Uniswap治理争端全复盘:选哪座桥其实没那么重要

Uniswap 算是治理机制最强大的去中心化项目之一。作为其治理代币,UNI 拥有约 37 万个持币者,而 Uniswap DAO 则拥有超过 28000 个独立投票人。

近日,围绕着 Uniswap 将在 BNB Chain 上部署这一提案,Uniswap 社区展开了激烈的讨论。而在此次提案中对立的两方资本力量也为我们提供了不一样的观察视角,治理渐趋中心化、巨鲸实体操控链上决议的困境也引发了理想人士的担忧。

而在本次治理中关于“桥的选择”这一议题上,人们或许投入了过度的关注。Odaily星球日报经研究治理流程和各方提案后认为,即便最终被 Uniswap 集成,也不会为被选中的桥带来更多 TVL 或增量用户。围绕 Uniswap 治理的跨链选择爆发如此强烈的争吵,其意义或许并不显著。

为什么 Uniswap 需要桥?

桥的选择是在本次投票治理中,争论最为广泛的核心议题。而在第一次看到这一议题时,为什么 Uniswap 需要一个桥引发了我的困惑。

目前,Uniswap 已在以太坊主网、Polygon、Optimism、Arbitrum、Celo 五条链部署。尽管 Uniswap 支持多条链,但这并非是一个跨链 DEX,不存在跨链交易,自然也无需使用桥来流通资产。既然如此,Uniswap 又为何因桥的选择而争论的喋喋不休?

Celer Network 联合创始人 Mo Dong 向 Odaily星球日报解答了这一困惑。

Mo Dong 解释道,Uniswap 采用了一主多从的结构,治理提案都在以太坊主网进行表决,而在投票之后通过跨链桥将投票结果这一消息传递到其他链上。

也就是说,尽管 Uniswap 已经部署了多条链(且未来还将继续增加),但他们的地位并不是完全平等的。其他链并不拥有治理权,仅以太坊主网负责进行治理流程,且需使用以太坊上的 ERC-20 版 UNI 代币进行投票。

回到我们的问题,为何 Uniswap 需要一个桥?当 UNI 在以太坊主网完成治理投票之后,需要将这一消息传递给 Polygon、Optimism、Arbitrum、Celo 其他四条链,而“以太坊主网→其他链”的链间通信则必然需要桥来进行。而未来通过何种桥将治理结果传递给 BSC,则是本次争论中的关键。

跨链桥背后的资本对垒

去年 12 月,0x Plasma Labs 的创始人 ilia_0x 发起了本次提案。提案的主要内容为将 Uniswap V3在 BNB Chain 部署。ilia_0x 还一口气为这一提案找了 17 个理由,包括 BNB Chain 庞大且不断增长的用户基础、高速度和低费用的交易、币安的品牌价值、安全合规、币安生态、链上治理等等。

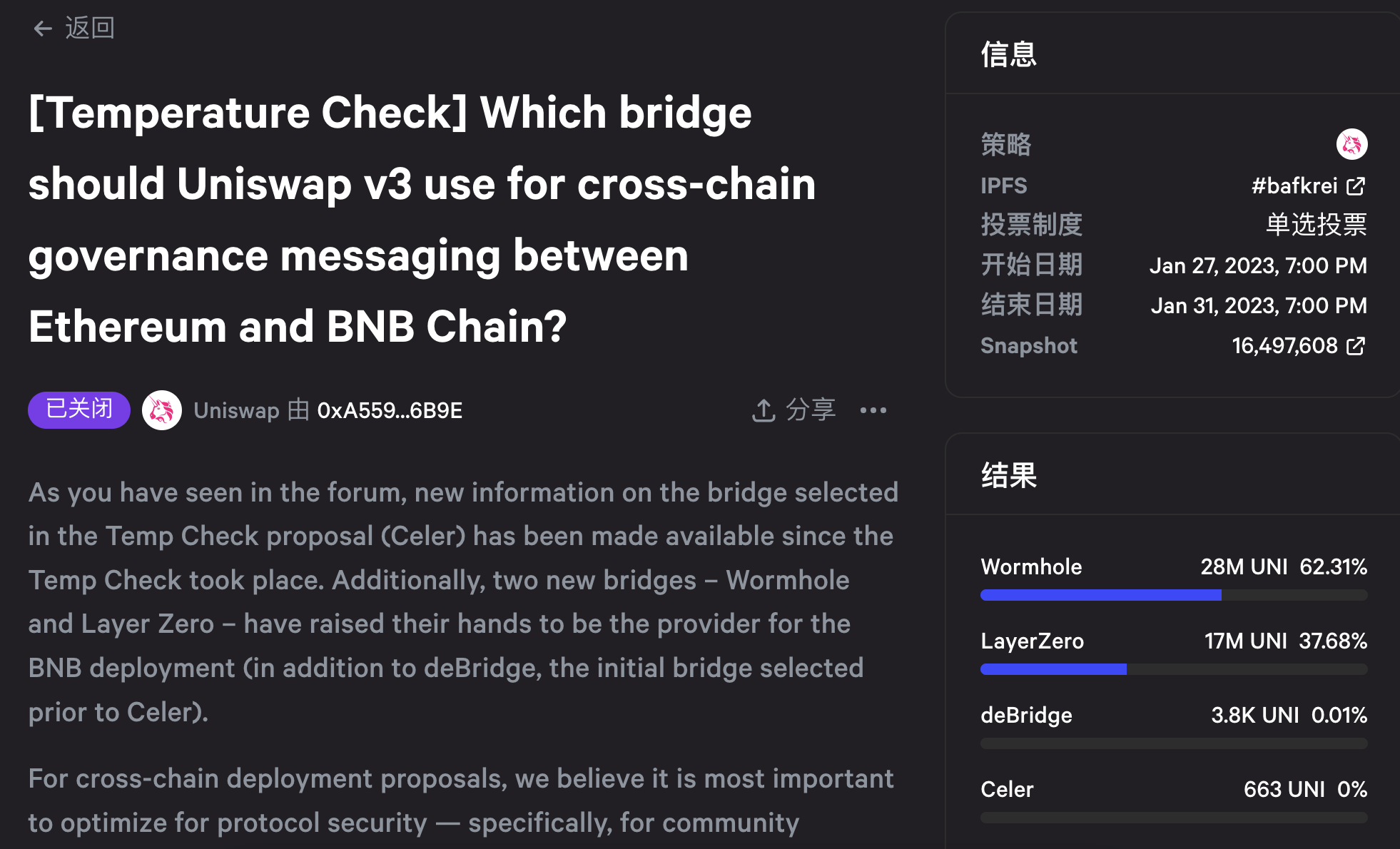

为了完成在新链的部署,必然需要一座桥来连接。而围绕着新桥的选择,多个桥展开了激烈的争论。为此,治理论坛还专门开了新的一个帖子进行讨论,Wormhole、LayerZero、 Celer、deBridge 都试图参与竞争。

此时,使用哪个桥已不单单是技术问题,还具有生态发展及品牌建设的价值。目前,LayerZero 和 Wormhole 均未发币,其项目价值由机构投资者捕获。因此,两者背后的资本势力就针对这件事展开了对垒。

LayerZero 和 Wormhole 的讨论开始针锋相对,目前在治理论坛上有 93 条帖文讨论。(此前关于费用开关这么重要的治理讨论仅 73 条贴文。)

在帖子里,包括桥、资本方、持币者等各方利益相关者均表达了自己的声音。但对于大多数不明确支持哪一个桥的中立派来说,这个选择并不重要。尽管每个桥协议都提出了使人信服的论点,但仍难以说服大多数人向其投票。

LayerZero 和 Wormhole 两个重量级的玩家,则分别阐述了自己的优势。

LayerZero 表示,他们的架构更加去中心化,并且可给予 Uniswap 自主控制链间消息传输背后的基础设施的权力。而 Wormhole 则依赖于 19 个验证者处理跨链,LayerZero 认为,验证者之间可能会相互串通,存在发起恶意攻击的风险。

Wormhole 则做出了反驳,保护系统安全的 19 个验证者与多个 POS 链的验证者有极大的重叠,其中包括 Solana、Cosmos、以太坊。如果这些 POS 链值得信任,那么 Wormhole 也值得信任。

另一个值得关注的点则在于桥的安全性。LayerZero 认为,Wormhole 的代码是可升级的,这可能会在将来产生漏洞,从而导致被黑客攻击的风险。而 LayerZero 的代码是不可变的,且已经进行了 35 次的代码审查。

而 Wormhole 则用自己的“坚强”来反对对于安全性的质疑。

2022 年 2 月 Wormhole 被盗 12 万枚 wETH,这一攻击事件导致了超 3 亿美元的损失。而在这一严重的攻击事件之后,Jump 填补了资金漏洞。而对于大多数桥来说,如此严重的攻击事件很难让项目存活,但 Wormhole 不但幸存了下来,还发展壮大,目前已经与 22 条链集成。

1 月 31 日,在 SnapShot 上对于桥选择的投票结束,Wormhole 以 62% 的得票率获得了胜利。而 deBridge 和 Celer 合计得票仅 0.01% 。

这也表示在 BSC 部署的提案已经确定要将 Wormhole 作为使用的跨链桥。但部署至 BSC 的提案仍在投票之中,这一天将于 2 月 11 日截止,截至目前,仍未达到足够通过提案的票数。

反对提案的a16z备受质疑

2 月 5 日,a16z公开表示,仍将继续支持 LayerZero,已对“在 BNB Chain 上部署 Uniswap V3”的提案使用 1500 万枚 UNI 代币投出了反对票。a16z合伙人 Eddie Lazzarin 表示,“如果技术上支持,我们会把 1500 万枚代币投给 LayerZero”。

a16z 的这一选择可能会产生更深远的影响。若最终 Uniswap 无法在 BSC 部署,或将影响 Uniswap 未来的竞争优势。

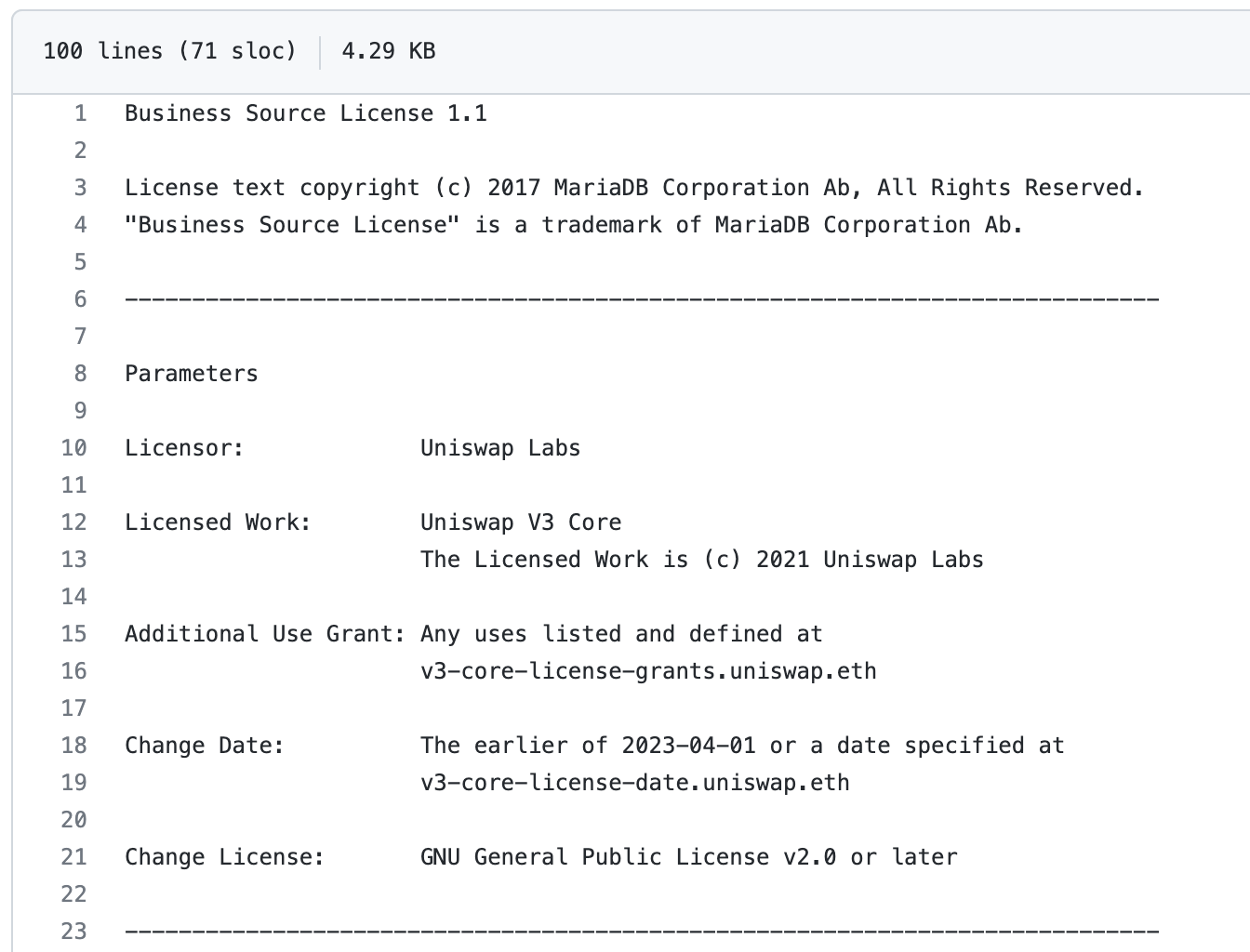

回到事件的起点,Uniswap 将于 BSC 部署,其中最大的动机或在于 V3 的许可证到期。

在 V3 部署之时,Uniswap 为这一版本的代码申请了商业许可证,并禁止了对 Uniswap V 3 的 fork 行为。Uniswap 认为,“我们认为 Uniswap 社区应该率先围绕 Uniswap v3 Core 代码库构建一个生态系统。”

2023 年 4 月 1 日,Uniswap V3 的许可证将到期。长期以来, V3 凭借其独特的机制而在市场上占据特殊的生态位。届时,任何人都可在 BSC 上 fork 一个使用 Uniswap V3 作为核心的 DEX。

在 BSC 的快速部署将带来巨大的先发优势,并可依靠这一优势来快速获得 TVL,以及大量的 BSC 用户。在 BSC 上部署 V3 ,也被社区认为是当下较为紧急的事情。而本次的提案若被否决,Uniswap 或将失去这一巨大优势。

正是由于这一原因,仅是因为桥的选择竞争落败,而在提案中进行阻挠的 a16z ,也在社区遭受了质疑和批评。

治理中心化引发各方担忧

尽管目前这一事件还未最终一锤定音,但事情的发展已经逐渐走向终局。不过对于治理中心化的担忧,仍然值得人们讨论。

除了 LayerZero 或是 Wormhole 这种“N 选一”的选项,也有部分社区成员主张这种选择都不可靠,使用单一的跨链桥可能会产生单点风险。

Celer 就在治理论坛中提出了多桥的解决方案。他们认为,就安全性和可用性而言,这种解决方案优于选择单个桥。

在 Celer 提出的解决方案中,具有多个副本的消息通过不同的桥发送到目标链,多个桥互相校验,并且只有当相同的消息通过不同桥被传递时,才会在目标链上执行。

“N 选一”的模式则必然存在一个最终胜出者,而各方资本的激烈竞争,则凸显了治理已经渐趋中心化。

Dune Analytics 数据显示,目前前五大 Uniswap 治理代表(Delegates)总共持有超 25.83% 的投票权重。其中排名第一的治理代表拥有 7.2% 投票权重。

数据公司 Bubblemaps 统计发现, a16z 可以通过 11 个地址控制 4150 万枚 UNI,占 UNI 供应量的 4.15% 。而在本次投票中,a16z 目前仅投出 1500 万票。

但目前的信息显示,未来 a16z 或将不会再投出任何一票。

今日,其技术合伙人 Eddy Lazzarin 发推称, a16z Crypto 将大约 4000 万枚 UNI 投票全委托给外部团体(对他们如何投票没有任何条件),用 1500 万枚 UNI 进行投票(不到委托给其他人的数量的一半)。 a16z 已经对其他 11 项提案进行投票,是 Uniswap 社区中最活跃的成员之一。“委托投票的原因是为了更广泛的观点、不那么中心化的投票权以及更多的社区参与”。

本次事件的持续发酵也引发了从业者的关注。强力资本的大量代币对去中心化协议的投票控制,早就成为加密世界的一大治理难题。CZ 对此事件评论道,人民投票与金钱投票是完全不同的,链上投票意味着巨鲸可能会控制区块链,就像股东一样。