「GMX乐高」一览:盘点建立在GMX上的28个项目

原文来源:TokenInsight

可组合性(Composability)是DeFi的核心功能,使开发人员通过集成现有协议来快速创建新项目。一个现有协议便是GMX,它在 2022 年取得了辉煌的成绩。其 LP 通证 GLP 稳定地提供了超过 20% 的以$ETH计价的回报,引发了流行的“真实收益率”(real yield)叙事。

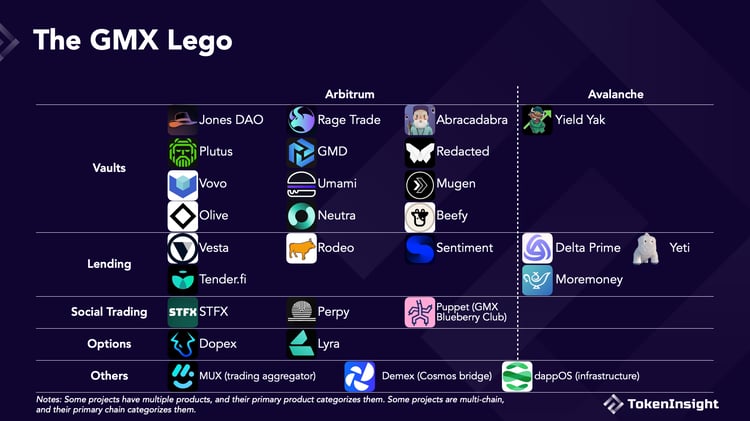

因此,开发人员开始在 GMX 之上构建新项目,时至今日已经有 28 个。本文介绍了所有项目,并对重点项目进行了分析。他们可以分为五类,金库、借贷、社交交易、期权以及其他。

金库(Vaults)

金库是其中最大的类别,有 13 个项目,从基本的自动复利池(auto-compounding)到旨在提高 GLP 回报的复杂的结构化金融产品。

利滚利(auto-compounding)

爱因斯坦认为复利是世界第八大奇迹。如果你像我一样,总是忘记将 GLP 收益重新投入 GLP 池,我们都错过了一些白捡的钱。

如果你不利滚利,年初投入的 100 美元在年底只会变成 120 美元,假设回报是 20% 。然而,如果你一天操作两次,将收益投回 GLP 池,你的 100 美元会在年底变成 122.14 美元。如果你考虑到复合乘数点(multiplier points)的提升,获得回报会更高。Multiplier points 是 GLP 的一个独特功能,以奖励长期用户。

相当多的产品为 GLP 持有者提供自动复利服务,这样他们就不会错过潜在的利滚利收益。

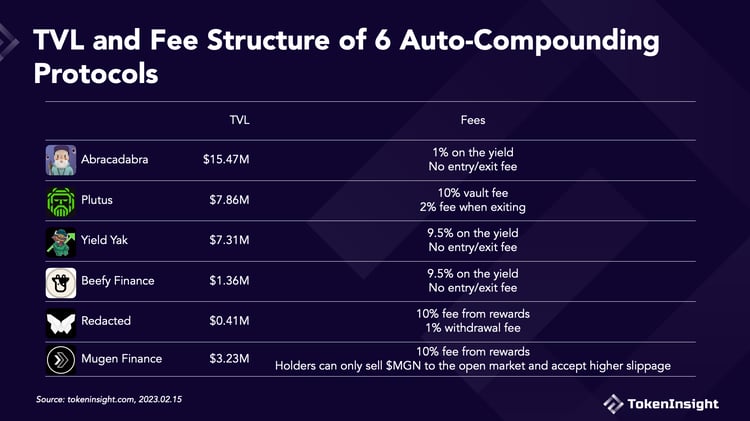

Abracadabra

Abracadabra是最大的 GLP 利滚利池,TVL 为 1, 547 万美元。用户存入 GLP 以获得 magicGLP,magicGLP 每天两次自动将获得的收益再投入到 GLP 池子中,从而最大化回报。与其他金库通证一样,magicGLP 的价值会随着时间的推移而增加,导致 magicGLP 兑换 GLP 的比率上升。

Abracadabra 对该服务的收益收取 1% 的费用,并且没有进入/退出费用,这是自动利滚利池中最低的价格。

Plutus

Plutus是第二大的利滚利池,其 TVL 为 786 万美元,用户可以将 GLP 存入得到 plvGLP。它每 8 小时自动复利一次,并收取 2% 的退出费和 10% 的保险库费。

作为交换,plvGLP 持有者获得 15% 的 $PLS 流动性挖矿奖励,相当于 2 年内分配给 plvGLP 持有者 225 万$PLS。奖励在最初几个月有加权,这意味着前几个月的奖励最高。$PLS 可以被锁定以获得 Plutus 协议产生的收益的一部分,并获得对锁定在 Plutus 内的 veTokens 的控制权。除了 plvGLP,Plutus 还有一系列治理权聚合和流动性相关产品。

Yield Yak

Yield Yak是 Avax 上的一个 GLP 农场,TVL 为 731 万美元。与 Abracadabra 和 Plutus 类似,Yield Yak 自动将$AVAX奖励投入 GLP,并获得 esGMX 以增加奖励。Yield Yak 收取收益的 9.5% 作为管理费,没有进入/退出费用。

Beefy Finance

Beefy Finance的 TVL 为 136 万美元。它的金库每天至少滚利一次,并在每次有存入时滚利。因此,利滚利操作每天发生会 10-20 次。它同样收取收益的 9.5% 作为管理费,且没有进入/退出费用,这与 Yield Yak 完全相同。

Redacted

Redacted为金库产品增加了一些多样性。Redacted 发布的 Pirex 在自动复利的基础上,为质押的 GMX 和 GLP 提供流动性。它有两种模式,简易模式和标准模式。

简易模式与上述其他利滚利池相同。很酷的是,他们还提供一个 GMX 金库。用户存入 GMX 或 GLP 以获得 apxGMX 或 apxGLP。简易模式收取 1% 的提款费,回馈给金库通证的持有者。此外,它还收取收益的 10% 作为平台费和 0.3% 的福利奖励费用。

标准模式为质押中的 GMX 和 GLP 提供流动性。用户存入 GMX 和 GLP 获得 pxGMX 和 pxGLP。存入的 GMX 和 GLP 与原生质押在 GMX 上一样。

不同的是,pxGMX 和 pxGLP 是可流通的,用户可以随时卖出,pxGMX 在 Arbitrum 上在Camelot有一个池子,在 Avax 上的Trader Joe有一个池子。

当通过 GMX 协议质押时,获得的 esGMX 是不可转让的。而通过 Pirex 存入,获得的 esGMX 被标记为 pxGMX 并可以转让。此外,获得的乘数点(multiplier points)永远不会丢失,因为当用户在公开市场上出售 pxGMX 时,其底层的 GMX 仍然被质押。因此,用户不会因为缺乏 multiplier points 或者 出售质押的 GMX 而受到惩罚。

标准模式收取 1% 的兑换费和收益的 10% 。

Pirex 的 GMX 金库是很有意思的创新,而 GLP 金库则与其他利滚利金库类似,可费用更高。因此,Pirex GMX Vault 的 TVL 为 404, 555 美元,而 GLP Vault 的 TVL 仅为 38, 557 美元。

Mugen Finance

Mugen Finance的 GLP 金库 TVL 为 323 万美元。它声称是一个多链聚合器,使用可持续的协议收入来产生收益。然而,Mugen 目前只支持一条链上的一个协议,即 GMX。

Mugen 的机制与上述 GLP 金库不同。$MGN是协议通证。用户将$USDC存入 Mugen 金库以铸造 $MGN,Mugen 用其金库购买 GLP。用户质押 $MGN 以获得 GLP 产生的收益。

购买 $MGN 和直接购买 GLP 有什么区别?购买 $MGN 更糟糕 3 倍。

当你以 $MGN 购买时,Mugen 团队将从你的 GLP 回报中扣除 10% 。

虽然你可以烧掉 GLP 从 GLP 池中赎回资产,但你不能从 Mugen 金库中提取资产。你只能在公开市场上出售 $MGN。目前,$MGN 的市场价格为 81 美元,而其对应金库价值为 126 美元,这意味着如果早期用户想要退出,他们必须接受 35% 的损失。

Mugen 还有一个特别的设计,以“防止用户在收益分配之前和之后开启并解除质押”。这个设计使得协议在会 30 天内延期支付 GLP 奖励。例如,如果 Mugen 从今天的 GLP 收益中获得 100 个 $ETH,那么每个 Mugen 质押者在接下来的 30 天内将每天获得 100 $ETH 中他们那一份的 1/30 。如果你想提前退出,你将失去剩余的奖励。

那么为什么还会有人购买 $MGN 呢?他们可以从早期用户的损失中受益。因为早期用户只能在公开市场上出售 $MGN,导致 $MGN 的价格低于其实际价值。如果你今天购买 $MGN,只花 81 美元可以购买价值 126 美元的 GLP。

此外,只有 84% 的 MGN 被质押。因此,质押者获得的收益更高,因为 16% 的 MGN 持有者愿意放弃他们的 GLP 收益(不过,需要指出的是 GLP 是自动质押的)。

使用任何利滚利池都伴随着额外的智能合约风险。当用户认为收益分配应该通过智能合约自动进行时,Mugen 此前曾暂停了收益分配,并没有做出解释。

最后,该项目依靠社区开发的前端供用户与其合同进行交互。该项目有自己的官网链接,但其功能非常有限。

下表总结了以上提到的六个利滚利池的基本信息。

高级策略

除了基本的利滚利外,不少项目还设计了更为复杂的 GLP 策略。

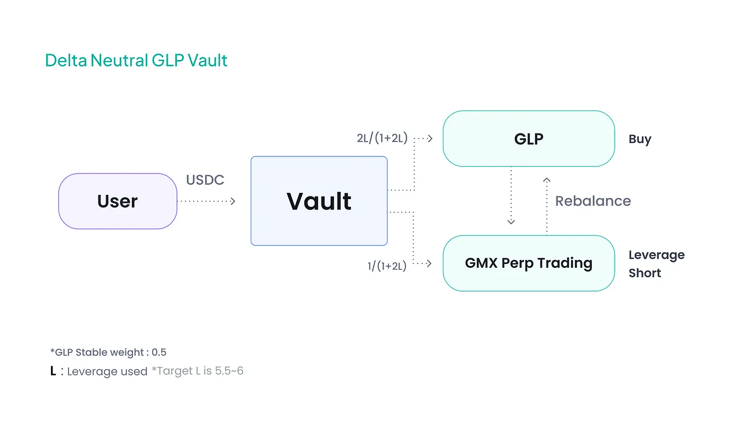

最常见的是 Delta Neutral 策略。由于 GLP 由 50% 的稳定币和 50% 的$BTC+$ETH组成,GLP 持有者相当于持有 0.5 倍杠杆的 Crypto 多头头寸,因此面临 BTC 和 ETH 的价格变动风险(加上对 GLP 池中其他一些小币的轻微敞口,如$UNI和$LINK)。这在牛市中很好。但在熊市中就有问题了。因此,市面上出现了 Delta Neutral 金库来对冲这些风险。

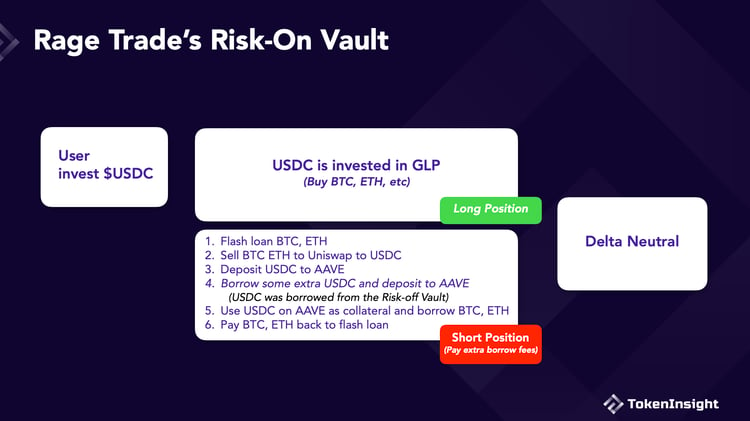

Rage Trade

Rage Trade的 Delta Neutral 金库是最受欢迎的,它被称为 Risk On Vault。Rage Trade 的 Risk On Vault 将用户存入 $USDC 投资进 GLP 池,同时通过闪电贷建立 $ETH 和 $BTC 的空头头寸。我们之前的文章更详细地解释了 Rage Trade 的机制。最终的结果是,当你持有 GLP 时,Rage Trade 自动对冲了你的多头敞口。

Rage Trade 还设计了一个 Risk Off Vault,以配合 Risk On Vault。Risk Off Vault 把 USDC 借给 Risk On Vault 来建立空头头寸。Risk Off Vault 获得Aave借贷利率和 Risk On Vault 获得的部分 GLP 奖励。

Risk On Vault 的 TVL 为 7, 330, 180 美元,Risk Off Vault 的 TVL 为 3, 799, 645 美元。合计 TVL 为 1, 113 万美元。

Neutra Finance

Neutra Finance通过另一个的途径实现了 Delta Neutral。它通过在 GMX 开设杠杆空头头寸来对冲 GLP 的多头敞口。它通过独特的再平衡机制保持 Delta Neutral。它目前的 TVL 为 116 万美元。

来源:Neutra Finance

Umami

与 Neutra 类似,Umami的 Delta neutral 策略也涉及在 GMX 上的对冲交易。它还实施了内部净额结算策略,该策略在 Umami 金库之间重新分配 Delta 以最小化对冲成本。对冲金额定期通过算法重新平衡。

Umami 原定于 3 月启动 Beta。然而,其 CEO 最近跑路了,并抛售了他所有的代币。虽然团队其他成员决定继续以 DAO 的形式继续开发 Umami,但这个不幸的插曲可能会导致产品延误。

来源:Umami

Vovo Finance

Vovo Finance是另一个有趣的 Delta Neutral 解决方案。Vovo 允许用户手动对冲,而不是自动对冲。

每周,金库收集质押的 GLP 的收益,并使用这些收益在 GMX 上开设 10 倍杠杆的头寸。用户可以从 ETH 涨、ETH 跌、BTC 涨 和 BTC 跌中选择他们青睐的资产和方向。一周后,金库会自动关闭杠杆头寸,并将利润再投资以购买和质押更多的 GLP。

Vovo 在四个金库中的 TVL 合计为 66, 013 美元。

GMD

GMD提供一种变体的 Delta Neutral 策略。GMD 不是直接对冲 GLP 标的资产的价格变动,而是通过创建三个独立的金库,允许用户只对一种资产有风险敞口,而不是 GLP 池中的所有资产。例如,持有 GLP 意味着同时持有 BTC 和 ETH,但 GMD 允许用户的 GLP 只包括 BTC、ETH 或 USDC 中的一种。它还使用协议收入来保护用户免受交易者 PnL 的影响。不过,就像我之前的文章讨论的,但在大多数情况下,GMX 交易者都是在亏钱。

GMD 的 GLP TVL 是 427 万美元。

Olive

Olive在竞争中加入了更多的金融炼金术。它提供本金保护金库,通过将可组合性和结构化产品结合起来,提高收益率,且不会让用户的本金面临风险。Olive 通过各种复杂的策略交易存入的 GLP 每周的收益。它以周为单位进行交易,按比例收取 2% 的管理费用,如果当个周期收益为正,还收取 10% 的绩效费。

它的 TVL 目前 29.9 万美元。

Jones DAO

GMX 战争的最后一个参与者是Jones DAO,TVL 为 1, 075 万美元。

这是一个加了杠杆的利滚利池,有两个金库组成,一个 GLP 金库和一个 USDC 金库。我们之前的文章非常详细地讨论了它的机制。简单来说,Jones DAO GLP 金库购买 GLP 并铸造 jGLP,然后从 USDC 金库借入 $USDC 来购买更多的 GLP。杠杆的多少是动态的,根据市场趋势确定。

USDC 金库的存款人作为贷方赚取利息和部分 GLP 奖励。

jGLP 可用于在 Jones DAO 平台和整个 Arbitrum 生态系统中提供流动性。例如,用户可以在 Camelot 上的 jGLP-USDC 池中提供流动性。

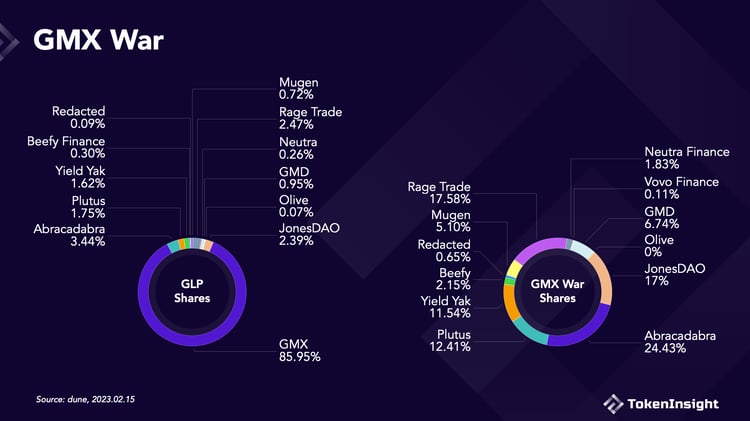

GMX War

GMX War 已经开始,在 GMX 基础上建立的金库玩家们正在相互争夺更多的 GLP 份额。虽然基本的利滚利功能已经很有吸引力,但进一步的创新可能会进一步提高 GLP 收益率。

我非常看好金库产品。GLP AUM 目前为 4.43 亿美元,而所有金库产品加起来仅占 GLP 总额的一小部分(15% )。大多数 GLP 仍闲置在持有人钱包中,等待被金库提供商捕获。

此外,GLP 作为一种产生收益的产品,本身具有巨大的潜力。承诺从庞氏骗局中获得 20% 回报的 Anchor(Terra 上那个)成功积累了超过 170 亿美元 AUM。而 GLP 的表现一直优于 20% 这一基准,而且其收益来自于真实的交易手续费。4.43 亿美元和 170 亿美元之间存在很大差距,而更好的金库产品也将吸引更多的人来铸造 GLP。

但有一点需要注意。我们正处于或接近一个 crypto 周期的底部。虽然 Delta Neutral 是过去一年 GLP 上的一个很好的策略,我们正从历史高点回落。但当我们上涨时,它反而起到的是副作用,因为价格上涨的所有收益都被这个策略对冲了。

借贷

在 Vault 产品之外,借贷是 GMX 上的第二大生态,使用户能够以其 GLP 资产为抵押去借款,来为 yield farming 加杠杆。Jones DAO Vault 也是一种内置借贷的收益产品。

借贷领域主要的玩家是 Vesta、Sentiment、Rodeo 和 Tender.fi,以及 Avax 上的 Delta Prime、Yeti 和 Moremoney。所有这些都允许用户以他们的 GLP 做抵押来借款。Sentiment 还允许使用 GMX 作为抵押品,而 Rodeo 有自己的 GLP 利滚利金库。

期权

GMX 上 perp 交易也与期权交易所很好地协同。

Lyra

Lyra是交易期权的 DEX。该协议旨在将流动性提供者的敞口保持在接近 Delta Neutral,这是通过在GMX或Synthetix上开设多头或空头头寸来实现的。

Dopex

Dopex也是一家期权 DEX,它以两种方式集成了 GMX。

他们的 Atlantic Perp Protection 保护 GMX 上的交易员免受清算风险。购买了期权后,当一笔交易接近清算时,Dopex 上期权的稳定币抵押品将自动从 Dopex 合约转移到交易者的 GMX 抵押品账户中。

Dopex 还帮助用户对冲 GLP 价格变动风险。如果 GLP 价格低于期权执行价格,用户将获得结算收益。如果 GLP 价格上涨,用户可以保持他们的 GLP 持仓,并获得价格上涨带来的收益。

社交交易(Social Trading)

随着 STFX 和 Perpy 的推出,社交交易(Social Trading)最近势头强劲。它允许用户复制高利润的交易者的交易。

STFX

STFX全称是 Single Trade Finance Exchange。它提供专门用于一次交易的短期、非托管、活跃的资产管理金库。STFX 交易者使用 GMX 来执行他们的交易。该平台收取 20% 的固定绩效费。

Perpy Finance

Perpy Finance在概念上与 STFX 相似,但在设置上有所不同。根据 Perpy 的说法,主要区别在于 Perpy Vault 是连续的,收取可变费用,没有筹款期,并保护隐私。

来源:Perpy Finance

Puppet Finance(GMX Blueberry Club)

Puppet Finance是 GMX Blueberry Club 即将发布的复制交易功能。用户可以根据意图将资金存入不同的池。例如,将 ETH 存入 ETH 看涨池或把 USDC 存入 ETH 看跌池。Puppet 跟踪每个注册的交易者的表现,用户可以将其交易与之匹配。这个产品还在研发中,更多细节将在 GMX synthetics 产品推出时公布。

其他

DappsOS

DappOS是一种操作协议,旨在降低与加密基础设施交互的障碍。在 GMX 上,DappsOS 允许用户通过 BSC 钱包直接访问 GMX。它非常酷,将为 GMX 带来更多用户。

Demex

Demex通过智能合约将 GLP 桥接到 Cosmos,并提供自动复利服务,允许 Cosmos 用户访问 GMX 并从 GLP 中获得收益。

MUX

MUX由 MCDEX 改名而来,是一个独立的 perp DEX 和交易聚合器。MUX perp DEX 与 GMX 相同。如果费用较低,它还允许 MUX 交易者直接在 GMX 上开仓。

写在最后

GMX 生态系统提供的协同效应使其所有项目受益。例如,Vault 产品可以与借贷协议合作,使 degens 能够为其 GLP farm 增加杠杆。社交交易产品可以推动 GMX 的交易量,并通过增加的手续费为 GLP 带来更大的回报。

另外,Arbitrum 空投随时可能发生,我预计大部分空投收益将被再投资到 Arbitrum 项目中。GMX 生态系统目前是 Arbitrum 上最具活力的。上述一个或多个项目都将从 Arbitrum 空投中受益。

此外,我相信,尽管存在监管风险,但“真实收益”叙事将席卷 DeFi。像 Uniswap 这样的现有头部项目将被分享收入的协议所取代。正如贝索斯的名言,“你的抽成就是我的机会”。Uniswap 想必无法与一个和用户分享收益的同类协议竞争,如果他们的产品体验做得一样出色。GMX 作为“真实收益”叙事的领头羊,也会受到更多关注,而其生态系统项目也将得到蓬勃发展。

因此本文提到的项目都值得持续关注,其中可能包括下一个牛市期间的百倍项目。