DAOrayaki:熊市下DAOs的财库管理现状

原文作者:twinFin

原文翻译:Shaun@DAOrayaki.org

原文标题:The State of Treasury Management for DAOs

财库(Treasury)管理是对项目资源进行长期管理的一种做法(a16z)。听起来对所有DAO来说都是至关重要的。那么,熊市下DAO的财库现状是怎么样的、如何应对熊市环境以及如何进一步优化。DAOrayaki 对《The State of Treasury Management for DAOs》一文进行编译和报道。

DAO 财库分布现状

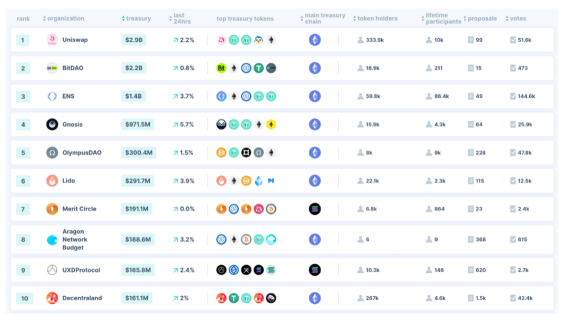

根据DeepDAO的数据显示,截止2022年万圣节,前10名DAO的财库(86亿美元)占总财库(112亿美元)的77%。其余的由近5000个其他DAO持有。

Autonolas的一份报告(2022年5月)披露了关于国库多样化和资本效率的一个值得注意的趋势:原生代币构成了大部分的持有量,但只有一小部分在使用。在这份研究报告中,65个国库超过1000万美元的DAO中(在本文发表时为61个,2022年10月),40个DAO的单一资产占国库总价值的80%以上。

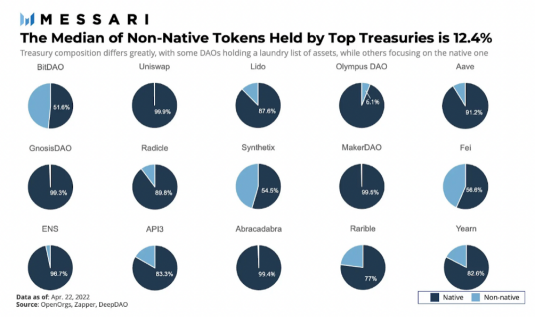

图为Messari, 2022年4月

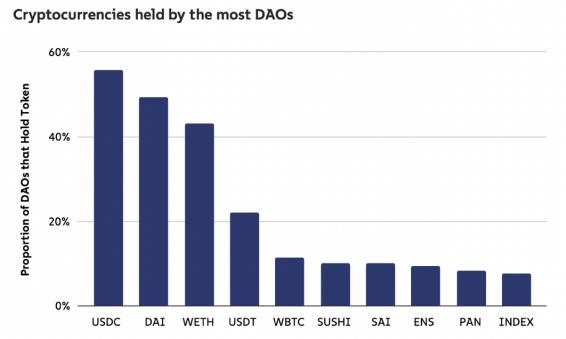

稳定币和蓝筹代币是DAO持有的最常见的资产,然而平均而言,85%的DAO财库都储存在单一资产中,主要是原生治理代币。稳定币只占23%。(以下数据和图表来自Chainalysis报告,2022年6月)

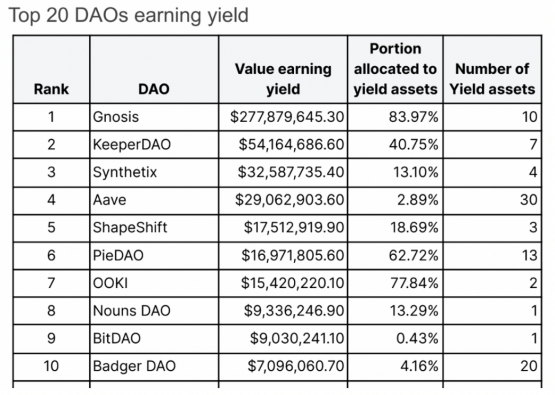

尽管超过一半的 DAO 参与了质押或挖矿收益,但整个国库中只有 4.3% 正在累积收益。考虑到 DAO 管理的是产生收益的协议本身,这是一个具有讽刺意味的趋势。

Gnosis 是一个例外,它分配了超过 80% 的资金来赚取收益。超过一半的 DAO 资产收益(53%)来自 Gnosis。 (旁注:Karpatkey 过去两年一直在管理其基金——参见他们的每周评论)流动性提供(占总价值的 61%)和贷款(25%)是产生收益的最常见做法。

Messari 的一份报告发现,中型 DAO 比前 15 名 DAO 更倾向于使用其原生代币,并指出这可能是由于随着时间的推移财务实践的变化和引入了新的多元化方法。

以上是DAO 财务的分布,DAO 的财库管理有哪些独特的挑战,以及 DAO 正在做什么来解决这些问题?

DAO财库管理的独特挑战

1.市场波动和财政的可持续性

80%的DAO完全依靠其原生代币,只有4%的总资产用于获得收益。Crypto和其他处于早期阶段的市场一样,以其波动性而闻名。那么,在低迷时期会发生什么?当所有的资本市场冻结时,DAO正忙于支付账单,更不用说投资于生态系统了。

"资产超过100万美元的DAO平均年化波动率为82%,而比特币为69%" (Chainalysis)。

尽管如此,多样化对任何DAO来说都是困难的;毕竟,出售自己的代币会向市场发出一个不好的信号,并最终对自己作为最大的代币持有者的价格产生负面影响。

2. 治理

通过原生治理代币,治理权和财务权合二为一。因此,与公司不同的是,DAO 必须担心与其上限表捆绑在一起的资产管理。

以 YamDAO为例,了解在周期性加密世界中很容易发生的治理和资金攻击的 DAO 特定组合。去年 7 月,$YAM 的完全稀释市值约为 230 万美元,而 $YAM 持有者控制的其国债价值为 310 万美元。

因此,攻击者准备了 200 ETH(当时约为 24 万美元),购买了 YAM/ETH SLP 代币,创建并投票支持恶意提案(#26)。该提案看起来就像最近执行的最后一个提案(#25),但其代码将使攻击者自己的钱包地址成为 YAM 国库的管理员(310 万美元)。它的投票权超过了提案门槛和成功法定人数。

Yam 治理过程要求提议者保持投票权,直到投票过程结束。然而,攻击者在提案提出后立即出售了 ETH 的 YAM 头寸,这使得社区可以取消该提案。此外,以太坊社区通知了 3-of-5 multisig 的 Yam Finance Guardian,如果提案继续进行,他们可以在执行前否决该提案。

然而,这个故事才刚刚开始。现在,"攻击 "发生在社区内部,要求对Yam国库进行YAM赎回。攻击发生后不久,关于让国库以每任0.25美元(当时为0.12美元)的价格赎回的快照提案被投票 "赞成"。然后核心团队提出了一个重新投票的提案,投票结果是 "反对"。然而,这个赎回计划最近在2022年10月再次出现。核心团队再次提出禁止提议者的提案,并在链上被投了 "赞成"。

有趣的是,Yam Finance团队本身是一家财资管理服务提供商,根据OpenOrgs的数据,其提议的sushiHOUSE占Sushi DAO财资的16%。 sushiHOUSE在去年7月被提议并通过了赎回。

另外,虽然去中心化治理有一个习惯,就是什么都要问,但不是每个代币持有者都是国库管理的专家,也不是对国库的具体情况感兴趣。分散治理中选民冷漠的悠久传统不断阻碍财务决策。

例如,Gitcoin在2022年1月与Llama成立了一个关于国库多样化的工作组,当时99%的国库都在其原生代币GTC中。然而,出售GTC换取USDC以资助其工作小组的实际提议在2022年7月被投票通过,而GTC代币价格在这个过程中下跌了59%(从6.93美元跌至2.82美元)。(Messari Report)

那么DAO应该如何管理财库?

DAO 资金管理指南

让我们首先回顾业内专业人士建议。

首先,Aragon 强调资产(Stables、L1s、Staking 和 LP、App 代币等)和成员资格(集体智能)的风险管理和多样化。Bankless建议拥有一定的稳定币,并展示了分散投资稳定币的不同方式。

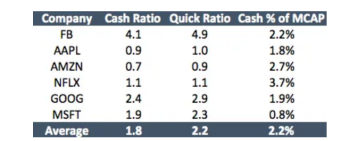

Bankless对FAANG+M现金组合的比较,现金比率=现金/流动负债|速动比率=(现金+有价证券+应收账款)/流动负债

Hasu 将国库中的原生代币与在公司资产负债表中不计为资产的“授权但未发行的股票”进行比较。这些未发行的股票不构成购买力,DAOs 应该成为“自己代币的非周期性交易者”,以最大化长期代币价值。

Karpatkey 指出,“去中心化一切运动”阻碍了财务管理的进展;技术决策不应受制于民主。作者提出了一个资金执行框架,其中只有 DAO 本身对整体战略进行投票并决定资金团队的范围。在整个社区规定的参数范围内,一个小型专家团队应该做出日常决策并执行。

那么 DAO 正在做什么来管理财库?

一段时间以来,财库多元化一直是备受热议的话题,每个 DAO 都采取了自己的方法来实施它。从 Lido 与 Paradigm 到 FWB 与 a16z,战略合作伙伴关系是受欢迎的选择之一。

DAO to DAO (D2D) 交换可以在激励一致的 DAO 中找到。 TempleDAO 是 FRAX 的最大 DAO 持有者,Frax 社区决定对其治理代币 TEMPLE 和 FXS 进行 D2D 交换。

OlympusDAO也是FRX的大持有人,并做了OHM<>FXS的交换。但并不是所有的D2D互换提案都能通过,正如在LOBI<>FXS中看到的那样。

有时,原生代币持有者会拿出一部分质押奖励,放在国库里,就像Kanpai对Sushi的提议一样。该提案是以其投资者之一Blockchain Capital的名义撰写的,社区在今年年初实施了该提案。

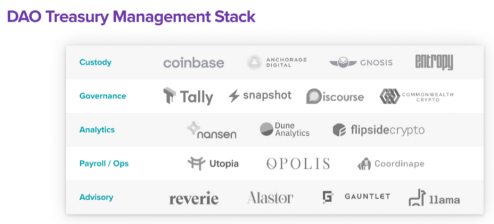

虽然像Bankless这样的媒体DAO可以用自己的财政部门来管理国库,但对于拥有数百万美元国库的DeFi协议DAO来说,要做到这一点可能比较困难。像Aave、Compound、Sushi和Maker这样的顶级DeFi DAO采用了Gauntlet和Llama这样的财库管理服务。

例如,Gauntlet 是一个金融建模平台,可以降低 DAO 资金库的风险并优化资本效率。他们建立了一个风险管理仪表板(COMP 示例),并代表社区更新了风险参数,例如借贷/供应上限(Aave 提案)。 Gauntlet 最近推出了 Aera,这是一个针对 DAO 的基于奖励的财务管理系统。

Hedgy Finance 是“DAO 国库的金融基础设施”,具有 Escrowless OTC 和 DAO to DAO Swaps。归属补偿,捆绑到 OTC 合约中的代币补偿,在链上表示为 NFT(时间锁定),可以在 DAOhaus 和 Shapeshift 的示例中找到。

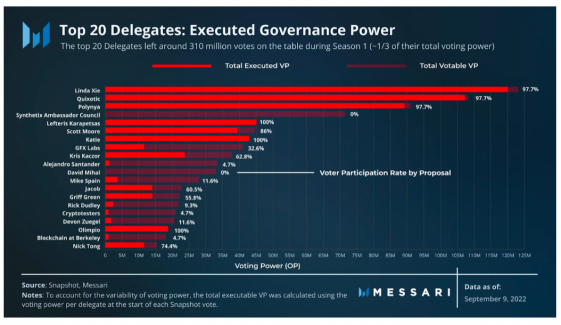

在社区中拥有敏锐的观察者也是一个很好的策略。Messari关于乐观治理的报告解释了治理基金和合作伙伴基金如何存在“双重支出”。一些项目获得了两者的资助,并建议确定这两个基金的范围。提出的其他一些要点是 1) 超过 60% 的总资金用于 LP 奖励和 2) 协议政治家的不同参与记录。

展望:

在 Vitalik 最近关于 DAO 的文章中,指出 DAO 应该“从政治学中学到更多,而不是从公司治理中学习”,因为我们在 DAO 中寻找的不是利润最大化,而是在于保持整个生态系统的稳定和弹性。

我们怎样才能在不牺牲主权的情况下保证生态系统或每个DAO的生存?财库管理是主要支柱之一,预计未来会有更多的实验和迭代。