一文梳理6个主流跨链桥特性及进展

原文作者:Route 2 FI

原文编译:Peng SUN,Foresight News

与物理世界用来连接两个物理地点的桥梁相似,加密世界的跨链桥连接着两个区块链生态系统,通过信息和资产转移促进不同区块链之间的沟通。在区块链早期、需求大于供给的情况下,公链的不可能三角问题、资本驱动、区块链的「继续革命」属性等因素使多链并存成为可能,很难出现某一条区块链一家独大,群雄逐鹿的格局仍将持续。那么,在这种情况下,不同的区块链在性能、生态等方面各有千秋,分散在不同网络上的用户及其经济需求则要通过跨链桥进行桥接。

目前,已经有无数的项目布局跨链桥赛道,试图提前抢占市场份额。在众多项目中,Stargate、Orbiter、Synapse、Bungee、Multichain、Lifi protocol、Rango、LayerZero、Connext、Relay、Hop Protocol 与 Router protocol 等 12 个项目比较火热。我将挑选 6 个主流跨链桥简要介绍其基本概念、创新特点、数据指标、未来发展与代币空投等相关信息,并再次提醒大家注意跨链桥的风险问题。

一、Synapse Protocol(SYN)

Synapse 本质上是一个跨链流动性协议,允许用户在不同链之间桥接资产。为了玩好多链的叙事,用户最好要熟悉不同的跨链桥,而 Synapse 代表的是用户友好的桥梁之一。根据 DefiLlama 数据,我们注意到 Synapse 目前的总锁定价值(TVL)为 2.04 亿美元,在整个生态系统中排名前十。

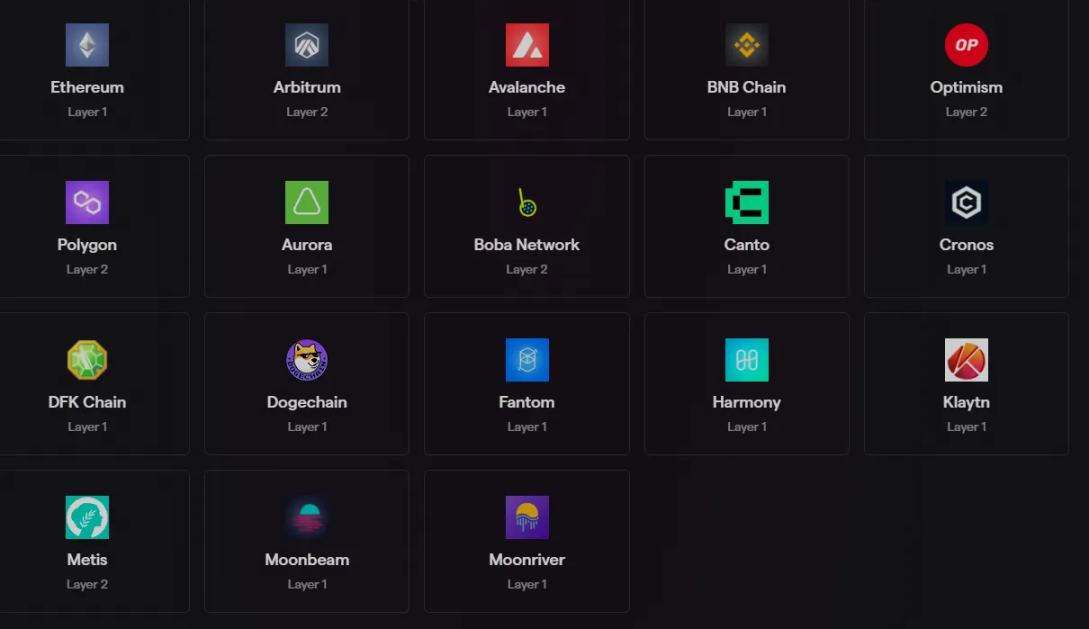

在 Synapse 上,用户可以在以太坊、Arbitrum、Avalanche、BNB Chain、Optimism 与 Polygon 等不同链上来回跨链:

Synapse 计划推出自己的区块链:SynChain。推特上的加密评论家根据价格走势和 Discord 的互动推测,推出 SynChain 公告将在 ETHDenver 2023 前后发布。

鉴于 L2 的叙述和大量独特的钱包支持 Optimism 与 Arbitrum,我们可以推断 Synapse 希望通过大约 3.5 亿美元的完全稀释估值(FDV)将自己定位为最便宜的 L2 rollup。

需要注意的是,即将到来的 SynChain 可能会通过空投来获取早期用户——虽然是猜测,但有传言称可能会有针对持有者的 Synapse 空投。

随着 Synapse 在 11 月已经批准了单边质押,如果 Synapse 加入真实收益的叙事并最终开始分享协议利润,这将不足为奇。请记住一定要自己对该项目进行研究。

最后,我们看一下 Synapse 的数据指标:

市值: 2.47 亿美元

价格: 2.3 美元

完全稀释估值(FDV): 3.25 亿美元

总锁定价值(TVL): 2.04 亿美元

二、Connext

Connext 是以太坊 Layer 2 互操作性协议。之前叫做 xPollinate,其主要功能是促进资产跨区块链与 Rollup 的转移。

自 2 月初推出封闭测试版以来,Connext 在 2 月出现巨大增长,每周交易量平均为 550 万美元,每周交易数约 5000 笔。

值得注意的是,Connext 依靠 AMM 对每条链上的流动性进行定价。根据 Twitter 用户 pepes 的信息,Optimism 与 Arbitrum 上的流动性过剩,这意味着 Connext 用户在跨链时可以获得正向滑点。通俗点说,Connext 付给你 ETH 来跨链到 Optimism 与 Arbitrum 上。

Connext 是一个速度快且安全的跨链桥,这对普通的加密爱好者来说是非常理想的。它通过活跃流动性(active liquidity)来将它分解,基本上意味着 Connext 的路由器将流动性提供给目标链上的用户,之后再由协议来偿还。

Connext 有效地将资金借给等待用户,然后通过协议得到偿还——这影响了交易的延迟。总的来说,Connext 产品既有创新性,又有前景。

最后,我们看一下 Connext 在 2 月的数据指标,可以判断这是月度指标:

总锁定价值(TVL): 1840 万美元

总交易量: 1740 万美元

总跨链数: 20, 221

三、RelayChain(RELAY)

Relay 是一个跨链桥聚合器,主要为了解决不同链之间的碎片化和缺乏互操作性的问题。其核心产品是跨链桥,为用户聚合最有效的跨链桥;为了激励新用户,Relay 还为用户每次使用跨链桥设置了一个抽奖系统(最高可获得 5000 美元奖金)。Relay 聚合了 5 种跨链桥的流动性,充当一个价格比较网站,为用户找到最便宜、速度最快、流动性最强的跨链桥。

目前,Relay 跨链桥已支持 15 条区块链。Relay 还具有质押功能,旨在为协议提供流动性。

Relay 的定位是一个长期项目,其代币解锁模型确保了顾问对项目的中短期支持。简单来说,代币解锁是基于时间的:第一次解锁 10% (30 天),第二次 15% (60 天),之后每个季度解锁 25% 。该团队已与 Web3 领域的各大公司合作,也是最早支持 Avalanche 上第一个 DEX 的团队。

最后,我们可以看一下 RelayChain 的数据指标:

总锁定价值(TVL): 7700 万美元

已跨链价值: 10.3 亿美元

总交易数: 50, 988

市值: 400 万美元

请注意,Relay 的市值比较小,如果你决定购买该代币,要非常谨慎,但最好不要购买,因为其暴涨或暴跌的几率比较大。

四、Stargate

Stargate 是一个基于 LayerZero 的跨链流动性协议,也是第一个使用 LayerZero 部署的 DApp。与其他跨链桥相比,Stargate 的主要差异化因素在于其实现,据说这是第一个解决由 Vitalik 首次提出的著名的跨链桥不可能三角问题的方案。

虽然跨链桥通常被迫放弃不可能三角(即时的交易确认、原生资产与统一流动性)中的某一个要素,但 Stargate 并没有牺牲任何这些属性。

Stargate 还使用一种创新的资金池平衡算法,激励用户在深度不足的资金池中存款(从深度充足的资金池中提款)。这确保流动性在 Stargate 支持的链上保持深度,通过低滑点和价格影响给用户提供更好的跨链桥体验。

Stargate 得到了该领域资本最雄厚的团队之一 LayerZero 的支持。事实上,LayerZero 的资金非常充足,它们在 FTX 事件之后回购了 Alameda 持有的与 Stargate/LayerZero 有关的所有代币和股权。因此,这消除了许多 Alameda 支持的项目在资产回收清算时面临的强制出售的风险。

最后,Stargate 数据指标如下所示:

市值: 1.76 亿美元

完全稀释估值(FDV): 10.65 亿美元

总锁定价值(TVL): 4.801 亿美元

市盈率(P/E ratio): 490.93 x

五、Hop Protocol

Hop Protocol 是一个可扩展的 Rollup 之间通用代币跨链桥与 DEX,允许用户从一个 Rollup 或侧链向另一个 Rollup 或侧链转移与发送代币,而无需等待网络的挑战期。

Hop Protocol 能够通过引入做市商(或 Bonder)在目标链上提供流动性以换取少量费用,从而为多链未来做出贡献。Bonder 以 hTokens 的形式提供这种信用担保,随后在目标链的 AMM 中将其兑换成等值的原生代币。

创建 hTokens 是为了使 Hop Protocol 能够以编程方式创建与销毁代币,以便在不同链之间实现更快地转移,以及减少所有扩容解决方案的原生退出时间,并使 Bonder 能够更有效地部署和利用资本。

为了确保用户的安全跨链体验,Hop Protocol 确保链上保证即使在 Bonder 离线的罕见情况下,用户也能收到资金。增加链上保证确保 Hop 跨链桥无法提取资金,但同时也要权衡,如果 Bonder 离线,用户的跨链体验将变慢。

由于其安全模式,Hop Protocol 能够与无需信任的跨链桥(trustless bridges)竞争,因为与 Hop Protocol 等无需信任的跨链桥相比,其他跨链桥可能需要支付更高的利息来吸引流动性。考虑到这种效率,无需信任的跨链桥能提供比中心化跨链桥更低的费用。

截止 2023 年 3 月 1 日,Hop Protocol 基础数据指标如下:

市值: 13, 135, 651 美元

完全稀释估值(FDV): 201, 000, 502 美元

总锁定价值(TVL): 79, 733, 768 美元

六、Multichain(之前的 Anyswap)

Multichain 是一个使用 SMPC 网络的 Web3 路由协议,支持近 40 条链与 1000 多种代币。

Multichain 由跨链桥与跨链路由两部分组成。跨链桥的工作方式与其他跨链桥类似。当源链上的资产需跨链至目标链时,资产会存入源链上的 MPC 智能合约中,目标链铸造封装资产。反过来,封装资产需存入智能合约销毁,以换取源链上的资产。另一方面,跨链路由确保任何资产能够在多链之间转移,无论是原生资产还是用 Multichain 跨链桥创建的封装资产。

Multichain 代币是 MULTI,可以锁定以换取 veMULTI NFT。持有 NFT 就拥有协议的治理权,并能够发起提案与投票。除了治理权之外,NFT 还可以获得收益。

如上所述,加密市场上存在无数的跨链桥,但最重要的问题也许是「在什么场合选择哪个跨链桥?」这取决于你想将资产跨链至哪条链上。

就个人而言,我经常使用 Multichain,因为它支持很多条链,我也不必思考很多问题。但我不确定这是不是最好的,因为有时它所需的跨链时间比其他桥更长。我曾用过一次 Connext,其 UI/UX 与跨链速度令人很满意。

我也喜欢使用「Find My Bridge」这个工具。你只需输入源链与目标链,「Find My Bridge」会检索 55 个跨链桥,从而找到最便宜的方式。

除此之外,只要尝试使用不同的跨链桥,就会找到自己最喜欢的那一个。切记,一定要通过其官方 Twitter 或 CoinGecko 进入其应用程序。不要在谷歌上搜索,因为有可能会进入钓鱼网站。

七、跨链桥的风险

以下关于使用跨链桥的风险来自以太坊官网,它已经解释得足够完美而无需其他的文词修饰。

跨链桥正处于发展的早期阶段。最佳的跨链桥设计很可能尚未出现。与任何类型的跨链桥互动都存在风险:

智能合约风险 — 代码漏洞导致用户资金损失的风险

技术风险 — 软件故障、代码漏洞、人为错误、垃圾邮件与恶意攻击可能会干扰用户操作

此外,由于受信任的跨链桥增加了信任假设,因此具有额外的风险,譬如:

审查风险 — 理论上跨链桥运营商可以阻止用户使用跨链桥转移资产

托管风险 — 跨链桥运营商可以串谋窃取用户的资金

如果存在以下情况,用户资金将有风险:

智能合约存在漏洞

用户犯错

底层区块链遭遇黑客攻击

跨链桥运营商在受信任的桥上试图作恶

跨链桥被黑客攻击

不要以为跨链桥不存在黑客,BNB 跨链桥、Wormhole 与 Harmony 跨链桥商都有一些大型黑客,可以在 rekt 网站上查看。