Maple面临3600万美元恶意违约,无抵押贷款是不是伪命题?

12 月 5 日,当前链上规模最大的无抵押贷款协议 Maple Finance 发布公告称,因合作方 Orthogonal Trading 对其财务状况存在重大陈述失实,致使协议面临巨额违约风险,将断绝与该公司的所有合作(包括取消 Orthogonal Trading 附属公司 Orthogonal Credit 的代理人资格),并寻求所有适当的法律途径来追回资金。

根据公告及 The Block 的跟进披露内容,Orthogonal Trading 隐瞒了该公司早已资不抵债的事实,在 M11 Credit 作为代理人的 USDC 池和 WETH 池合计借走了约 3600 万美元的资金,并持续拖延欠款,致使 Maple Finance 协议以及所有存款用户面临巨额损失风险。

Maple Finance 的运行机制

在解释 Orthogonal Trading 这笔违约具体构成什么影响之前,我们先来简单解释一下 Maple Finance 的运行机制。Maple Finance 的系统循环依赖于四种角色——存款人、保险人、借款人、代理人。

存款人和保险人很好理解,即向池内提供可借资金的用户,以及负责应对池内突发情况、垫付损失的保险方,二者均可通过各自的行为获得借贷利息收入以及 Maple Finance 所释放的代币激励。这里我们需要着重解释的是后两种角色。

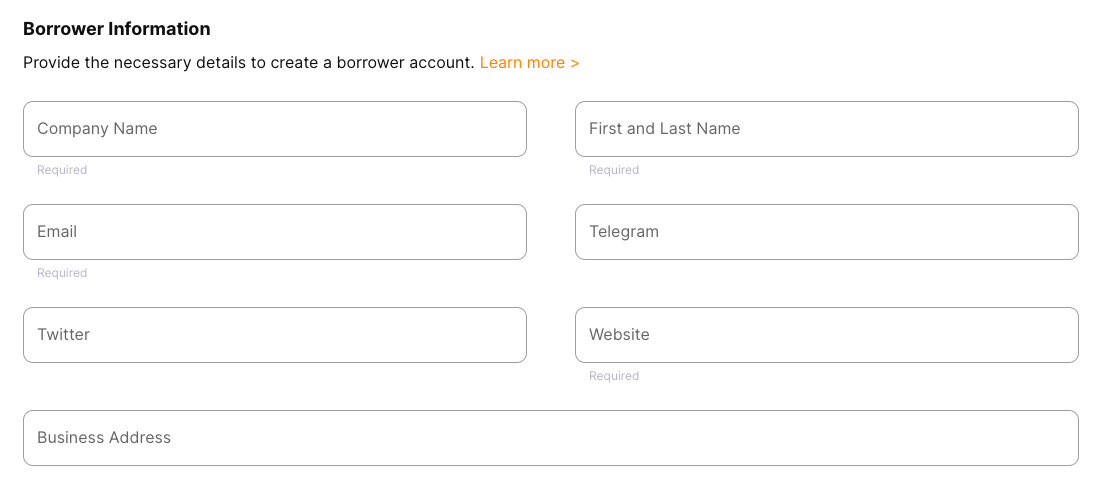

借款人即有着借款需求的用户,在 Maple Finance 内一般都是机构客户,借款人提交借款申请前需填报公司资料、借款用途、还款规划等等信息,申请最后会交予代理人审核。

代理人则是负责审批贷款的角色,在 Maple Finance 一般都是专业信贷机构,代理人会审核借款人的财务状况、信誉质量、方案合理性等等来决定是否发放这笔贷款,并通过有效运行来赚取一定的收入。

Odaily 星球日报注:为了隔离风险,Maple Finance 每个代理人所负责的每个币种都会有单独的池子。

违约细节

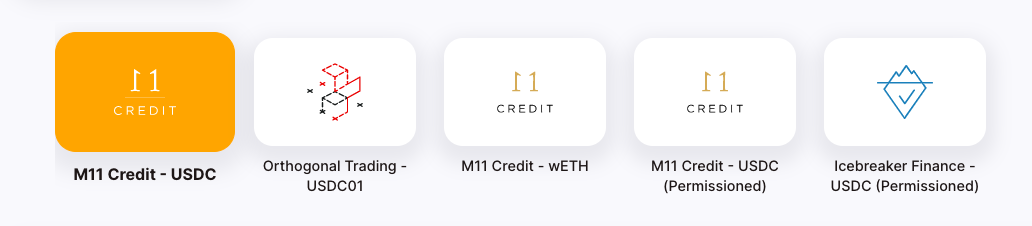

从 Maple Finance 协议内可看出,当前该协议在以太坊链上共拥有三名合格的代理人:M11 Credit、Orthogonal Trading(作为代理人的实际上是子公司 Orthogonal Credit)、Icebreaker Finance,其中 Icebreaker Finance 作为最近达成合作的代理人,其所负责的池子尚未发放任何贷款。换句话说,目前 Maple Finance 上活跃的代理人只有 M11 Credit 和 Orthogonal Trading。

这时候再回头去看违约就很有意思了……Orthogonal Trading 在作为代理人的同时也作为借款人从 Maple Finance 申请借款,所以只能选择仅剩的一家活跃代理人 M11 Credit,这等于说是协议之上的两家代理人都出了问题,一家财务信息造假,一家所谓的专业信贷机构愣是没看出来……

事后,涉事各方已通过官方渠道给出了不同角度的称述。

M11 Credit 称导致事态发生至此的主要原因是 Orthogonal Trading 一直都在故意虚报财务信息。具体来说,Orthogonal Trading 虽然在 11 月里多次向 M11 Credit 表示确实在 FTX 上有资金被困,但实际损失比他们给出的数字要大得多。而在事情发生后,Orthogonal Trading 也没有向 M11 Credit 披露风险,反而是试图通过进一步交易来弥补损失,最终损失了大量资金。

Orthogonal Credit 方面也发布回应称,母公司 Orthogonal Trading 确实存在歪曲风险敞口的行为,但 Orthogonal Credit 一直都是独立运营,对母公司作出的虚假陈述一无所知……

损失规模及追偿方案

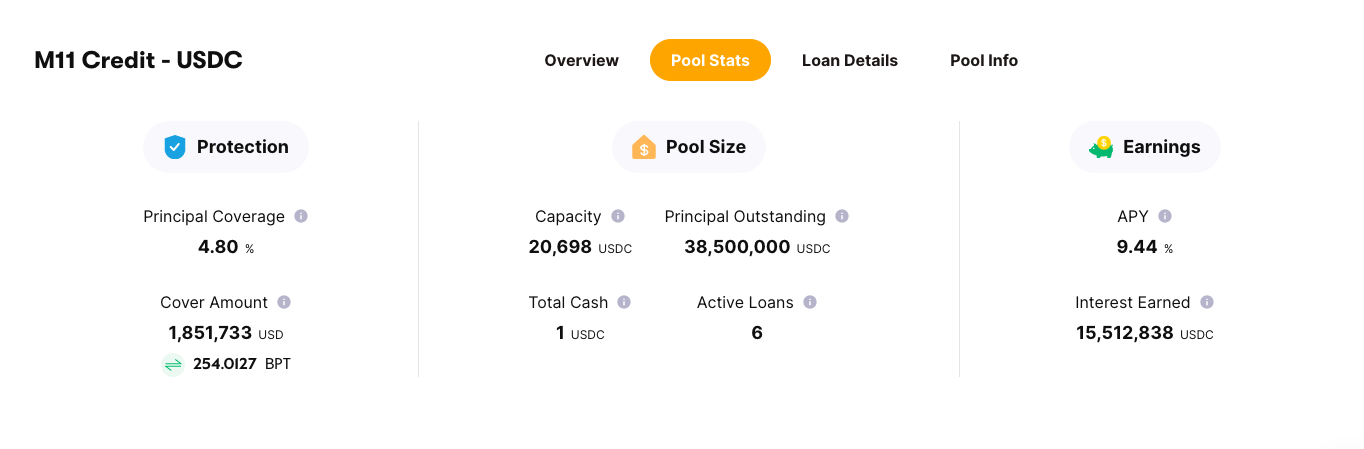

如前文所述,Orthogonal Trading 的违约合计造成的损失约为 3600 万美元,影响了 M11Credit 作为代理人的 USDC 池和 WETH 池。其中,约 3100 万美元的 USDC 违约占相关池子总规模的 80% ,且该池的保险规模总额仅有约 185 万美元,预计会对存款用户造成较严重影响;约 500 万美元的 WETH 违约占相关池子总规模的约 17% ,虽然该池的保险规模总额仅有约 20 万美元,但影响相对也小一些。

不过,由于还有小规模的借款人也存在违约风险,比如 M11 Credit 数日前曾提到加密交易公司 Auros Global 因受 FTX 事件或已无力偿还 2400 WETH,所以不同池子潜在的损失情况仍存有一定变数。

截至发文,业内多家公司已向用户及社区披露了潜在的损失可能。

DeFi 保险平台 Nexus Mutual 披露,其在 M11 Credit 作为代理人的 WETH 池存有资金,现已启动了撤资程序,但由于存在 10 天的强制性等待期,希望届时能顺利收回大部分资金,但预计仍会损失 2461 ETH。

智能合约审计平台 Sherlock 也披露称,其在 M11 Credit 作为代理人的 USDC 池中存有 500 万美元,或因借款人违约损失约 400 万美元。

根据 Maple Finance 以及 M11 Credit 方面的表态,未来双方均将寻求所有适当的法律途径来收回资金,必要时会选择仲裁或诉讼。

同时,Maple Finance 也提到预计可以收回 250 万美元左右的资金。这些资金主要来源于 Orthogonal Credit 作为代理人的借贷池,特别是 Orthogonal Trading 在该池启动时所提供的保险资金,以及运行至今所产生的代理人收入。

无抵押借贷是伪命题吗?

信用贷款乃至无抵押贷款一直被视为解决 DeFi 资金利用效率低下问题的潜在路径。

不过,受限于加密世界暂时仍缺乏较为成熟的信用体系及配套的清偿体系,这一方向的创新始终未能实现规模化。在诸多探索信用贷方向的项目之中,Maple Finance 从实现规模上看已是罕见的“优等生”代表。

然而,这次的 Orthogonal Trading 还是暴露了 Maple Finance 的设计缺陷,当所有借款人和代理人都能够有效履行职责时,该协议确实可以满足用户更高的资金利用效率需求,但一旦某方或双方渎职甚至蓄意作恶(极端情况下还可能联合做局),协议还是没能表现出足够的鲁棒性。

回顾本次违约事件,虽然你也可以说如果 Orthogonal Trading 没有走到山穷水尽,如果 M11 Credit 的审核再严厉一些,或许就可以避免这起人祸,但这种人性依赖本质上就与 DeFi 所倡导的 code is law 存在矛盾。究其原因,是因为 Maple Finance 所采用的信誉方案仍是传统金融领域的征信模式,只是把这套模式搬到了链上,并为在范式上实现任何突破。

作为 DeFi 的信仰者,我们仍期待着未来的 crypto 世界能够出现真正去中心化、去信任化的信用贷方案,但就目前来看,当下或许还是太早了些。

正如 Maple Finance 创始人 Sid Powell 事后所说:“我对这一事件感到震惊与失望,我们会采取更严格的尽职调查,并考虑引入部分抵押机制。”