最高可领320万枚BLUR,市占率超OpenSea,Blur第二轮空投是否值得期待?

今日凌晨,BLUR 空投成为了市场热议的话题。原定于凌晨 1 : 00 开启的空投,被官方推迟至 2 : 30 开始,但迟来的空投仍然点燃了交易者的情绪。巨额空投的造富传说再次牵动着人们的眼球。

欧易 OKX 行情显示,BLUR 代币上线最高涨至 8.36 美元,截止本文发布时,稳定在 0.6 美元附近。

Blur 将自己标榜为“职业交易员的市场”,在 2022 年 3 月完成 Paradigm 领投的 1100 万美元融资。与此前通过空投捕获用户的其他竞品一样,这一市场的空投吸引了大量的交易,并最终在今日让用户将自己的潜在收益兑现。

最高 320 万枚的空投收入,虚假交易引质疑

在推特上,名为 Keungz 的用户晒出了自己的空投战绩。这名交易者收到了高达 61 万枚 BLUR,以现价计算约合 36 万美元。

而这并不是空投猎手的最佳战绩。Dune 数据显示,一个不具名的地址“0xD5eE00b7BAbd9374D32159CD7cD82bb99eF831fd”领取了超过 320 万枚 BLUR, 以现价计算约合 1920 万美元。

而紧随其后的两个地址则分别领取了297 万枚和250 万枚。分别为“0x8BC110Db7029197C3621bEA8092aB1996D5DD7BE”和“0x9e91F274F175388dd1950799Fa69e00d699ae2ee”。

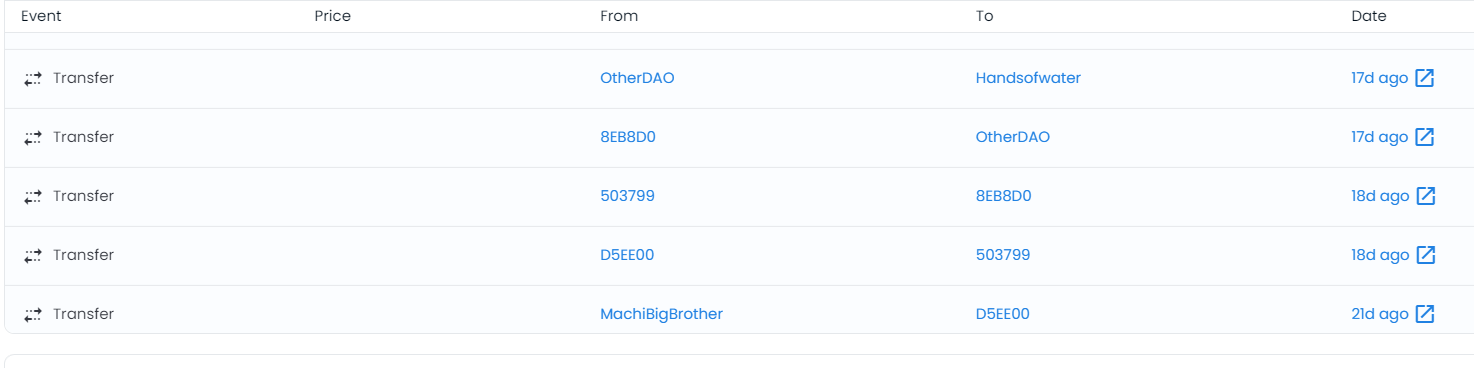

查阅链上数据,Odaily星球日报还发现一些有趣的事实。

查看其交易活动,可以发现领取量前三的这三个地址之间存在大量的互动。不难猜测,这三个钱包之间存在关联。

以 Otherside #81212 为例,这一 NFT 于 21 天前被“0xD5eE”首次买入,随后该地址反复买入这一 NFT,累计买入 6 次。而其他 NFT 持仓也存在此类反复买卖的现象。

虚假交易和刷量始终是空投难以回避的问题,这也成为诸多用户对平台提出置疑的一个主要原因。 Dune 数据显示,大约 13% 的 Blur 交易被列为疑似虚假交易,而 OpenSea 的这一项数据仅为 2% 。

虚假交易和刷量始终是空投难以回避的问题,这也成为诸多用户对平台提出置疑的一个主要原因。 Dune 数据显示,大约 13% 的 Blur 交易被列为疑似虚假交易,而 OpenSea 的这一项数据仅为 2% 。

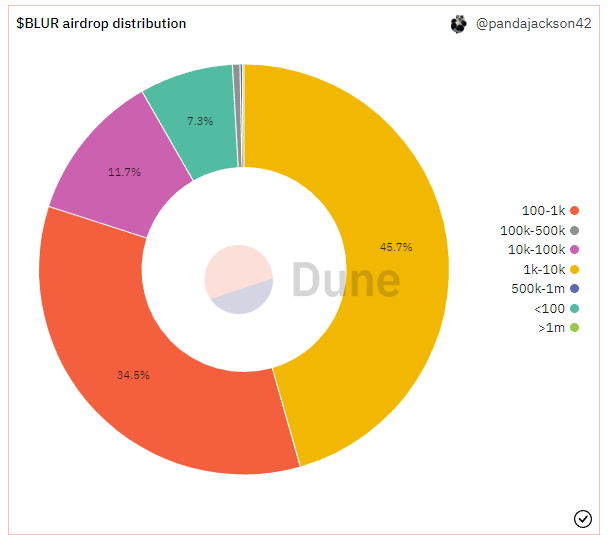

虽然造富效应十分可观,但并非所有人都可有幸获得巨额空投。本轮空投总计 3.6 亿枚,约 80% 的人领取空投数量在 1 万枚以下,约三分之一用户领取不到一千枚。

到目前为止,已有 40, 585 个地址领取了 2.73 亿枚空投代币,约占本轮空投总量的 76% 。

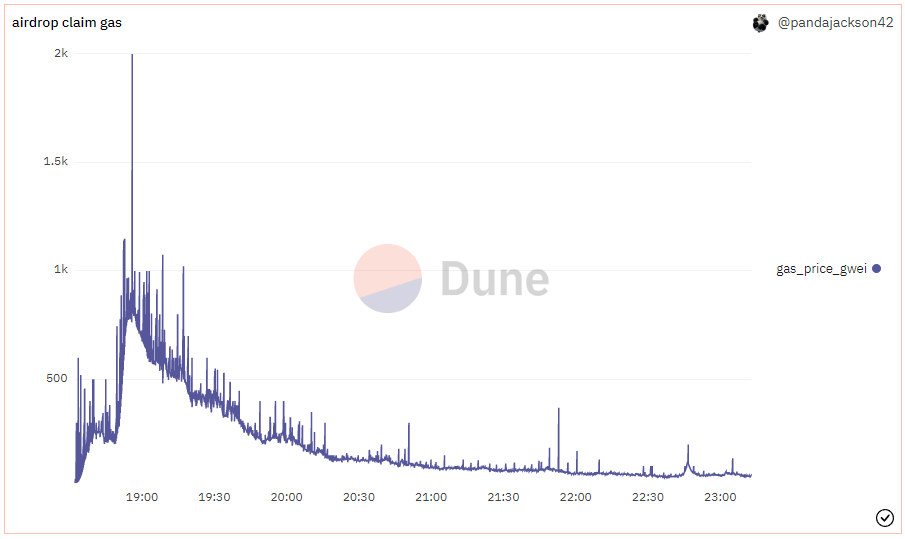

海量的领取和交易也为以太坊带来了拥堵,gas 一度飙升至超过 2000 gwei。在空投约 2 小时之后 gas 才回归正常水平。

Blur 市占率冲上第一,传将有巨额融资

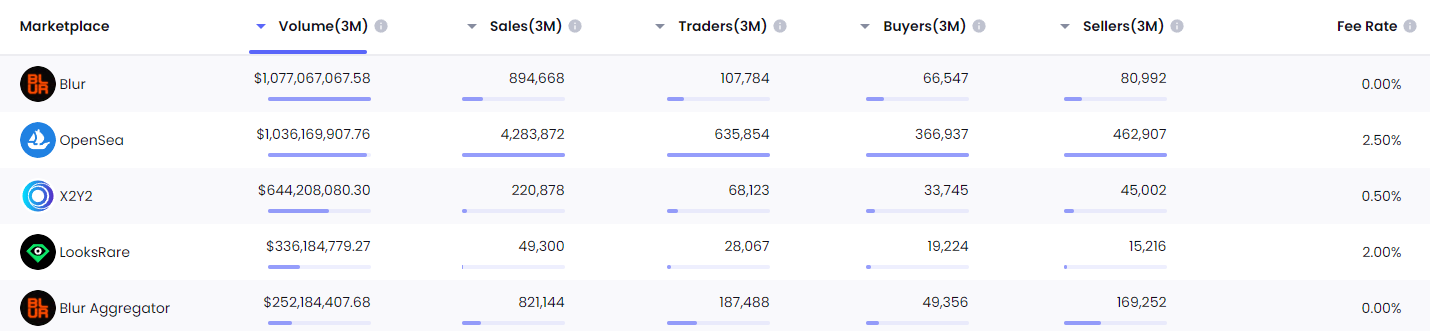

Blur 于去年 10 月推出,并在 NFT 市场这一竞争日益激烈的赛道迅速抢占了大量市场份额。而 The Block Research 的数据则显示,在刚刚过去的 1 月,BLUR 已成交易量最大的 NFT 市场。

NFTgo 数据显示,Blur 三个月交易量已超 OpenSea ,但在空投结束之后,交易量能否继续增长仍未可知。在空投的巨大诱惑下,多个 OpenSea 的竞争对手都曾短时超过 OpenSea。

今日,Blur 官方对刷量交易做出回应:Blur 平台不包含虚假交易的真实交易额达到 12 亿美元,用户数量达 146, 823 名。

推特用户@tier10k 透露,NFT市场 Blur 将以 10 亿美元估值进行融资。若以时价 0.6 美元计算,BLUR 目前流通市值 2.16 亿美元,FDV 18 亿美元。

昨日,恰逢 CZ 进行 AMA,由推特用户关于“传闻称币安即将上线 Blur(BLUR)”提出询问,CZ 回应称:自己不会对任何特定项目发表评论,尤其对上线或不上线的问题发表评论,任何要在币安上线的项目都需要遵守严格的上线规则,包括信息披露等。不过虽然现在没有上线,并不代表未来不会上线。

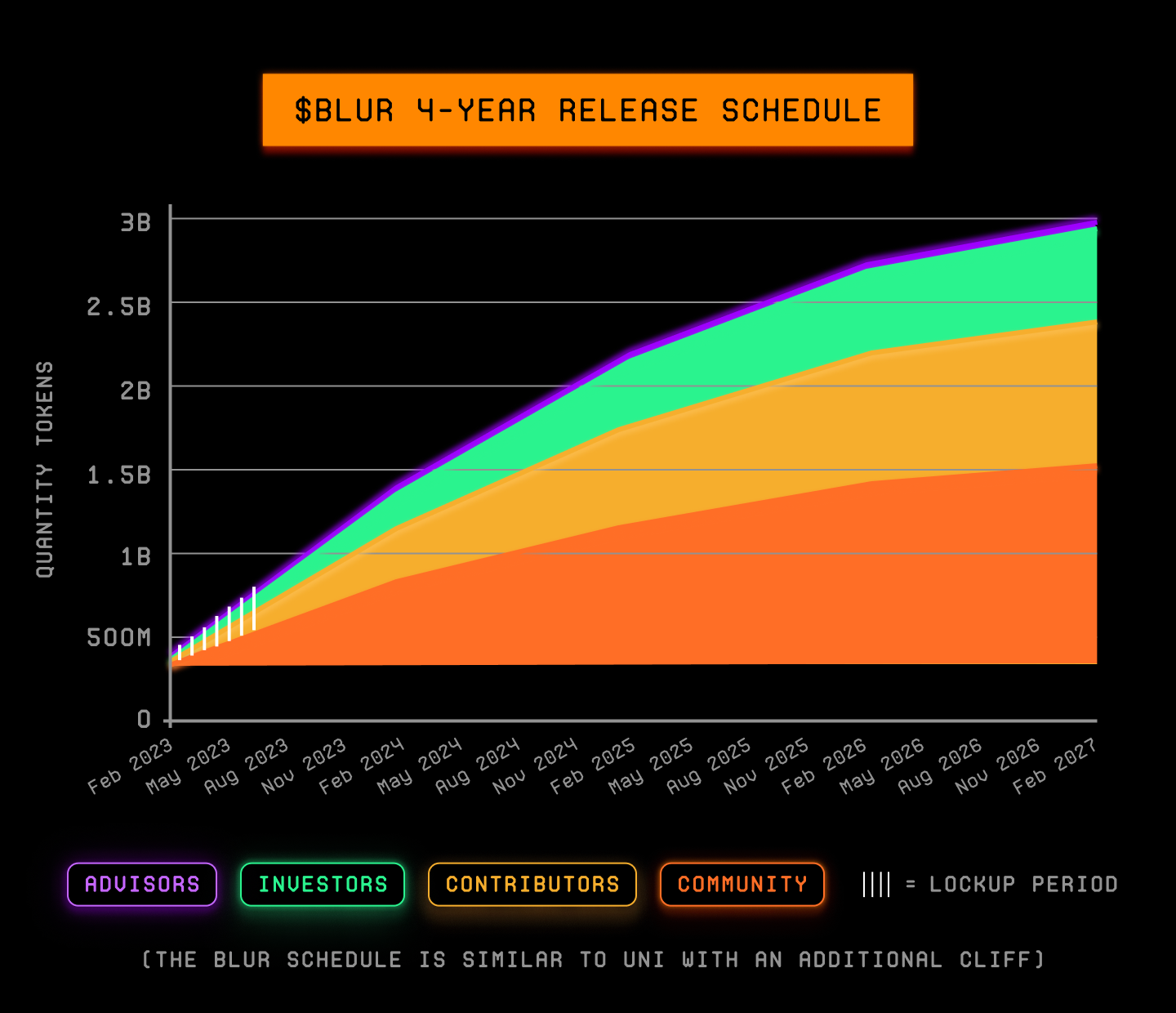

BLUR 的代币数量十分可观,其总供应量高达 30 亿。

本轮空投的 BLUR 代币,只占总供应量的 12% ;且未来流通量将快速上涨。

根据官方公布的代币经济学,BLUR 代币分配如下:

15.3 亿枚分配给社区,分四年分配,占比 51% 。

约 8.7 亿枚分配给核心贡献者,分四年解锁,占比 29% 。

约 5.7 亿枚分配给投资人,分四年解锁,占比 19% 。

约 3700 万枚分配给顾问,分四至五年解锁,占比 1% 。

财富效应引发了交易者的热议,纷纷期待下一次空投。按照官方的规则,未来我们将迎来第二轮及第三轮空投。

Airdrop 2 是为积极在 Blur 上列出 NFT 的用户所准备的,本次活动将持续到今年 11 月。

Airdrop 3 则是为在 Blur 上提交出价(bid)的用户所准备的,且这将是最大的 Blur 空投(大约是 Airdrop 2 的 1-2 倍)。

代币经济学显示,第一年(至今年 10 月)社区金库将被分配 4.68 亿枚 BLUR,首次空投已用掉了 3.6 亿枚。而到今年 11 月时,Blur 诞生的第二年到来,社区金库又可增加 3.51 亿枚 BLUR,届时,我们是否又可见证新一轮的空投盛宴?