一文探讨区块空间竞争如何扭曲交易打包时间?

原文作者:Tripoli

原文编译:0x11,Foresight News

本周早些时候,我在以太坊基金会举办的 Reddit AMA 上提出了一个问题,其中一个回答引起了我的注意:

我期待看到合并后交易打包时间的改变!

理论上合并后平均打包时间应该降低约二分之一,因为下一个区块的预期时间现在是 6 秒,而之前是 13 秒,更规律的打包时间也减小了峰值。根据我的个人经验,如今的交易打包速度非常快,甚至与 EIP-1559 之后、合并之前的那段时间相比也是如此。看看数据具体的数据会很有趣。

- /u/vbuterin

比特币区块时间动态被研究得更多,数据可用性更高。因此,我将把以太坊的工作量证明转移到比特币上进行分析【 1 】。这两个系统非常相似,主要区别在于难度调整将比特币的平均出块时间保持在 10 分钟,而以太坊的平均出块时间保持在 13 秒左右【 2 】。

然而,区块时间平均值是一个巨大的简化。媒体经常将比特币矿工称为一群解决复杂数学问题的计算机,但事实并非如此。解决这个词隐含的意思是,这类主流类比表明采矿设备不断接近解决方案,但这不是加密挖矿的工作方式。最简单的散列类比是抛硬币并尝试连续 77 次正面朝上【 3 】。 不正确的散列不会提供有意义的进展,这是赌徒谬误的一个版本:所有散列都是独立的,当散列失败时就没有进展。

尝试的独立性和由此导致的缺乏进展被描述为失忆。不管上一个区块已经过去了多长时间,比特币矿工发现下一个区块的可能性总是一样的:下一个区块出现的平均时间总是在 10 分钟后。

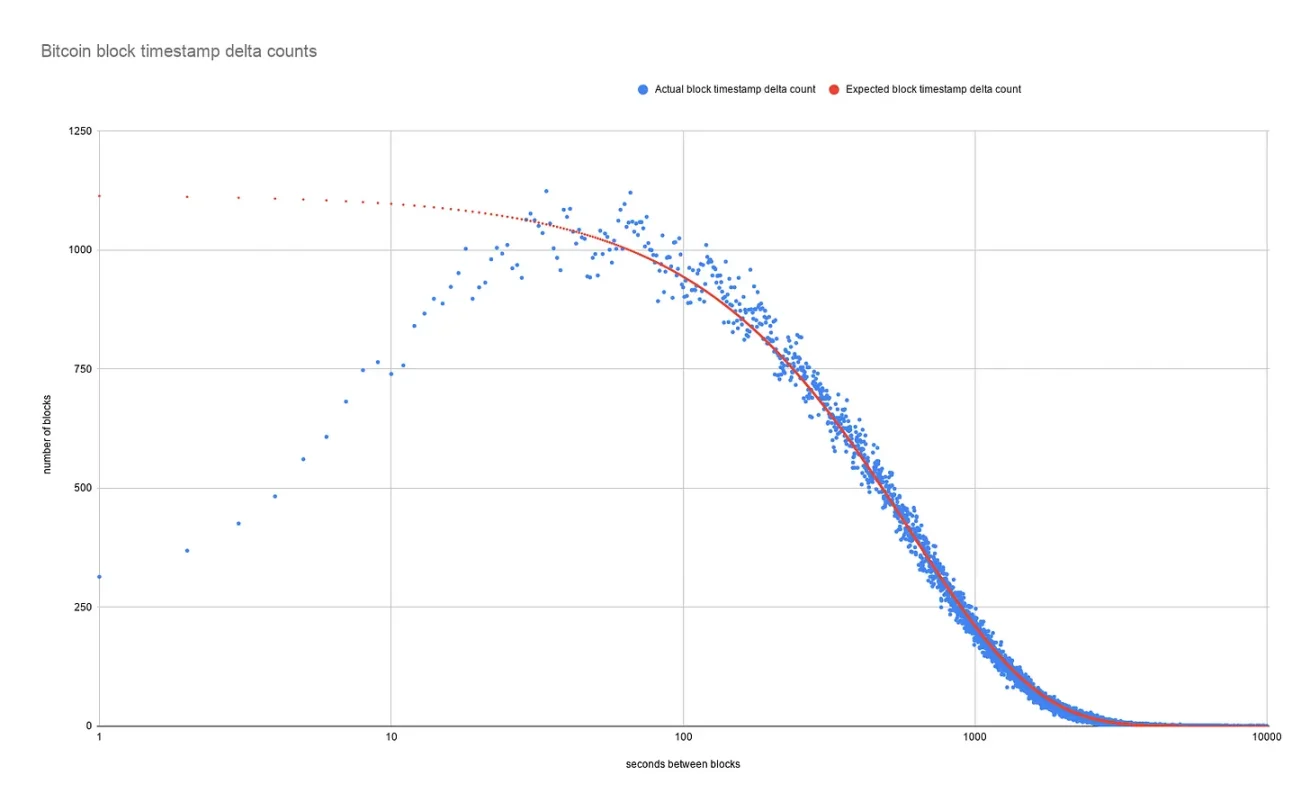

如果你对比特币区块间隔方差的数据感兴趣,Jameson Lopp 几年前写了一篇很棒的文章。简单来说就是,忽略源自非常快速出现的区块的边缘案例,区块间隔遵循指数概率分布。

比特币出块时间方差:理论与现实;资料来源:Jameson Lopp

为了讨论交易打包时间,我们需要在分析中添加另一层。天真的说法是,当比特币交易被提交时,它应该被包含在下一个区块中,该区块平均会在 10 分钟内完成;因此,打包时间应为 10 分钟。在实践中,区块空间的竞争本质扭曲了打包时间并挑战了可交换性的假设。

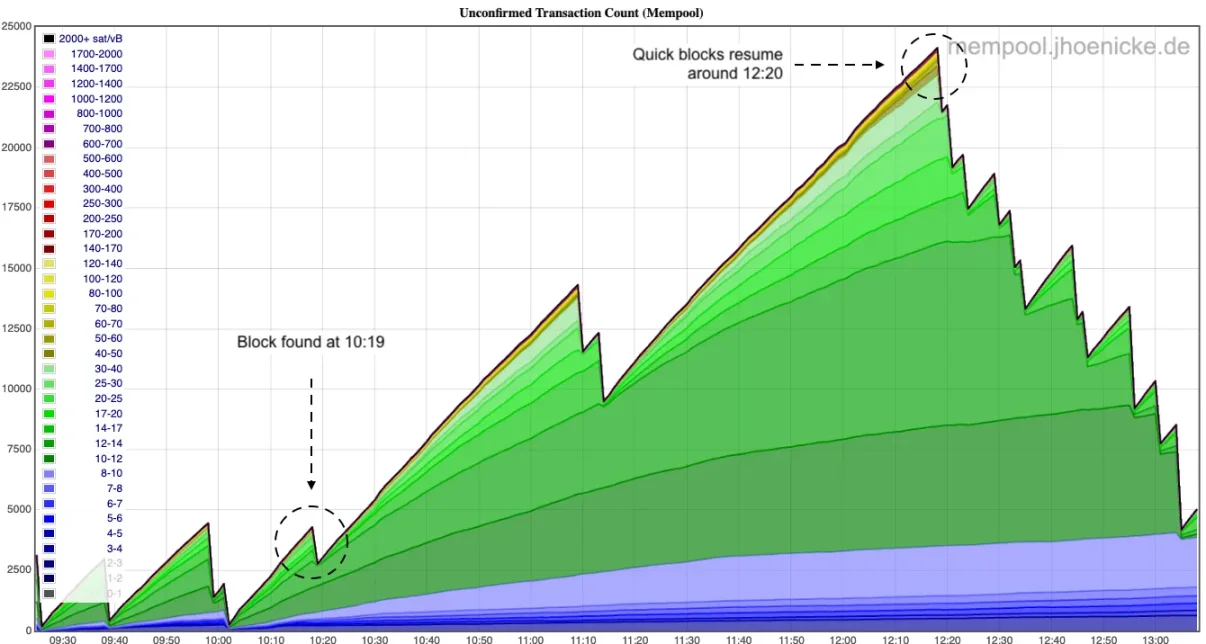

下图显示了 2022 年 9 月 2 日待处理交易的攀升。图表中的每个断崖或下降都表示发现了一个新区块并处理了一批最有价值的交易。为了方便,网格竖线以 10 分钟为间隔,既比特币平均出块时间。

比特币内存池

该图显示了区块发现中的非典型但并非罕见的差距。从 10: 20 到 12: 18 ,只发现了两个区块,而不是预期的十二个。

虽然在 10: 20 发送 12 sat/vB 交易似乎是安全的,但它可能直到 13: 00 才被处理,至少 8 个,可能多达 11 个区块。延迟的两个来源是区块时间方差和不对称时间信息,即较晚提交的交易具有额外信息的优势,并且能够支付更大的费用以跳过交易队列。

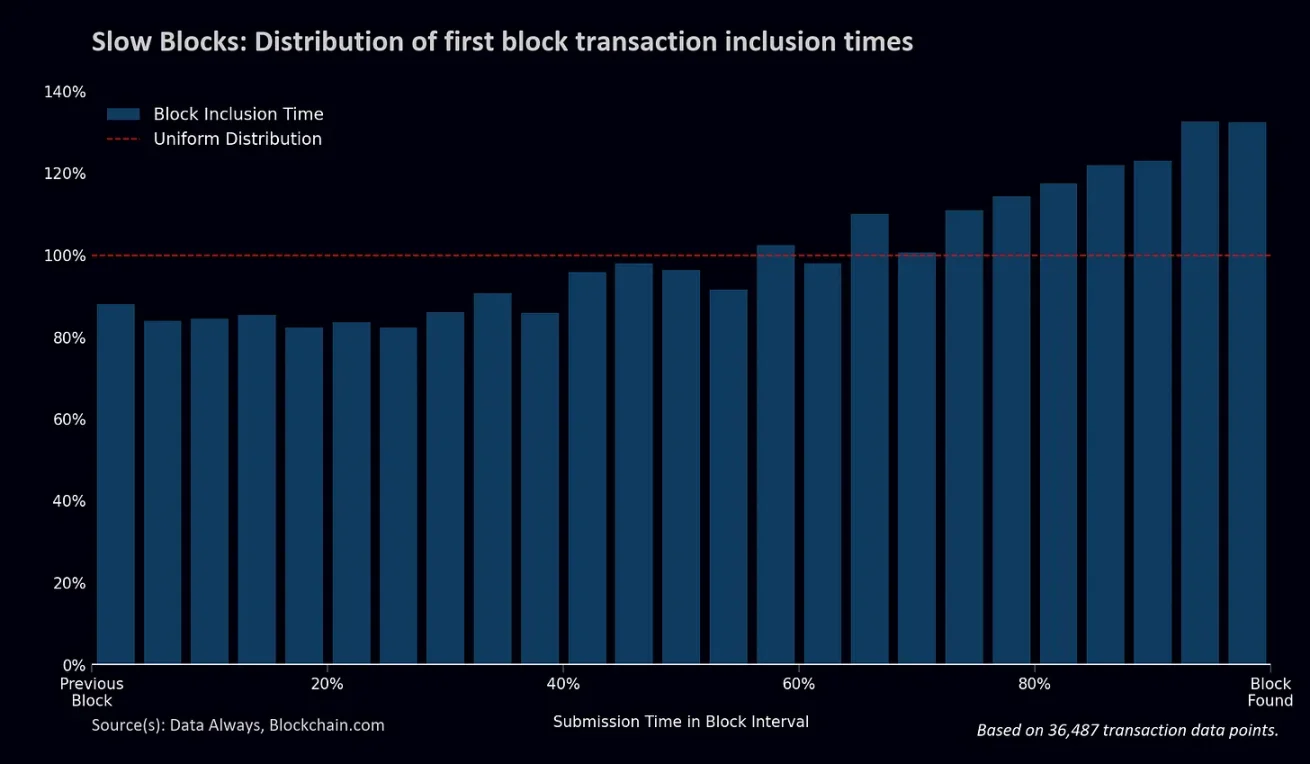

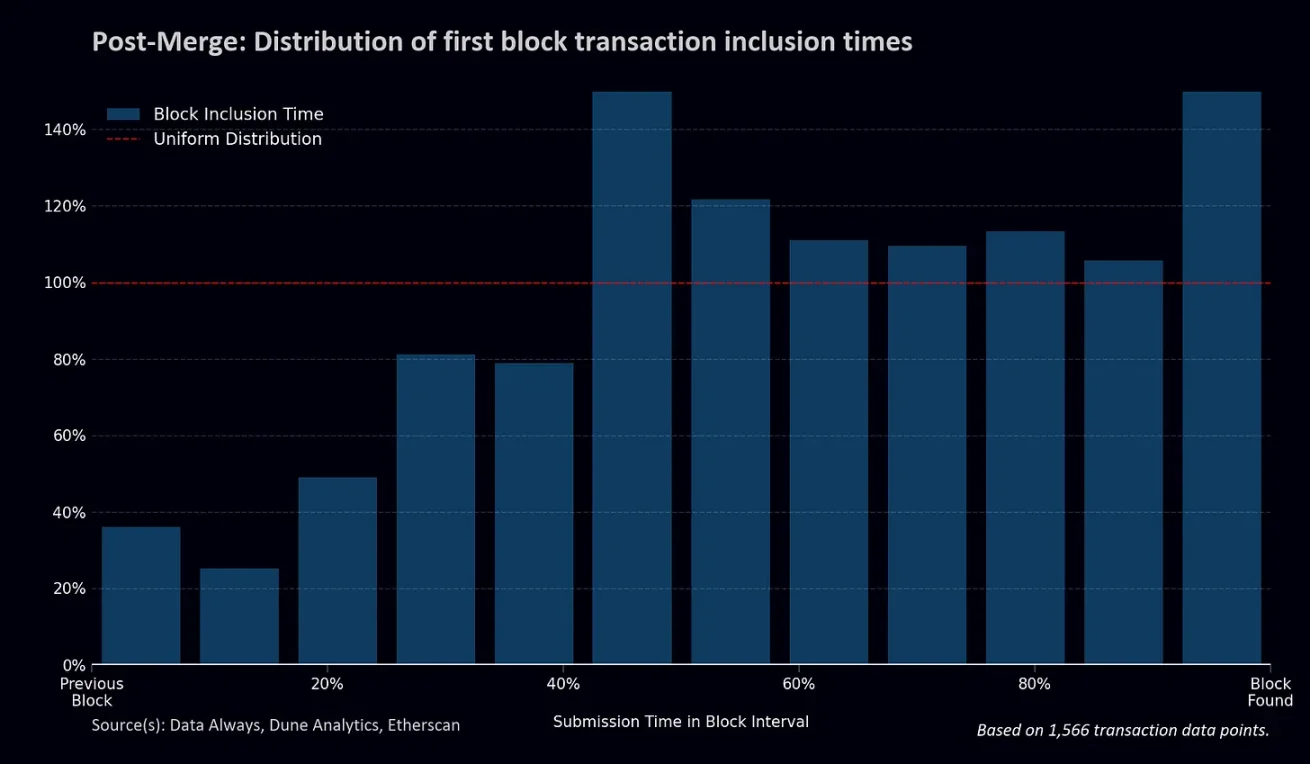

从缓慢发现的区块中随机抽取样本并分析其中包含的交易,在交易提交时间和包含在下一个区块中的交易相对密度之间出现了一个清晰的模式【 4 】。慢速区块包含的交易来自紧接在发现区块之前的时间仓,比来自紧接在前一个区块之后的时间仓多出大约 50% 。

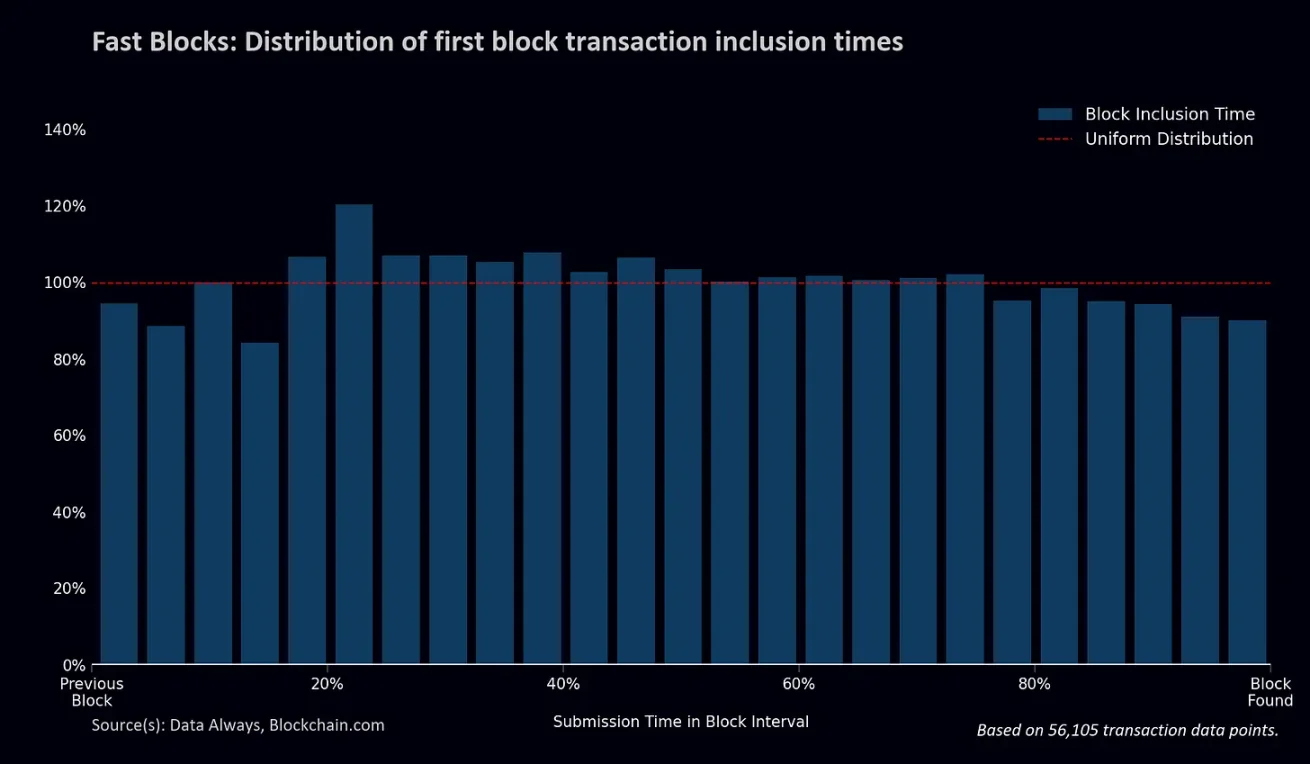

与此形成鲜明对比的是,如果我们查看快速区块,则提交时间的分布要均匀得多【 5 】。这表明在快速区块中的时间竞争没有意义。

大多数区块都可以很快发现,所以这有什么关系吗?

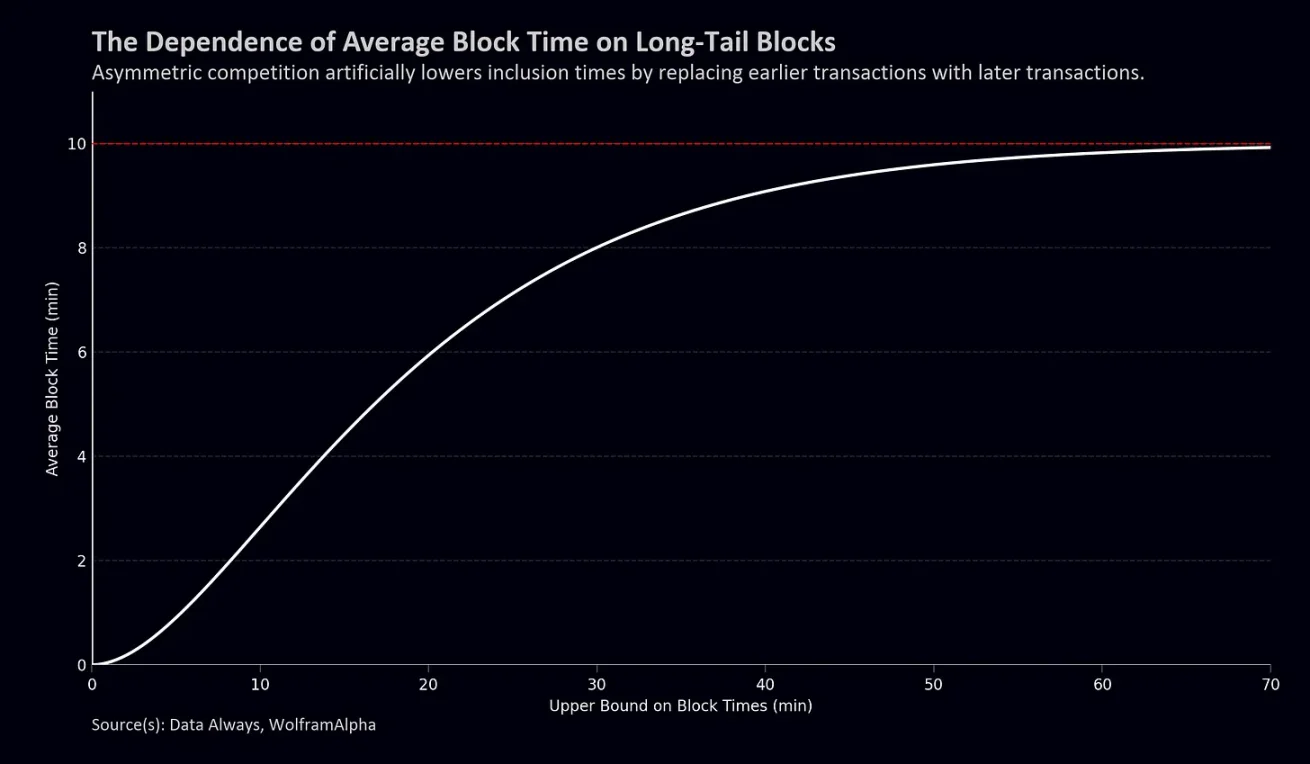

如果我们计算预期出块时间,长尾区块的贡献其实出奇的大。如果计算平均出块时间但忽略 20+ 或 30+ 分钟这样的异常值,则预期的出块时间将下降到 6-8 分钟。

关于打包时间,区块空间的时间竞争基本上忽略了这些长尾块。例如,我们假设超过 20 分钟的交易被新的更高费用的交易取代,那么进入第一个区块的交易的平均打包时间理论上应该下降到只有 6 分钟。

实际上,并没有下降到 6 分钟。我们在慢速区块分布中看到交易没有被完全替换,但我预计第一个区块打包时间可能在 8-9 分钟范围内,而不是天真的 10 分钟近似值。

进一步计算被替换的交易将需要比本文提供的更全面的数据分析(严重依赖于区块空间需求的趋势、区块间隔的后续随机滚动等),结果可能是多峰谐波分布。

回到权益证明以太坊,假设非竞争性区块空间,不变的 12 秒区块间隔表明平均打包时间为 6 秒【 6 】(与工作证明中的 13 秒相比)。

然而,以太坊区块空间竞争异常激烈。

即使区块间隔不变,我们似乎也看到了强烈的时间竞争,甚至超过了比特币长尾区块空间的竞争。所有这些都在几秒钟内发生,每 12 秒重复一次。

那么,打包时间是否更短?我想这将取决于如何定义打包时间。如果以太坊上的第一个区块是在区块间隔的最后几秒内提交的交易占主导,那么我不清楚方差的下降是否会产生有意义的差异。另一方面,如果我们谈论的是单笔交易,其优先费用足以确保交易包含在内,那么预期的打包时间应该从 13 秒减少到 6 秒【 7 】。

注解:

【 1 】 指数概率分布的方差与区块时间的平方成比例,因此比特币区块时间的方差是以太坊 PoW 区块的 ( 600/13)^ 2 = 2130 倍。也许这可以解释为何对以太坊区块时间的分析相对缺乏。

【 2 】该指标假设以太坊不处于硬分叉的时间窗口,在硬分叉时间窗口,出块时间开始呈指数增长,以迫使矿工采用这种变化。

【 3 】截至撰写本文时, 30 天的平均哈希率为 2.5075 亿 TH/s,因此在一个 10 分钟的区块中有 250.75 ×E 6 ×E 12 ×( 60 × 10) = 1.5 E 23 次哈希尝试。为了找到一个硬币翻转等效物,我们采用一个以 2 为底的对数,它等效于 76.9 次连续的硬币翻转。

【 4 】该样本中的慢速区块是在 2022 年 12 月 22 日至 2023 年 1 月 12 日之间发现的伪随机序列,包含 40 个块,区块间隔时间在 42 到 75 分钟之间。

【 5 】该样本中的快速区块是在 2022 年 12 月 22 日至 2023 年 1 月 12 日之间发现的一个由 86 个区块组成的伪随机序列,区块间隔时间在 2.5 分钟到 6 分钟之间。

【 6 】如果我们由于验证者的错误而忽略空块,则不变。

【 7 】不幸的是,合并前数据似乎不可靠,尽管这可能只是由于区块空间的超级竞争性质加上区块时间差异而造成的,我没有足够的信心发布它。