公募8222 ETH后,Arbitrove接下来会做些什么?

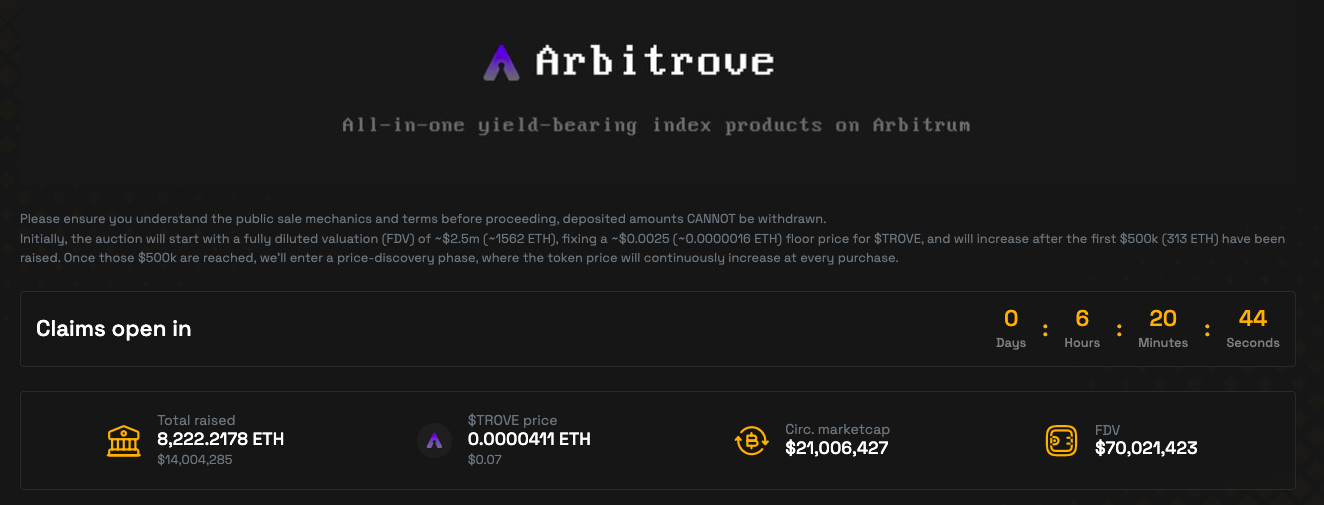

北京时间昨晚 22: 00 ,Arbitrum 生态指数协议 Arbitrove 在去中心化交易所 Camelot 的 Launchpad 上完成了其治理代币 TROVE 的公募,最终合计募资 8222.2178 ETH,约合 1400 万美元。

根据本次的拍卖设计,这一募资总额意味着 Arbitrove 本次公募所释放的 2 亿枚 TROVE(占总供应量的 20% )将以 0.0000411 ETH(约 0.07 美元)的价格于今晚 22: 00 正式开盘。

拍卖结束之际,Arbitrove 项目方接连发布了多条推文,向社区公示了 Arbitrove 当前的开发进展以及未来的工作计划。

“ 70% 公募资金将用于维持流动性”

Arbitrove 首先提到了公募参与者当下最为关注的流动性池情况,由于 Arbitrove 当前尚未与 Camelot 之外的任何其他交易所进行合作(虽然已有部分 CEX 宣布上线),所以在开盘后 Arbitrove 将于第一时间在 Camelot 上部署 TROVE/ETH 的流动性,同时会将公募 50% 的 ETH 投入该池以补充流动性(原计划是 30% )。

除此之外,Arbitrove 还将引入持续 14 天的底价保护措施,如果 TROVE 的价格下跌超过 20% ,Arbitrove 将“使用各种订单类型”进入买入,该措施的最大投入规模为公募总规模的 20% 。

这两项措施意味着,Arbitrove 总计最多会贡献出 70% 的募资 ETH,用于维持 TROVE 的流动性状况。

“ALP 预计会在月底发布”

产品方面,Arbitrove 正在推进 V1 版本的交付工作,该版本目前仍处于审计之中。此外,Arbitrove 也在试图扩充团队规模,当前正在与潜在对象进行沟通。

至于未来的开发计划,Arbitrove 接下来的重点将是推出指数代币 ALP 以及推出 TROVE 的质押功能,其中 ALP 预计会在月底收到剩余的一些审计机构的结果反馈后快速启动。

根据描述,ALP 是一个基于 GMX、MAGIC、GRAIL 等一篮子精选代币的收益率指数代币,Arbitrove 会通过各种策略来提高 ALP 的收益率,其本身作为单一代币也可在 Arbitrum DeFi 生态系统中作为抵押品或资产使用。

Arbitrove 预计,ALP 将会提供非常可观的收益率,因为除了基于各种基础资产的 50% 收益率外,还会加上 TROVE 的流动性激励收益,以及利用所筹资金所推动的其他额外收益。

在 ALP 之外,Arbitrove 未来还将推出其他更多的收益指数代币,预计接下来的第一个产品将是 GMX 生态指数。

投资情绪火爆,但风险亦不容忽视

或许是受潜在的空投预期趋势,近期整个 Arbitrum 生态的投资情绪相当火爆,除了 Arbitrove 之外,昨晚于 Camelot 启动公募的另一个项目 Factor(FCTR)当前也已募集了约 440 万 USDC。

不过,需要注意的是 Arbitrove 以及 Factor 等 Camelot 公募项目采用的拍卖机制不设硬顶、不能撤资,所以潜在的风险系数也相对较高。公募阶段的数据虽然好看,但由于该阶段只有买方没有卖方,所以无法准确代表二级市场对于该项目真实的估值状况,反过来看,过热的数据甚至更容易在开盘后造成反噬(今晚可以先看看 TROVE 开盘后的表现)。

因此,建议大家更为理性地看待 Arbitrum 生态(当然也不仅仅是该生态内)近期的所谓公募机会,切莫被 FOMO 情绪支配。