Outlier Ventures:如何用联合曲线管理DAO治理代币?

原文作者:Karim Halabi,Outlier Ventures

原文编译:aididiaojp.eth,Foresight News

代币治理委员会可以通过许多不同的方式将代币分配到社区和利益相关者手中,其中包括空投、流动性挖矿、拍卖或上述方法的不同组合。本文将介绍一种新的方法来提升各种分配策略的效果以尽可能地加强利益相关者之间的一致性。

目前 DAO 面临着许多问题,其中最主要的是无所不在的选民参与度问题,任何积极为 DAO 做出贡献的人都深有体会。当然并不一定是说每个持有特定治理代币的地址都必须参与和讨论每一个细致的细节,而且在参与社区活动时,并非每个人都有相同的动机。

另一个常见问题是一种常用的分配方法,即流动性挖矿,将代币交到不一定对产品治理感兴趣的人手中。如果参与流动性挖矿的人对治理不感兴趣,他们可能试图将代币卖给其他人。在无情的 DeFi 对战世界中仿佛只有两个选择:要么套现离场,要么高位接盘。

用户为代币提供流动性以及买卖行为本身并不一定是坏事,这很正常,有时甚至值得鼓励。但它的缺点是质押者的利润是以牺牲社区和 DAO 财政部的利益为代价的。正如这篇文章所指出的那样,我们可以在收益农场启动后代币抛售情况观察到这一点。

有一些方法可以量化贡献并更公平地向那些投入时间和精力的人发放代币,但是这些忠诚的持有者通常与投机者和流动性挖矿参与者相比,没有竞争优势。一个直观的解决方案是为质押者和不是 DAO 成员的早期买家创建归属时间表,尽管这样做的缺点是贡献者不会真正通过出售他们的代币获利,因为质押提供的流动性较少,对代币的需求减少。此外,归属时间表并不一定会减少抛售压力,它只是将其分散在不同的时间点上。

没有完美的方式来管理治理代币,但确实存在的是可以减轻某些风险的方法,这具体取决于代币发布的确切目标和要求。

一种经常被忽视的代币分配方法是使用联合曲线来铸造和销毁治理代币。对于那些不熟悉联合曲线的人,以下是简单介绍。

联合曲线:固定代币价格和供应之间关系

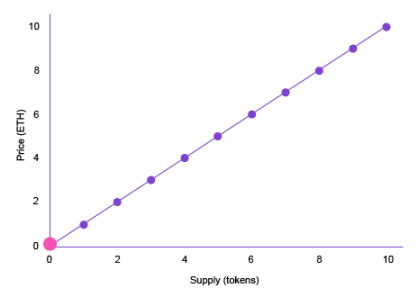

联合曲线本质上是一种简化价格和供应之间关系的方式。一种更简单的说法是:当代币供应量变化 X 时,价格变化 Y,其中 Y 可以是固定值或百分比。

这类似于 AMM 的工作方式,除了不需要流动池,因为 ETH 或稳定币可以存入曲线以按需铸造代币,而不是需要池中的流动性来便于交易。例如,我们有一条联合曲线,其中尚未创建任何代币,并且每次铸造或销毁价格都会增加和减少「 1 ETH」。铸造第一个代币的起始价格是 1 ETH。

现在第一个人将 1 ETH 存入联合曲线后,将获得一个代币作为回报。然后曲线开始移动,X 从 0 变成 1 ,Y 变成当 X 等于 1 时的纵坐标,现在铸造下一个代币的价格现在是 2 ETH。

这时出现了另一个人希望参与其中。她以 2 ETH 的价格铸造了一个代币后,又铸造了另外一个,定价为 3 ETH。总的来说 Alice 已将 5 ETH 存入曲线并收到 2 个代币作为回报。

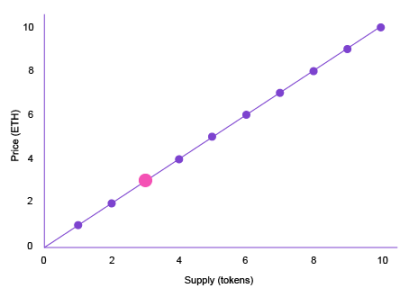

第一个人这时看到价格上涨,并决定兑现他的代币以获利。由于价格现在为 3 ETH,Bob 可以将他的治理代币存回曲线并赎回 3 ETH,因此点沿曲线向后退一个单位,价格降至 2 ETH。

这就是简单联合曲线的本质,一旦我们开始试验曲线本身的形状,它就会变得更加有趣。如果价格上涨 10% 怎么办?如果它改变 0.5 ETH 直到达到 100 个代币的供应量,此时曲线变平并且每次铸造和销毁仅移动 1% 怎么办?如果曲线是某种形状,但一旦某些产品里程碑被某些预言确认,它就会发生变化怎么办?这样的曲线可以用来奖励在风险较高时铸造代币的早期信徒,并且在产品更加成熟之后,曲线可能变得更加陡峭。

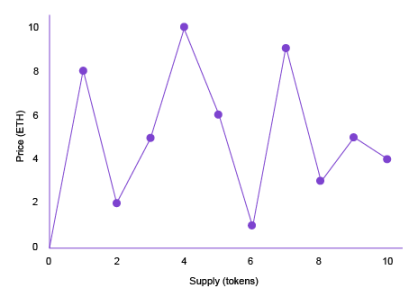

可能性是无穷无尽的,联合曲线可以是无数种形状。它看起来像这样:

另一种选择是对买入(铸造)和卖出(销毁)使用不同的曲线,其中当 X 一致时,卖出比买入成本更高,增量可以保留并发送到国库,或者由图表保留为每个卖回曲线的代币授予更高的赎回率。

其他类型的联合曲线

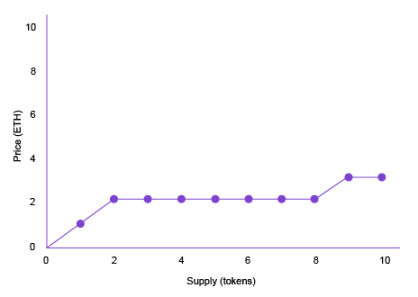

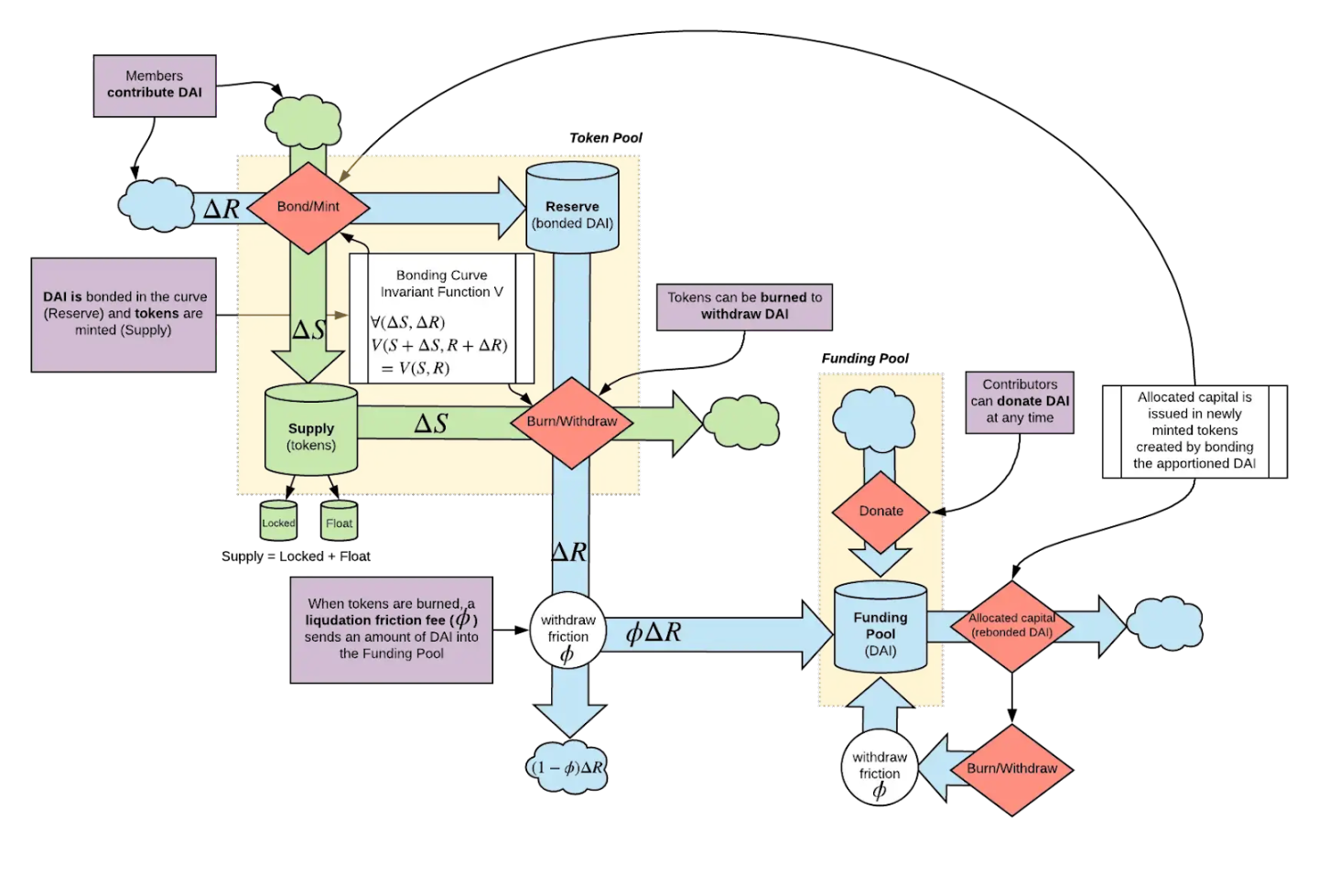

当然也存在其他更复杂类型的联合曲线,有两种较为突出,其中之一是由 Commons Stack 引入的增强联合曲线。

上图是添加了一些有趣内容的增强结合曲线。增加的内容包括「孵化期」,即铸币前期阶段,早期投资者可以存入资金以获得代币并做出早期贡献。一些资金直接流向曲线本身,一些资金流向国库,这些资金可用于联合曲线外的资本配置,以促进产品的发展。除此之外,还有一个在初始阶段授予「孵化器」代币的归属时间表,以及卖家支付少量费用的退出税,该费用被重定向成曲线。Commons Stack 甚至提供了一个可以在网站上使用的模拟器,它被认为是为公共物品提供资金的有效方式。

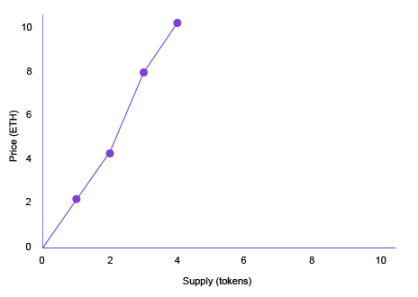

另一种变体是由 Paradigm 创造的可变利率渐进式荷兰式拍卖 (VRGDA) 。本质上来说它是一条同时考虑了时间因素的联合曲线。例如我们有一条联合曲线,我们希望在前两天分配 10 个代币。如果在此期间铸造的数量少于 10 ,则价格 (Y) 根据预设公式降低,以激励加速铸造。这也适用于另一种方式,如果实际铸造量超过目标铸造量,价格可能会上涨。可以这在文章中找到带有示例的更完整解释。

总而言之,联合曲线是一种使 DAO 利益相关者保持一致的有效方式。了解不同类型的联合曲线及其工作方式有助于为更广泛的讨论「SuperPowered Tokens」以及它们如何激励 DAO 利益相关者之间更紧密的合作奠定基础。