Foresight Ventures市场周报:市场强势反弹,Cosmos生态利好不断

市场观点

宏观流动性

货币流动性整体紧缩。9月美联储缩表950亿。在美联储鲍威尔及多位票委鹰派发言后,9月加息75BP概率上升为90%。美元指数创下20年新高,如果美元上涨趋势继续,可能会对风险资产施加压力。美股连续三周下跌,加密市场紧跟美股波动。展望未来,下一个行情指路明灯将是下周二的美国8月CPI数据。

全市场行情

市值排名前100涨幅榜

本周加密市场整体下跌,BTC下跌4%,ETH上涨5%。BTC统治率跌到2020年以来的最低位37%。ETH持续强势,ETH/BTC汇率自22年低点以来已上涨62%。LUNC等MEME币领涨市场。历史上MEME币暴涨之后的1-2个月,市场行情大概率向下。

1)ETC:POW挖矿的ETC, 以及山寨RVN, FLUX, ERG, CFX, NEOX整体表现较好。9月13-15日后ETH将采用POS验证机制。原来挖矿ETH的近900TH/S的算力将需要转型。例如比特大陆今年8月宣布投资1000万美元牵头做ETC基金会,共同帮助ETC生态成长,预计将会筹集到3000万美元。

2)FOLD:Manifold finance原来做MEV保护,ETH转POS后有望和LIDO合作分成。现在市值是1亿美元左右,按之前路由收益参照为最低每月收益40万美元。海外社区的聪明钱都在赌FOLD真实收益率的现金分红,赌POS后协议更多的合作推高协议的利润。

3)TSUKA: SHIBA创始人RYOSHI的另一个MEME币TSUKA较低点涨幅1000倍。SHIB社区有部分人跟随RYOSHI到了TSUKA,社区带有宗教信仰色彩。链上交易数据好,日交易量在150万美元以上,独立交易地址达到6000多个。比较成功的MEME币通常可以做到2亿美元市值。

BTC行情

1)链上数据

BTC囤币党信念没有丧失,但熊市格局继续,没有好转迹象。1年未动的BTC达到了66%,流动性进一步减少。但是BTC巨鲸在每次市场反弹期间出货。7年前休眠BTC的最后一次移动数量最近一周飙升,每当这些链上信号出现,市场随后几个月大概率下跌20%+。

长期趋势指标MVRV-ZScore以市场总成本作为依据,反映市场总体盈利状态。当指标大于6时,是顶部区间;当指标小于2时,是底部区间。当前指标为-0.16,处于绿色抄底区间。

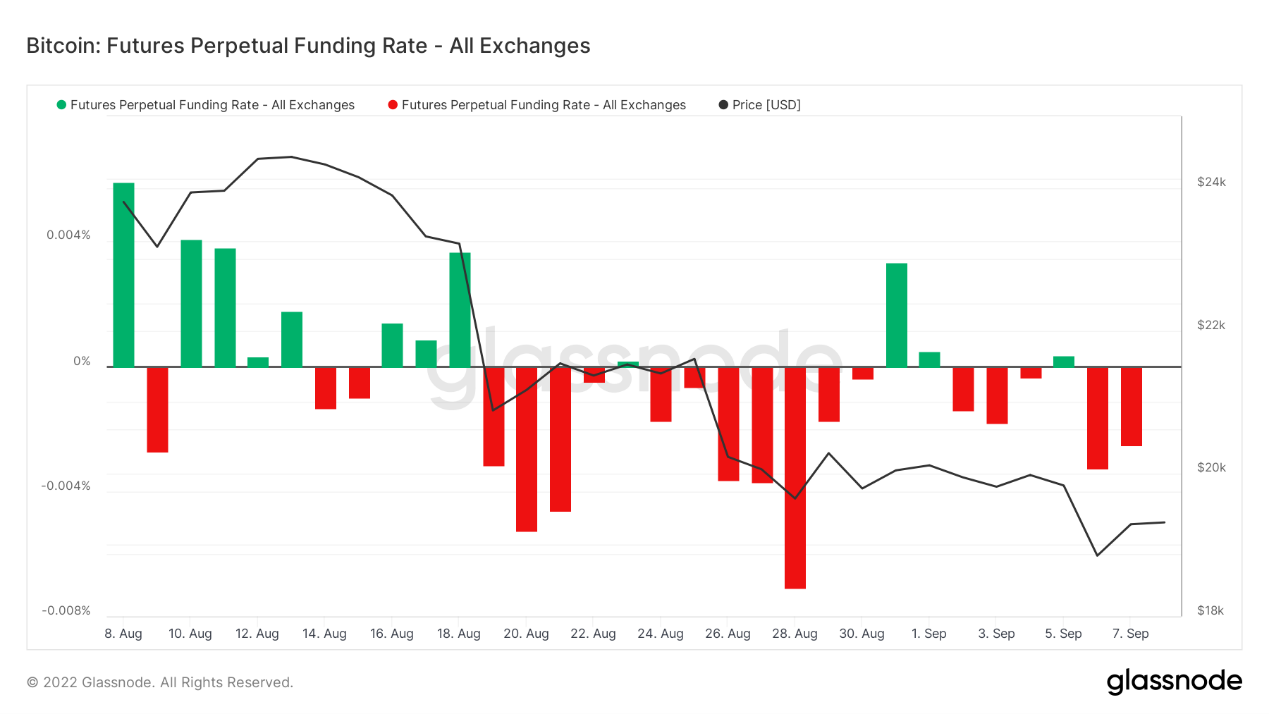

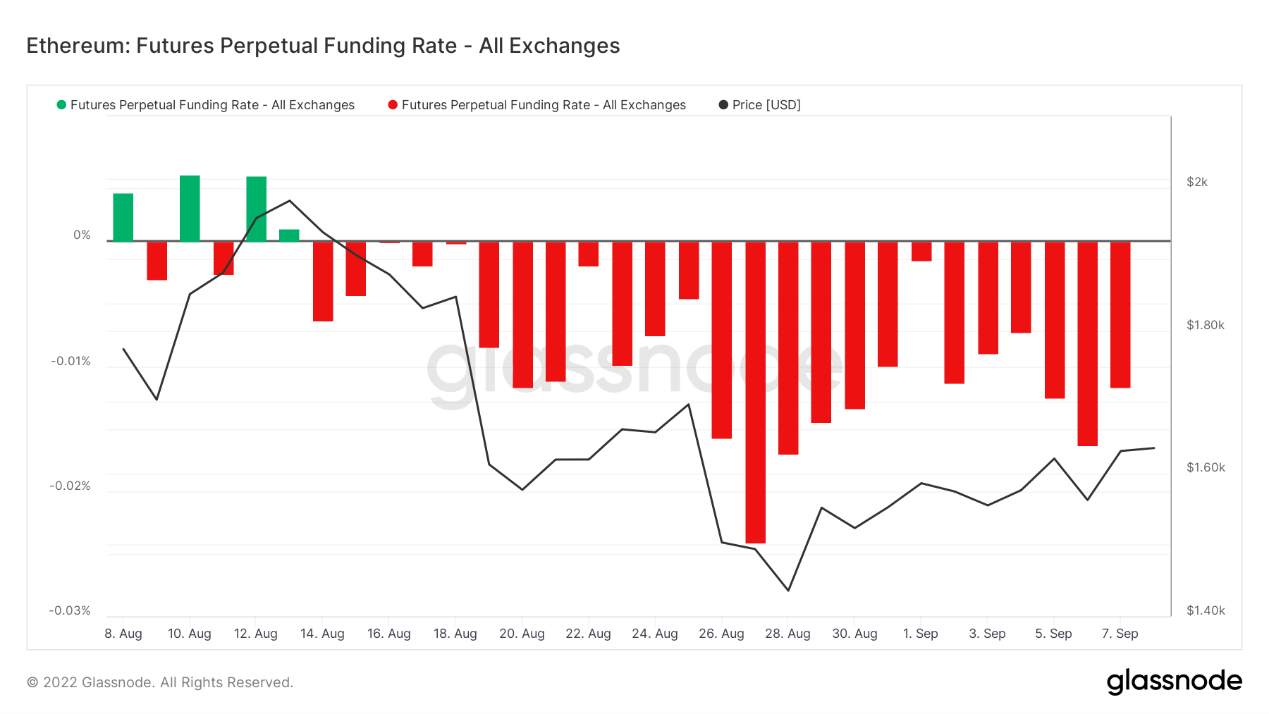

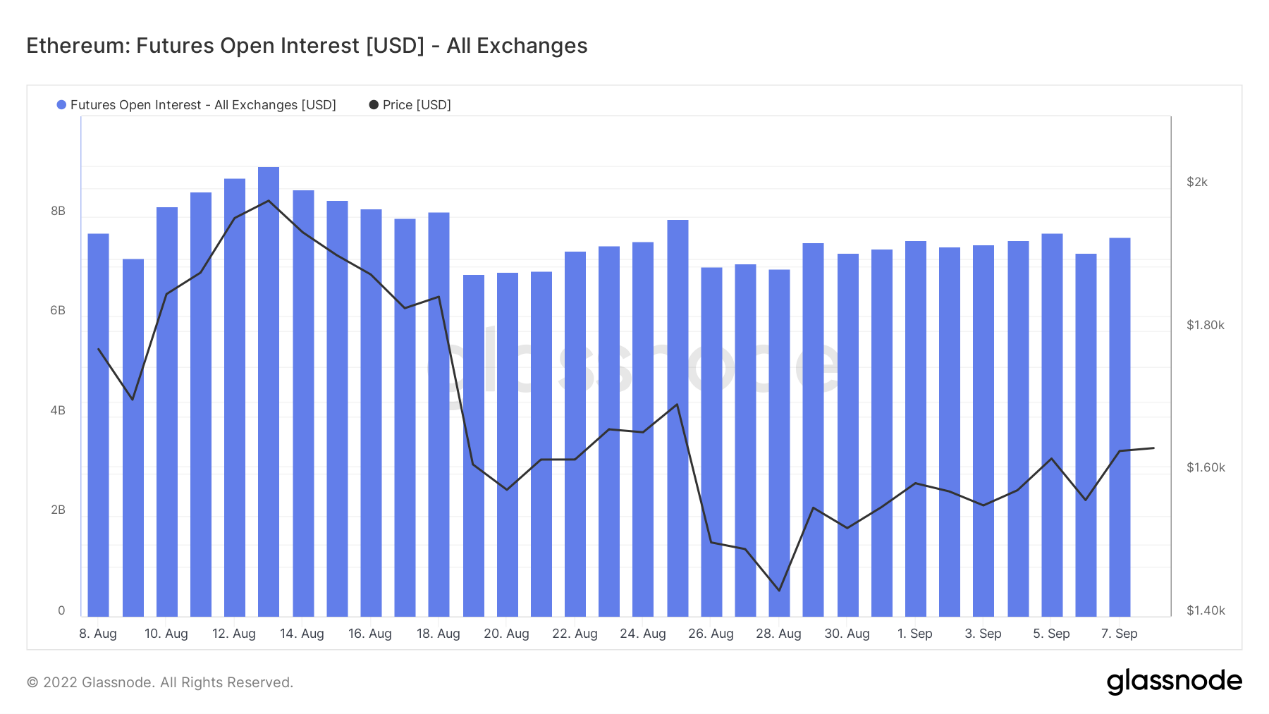

2)期货行情

期货资金费率:本周费率负值为主,空头做空明显占优。市场做空ETH的更多。费率0.05-0.1%,多头杠杆较多,是市场短期顶部;费率-0.1-0%,空头杠杆较多,是市场短期底部。

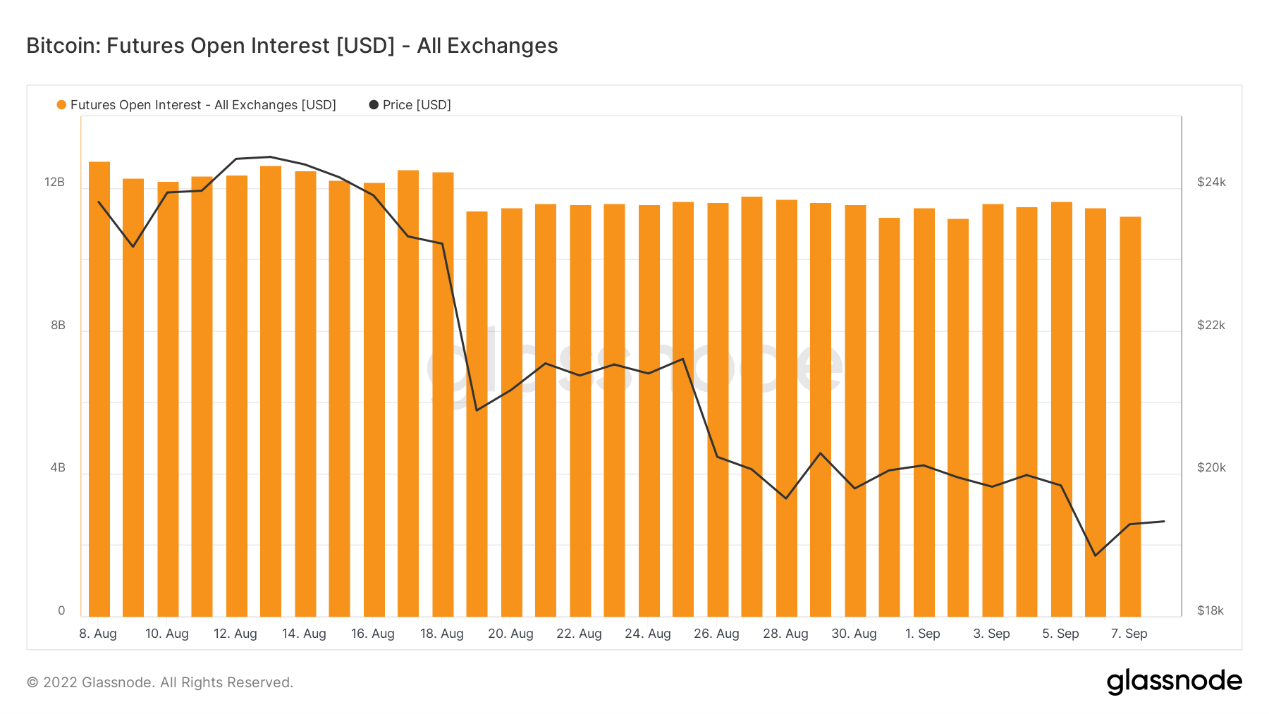

期货持仓量:本周持仓量略有增长,市场主力有返回的迹象。

期货多空比:1.5。多头人数大于空头,但费率为负值,表明小散户做多,大户做空。费率更能反应市场真实状况,市场还是做空为主。多空比数据波动大,参考意义有所削弱。

3)现货行情

本周BTC下跌4%,ETH上涨5%。在全球流动性持续萎缩的情况下,BTC短期持有者发现自己面临巨大压力,难以维持20000的心理支撑水平。美股遇到阻力位,可能反弹2-3天,之后继续下跌,估计加密市场有可能跟随美股走势。

市场数据

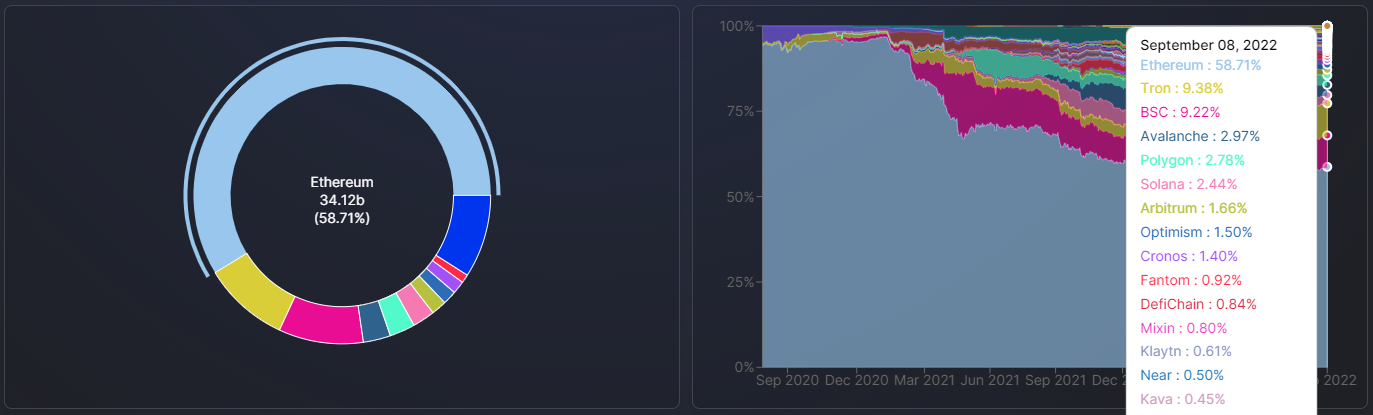

公链总锁仓量情况

本周整体TVL下降1.63B,下降幅度达2.72%;整体TVL已出现连续1个月的下降,短期行情端有向上空间,可能会伴随行情上涨出现TVL总量的增长。

各公链TVL占比情况

本周各链占比波动较小,BSC链出现小幅增长,除极个别老牌蓝筹协议外,多数协议已经长期走下坡路,后期市场出现新增长时,可能也会更多集中于具备一定话题或创新性的新协议。

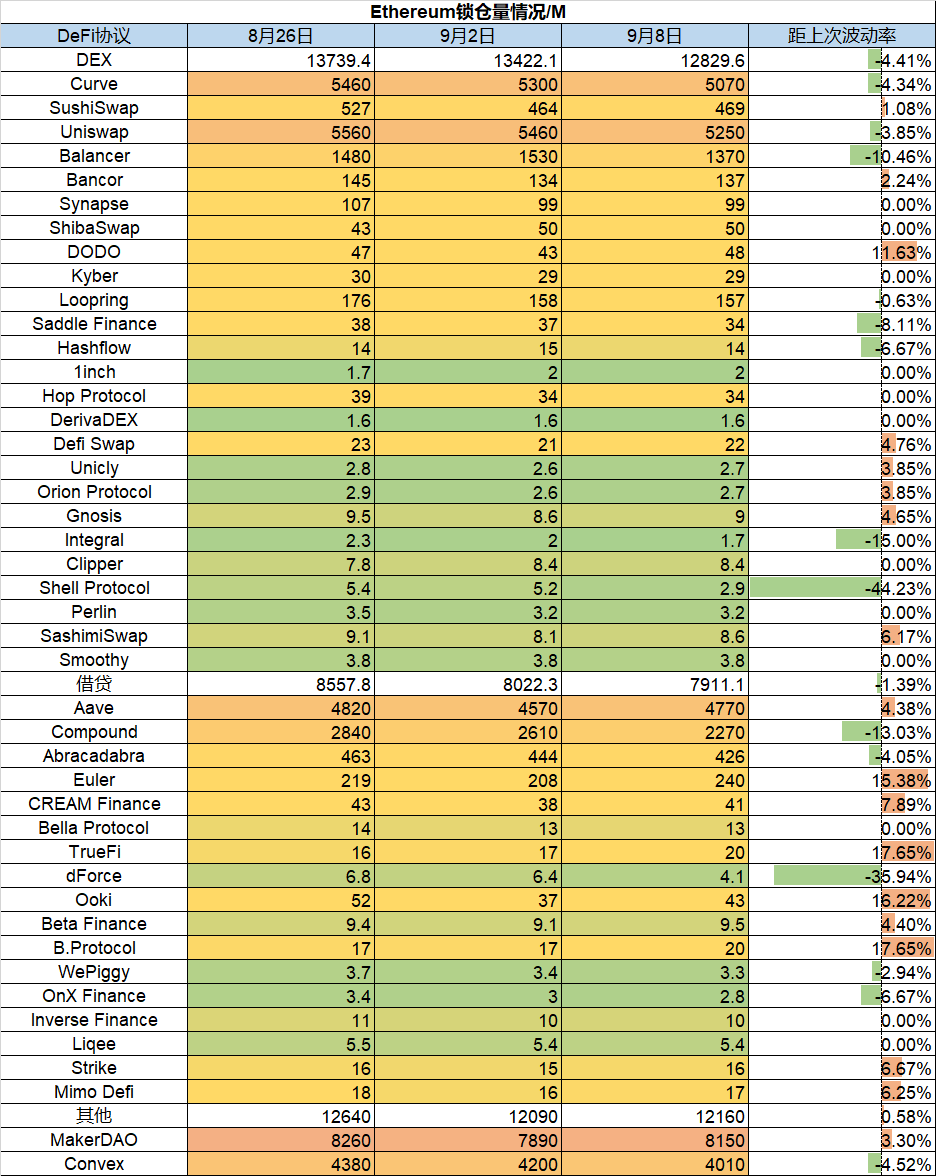

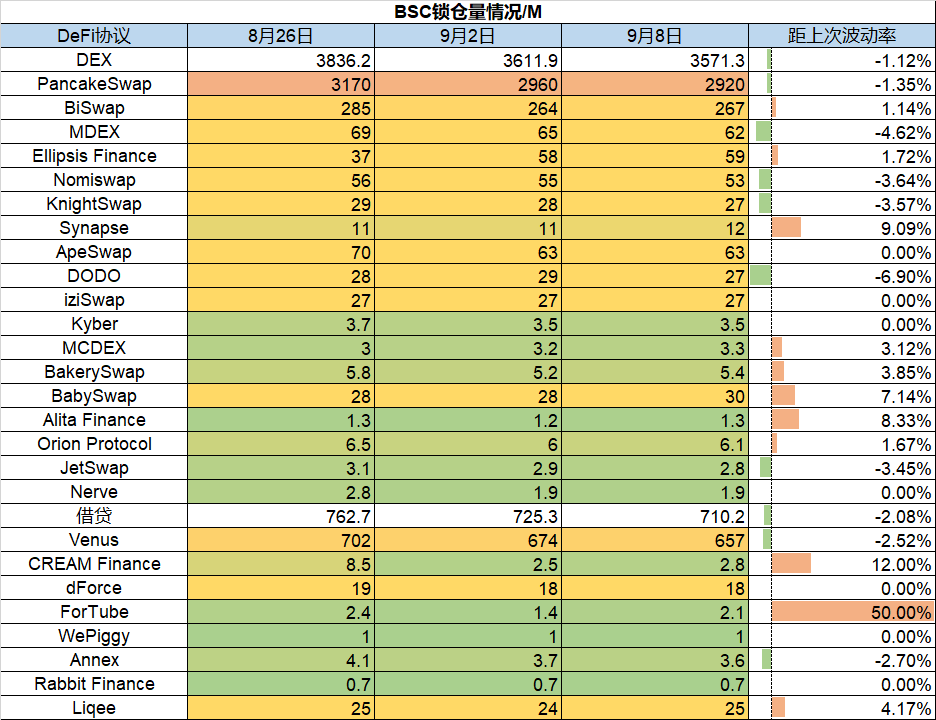

各链协议锁仓量情况

1)ETH锁仓量情况

2)BSC锁仓量情况

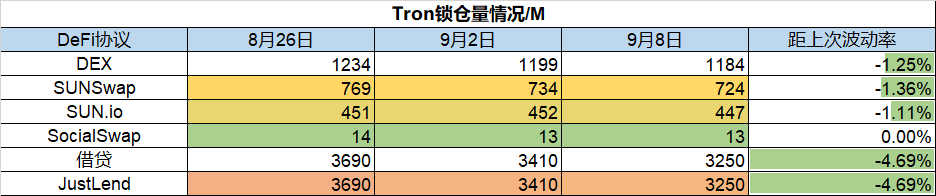

3)Tron锁仓量情况

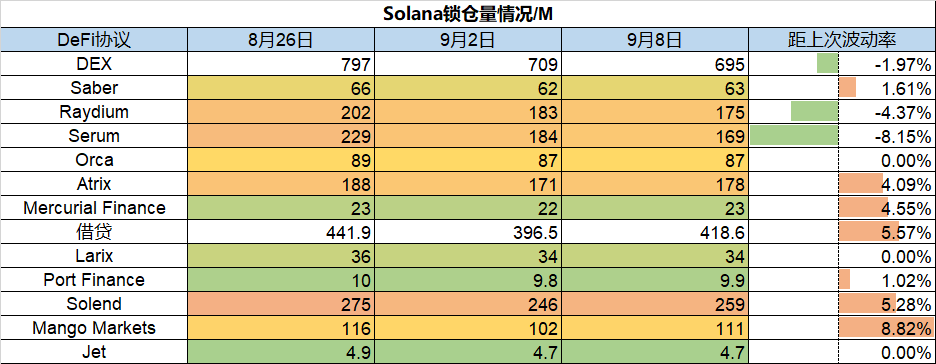

4)Solana锁仓量情况

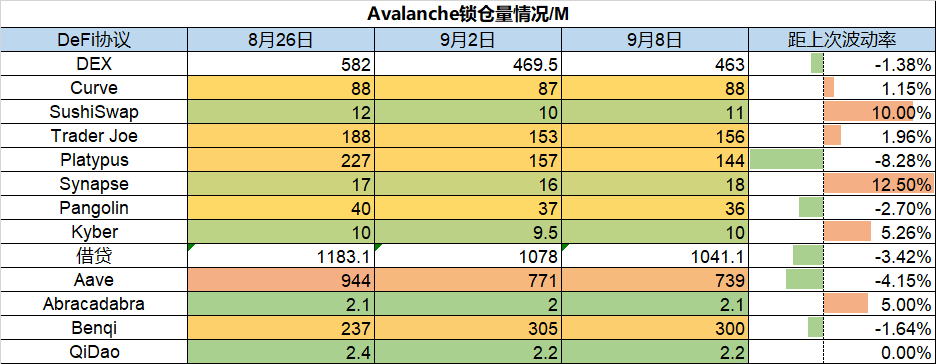

5)Avalanche锁仓量情况

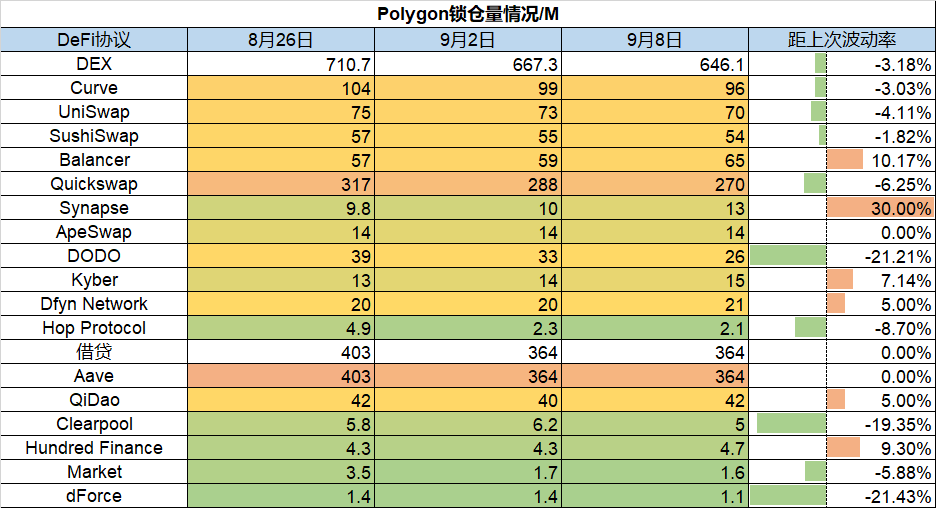

6)Polygon锁仓量情况

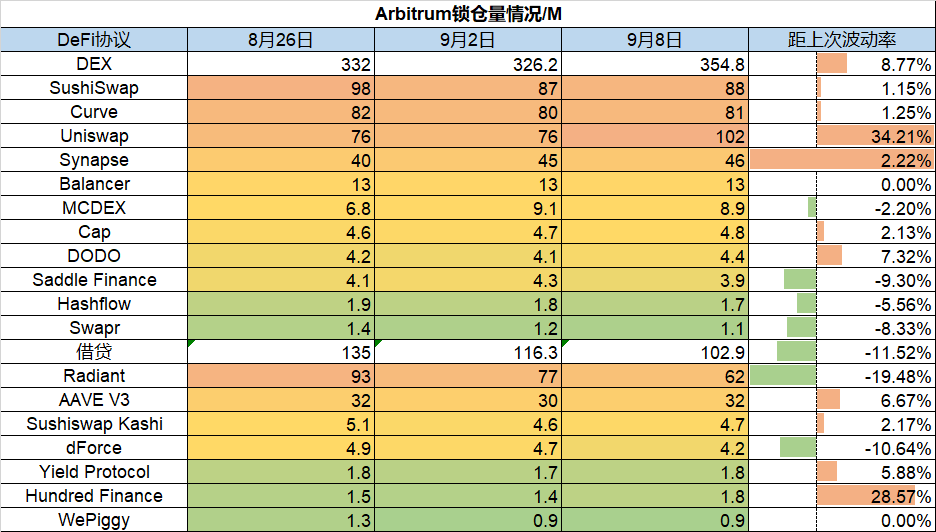

7)Arbitrum锁仓量情况

8)Optimism锁仓量情况

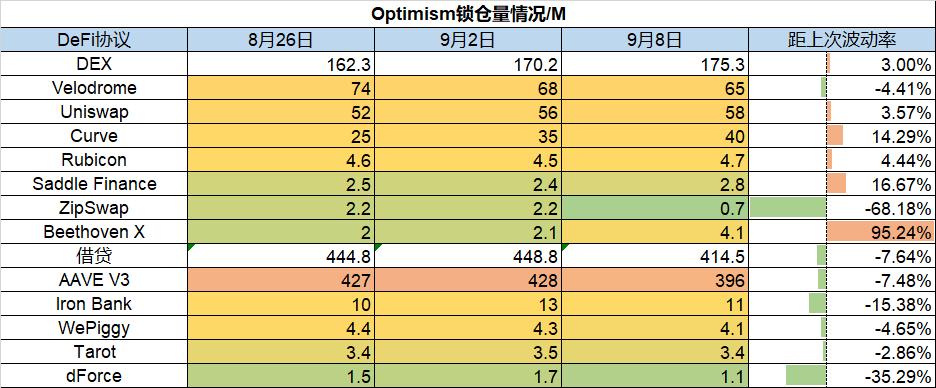

ETH Gas fee历史情况

当前链上转账费用约为$1.19,Uniswap交易费用约为$4.07,Opensea的交易费用约为$1.58,本周Gas日均值出现一定攀升,基本保持在7~23gwei。

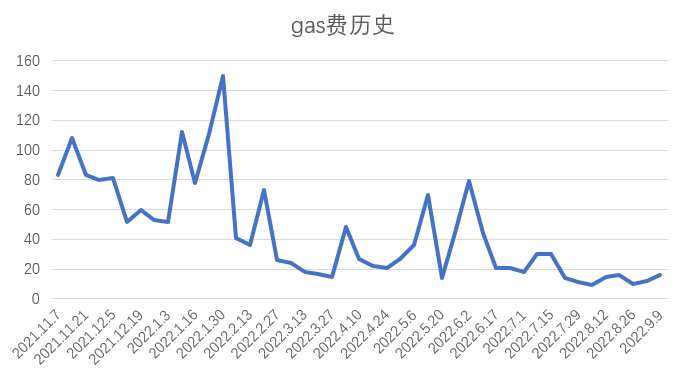

NFT市场数据变化

NFT-500市值

NFT板块指数

NFT市场交易概览

整个NFT市值持续走低,距两个月前Social类型已下跌约40%,Metaverse类型已下跌50%,短期内仍未出现NFT的好叙事;短期值得关注的项目是RTFKT Clone X Forging SZN 1,其与Clone X发布了一些数字虚拟服装,如球鞋、帽子和衣服等,可以通过AR设备看到虚拟物品的实体展现,短期交易活跃。

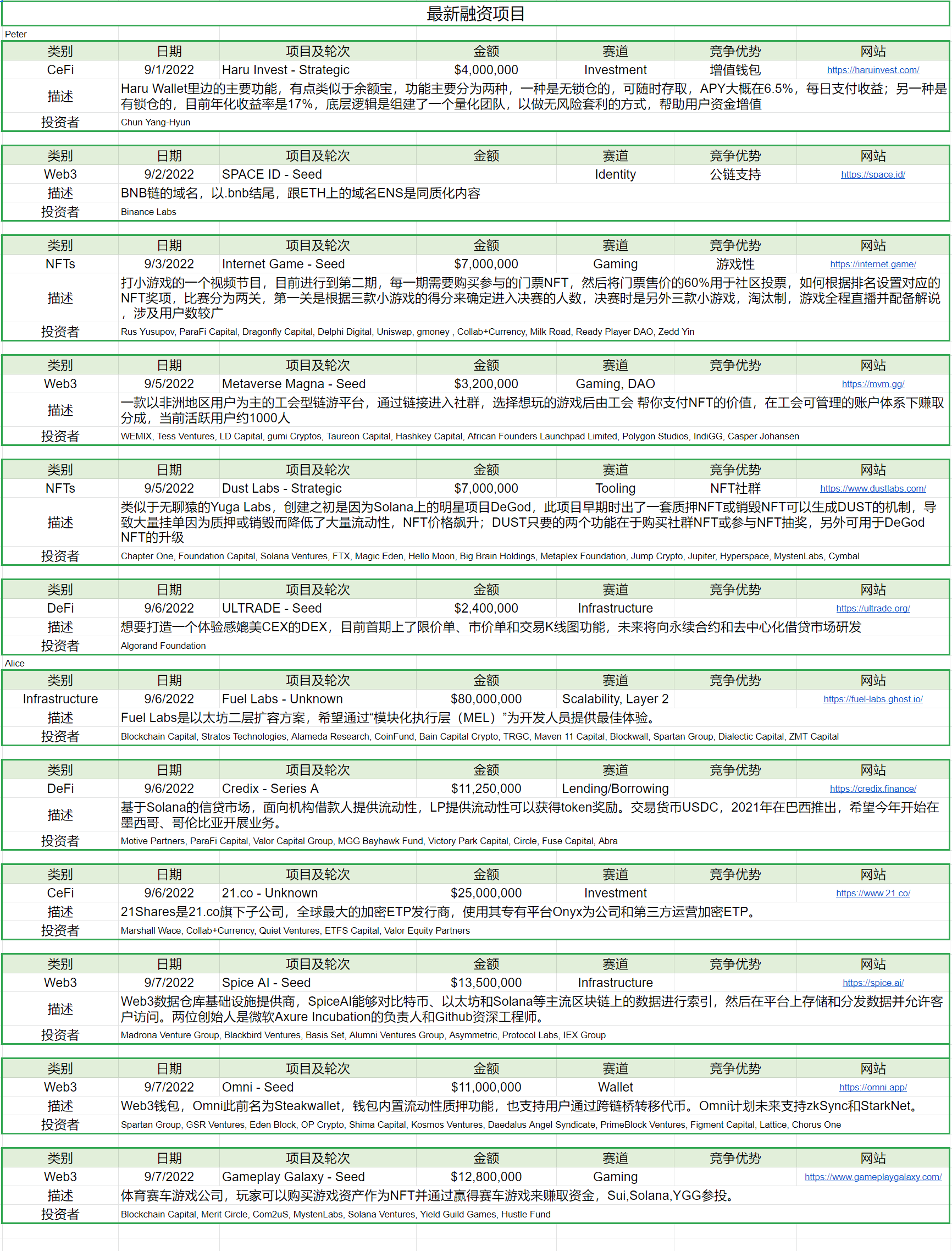

项目最新融资情况