BUSD大旗倒下,BNBChain的稳定币生态将有何变局?

原文作者:GaryMa 吴说区块链

近期吴说发表了BUSD 遭受监管突击的全过程综述,美国证券交易委员会 SEC 以 BUSD 为未注册证券的切入口状告 Paxos,随后纽约州金融服务部 NYDFS 指示 Paxos 停止铸造新的 BUSD,CZ 也表示 “将相应地进行产品调整。例如,不再使用 BUSD 作为交易的主要货币对等”。

可以预见,BUSD 将逐渐淡出稳定币的历史舞台,而鉴于 BUSD 为 BNBChain 的王牌稳定币,这一大旗倒下之后,BNBChain 的稳定币生态会有何变局?

BNBChain 的稳定币生态现状

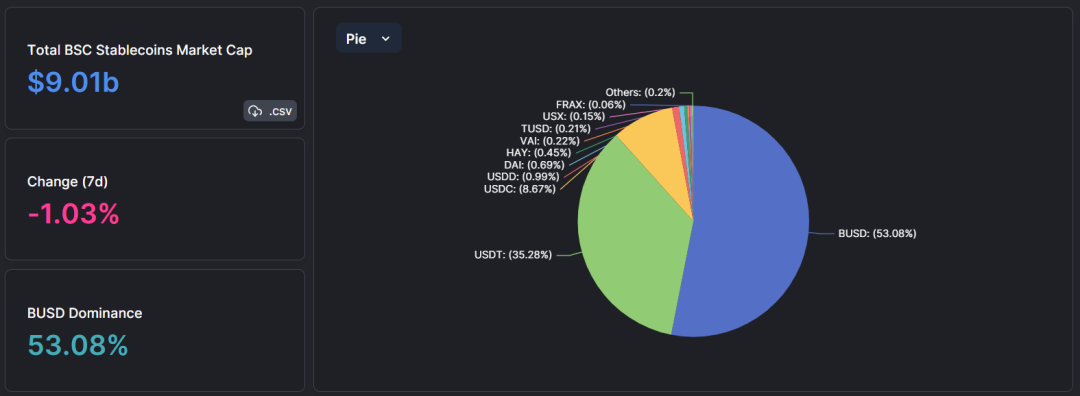

根据 defillama 的数据统计,目前 BNBChain 上的稳定币生态总市值已经超过 90 亿美元,而其中 BUSD 的占有率便高达 53% ,市值约 48 亿美元。

紧接着是 USDT 市值约为 32 亿美元(35% )、USDC 市值约为 7.8 亿美元(8.67% ),以及一些市值低于 1 亿美元的稳定币如 USDD\Dai\HAY 等。

根据 Paxos 的说法,至少在 2024 年 2 月之前,BUSD 依旧能够得到赎回。虽说有至少一年的缓冲期,但是面对这数十亿美元稳定币的流出,摆在我们面前的问题便是,这会如何搅动 BNBChain 的稳定币生态?

是激发去中心化稳定币的发展?

还是强化 USDT/USDC 在 BNBChain 的主导地位?

对于前者,在面对让币安自己下场构建类似 DAI 的去中心化稳定币的建议时,CZ 已经回应称,在这个关头,我们更希望其他人来做,以使其更加去中心化。我们不能什么都做。

而回顾目前 BNBChain 该赛道的两位选手 HAY & VAI,目前其稳定币市值仅数千万,即使我们乐观想象有该类项目能够扛起大旗,似乎自身赛道也有所上限,发展好如以太坊上的 DAI,目前其稳定币市值也仅约 50 亿美元,折算到 BNBChain 上来,依旧无法跟 BUSD 这类中心化稳定币的规模媲美。

那么目前看,似乎由 USDT/USDC 继承 BUSD 退出的这部分稳定币市场份额是最合情合理的。但这里我们需要知道的是,其实 USDT\USDC 官方是没有在 BNBChain 上发行原生稳定币的,甚至严格来说,BNBChain 就没有原生的中心化美元稳定币,包括 BUSD,本质上也是一种 Binance-Peg Token,由币安官方持有原生资产(即以太坊上的 BUSD),然后在 BNBChain 上 1: 1 锚定发行的 BEP 20 Token。

Binance-Peg Token,BToken

由于大多数用户只需要关注应用体验层面,所以对于各类资产的具体底层属性其实并无深刻了解。其实在 BNBChain(最初命名为 BSC)上线初期,币安为了吸引 BTC\ETH 以及稳定币等外部优质资产,便发起了 Token Canal(通证运河)计划,本质类似于封装资产(Wrapped Assets),而币安官方则充当这个原生资产托管和封装资产发行赎回的处理中心。

后来随着引入资产的多样以及规模的扩大,币安正式将这类通证统称为 Binance-Peg Token,BToken。

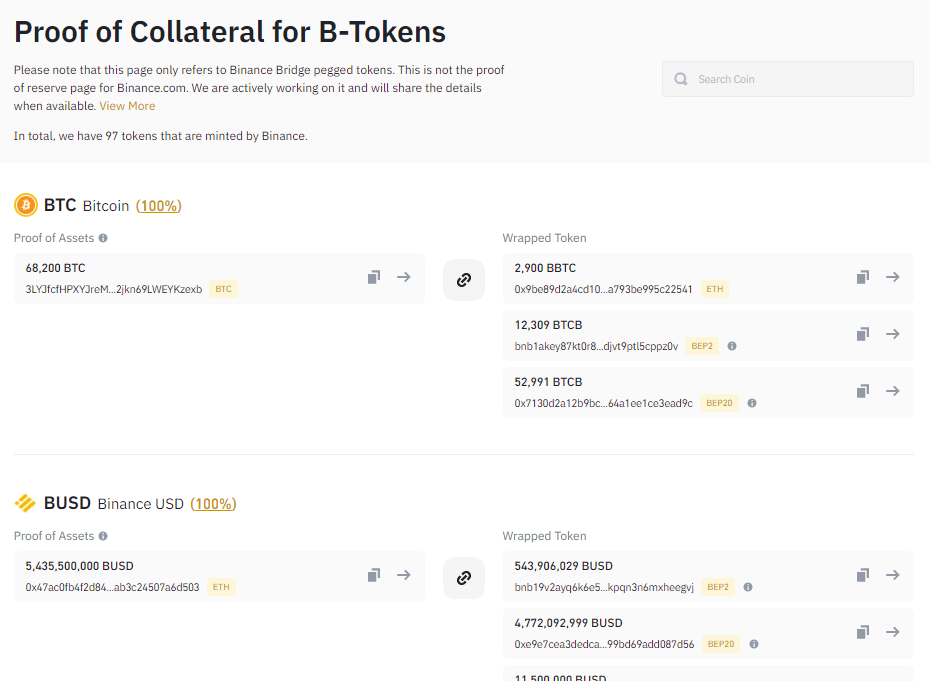

根据币安官方对 BToken 的抵押储备证明,我们了解到目前已经有 97 个 BToken,其中就包含约 54 亿的 ERC 20 BUSD 储备,对应着约 48 亿的 BEP 20 BUSD 以及其他各链对应的 BUSD。

而此前 NYDFS 强调,系授权 Paxos 在以太坊区块链上发行 BUSD,但该部门尚未在任何区块链上授权 Binance-Peg BUSD。似乎 NYDFS 的真正动机实际上是 Binance Pegged BUSD,而不是对是否有 100% 储备支持的担忧,毕竟这一块币安有公开透明的储备证明可验证,而 Binance Pegged BUSD 这一封装资产严格来说属于币安的链上行为所造,那么 NYDFS/SEC 矛头是否应该指向币安,且 USDT\USDC 同样也有对应的 Binance Pegged,Tether\Circle 是否也将被动存在同样问题?还是说只是一种借口,本质只是一种针对?当然,即使是一种针对,那可能也与当初币安全面支持 BUSD,默认自动将 USDC、USDP、TUSD 转换为 BUSD 的举措有关,毕竟在币安的支持下,BUSD 的更多场景可能会偏向 BNBChain,会让人产生一种 Binance Pegged BUSD 这种封装资产才是原生资产的误解。

现在我们回到最初的问题 “BUSD 的退出会如何搅动 BNBChain 的稳定币生态”,答案似乎也比较清晰,对于去中心化稳定币赛道,会有一定助推,但是可能激起的浪花高度有限;大概率是 Binance Pegged USDT\USDC 分食让出来的这些稳定币需求,同时 BUSD 的逐渐抽身对 BNBChain 生态可能也是利空。至于 Binance Pegged USDT\USDC 会不会遭受同样的“发行”授权的监管限制,这类担忧可以暂时先放下,虽然币安不是像 WBTC 的托管者 BitGo 一样有合规托管执照,但其资产托管储备公开透明,而且监管也应该不至于如此赶尽杀绝。

相关数据链接:

https://www.binance.com/en/blog/all/token-canal-upgrade-binance-wrapped-btokens-on-ethereum-panama-turns-into-bridge-421499824684901158

https://www.bnbchain.org/en/blog/binance-presents-project-token-canal-2/

https://www.binance.com/en/collateral-btokens