退圈半年的AC再发声:对Crypto 2022的针砭与提议

本文来自 Medium,原文作者:Andre Cronje,由 Odaily 星球日报译者 Katie 辜编译。

作为 DeFi 领域曾经最知名的 KOL,自今年 3 月份宣布“退圈”的 AC(Andre Cronje)于昨日发布新文章,复盘了 2022 年最惨淡的几个时刻,表达了对监管的看法和改进行业的相关提议。

2022 年,加密货币的价格下跌、一些协议和交易所的失败导致了 2 万亿美元的损失。迄今为止,市场受到的最大冲击包括 Terra 的崩溃、Celsius 申请破产、Voyager Digital 申请破产以及三箭资本的破产。这些冲击并不是孤立的,而是波及整个市场,导致比特币和以太坊的整体价格下跌。在这个“寒冬”中损失了大量资金的交易所的投资者们都在想,他们有什么补救措施,能否从这个系统中任何不负责任的参与者那里得到索赔。

1. Terra Luna 崩溃

Terra 曾因向全球用户提供链上投资机会而受到称赞,现在却被指责为 2022 年加密货币冬天的催化剂。背后的原因值得市场和监管机构的关注。

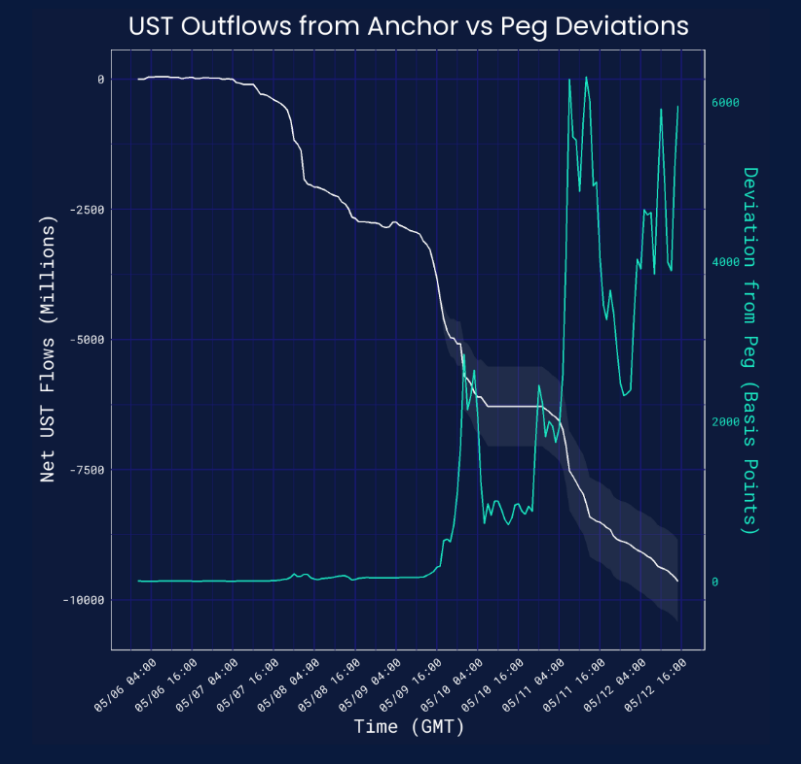

2022 年 5 月,价值 20 亿美元的 UST 从 Anchor Protocol 中退出并清算。一系列问题导致了 Terra 的崩溃:储量不足,算法有缺陷,Anchor Protocol 没有取款限制。如果有适当的限制来控制大额提款,也许 UST 就不会脱钩了。

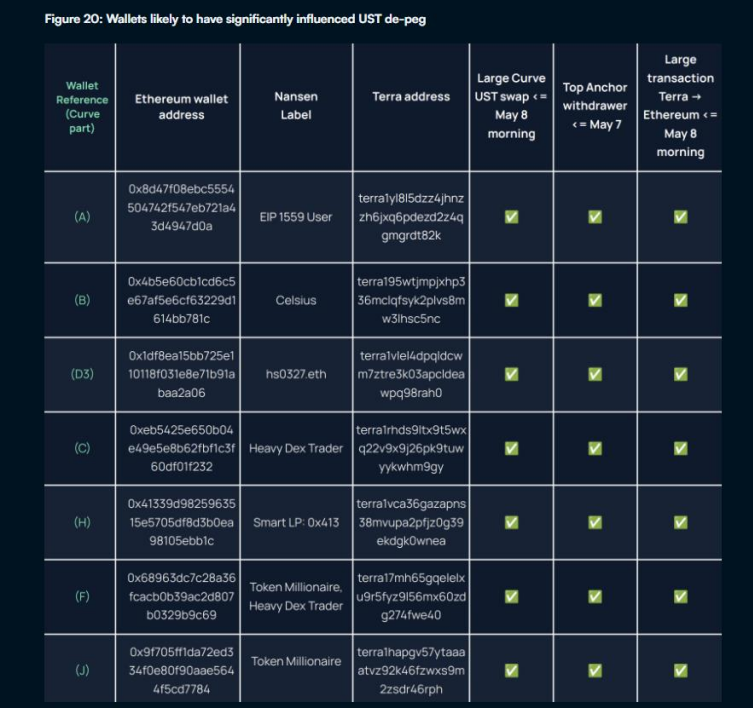

Jump Crypto 在 5 月审查了 UST/LUNA 的活动,发现是少数大型交易导致了货币的不稳定和崩溃。这些交易已追查到部分钱包,所有钱包持有人的身份仍然未知。令人担忧的是,如此小部分的人就能够在没有后果或责任的情况下破坏整个加密货币生态系统的稳定。UST 从 Anchor Protocol 中提取的 20 亿美元可以追溯到 7 个钱包,包括 Celsius。

下图显示了当 UST 从 Anchor 撤出后,其与挂钩的偏差越来越大。

Nansen 在分析 UST 的脱钩过程中,列出了 7 个对脱钩影响最大的钱包。其中一个钱包被确认属于 Celsius。

少数几个主要 UST 持有者的行为足以破坏 Terra 生态系统的稳定,并掏空了那些资金量小的钱包持有者的口袋,且没有任何追索权。

2. Celsius

加密交易平台 Celsius 在美国申请破产。这是在 6 月 12 日投资者账户被冻结后一个月之后发生的,这一举动几乎没有任何警告,而且是由于交易所流动性不足而造成的。Celsius 无法满足投资者取款的原因似乎是杠杆率过高的贷款(和糟糕的储备金)、主要参与者的糟糕决策,以及主要加密资产持有者和 Celsius 高管的一定程度的渎职行为的最终结果。

ETH & stETH 事件导致了用户对 Celsius 的挤兑,他们恐慌地撤回了自己的投资,最终导致 Celsius 冻结了其网络。随后的流动性危机导致了 Celsius 在 7 月 17 日申请清算。

Celsius 在 Terra 的 Anchor Protocol 中有大量的用户资金投资。尽管该公司在 Terra 崩盘前撤回了大部分资金,但事实证明这是一把双刃剑。通过撤出这些资金并促使 UST 与美元脱钩,消费者对加密货币市场的不稳定感到恐慌,导致加密货币的大面积提取和价格下跌。这也因此影响了 Celsius 的其他持有资产,特别是比特币,直接受到 Terra 试图稳定 UST 的影响(导致比特币价格下跌)。Celsius 还披露了三箭资本欠它的近 4000 万美元的债务——鉴于三箭资本的破产,这一债务不太可能实现。

由于加密货币没有作为金融产品或法定货币进行监管,因此 Celsius 不算在法律层面上违反了监管。然而,可以发现他们的行为疏忽,没有实施审慎的做法和故意误导用户。

3. 三箭资本

2022 年年中,三箭资本(3AC)的倒闭令业内许多人感到意外。3AC 的下跌与其在 Terra 的敞口有关。3AC 以 5 亿美元的价格购买了 1090 万枚 LUNA,这些代币随后被锁定并质押。随着 Terra 的崩溃,3AC 的所持资产减少,其质押的 LUNA 现仅值 670 美元。

3AC 还持有 Grayscale 的比特币信托基金(GBTC)的大部分股份。在 Terra 崩盘后,3AC 专注于 GBTC 套利,期待如果 GBTC 被批准转换为 ETF 就会出现逆转。但这并没有发生,随着 Terra 出售比特币储备,比特币价格下跌,进一步耗尽了 3AC 的其他资产。和 Celsius 一样,3AC 也受到了 stETH 的影响——也随着 stETH 的脱钩而贬值。Voyager Digital 向 3AC 提供了 6.6 亿美元的无抵押贷款。Voyager Digital 现在也申请了破产。

3AC 是加密市场互联性的一个典型例子,相对较小的冲击会对一个过度杠杆化、缺乏储备的生态系统产生广泛影响。批评人士指出,3AC 受到了很多的借贷机构的影响,其中许多借贷机构在正常业务过程中从散户那里吸收存款,从而使他们的债务达到顶峰。3AC 的投资决策不仅影响了机构客户,也影响了散户,进而影响到了向 3AC 发放了坏账的普通网络用户。

除了有问题的投资决策外,3AC 还被新加坡当局指责为获得更多贷款而向贷款机构提供误导性和虚假信息——据称是欺诈行为。这凸显了加密资产贷款缺乏审慎监管的问题,因为行业未能检查大户为快速获得回报而采取的过度风险敞口。

4. 潜在的市场影响

目前使全球经济面临压力的宏观经济因素加剧了这些崩溃。加息、战争以及燃料和粮食短缺都有助于提高消费者的预期,从而推动市场行为甚至跨越到加密资产。

随着全球金融前景日益黯淡,消费者正在寻求降低风险,寻求更安全的投资,包括更安全的加密货币投资和传统投资。这包括投资风险较低的加密产品,如 ETH & stETH 事件。

在加密货币中,如果消费者的存款没有任何安全保障,就会更容易引发恐慌,引发交易所和质押池的“挤兑”——这正是 Celsius 和 Anchor 所发生的情况。对于监管机构来说,市场操纵变得越来越清晰,这表明有必要在加密市场的主要机构角色参与者之间实施制衡。监管的不确定性进一步增加了消费者的不良预期,推动市场转向被认为更安全的投资。

加密货币市场是全球经济的一部分,因此也会根据普通消费者的感受而经历起伏。尽管如此,通过监管干预,该行业的起伏周期可以被平息,这样对系统的冲击就不会像最近发生的那样产生灾难性的影响。

5. 监管改革的必要性

最近的冲击对加密市场的影响显示,在多家加密交易所和投资基金崩溃后,市场显然遭遇了经济困境。市场集中在几个大玩家之间,这表明在链和使用社交媒体上可能存在操纵(考虑到破坏 Anchor protocol 稳定的少数钱包)。这些交易所和投资基金缺乏透明度——消费者实际上并不知道他们的资金被用来做什么,也不明白他们被告知了什么——显然是信息不对称的问题。

所有这些问题都催促法律对加密行业进行一些与传统金融法规相一致的监管,让消费者既能得到保护,又能在遭受损失时获得补救。

6. 借用传统金融中的补救措施

6.1 保险计划

之前的经济衰退发生后,全球许多央行都采取了强制保险措施,迫使银行为存款提供最低限度的保险,以确保在银行破产时消费者得到保护。这为存款人提供了安全保障,并在金融困难时期增强了对银行的信心,确保银行挤兑事件减少。即使在没有明确存款保险计划的国家,央行也可能根据具体情况,酌情赔偿在破产银行失去存款的消费者。存款保险的安全网是传统银行的消费者可以得到的补救措施,而加密交易所(如 Celsius)的储户则无法得到。

6.2 审慎监管

一个强有力的监管机制,既要制定吸收消费者存款的规则,又要监督这些存款的使用方式,这将确保倒闭的银行减少,并提高人们对银行体系的信心。世界各地的许多央行基于以下因素对私人银行进行监管:资本、资产质量、管理的稳健性、收益、流动性和对风险的敏感性。这同样适用于加密投资和交易所。

6.3 对用户的补救措施

目前,在大多数司法管辖区,当交易所或投资工具申请破产时,消费者基本上拥有与无担保债权人一样的权利。这会让他们排在长长的债权人队伍的最后,支付赔偿的几率很小。与大多数行业一样,加密行业也存在安全风险。由于加密交易通常是无管辖权和匿名的,黑客很难追踪。这是监管机构在实施最低限度监管时需要牢记的一点,最低限度监管可能会要求交易所就消费者钱包的损失承担责任。

7. 即将到来的监管

全球大多数司法管辖区都计划监管加密货币。有些人想宣布它为商品,有些人想宣布它为法币,有些人想宣布它为金融产品。在欧盟,反洗钱指令目前要求加密资产服务提供商获得提供这些服务的许可证。加密资产市场(MiCA)法案正在欧洲议会进行审议,预计将于 2024 年通过——它使加密资产服务提供商与金融行业更加一致。

MiCA 的目标是协调监管,“抓住”那些不属于现有立法的加密资产活动。该法案对加密资产服务提供商提出了许可证要求,并对稳定币提出了准备金要求。MiCA 并没有处理大面积的加密问题,但它确实处理了市场上一些更大的问题——特别是解决加密交易所提供的服务和消费者保护的责任。在全球范围内,加密产业将从对加密资产的监管中受益,这些监管措施将抑制风险资产的过度敞口,并鼓励市场对该行业的信心。

8. 总结

最近加密市场的衰落表明了该系统的缺陷,以及需要监管来控制不负责任的参与者和保护消费者。Terra 的崩溃不是孤立的,它是暴露几家加密对冲基金和交易所投资组合杠杆过高的转折点。Celsius 它不仅在对 Terra 的过度风险敞口,而且是刺激 Anchor Protocol 运行的主要参与者之一。对 stETH 的敞口加剧了 Celsius 的损失。3AC 可能是整个行业“多米诺骨牌事件”中最具代表性的案例之一。作为一个主要借贷者和随后在交易所账簿上的坏账,3AC 的过度杠杆头寸使其进入自愿清算。在所有这些动荡中,包括这些基金和交易所高管的行为,基本上是在拿别人的钱赌博。

对于许多监管机构提出的如何在加密市场保护消费者的问题,答案是采用传统金融中存在的相对安全措施。即监管任何交易所可能持有的最低储备金,规定这些服务提供商必须获得许可、监管风险敞口和应用透明度标准,并将加密货币纳入金融产品的含义。

加密市场的参与者可能是私人企业(如对冲基金),但仍然影响着市场,因为它们接触到很大比例的市场资源。对所有可能破坏市场稳定的机构实施监管,将为消费者提供急需的保护,并有助于市场的长期稳定。