NFT简史:跨越六十年的NFT群星闪耀时刻

原文作者:0x11

莱布尼茨说,世界上没有两片完全相同的树叶。这句话换成今天时髦的技术载体来表达就是:我们每个人,都是一个 NFT。

NFT,相信今天加密世界的每一个人都不陌生。在过去两年,它像一阵飓风,刮遍加密世界的各个角落,甚至穿透那道窄门,抵达了辽阔的物理世界。一个代码随机生成的像素头像以 2370 万美元成交;加密艺术家 Beeple 的作品《Everydays:The First 5000 Days》在佳士得拍得 6930 万美元。

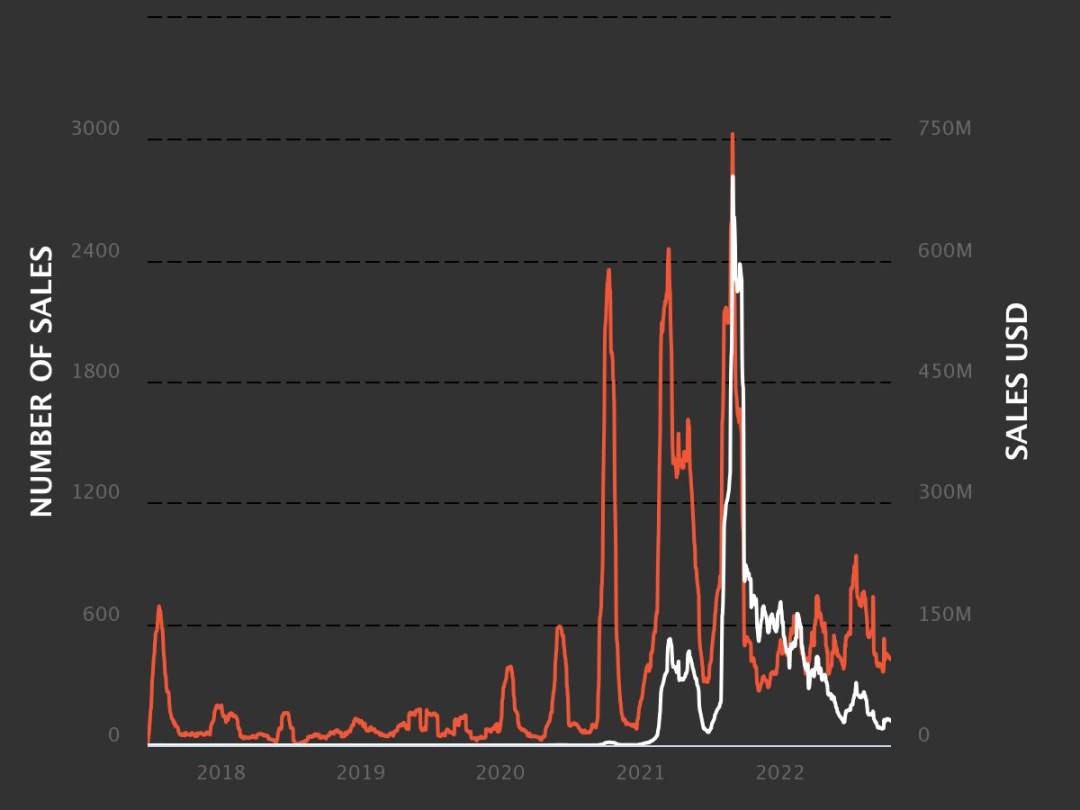

或许你难以理解,这些毫无作用甚至没有美感的图片为什么这么值钱?在近期加密寒潮的冲击下,曾经如日中天的 NFT 突然跌落神坛,日成交额从巅峰时期的 36 亿美元跌至近期的 2 亿美元。于是有人唏嘘:NFT 神话破灭了。

NFT 历史成交额走势,数据来源:NFTGo

如果就此将 NFT 与历史上臭名昭著的郁金香泡沫混为一谈,未免有鼠目寸光之嫌。黑格尔曾言,「存在即合理」。关于 NFT 价值和前景的讨论分析已经屡见不鲜,而答案也是见仁见智。这里,我们想回到源头,用几个人物和故事串联起 NFT 的发展轨迹,以此来解答你心中的一些疑惑。

NFT 的发展是具有明显的阶段性特征。第一个阶段在比特币诞生之前,NFT 思潮和概念在此萌芽;到了比特币时代,NFT 有了实验的土壤,开始了早期探索;最后的以太坊时代,NFT 迎来了生态的全面爆发。下面就让时间回拨到 60 年前,开始讲述我们的故事。

萌芽时代

安迪·沃霍尔:精神旗帜

一切从一幅画开始。

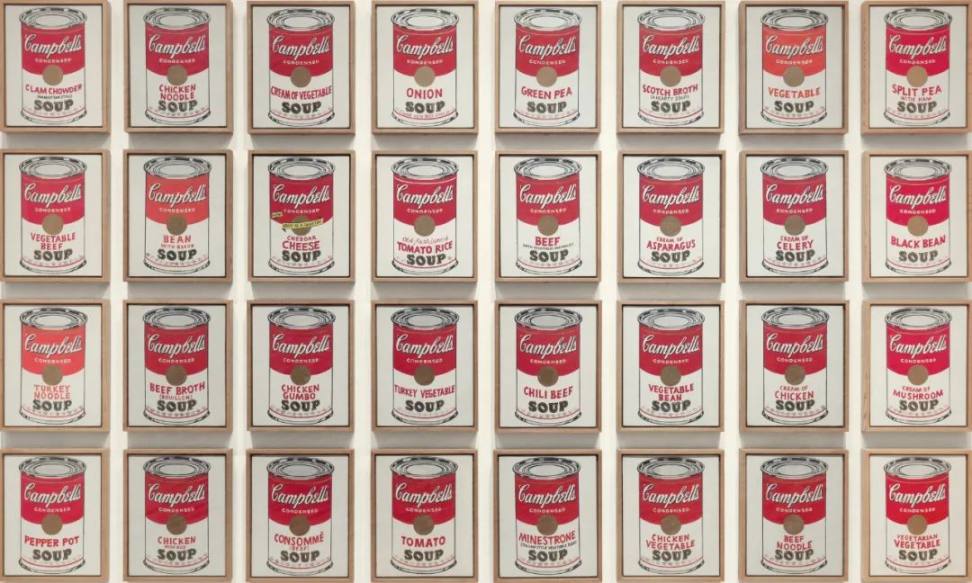

《金宝汤罐头》,安迪·沃霍尔于 1962 年创作

这是一组整齐排列的 32 个罐头,就像超市货架上的陈列,每一个看起来近乎一样,区别在于每个罐头标注的口味不同。这幅看起来略显「单调无聊」的《金宝汤罐头》却在 20 世纪后半叶掀起了一场艺术风暴,它的作者安迪沃霍尔被誉为波普艺术教皇,并凭借一系列近似风格的作品跻身世界顶级艺术殿堂,成为比肩毕加索、梵高的传奇艺术家。

而这幅画的最初的创意来自一个朋友无意中话:你把每天中午吃的罐头画出来,会怎样?安迪·沃霍尔被一语点醒,在画完上面的《金宝汤罐头》后,又开始了一系列类似风格的创作,只不过主题变成了玛丽莲梦露、政治领袖、以及他自己。

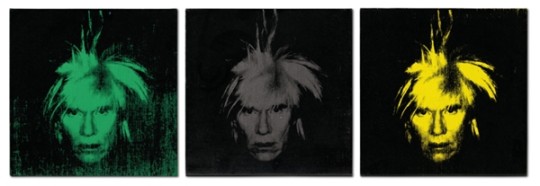

安迪沃霍尔自画像,他没想到的在其去世三十多年后,这三幅头像被制作成 NFT,并最终以 280 万美元成交

如果仔细观察安迪·沃霍尔的作品,很容易发现它们都有一个共同的逻辑:简单重复的主体叠加随机变量。英国《卫报》曾评论道:「沃霍尔在展现重复的力量上是专家,通过重复,他增添了一些东西,没有让我们感到乏味,也没有消解事物本身。」他的创作和生活都在实践这种重复,「我喜欢不断重复的事,我二十年都吃相同的早餐 」。

这种毫无顾忌地大胆重复,在人类艺术史上绝无仅有。有人质疑他的作品不是艺术品,而是工业品印刷品。这种不断重复的「印刷品」为何能成为人类艺术的瑰宝?

艺术之所为艺术,它的价值从来不是源于视觉上的美感,而是背后蕴藏的人文精神。用安迪·沃霍尔的话来回答:

美国最伟大的地方在于开创了一项传统:最富裕的消费者与最贫穷的消费者基本上购买相同的东西。

你可以在电视上看见可口可乐,你知道总统喝可口可乐,伊丽莎白·泰勒喝可口可乐,然后你想想,你也可以喝可口可乐。可口可乐就是可口可乐,没有钱能让你买到比街角流浪汉所喝的更好喝的可乐。所有的可口可乐都一样,而所有的可口可乐都很好喝。伊丽莎白·泰勒知道,总统知道,流浪汉也知道,而你也知道。

这就是安迪·沃霍尔作品所揭示的工业时代的人们普遍的精神状态。任何一个普通人都能掏出腰包享受和国家总统、女王一样的可乐和汉堡,在某种程度上,你与那些声名显赫和腰缠万贯的人没什么不同。那么,什么是不一样的?

正如那整齐排列的 32 个罐头,它们的区别是口味;而工业时代大众之间的微小变量,这就是每个人成为他自己的根本。于是,安迪·沃霍说出了那句经典语录:「在未来,每个人都会出名 15 分钟。」因为每个人都与众不同,那些大量重复的特性才凸显了那微小的不同之处。

到这里,你是否发现安迪沃霍尔重复主体加随机变量的风格,与 FT(同质化代币)到 NFT(非同质化代币)的思想根源如出一辙,既然一枚比特币等于一枚比特币,那么如果我想让自己手中的比特币与众不同,要怎么办?

不过在安迪沃霍尔的时代,没有比特币,没有 NFT 甚至互联网也才刚刚萌芽。

安迪沃霍尔的故事并没有随着他本人在 1987 年去世而结束,波普艺术在之后经历了发展,成为主要艺术流派之一。而后来的波普艺术家班克西、村上隆与草间弥生,也宿命般地在 NFT 浪潮中留下了足迹。

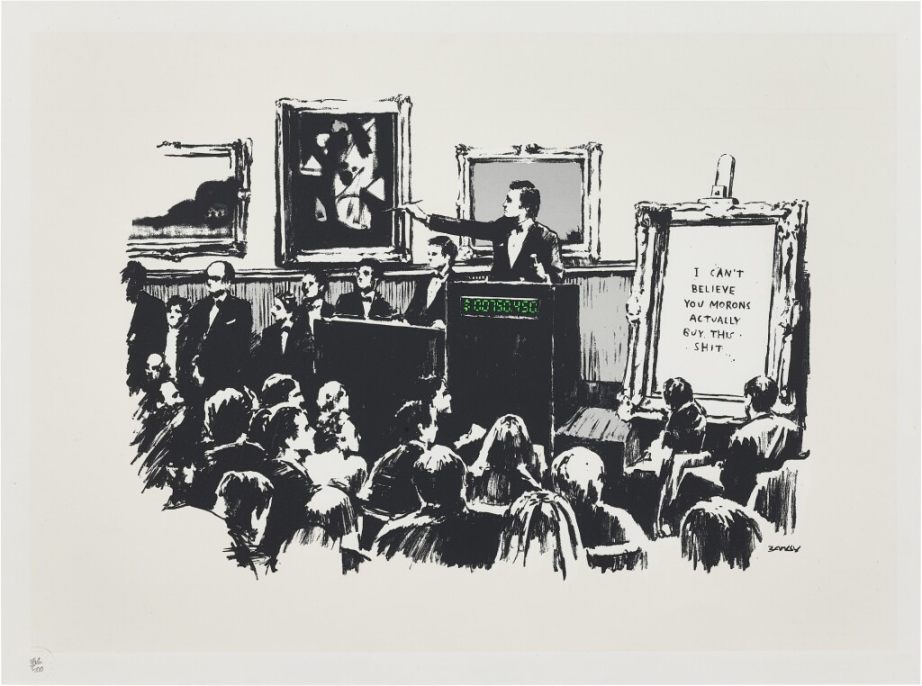

知名街头艺术家班克西的《傻子》,该作品创作于 2006 年,意在讽刺肤浅、过度膨胀的艺术市场。画作描绘了一个拥挤的拍卖大厅,拍卖师旁边是一件镶有华丽边框的作品,上面写着:「我不敢相信你们这些傻子真的买了这个。」

2021 年 3 月,街头艺术家班克西的作品《傻子》被一群艺术爱好者烧毁,随后其电子版本被制成 NFT ,以 38 万美元(原作品价格的 4 倍)卖出。这群疯狂的爱好者甚至在社交媒体上对烧画全程进行了直播,他们还表示,烧画 「本身就是一种艺术表达」。

这都是后话,安迪沃霍尔去世后的第六年,在与艺术毫无关联的密码学领域,一场思维实验带着 NFT 概念的雏形缓缓来到历史舞台。

Hal Finney:NFT 概念先驱

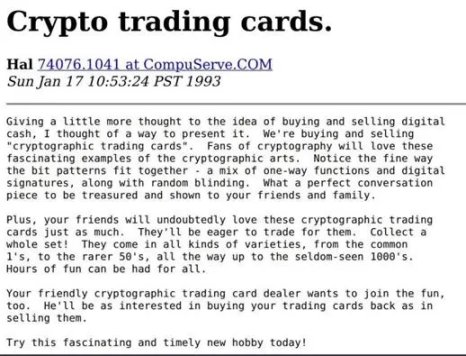

1993 年,一位名叫 Hal Finney 的密码学家在给密码朋克成员的一封电子邮件中,提到了加密货币交易卡的概念。

Finney 在邮件中这样介绍:

我对购买和销售数字现金的想法多了一些思考,我想到了一个展示它的方法。我们在买卖「加密交易卡」。密码学的爱好者会喜欢这些迷人的密码艺术的例子。请注意它完美的组合呈现形式是——单向函数和数字签名的混合,以及随机盲法。这是一件多么值得珍藏和展示给你的朋友和家人的完美作品。

他还描述了加密货币交易卡的稀缺性,「它们有各种各样的属性,从常见的 1 到稀有的 50,一直到极度稀有的 1000。」

这段话基本上勾勒了今天 NFT 的雏形——数字藏品。可惜的是由于技术的局限,这一设想并未在当时实现。

命运在关上一扇门时,又打开了一扇窗。Finney 在密码学领域持续的努力最终没有付诸东流。2009 年 1 月 3 日,一个全新的世界打开了,因为这一天,比特币诞生了。

Hal Finney 成为比特币最早的开源贡献者之一,同时他也是世界上第一个接受到比特币转账的人。甚至,他被认为是化名「中本聪」的比特币发明人真身之一,但是这个说法被他本人否认了。

而关于十六年前那封邮件中提到的设想,不知是被他本人遗忘了,还是碍于身体状况恶化没有实现。2009 年 10 月,Hal Finney 宣称自己患上了罹患肌萎缩性脊髓侧索硬化症,最终在 2014 年 8 月,他与这个刚刚铺展开的新世界永久告别了。

在比特币的世界,新旧事物在这里碰撞、萌芽、生长。Finney 当年未完成的设想后来也在比特币上实现了。

比特币时代

2012 年 3 月,一个名为 Yoni Assia 的人在自己的网站里写下了《bitcoin 2.X (aka Colored Bitcoin) – initial specs》的文章,介绍了他关于 Colored Bitcoin(彩色币)的想法。

在这篇文章里,彩色币设想在比特币网络上创建新的代币,这个新奇的想法立刻吸引了比特币社区一群人的兴趣,他们参与到这个想法的讨论与完善中。随着越来越多的人加入,彩色币的功能被不断扩充,由一个简单的想法变成了一份完整的白皮书。后来缔造以太坊帝国的天才少年 Vitalik Buterin 就是其中之一。

被完善后的彩色币核心思想是:

「如果能对比特币做标记,且这些被标记的比特币能被追踪到,那么这些特殊的比特币就能产生许多其他的用法。」

在技术逻辑上,彩色币就是小面额的比特币,只不过它们被标记了额外的数据,以此来代表多种资产并具有多样用途,包括财产、优惠券、发行公司股份等。

但是彩色币的局限也相当明显,那就是给原本差强人意的比特币网络带来灾难性的性能压力。在社区持久的争论中,彩色币迟迟没有盼来落地应用的时刻。

直到 2014 年初,名为 Robert Dermody,Adam Krellenstein 和 Evan Wagner 的三位青年创立了一个叫作 Counterparty 的项目。它将彩色币的思想快速落地,通过在比特币交易脚本中写入数据,来完成一般比特币软件无法实现的功能。Counterparty 支持资产创建,拥有去中心化交易所、XCP 合约币及许多项目和资产,包括卡牌游戏和 Meme 交易。而真正推动 NFT 出现的便是在 Counterparty 上创建的「Rare Pepes」——将热门 meme 悲伤蛙做成了 NFT 应用。

到这里为止,那些在加密货币历史河流中闪现过的名字,无论是加密货币交易卡,彩色币还是 Counterparty,在数年后蜂拥而入加密用户的印象中已经成了古老的纪念碑,甚至从未听过。他们第一次接触到 NFT 可能要等到 2017 年的 CryptoPunks,或者之后名噪一时的加密猫。

以太坊时代

「如无必要,勿增实体。」比特币是奥卡姆剃刀原理成功应用的典范,作为一个点对点电子现金系统,它的成就毋庸置疑;但要带领整个网络世界迈入加密世界,它却力有不逮,成为「世界计算机」的任务还要交给它的追随者以太坊来实现。

2013 年,曾经彩色币白皮书众多作者之一的 Vitalik Buterin,在以色列旅游途中,遇到了两家正尝试开发基于比特币智能合约的公司。Vitalik 被这个想法吸引了,他向当时正在研究比特币扩展性的 Mastercoin 社区提出了一个设想:为比特币开发一个智能合约平台,让用户可以方便快捷的编写脚本。遗憾的是 Vitalik 的提议没有被接受,失望之余,他转头研究一个全新的智能合约平台,于是在当年 11 月,以太坊白皮书诞生了。到 2015 年 7 月,以太坊主网上线,一个新时代就此拉开序幕。

以太坊之所以成为去中心化应用的乐土,得益于 Fabian Vogelsteller 在 2015 年 11 月提出 ERC-20 标准。ERC-20 提供了一系列标准接口,允许开发人员构建可与其他产品和服务互操作的代币应用程序,孕育了第一次加密应用大繁荣,后来的 2017 年粗暴的 ICO 牛市与此不无关系。以太坊官网文档中这样介绍这个标准:

ERC-20 引入了同质化代币的标准,换句话说,它们具有使每个代币与另一个代币完全相同(在类型和值上)的属性。例如,ETH 就是 一个 ERC-20 代币, 1 ETH 永远等于另一个 1 ETH。

这一段描述中的核心:一个代币等于另一个代币,很容易让人朝着相反的方向去思考:一个代币如果不等于另一个代币,可以用来干什么?最先回答这个问题的是以太坊上的 NFT 先驱:CryptoPunks。

CryptoPunks:历史的交汇

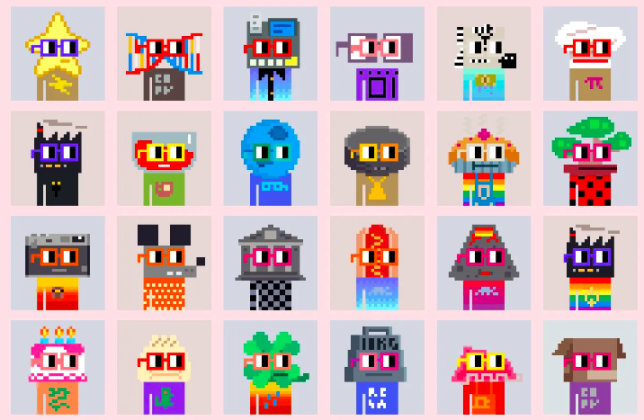

这是一个风云际会的时代,这也是科学与艺术的一个交汇点。五十多年前《金宝汤罐头》的剧本在以太坊上重新上演。

这一组排列整齐的头像,是不是和五十多年前《金宝汤罐头》散发着类似的韵味:重复主体叠加随机变量,只不过是变量更为丰富:肤色、发型、帽子、眼镜……

即便你是初窥 NFT 门径的新人,想必对上面这幅图中一个个表情冷峻的头像也已经屡见不鲜。这一万个各不相同的头像中的 5822 号,在今年 2 月 12 日以 2370 万美元价格成交。

没错,就是上面这个头像,CryptoPunks#5822。什么,你问它凭什么这么值钱?

如果你有幸拥有一枚 CryptoPunks,并将它设置为社交媒体账号的头像,一定会吸引众多人的艳羡和围观。因为这样的头像只有一万个,拥有它,你就拥有了和 Shopify 创始人 Tobi Lutk、达拉斯小牛队的老板 Mark Cuban 这些重量级大佬同样的资本。这还不够吗?

CryptoPunks 作为最昂贵的 NFT 之一,它的价值来源是丰富而多元的,其中重要的一方面就是它历史地位,要理解 CryptoPunks 的开拓性价值及对后来 NFT 的影响,需要先读读下面这段故事。

2005 年,名为 Matt Hall 和 John Watkinson 两个加拿大人在美国组建了 Larva labs,翻译成中文就是幼虫实验室。就是他们,后来缔造了以太坊上的 NFT 教父:CryptoPunks。

早在 1994 年,Matt 和 John 就相识了,他们同在多伦多大学学习计算机科学。毕业后,Matt 成为一名软件工程师,先后在 Modus 和哥伦比亚大学医学中心工作。而 John 在多伦多大学读完计算机科学专业研究生,之后又在哥伦比亚大学攻读电气工程和遗传学博士。编程和数学方面的背景,为 Matt 和 John 走向独立的创业之路打下了基础。

左边是 Matt Hall,右边是 John Watkinson

Larva labs 不是为 NFT 而生的,在很长一段时间内,这是一家专为 iPhone 和 Android 开发移动应用的小型软件公司,公司一直只有 Matt Hall 和 John Watkinson 两个人。

在他们开发的众多应用程序中,有一款可以帮你随机生成安卓机器人头像的 App。

到 2017 年初,常年琢磨数字头像的他们又琢磨出了一个头像生成器。但是,该用这个生成器干点啥呢?

伟大的的艺术品通常源于灵感迸发的瞬间。正在这时,痴迷于收集洋娃娃的 John 小侄女给了他们灵感:既然收藏是全人类的天性,为什么不做一个数字收藏品呢?但是,一个新的问题又出现了,如何保证数字收藏品的稀缺性?

两个人随即去寻找答案,却意外发现了一个新大陆。前文我们提到了比特币上的 NFT 解决方案,Matt 和 John 不满足于在 Counterparty 上体现的局限性。他们把目光投向了年轻却充满活力的以太坊。

彼时还没有 ERC-721 标准,在以太坊上发行 NFT 远没有今天这么简单。Matt 和 John 只能借助 ERC-20,在它的基础上增加一些功能,于是以太坊最早的 NFT 就这样诞生了。

出于对加密朋克精神的致敬,Matt 和 John 决定将这些极富个性的头像免费发放出去,当然他们为自己保留了 1000 个。最早开放申领的时候门可罗雀,直到一位叫作 Jason Abbruzzese 的科技记者注意到这个有趣的新实验,并写了一篇文章报道,《这个基于以太坊的项目,或许会改变我们对数字艺术认知的》。随后,CryptoPunks 名声大噪,剩下的 NFT 很快被领完。虽然,受到收藏爱好者追捧,但距离 CryptoPunks 登上历史巅峰的还有一段不短的时间。

在 2018 年的初一次 NFT 会面上,Matt 和 John 两位技术宅遇到了一位叫作安妮的摄影师,后者建议他们:要想让 CryptoPunks 获得更广泛的影响力,他们应该与画廊和拍卖行合作。Matt 和 John 深以为然,结果在首次拍卖活动中 24 个 NFT 被一扫而空。传统收藏家对数字艺术藏品这个新物种表现出的兴趣出人意料。

随后,那场令很多加密 OG 刻骨铭心的寒冬到来了,CryptoPunks 也不能幸免地跌落,等待着王者归来的时刻。

加密猫:引爆加密收藏品的火药桶

CryptoPunks 虽然吸引了不少关注,但与几个月后风靡加密世界的 CryptoKitties 相比,却是相形见绌。以太坊上最早的 Gas 战争就是由它掀起。

2012 年,从斯坦福毕业三年后的 Roham Gharegozlou 创立了一家工作室 Axiom Zen,专注于区块链和人工智能等新技术。在 2014 年的拉斯维加斯 Money 20/20 黑客松上,Roham 带领的 Axiom Zen 获得大奖,团队提交的 3 个参赛作品中,有 2 个是比特币 App。

2016 年,他成功说服 Axiom Zen 的首席软件架构师 Dete,基于以太坊开发一个切实、有趣甚至有点笨拙的东西,来为开发人员消除平台风险。 同一时间,Roham 的高中同学 Mik Naayem 刚刚把自己的手游平台初创企业卖给 Animoca Brands。在 Roham 坚持不懈的「洗脑」和邀请之后,Mik 很快加入了新的事业。这时团队还在构思如何探索去中心化世界。

稳定币、隐私区块链……在短暂构思这些念头后,他们果断放弃,因为这些技术很难渗透到的普通人的生活中。

「有一天在结束了又一场一无所获的头脑风暴后,一位叫作 Mack Flavelle 的同事说,我们需要把猫放到区块链上。」

就这样,拉丁美洲的一只蝴蝶扇动了翅膀,一场席卷加密世界的风暴进入倒计时。

2017 年的 ETH Waterloo 黑客松和所有黑客松一样,是一次技术宅的盛宴。 8 个新项目脱颖而出,这其中就包含 Axiom Zen 的加密猫。

他们选择要把猫,而不是狗或者其他动物放在区块链的原因如此清晰简单:互联网爱猫。对于很多爱猫又富有探索精神的互联网居民,这个理由足够他们冲进新奇的加密世界。

到 2017 年底,以太坊网络上出现了长期的拥堵现象,用户为争夺优先交易权,不惜提交高额的手续费,后来这一现象有了一个臭名昭著的名字:Gas 战争。虽然 Gas 战争对于几年后的以太坊用户早已习以为常,但是在当时以太坊网络持续拥堵还是首次。

从下面数据可以一窥当时的盛况:未确认交易从 2000 不到飙升至超过 11000,加密猫合约地址约占以太坊总交易数量的 12%。

编号 40 的加密猫以 225ETH 成交,是加密猫历史上的最高价

加密猫是一款数字收藏游戏,不再是和 CryptoPunks 一样单纯的收藏品。作为游戏,加密猫提供了新的玩法,比如两只猫可以混合基因,生出小猫。不过,正因为是一款游戏,加密猫拥有了和众多热门小游戏同样的命运,像昙花一现的烟火,很快就淡出了历史舞台。

但加密猫也不仅仅只是一款 NFT 游戏,或者也不仅仅是一款 NFT 收藏品游戏,它还有另一个影响深远的身份:第一个 ERC-721 NFT 项目。没错,后来 NFT 世界最广泛的代币标准就是出自 Axiom Zen,「NFT」这个术语也诞生于此。其实在 CryptoKitties 发布之前,Axiom Zen 的 CTO Dieter Shirley 就在 CryptoPunks 的启发下提出了最初版的 ERC-721 协议。

到这里,你可能会疑惑:作出如此显赫成绩的 Axiom Zen 为何名不见经传?因为他们后来换了另一个名字:Dapper Labs。至于改名的原因,你也一定能猜到:将加密猫独立出去,开拓新的业务。

名声大噪的 Dapper Labs 很快在 2018 年 3 月公布了 a16z 和 USV 领投的 1200 万美元融资,并随后与 NBA 接触,希望双方合作在区块链上推出体育 NFT 藏品。

以太坊上加密猫拥堵的前车之鉴就在眼下,这项合作没有顺利推进,但 Dapper Labs 却意识到了新的问题:把 NFT 的新技术带给亿万用户,以太坊已经靠不住了。一个新的想法应运而生:Flow。

在 Dapper Labs 的工作重心转向 Flow 之时,漫长的加密寒冬悄然到来,到年底,以太坊价格已从年初的 1300 美元下跌至 140 美元。市场戏剧性的变化,加密猫持续降温,Dapper Labs 的账户上曾一度资金紧缺,在接下来近两年时间,又进行了三轮融资。

转机出现在 2020 年 9 月,Flow 在 Coinlist 上的代币销售大获成功,来自 100 个国家超过 12500 名用户投资了近 900 万美元,打破 CoinList 当时的记录。第二周,Dapper 又拿出 2500 万 FLOW 进行拍卖,再次募得 950 万美元。

随后,Flow 网络上线,一款纪录 NBA 球星投篮瞬间的 NFT 收藏品项目 NBA Top Shot 成为这条为 NFN 量身定做的公链上第一个实验者,这也是 Dapper Labs 此前寻求与 NBA 官方合作的成果。NBA Top Shot 也不负众望,续写了 Dapper Labs 爆款工厂的传奇。

2021 年开门红,NBA Top Shot 的较量持续飙升,在 2 月 21 日,单日成交量达到 4790 万美元的峰值,5 月 7 日,用户数最高达 186, 000。

NBA Top Shot 之后,NFT 人气开始飙升。复盘一下当时的市场背景:DeFi 在 2020 年夏天掀起了一阵狂热,点燃了整个加密世界的热情,新一轮牛市的号角在很多人尚未觉察之前已经吹响。也许正是一群后知后觉的赶潮人,错过 DeFi 最早那波巨大红利后,在这个市场寻找新的财富叙事。NFT 成为那个被选中的幸运儿。

我们的讲述中跳过了 2018 年至 2020 年上半年这段灰暗的时光,在这段漆黑夜空中,并非没有明星闪烁的时刻。今天在 NFT 交易市场占据绝对统治地位的 OpenSea 就诞生在那段时光。

OpenSea:NFT 市场的绝对统治者

Opensea 的诞生同样是两位技术男发家的故事。2017 年那轮罕见的加密牛市吸引了拥有计算机背景的 Devin Finzer 和 Alex Atallah,两人在当年 9 月 Techcrunch 黑客马拉松上展示了他们第一个加密项目 Wificoin,激励用户共享 Wifi 路由,以换取相应激励。Wificoin 有幸被硅谷顶级孵化器 Y Combinator 看中,后者希望将 Wificoin 纳入孵化计划以推动项目进一步发展。

在 Wificoin 接受该计划到 2018 年 1 月启动的过渡期间,加密货币市场发生了巨大的变化。以太坊达到了那轮牛市的巅峰,疯狂不仅体现的以太坊势如破竹的上涨,还有上文提到的在当时刚刚问世的加密猫,那万人空巷的盛况无需再描述,多数人惊讶于 NFT 的能量,而 Finzer 和 Atallah 嗅到了新的商机:既然加密猫建立在 ERC-721 之上,那么如果在 ERC-721 基础上建立一个交易市场,就可以支持多种 NFT。

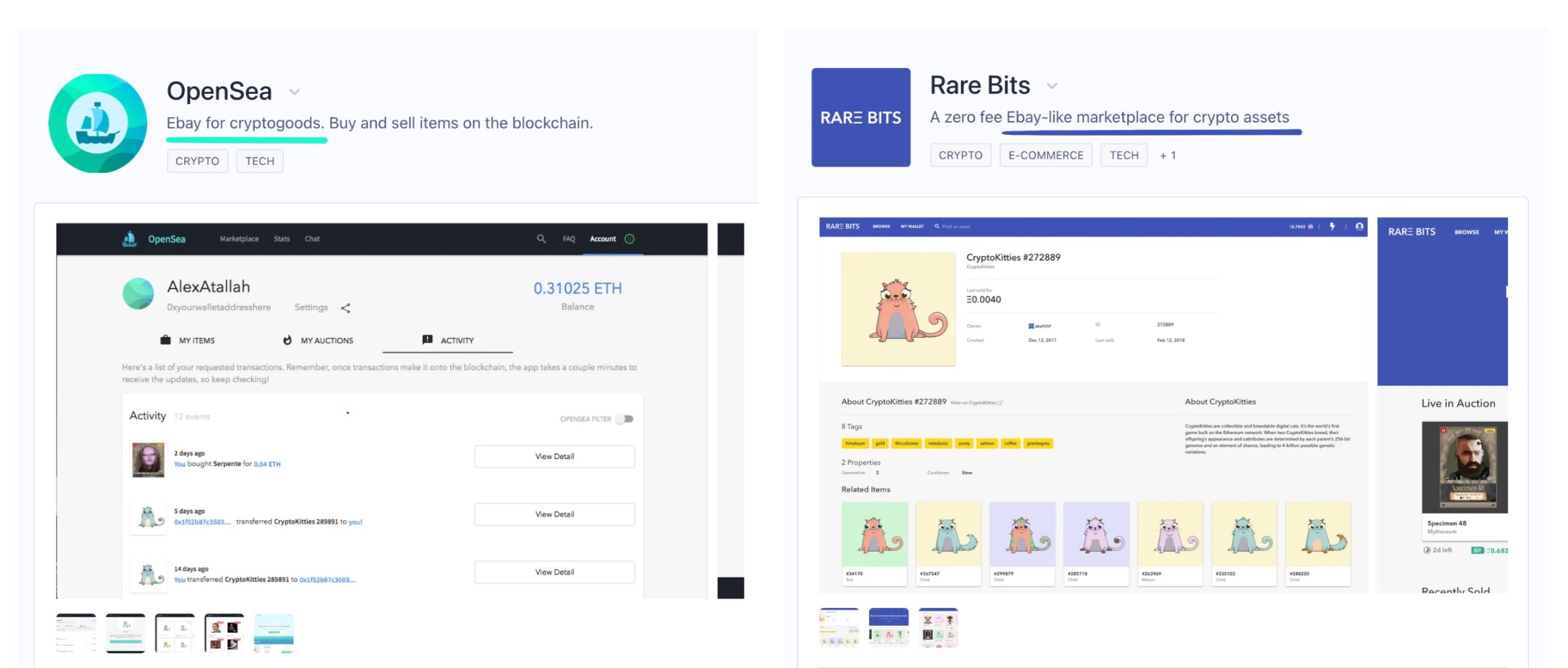

Finzer 和 Atallah 是对市场敏锐的创业者,但不是唯一嗅到商机的人。他们的竞争者几乎在同一时间开始了一个名为 Rare Bits 的 NFT 市场。

2018 年 2 月同一天,OpenSea 和 Rare Bits 在 Product Hunt 上发布。OpenSea 将自己描述为 「加密商品的 eBay」。Rare Bits 定位为「一个类似 eBay 的零费用加密资产市场」。两者都瞄准了 NFT 世界的 eBay 这个方向,但运营策略不同。OpenSea 坚持从用户交易中收取佣金,而 Rare Bits 则提供了免费的交易模式。历史盖棺定论,互联网时代补贴用户从而依靠流量构建护城河的策略在这里失效了,今天的 NFT 市场早已是 OpenSea 一家独大的局面,Rare Bits 却早已消失在历史尘埃中。

OpenSea 最早的投资者之一,1confirmation 普通合伙人 Richard Chen 曾这样总结回顾过两者间的竞争:

Rare Bits 是一个纸上谈兵的团队,他们是前 Zynga 公司的员工,从传统风投筹集的资金远比 OpenSea 多。但 OpenSea 团队更加精干,Devin 和 Alex 在发现新 NFT 项目方面做得很好,并且支持这些项目在 OpenSea 上交易,OpenSea 上大部分交易量来源于此。在我们于 2018 年 4 月投资时,OpenSea 的交易量已经是 Rare Bits 的 4 倍。

OpenSea 在 2018 年那轮熊市中道路并不平坦,好在 2019 年 11 月他们从 Animoca Brands 那里募集到了 210 万美元投资,顺利度过了艰难时刻。到 2020 年 3 月,新冠病毒疫情在全球蔓延时,OpenSea 才仅有 5 名员工,当时每月交易额为 110 万美元,按照 2.5% 销售佣金计算,OpenSea 此时每月收入只有微不足道的 2.8 万美元。

到 2021 年,NFT 市场苏醒,OpenSea 步入增长的高速通道。2022 年 1 月,OpenSea 月交易额达到巅峰的 58.6 亿美元,此时按照 2.5% 销售佣金计算的月收入达 1.46 亿美元。同时,OpenSea 宣布了一笔高达 3 亿美元的 C 轮融资,估值更是飙升到 130 亿美元,成为 NFT 世界当之无愧的巨头。

到此为止,那些缔造 NFT 盛世的先驱们都已经登台亮相。如果照搬 DeFi 的经验,ERC-20 和 Uniswap 的出现奠定了 DeFi 之夏的基础;那么我们有理由推断,NFT 在拥有了 ERC-721 和 OpenSea 之后,离爆发也只差一个导火索。

如果拔高视野,从整个加密货币的历史潮流去审视 ,NFT 不过是一个插曲。NFT 能在 2021 年迎来它的爆发,也不过顺应天时。2021 年年初,延续半年的 DeFi 狂潮为加密市场吸引了新鲜的血液。但 DeFi 市场的创新步伐却渐显颓势,市场在寻求新的增长点。

根据 NFT 数据公司 Nonfungible.com 数据,2020 年的 NFT 交易总额为 8200 万美元,而 2021 年这个数据达到 176 亿美元。2021 年是 NFT 爆发的元年,这一点毋庸置疑。而在 2021 年初那个时间节点上,NBA Top shot 的出圈,也许就是引爆整个 NFT 市场的火药桶。

在接下来的一年,加密艺术、PFP 头像相继登场,成为牛市交响曲中那段最引人注目的旋律。

加密艺术:Beeple 和 Pak

提到加密艺术,可能多数人最先想到的就是 Beeple, 以及他那副声名显赫的《Everydays:The First 5000 Days》。

Beeple 从 2007 年 5 月 1 日起每天在网上发布的画作,在画满 5000 张画后,他用 NFT 技术将它们组合到一起生成的新的作品《Everydays:The First 5000 Days》

Beeple 是他在加密世界里的名字,在真实世界中,他有另外一个名字 Mike Winkelmann。Mike 生于 1981 年,是一位来自美国的平面设计师,在自己的工作领域里小有名气。他曾为耐克、苹果、可口可乐、LV 和 Space X 等公司做过设计。

作为平面设计师的 Mike 在一次浏览网页的时候发现一位英国艺术家,每天都会绘制素描放在自己的社交网站上,吸引了众多粉丝。

受这位艺术家的启发,Mike 为自己在网络上取了个名字叫 Beeple。从 2007 年 5 月 1 日开始,他坚持每天完成一幅画作,日复一日,从未中断。

Beeple 在 2017 年 5 月 1 日创作的第一幅画,画的是他的外号「Uber Jay」的叔叔

一天一幅画,Mike 坚持了 13 年,5000 多天。他将每日一画的所有画作做成了一幅巨幅合集,命名为《EVERYDAYS: THE FIRST 5000 DAYS》。接下的事情众所周知,2021 年 3 月 11 日佳士得拍卖会上,这幅《Everydays:The First 5000 Days》以 6930 万美元成交,成为当时最昂贵的加密艺术品。这是加密艺术在整个艺术世界一鸣惊人的时刻,也是 NFT 作为艺术的新载体,展现出无限潜力的时刻。

正如 Beeple 所言,他不是一个纯粹的加密主义者。在减去拍卖收费和税款之后,Beeple 从拍卖中获得了价值 5300 万美元的以太坊。 就在拍卖会后不久的 3 月底,Beeple 对《纽约客》表示,他被以太坊的价格波动吓到了,立即将所有的以太坊换成了美元,并抛下「NFT 是泡沫」的论断扬长而去。Beeple 表示,「我早在做这些事情之前就从事数字艺术创作,如果明天所有这些 NFT 都消失了,我仍然会从事数字艺术创作。」

Beeple 的功绩并不能因为他对当时 NFT 市场的悲观而被否定,而加密艺术也不会因为 Beeple 的离场而黯淡无光。事实上,加密艺术有了一个梦幻开局,但更为精彩的故事还在后面。

Beeple 的记录甚至还没保持一年,就被另一位艺术家打破了。

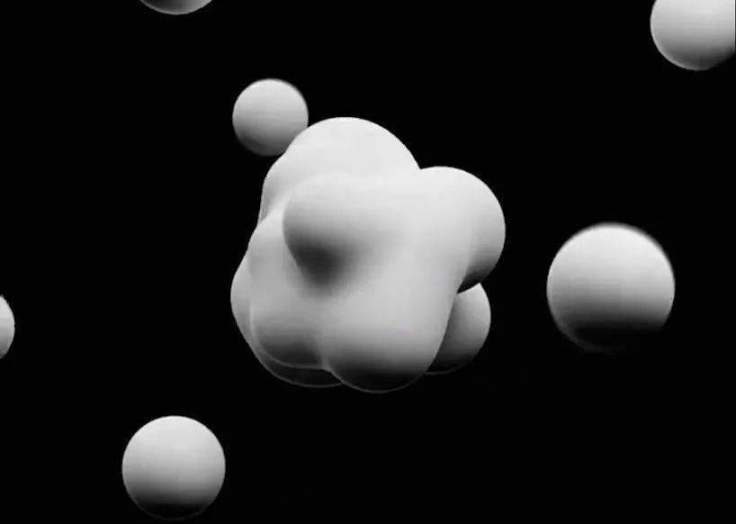

2021 年 12 月 2 日,在 NFT 市场 Nifty Gateway 上,一场为期 48 小时拍卖开始了。拍卖的这幅作品名为 The Merge,它由一个个小球 mass 组成。拍卖期间,收藏家可购买任意数量的 mass,但每个钱包都只能拥有一个小球,当买入第二个球时,两个球就会合并成一个,颜色和体积也会发生变化。在拍卖结束后,小球就不会再产生了,而且「吞并」会随二级市场交易不断发生,球的数量也会越来越少。

这场拍卖活动最终吸引了超过 28000 名收藏家参与,拍卖总价值达 9180 万美元,而这个作品背后的创作者 Pak 也就此登上神坛,被赞誉为 NFT 世界的中本聪。

与 Beeple 在物理世界有一个真实身份不同,Pak 至今还是一个身份成谜的艺术家。没有人知道他的姓名、长相、甚至性别。人们知道的是,他是 Undream 工作室创始人、AI 策展活动 Archillect 首席设计师,从事数字艺术创作已经超过 25 年,曾与数百个大品牌和工作室合作。

Pak 塑造了加密艺术的新巅峰,不仅如此,他还创造了在世艺术家公开拍卖艺术品的最高价。此前的记录由 Jeff Koons 在作品「兔子」在 2019 年创造。人们在惊叹之余才蓦然发现,实体艺术的巅峰已经被加密艺术所超越。

PFP:主旋律

在加密艺术大放异彩之际,CryptoPunks 也重新回到人们视野,CryptoPunks 作为以太坊上 NFT 的先驱,其意义和价值潜力不言而喻,有人称之为 NFT 世界的比特币、数字藏品界的黄金。

CryptoPunks 的历史成交数据,黄色为成交数量,白色为成交金额,CryptoPunks 的交易量在 2021 年 2 月迎来了明显增长,在 8 月达到巅峰。数据来源:NonFungible

CryptoPunks 王者归来,同时打开了「PFP」NFT 的大门。PFP 是「profile picture」(个人资料图片)的缩写,是一种以 NFT 形式存在的带有版权性质的头像。

如果说 NFT 是这轮加密牛市最引人注目的戏剧,那 PFP 就是舞台上最闪耀的新星。

截至目前的 NFT 总交易额排名,前十名中 PFP 占据大部分席位,数据来源:NFTGo

舞台的聚光灯不会永远停留在 CryptoPunks 身上,这一次故事的主角另有其人,这是一群未来加密世界大获成功,在沼泽中的秘密俱乐部闲逛的猿猴,他们着装、肤色各异,但脸上都挂着一幅百无聊赖的神情。他们叫做 Bored Ape Yacht Club(BAYC)。

至于这群无聊猿做了什么?先把目光投向他们的高光时刻。

2022 年 3 月 12 日,BAYC 母公司 Yuga Labs 宣布收购 Larva Labs 开发的 CryptoPunks 和 Meebits NFT 系列,3 月 23 日 Yuga Labs 以 40 亿美元估值完成 4.5 亿美元融资。

这是一个后进者逆袭的故事,而故事的脚本几乎沿袭了 CryptoPunks,早期销售冷淡,团队籍籍无名,但 BAYC 幸运的诞生在 NFT 热潮的起点,还有一点更为关键的区别是 BAYC 的开放策略和营销思路。

据《纽约客》的报道,BAYC 有四位匿名创建者,他们是现实生活中的朋友,Gargamel 是一名作家和编辑,Goner 从事加密货币日间交易,Tomato 和 Sass 是程序员。

BAYC 灵感来源于一个叫做 Hashmasks 的 NFT 项目。他们意识到,NFT 的重点不在技术,文化创新才是关键。于是,他们希望打造一个俱乐部,弥合主流文化与 Web3 之间的鸿沟。

最初,BAYC 是一个多人协作的艺术作品,有一张画布,允许多人每 15 分钟将其中一个像素更改为自己喜欢的颜色。创始团队将这个想法告诉了 Nicole Muniz。于是,一个协作项目的简单想法最终变成了一幅蕴含故事的图片:在未来的迈阿密沼泽中,居住着一群无聊的猿猴。Gargamel 希望它们是「一种存在主义无聊感」的朋克猿。

随后,团队花费 4 万美元聘请了专业的插画师。首席设计师 Seneca 将自己想象成为一个猿猴的邻居,在一个邋遢的城市里,猿猴作为这个城市的公民自由地游荡着。Seneca 这样描述这群公民,「对生活感到厌倦,却拥有世界上所有金钱和时间的猿猴,他们在金属酒吧里闲逛着」。于是,我们今天熟知的 BAYC 无聊猿就此诞生。

2021 年 4 月 23 日,BAYC 开启了预售。7 天之后,500 枚 NFT 才被售罄。不过,到了 5 月 1 日,剩余的 9500 个 BAYC 被一扫而空。

当时,每个 BAYC 的铸造价在为 0.08ETH,而仅仅不到一年后的 2022 年 3 月 17 日,BAYC 在 OpenSea 上的地板价已突破 100ETH。

BAYC 与 CryptoPunks 对 NFT 版权态度的差异,被认为是前者成功超越后者的关键。CryptoPunks 对 NFT 版权的开放相当克制,招致社区的强烈不满。其中一位名为 Dom Hofman 的持有者抛售了手中所有的 CryptoPunks,并创建了一个新 NFT 项目 Nounce,它是最早采用开放版权 CC0 模式的 NFT,将所有版权开放给社区。

BAYC 赋予其持有者几乎完全的商业版权,鼓励了持有者对作品进行二次创作,每个持有者都可以基于 BAYC 创作品牌或产品,并进行独立销售。

随着 BAYC 渐渐壮大,团队也从匿名四人组升级为拥有 40 余人的 Yuga Labs。Yuga 其实是《塞尔达传说:众神的三角力量 2》中的大反派。它有一种特殊能力,将自己和他人都变成画作。BAYC 创始人称,取名「Yuga」则寓意团队的非凡创造力。

让 BAYC 真正名声大噪的转折点来自名人效应。亿万富翁、达拉斯小牛队老板马克·库班是第一个持有 BAYC 的名人。2021 年 5 月,马克·库班收到了 BAYC,将其展出在自己的 Lazy.com NFT 画廊里。随后,许多名人涌入,包括 NBA 球星斯蒂芬·库里、Youtube 大 V KSI。

BAYC 开始走上顶流之路,但如果仅仅只有 BAYC,或者 CryptoPunks,不足以描述 PFP NFT 的盛况。如今我们称之为蓝筹的 NFT 多数都在其列。

2021 年 6 月,三位 Dapper Labs 前成员 Evan Keast、Jordan Castro 和 Scott Martin 联合推出了 Doodles,其中 Evan Keast 和 Jordan Castro 是「加密猫」 Cryptokitties 的核心开发人员。

2022 年 1 月,前科技企业家 Zagabond 牵头的 Chiru Labs 推出 Azuki。有趣的是,Zagabond 在今年 5 月自曝曾创建 CryptoPhunks、CryptoZunks 等 CryptoPunks 的山寨版,并失败的故事,导致 Azuki 一度陷入信任危机。

2022 年 4 月, NFT 收藏家、同时也是科技创业者 Kevin Rose 领导的社区 PROOF Collective 推出 Moonbirds,也引来 NFT 社区追捧。

PFP 的辉煌一直延续至此。不过,今天五月之后,曾经不可一世的加密帝国 Terra 和 Three Arrows 相继倒塌,整个加密市场被卷入流动性旋涡,NFT 也随之降温。

NFT 在它并不悠久的历史中表现出了显著的连续性。从文艺启蒙、到技术实践,最后到应用落地,都有着一脉相承的源流。正如,文学批评家哈罗德·布鲁姆在作品《西方正典》中所阐述的西方文学源自莎士比亚,NFT 历史中也有一位相似的角色:CryptoPunks。无论是 Dapp Labs 起草 ERC-721,还是后来 BAYC 和 Azuki 等流量明星,都无一利例外受到 CryptoPunks 的影响。那么之前提到如何理解 CryptoPunks 的价值,答案已经不言自明。

展望:民主时代

总是需要有无数的光阴无谓地流逝,才能等到一个真正具有历史意义的时刻——一个人类群星闪耀的时刻出现。

茨威格的这句话同样适合于 NFT。

我们详细回顾了 NFT 历史上那些举足轻重的项目、团队和他们的闪耀时刻。这样的高光时刻在任何历史中都不多见,正是他们清晰地篆刻了历史发展的骨架。

抛开这些主旋律和高光时刻,我们也跳过了大量在 NFT 领域有所建树的人和事。比如,曾经一度声势浩大的区块链游戏 Axie Infinity 和 STEPN,它们都融入了 NFT 的代币经济学设计;再比如将 DeFi 与 NFT 结合的 NFTFi 赛道涌现了不少创新的身影:NIFTEX、Unicly 和 Fractional 等开辟了 NFT 碎片化实验,NFTfi、BenDAO 等在 NFT 借贷领域大展拳脚。它们汇聚成了 NFT 发展的血肉。

所有这些故事,都为 NFT 世界的后浪们总结了经验和方向。

最后回到那个所有人都关心的问题,NFT 的历史河流会奔向何处?没有人能给出确切的答案。不过,我们可以借鉴先贤的思路窥探一二。

维科曾在《新科学》中提出了历史循环的三个阶段,即神权时代、贵族时代、民主时代。历史总是押着相同的韵脚,从更高维度的大历史视角去观察,NFT 发展史也基本符合维科历史三段论的特征。如今 NFT 在以太坊以及其他公链上遍地开花,普通人能够轻松触及,这正是民主时代的开端。

参考链接:

https://www.notboring.co/p/flow-the-normie-blockchain