Arthur Hayes:比特币触底了吗?

本文来自 Medium,原文作者:Arthur Hayes,由 Odaily 星球日报译者 Katie 辜编译。

比特币作为加密货币储备资产,也是最“久经沙场”的加密货币,其价格走势是我们判断市场是否已经“触底”的标志。

我们将从中心化借贷机构、比特币矿企和普通投机者这三类交易中分析比特币触底情况,并解释为什么这三类交易已经没有更多的比特币可抛售,以及为什么在最近的 FTX/Alameda 暴雷中,我们可能已经触及了这个周期的最低点。最后,我将介绍我计划如何抄底。

中心化借贷公司

中心化借贷公司(CEL)通常会破产的原因,要么是他们把钱借给了无法偿还的实体,要么在借贷账簿中存在期限不匹配。发生期限不匹配的原因是,贷方利用这些存款发放长期的贷款,但贷方收到的存款可以在短时间内被储户撤回。如果储户想要回他们的钱,或者由于市场条件的变化而要求更高的利率,那么 CEL(没有其他资金注入的情况下)就会资不抵债,很快就会破产。

在 CEL 无力偿还债务或破产之前,他们将试图筹集资金来改善情况。他们要做的第一件事就是尽可能地收回所有贷款。这主要影响到那些在短期内向他们借钱的人。

想象一下,你是一家向 Celsius 借钱的交易所,但在一周内,Celsius 要求归还这些资金,你必须照办。作为一家交易所,在牛市中被要求还钱并不是什么大事。还有很多其他 CEL 会借给你资金,这样你就不必清算现有的头寸。但当牛市消退,整个市场出现信贷紧缩时,所有 CEL 通常都会在同一时间收回贷款。由于无处可以寻求额外的信贷,交易所被迫清算头寸以满足资金需求。他们将首先清算其最具流动性的资产(即 BTC 和 ETH),并希望他们的投资组合不包含太多非流动性的垃圾币。

在 CEL 尽可能收回所有短期贷款后,它将开始清算支撑其贷款的质押品。在加密市场,如最近的内爆之前,最大的抵押贷款类别是由比特币和比特币矿机担保的贷款。因此,一旦市场情况开始恶化,CEL 就会开始出售比特币,因为比特币是最常用来质押贷款的资产,也是流动性最强的加密货币。他们还求助于他们贷款的矿企,要求他们支付比特币或他们的矿机。但如果这些 CEL 没有使用廉价电力运营数据中心,那么矿机就和 SBF 的记账技能一样“派不上用场”(讽刺 FTX 记账混乱)。

因此,尽管信贷危机仍在持续,但我们看到大量比特币卖出冲击了金融机构:

CEL 试图通过出售作为质押品的比特币来规避破产;

交易所看到他们的贷款被召回,必须清算头寸。

这就是为什么在 CEL 破产之前比特币的价格会暴跌。这是一个大动作。而第二次下跌是由一种恐惧驱动的,那些曾经被认为“坚不可摧”的公司突然清算资产。这往往只是一个较小的举动,因为任何面临破产风险的公司都已经忙着清算比特币,为了在崩溃中幸存下来。

上面的币安 BTC/BUSD 交易量图表表明,在 2022 年的两次信贷崩溃期间,交易量飙升。正是在这段时间里,所有这些曾经的传奇公司都消失了。

随着 CEL 从偿付能力到资不抵债再到破产,生态系统的其他参与者也会受到影响:

从 CEL 借入短期资金并发现其贷款被收回的交易所;

借入了资产负债表上以比特币、未来要开采的比特币和/或比特币矿机质押的典型法定资产的比特币矿企。

Alameda 和 3AC 这两家最大的被操控的加密金融公司,都因为借贷便宜而发展到庞大的规模。在 Alameda 的案例中,他们从 FTX 客户那里“借用”了资金。在 3AC 的案例中,他们欺骗了轻信他们的 CEL,让他们在几乎没有质押品的情况下借给他们资金。在这两种情况下,放贷人都认为这些公司从事的是“天衣无缝”的套利交易,使这些公司不受市场变化的影响。然而,我们现在知道这些公司只是一群“对做多上瘾”的投机者。他们与散户的唯一区别是,他们有数十亿美元可供支配。

当这两家公司陷入困境时,我们看到流动性最强的加密货币——比特币(DeFi 中的 wBTC)和以太坊(DeFi 中的 wETH)大量转移到交易所,然后抛售。这发生在大跌期间。最终两家公司都资不抵债,它们剩下的资产几乎完全是流动性最差的垃圾币。通过查看中心化借贷方和交易公司的破产申请,还剩下哪些加密资产尚不清楚。因此,我无法证明这些破产机构持有的所有比特币都在多次崩溃期间被抛售,但看起来他们确实在破产前尽了最大努力清算了最具流动性的加密质押品。

CEL 和所有大型交易公司已经卖出了大部分比特币。现在剩下的只有缺乏流动性的垃圾币、加密公司的私人股份和锁定的预售代币。破产法庭最终如何处理这些资产与加密熊市的发展无关。这些实体几乎没有没有多余的比特币可以出售。接下来,让我们看看比特币矿工的情况。

比特币矿企

电力以法币定价和出售,电力是任何比特币挖矿业务的关键部分。因此,如果一家矿企想要扩张,他们要么需要借入法币,要么在资产负债表上出售比特币以换取法币,以支付电费。大多数矿工都希望不惜一切代价避免出售比特币。因此,他们会以资产负债表上的比特币(尚未挖到的比特币)或比特币矿机为抵押,从而获得法定贷款。

随着比特币价格上涨,贷方将向矿企放贷更多的法币。矿工是盈利的,而且有硬资产可供借贷。然而,贷款的持续质量与比特币的价格水平直接相关。如果比特币价格迅速下跌,那么在矿企赚取足够的收入来偿还贷款之前,贷款将超过最低保证金水平。如果发生这种情况,贷方将介入并清算矿工的抵押品。

据我们所知,这是因为资产价格大幅下跌,尤其是在加密熊市,加上能源价格上涨,挤压了整个行业的矿工。Iris Energy 面临债权人拖欠 1.03 亿美元设备贷款的索赔。9 月,Compute North 第一次根据破产法第 11 章破产,包括 Argo Blockchain(ARBK)在内的其他大型公司似乎也在偿付能力的边缘徘徊。

通过图表,可以了解这些加密信贷紧缩浪潮是如何影响矿工的,以及他们是如何应对的。

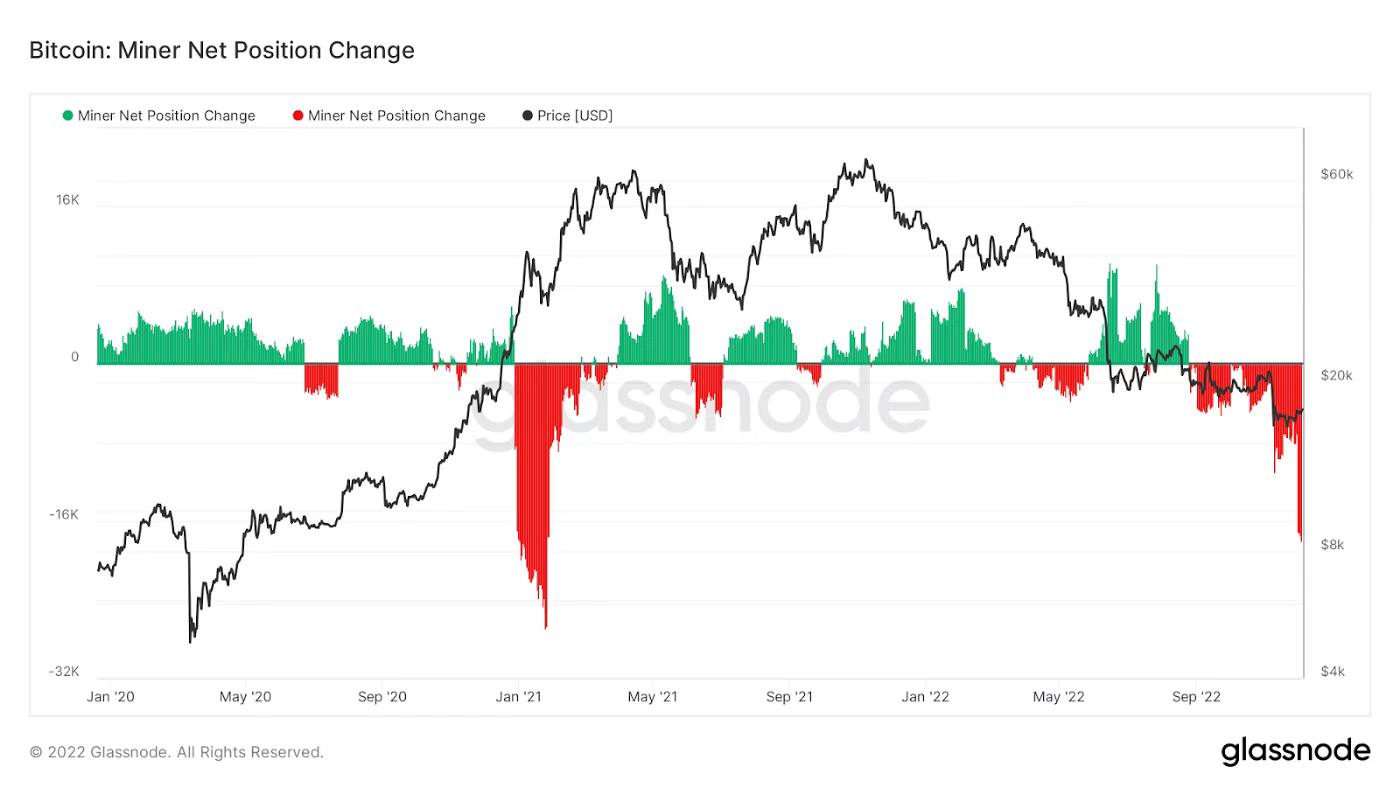

下图来自 Glassnode,显示了矿工持有的比特币 30 天的净变化。

正如我们所看到的,自今年夏天的第一次信贷危机以来,矿工们一直在净抛售大量比特币。他们必须这样做才能及时偿还巨额法定债务。如果他们没有债务,他们仍然需要支付电费,但由于比特币的价格走低,他们不得不出售更多的比特币来维持设施的运营。

虽然我们不知道是否已经达到净抛售的最大值,但我们可以看到在这种情况下,矿企的行为符合我们的预期。

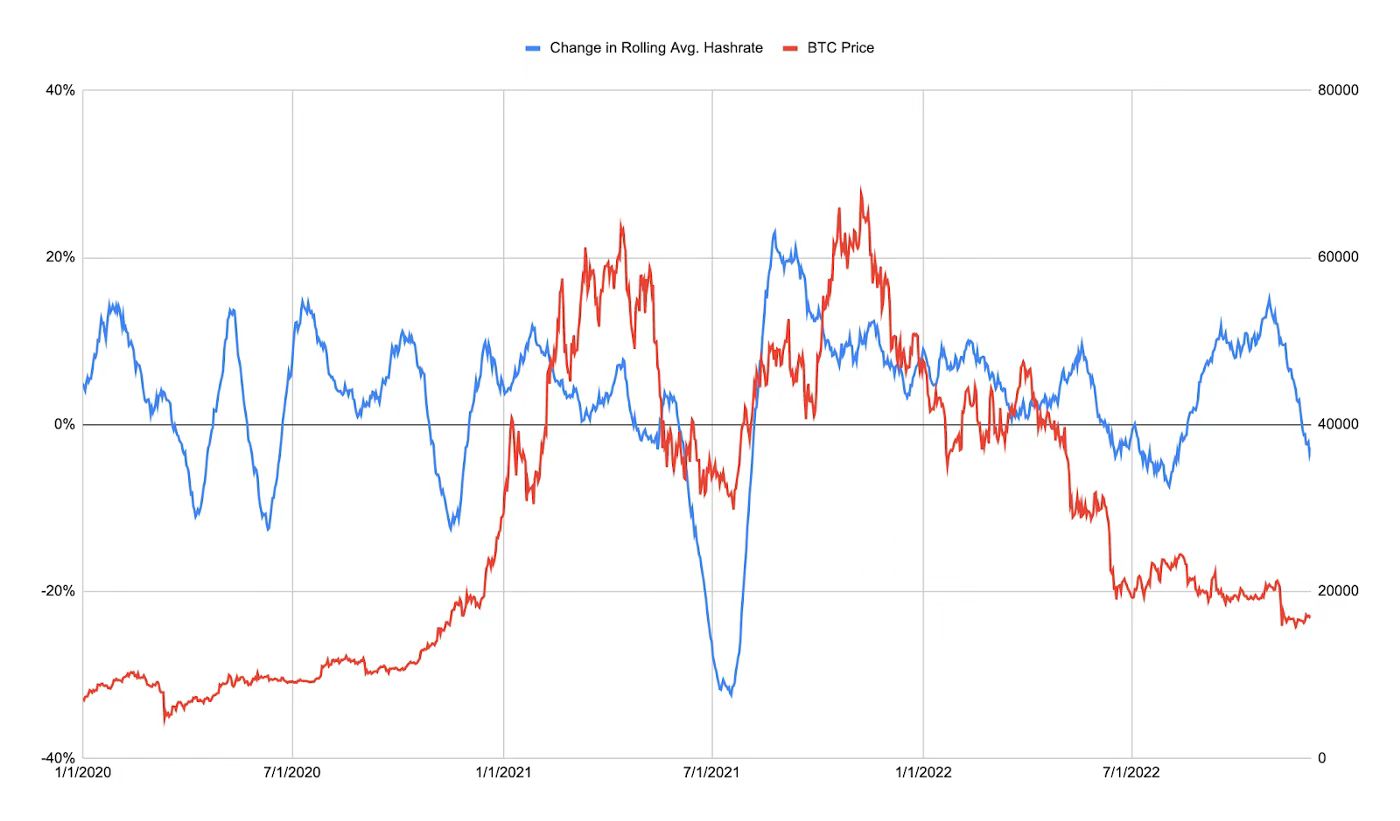

其中一些矿工没有成功避开风险,或者他们不得不缩小业务规模。这在哈希率的变化中很明显。我使用哈希率计算滚动的 30 天平均值。然后用这个滚动平均值来观察 30 天的变化。因为哈希率是相当不稳定的,需要一些平滑处理。

总的来说,哈希率随着时间的推移呈上升趋势。但在某些时期, 30 天的增长是负的。哈希率在夏季崩溃后立即下降,最近由于 FTX / Alameda 的影响而骤降。这再次证实了我们的理论,即当没有更多的信贷可用于支付电费时,矿工将缩小业务规模。

一些高成本的矿工因为拖欠贷款而不得不停止运营。任何将矿机作为质押品的贷款机构都可能无法从矿机上直接获利,因此贷方必须在二级市场上出售这些机器,而这个“变现”过程需要时间,这也会导致哈希率在一段时间内下降。

想象一下,你借出美元来抵押矿机,向你借钱的矿工试图出售比特币,以获得更多法币来偿还你的贷款,但最终无法这样做,因为边际利润率下降了。矿工们随后拖欠贷款,并交出了他们的矿机作为偿还,而这些矿机现在的价值几乎比贷款时低了 80% 。我们可以猜测,最狂热的贷款发放点是在市场顶部附近,而这些暗中操纵的贷方每次都是“抄顶 & 逃底”(buy the top and sell the bottom)。

既然 CEL 拥有大量无法轻易出售和运营的矿机,他们可以尝试出售这些矿机并收回一些资金,但收回的资金远远不够,因为新矿机的交易价格比一年前低了 80% 。他们无法经营矿场,因为他们缺乏一个有廉价电力的数据中心。这就是哈希率消失的原因,因为无法重新启动机器。

展望未来,如果大部分挖矿贷款已被取消,并且没有新的资本可借给矿工,那么我们可以预计矿工将出售他们获得的大部分区块奖励。

如上表所示,如果矿工卖出他们每天生产的所有比特币,这几乎不会影响市场。因此,我们可以忽略这种持续的抛售压力。

我相信 CEL 和矿工对比特币的强制抛售已经结束。考虑到几乎所有主要的 CEL 都停止了提款(资不抵债或破产),没有更多的矿工贷款或质押品需要清算。

普通投机者

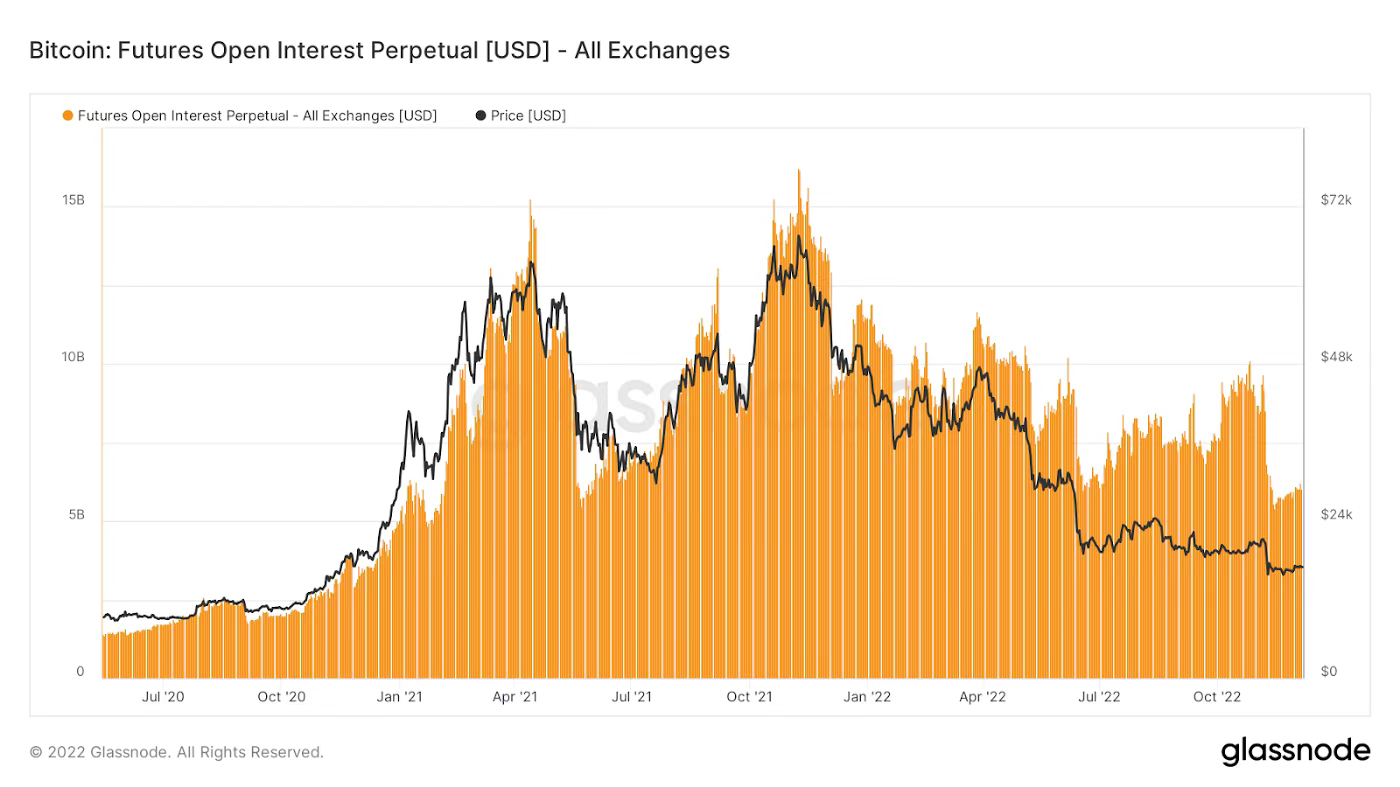

比特币/美元永续合约是所有加密工具中交易量最大的。未平仓的多头合约和空头合约的数量——称为未平仓合约(OI)告诉我们市场的投机程度有多高。投机程度越高,使用的杠杆就越多。正如我们所知,当价格快速变化时,会导致大量的平仓。在这种情况下,OI 的历史高点与比特币的历史高点同时出现。

随着市场下跌,保证金多头被清算或平仓亏损头寸,这也导致 OI 下降。

看看所有主要加密衍生品中心化交易所的 OI 总和,我们可以看到,OI 的本地低点也与 11 月 14 日周一比特币跌破 16000 美元的价位相吻合。现在,OI 已经回到了自 2021 年初以来的水平。

OI 下降的时间和幅度让我相信,大多数过度杠杆化的多头头寸已经消失。剩下的是使用衍生品作为对冲工具的交易者,以及那些使用极低杠杆的交易者。这给了我们一个向上涨的基础。

当我们进入熊市的横盘、非波动部分时,OI 会进一步下跌吗?肯定会。但 OI 的变化速度将放缓,这意味着以大量清算(特别是长期清算)为特征的混乱交易期不太可能发生。

我不了解的情况

我不知道 15900 美元是不是这个周期的底部。但是,我确信这是由于信贷紧缩所带来的被迫抛售导致的。

我不知道美联储何时或是否会再次开始印钞。我认为由于美联储收紧货币政策,美国国债市场将在 2023 年的某个时候出现失调。到那时,我预计美联储将打开印钞机,届时比特币和所有其他风险资产将飙升。

我所知道的情况

一切都是周期性的。跌下去的,就还会再涨回去。我喜欢通过投资期限短于 12 个月的美国国债来获得接近 5% 的收益。因此,我希望在等待加密牛市回归的同时获得收益。

我会如何“抄底”?

我理想的加密资产必须是比特币的 beta(趋势收益资产),至少是以太坊的 beta。这些是加密货币的储备资产,如果它们在上涨,我的资产应该至少上涨相同的金额。该资产必须产生收益,这个收益率肯定比我购买 6 个月或 12 个月国库券所能获得的 5% 要高得多。

我的投资组合中得有一些超级强大的资产,如 GMX 和 LOOKS。本文我不会解释为什么我会在未来几个月的横盘熊市中投机地买卖我的美国国债。但如果你想寻找在等待牛市回归的同时,既能参与上涨,又能赚取收入的资产,那就打开一个像加密资产分析工具 TokenTerminal 这样的网站,看看哪些协议能产生实际收入。然后研究哪些协议具有吸引人的代币经济。有些人可能会赚取很多收入,但代币持有者很难将他们的收入份额提取到自己的钱包中。一些协议将大部分收入直接支付给代币持有者。

DeFi 在 2022 年加密信贷危机的两次下行浪潮中遭到了重创。投资者把好的项目和坏的项目一并抛出,因为他们急于筹集法定资金来偿还贷款。因此,许多此类项目的市盈率都非常糟糕。

如果我可以从国债中获得 5% 的收益,那么当我购买这些代币时,我至少应该获得 4 倍的收益,即 20% 。20% 的年收益率意味着我应该只投资市盈率(P/F)比为 5 倍或更低的项目。每个人都有不同的期望率,这只是我个人的打算。

我可以购买比特币或以太坊,但这两种加密货币都不能给我带来足够的收益。如果我没有获得足够的收益,我希望当市场转向时,以法定价格计算的价格将大幅上涨。

我相信这将会发生,但如果有便宜的协议,我可以获得比特币和以太坊的回报,加上实际使用的收益,不亦乐乎。在你认为是“底部”的时候投资肯定是有风险的,DYOR。