大户交易员「出逃」?一文理解dYdX为何将交易奖励减少45%?

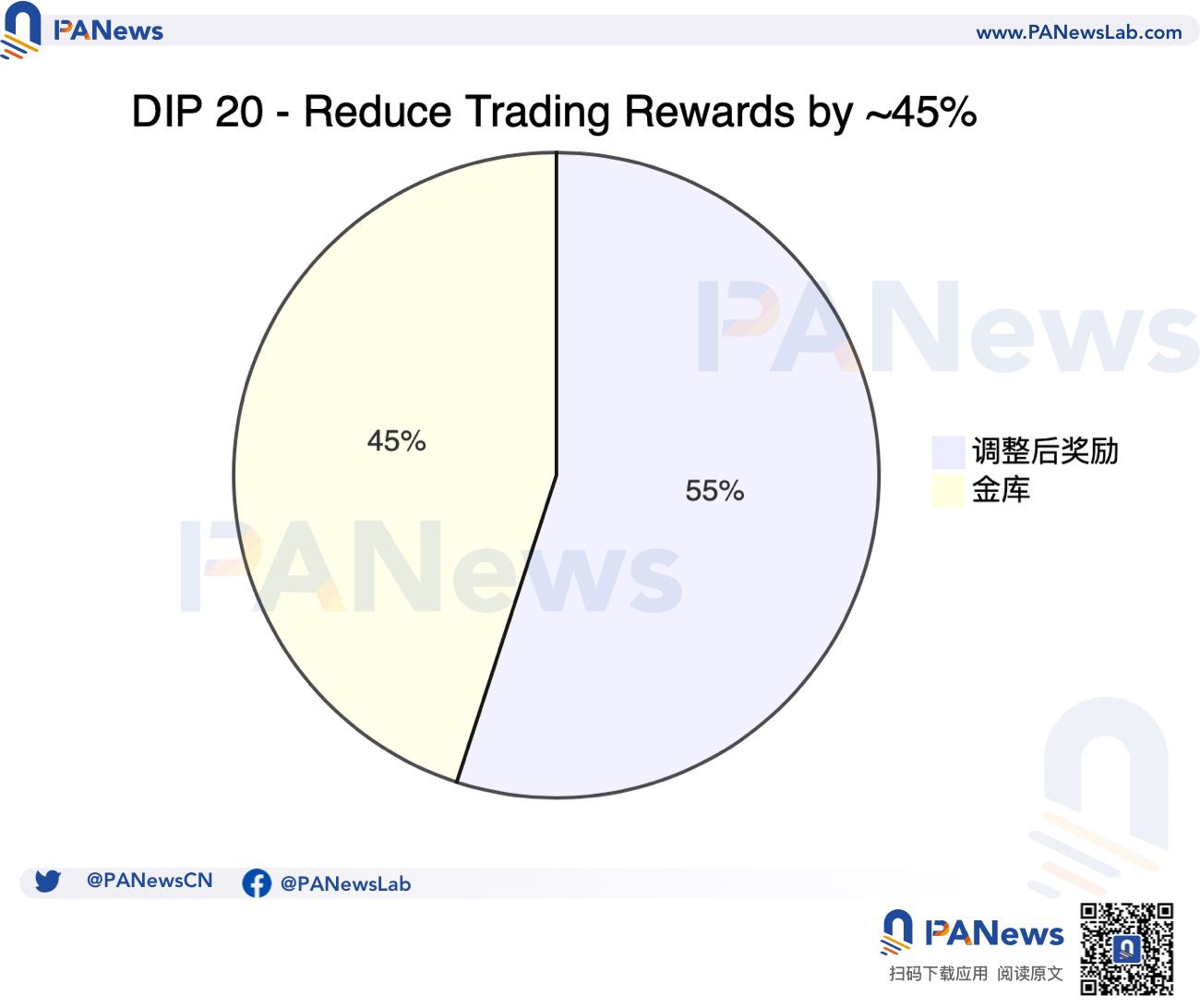

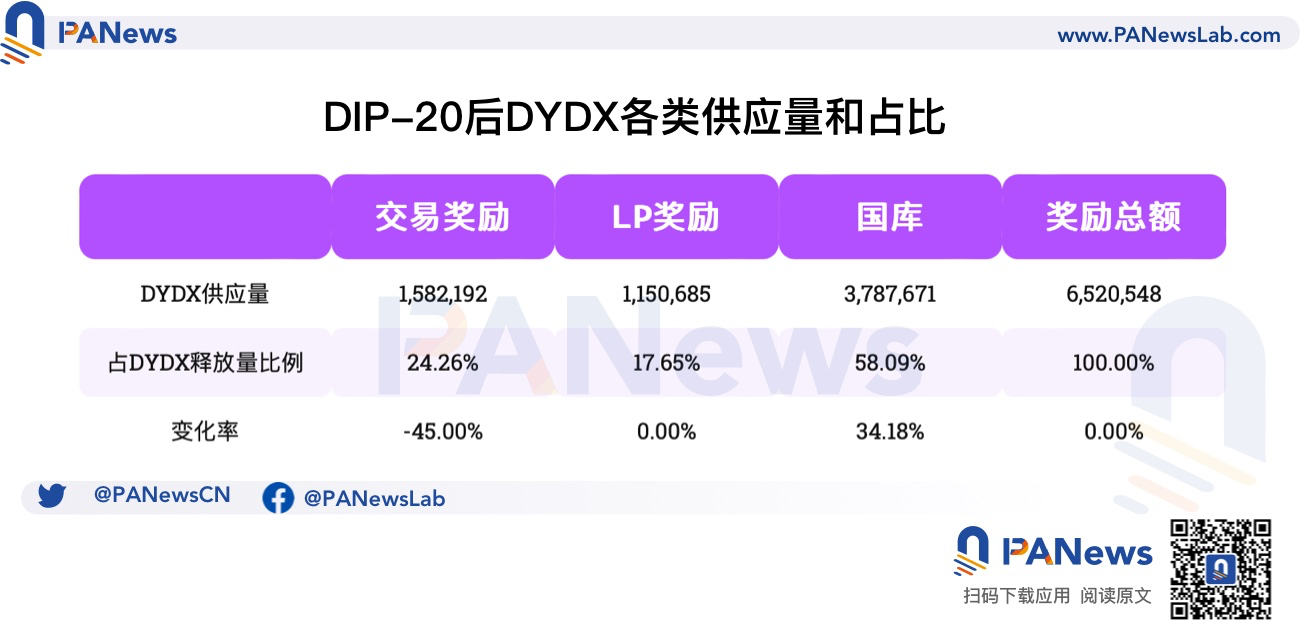

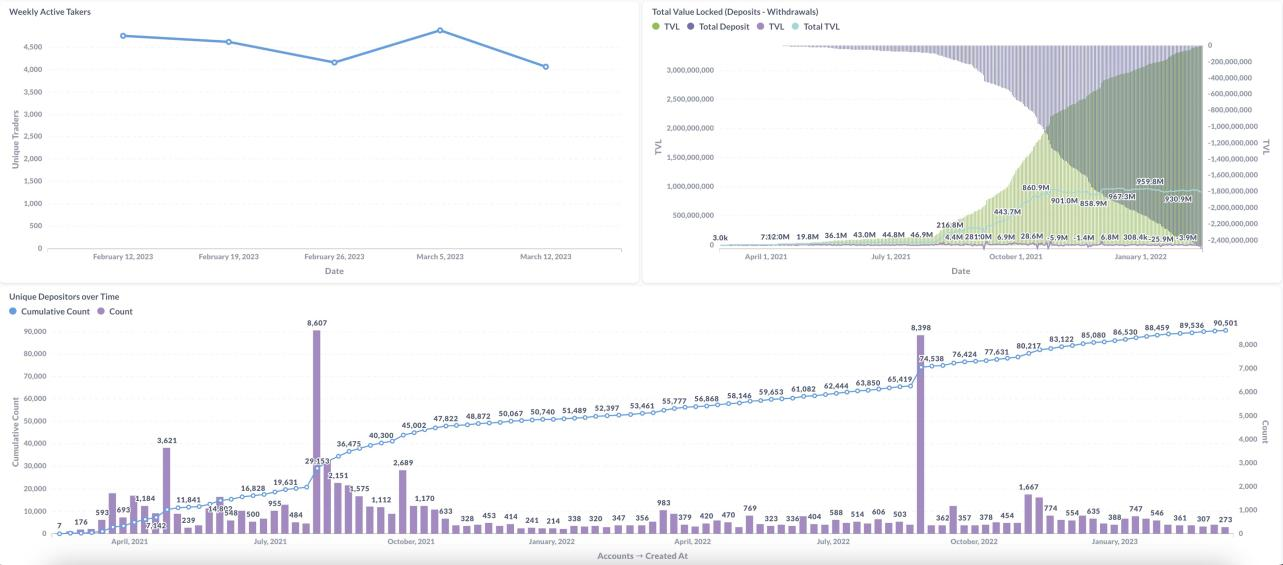

3 月 14 日,dYdX 社区投票通过 DIP-20 提案,决定将交易奖励减少 45% (约 130 万枚),剩余的 55% (约 158 万枚)奖励将由国库留存,并可经由社区投票改做他用,其中赞成票比例为 83% ,反映出 dYdX 社区围绕 DYDX 代币的改进迈出了实际的一步。

在市场行情动荡的大气候下,叠加 GMX 等新锐竞争对手的挤压下,减少交易奖励可以锁定部分流通量,以支撑代币价格,并且可以给予社区更多财政宽裕度,以规划 dYdX 的未来发展。

目前 dYdX 的 24 h 交易量在 20 亿美元左右,减少交易奖励势必会对交易量产生不利影响,整体上,这是 dYdX 在其 V 4 Vanguard 计划的一部分,核心是通过对 DYDX 的用途和释放标准进行改造。以重新设计激励路径,希望解决 dYdX 存在的交易低效问题。

打击通胀,收归国库

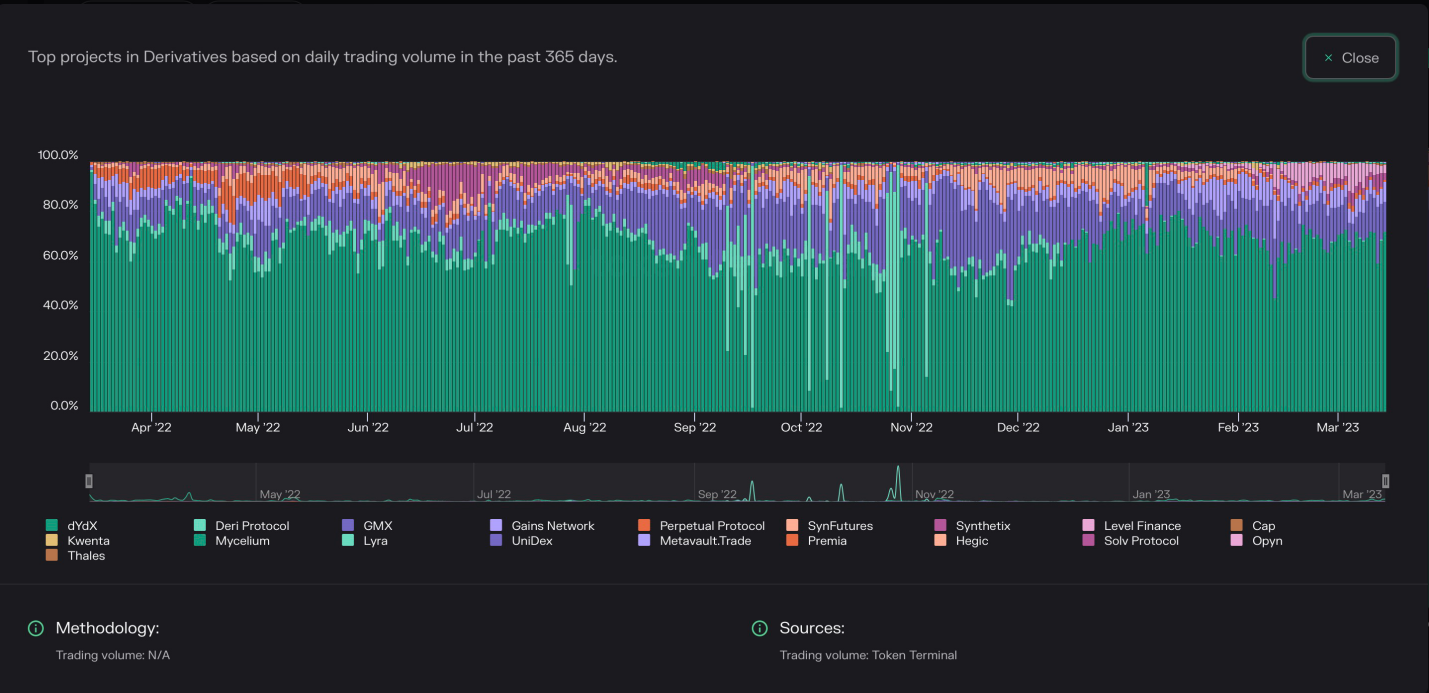

本次更新分配机制的直接原因是市场环境的变化,DYDX 代币在近一年的时间里下跌了近 70% ,而市场份额也面临后起之秀们 GMX 追击从一年前的 95% 降至目前的 70% 。

尽管有一些社区成员不赞成,但鉴于当前的市场状况,在 2 月 15 日的投票测试中,共计有 776 名参与者进行票决,最终以 91.6% (约 2700 万枚)赞成票通过。

并且,分配给流动性提供者的奖励和社区/奖励金库相比分配占比过高,因此对交易奖励需要进行大幅度削减。此外,减少交易奖励也符合 V 4 Vanguard 提案中设计的新分配模式。

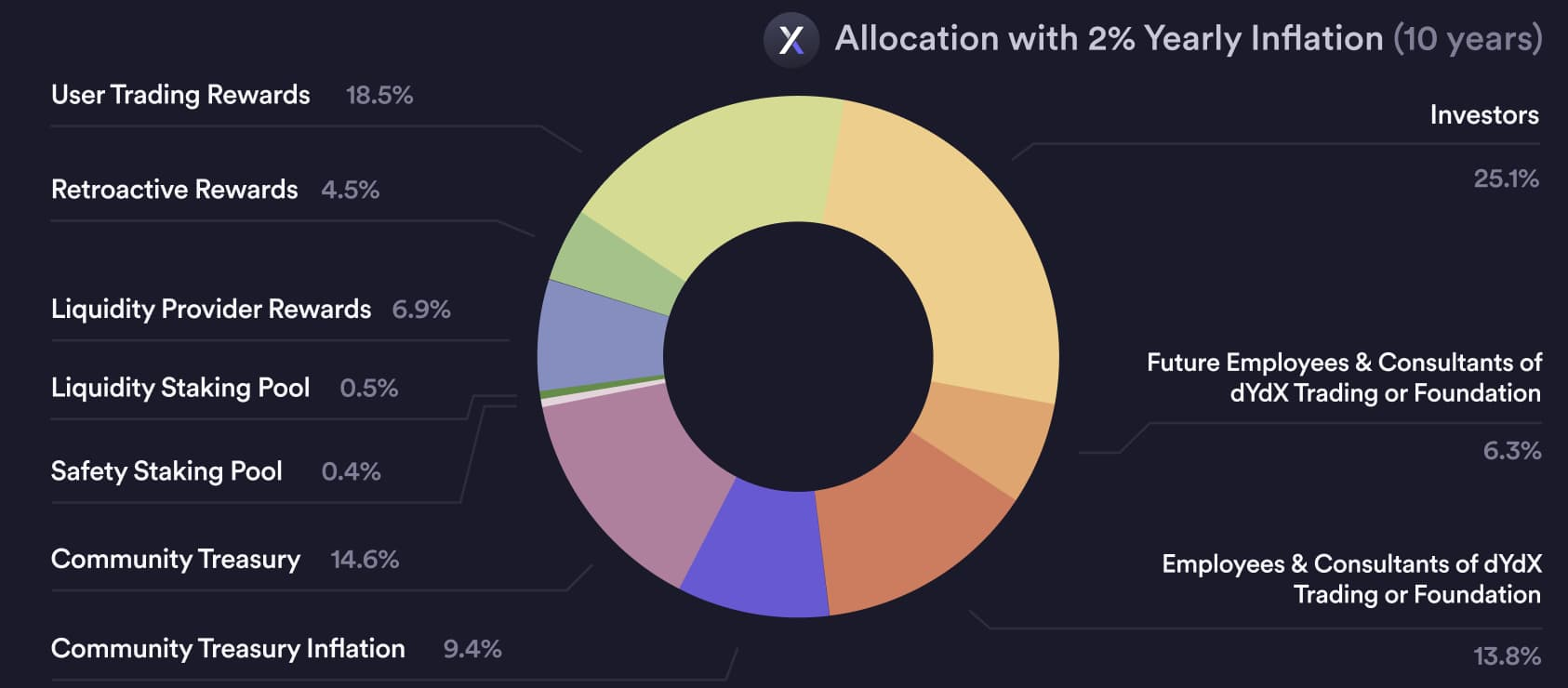

DYDX 总供应量的初始五年分配模型中, 25% 比例分配给交易奖励,而 LP(流动性提供者)和国库分别只占 7.5% 和 5% ,而在协议上线的稳定期,虽然减少了交易奖励至 20.2% ,但仍然高于 LP(7.5% )和金库(16.2% )。

其中,DYDX 总供应量的 50% (5 亿枚 DYDX)在 5 年内分配给社区,其余 50% 分配给早期投资者、协议开发者、社区成员和国库等。但是目前只能将把重点限制在社区分配比例上,因为这是唯一可以改变的事情。

按照 dYdX 机制设计,从推出的五年后开始,每年 2% 是$DYDX 的通胀率最高限制,因此,dYdX 的总体趋势是逐步降低市场上的流通量,以抗衡通胀预期通胀带来的价值稀释。

而本次 DIP-20 降低交易奖励后,多余的的 DYDX 将被存入国库,事实上,降低交易奖励存入金库是 dYdX 历来做法。在之前的 DIP-14 中,便将质押 USDC 的奖励设置为 0 ,并将之前分配给 USDC 质押者的约 38 万枚 DYDX 存入国库中;而在 DIP-16 中,社区已经决议减少 25% 的交易奖励,并将交易奖励从 约 380 万枚 DYDX 减少至 约 280 万枚 DYDX,剩余的约 95 万枚 DYDX 存入国库;而在 DIP-17 中,已经将质押 DYDX 的奖励归零,并将之前分发给质押者的约 38 万枚 DYDX 存入国库。

经过多轮削弱后,交易奖励仍然占比过高。即使在 DIP-16 后减少了 25% 的交易奖励之后,交易奖励仍占所有代币释放总额的 44% ,仍然有较高的下降空间。

在更新代币模型后,交易奖励削减的 DYDX 份额将会转移至国库中,以配合即将到来的 dYdX V 4 有足够的资金去支持协议发展,并且 dYdX DAO 将演化为包含多个 subDAO 在内的自治体,包括潜在的 Growth SubDAO 都需要社区提供资金支持。

V 4 升级在即

减少交易奖励的直接原因是为 V 4 升级提供资金支持,但是实行初期必须要面对交易员的出逃和交易量下降的窘境。

目前,已经有超过 5 千万美元的大户交易员“威胁”要离开 dYdX,但是在社区看来依靠补贴的交易量无法维持,具备健壮性的协议必须服务于真正的用户。

而另一个后果会造成投票权的更加集中化趋势。dYdX 的主要价值在于社区治理,而投票权与 DYDX 持有量成正比,通过减少未来的供应量,减少交易奖励会直接增加现存 DYDX 的价值。

按照 dYdX V 4 升级协议的部分,交易奖励是其中一系列改进计划的组成部分,总体上遵循提高 DYDX 代币价值和促进 dYdX 交易量的目标前进,具体内容包含以下部分:

将交易奖励减少 45% ;

调整 Maker & Taker 费用;

引入做市商返利计划;

取消 DYDX/stkDYDX 交易费用折扣;

每年减少 DYDX 释放量并修改奖励分配;

调整细分市场的交易奖励分配机制。

在基于为奖励分配机制引入新的权重设计和将交易奖励减少约 45% 的基础上,希望进入通胀前,以减少社区奖励的方式控制 DYDX 释放量,以最终达到 2% 的通胀率。

如果要进一步消除交易者和 LP 的准入壁垒,最好的方式是仅根据交易量来奖励 LP,而不是采取复杂的质押模式。

因此,目前的交易费用折扣和交易奖励是不公平的机制设计,一方面,交易费用折扣造成了 DYDX 持有者降低自身的交易成本,这对非持币用户而言并不公平;另一方面,交易奖励已经起到了基于用户支付的费用的回扣的作用,并且 94% 的 DYDX/stkDYDX 持有者并不是协议的活跃交易者。

降低交易奖励和取消交易费用折扣,可以不再奖励低效质押和非活跃交易者,而是为任何参与者,都只根据为协议带来的价值获得奖励。

总结

交易奖励在协议启动初期,总体上是一个简单有效的激励系统。奖励和用户在给定时期内付出的交易费用成正比。从活跃用户的增长率来看,这种机制曾经非常有效,因为它本质上是对所有交易活动的回报,无论他们交易的细分市场和回报如何。但是将交易奖励在开拓激励长尾市场或提高市场交易量的机制,那么效率将会非常之低。

在 dYdX 协议进入稳定的发展期后,创业初期简单粗暴的激励模式不再适应新时代,需要被更为精细化的市场运营措施取代,最直接的是转向提供更优秀的用户体验,将纯粹的投机者和套利者驱离,以稳固真正的用户群体。