一览「USDC危机」中的DEX「大赢家」:Uniswap、Curve、SushiSwap

原文作者:Ambcrypto Suzuki Shillsalot

原文编译:PANews

硅谷银行倒闭导致美元稳定币 USDC 上周末出现脱锚并一度跌至 0.87 美元低点,FUD 情绪也在加密市场蔓延,不过这一黑天鹅事件造成的影响似乎并没有想象中的那么大,DEX(去中心化交易所)的交易活动和费用收入甚至出现了指数级增长。

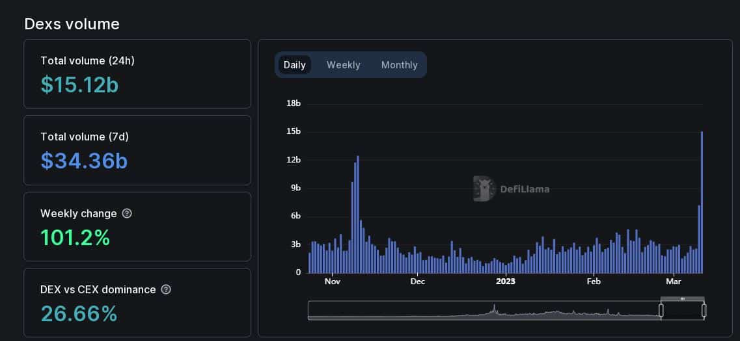

根据 DeFiLlama 数据显示, 3 月 11 日,DEX 总交易额飙升至 151.2 亿美元,创下过去四个月新高,周增长率超过 100% ,其中 Uniswap 收取的费用收入也达到了自 2022 年 5 月 10 日以来的最高值,聚合 DEX 和中心化交易所 (CEX) 交易额比例(该指标反映了 DEX 的市场主导地位)上升至 26.66% 。

Uniswap、Curve Finance、SushiSwap 成为市场不确定期间的“大赢家”

对于加密社区而言,中心化实体的衰落有利于 DeFi 发展,尤其是在 FTX 崩溃后,越来越多用户选择放弃中心化交易所而开始探索自我托管,最近因硅谷银行倒闭导致的“USDC 危机”更是加速了这一趋势——数据显示,Uniswap、Curve Finance、SushiSwap 这些 DEX 在上周末取得了令人瞩目的增长。

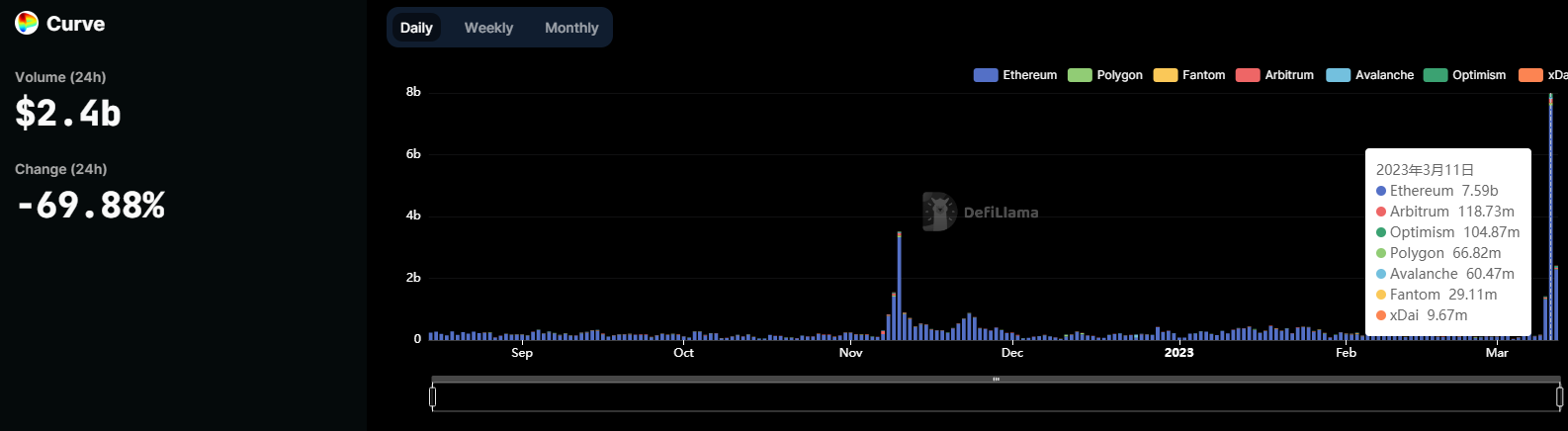

首先,作为一个专为稳定币兑换而设计的 DEX,Curve Finance 过去 24 小时内创下了接近 80 亿美元的最高单日交易额记录。另据 CryptoFees 数据显示,由于交易量激增,Curve 平台上收取的费用收入也跃升至 952, 000 美元,创下过去四个月以来的新高。

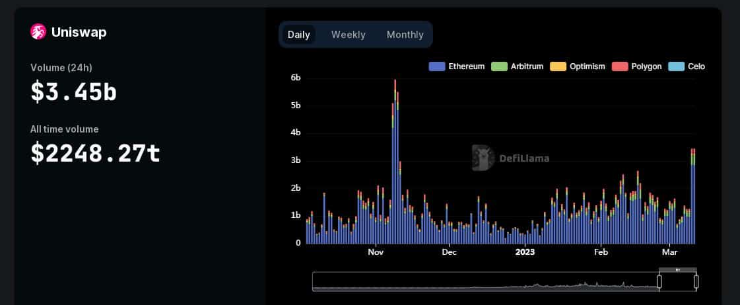

其次是 Uniswap,Uniswap 也是当前加密市场中交易量最大的 DEX 之一,USDC 脱锚后的 24 小时内交易额飙升至 34.5 亿美元,创下过去四个月以来的最佳表现。截至本文撰写时,Uniswap 用户支付的交易费用也升至 87.5 亿美元,触及过去 10 个月以来高点。

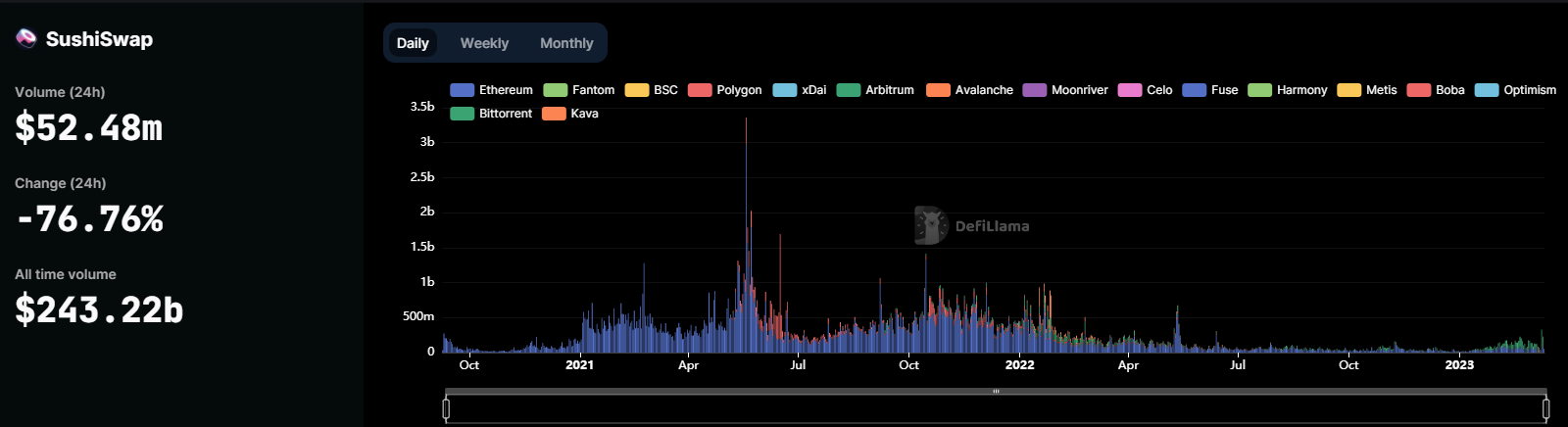

另一个受欢迎的 DEX 是 SushiSwap,USDC 危机期间该平台也见证了活跃度激增并成为以太坊巨鲸使用最多的智能合约之一。

不过根据 DeFiLlama 数据,此前一周 SushiSwap 的日均交易额并未出现较大幅度增长,本文撰写时过去 24 小时交易额为 5248 万美元,反而下降了 76.76% 。

未来属于 DEX 和 DeFi?

在过去 3-4 年里,DEX 取得了突飞猛进的发展,Token Terminal 披露数据显示,DEX 平台的活跃开发者数量一直在稳步增长,说明支持 DeFi 未来的基本面向好。

另一方面,随着美联储于北京时间 3 月 13 日凌晨宣布新的紧急银行定期融资计划并支持硅谷银行储户于当地时间周一动用资金,USDC 美元锚定价格出现反弹并上涨到 0.995 美元区间,已基本恢复美元锚定,其市值也重返 400 亿美元上方。

相信在这次危机之后,加密社区将进一步了解到中心化实体的风险,未来势必将会更多地选择 DEX 和 DeFi。