GMX的挑战者们:盘点7个GMX分叉项目

原文标题:《GMX 的挑战者们》

原文来源:DODO Research

原文作者:Flamie

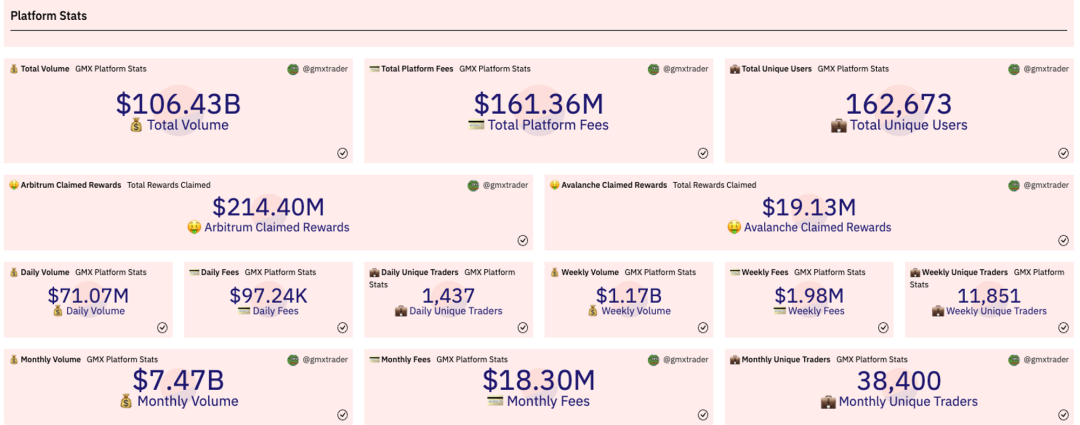

自 22 年 GMX 代币上线币安后,GMX 的各项数据接连创下新高。截至目前,GMX 的平台总交易量已超过 1000 亿美金,AUM 超 10 亿美金,独立地址超过 16 万,分发给用户的费用超过 1 亿美金。

https://dune.com/gmxtrader/gmx-dashboard-insights

在正式上线至今近 1 年半的时间里,GMX 一直在质疑的声音下运行,但在真实收益(real yield)叙事下, GLP 的“对赌”模式渐渐被人们所接受。

截至目前,由 Defillama 统计的已上线 GMX fork 协议已经有近 20 个,分布在不同链上,下面我们将挑选七个代表项目进行盘点。

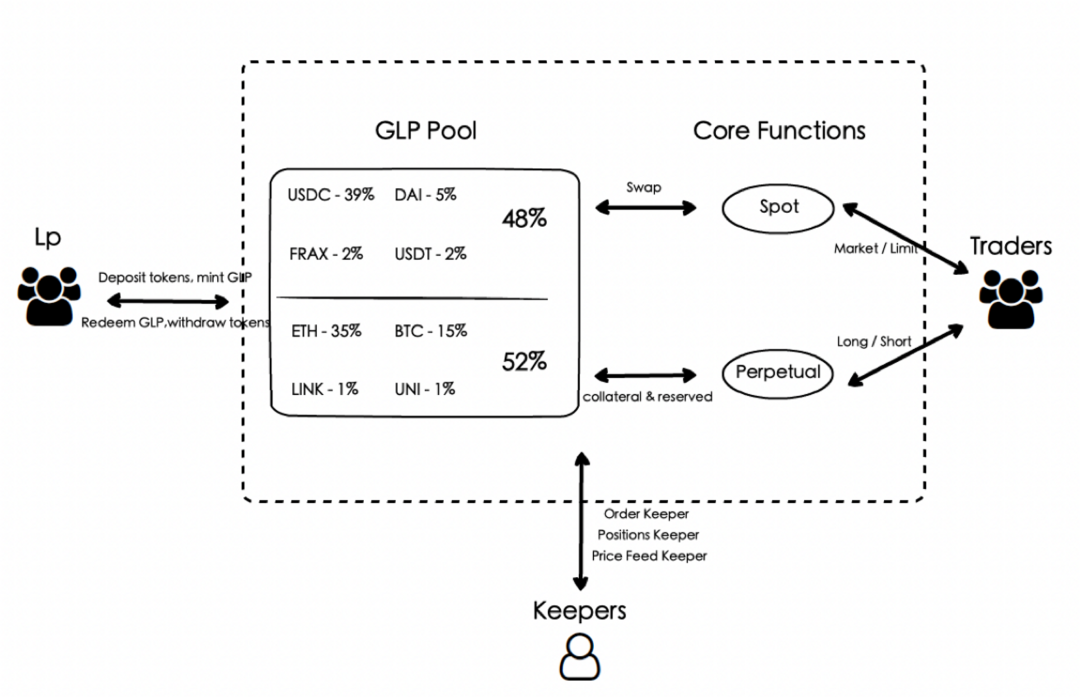

GMX 机制图解

GMX 的 forks

1. Mummy Finance

Mummy Finance 是由 Fantom 基金会支持的 GMX fork。机制上,Mummy Finance 在冷启动代币的分发上新增了使用 NFT 发放 esMMY 并给予了 NFT 持有人 80% 的国库 FTM 分红。在费用分配上将 MLP 的比例由 70% 下调至 60% ,其中 5% 分配给开发团队, 5% 用于回购并添加 Equalizer(Solidly fork)的 MMY-FTM LP。此外,除了 MLP 中有 FTM 作为一揽子资产外,其余机制与 GMX 相同。

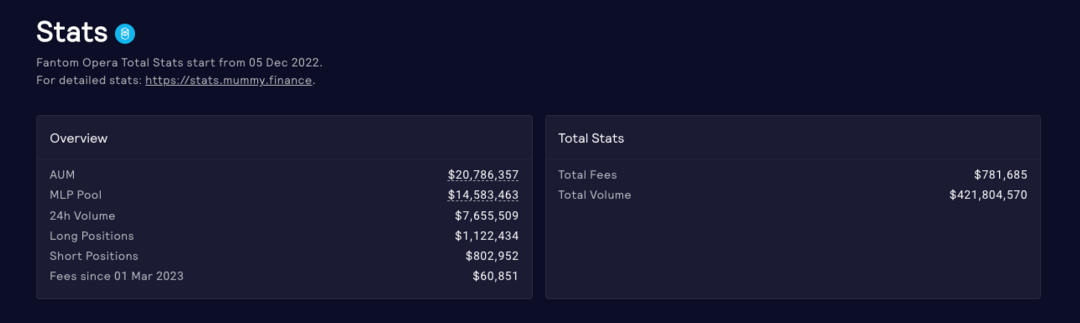

截至目前 (数据均为 3 月 5 日),Mummy finance 的平台交易量已超过 4 亿美金, MLP 已有近 1500 万美金的 TVL,产生了约 78 万美金的费用,数据并不亮眼。

https://app.mummy.finance/#/dashboard

2. Vela Exchange

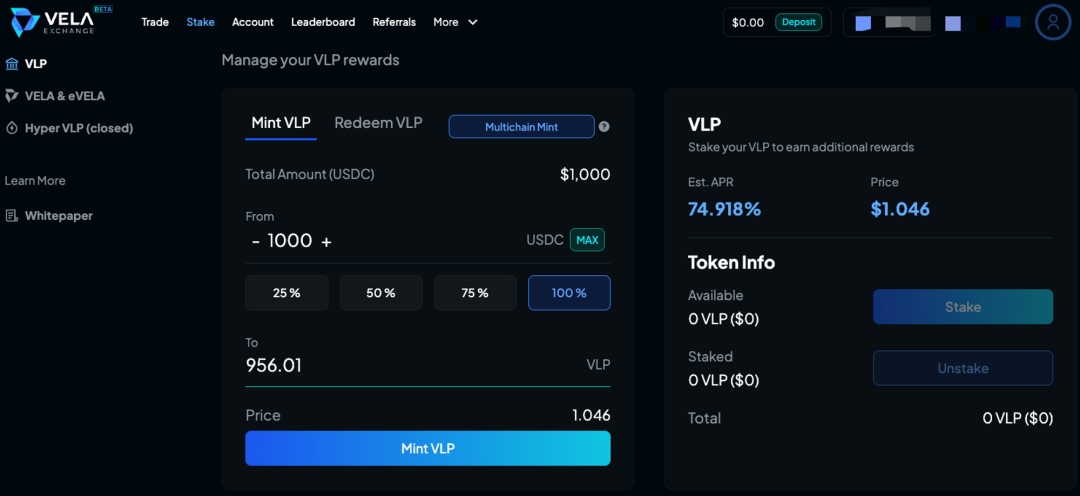

Vela Exchange 的前身是 Dexpool,一个 OTC 市场。而严格意义上讲,Vela 也不完全是 GMX fork,其还融合了 Gains Network 的机制。Vela 效仿 Gains 的 gDAI,使用 USDC 铸造 VLP 且可以进一步抵押获取 eVELA。Vela 允许用户交易多品种的资产,并支持用户更多管理头寸的功能,例如当前头寸多次止盈、随时更改仓位中抵押品的数量、随时增加已开仓位的杠杆等等。

有别于 GMX,Vela 的资产喂价相对去中心化一点,仅部分合约地址拥有管理员身份,相对降低了作恶风险,且价格会在每一分钟或当价格波动多于 0.1% (外汇则是 0.02% )时刷新。Vela 还增加了 GMX 没有的实时资金费率,在用户开仓后实时计算且在仓位中自动扣除。

由于没有波动资产,VLP 持有者只有在交易者获利时才会亏损。协议费用的 50% 以 USDC 形式分配给 VLP 持有人, 10% 以 eVELA 形式分配给 VLP 质押者, 5% 以 USDC 形式分配给 VELA 质押者, 10% 以 eVELA 形式分配给 VELA 质押者,其余 25% 归项目所有。

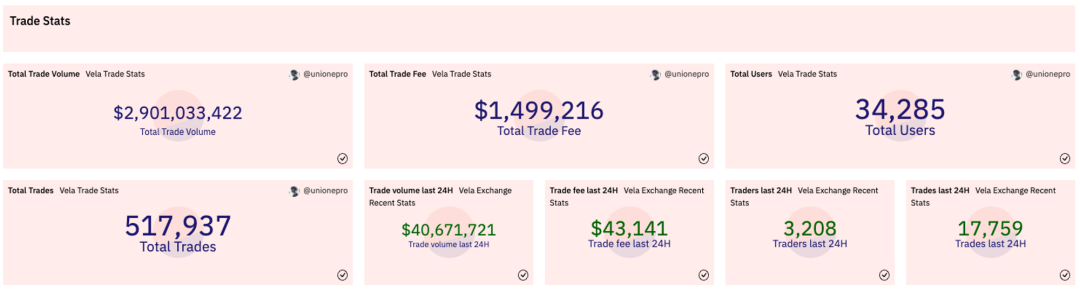

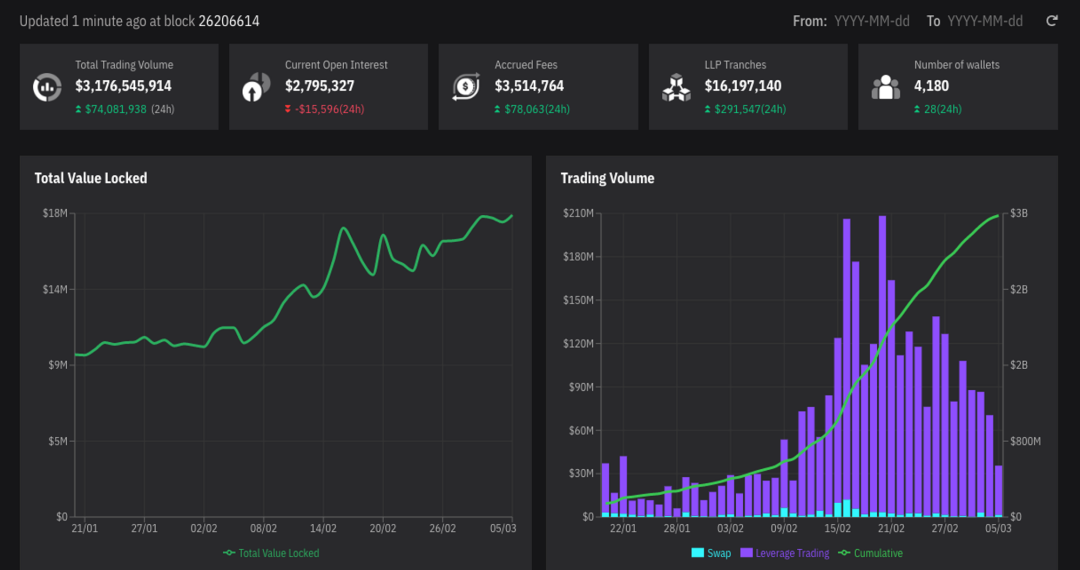

截至目前,拥有 VC 支持的 Vela 在上线短短几周内拥有近 30 亿美金的交易量,产生了仅 150 万美金的交易费用。配合近期的交易激励活动,Vela 数据仍呈现明显的上升趋势。

https://dune.com/unionepro/vela-exchange-stats

3. Mycelium

Mycelium 是由前 BitMEX 创始人 Arthur Hayes 支持的协议,由 TracerDAO 合并而来。其 GMX fork 产品名为 Perpetual swap。其中,MLP 的经济模型与 GLP 几乎相同,非稳定币资产的交易费用为 0.4% ,稳定币资产为 0.03% 。MYC 质押奖励来自 10% 的平台费用,有 14 天提取时间。对于 LP 部分奖励的 esMYC,没有复投的乘数奖励;且选择线性赎回的周期缩短,相比 GMX 变为 6 个月。

此外,与 GMX 最大的不同是 Mycelium 宣称可交易品种更广泛,涉及外汇、商品期货等,但目前除 BTC、ETH 外仅支持 WTI 原油期货。截至目前,Perpetual swap 的 TVL 只有约 600 万美金,但总交易量达到 17 亿美金,产生了超过 160 万美金的协议费用。

https://swaps.mycelium.xyz/dashboard

4. MUX Protocol

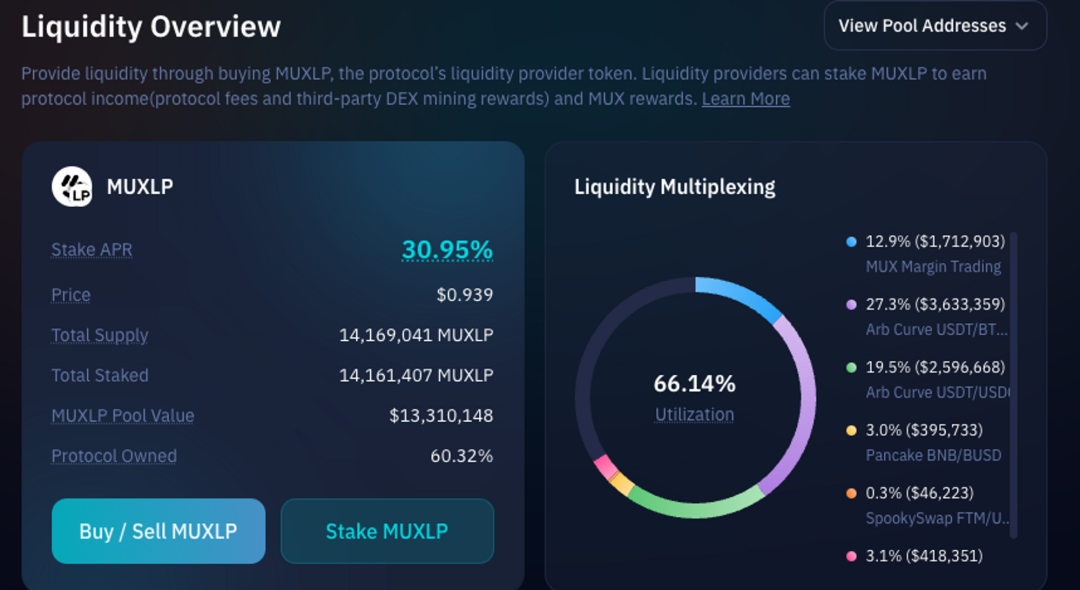

MUX 的前身是 MCDEX。在彻底转型做 GMX fork 的过程中,团队在其 V2 版本中做出了一个非常亮眼的改动,即做一个 Perp 聚合器,自建了流动性路由。允许用户一键开仓将杠杆头寸合理分配至不同衍生品协议。在聚合交易的过程中,因为不同平台支持的最大杠杆差异与清算阈值的不同,MUX 为用户提供了额外的保证金已保护用户蒙受损失。

此外,MUX 还聚合了用户的稳定币与波动资产,利用一部份去做衍生品市场的流动性,其余放到其他生息协议中为用户赚取额外收益。在未来推出的 V3 版本中,MUX 还将支持跨链聚合的功能,统一 Arbitrum、Optimism、BNB Chain、Avalanche 和 Fantom 之间的衍生品流动性。

截至目前,MUX 协议的交易量呈现了相较其他 fork 协议更健康、稳定地增长趋势, 7 日交易量超过 6000 万美金,独立地址数也超过 1 万。

https://stats.mux.network/public/dashboard/13 f 401 da-31 b 4-4 d 35-8529-bb 6 2c a 408 de 8

5. Level Finance

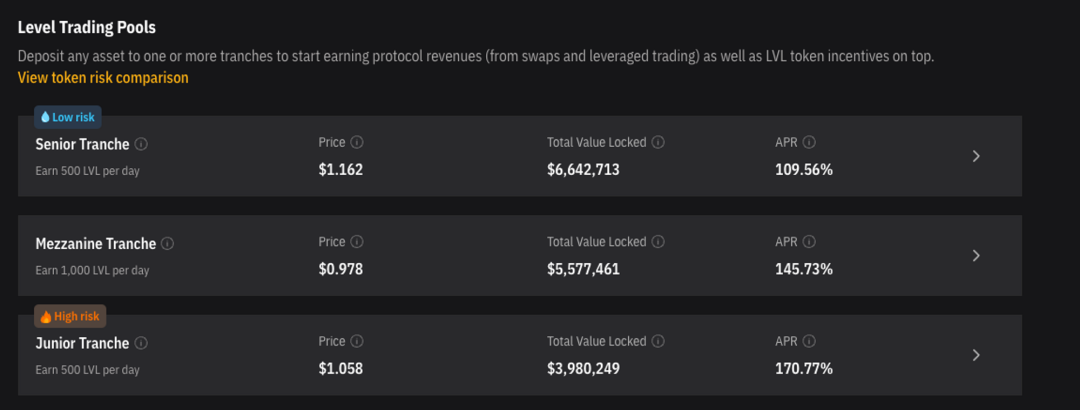

BNBChain 上的 Level Finance 也是一个十分有特色 GMX fork 协议。Level 利用分级基金的思路,为不同的比例的一揽子资产赋予了不同的激励与收入分配,为用户提供了多种配比的 ETF 选择。

https://app.level.finance/

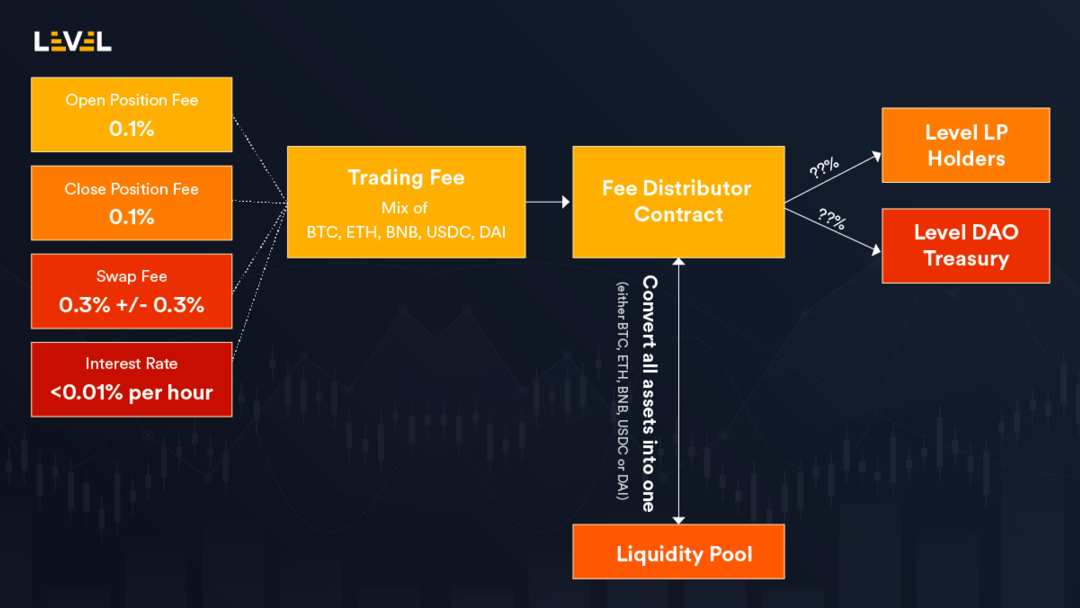

值得注意的是,Level 采用了双代币模型,LVL 作为激励代币补贴所有 Tranche,LGO 作为纯治理代币参与 50% 协议费用的再分配(另 50% 通过 lyLVL 分配给所有 Tranche)。此外,Level 基本的非稳定币资产的交易费用为 0.2% ,稳定币资产为 0.01% ,动态范围为 0 - 0.6% 。

https://app.level.finance/

截至目前,交易员为 Level finance 贡献了超过 30 亿的交易量, 数据虽不如 Vela 爆炸,但也稳定运行了近 2 个月,但其双代币的博弈设计还有待考验。

https://app.level.finance/analytics/overview

6. El Dorado Exchange

在 BNBChain 上,除了 Level finance,还有一个做了微创新的 GMX fork — El Dorado Exchange。El Dorado 在 Level 的分级概念上又加入了由协议费用支持的稳定币 EUSD, 60% 分配给 ELP, 40% 分配给 gEDE 持有人。

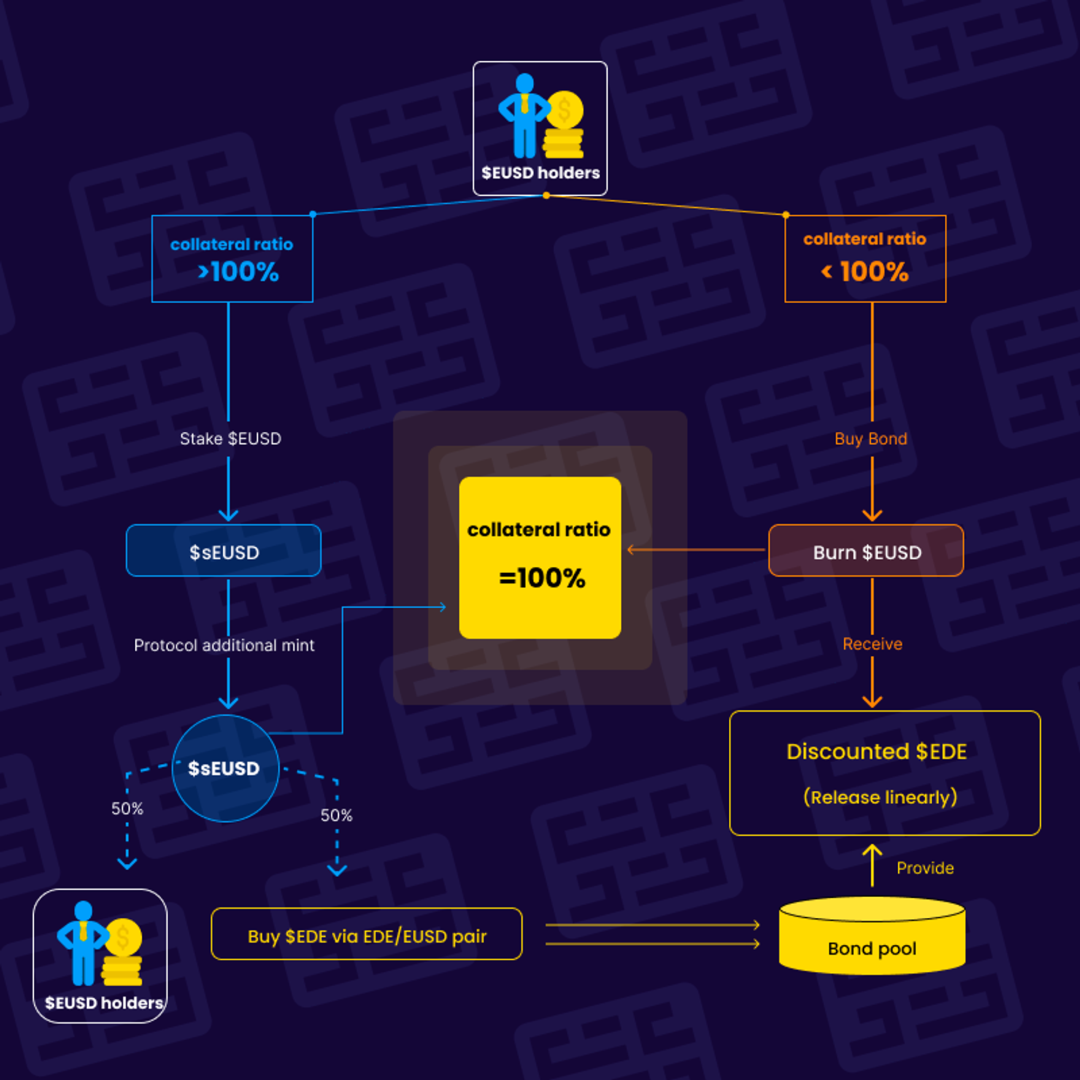

由于 EUSD 需要维持锚定,因此还有在抵押品价值波动时候维持锚定的 Stake & Bond 机制:

当价格上涨抵押率大于 100% 时,启用 Stake 机制,用户质押 EUSD 获得利息奖励,EUSD 总量增加,抵押率回到 100% ;

当价格下跌抵押率低于 100% 时,Bond 机制启动,用户将 EUSD 出售给协议获得相当于打折的 EDE 代币。协议销毁用户出售的 EUSD,并将抵押率逐渐拉回 100% 。

https://docs.ede.finance/tokenomics/usdeusd

数据上,由于与 Level 过于同质化,El Dorado 数据上被压了一头。El Dorado 已在尝试多链运行,即将已扩展至 Arbitrum。

除了上述协议外,还有像 Metavault(Polygon)、Madmex(Polygon)、Tethys Perpetual(Metis)、Lif 3 Trade(Fantom)、OPX(Optimism)等基本与 GMX 同质化的 Fork 运行在各自的生态上。可见绝大多数的 GMX fork 都是社区项目,GLP 与交易员“对赌”的模式收到了社区的认可,伴随着高额的 LP 激励,如此数量的 fork 是否让你想起了曾经 Defi summer 的 Uniswap V2 fork 潮呢?

如今的 GMX 仍有不少缺陷:中心化的预言机喂价、没有双边的资金费率、GLP 未平仓合约量的限制、熊市单边下跌可能的踩踏,也曾发生过在 Avalanche 上因 AVAX 深度差预言机价格被操纵,致使 GLP 蒙受损失的情况。而 20 年中的 Uni V2 也饱受诟病:LP 只能靠协议撒币补偿巨大的无常损失、没有足够护城河(Sushiswap Vampire Attack)、资金利用率低等。

可以预见的是,GMX 上述机制的不足也将很快被 X 4 的合成资产版本迭代或由新协议做出更灵活的创新。目前,有几个有资本支持且仍未被广泛关注的协议值得跟踪:

Lighter,由 a16z 支持的衍生品协议,机制不详。

Vest Exchange,由 Jane Street 支持的类 GMX fork。

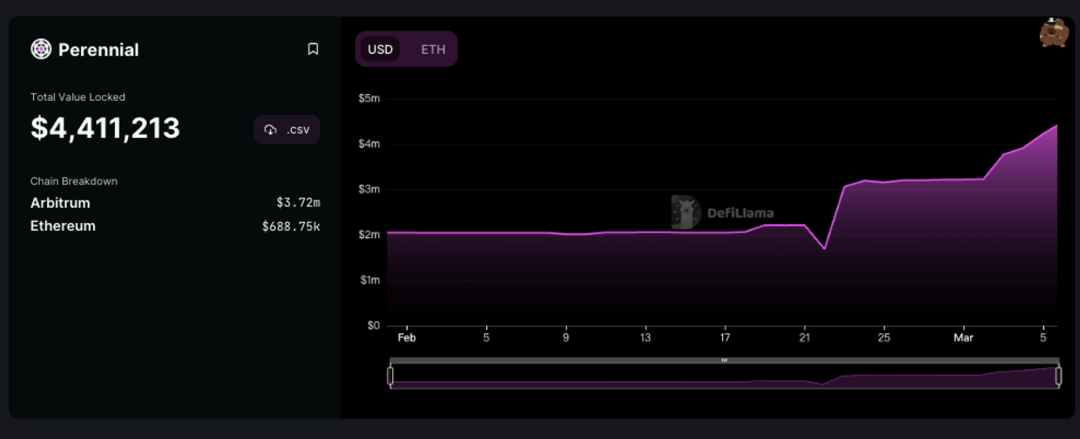

Perennial Labs,推出的由合成资产支持的 AMM 衍生品市场,很多机制非常类似 GMX 的 X 4 版本,但底层是 Opyn。

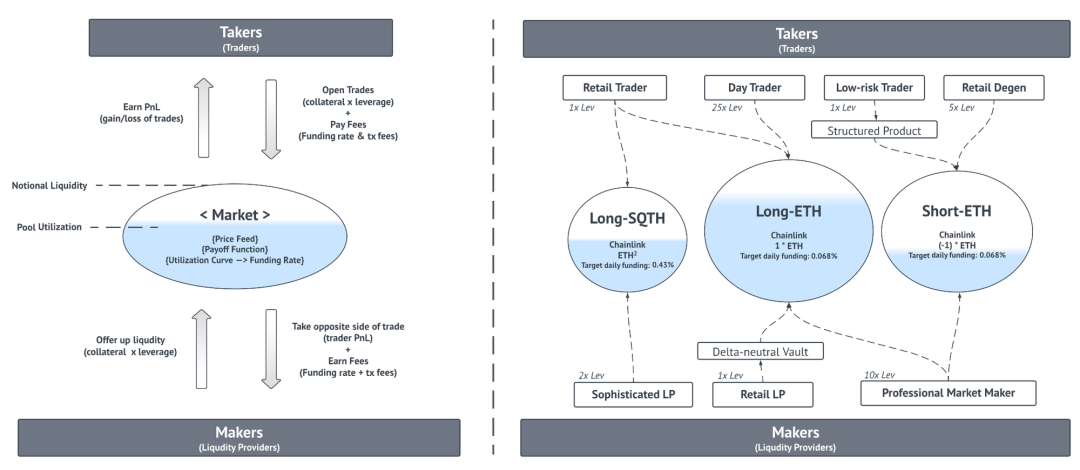

这里面最值得期待的莫过于 Perennial。具体来讲,Perennial 提供了一个无需许可的建立衍生品市场的工具,而并非是单纯的提供交易市场。其设置了一套衍生品的交易规则,并允许任何人去设置其中的关键参数来建立自己的市场。

https://perennial.finance/

Perennial 通过点对池的交易模式,让每个公开的市场都包括了市场建设者、流动性提供者和交易者三个角色。文档显示,当前 Long-SQTH 池就是由 Opyn 的多签地址充当运营商。而其他两个市场:以太坊的多头和空头市场,都是由 Perennial 多签地址管理。

首先,作为市场的建设者仅会从衍生品市场费用中收取一部分作为收入,而不会被强制要求提供流动性。对市场建立者而言,其需要设置的参数包括了利用率曲线、费用结构、杠杆和最大流动性。其中费用结构(开仓、平仓)和最大流动性都比较好理解,关键是利用率曲线和杠杆两个参数。

利用率曲线,即市场利用率和资金费率之间的函数关系。Perennial 表示这项参数参考了 Aave 与 Compound 关于借贷利用率和利率的关系,在 Perennial 中,交易者需要向流动性提供者支付资金费用,而该费用的高低取决于资金利用率(即交易者开仓的名义价值和流动性提供方开仓的名义价值比例),利用率越高资金费用就越高,但在 80% 前保持较低的增长率,在达到 80% 之后,为了平衡市场两边的流动性,资金费用将大幅升高,而市场仅仅由多空双方 PvP,所有的设计与 GMX X 4 的构想不谋而合。

https://perennial.finance/

目前,Perennial 还处于初期阶段,如果 GMX X 4 出现,二者将成为直接竞争对手。

总的来说,GMX 在上线 1 年半后才全面被社区接受,整个“价值”发现的过程也与 Uniswap 的出现极为相似。或许某些时候,并不是某个赛道跑不起来,而是时候未到。

参考文献

https://app.mummy.finance/#/dashboard

https://www.vela.exchange/

https://swaps.mycelium.xyz/dashboard

https://mux.network/

https://app.level.finance/

https://app.ede.finance/#/

https://perennial.finance/

免责声明

本研究报告内的信息均来自公开披露资料,且本文中的观点仅作为研究目的,并不代表任何投资意见。报告中出具的观点和预测仅为出具日的分析和判断,不具备永久有效性。