今日上线的Compound III都有哪些改动?

8 月 26 日,龙头借贷协议 Compound 官方宣布其最新版本 Compound III 已于以太坊主网上线。在发布初期,Compound III 将仅开通一个 USDC 基础资产池,同时支持 ETH、WBTC、LINK、UNI 和 COMP 等五种抵押资产。

在今日的新版本上线公告中,Compound 创始人 Robert Leshner 将 Compound III 描述为一个更加精简的协议,称其将更强调安全性、资本效率和用户体验,并在一定程度上降低了复杂性,最终呈现是当前 DeFi 世界内最有效的借款工具。

在今日的新版本上线公告中,Compound 创始人 Robert Leshner 将 Compound III 描述为一个更加精简的协议,称其将更强调安全性、资本效率和用户体验,并在一定程度上降低了复杂性,最终呈现是当前 DeFi 世界内最有效的借款工具。

那么,Compound III 究竟带来了哪些具体变化呢?下文中,Odaily 星球日报将结合自身体验加以梳理。

核心改动:资产池隔离

综合来看,Compound III 最核心的改动在于放弃了其首创的“全池风险模型”(pooled-risk model),改为根据基础资产的不同将各个资产池隔离开来。这里的“基础资产”是一个相对于“抵押资产”的概念,与旧版本(Compound v2)不同,Compound III 在新的协议中对这两个概念做了很清楚的划分。

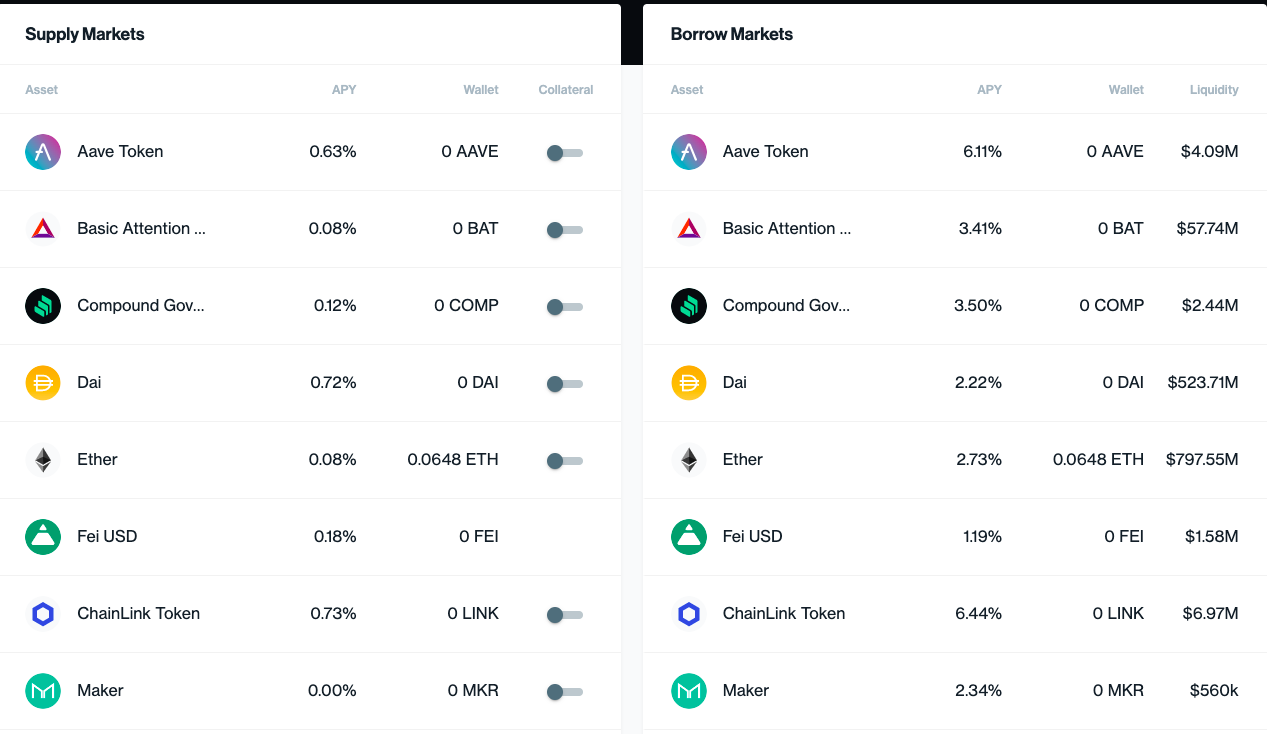

具体来说,在 Compound v2 之中,由于协议允许用户自由存入(抵押)或借出所有已支持的资产,因此这些资产既可被视为“基础资产”,也可以被视为“抵押资产”。如下图所示,以太坊主网上的 Compound v2 现已支持 ETH、COMP、USDC、USDT、DAI 等 17 种资产,用户可以在这 17 种资产内自由选择存入(抵押)某种代币,再自由借出另一种代币,具体借出哪种代币不受限制,甚至还可以将借出的代币再抵押一遍去借出其他代币……总而言之,这些不同的资产池在借贷规则内是打通的。

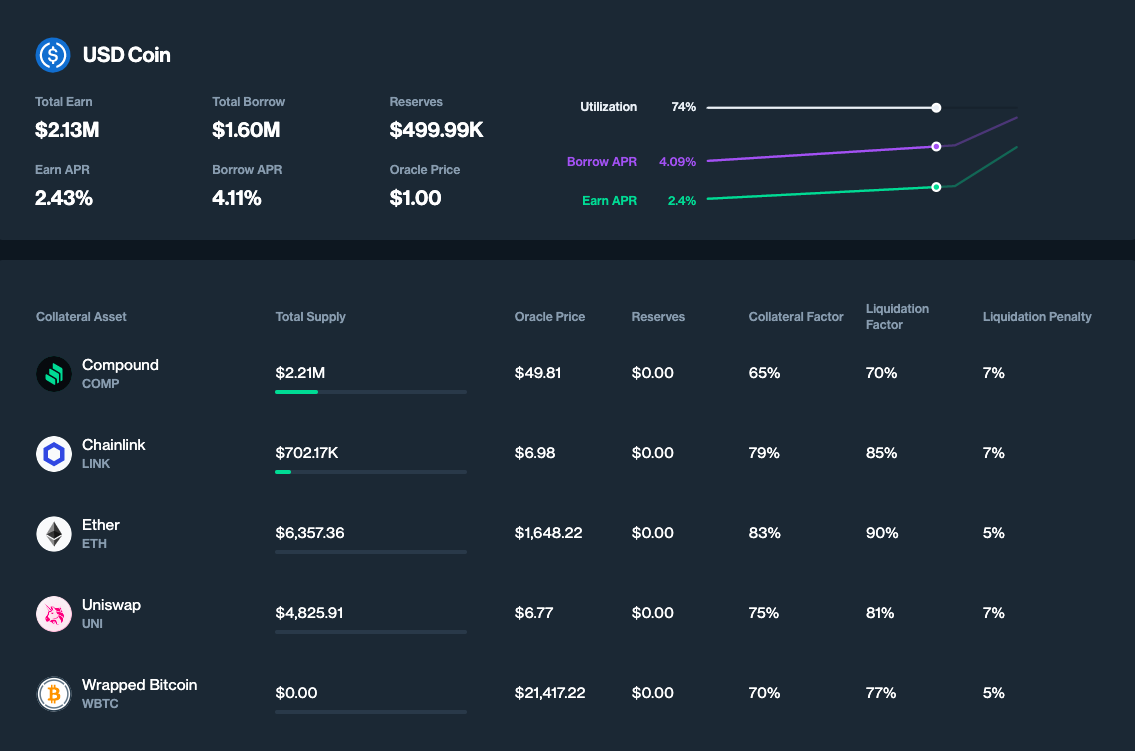

而在 Compound III 之中,每个池子将仅有唯一的基础资产(抵押资产数量不受限制)。如下图所示,以当前已上线的 USDC 基础资产池为例,池内支持 ETH、WBTC、LINK、UNI 和 COMP 等五种抵押资产,这意味着用户可以在这 5 种资产内自由选择存入(抵押)某种代币,但无论存入什么都只能借出 USDC,借出的 USDC 也无法再度作为抵押资产存回该池内。

值得一提的是,在 Compound III 的新模式下,用户所存入的抵押资产将不会再被借出,而是会被静态地存储于合约之内,因此只要保证合理的抵押率,将无需再担心拿不回抵押资产的极端情况(参考 Harmony 上 Aave 最近发生过的故事)。

之所以作出这一改动,Robert Leshner 解释称是因为在完全打通的旧模型之下,单个资产的崩坏极有可能耗尽整个协议的资金,进而造成不可挽回的系统性损失。而随着 Compound III 选用资产池隔离的模型,这一风险蔓延的可能性将从架构层面被彻底切除,从而改善整个协议的安全级别。

连带改动:利率、抵押率、清算率……

由于采用了全新的模型,Compound III 不可避免地也会带来一些连带的影响。

最直接的改变在于利率,在 Compound v2 之内,由于协议所支持的资产均可被借出,所以存入任何资产都可以获得一定的利息收益。但在 Compound III 内,由于可被借出的仅有基础资产(暂时有 USDC),所以单个池子内可产生利息收益的也将只有基础资产,其他可存入的抵押资产(暂时有 ETH、WBTC、LINK、UNI 和 COMP)将不会再有任何利益。

此外,在 Compound III 的全新模型下,抵押率及清算率的设置也将变得更加灵活。具体来说,在旧版本内对某个代币的抵押率及清算率设置会直接对应所有可借出的代币,但在 Compound III 内,各个基础资产池内不同抵押资产的规模上限、抵押率、清算率的设置均需要由治理分别决定,这些参数也将仅对应这一个基础资产池,理论上来说有机会实现更高的资金利用效率。举个例子,假设某个抵押资产崩盘,最坏的影响也就是带崩相关的基础资产池,不会对整个系统造成全面影响。

其他改动:清算机制

Compound III 的另一大关键改动在于清算机制的迭代。

此前,Compound v2 采用的是代还款的清算模式,这需要引入一个全新的角色“清算人”,清算人有清算需求时将代借款人偿还债务,并得到借款人的抵押资产。

而在 Compound III 内(这部分参考了 Eitan K 的文章),“清算人”的角色被淘汰,协议储备金将负责偿还被清算的头寸债务,同时也可获得相应的抵押资产。随着储备金内不同的抵押资产达到某一阈值,清算才会启动,届时相关抵押资产将被折价出售。

如此将带来两大变化,其一是建立了一个清算缓冲区,对于不需要马上出售的抵押资产,储备金会保留资产一段时间,从而避免因 DEX 流动性不足而造成短时间的价格闪崩与连环踩踏,其二是把潜在的坏账损失承担方从贷款者转移到了协议储备金。

小结:DeFi龙头在进化

整体来看,Compound III 几乎是对整个协议的运转机制做了一次再设计。Leshner 称新版本更强调安全性、资本效率和用户体验。前两点其实非常清晰,Compound III 的资产池隔离模型有效阻隔了系统性风险的蔓延,同时独立设置各池参数的新机制也赋予了协议更灵活、更高效的资产利用可能性,至于用户体验这一点,操作层面 Compound III 其实并没有太大改变,熟悉 DeFi 借贷的用户基本看一眼就能上手。

就我个人的感觉来说,如果未来 Compound III 将仅聚焦于将稳定币作为基础资产,其在定位上似乎也应该稍稍有一些调整(有点儿从 Aave 靠近 Maker 的感觉?)。

值得一提的是,Compound III 在代码保护方面效仿了 Uniswap v3 曾经的做法,选择了商业开源许可(BSL)保护,后者曾为 Uniswap 赢得了相当长一段时间的身位优势,从这个角度看 Compound 对其新版本还是有着相当强的自信的。

至于这个新版本究竟能够在 DeFi 这条沉寂了许久的赛道上掀起多大的浪花,鉴于当前 Compound III 刚刚上线,其重点的多链战略也还没有起步,所以暂时无法就此给出答案。不过,看着 Curve、Aave 积极捣鼓着自己的稳定币,Synthetix、Yearn 眼瞅着就要推出 v3,dYdX 做起了自己的应用链……悄然间 DeFi 赛道似乎久违地热闹了起来,或许也是时候将目光再次聚焦回来了。