Pantera Capital:2024年减半时,比特币价格会到多少?

FTX 相关更新

我们想提供一个关于 FTX 情况的更新,以及它是如何影响我们的。总结一下,本月,FTX 和 Alameda Research 以 FTT 代币为抵押进行了过度举债。截至今天上午,两家公司都已申请破产。总的损失尚不清楚,但网上估计损失高达几十亿美元。FTX 交易所内的用户存款也被大幅折价交易。这可能意味着那些在 FTX 上有资金的人损失了大部分资金。

一般来说,我们处理这些情况的方法首先关注尽可能多地保护投资组合。然后,一旦我们采取了所有可能的措施,我们就可以更新我们的有限合伙人关于我们做了什么以及我们的基金的情况。但最重要的是,我们的目标是降低永久性资本损失的风险。受此消息影响,市场大幅下跌,这将在我们的业绩中体现出来,但当市场反弹时,我们预计也会如此。在这种情况下,我们主要要避免的是资产的永久流失。

我们的做法是,在保持一定的交易灵活性的同时,总体上减少对中心化交易对手方的敞口。我们在 FTX 事件中的主要风险/损失来自于我们的 Blockfolio 收购收益,这些收益是以 FTT 和 FTX 股票计价的。我们在 11 月 8 日星期二尽可能地清算了 FTT。在崩溃之前,周一晚上,我们的 FTX 股票和 FTT 代币头寸总计不到我们公司总资产管理规模的 3%。

周二上午 FTX/Alameda 陷入困境的消息发布后,我们的团队立即组建了一个虚拟作战室,评估对我们早期投资组合的影响,并采取行动。我们的目标是 1 )识别我们的投资组合团队可能面临的潜在风险; 2 )直接接触有风险的团队,提供我们所能提供的任何帮助。

我们已经在我们行业类似的压力环境中进行了这项测试(例如, 3 AC 破产, 2018 年加密寒冬)。在危机时刻,“我们必须迅速行动。”对于陷入危机的企业来说,速度是至关重要的,与在危机的另一边生存并变得更强大相比,速度是至关重要的。

我们从我们的早期代币和区块链风险投资公司中确定并联系了投资组合团队,我们认为这些公司可能对 FTX/Alameda 有潜在的重要交易对手或托管敞口。在与投资者交谈或收到投资者最新消息后,绝大多数接触到的投资组合团队报告称,他们对 FTX/Alameda 几乎没有交易对手或托管风险敞口。我们最初的印象是,这种有限的风险敞口部分归因于我们寻找并定期向我们的创始人强调的积极的风险管理和托管/财务管理实践,但我们预计未来几周和几个月将提供更多的见解。

短期内,那些在 FTX 交易所失去资金的人将遭受痛苦。更广泛地说,我们预计整个加密生态系统的价格将进一步波动,因为对传染的担忧促使资产持有者调整他们的投资组合。与 FTX 相关的资产(Solana及其基础项目、Aptos等)可能会受到最严重的打击。这一事件也可能是应用的一个挫折,因为一些失去资金的零售用户选择离开这个领域,而其他可能更早加入的用户则被吓得留在场外。我们预计,此前对这一领域持谨慎态度的机构将加深他们的怀疑。这是意料之中的,但不幸的是,还没有严重到值得警惕的地步。它们可能需要更长的时间,但我们相信,它们终将实现,而且比许多人预期的要快。

监管部门可能会做出回应,但我们对此举将产生中长期积极效果持谨慎乐观态度。正如这场危机所突显的那样,金融交易的中央中介机构不透明,往往不值得信任。没有什么比去中心化的、不可信的协议更明显的需求了,它允许用户交易、持有和转移他们的资产,而不依赖于 FTX、Celsius 或 Voyager 等实体。由于加密货币领域存在中心化的中介机构,它们应该也可能很快就会受到更严格的储备、审计和风险控制监管,特别是如果这些中介机构与零售用户交互的话。相反,去中心化协议是公开的、开放的、更透明的,不需要用户以同样的方式信任。我们希望监管机构能够意识到这一点,并将注意力从监管 DeFi 转移到监管在该领域运营的中心化机构上。

在个人层面上,FTX 的崩溃提醒我们,我们正在做什么。作为一家公司和一个生态系统,我们的使命不是复制传统金融领域的风险和低效。而是要建立一个更高效、更分散、更开放的金融生态系统。这一愿景让我们比以往任何时候都更有动力,也让我们对拥有同样愿景的有限合伙人的支持更加感激。这一过程可能并不总是容易或顺利的,但它是必要的。我们要感谢你们每一个人与我们一起参与。

比特币减半

比特币协议的货币供应功能与量化宽松截然相反。比特币代码表明,总共将发行 2100 万枚比特币,新币的供应将随着时间的推移而减少。

如今,每十分钟发行 6.25 个比特币,不受人为意志所干预。

每四年,“区块奖励”就会减半,因此被称为“减半”。这个过程一直持续到 2140 年。

比特币的供应和分配规则集纯粹基于数学,设计上可预测且透明。

减半将近

下一次减半预计发生在 2024 年 4 月 20 日。挖矿奖励将从 6.25 BTC /块下降到 3.125 BTC /块。

有效市场理论认为,如果我们都知道它会发生,那么它就必须被定价。套用沃伦·巴菲特在教条上的一句话:“市场几乎总是有效的,但几乎和总是之间的差距对我来说是 800 亿美元。”因此,即使我们认为每个人都知道一些东西,这并不意味着没有大量的钱可以赚。

如果对新比特币的需求保持不变,而新比特币的供应减少一半,这将迫使价格上涨。在比特币减半事件之前,由于对价格上涨的预期,对比特币的需求也有所增加。

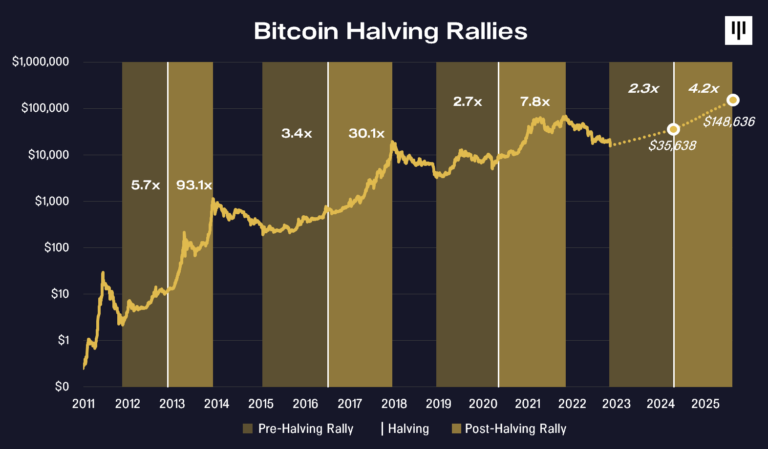

多年来,我们一直强调,减半是一件大事,但它需要数年时间才能发挥作用。典型的底部出现在减半前 1.3 年,平均而言,市场在减半后 1.3 年见顶。整个过程花了 2.6 年时间才看到全面影响。

比特币历史上曾在减半前 477 天触底,然后一路攀升,之后又开始上涨。减半后的反弹平均持续 480 天,从减半到下一个牛市周期的顶峰。

如果历史重演,比特币的价格将在 2022 年 12 月 30 日见底。然后我们会看到反弹持续到 2024 年初,然后在实际减半后出现强劲反弹。下面的图表显示了如果比特币重复之前减半的表现可能会发生什么。

Stock-To-Flow 模型价格预测

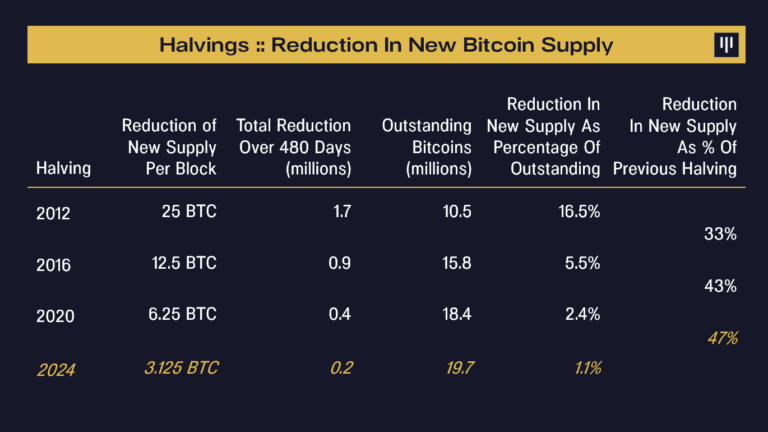

我们用来分析减半的影响的框架是研究每次减半的库存与流量比的变化。第一次减半导致新比特币供应量减少 17%。这对新供应产生了巨大的影响,对价格也产生了巨大的影响。

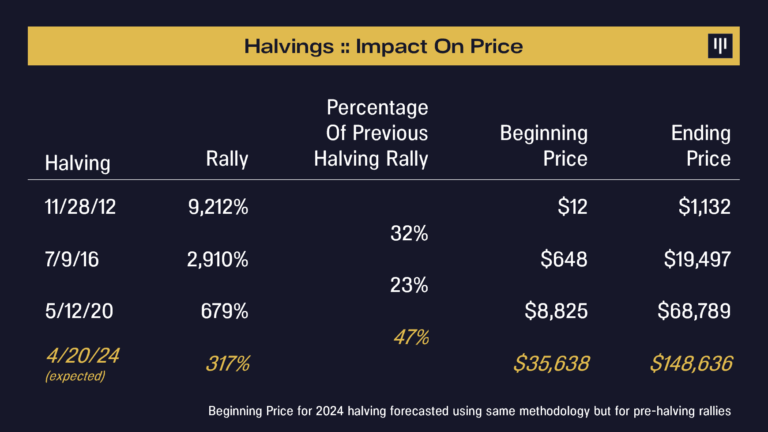

随着新比特币供应量从前两次减半到下一次减半的比例下降,以后每次减半对价格的影响可能会逐渐减弱。下图是一个图表,描述了过去一半的供应量减少,在一半的时间内余额比特币的百分比。

2016 年新比特币供应量减半,降幅仅为第一次的三分之一。有趣的是,它对价格的影响只有三分之一。

2020 年的减半使新比特币供应量较之前减半减少 43%。它对价格的影响是 23%。

下一次减半预计发生在 2024 年 4 月 20 日。由于大多数比特币现在都在流通中,每减少一半,新供应量的降幅几乎正好是其一半。如果历史重演,那么在下一个减半之前比特币将涨到 3.6 万美元,之后涨到 14.9 万美元。

结语

当人们怀疑减半是否完全反映在价格上时,我想起了 Kraken 联合创始人 Jesse Powell 的一句名言。在上一次减半期间与投资者的电话会议上:

Q:市场是否已经为减半预期定价?

Jesse Powell:比特币本身,都还没得到合理定价。