美国银行业“震后”,各领域Dapps受何影响?

本文来自 Dappradar,原文作者:Sara Gherghelas,由 Odaily星球日报译者 Katie 辜编译。

上周末,市场因美国银行界可能发生的系统性危机而受到冲击。

伴随硅谷银行(SVB)正式破产,其客户之一 Circle 的 USDC 部分质押品存在损失可能,随之 USDC 脱钩。这种现象令人想起了 2022 年的加密黑天鹅事件,如 Terra Luna 的崩溃,三箭资本和 FTX 的垮台。随着金融监管机构对 SVB 的债务作出回应以及 Circle 的积极运营,USDC 价格现已回锚。尽管如此,USDC 的波动仍在市场上引起了广泛的恐慌和不确定性。

稳定币们表现如何?

Dapp 和加密行业的震动与宏观经济事件高度相关。

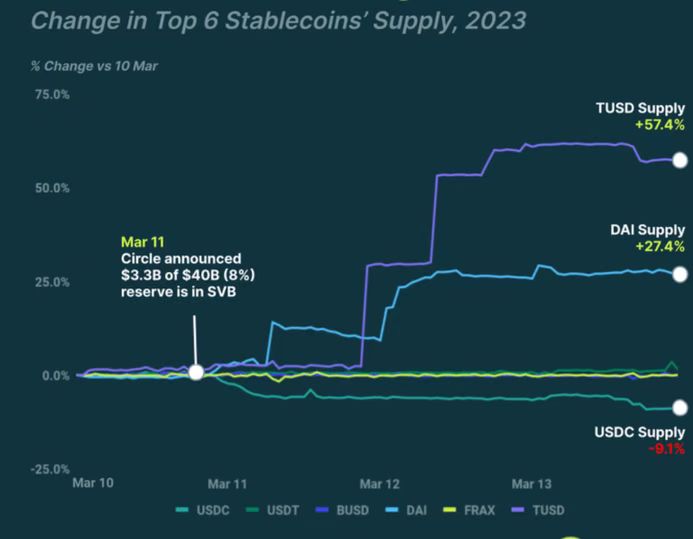

美国加密公司 Circle 是第二大稳定币 USDC 背后的公司,是受 SVB 下跌影响最大的公司之一。3 月 11 日,在该公司透露其 400 亿美元储备中有近 8% (即 33 亿美元)在硅谷银行后,该稳定币失去了与美元的挂钩,并创下历史新低。

由于 USDC 与美元脱钩,恐慌蔓延到整个加密社区,USDC 价格跌至 0.8789 美元的低点。截至当日收盘,USDC 供应涉及 19 亿美元的净流出,一夜之间从 3 月 10 日的 427.4 亿美元跌至 3 月 11 日的 408.4 亿美元,降幅 4.4% 。

美国监管机构于 3 月 12 日介入,为受 SVB 破产影响的储户和金融机构提供支持。尽管这一消息导致 USDC 重新挂钩,但稳定币的供应量和市值仍下降了 9.1% 。美元供应量净流出为 39.3 亿美元,从 3 月 10 日初的 434.3 亿美元跌至 3 月 13 日底的 395 亿美元。

尽管如此,稳定币 TrueUSD(TUSD)和 Dai(DAI)在同一时期出现了显著的供应增长,净流入分别为 57.4% 和 27.4% 。Tether (USDT)和 Frax(Frax)等其他稳定币的供应也略有增长。从绝对值来看,DAI 的收益最大,供应增加了 13.5 亿美元,尽管在这个过程中也受到了影响。

来源:CoinGecko

然而,BUSD 的供应量保持相对不变,BUSD 在 2023 年 2 月受到美国监管机构对发行商 Paxos 的制裁的打击。BUSD 供应量小幅下降了 466 万(-0.1% )。

幸运的是,当美国各银行周一开门营业时,硅谷银行持有的 33 亿美元 USDC 储备存款完全向公众开放,有助于稳定市场。尽管如此,SVB 的垮台提醒了人们加密行业所涉及的潜在风险以及风险管理的重要性。

在 USDC 波动期间,DeFi 交易激增

DeFi 是最容易受到市场崩溃和不确定性时期影响的 Dapp 类别。当 FTX 和 Luna 崩溃时,DeFi 明显受影响。3 月 11 日,在 SVB 崩溃和 USDC 脱钩之后,DeFi 市场的 TVL(总锁仓值)大幅下降,从 792.8 亿美元下降到 716.1 亿美元,下降了 9.6% 。这一消息在投资者中引起恐慌,导致大量抛售和 TVL 下跌。

幸运的是, 13 日硅谷银行的 USDC 储备金完全向公众开放,这一消息导致 DeFi TVL 销售额飙升 13% ,达到 811.5 亿美元。此外,在 3 月 8 日至 3 月 11 日期间,与 DeFi 合约交互的独立活跃钱包(UAW)数量增长了 13% ,从 421, 026 个增加到 477, 094 个。

同期,交易数量也从 1, 356, 483 次增加到 1, 668, 992 次,增长了 23% 。

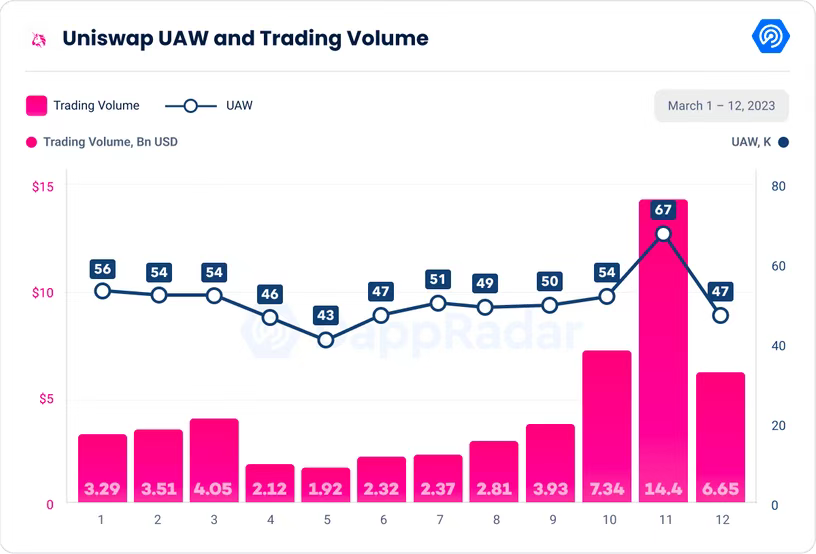

哪些 DeFi Dapp 是造成 DeFi 链上峰值的原因呢?Uniswap V3 是最受欢迎的 DEX 之一,其独立活跃钱包(UAW)数量大幅增加, 3 月 11 日星期六超过了 67, 000 个,交易量达到 144 亿美元,是 V3 有史以来注册的最高数字。67, 000 个独立活跃钱包是自 2021 年夏天以来 Uniswap Dapp 上注册的最高纪录。

此外,Uniswap V3周六的平均交易规模为 170, 080 美元,几乎是平均值的两倍,这表明以太坊 DeFi巨鲸在上周末非常活跃。

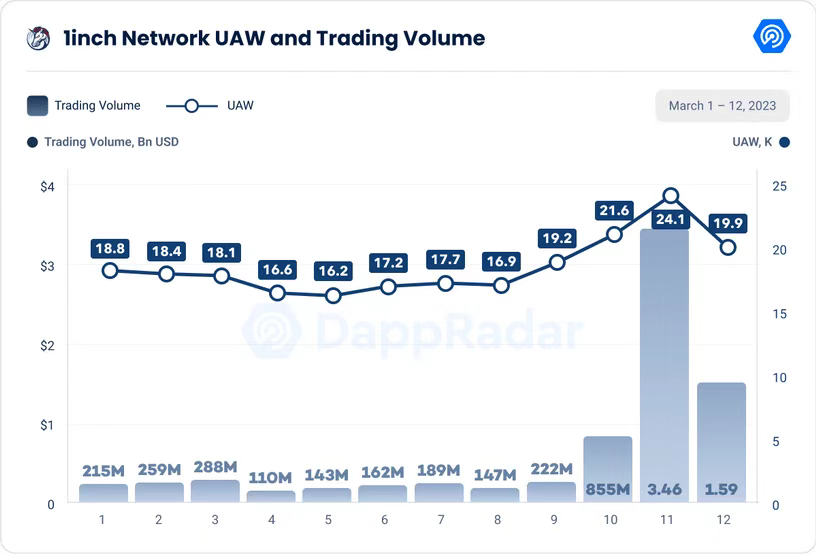

DeFi 聚合器 1inch Network 在周六创下了 34 亿美元的 Dapp 交易量纪录,在 DeFi Dapp 中排名第二。1inch 当天注册超过 24, 000 独立活跃钱包,表明其在 DeFi 领域广受欢迎。

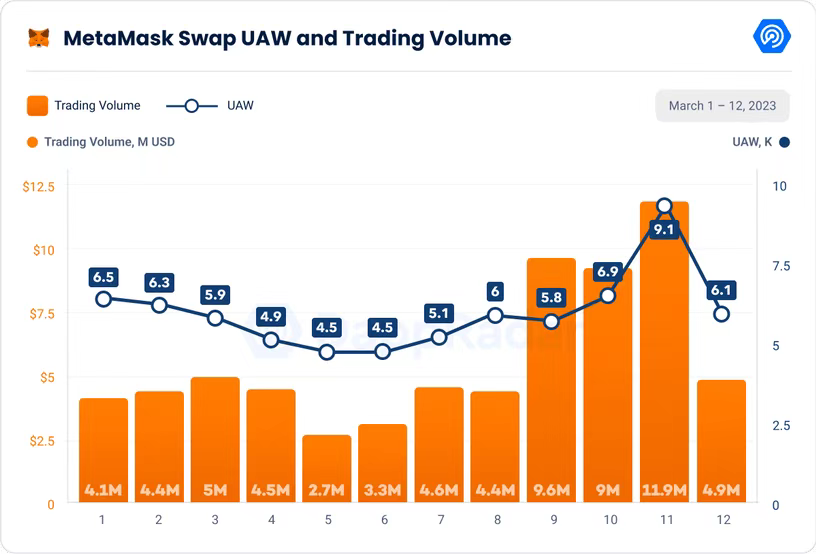

此外,MetaMask Swap 是一个内置于领先钱包软件中的热门代币交易所,在 3 月 11 日也经历了独立活跃钱包和交易量的激增,达到 9.1 万个独立活跃钱包和 1190 万美元交易量,这是我们在 2023 年 1 月初看到的数据,当时关于 MASK 代币的传言正在市场传开来。

其他 DeFi Dapp,如 0x、Aave 和 GMX 也交易量暴增。

虽然周末银行都关门,传统投资者需要等到周一才能对 SVB 的消息采取行动,但 DeFi 7* 24 小时在线。这突出了开放系统和透明度的必要性。

蓝筹 NFT 在混乱的市场中仍然是一项稳定的投资

在 2023 年的大部分时间里,NFT 行业一直处于上升轨道,销量创下历史新高,主流采用率也在上升。然而,SVB 的崩溃及其对 USDC 的影响也在市场上有所体现。

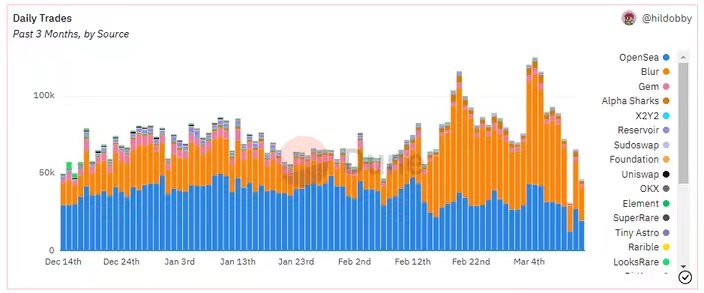

NFT 交易量自本月初以来下降了 51% ,销售额下降了 15.88% 。由于所有情况都受到“波动的稳定币”的影响,NFT 交易者活跃下降,周六出现了自 2021 年 11 月以来参与率最低的交易者人数(12, 000 人),以及 2023 年最低的单日交易数量(33, 112 次)。

值得注意的是,尽管 NFT 交易者的活跃度很低,但交易量并没有受到相同比例的影响,很可能是因为以太坊的 NFT 巨鲸仍坚持在 Blur 第二阶段空投中 farming。

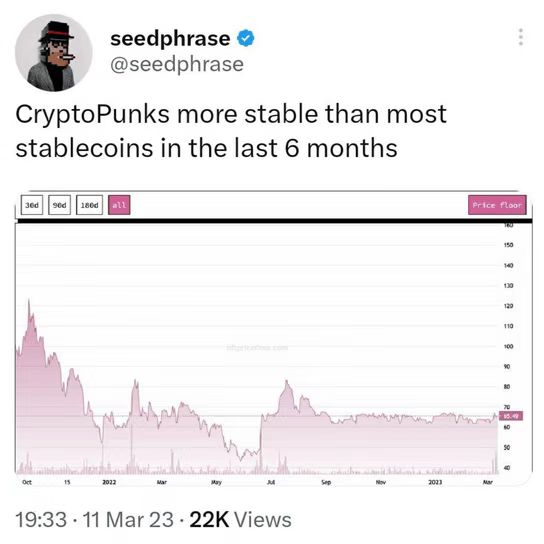

尽管 NFT 交易量整体下降,但 BAYC 和 CryptoPunks 等蓝筹 NFT 的地板价几乎没有受到影响, 3 月 11 日仅略微低于 10 万美元。“复苏”速度很快,显示出这些顶级 NFT 的韧性。

其他蓝筹系列,如 BAYC 生态系统、Azuki 和 Art Blocks 几乎没有受到影响。另一方面,Moonbird 和 PROOF 生态系统由于受到 SVB 的影响而受到严重打击。

自硅谷银行倒闭消息传出以来,Moonbird 的市值下跌了 18% 。然而,地板价有所回升,达到 6207 美元(4 ETH)。3 月 11 日,一个以太坊地址卖出了近 500 个 Moonbird NFT,损失在 9% 至 33% 之间。该地址在批量销售时实现了 9% 至 33% 的亏损,其中 200 个 Moonbird NFT 的亏损超过 32% 。这些交易都发生在 NFT 市场 Blur 上,总损失超过 700 ETH。

值得注意的是,Yuga Labs 对硅谷银行的敞口“非常有限”,这意味着该公司的财务状况不会受到此次危机的严重影响。

加密游戏也证明了其在金融动荡时期的韧性

在经济低迷时期,电子游戏行业一直表现出非凡的韧性,这让许多分析师认为它不会受到经济衰退的影响。最近的一次证明是在 2008 年的经济衰退中,当时电子游戏的销量增长了 12% ,而暴雪和任天堂等主要游戏工作室的交易和游戏机销量都创下了新高。

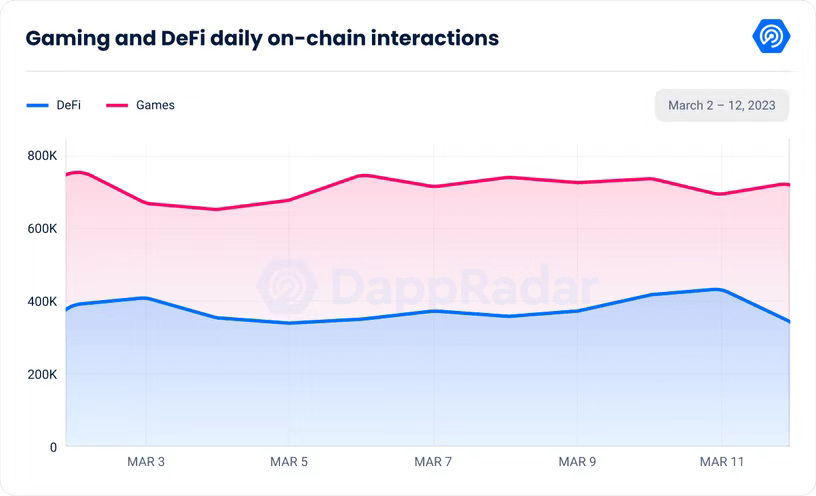

Web3游戏也是如此吗?事实是,现在下结论还为时过早,但与其他 Dapp 类别不同的是,游戏领域的活动在周末的波动性最小。

链上游戏活动在周末仅下降了 5% ,但比前一周增加了 10% 。因此,当 DeFi 交易者在 USDC 有崩溃可能性之际高度活跃时,Web3玩家仍然照常玩游戏。

在撰写本文时,还没有迹象表明任何大型游戏 Dapp 或游戏生态系统会受到美国银行界的影响。这再次证明,Web 3 游戏的表现应该与传统电子游戏类似,成功避开了严峻的经济波动时期。

哪些 Dapp 生态系统更受影响?

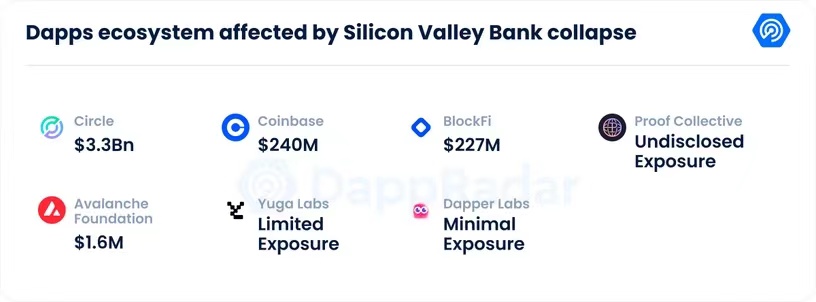

硅谷银行的垮台在加密货币社区引发了涟漪般的影响,受波动范围包括了几个 Dapp 生态系统。Circle、Paxos、Coinbase、BlockFi 和 Avalanche Foundation 已经公开确认了他们的敞口头寸。与此同时,Dapper Labs、Ripple、Yuga Labs、Pantera、Proof Collective、Nova Labs 和 Techteryx 只分享了他们被披露的信息。

SVB 倒闭最重要的影响之一是对 USDC 稳定币的影响。恐慌在加密社区蔓延,导致 USDC 的价格跌至 0.8789 美元的低点。USDC 的供应量为 19 亿美元,从 10 日的 427.4 亿美元跌至 11 日的 408.4 亿美元,降幅为 4.4% 。USDC 的脱钩已经影响了包括 MakerDAO 在内的几个 Dapp 生态系统。

MakerDAO 是第四大稳定币 DAI 的发行商,目前有价值超过 31 亿美元的 USDC 作为 DAI 的质押品。为了减少协议对 USDC 的影响,MakerDAO 在周二执行了紧急治理措施。MakerDAO 已将 USDC 流动性池的债务上限削减至 0 ,这意味着流动性提供者将无法从这些流动性池借入 DAI。

此举突显了用需要由银行托管的资产支持稳定币的风险。在这种情况下,USDC 发行者 Circle 表示在硅谷银行风险敞口约占其储备金总量的 8 %,随即 USDC 在周末脱钩。USDC 占 DAI 质押品的 40% ,这使得它很容易受到这种中心化风险的影响。

Maker 将支持 USDC 的四个 Uniswap 金库的债务上限降至 0 ,因为“这些质押品面临潜在的 USDC 突发事件的风险”。该协议扩大了对 Paxos 的 USDP 稳定币的支持,将其 USDP 保险库的债务上限从 4.5 亿美元提高到 10 亿美元,同时还将 USDP Swap 的费用从 0.2% 降低到 0% 。

根据提案,Gemini 稳定币 GUSD 的情况恰恰相反,该提案认为 Gemini 拥有“大量未投保的银行存款敞口,这可能与风险机构有关”。为了限制潜在的损失,Maker 将 GUSD 的每日铸币限额从 5000 万 DAI 降至 1000 万 DAI。

该提案计划通过将稳定币的每日铸造限额从 9.5 亿降低到 2.5 亿,限制 DAI 交易超过其挂钩汇率的可能性。此外,该提案将 USDC Swap 费用从 0% 提高到 1% ,使投资者将 USDC 转换为 DAI 的成本更高。最后,该提案主张暂时从 Aave 和 Compound 撤出所有资金,以降低整体风险。

总之,硅谷银行的倒闭影响了包括 MakerDAO 在内的几个 Dapp 生态系统。USDC 的脱钩在整个加密社区引起了恐慌,突显了用需要由银行保管的资产支持稳定币的风险。MakerDAO 的紧急治理措施目的是减少其对 USDC 的风险敞口并限制潜在损失。虽然 SVB 倒闭的长期影响仍然未知,但很明显,它对加密货币市场产生了重大影响。

SVB 和 Signature Bank 的崩溃对加密行业,尤其是 Dapp 生态系统带来了新的启示——加密行业需要变得更加“自给自足”,减少对传统银行基础设施的依赖的提案必须提上议程。Silvergate 的加密货币支付网络 Exchange Network 和 SigNet 网络等实时支付网络对于管理流动性、促进场外交易、交易所间套利以及正常营业时间之外的稳定币赎回至关重要。如果没有这些解决方案,加密行业必须找到其他方法来管理流动性和法币流入。