023 )

来源:Graysacle, Trend Research

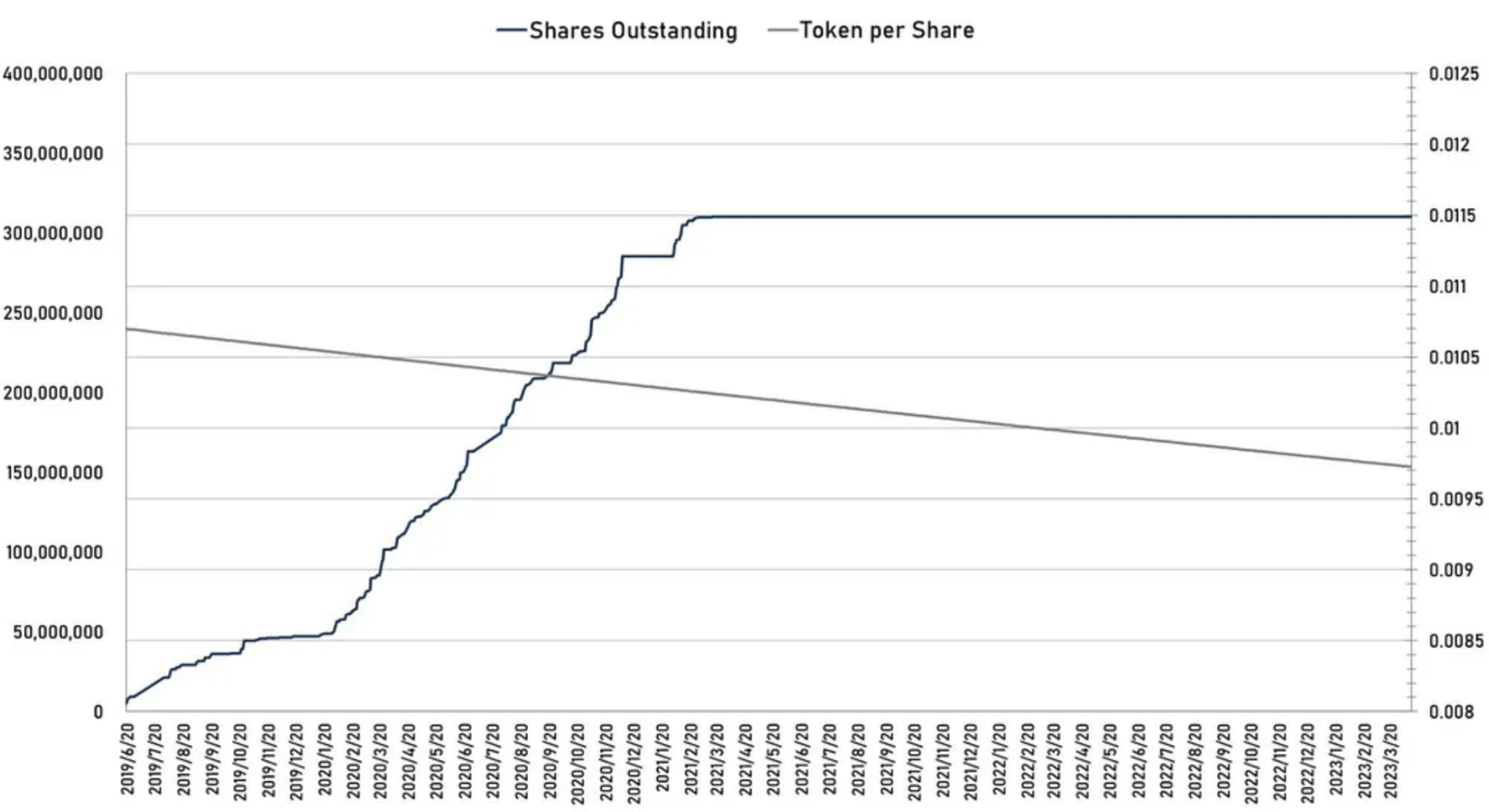

Grayscale Ethereum Trust 的管理费每年是资产净值(NAV) 2.5 %。在公开数据中,Grayscale 会将信托的预计应计但未付的费用每日扣减其 ETH 持仓,因此每股 ETHE 所代表的 ETH 数量是逐渐减少的,这点从下图里也能看到。

图 6 :ETHE 流通份额数量(左)Vs.每份额所对应的信托持有 ETH 数量(右)

来源:Graysacle, Trend Research

如果不考虑其它风险,如今的折价可以理解成持仓机会成本的折现。所以我们根据二级市场折价率 X 以及持仓的机会成本 Y 可以倒推出隐含的市场预期可赎回或恢复 NAV 平价所需的时间 T,我们假设 NVA 的潜在增长预期是 0 ,同时假设:

持仓机会成本+ 10 年期美国国债收益率+ 2.5% 管理费,则:( 1-Y)^T= 1+X

可得:T=ln( 1+X)/ln( 1-Y)

图 7 :ETHE 历史折价率 Vs. 隐含市场预期可赎回(恢复平价)时间(单位:年)

来源:Graysacle, Trend Research

从上图可以看出 2021 年中负溢价趋势形成以后市场对 ETHE 恢复平价的时间预期越来越长,在去年底由于监管打压+市场遇冷一度超过了 14 年,如今回落到 10 年左右。但我们认为这一预期仍然过长,待乐观预期来临之际这一隐含恢复时间可能回落至 2 年以下是较为合理的预期。最悲观的产品最终清算解散所需的时间预期可能才符合超过 10 年的定价,毕竟 Mt.Gox 的资产清算也才用了 9 年。

4、竞争性产品的冲击

2019 年以前,市场鲜有 Grayscale 信托产品的竞争者, 2021 年 2 月 18 日,Purpose bitcoin ETF-一支直接投资与比特币的加拿大基金正式开始交易,并在一个月内迅速累计超 10 亿美元的资产,而管理费 1% 只是 GBTC 的一半不到,其 ETF 结构可以跟密切的跟踪比特币,因此比 Grayscale 的产品更有吸引力。

而就在 2 个月后的 4 月 17 日,加拿大监管机构在同一时间批准了 3 支以太坊 ETF,分别是 Purpose Investments 的以太坊 ETF(ETHH)、Evolve 资本集团的以太坊 ETF(ETHR)以及 CI 全球资本管理公司的以太坊 ETF(ETHX),且三支都于 4 月 20 日上市。根据三家官网显示,三支以太坊 ETF 的管理费略有差距,CI Global 的管理费 0.4% ,Evolve 为 0.75% ,而 Purpose Investments 的管理费则是 1% 。上市首日,Purpose 以太坊 ETF 吸引了 2646 万加元(约合 2132 万美元)的资金,Evolve 的 ETHR 筹得了 222 万加元(约合 179 万美元)的资金,而 CI Global 的 ETHX 的资产规模为 225 万加元(约合 181 万美元)。

3 日后, 4 月 23 日,加拿大的第四支以太坊 ETF 也开始在多伦多证券交易所进行交易,这是由加拿大数字资产管理公司 3 iQ 和投资公司 CoinShares 联合推出的,提供加元份额(ETHQ)和美元份额(ETHQ.U)的交易。jin ri

除此之外,还有更多的 ETH 期货 ETF,相关股票,包括持币的上市公司,挖矿和资管业务等上市公司市占率增大,这些多样化的投资渠道弱化了 Grayscale 信托产品对传统金融投资机构和散户的稀缺性,成为 Grayscale 不得不考虑的竞争因素。

主题 2 :何时折价可能缩减-消失

有七种情况可以导致折价收窄甚至消失:包括开放赎回 ETH 现货(分为赎回获得 SEC 豁免以及 ETF 转换申请通过两种情况)、获得赎回豁免、产品解散清算、Grayscale 自行回购、套利策略的发展和市场信心的提升、机会成本的下降有助于折价修复。

1.监管环境的改善 — — ETF 申请通过

根据最新的一份 Grayscale 2022 年底发布发的 FORM 10-K 申报文件具体看来,他们依旧认为在获得 SEC 批准 ETF 转换后,其信托可以开展赎回计划。尽管 SEC 已经拒绝了将 GBTC 转换为 ETF 的申请,但美国联邦上诉法院法官在今年 3 月质疑 SEC 这一决定是否正确,因为该机构此前已批准比特币期货 ETF 产品。

需要注意的是,Grayscale 目前仅针对 GrayscaleBitcoin Trust (GBTC) 提出了 ETF 转换申请,尚没有公布将 Grayscale Ethereum Trust(ETHE)转换为 ETF 的计划。但最近的进展无疑是积极的,在 今年 3 月 7 日举行的最近一次听证会上,Grayscale 辩称,SEC 应用的标准存在不一致,因为他们批准了比特币期货 ETF 的申请,但一直拒绝现货比特币 ETF 的申请。

Grayscale 认为,由于这两种产品的基础资产相同,并且它们的价格都来自比特币,华尔街监管机构应该对这些产品进行类似的处理,但事实并非如此。Grayscale 声称监管机构的行为是武断和反复无常的,因此违反了美国联邦法律。SEC 回应称,它一直在应用相同的标准,但产品实际上是不同的。根据 SEC 的说法,比特币期货市场受 CFTC 监管,这使其不同于现货 BTC ETF,他们认为后者不受监管。

在听证会之前,彭博分析师 Elliot Stein 认为 SEC 在诉讼中具有优势,并且他们胜诉的几率远高于 GBTC 发行人,因为法院倾向于服从联邦机构,因为他们是各自领域的专家。然而,在听取最新论据后,Elliot Stein认为 Grayscale 有 70% 的胜算机会。若 GBTC 获批, 也会直接利好 ETHE 的情绪。不过需要注意的是与 BTC 已有基于期货的 ETF 被 SEC 批准上市不同,SEC 尚未批准任何基于以太坊的基金上市,这与有关以太坊的法律地位仍存在争议有关。

2.监管环境的改善 — — 成为注册投资公司或被认定为商品

Grayscale Ethereum Trust(ETHE)是一种注册的投资信托,而不是注册的投资公司。具体来说,是根据特定州的法律成立的信托,并且在美国证券交易委员会(SEC)根据 1933 年证券法规定的豁免条款下进行注册。这意味着 ETHE 不需要遵守 1933 年证券法规定的某些要求,例如向公众披露信息和进行注册等。

然而,如果 SEC 认为信托需要根据 1940 年投资公司法案需要注册成为投资公司,则 Grayscale 认为此种情况下信托架构可以解散,并且其份额可能会被转换为股票,但这只是一种猜测,最终取决于公司具体情况和监管意见,以及交易所的规定。

另外如果 ETHE 被 CFTC 认为是一种商品投资组合,需要符合《商品交易法案》(CEA)的相关规定并向 CFTC 进行注册和监管,也是一种可能的监管方向。

3.获得赎回豁免

其实 Grayscale 一度提供赎回计划,但该计划在 2016 年被 SEC 指控违反 Regulation M,因此被叫停。具体来看 SEC 担心 Grayscale 信托在创建新股份的同时进行股份赎回,可能会影响市场价格,导致市场操纵、内幕交易或不公平的交易实践。所以此后 Grayscale 暂停了 GBTC 的赎回计划,并且在后续发行的 BCH 和 ETHE 等信托基金都沿用了该操作,以确保其交易实践符合适用的法规和监管要求。

由于 Grayscale 目前不认为 SEC 当前会考虑豁免持续的赎回计划,因此,信托也没有寻求从 SEC 获得相关监管批准的动作。

但未来不排除主动寻求这种豁免的可能性,尽管时间和成功概率都不确定。并且开发赎回资产会让作为信托管理人的 Grayscale 收入减少,眼下其主动追求申请赎回豁免动力或不足。

如果获得了这样的豁免并且 Grayscale 同意赎回,赎回计划可以开展。赎回计划将使授权参与者(AP),在信托份额市值偏离 ETH 持仓价值、减去基金费用和其他负债的价值时,得到套利机会。这种套利的机会可能会被 AP 独占,也有可能被 AP 转移给客户,目前尚不清楚,因为目前仅有 Grayscale 关联公司作为独家 AP,独占可能引发不公平竞争的担忧。

4.折价与市场情绪的关系,套利策略的发展和市场信心

前文我们论述了折价套利的路径不通顺所以导致折价无法明显修复的问题。但是另一方面,因为 CTA 策略的存在,当加密市场整体进入积极势头时,即便当下仍然不能赎回,套利交易者也可能将折价区间压缩。因为自 2019 年 ETHE 诞生以来,该产品还尚未经历完整的“周期”。我们认为一个完整的周期应遵循 溢价→平价→折价→平价→溢价 的循环,目前 ETHE 产品只走完了前一半的周期。

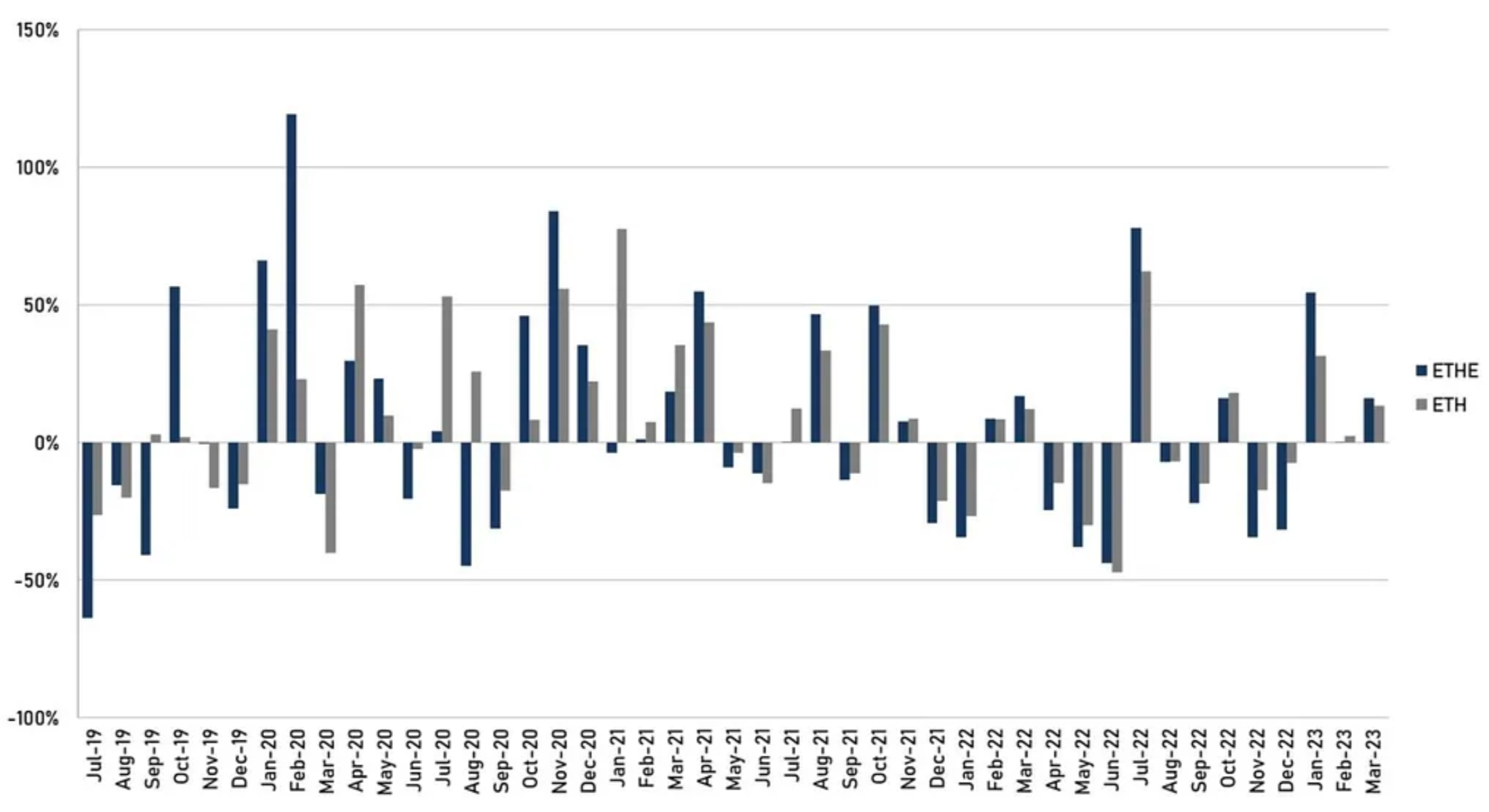

图 8 :Annual Return ETHE Vs. ETH(可看出以年为周期的长期表现上 ETHE 不及 ETH)

来源:Graysacle, Trend Research

图 9 :Monthly Return ETHE Vs. ETH(可以看出在短周期表现上 ETHE 弹性大于 ETH)

来源:Graysacle, Trend Research

从上图年度和月度回报对比可以看出,在 2019 – 2022 属于“溢价→平价→折价”周期,这一周期可以理解成消泡沫周期,ETHE 是不具备超额收益的,在此期间投资并非好选择。然而由于 ETHE 产品弹性大于 ETH 本身,所以在未来“折价→平价→溢价”的修复周期中,理应创造更好的正向收益,事实上从今年过去的 3 个月的表现对比中也明显可以看到这一点,ETHE 的涨幅是 ETH 的 1.7 倍。

5.无法转换 ETF 最终信托解散清算的情形

若即无法获得赎回豁免也无法获批 ETF 转换,这样的情况若持续太久,由于基金管理在不断扣费可能引发投资人不满,所以 Grayscale 会面临较大的清算解散压力。一旦清算确认,则二级市场针对 NAV 的折价可能很快恢复。

事实上已经破产的 FTX 其附属公司 Alameda Research 在 2023 年 3 月已起诉 Grayscale Investments 及其所有者 DCG 集团,攻击 Grayscale 收取高额费用,并拒绝让投资者从 GBTC 和 ETHE 赎回,Alameda 称由于这样的结构导致它正遭受“数亿美元的损失”。类似的情形随着时间的推移可能越来越多。

此外,根据申报文件,可能触发 ETHE 信托提前终止并清算的主要情况还包括:

美国联邦或州监管要求信托基金关闭,或者强制信托基金清算其 ETH,或者查封、扣押或以其他方式限制信托基金的资产使用;

如果 CFTC 或 SEC、FinCEN 等监管机构认为该信托需要遵守特定的法规和规定,Grayscale 可能会选择解散信托,以避免不必要的法律责任和财务风险;

Grayscale 认为信托的资产与费用相比风险、成本与收益不成正比;

信托牌照被吊销;

信托无法转换或使信托合理努力将比特币转换为美元变得不切实际;

托管人辞职或被解雇而没有替代人选;

该信托变得资不抵债或破产。

6.Grayscale 自行回购

假设一种极端情况,即 Grayscale 愿意回购市场以低于 NAV 的成本上所有流通份额,并决定将信托私有化或解散清算,这样的操作显然是有利可图的。并且宣布大额回购计划有助于提升市场信心,可能利于折价回归。

Grayscale 的母公司 Digital Currency Group 2021 年~ 2022 年曾陆续宣布总计高达 10 亿美元的信托份额回购计划。但此后 GBTC 仍然以低于 NAV 的价格交易,这可能是因为回购规模相对数百亿美元的总体资管规模来说杯水车薪,尽管二级市场回购助于缩小价差。

此外,在 Grayscale 首席执行官 Michael Sonnenshein 2022 致投资者的年终信中提到,如果 GBTC ETF 没有实现,其中一项让投资人解锁的方法就是要约收购,例如回购 GBTC 不超过 20% 的流通股。如此事发生,应该会兼顾所有旗下信托产品,ETHE 的折价也可能收窄。

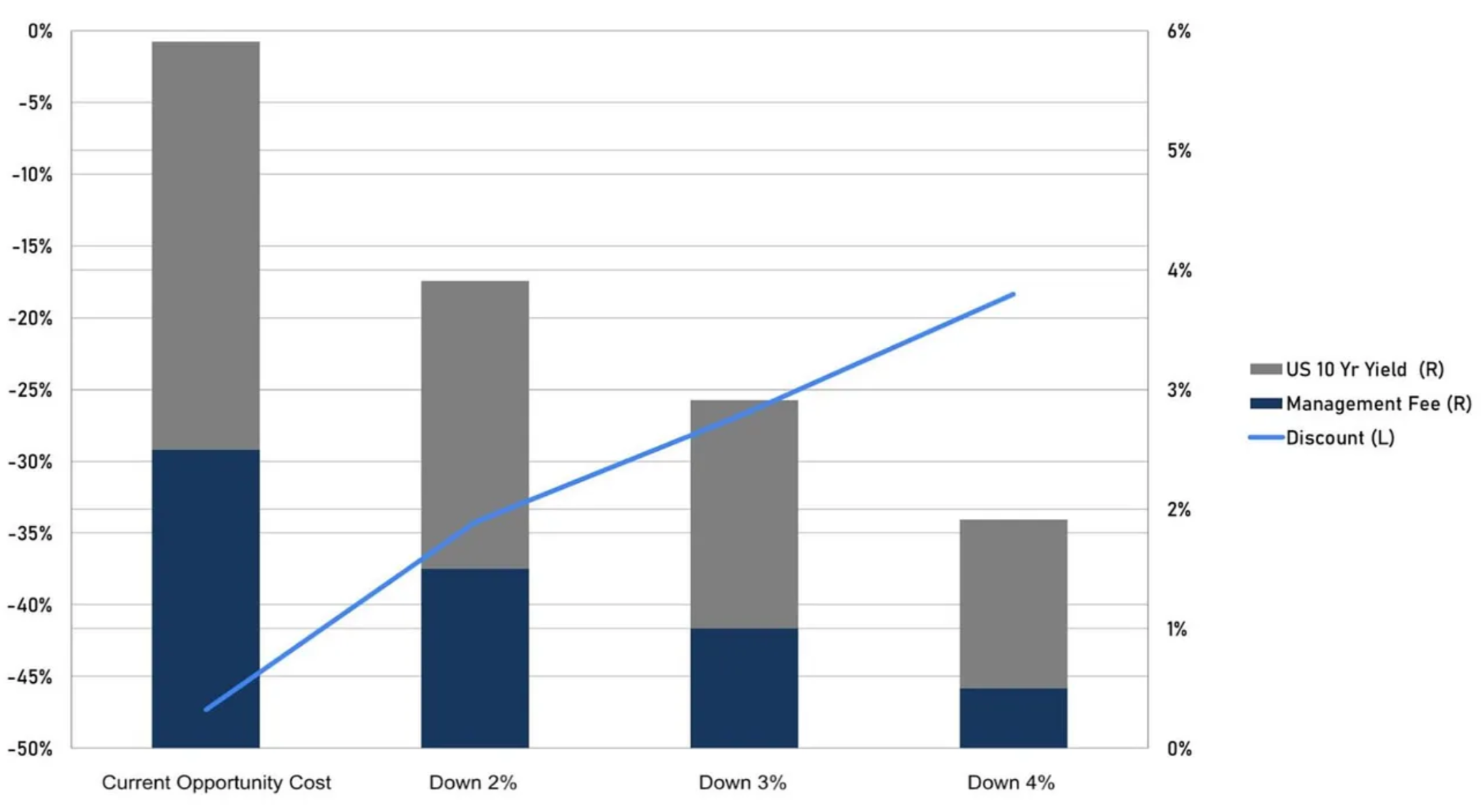

7.机会成本下降

根据我们在主题 2 中讨论的如今的折价部分可以理解成为机会成本的折现,所以如果 Grayscale 削减管理费用,或者市场无风险利率下降,将在同样的恢复平价时间预期的基础上有助于折价收窄,事实上Grayscale 首席执行官 Sonnenshein 在今年 3 月份也曾提到可能削减费用。

即便现在 10.5 年的预期不变,进行简单模拟:

10 年期国债与管理费各下降 1 个百分点,此时机会成本是年化 3.91% ,可帮助折价从 -47.3% 收窄到 -34.2% ;

若各下降 1.5 个百分点,此时机会成本是年化 2.91% ,则折价或收窄到 -26.7% ;

若各下降 2 个百分点,此时机会成本是年化 1.91% ,则折价或收窄到 -18.35% 。

图 10 :无风险利率下降可能带来的折价收窄模拟

来源:Graysacle, Trend Research

主题 3 :为什么适合专业投资者押注加密市场

Grayscale 数字货币信托产品在可触达性、资产负债表入账处理、相比自己保管私钥的成本优势、投资税收优势等方面的优势,并且截止目前,ETHE 仍是美股市场提供的唯一将以太坊现货作为其主要资产的“股票”。

具体看来:

可触达性:Grayscale 数字货币信托份额可以通过常见的美股券商进行交易,这意味着投资者可以更容易地买入和卖出这些产品。相比之下,通过加密货币交易所或其他渠道进行交易,这可能会涉及到更多的风险和手续费。

资产负债表管理:Grayscale 数字货币信托产品是一种证券产品,这意味着专业投资者不必担心如何在资产负债表中处理自己的数字资产,并且可以更容易地将其纳入自己的投资组合中。

托管成本优势:相比于自己保管私钥的数字货币,Grayscale 数字货币信托产品可能具有更低的成本。例如在链上购买数字货币时,投资者可能需要承担较高的学习成本和网络费用。并且在保管私钥时可能面临泄露风险,面临一旦丢失可能完全无法回收资产的可能性。而在购买和销售 Grayscale 数字货币信托产品时,投资者只需要支付与证券交易相关的佣金和费用。

投资税收优势:根据美国税法,Grayscale 数字货币信托产品被视为证券产品,因此可能享有与其他证券产品相同的投资税收优惠。例如,在长期持有 Grayscale 数字货币信托产品超过一年后出售,投资者可能可以享受更低的资本利得税率。

假若押注潜在的牛市,则 ETHE 具有更好的弹性:

2022 年底以来的牛市反弹,ETHE 最高 107% ,远大于 ETH 的 61% ,可见在折价周期中已经计入了相当多悲观因素,所以当市场反弹时,ETHE 的弹性大于 ETH,是对牛市更好的押注。

图 11 :ETHE 和 ETH 2022 年底以来底涨幅对比

来源:Tradingview, Trend Research

主题 4 :ETHE 投资的风险

1.政策和机制风险

对 ETH 或任何其他数字资产的认定为“证券”可能会对 ETH 和该股票的价值产生不利影响;

任何司法辖区限制 ETH 的使用、验证活动或以太坊网络或数字资产市场的运作,可能对该股票的价值产生不利影响;

法规变化或解释可能会强制信托注册并遵守新的法规,这可能会对信托产生额外支出;

因为 Grayscale 的关联公司是唯一可以创建或销毁基金份额的机构,不管因为监管限制,还是技术原因,都可能导致发行和销毁的数量未必可以高效的根据市场需求调节,进而导致二级市场交易价格可能经常大幅偏离 NAV;

2.统计特征风险

历史上看 ETHE 的风险回报比不佳,如表 2 可见 ETHE 几乎在所有方面相较于 ETH/USD 表现较弱。意味着如果准备长期持有 ETHE 可能要做一些针对性的收益增强策略,否则如果牛市不能快速到来的话其表现有弱于大盘的风险。

表 2: Risk and Return Metrics (Jul 2019 — Mar 2023)

来源:Graysacle, Trend Research

收益率:无论是月度还是年化的算术平均收益率、几何平均收益率,ETH 的表现均优于 ETHE。特别是在年化收益率上,以太坊美元达到了 150.24% ,而灰度以太坊信托仅为 102.18% 。年化几何平均收益率方面,以太坊美元达到了 62.90% ,而灰度以太坊信托则为-11.12% 。

风险调整收益:从夏普比率、索提诺比率和特雷诺比率等风险调整收益指标来看,ETHE 在调整风险后的收益表现均弱于 ETH。

波动性:ETHE 的波动性(标准差)较高为 137.75% ,这意味着投资者可能面临较大的价格波动风险。相比之下,ETH 的波动性较低为 100.48% 。

最大回撤:ETHE 的最大回撤达到了-89.6% ,高于以太坊美元的-77.96% ,这意味着在过去的表现中,ETHE 在最糟糕的情况下损失更大。

主动回报和信息比率:ETHE 的主动回报为-74.02% ,信息比率为-0.73 ,这意味着相比于以太坊美元,灰度以太坊信托在主动管理方面的表现较差,尽管这主要由于二级市场价格波动造成,基金持仓资产并没有因为主动交易变少。

关于如何针对 ETHE 做收益增强确保穿越牛熊,我们会在系列报告的第二篇进行探讨。