Messari:dYdX三季度市场表现和生态进展报告

原文作者:John_TotalValue_Locke

原文来源:Messari

原文编译:DeFi 之道

图片来源:由无界版图 AI工具生成

要点

与第二季度相比,dYdX 的使用量中位数(median)有所提高,而总量下降主要是由于第三季度的波动事件减少。

尽管用户和交易量活动健康,但存款人继续从 dYdX 提取资金。到目前为止,这似乎并未影响流动性和交易。

第三季度的治理重点是优化奖励支出。投票通过提案包括关闭流动性质押模块,增加 LP 奖励公式中的交易量权重,将 BTC 和 ETH 市场的 LP 奖励从 40 减少到 20%,以及减少交易奖励。

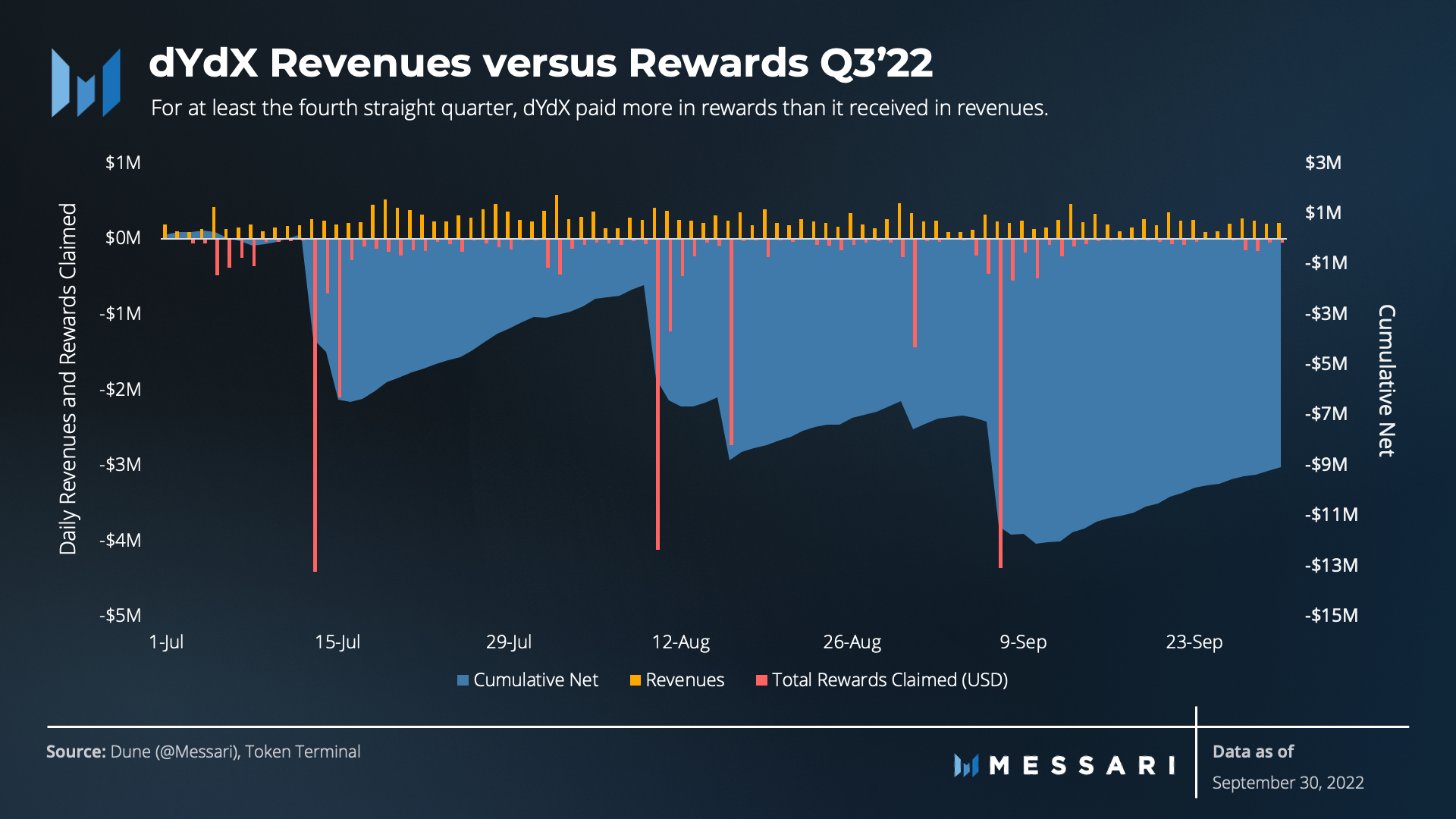

dYdX 链主网预计将于 2023 年第二季度启动。当比较收益和奖励时,该协议至少连续第四个季度完成净支出,使用该代币作为 L1 代币的新模型带来了重置协议代币经济学、价值增值和去中心化的机会。

关于 dYdX

dYdX 协议在第 2 层(L2)StarkEx 网络上运行一个衍生品交易所。该混合去中心化交易所提供类似于 Binance、FTX 和其他中心化交易所的永久期货合约。该协议的最终目标是建立一个完全去中心化的衍生品交易所,包括团队本身在内的任何一方都不能声称有权管理该协议的基本操作。

2017 年夏天,前 Coinbase 工程师 Antonio Juliano 创立了 dYdX。该协议的前两个产品 Expo 和 Solo 是为在以太坊上进行保证金交易而构建的。在看到 2019 年 Bitmex 上永续合约(perp)交易的爆炸式增长后,dYdX 决定成为第一个提供永续合约交易的 DeFi 协议。为 BTC 和 ETH 等主要代币推出的 perps 在寻求使用保证金的交易者中迅速普及。2021 年 dYdX 增加了 StarkEx L2 rollups,进一步提高了易用性。

2022 年第二季度,dYdX 宣布从 StarkEx 过渡到其原生区块链,称为 dYdX Chain,作为其完全去中心化努力的一部分。

介绍

第三季度缺乏第二季度的火爆场面,但合并是一个重要事件,不可避免地对季度数据产生了影响。按中位数计算,第三季度 dYdX 的日交易量和用户与第二季度一样活跃。ETH 的交易比例比高于前几个季度,因为交易者为以太坊合并做准备。尽管有健康的交易者活动,但 dYdX 继续从网络中看到大量提款。

本季度的治理工作侧重于优化 DYDX(协议的原生代币)的通货膨胀奖励。在另一个季度,该协议产生的收入超过了作为奖励支付的代币的美元价值。目前收入归 dYdX Trading 而非社区资金库,因此资金库中只有 DYDX 代币来资助各项活动。

现在预计 dYdX 链将于 2023 年第二季度推出,创建一个去中心化的订单簿,并改善代币持有者和协议之间的一致性。

表现分析

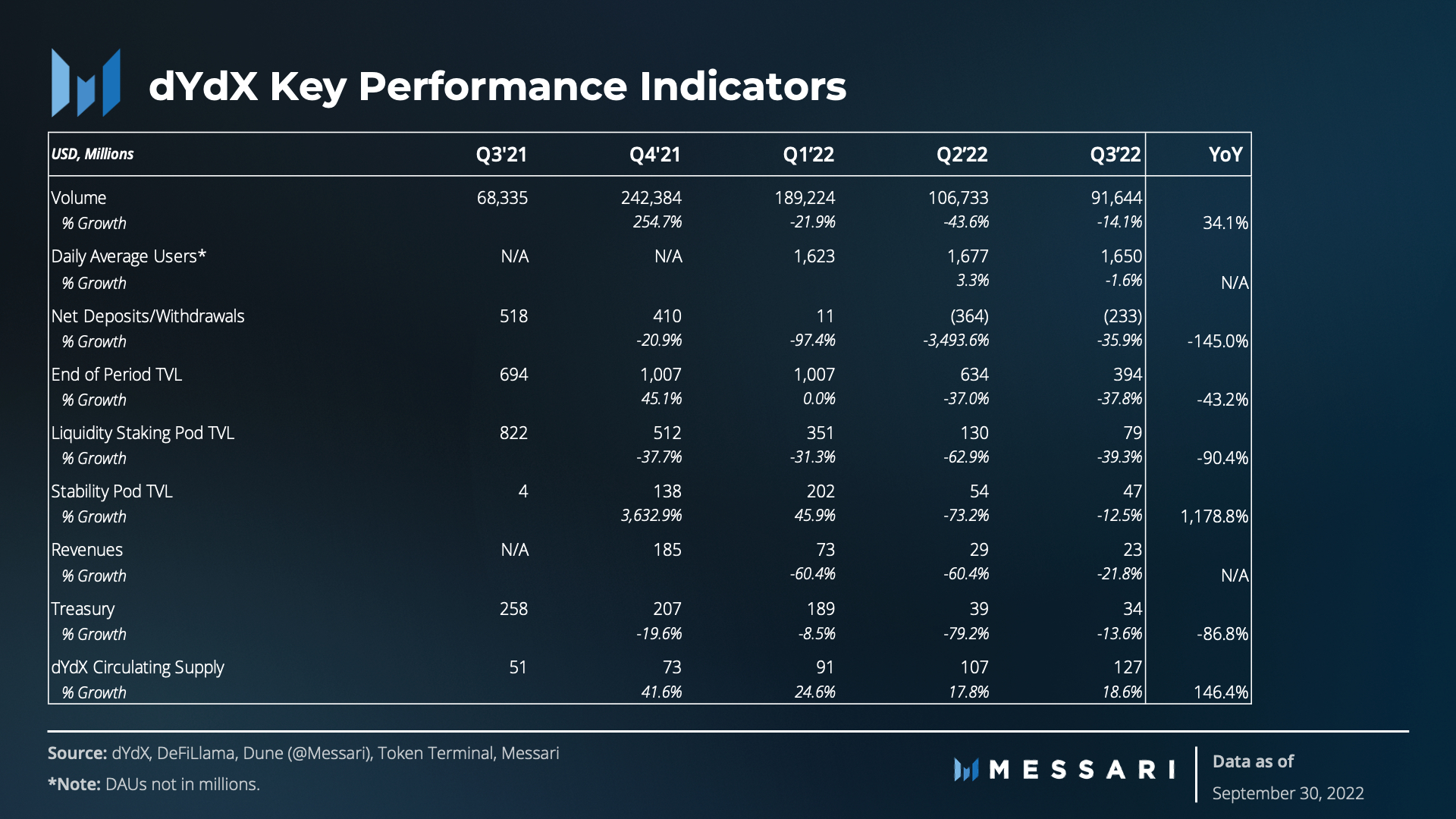

dYdX 交易收入下降了 22%,从第二季度的 2900 万美元降至第三季度的 2260 万美元。尽管代币价格下跌,但支付的奖励(在认领后以美元衡量)仍然超过收入。900 万美元的净成本是过去四个季度中最低的。

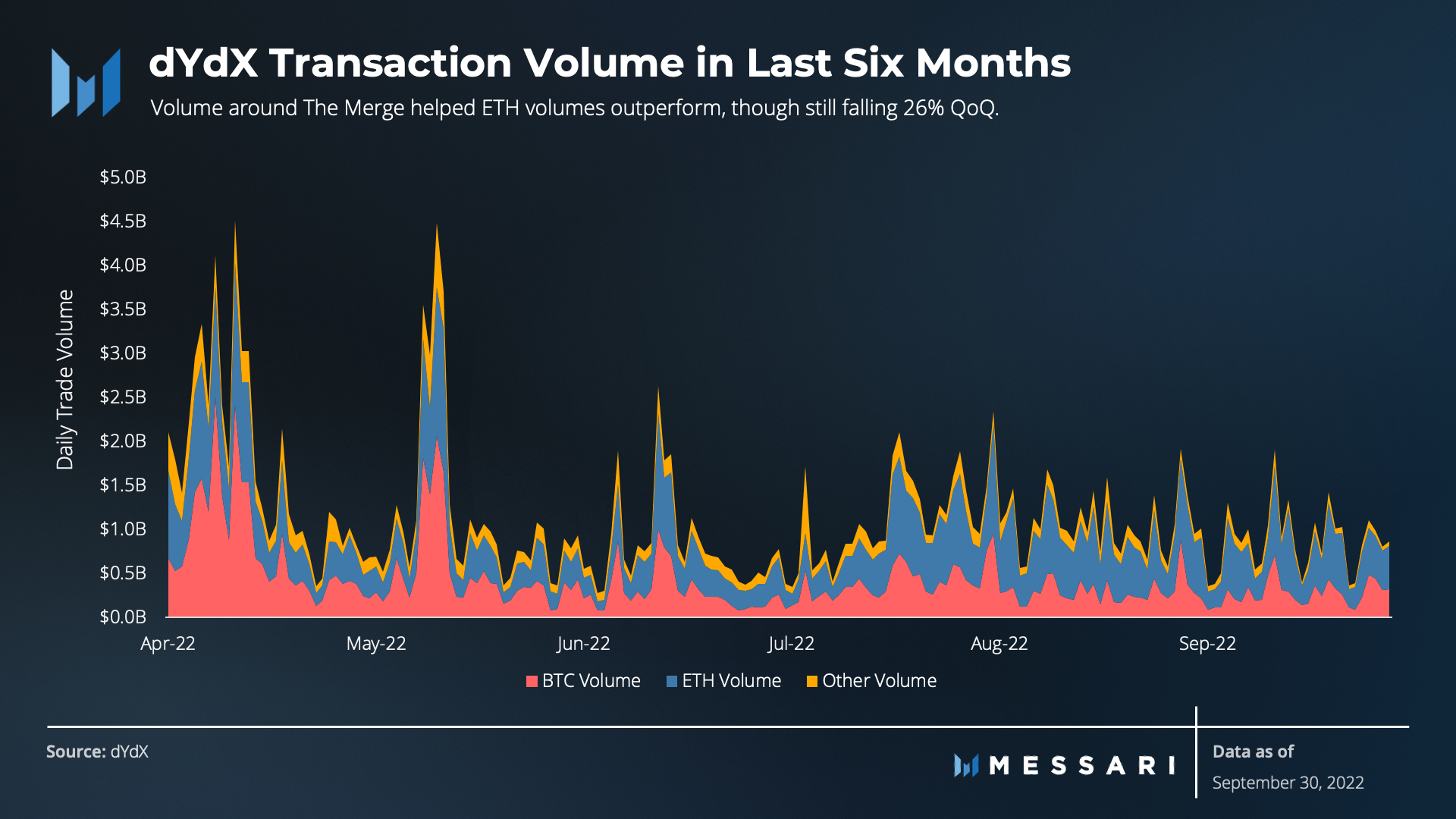

在第三季度,dYdX 交易量下降了14% 至 916 亿美元。第二季度的交易量因 4 月、5 月和 6 月的三个大型交易量事件而有所提升。以太坊在 9 月进行了合并,这推动了 ETH 交易量份额的提高。尽管总交易量减少,但第三季度 dYdX 的日交易量中位数(median)实际上比第二季度高出 1.15 亿美元。

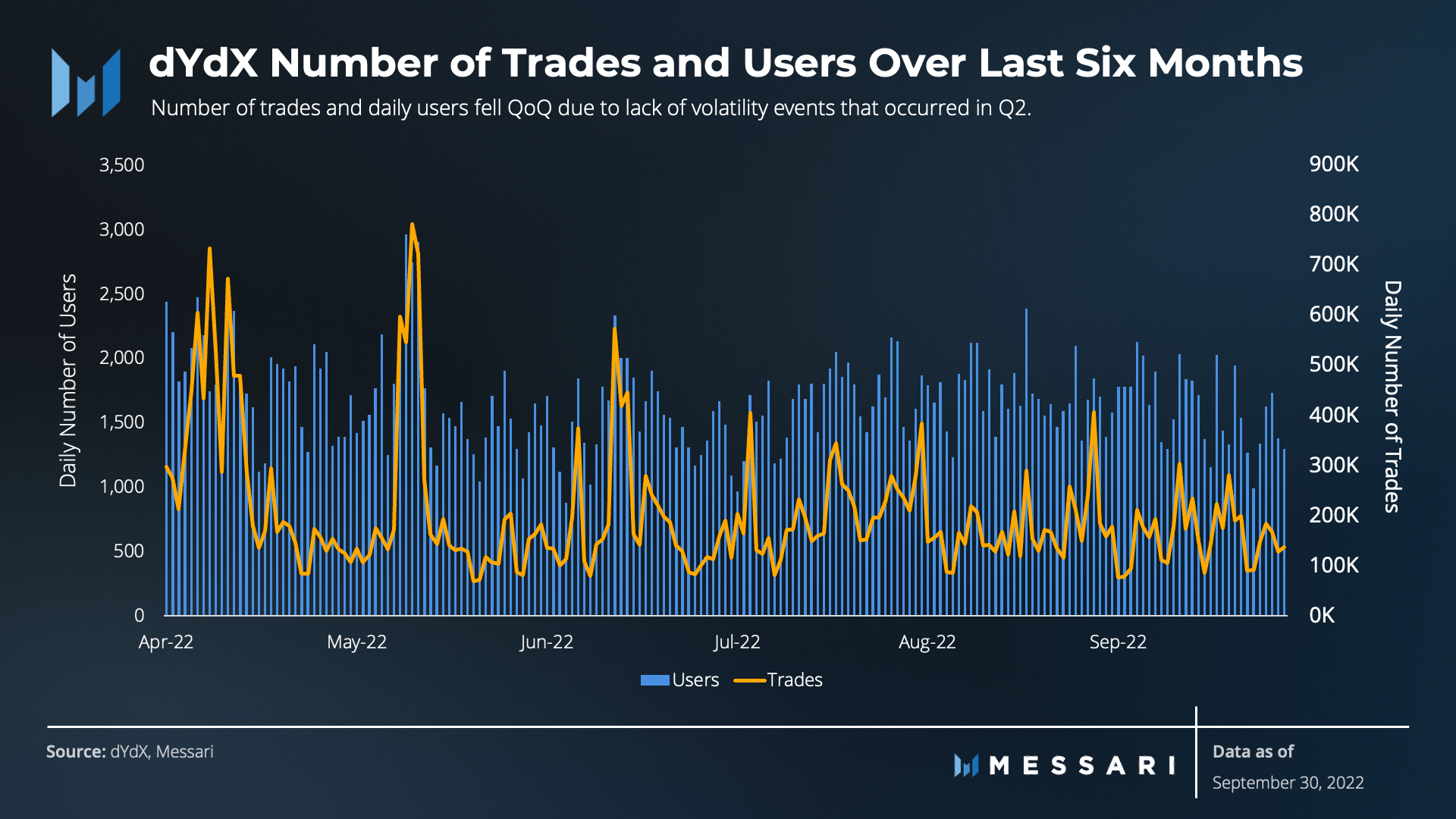

与交易量类似,第三季度的每日活跃用户(DAUs)和交易总数均有所下降。这可能是事件减少的结果。网络活动仍然保持健康,DAU 和每日交易数量的中位值从第二季度开始上升。第三季度,dYdX 成交量中位数为 16.7 万笔和 1667 DAU。

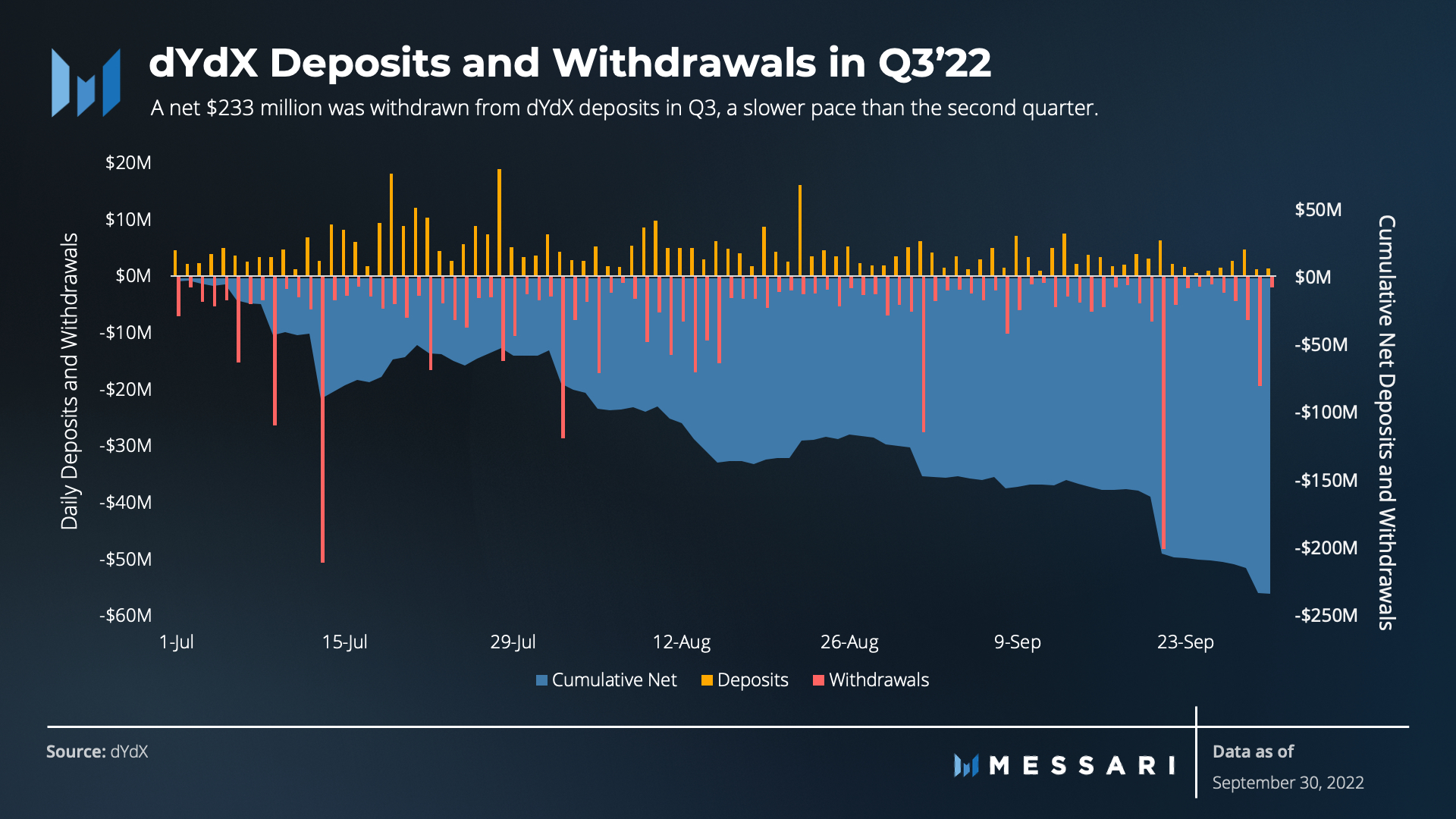

尽管以交易量和 DAU 衡量的使用状况良好,但 dYdX 在第三季度继续出现撤资。继第二季度流出 3.62 亿美元后,第三季度流出 2.33 亿美元。更大的提款事件发生的时间似乎与奖励减少的时间不一致,但可能集中在周期的末期。

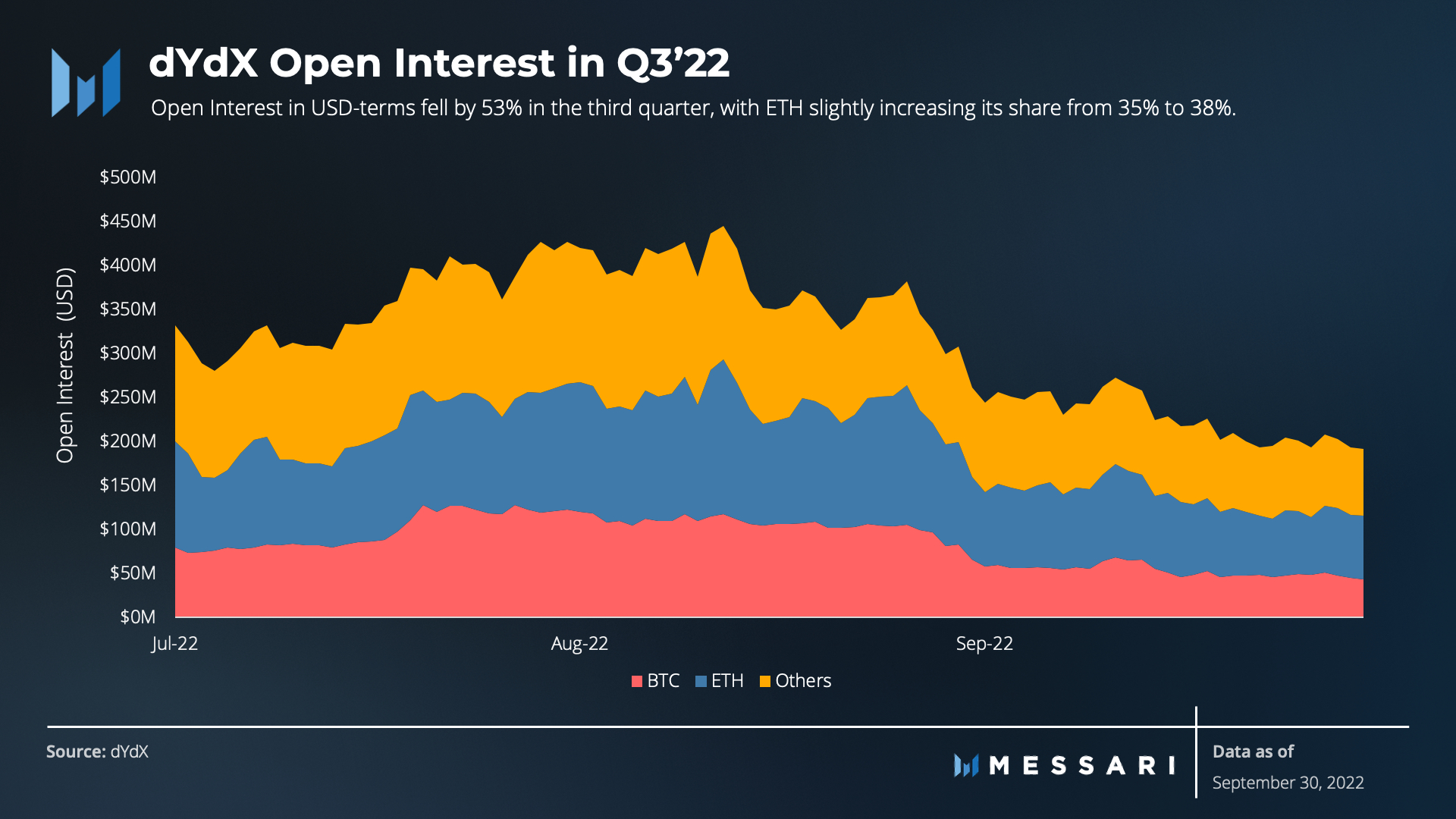

由于存款下降,dYdX 的未平仓合约(OI)在第三季度减少了一半。在合约方面,BTC OI 下跌 50%,ETH OI 下跌 38%,相对表现较好。其他代币的情况要差得多:SUSHI、SOL、LTC、EOS 和 AVAX 的 OI 均下跌 80% 以上,而 AAVE、DOGE、DOT、FIL、MATIC、MKR 和 UNI 下跌至少 70%。OI 的唯一增长是 ETC,在第三季度以代币计算增长了 59%。

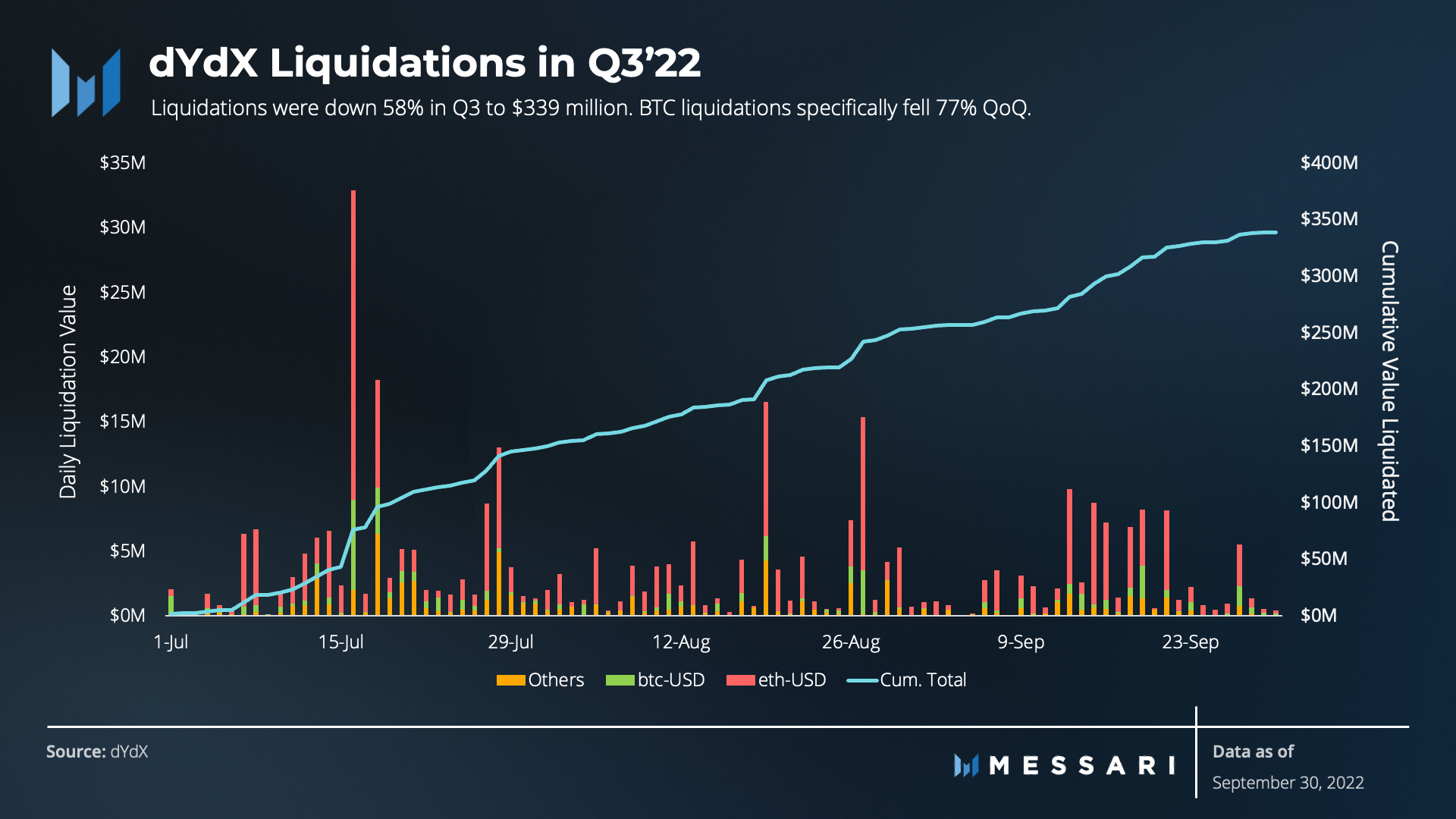

市场波动较小,意味着第三季度的清算量较少,清算量下降 58% 至 3.4 亿美元。以太坊的清算量从第二季度的 52% 增加到第三季度的 65%。比特币的波动性下降,导致清算量下降 77%,BTC 清算量只占第三季度总清算量的 14%。

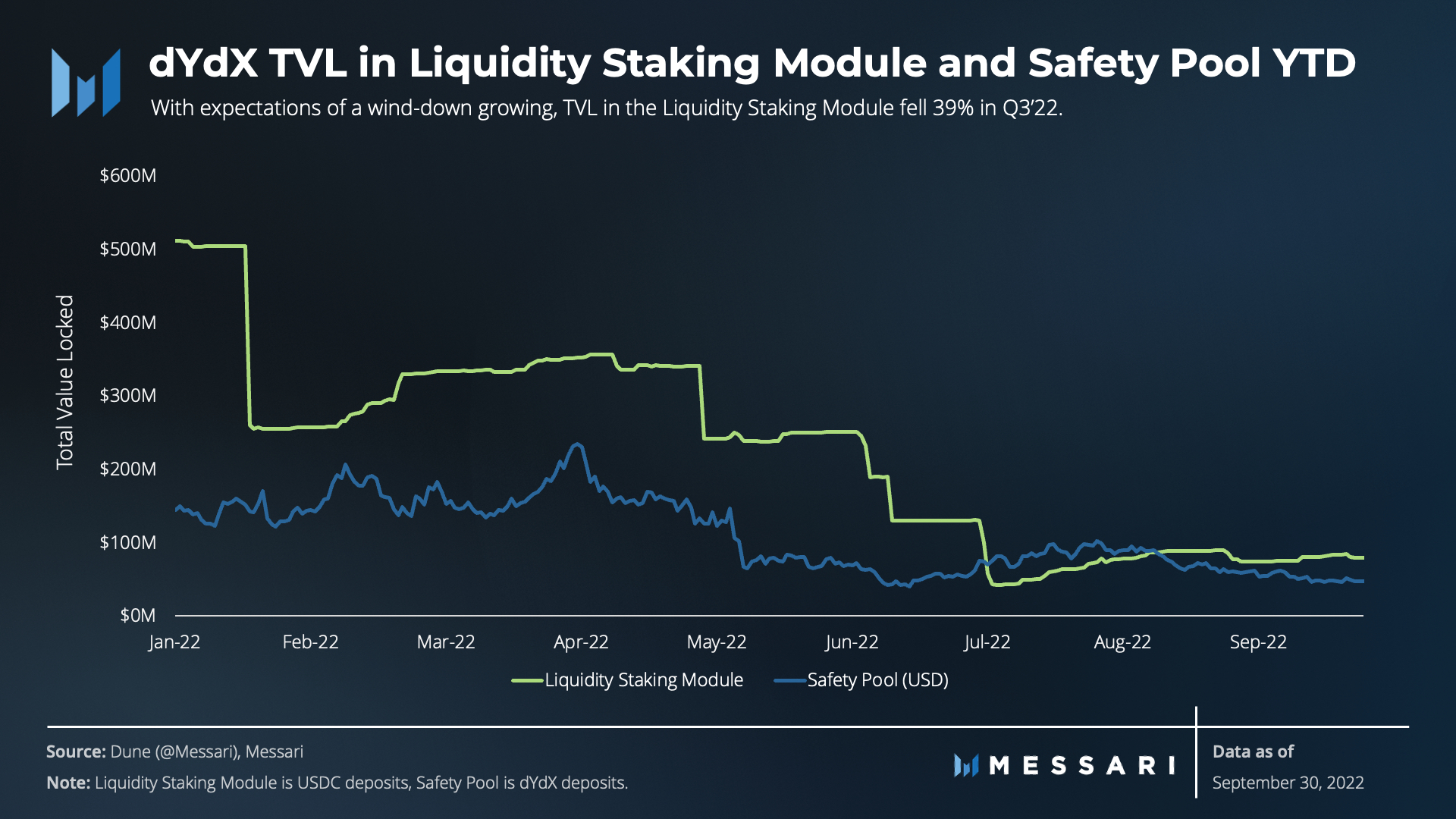

7 月2 日,一项快照提案发起投票以结束流动性质押模块。虽然论坛讨论从 6 月开始,在快照投票后的一周内,该模块中的 TVL 从 1.3 亿美元下降到 4200 万美元。9 月 27 日,链上投票通过。10 月 29 日,一项快照投票通过,支持关闭安全池并将分配的 DYDX 代币发送到资金库。这仍然需要链上投票来执行。

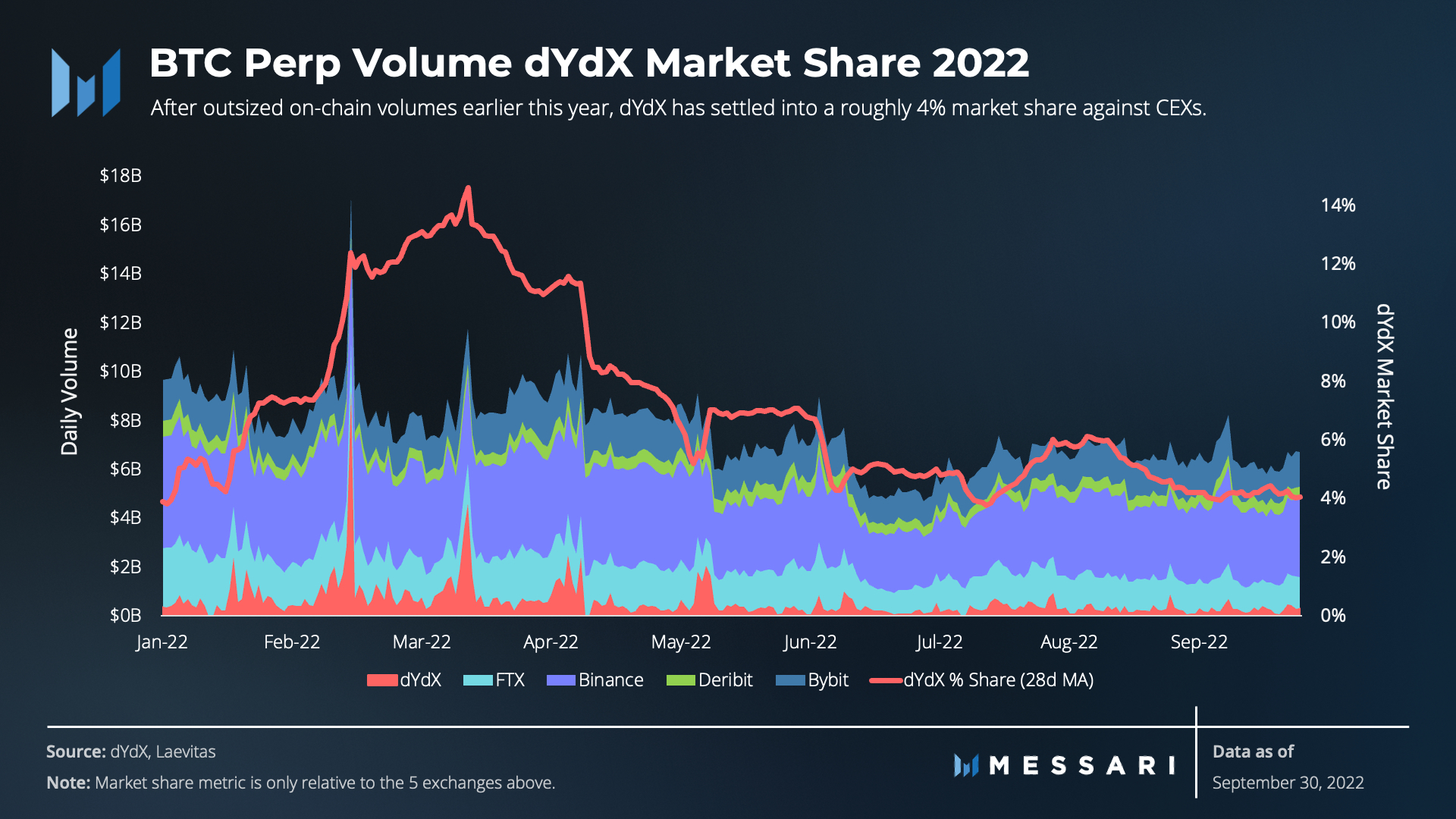

第一季度和第二季度的链上事件导致 dYdX 在 2022 年上半年的交易量份额增加。该协议的一个积极因素是在周期结束时看到交易量峰值正常化。这种典型的非生产性交易是通过奖励来激励的。修改奖励计划似乎已经取得了预期的效果。

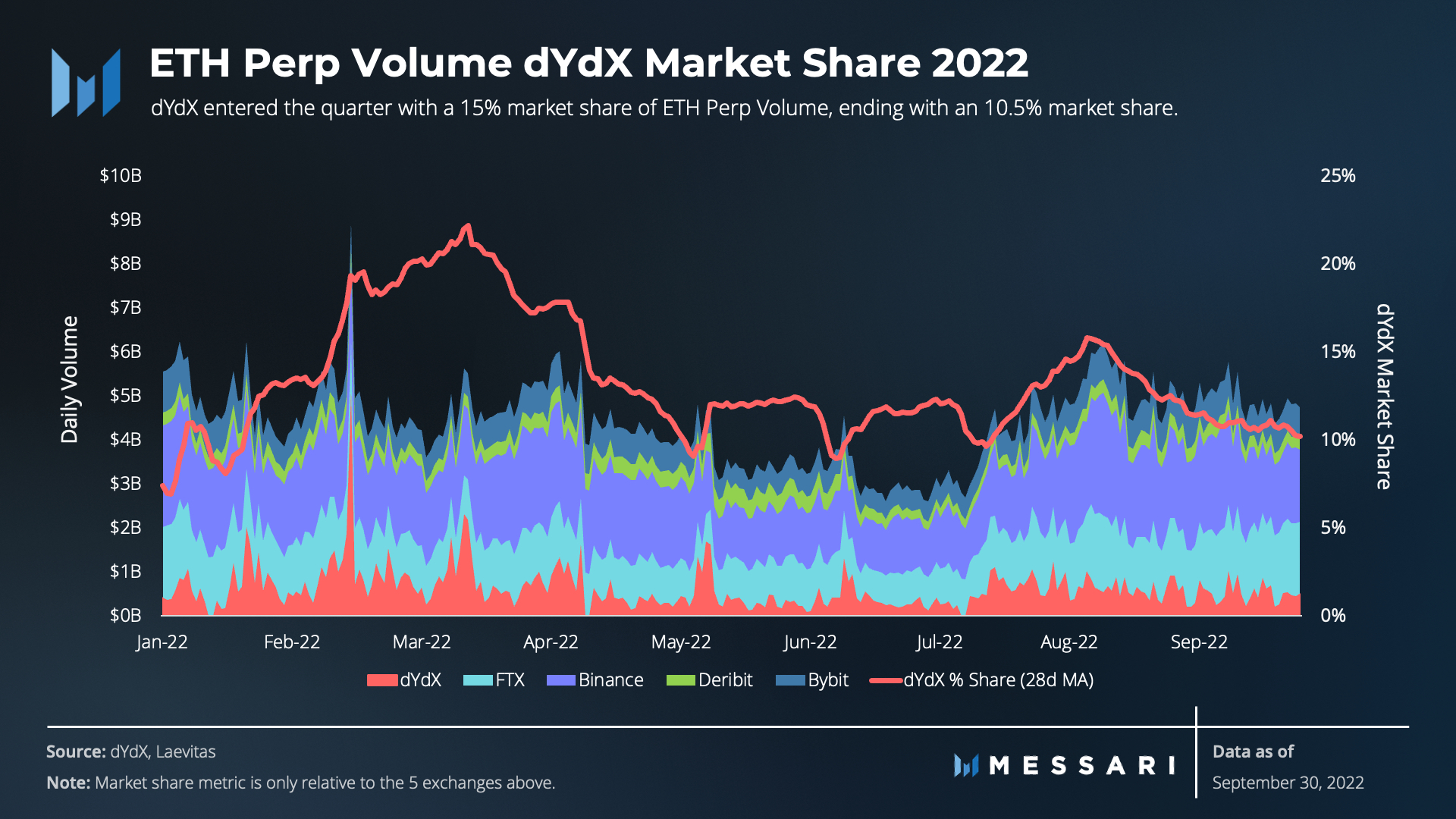

这五家交易所的 ETH perp 交易从第二季度的 3500 亿美元增长到第三季度的 4200 亿美元,增长了 17%。在合并之前,有一种流行的交易来对冲 ETH 多头头寸和 perps 空头头寸,以对冲技术风险或博弈 ETH POW 分叉。dYdX 在整个季度保持 10-15% 的份额,与最大的 CEX 相比显示出具有竞争力的融资利率。

定性分析

流动性质押模块

dYdX 提供了一个流动性质押模块(LSM),任何人都可以存入 USDC,由社区批准的做市商可以将其用作抵押品,在 dYdX 上提供流动资金。质押者获得了 DYDX 代币作为奖励。做市商可以获得只能在生态系统内使用的廉价(零利息)资本。9 月 27 日,dYdX 社区投票赞成关闭借款池,将与抵押 USDC 相关的 DYDX 奖励设置为 0。

尽管设计很吸引人,但它似乎并不能有效地为协议分配资源。在 dYdX Grants 的资助下,Xenophon 实验室发布了一个LSM 研究报告发现“81% 的奖励代币用于未借给任何做市商的 USDC。” 问题主要在于 USDC 的质押数量取决于 dYdX 的价格,而可用资金的可变性导致做市商的利用率非常低。

7 月 6 日,社区投票关闭与 LSM 相关的借款池,并重新利用剩余的 DYDX 代币奖励。

7 月 31 日,TrueFi 的 Ryan Rodenbaugh 发布了一条论坛上的提案利用 TrueFi 的“自动信用额度”(ALOC)产品来改造 LSM。理想情况下,TrueFi 的浮动利率 ALOC 将根据贷款池的利用率收取可变利息。这些利率主要基于 USDC,但也受到一些 dYdX 的激励,应该会降低可用资本的波动性,从而提高利用率。然而,一个重要的问题是,做市商愿意以什么利率借款?

交易奖励方程

dYdX 通过奖励使用 DYDX 代币的交易来激励其交易所的使用,以帮助补偿支付的费用。以前版本的交易奖励公式包括支付的费用、未平仓合约(OI)和 stkDYDX(质押的 DYDX)。

3 月的一份新研究表明,大量 OI 获得奖励的机会为 Farmers 创造了一个非常大的游戏空间,可以在不增加流动性或支付费用的情况下赚取 dYdX。4 月,该项目团队对奖励方程进行了初步改变,降低了给予 OI 的权重,社区投票决定取消任何归因于较大未平仓合约的奖励。该投票还将每个 epoch 的总交易奖励减少了 25%。

自从这些变化以来,OI 已经明显下降,但 OI 不一定影响流动性。事实上,OI 和交易所交易量似乎并不高度相关。

整体奖励的减少有助于提振资金库,为长期投资提供更多资金。

LP奖励方程

管理代币奖励是本季度的一个主要主题,流动性提供者的奖励也得到了解决。第一个变化出现在 2 月,它降低了 LP 的门槛,并向更多的供应商开放了奖励。然后在 5 月,在 Wintermute(dYdX最大的做市商之一)的要求下,社区投票决定在 LP 的奖励方程中增加一个数量因素。今年 8 月,社区将该计划向前推进了一步。8 月的投票增加了所有市场的交易量因素的权重。

重要的是,它增加了 BTC 和 ETH 市场的权重,因为担心过度降低深度因素会对流动性较差的市场产生负面影响。为了进一步平衡这种激励,社区将 BTC 和 ETH 市场的奖励份额从各 20% 降低到各 10%,现在允许更多的奖励进入其他市场。这是交易所中最深的两个市场,可能不需要花费太多来吸引流动性。

到目前为止,这些变化已经减少了吸引深度的支出,而总体上没有损害流动性。由于 DAO 专注于优化在熊市中花费的资源,因此调整他们提供给用户的奖励是他们正在使用的一个关键杠杆。

资金资助 V1.5

7 月 15 日,社区投票资助由 Reverie 执行的第二个赠款计划。最初的建议是增加 33%,从 600 万美元增加到 800 万美元,而构成资金库的代币价值已经下降了大约 85%。在论坛上进行了一些讨论后,未来 6 个月的赠款计划减少到 550 万美元。

更新后的赠款计划突出了 dYdX 的去中心化管理流程。dYdX 资助计划(DGP)的受托人做出资助决定并执行,同时他们将管理和策划外包给 Reverie。社区同意为中央计划者 Reverie 提供资金,后者负责资助工具、研究和贡献者。

最终的资助决定由 DGP 的受托人做出。尽管获得 65.5% 的选票,但大使计划(Ambassador program)没有达到 67% 的投票差额要求,因此没有约束力。该计划为社区成员提供了加入 Burrows 并以兼职身份为 DAO 工作的机会。据悉,大使计划是通过 Reverie 申请赠款资金的去中心化替代方案,它产生了许多积极的贡献。

dYdX 链更新

8 月 23 日,dYdX Trading 发表了一篇博客,更新了 V4 的进展。主要的公告是 Milestone 1,即启动一个开发者测试网,已经完成。此外,本次更新给出了主网启动的时间表,预计将于 2023 年第二季度发布。其他计划包括:

Milestone 2:内部测试网——2022 年第三季度

Milestone 3:私人测试网——2022 年第四季度

Milestone 4:公共测试网——2023 年第一季度

开发者测试网的启动包括完成订单簿、匹配引擎和保证金系统。作为第一步,该团队实现了每秒 50 次的交易。还有许多优化和改进工作要进行,但这是该协议一个重大变化的积极进展。

结论

交易者继续在最大的链上永续合约交易所进行交易,尽管不断有人从协议中提款。从第二季度到第三季度,日交易量和用户的中位数都在增加,支付给交易者和质押者的奖励再次高于协议的收入。而社区利用治理和投票来改变所有的关键奖励项目,关闭流动性抵押模块并减少交易奖励。此外,dYdX Chain 的推出目前定于2023年第二季度,它提供了进一步去中心化协议和更好地使代币持有者与用户保持一致的机会。