Alameda清算账户追踪:清算人接管后已造成逾千万美元损失

原文作者:Arkham

原文编译:Karen

加密数据分析公司 Arkham 在分析 Alameda Research 清算人钱包数据后发现,该账户已经对 Alameda DeFi 头寸造成了共计约 1150 万美元的的清算损失。此外, 2022 年 11 月 8 日,Alameda 在公司破产时就做空了至少价值 8 位数字的 ETH。

Arkham 的具体分析如下:

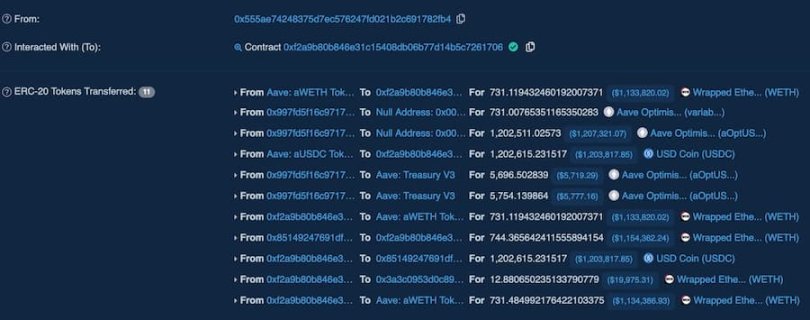

1 月 14 日,0x997 开头的 Alameda 清算人(Alameda Liquidator)账户在 Optimism 网络的 Aave 上被清算逾 100 万美元。这是该账户近两周内在清算人控制下的一系列清算中的最新一次清算。

在过去两周里,在清算人的控制下,该账户遭受了重大损失,最大单笔被清算价值在 485 万美元左右,被清算总额为 1150 万美元,可避免的损失为 400 万美元以上。

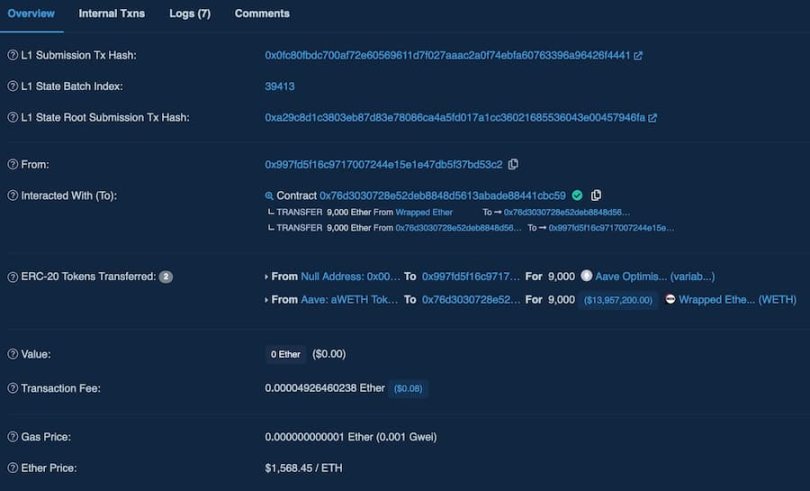

被清算人接管的两周前,0x 997 地址持有 9000 枚 ETH(约 1080 万美元)的空头头寸,抵押品为 2000 万美元 USDC 和 400 万美元 DAI,净余额为 1520 万美元。

截止今日,该账户的当前价值为 110 万美元的空头以太坊和 140 万美元的 USDC,净余额为 30 万美元。

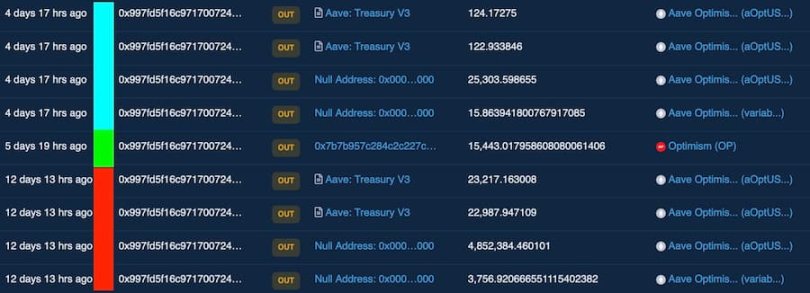

今日 Alameda 清算人账户资产并非首次被清算, 12 月底,Alameda 清算人移出资产以应对攻击约 30 小时后,即, 12 月 29 日上午, 700 万美元的 USDC 和 400 万美元的 DAI 从 Aave 活跃仓位中提取,并发送到 Optimism 上「0x 7 b 7 」开头地址。

从 Aave 移除 700 万 USDC 和 400 万 DAI 使得该地址接近清算价格,之后, 1140 万 USDC 被卖给了 Optimism 上的清算机器人,Aave 金库也收取了超 10 万 USDC 作为清算税,总清算价值为 1150 万美元。

但令人惊讶的是,从钱包中移出资产的交易发生在清算之前或清算期间。在两项清算交易中间,0x 997 帐户将 5 位数字的 OP 转账至 0x 7 b 7 帐户。

在 Aave 中,用户可以通过出售抵押品来立即要求平仓,如果调用这个函数,而不是从钱包中取出多余的抵押品的话,本来可以保留 1500 万美元的价值,而非目前收回的约 1100 万美元。

在以太坊主网上,清算人从 0x979 钱包发起了两笔交易:

将 0.03 ETH Gas 发送到另一个钱包;

向中央多重签名发送 1770 枚 BUSD。

0x7b7 开头地址在主网上没有任何交易。

假设 0x7b7 开头地址也由清算人控制,从活跃头寸中移除多余抵押品的模式符合他们通常的行为模式。来自 BNB Chain 等网络上其他 Alameda 清算人账户的资产也被发送到这里。

那 0x997 地址最初借入的 9000 枚 ETH 去往了何处?在开仓后这 9000 枚 ETH 被立即转至币安交易所,假设直接抛售,可获得价值近 1400 万美元。这也意味着 11 月 8 日 Alameda 在导致其自身毁灭的一场崩盘事件期间中做空了价值 8 位数的资产。

目前,Alameda 清算人在 AAVE 的头寸中仍可以收回大约 30 万美元的资产,不过,如果以太坊继续上涨就会被清算。