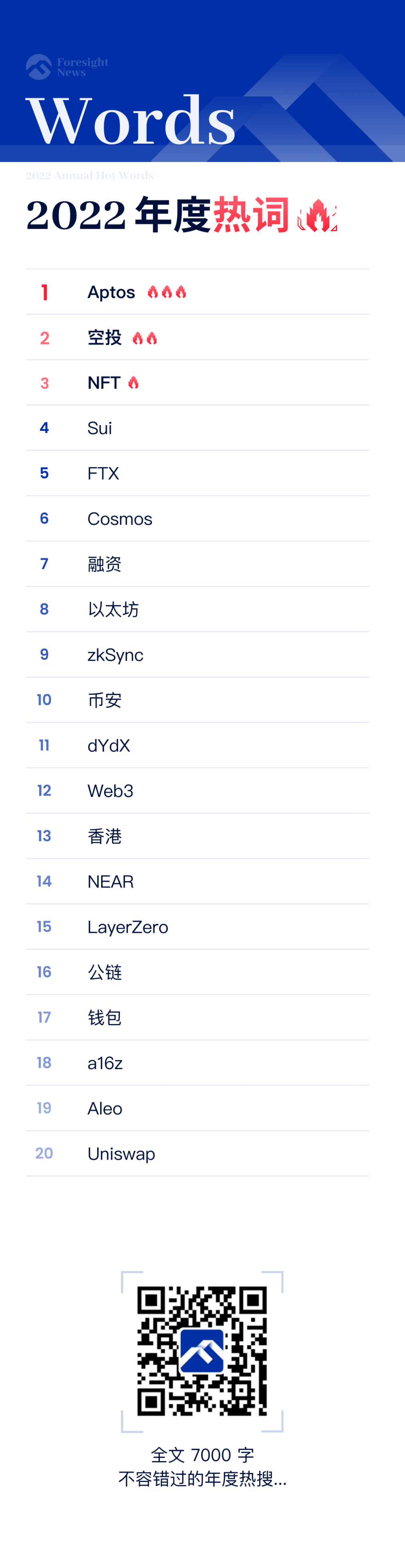

一览2022年加密行业热搜榜

原文作者:Frank,Foresight News

2022 年倏忽而过,今年的行业更加变动不居,尤其是经历了数次「黑天鹅」事件,从多方面对整个加密市场进行了极限压力测试,也由此贡献了足够的行业内外的关注与话题热度。

凡是过去,皆为序章。本文统计了本年度 Foresight News 的用户搜索结果,同时对相同概念的大小写进行了合并处理,就此整理出了 2022 年度热搜榜单(包含站内热搜榜与 Mirror 热搜榜)。

通过该榜单,我们既可以一窥今年在用户眼中热度最高、最被关注的项目或赛道,或许也可以此为鉴,发现那些隐藏在背后的火种可能,收获一份 2023 年的生存指南。

站内年度热搜榜

Aptos:年度新公链顶流

「Aptos」能够跻身今年的站内年度热搜榜榜首,并不令人意外,虽然它是 10 月份才开启代币 APT 的空投,但作为一开始便含着金汤匙出生的新公链龙头,Aptos 今年无论是在社区关注度还是生态热度方面,都顺利接过历史上 EOS、波卡、Solana、Avalanche 的接力棒,成为新一届的公链顶流。

如果我们回顾 Aptos 今年以来的重大项目进展节点,也会发现其几乎贯穿了 2022 年始终:

3 月 15 日,Aptos 完成 2 亿美元战略融资,a16z 领投,Tiger Global、Katie Haun、Multicoin Capital、Three Arrows Capital、FTX Ventures 和 Coinbase Ventures 等参投;

5 月 13 日,Aptos 开放激励测试网 1 注册,并于 5 月 16 日正式开启,持续至 5 月 27 日;

7 月 1 日,Aptos 开放激励测试网 2 注册,并于 7 月 12 日正式上线,持续至 7 月 22 日;

8 月 19 日,Aptos 开放激励测试网 3 注册,并持续至 9 月 9 日;

7 月 25 日,Aptos 完成 1.5 亿美元融资,FTX Ventures 和 Jump Crypto 领投;

10 月 18 日,Aptos 上线主网,随即发布代币经济学概览,APT 初始总供应量为 10 亿枚,其中分配给社区 51.02% ,分配给核心贡献者 19.00% ,分配给基金会 16.50% ,分配给投资者 13.48% ;

10 月 19 日,Aptos 向完成 Aptos 激励测试网申请或铸造 APTOS:ZERO 测试网 NFT 的用户发放约 2000 万枚 APT 代币空投;

发轫于 2022 年 的 Aptos,在 2023 年究竟会逐步迎来生态的繁荣,还是复刻 EOS、波卡的发展轨迹,尚未可知。

空投:贯穿全年的核心议题

「空投」则是今年仅次于 Aptos 的热词,从 3 月份的 APE 到 6 月份的 OP,再到 10 月份的 APT 和 Blur 多轮 Package,今年已经兑现的大额空投也几乎贯穿了全年:

3 月 17 日,BAYC 母公司 Yuga Labs 推出代币 APE,总量 10 亿枚,其中 62% 将分配给社区、 15% 空投、 47% 分配给生态基金、 8% 分配给 BAYC 创始人、 16% 分配给 Yuga Labs 团队、 14% 给合作伙伴和投资人;

6 月 1 日,Optimism 正式开放认领 OP 治理代币空投,初始发行总量为 4294967296 枚,并将以年度 2% 的固定速率通胀,首轮空投总量 5% 的代币;

10 月 18 日,Aptos 上发布代币经济学概览,APT 初始总供应量为 10 亿枚,向完成 Aptos 激励测试网申请或铸造 APTOS:ZERO 测试网 NFT 的用户发放约 2000 万枚 APT 代币空投;

10 月 20 日,Blur 正式上线,并将向过去 6 个月内交易 NFT 的所有用户空投 Packages;随后 12 月 6 日开放申领第二轮空投,规模是第一次的十倍,且第三轮空投将于明年 1 月结束,届时还将上线 BLUR 代币;

与此同时,Sui、zkSync、StarkNet、Scroll、Aleo、Sei 等潜在的空投可能也都让大家寄予厚望,所以今年大家参与测试网、刷空投的行为成为基本操作,也注定会将空投这个议题的热度延续下去(参见时间线《精选潜在空投汇总》)。

Sui:后发先至的新公链主角

「Sui」在今年厚积薄发的热度演变趋势,则完美验证了加密世界的好饭不怕晚逻辑——作为同样从 Diem 核心团队成员走出来的两个相关项目,相较于强势的 Aptos,Sui 更像当年的 Cosmos, Aptos 则像当年深受偏爱的 Polkado:

Sui 在一开始的关注度与讨论都远远不如 Aptos,尤其是在今年 10 月份 Aptos 发布代币后,热度更是一度远远被甩在后面。

但近一个月以来,与 Aptos 生态的声量渐小不同,伴随着关于代币分配等大家翘首以盼的细节的披露,Sui 的热度始终高企不下。而伴随着 2023 年的到来,Sui 也大概率会如今年的 Aptos 一样,成为受尽关注的主角之一。

FTX: 2022 最大行业黑天鹅

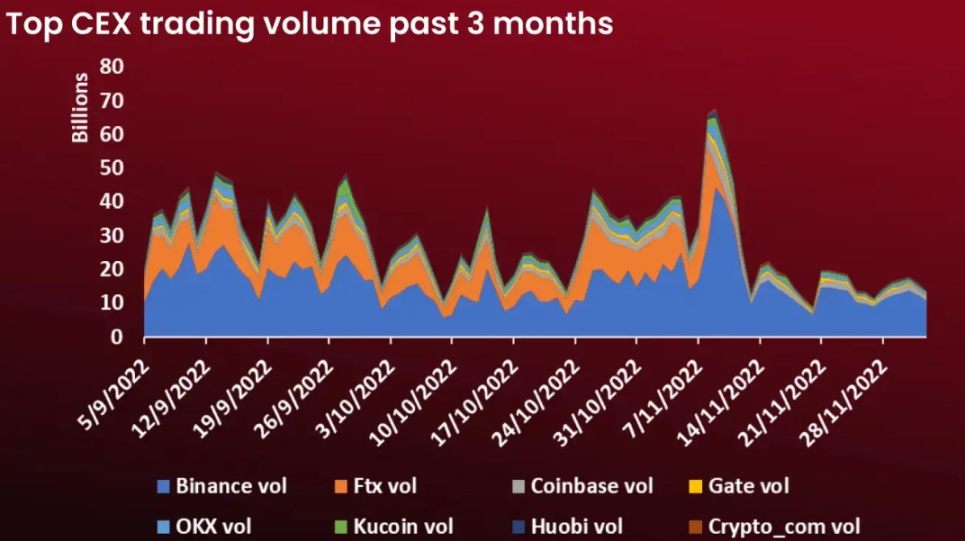

「FTX」的爆雷,应该是今年对行业影响最深重的黑天鹅事件,也被视作加密世界的雷曼危机,其资金窟窿之大与离谱操作之多,导致没有人知道谁会是下一个爆雷的对象。

所以它对整个市场的冲击不仅仅在于资产与价格维度,更重要是对行业信心与监管预期的深远影响:一个全球前三大交易所,一个风头正劲的头部企业,却私自挪用用户资产甚至导致数十亿美元的亏空,以致于一夕之间迅速垮塌。

要知道仅仅数个月前,FTX 还似乎并未受 Terra、Three Arrows Capital 的影响,给市场的感觉是兜里有钱,四面出击,在并购战线全面扩张——以约 14.22 亿美元赢得 Voyager 的破产拍卖,击败了此前传闻的币安等竞争对手,同时表示考虑竞购破产的加密借贷平台 Celsius Network 的资产等等。

所以很少有人能够想到这一切的开端会如此的戏剧化,更没有人想到一个 320 亿美元巨头的崩塌又会如此迅速,而它所引发的一连串连锁反应,无论是 FTX 及其相关实体本身,还是作为交易对手方的 Genesis、DCG 等中心化机构,危机都仍在深度发酵。

而 12 月 13 日巴哈马警方逮捕 SBF,则算是为整个 FTX 事件翻开了全新的一页,事件后续料将在 2023 年继续余波荡漾,注定战线漫长。

Cosmos:隐然第二大公链生态

「Cosmos」在今年上半年借助 LUNA 与 Terra 生态的火热,一度时移势易,发展势头明显远胜如今反而落寞的 Polkadot 平行链项目。

即便随后的 Terra 崩盘对牵扯颇深的 Cosmos 生态造成了严重冲击,但不同于 Polkadot 平行链拍卖与项目关注度的冷清,Cosmos 仍是热点项目不断,尤其是伴随着 Cosmoverse 大会上重磅发布的 2.0 版白皮书,其在链间安全、流动性质押、新代币模型以及费用机制等方面极大扩展了叙事空间。

虽然在 ATOM 代币释放方面可能为中短期内的二级市场带来抛压,但对更长期的叙事来说无疑是一次预期拉满的提振,毕竟有故事可讲,才是公链等加密项目生生不息的源动力。

此前专注于研究和开发 Terra 生态的 Delphi Digital 也表示,将在未来专注于 Cosmos 生态系统,虽然安全问题和技术问题方面的表现不尽如人意,但至少就目前而,Cosmos 隐然有在 2023 年成为仅次于以太坊的第二大公链生态的趋势。

融资:全年逾 20 起上亿美元级别融资

「融资」作为大类话题持续受到关注,在此仅简单罗列一下今年值得关注的一些「知名项目 + 1 亿美元级别以上」的融资事件(剔除了了一些关联度不高和特殊赛道的项目,但不完全统计之下仍有 20 多起,且前后相对均衡,足见今年虽风波不断,但融资热潮仍盛):

Solana 生态钱包 Phantom 完成由 Paradigm 领投的 1.09 亿美元新一轮融资,估值为 12 亿美元;

区块链开发平台 Alchemy 以 102 亿美元估值完成 2 亿美元融资,Lightspeed 和 Silver Lake 领投;

Amber Group 以 30 亿美元估值完成 2 亿美元融资,淡马锡、红杉中国、Pantera Capital 和 Tiger Global Management 等参投;

NFT 二层扩容解决方案 Immutable X 的开发公司 Immutable 以 25 亿美元估值完成 2 亿美元融资,淡马锡领投;

ConsenSys 以 70 亿美元估值完成 4.5 亿美元 D 轮融资,由 ParaFi Capital 领投;

Optimism 完成 1.5 亿美元 B 轮融资,a16z 和 Paradigm 共同领投;

BAYC 母公司 Yuga Labs 以 40 亿美元估值完成新一轮 4.5 亿美元融资,a16z 领投;

Helium 以 12 亿美元估值完成 2 亿美元 D 轮融资,Tiger Global 领投;

LayerZero 的开发团队 LayerZero Labs 宣布完成 1.35 亿美元 A+ 轮融资,FTX Ventures、红杉资本与 a16z 共同领投;

NEAR Protocol 完成 3.5 亿美元融资,Tiger Global 领投;

印度加密交易所 CoinDCX 以 21.5 亿美元估值完成 1.35 亿美元 D 轮融资,Pantera Capital 和 Steadview Capital 领投;

KuCoin 以 100 亿美元估值完成 1.5 亿美元融资,Jump Crypto 领投,Circle Ventures、IDG Capital 和 Matrix Partners 等参投;

Chainalysis 以 86 亿美元的估值完成 1.7 亿美元 F 轮融资,该公司的现有投资者新加坡主权财富基金 GIC 领投;

Solana 生态 NFT 市场 Magic Eden 以 16 亿美元估值完成 1.3 亿美元 B 轮融资,Electric Capital 和 Greylock 共同领投;

数字资产经纪公司 FalconX 以 80 亿美元估值完成 1.5 亿美元 D 轮融资,GIC 和 B Capital 领投;

数字资产管理平台 Gnosis Safe 宣布更名为 Safe,并完成由 1 kx 领投的 1 亿美元融资;

NFT 项目 DigiDaigaku 母公司 Limit Break 共完成两轮共计 2 亿美元融资,两轮融资由 Josh Buckley、Paradigm 和 Standard Crypto 领投;

Sui 开发团队 Mysten Labs 完成 3 亿美元融资,FTX Ventures 领投;

Animoca Brands 完成由淡马锡领投的 1.1 亿美元融资;

Uniswap Labs 以 16.6 亿美元估值完成 1.65 亿美元 B 轮融资,Polychain Capital 领投;

zkSync 开发公司 Matter Labs 完成 2 亿美元 C 轮融资,Blockchain Capital 和 Dragonfly 共同领投;

Aztec Network 完成 1 亿美元融资,a16z crypto 领投;

Amber Group 完成 3 亿美元融资,Fenbushi Capital US 领投;

以太坊:迈入 PoS 新纪元

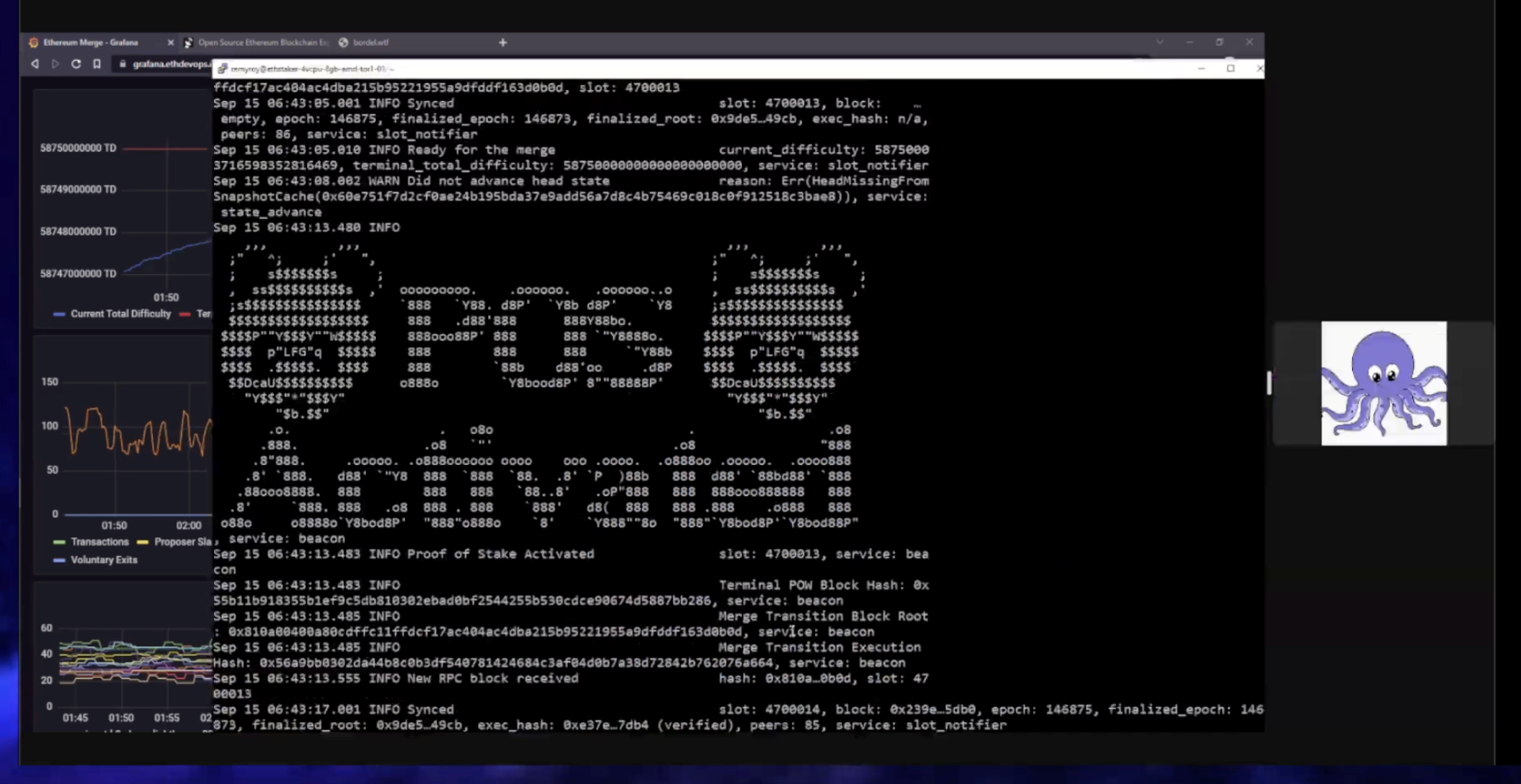

「以太坊」今年最盛大的行业盛事,非 PoS 合并莫属—— 2022 年 9 月 15 日 14: 42 ,以太坊顺利达到主网合并终端总难度,PoW 时代最后一个区块由 F 2 Pool 挖出,区块高度为 15537393 。

以太坊执行层(即此前主网)与权益证明共识层(即信标链)于区块高度 15537393 触发合并机制,并产出首个 PoS 区块(高度为 15537394 )。

Hello,PoS;Byebye,PoW。 作为如今的千亿美元巨兽,诞生近十年的以太坊,彻底成为分别代表 PoS 的龙头币种,从而将加密竞赛带入新的纪元, 2023 年也会是以太坊全面进入 PoS 后的全新一年,将迎来上海升级等诸多关键里程碑,值得期待。

zkSync:角色日渐吃重的 zkEVM 主力

「zkSync」作为以太坊最值得期待的未来方向之一,一直被视为整个 Layer 2 尤其是 zkEVM 试金的主力,而今年 10 月份 2.0 主网的启动,也意味着作为与 EVM 兼容的 ZK Rollup,zkSync 走在了一众 Layer 2 擂台赛的前列。

今年的韩国区块链周上,Vitalik 也又双叒叕一次重申了在 Layer 大战中对 ZK Rollup 的看好:

仍然相信今天的一些 Optimistic Rollup 项目会成功,但预计今天致力于扩展以太坊的一些 Optimistic Rollup 项目将转向拥抱 ZK-Rollups,因为 ZK-Rollups 具有「基本优势」,甚至直言「ZK Rollup 很可能是以太坊的顶级 Layer 2 扩展武器」。

如今在加密市场情绪低迷的背景下,Layer 2 尤其是 zkEVM 在接下来整个以太坊生态的所扮演的角色尤其吃重, 2023 年的 zkSync 究竟会如何表现(何时发币),料将会是最受关注的议题之一。

币安:FUD 之中稳坐钓鱼台

「币安」在今年多灾多难的行业背景下,依旧稳坐钓鱼台。

尤其是在 FTX 事件之后动作频频,不仅参与 Voyager 等受 FTX 波及机构的竞标,还成立规模或达 20 亿美元的行业复苏基金。

虽然最近因监管问题、储备金疑云、在 FTX 崩溃中的作用等受到质疑,甚至一度形成 FUD 潮,但目前市场对于币安的信任应该还是相对稳固,交易所赛道暂时步入「后 FTX 时代」。

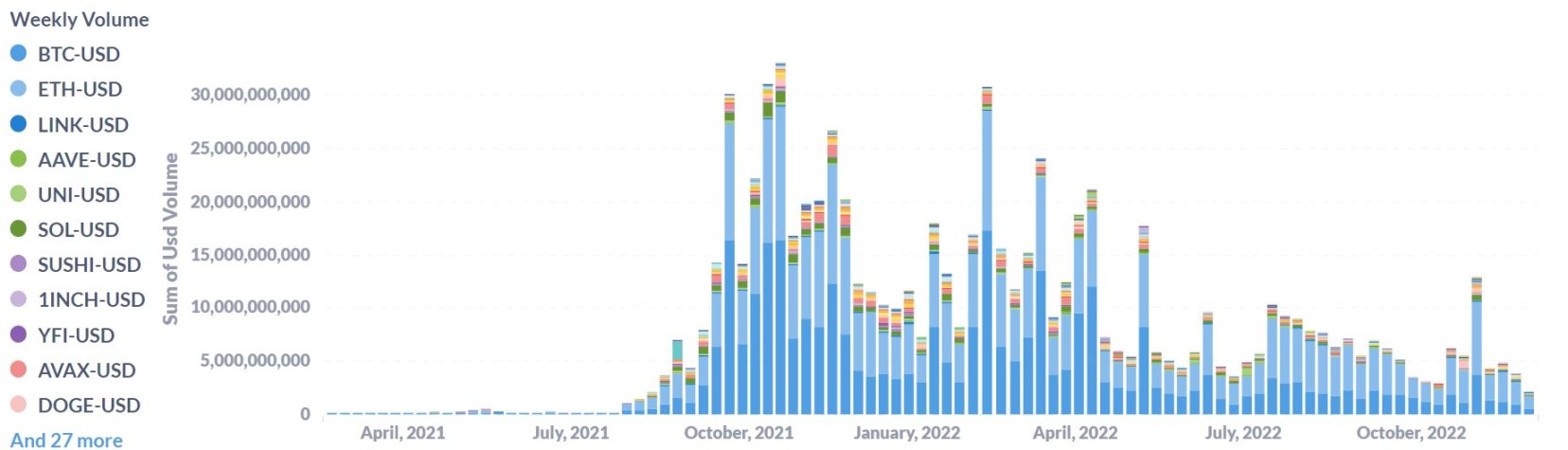

dYdX:受 FTX 影响大放异彩

「dYdX」的上榜则应该主要得益于 FTX 事件贡献的热度——FTX 此轮的骤然崩溃,再次证明了加密行业没有「大而不能倒」的神话,也在一定程度上引爆了加密行业的信任危机与流动性困境。

而在危机不断传导到中心化交易所和机构们的同时,像 dYdX 这样的去中心化项目反倒再一次大放异彩,无论是交易量还是新增用户数都增长明显,成为此次行业危机的最大受益者之一。

从数据层面看,无论是 dYdX、GMX、Gains 这样的链上衍生品项目,还是 Uniswap 这样的传统 DEX 协议,在 11 月初 FTX 事件开始发酵后,交易量开始相比前日大幅走高数倍,并且在随后的 9 日、 10 日左右创下历史记录。

其中 dYdX 更是在 11 月 6 日至 11 月 12 日的一周时间里,实现了 130 亿美元以上的交易量,创下自今年 5 月 8 日 Terra 危机以来的单周新高。

虽然在此之后,这股 DEX 热潮仅仅持续了一周——譬如 11 月 13 日开始,dYdX 的周交易量又跌回了 20 亿美元左右的平均水准,但去中心化的必要性也再一次得到逻辑验证。

香港:力图重返加密舞台中央

「香港」则在今年逐步尝试回归加密行业与 Web3 世界的地理中心之一。

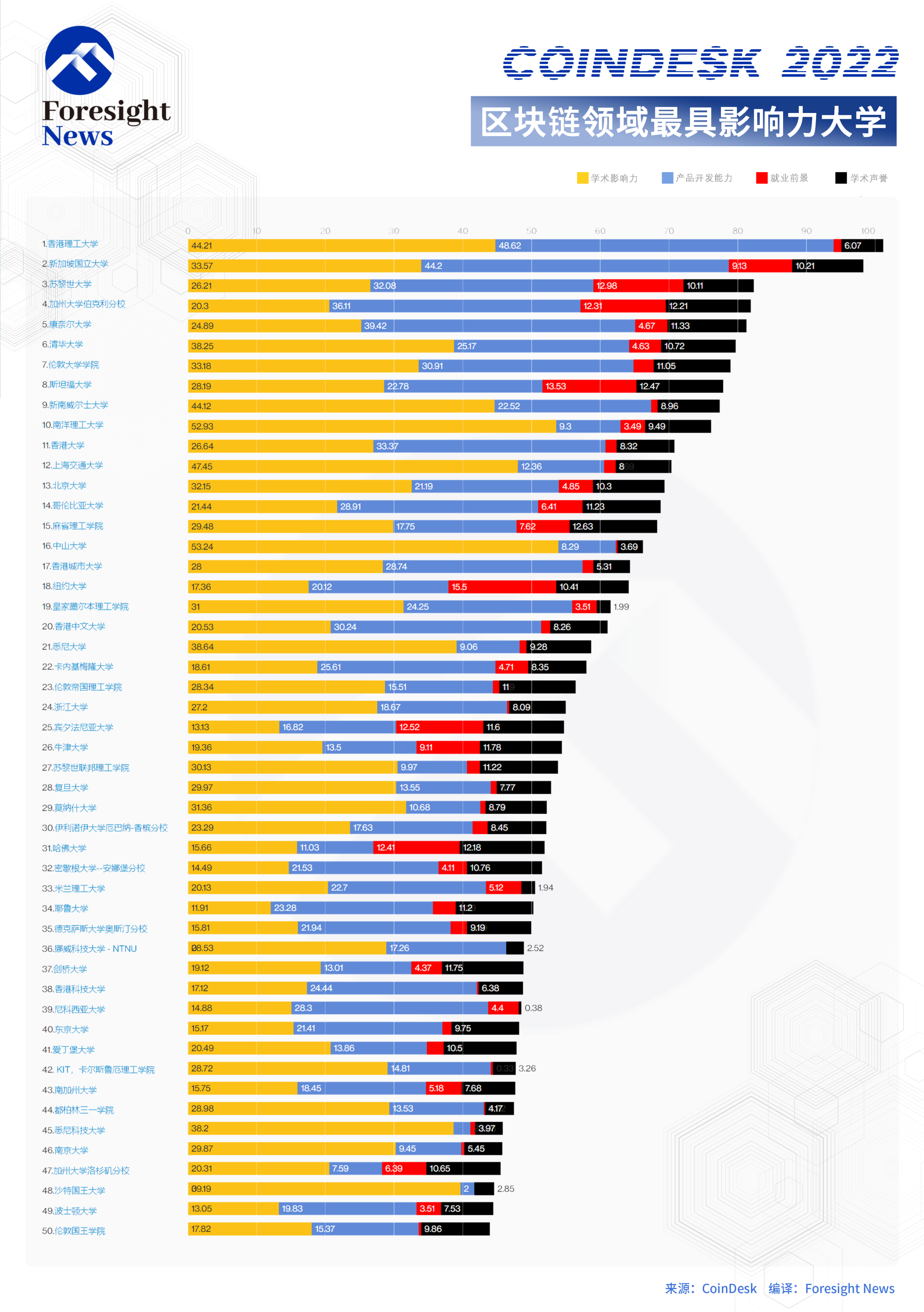

此前在 Foresight News 编译的《CoinDesk: 2022 年区块链领域最具影响力的 50 所高校》中,香港理工大学高居第一,其它如香港大学、香港中文大学、香港科技大学也赫然在列,跻身上榜高校密度最高的地区之一,说明香港本就具备足够的竞争实力与底蕴。

然而今年以来,在甚嚣尘上的 Web3 卷向新加坡的论调中,香港逐步跌落前排,似乎在错失互联网浪潮之后要进一步落后于 Web3 的时代脉搏,直到本届港府上台之后,香港下定决心与新加坡、伦敦、纽约等城市争夺全球加密金融中心和虚拟资产中心地位。

其中 10 月 16 日,香港财政司司长陈茂波发表文章《香港的创科发展》,并指出要推动香港发展成国际虚拟资产中心,「政策宣言将清晰表达政府立场,向全球业界展示我们推动香港发展成国际虚拟资产中心的愿景,以及与全球资产业界一同探索金融创新的承担和决心」。

无论是从今年金融科技周首日 Web3 相关人士的密集压阵亮相,还是虚拟资产政策宣言中令人心潮澎湃的庄严许诺,都进一步旗帜鲜明地向全世界宣告香港对 Web3 与加密资产大门敞开的十足诚意。

而且辩证地看, 10 月份大家还在以 FTX 离开香港前往巴哈马而对香港严格的监管制度有所议论,仅仅一个月后 FTX 的爆雷,却似乎反而证明了香港对风险的敏感度,监管与创新本就是一体两面,祸兮福之所倚,大潮退去才能更见真章。

而 12 月,先是香港证监会也表示正在草拟新制度下持牌虚拟资产交易所的监管规定,并会展开公众咨询,正在密切监察虚拟资产领域最新发展形势;随后南方东英资产管理有限公司在港交所推出亚洲首批虚拟资产 ETF:南方东英比特币期货 ETF(3066.HK)、南方东英以太坊期货 ETF(3068.HK),再度说明了本届港府对加密资产及 Web3 持开明态度,已在加速拥抱加密浪潮。

NEAR:仍在日拱一卒的明星公链

「NEAR」作为最受资本青睐的明星公链之一,今年的发展只能说是差强人意,在生态实际发展方面明显落后于其它主流公链(甚至于本寄予厚望的算法稳定币 USN 也落寞收场)。但作为一直以无限扩容作为愿景之一的特色公链,NEAR 在开启质押之后,接下来新分片就是开启下一阶段的关键叙事,仍需持续关注。

LayerZero:热度不减,声量减弱

「LayerZero」作为全链(omnichain)互操作性协议,理论上支持所有 Layer 1 以及 Layer 2 间的跨链通信,因此一直颇有叙事热度,今年伴随着 Coinbase、币安的上线及 Aptos 主网上线之初的快速接入,也带来了几波短暂的热度高峰。

不过此前其开发团队 LayerZero Labs 完成 1.35 亿美元 A+ 轮融资由 FTX Ventures 领投,所以此番 FTX 爆雷之后,LayerZero 及其旗下 Stargate(STG)明显声量和表现都弱了很多,为其未来的发展蒙上了一层阴影。

公链:新王相继陨落,激情消退

「公链」无疑是今年最能引发人们反思的赛道之一,其中以 Terra 生态的崩盘和 Solana 的跌落为代表事件,几乎验证了新王陨落、新新王未知。

年中 Terra 的崩盘及其次生灾害,已经在一定程度上将新公链们(SolanaAvalanche、Fantom)庞大与虚弱的二象性呈现在大众面前,而年末 FTX 所引发的 Solana 危机则彻底撕开了所谓的生态光环:

一个曾经炙手可热的新生代公链,短短几天云泥之别,而与此同时,Solana 里斯本大会讨论正酣,然而议程尚未结束,命运却早已转向,不由得让人唏嘘。

这让人也不由得重新审视新公链迷思,尤其是像 Solana 这样曾经大旗高举的「以太坊杀手们」,如今一个个跌落神坛,而那些彼时看似庞大的生态,在雪崩般垮塌的信心和朝露般蒸发的市值面前,也一触即溃。

而 Aptos、Sui 的声量则又暂未令人看到足够的希望,所以新公链的激情消退之后,似乎只有比特币、以太坊更有韧性,更值得关注与期待。

钱包:掌控私钥,才能掌控未来

「钱包」则伴随着用户对更多中心化交易所的不信任感加剧而再度受到关注,在市场资金外流到链上的趋势下,钱包背后的资产个人掌控的重要性也进一步凸显。

此次 FTX 的爆雷更说明没有大而不能倒的中心化交易所,「Not your keys, not your crypto」,掌握自己的私钥,才能掌握自己的未来。

a16z:加密风投扛把子

「a16z」的上榜应该得益于其在投融资领域的持续出手,据此前 Foresight News 根据公开信息统计,a16z 投资的 Web3 领域公司或项目数量超过了 90 个,包括了公链、Layer 2、DeFi、NFT、游戏、元宇宙等几乎所有的 Web3 赛道。

Aleo:空投重点关注对象

「Aleo」的定位是可编程隐私网络,今年最大的项目进展里程碑应该就是 2 月份完成的 2 亿美元 B 轮融资,此后也成为大家搞学习(刷空投)的主要对象之一。

Uniswap:NFT 布局、费用开关双发力

「Uniswap」虽然位列今年热搜榜末位,但在 NFT 市场布局、费用开关等方面的进展却备受关注。

其中介入 NFT 赛道方面,Uniswap 先是收购 NFT 聚合市场 Genie,随后又通过集成 sudoswap 实现 NFT 交易,并聚合 OpenSea、X2Y2、LooksRare、sudoswap、Larva Labs、Foundation 和 NFT 20 上的 NFT 订单,逐步实质性切入 NFT 交易赛道,后续成效也颇值得关注。

费用开关方面,则一直是饱受关注的 UNI 赋能关键,此前 8 月 10 日 Uniswap 的「费用开关」提案通过共识检查投票,随后也已顺利温度检查(temperature check)投票,而最后一步的链上投票则由于社区反馈意见而暂时推迟,预计将在 2023 年初给出答案。

Mirror 年度热搜榜

Mirror 年度热搜榜上和站内有部分重叠,正好达到一半,包含「Aptos」、「zkSync」、「Sui」、「Cosmos」、「LayerZero」,说明了热词关注度的普遍性,具有足够的代表意义。

而其余 5 个里面,「空投」、「教程」、「测试」则是历来 Mirror 每周热搜榜的前排常客,契合 Mirror 一直以来的历史数据,佐证了 Mirror 在不少用户的心中,就是一块充满财富密码或者宝藏教程的文章库,因此不少用户的搜索偏好也集中在空投、教程这样的技术类或者教程类文章。

另外两个的「Sei」和「Optimism」,也是今年的新公链势力的代表,借助空投预期、大额融资等积攒了足够的热度。

小结

总的来看,今年年度(站内)热搜榜上的具体项目类热词占比过半,正好 11 个,「融资」、「NFT」、「Web3」、「空投」、「钱包」、「公链」等大类话题又占据 6 个,其余则基本为事件类热词。

此外今年的年度热搜榜上,不少热词的热度贡献也都离不开 FTX 事件的催化,除了「FTX」、「币安」等直接关联的热词外,「dYdX」、「钱包」、「LayerZero」、「公链」等或多或少受其影响。

草蛇灰线,伏脉千里。对加密货币市场来说,今年暴露出来的风险虽然引发了足够的动荡与外界猜疑,但也至少会慢慢增强系统的鲁棒性。在此我们可以重温 Authur Hayes 曾在「 3.12 」后的博客里写到的一句话:

「Long live volatility, and stay healthy」(从波动中成长,永远保持身体健康)

这或许是在当下变动不居的市场里, 2022 年我们所得到的最大收获,也是 2023 年最好的生存指南。