SBF最新发声:总结FTX崩盘的真正原因

本文来自 substack,作者:SBF

Odaily 星球日报译者 | Moni

2022 年 11 月中旬,FTX International 面临资不抵债。归根到底,这件事由 Voyager 和 Celsius 引发。

是三件事结合在一起,共同导致了 FTX 内爆:

a) 在 2021 年期间,Alameda 的资产负债表增长到大约 1000 亿美元的资产净值、 80 亿美元的净借款(杠杆)和 70 亿美元的现金。

b) Alameda 未能充分对冲其市场风险。 在 2022 年期间,股票和加密货币领域发生了一系列大范围的市场崩盘,导致资产市值下跌约 80% 。

c) 2022 年 11 月,币安 CEO 促成了这场极端、迅速、有针对性的崩盘,导致 Alameda 资不抵债。

然后 Alameda 的问题蔓延到 FTX 和其他地方,与三箭资金影响到 Voyager、Genesis、Celsius、BlockFi、Gemini 等加密公司类似。

尽管如此,FTX 仍有可能恢复元气,FTX US 仍然有完全偿付能力,应该能够退还所有客户的资金。 FTX International 拥有数十亿美元的资产,而我几乎将我所有的个人资产都奉献给了客户。

这篇文章是关于 FTX International 破产事件的,与 FTX US 无关,因为 FTX US 是完全有偿付能力的,且一直都是。

当我将 FTX US 交给新任 CEO Ray 并申请破产时,公司手头上的净现金超过客户余额约 3.5 亿美元,FTX US 的资金和客户与 FTX International 是隔离的。荒谬的是,FTX US 用户还没有完全恢复并取回他们的资金,下表是我移交时 FTX US 资产负债表的记录:

FTX International 是一家非美国交易所,在美国境外运营,在美国境外监管,在美国境外注册成立,并接受非美国客户。(事实上 ,FTX International 总部设在巴哈马,从巴哈马运营并在巴哈马注册成立,名称为 FTX Digital Markets LTD。)

美国客户在(仍有偿付能力的)FTX US 交易所交易。

参议员对律所 Sullivan & Crowell (S&C) 的潜在利益冲突表示担忧。与 S&C 的声明相反,他们与 FTX 的关系有限且主要是交易关系,S&C 是 FTX International 在破产前的两家主要律师事务所之一,也是 FTX US 的主要律师事务所。 FTX US 的 GC 来自 Sullivan & Crowell 公司,他们与 FTX US 合作处理其最重要的监管申请,他们与 FTX International 合作解决其一些最重要的监管问题,并与 FTX US 合作处理其最重要的交易。 当我访问纽约时,有时我会在 S&C 的办公室外工作。

尽管 FTX 资不抵债,但在过去几天的运营中仍处理了大约 50 亿美元的提款,FTX International 仍保留了大量资产——截至 Ray 接任时大约有 80 亿美元的流动性资产。

除此之外,还有许多潜在的资助提议——包括在破产申请提交后签署的 LOI,总额超过 40 亿美元。 我相信,如果在给 FTX International 几周时间,可能会利用其非流动性资产和股权筹集足够的资金,使客户资产保持完整。

然而,由于 S&C 向 FTX 施压进入破产备案,我担心上述解决方案可能已无法被执行。 即使是现在,我相信如果 FTX International 重新启动,也确实有可能让客户资产基本上变得完整。

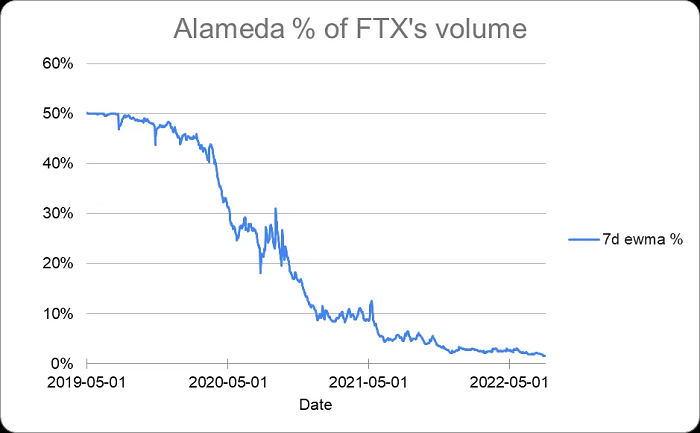

虽然 FTX 的流动性从 2019 年开始主要依赖与 Alameda,但到 2022 年已经大大多样化,Alameda 的交易量也下降到 FTX 总交易量的 2% 左右(如下图所示):

我没有偷钱,当然也没有私藏数十亿美元。过去和现在,我的几乎所有资产都可用于支持 FTX 客户。FTX International 和 Alameda 在 2021 年都是合法且独立盈利的企业,这两家公司每个都赚了数十亿美元。

然后,由于一系列市场崩盘,Alameda 在 2022 年期间损失了约 80% 的资产价值——三箭资本 (3AC) 和其他加密货币公司去年也是如此。 FTX 也受到 Alameda 衰落的影响,因为 Voyager 和其他公司早些时候受到三箭资本和其他公司的影响。

另外——过去几年,我并没有经营 Alameda。

其中很多都是事后拼凑而成的,来自模型和近似值,通常基于我辞去 CEO 职务之前的数据,以及基于该数据的建模和估计。

2021 年事件概览

在 2021 年期间,Alameda 的资产净值飙升,根据我的模型,到年底上市时达到大约 1000 亿美元。 即使你忽略像 SRM 这样的完全稀释比循环供应大得多的资产,我认为它仍然大约是 500 亿美元。

在 2021 年期间,Alameda 的头寸也有所增加。

特别是,我认为 Alameda 有大约 80 亿美元的净借款,这些借款用于:

a) 向贷方支付约 10 亿美元的利息

b) 大约 30 亿美元从 FTX 的市值表中买断 Binance(所持股份)

c) 大约 40 亿美元用于风险投资

(我所说的“净借款”,基本上是指借款减去手头可用于偿还贷款的流动资产。2021 年的净借款主要来自第三方借贷平台——Genesis、Celsius、Voyager,而不是来自 FTX 的保证金交易。)

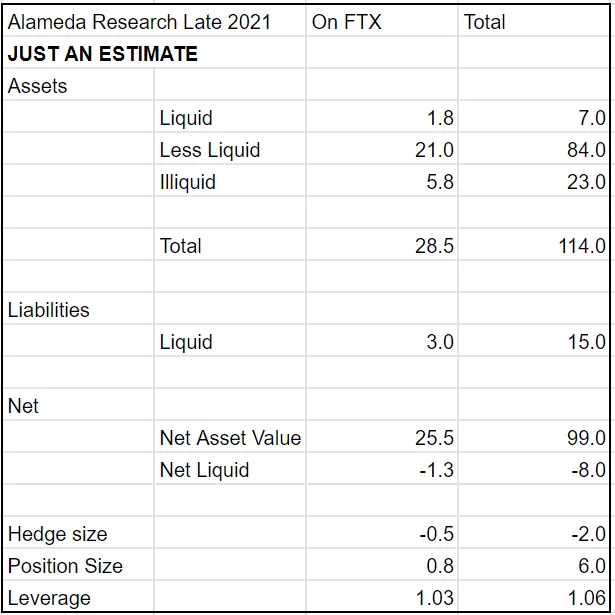

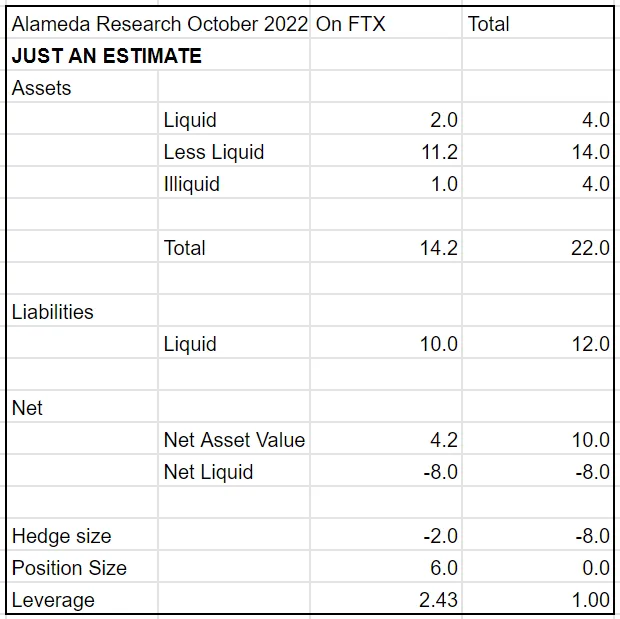

因此,到 2022 年初,我认为 Alameda 的资产负债表大致如下所示:

a) 大约 1000 亿美元资产净值

b) 来自第三方服务台(Genesis 等)的 大约 120 亿美元流动性

c) 可能从第三方那里获得的流动性增加了 100 亿美元

d) 大约 1.06 倍杠杆

在这种情况下,约 80 亿美元的非流动性头寸(有数百亿美元的可用信贷/来自第三方贷方的保证金)似乎是合理的,而且风险不大。 我认为,仅 Alameda 的 SOL 就足以支付净借款,这些资产来自第三方借贷服务台。

我认为,Alameda 当时在 FTX International 上的头寸是合理的——根据我的模型,大约为 13 亿美元,以数百亿美元的资产作为抵押——并且 FTX 成功通过了 GAAP 审计。

那么,到 2021 年底,将 Alameda 拖入水下需要市场下跌 94% ! 不仅仅是 SRM 和类似的资产——如果你忽略这些,Alameda 仍然被大量超额抵押,我认为仅其 SOL 头寸就大于其杠杆作用。

但是,Alameda 未能充分对冲市场极端崩盘的风险:千亿资产只有几十亿美元的对冲,净杠杆率约为 1.06 倍([净头寸-对冲]/NAV)。

因此,Alameda 在理论上面临着一场极端的市场崩盘。

2022 年市场崩盘

进入 2022 年,Alameda 的大致情况是:

1000 亿美元的资产净值

80 亿美元的净借款

1.06 倍杠杆

数百亿美元的流动资金

然后,在这一年中,市场一次又一次崩盘。 直到仲夏,Alameda 未能充分对冲其头寸。

–BTC 暴跌 30%

–BTC 又暴跌 30%

–BTC 又暴跌 30%

–利率上升限制了全球金融流动性

–Luna 归零

–3AC 破产

–Alameda 联席 CEO 辞职

–Voyager 内爆

–BlockFi 差点破产

–Celsius 破产

–Genesis 开始关闭

–Almaeda 的借/贷流动性从 2021 年底的约 200 亿美元降低到 2022 年底的约 20 亿美元

因此,Almaeda 的资产一次又一次地受到打击。 但这部分并不特定于 Alameda 的资产。 比特币、以太坊、特斯拉和 Facebook 的年跌幅均超过 60% ,Coinbase 和 Robinhood 的股价比去年的峰值下跌了约 85% 。

请记住,到 2021 年底,Almaeda 大约有 80 亿美元的净借款:

a) 向贷方支付约 10 亿美元的利息

b) 大约 30 亿美元从 Binance 手中买断 FTX 持股

c) 大约 40 月美元用于风险投资

80 亿美元的净借款,减去它所拥有的几十亿美元的对冲,导致了大约 60 亿美元的超额杠杆/净头寸,并得到了约 100 亿美元资产的支持。

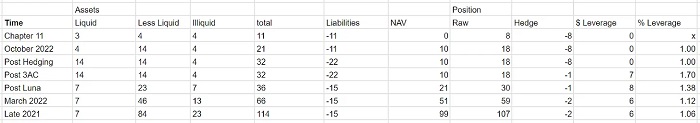

随着市场崩溃,这些资产也随之崩溃。 Alameda 的资产——山寨币、加密公司、上市股票和风险投资的组合——在这一年里下跌了约 80% ,其杠杆率一点点提高。

在同一时期,流动性在借贷市场、公开市场、信贷、私募股权、风险投资以及几乎所有其他领域都枯竭了。 在这一年中,几乎所有加密货币的流动性来源——包括几乎所有的借贷平台——都耗尽了。

这意味着 Alameda 的流动性—— 2021 年底时大约为数百亿美元——到 2022 年秋季已经降到只有数十亿美元。加密领域的大多数其他平台已经倒闭或正在倒闭,而 FTX 成为剩下的最后一位。

2022 年夏天,Alameda 以 BTC、ETH 和 QQQ(纳斯达克 ETF)的某种组合进行了大量对冲。但即使在 2022 年的所有市场崩盘之后,在 11 月之前不久,Alameda 仍有约 10 亿美元的资产净值; 即使你排除 SRM 和类似的代币,Alameda 的资产也是正数,但最终被对冲了。

保证金交易

在 2022 年期间,许多加密平台因保证金头寸爆棚而资不抵债,可能包括 Voyager、Celsius、BlockFi、Genesis、Gemini 以及 FTX。

这种情况在保证金平台上相当普遍,但也会发生在其他地方,比如:

传统金融:

伦敦金属交易所

明富环球

LTCM

雷曼

加密货币:

CoinFlex

EMX

Voyager、Celsius、BlockFi、Genesis、Gemini 等。

十一月的崩盘

在针对 FTX 和崩溃进行了长达数月的极其有效的公关活动之后,CZ 发布了决定性的推文。

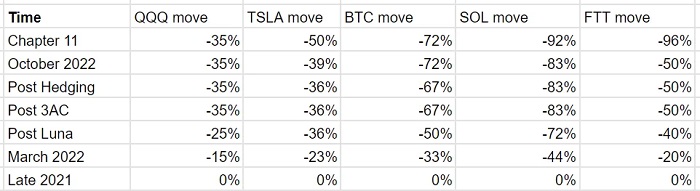

在 11 月最后一次崩盘之前,QQQ 的波动幅度大约是 Alameda 投资组合的一半,而 BTC/ETH 的波动幅度大约是 Alameda 投资组合的 80% ——这意味着 Alameda 的对冲(QQQ/BTC/ETH)策略已经开始发挥作用。 不幸的是,直到三箭资本崩盘之后,对冲才足够大,直到 2022 年 10 月,终于大到令人难以相信。

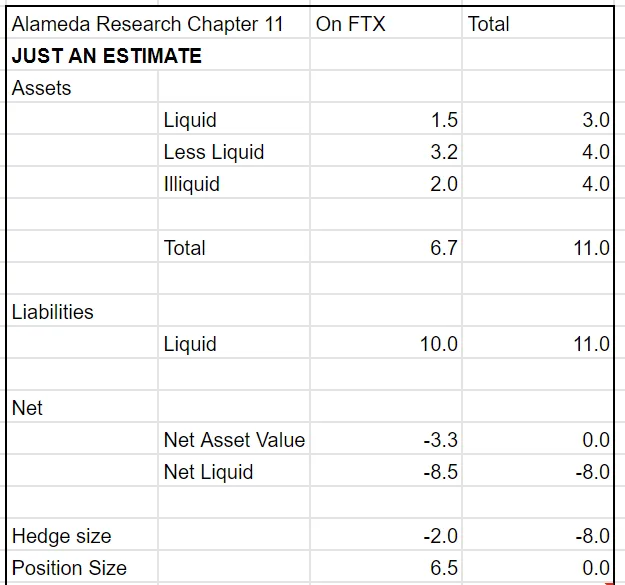

当时加密市场崩盘对 Alameda 持有资产的影响非常大。在 11 月的几天里,Alameda 的资产下跌了大约 50% ; BTC 下跌了约 15% (BTC 跌幅只有 Alameda 资产跌幅的 30% ) 。

在 11 月 7 日至 8 日的过程中,事情从压力大但基本处于控制状态转变为明显资不抵债。

到 2022 年 11 月 10 日,Alameda 的资产负债表只剩下约 80 亿美元资产,而流动负债大致相同,也只有约 80 亿美元,如下图所示:

由于面临挤兑威胁,瑞士信贷今年秋天股价下跌近 50% ,挤兑需要流动性——而 Alameda 当时已经没有流动性了。

因此,随着 Alameda 变得缺乏流动性,FTX International 也变得缺乏流动性,因为 Alameda 在 FTX 上有未平仓的保证金头寸; 银行挤兑使流动性不足变成资不抵债。这意味着 FTX 加入了 Voyager、Celsius、BlockFi、Genesis、Gemini 和其他因借款人流动性紧缩而遭受附带损害的公司。

所有这些就是说:Alameda 没有资金被盗,而是因市场崩盘而亏损,的确,Alameda 没有对风险进行充分的对冲——正如三箭资本和其他公司今年所做的那样。 FTX 受到了影响,但 Voyager 和其他公司早些时候也都受到了影响。

结尾

我依然认为,如果齐心协力提高流动性,FTX 可能会让所有客户都受益。

新任 CEO 接手时,FTX 有数十亿美元的资金要约,甚至一度超过 40 亿美元。

如果给 FTX 几周的时间来筹集必要的流动性,我相信能够让客户资产保持基本完整。 当时我没有意识到 Sullivan & Cromwell——通过压力要求 Ray 担任 CEO 并提交破产,包括 FTX US。 我仍然认为,如果 FTX International 今天重新启动,确实有可能让客户资产保持基本完整。 即使没有这些,也有大量资产可供客户使用。

遗憾的是,我对公众的误解和重大错误陈述反应迟缓。我花了一些时间来拼凑我能做的——我无法访问很多相关数据,其中大部分是关于我当时没有运营的公司 (Alameda)。

我一直计划在 12 月 13 日向美国众议院金融服务委员会作证时对所发生的事情进行首次实质性说明。 不幸的是,在听证会的前一天晚上我被逮捕了。

我还有很多话要说——为什么 Alameda 未能进行对冲、FTX US 发生了什么、导致启动第 11 章破产流程的原因、S&C 等等。 至少,这是一个开始。