详解合并后的以太坊交易生命周期:哪些参与者能够捕获价值?

原文作者:David Hoffman

原文来源:Bankless

原文编译:DeFi 之道

在本文中,我们将介绍合并后的以太坊交易生命周期。

你将了解如何构建以太坊上的区块,以及在此过程中哪些参与者捕获了价值

你将了解到每个步骤背后的机制设计

你将看到 ETH 如何在这个过程的最后成为最终赢家

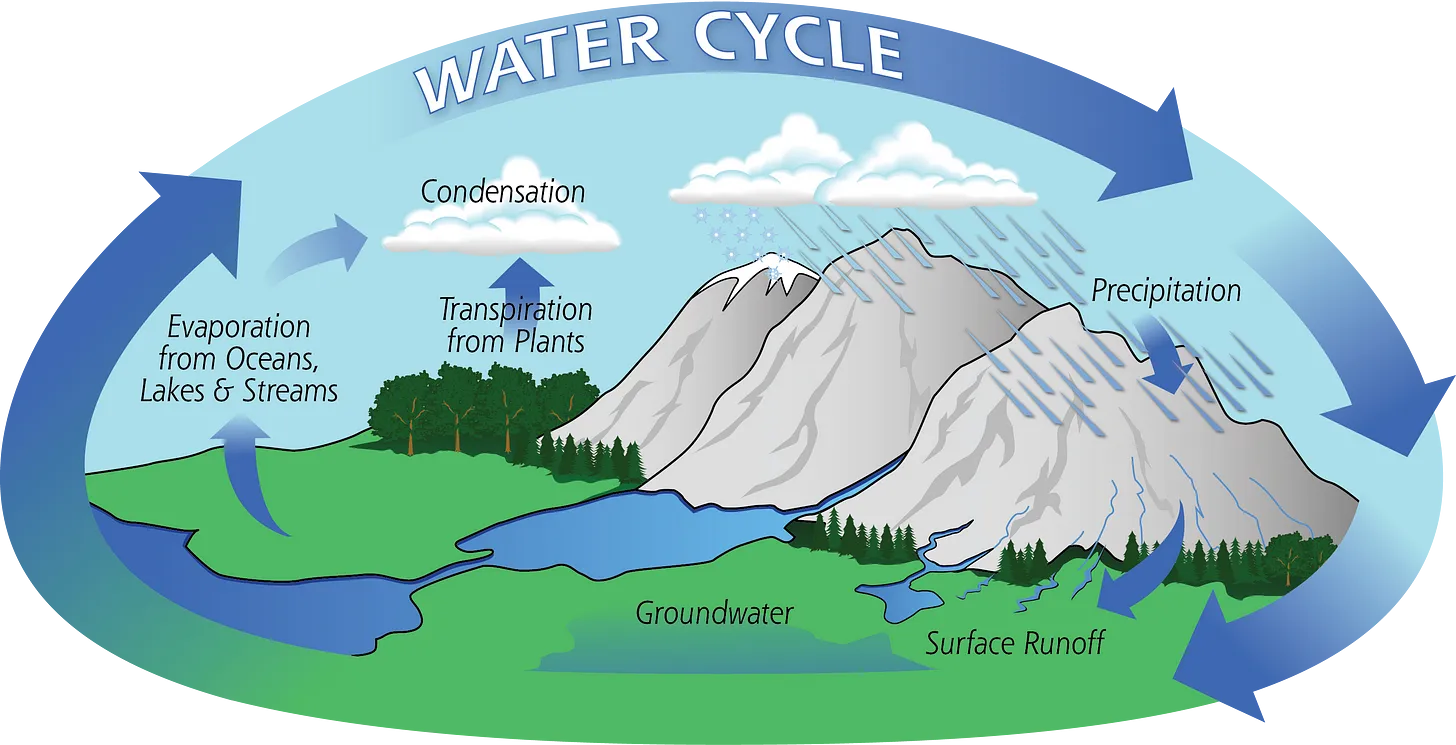

以太坊“流域”

图片来源:Logan Craig

在合并后的世界中,以太坊交易将通过一个非常具体和有序的流程进行。一个强大的交易供应链正在构建,庞大的权力结构即将出现。

以太坊交易供应链的当前状态是生硬而幼稚的。我们都将交易提交给内存池(mempool),套利机器人出现并争夺每一分钱的价值,然后矿工整理所有这些交易以构建一个区块。

在合并之后,以太坊上这个过程被编码并定义到协议中。这从根本上允许 ETH 质押者在每一步骤中利用价值捕获,确保价值在供应链的末端传递给他们。

我曾说过:全面理解加密货币的最佳视角是通过生物学。

加密是一种新兴的有机系统,它模仿自然规律。尽管人类正在建造一些结构,但已发现的“最佳结构”是一种模仿自然的结构。

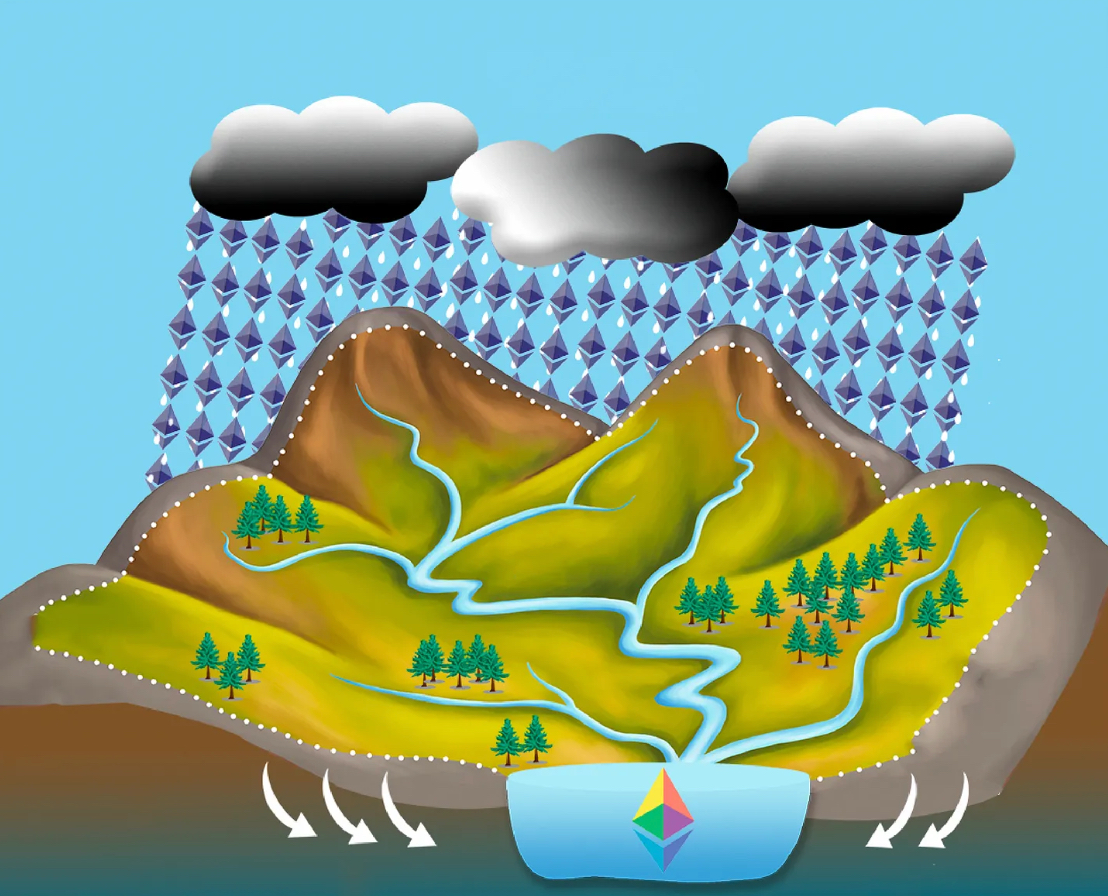

经过多年的研发,以太坊开发者已经建立了一个看起来很像“流域(Watershed)”的交易供应链。流域是将降雨或融雪引导至小溪和河流,并最终流向水库、湖泊或海洋等流出点的陆地区域。

这些雨滴(交易)遍及以太坊。有些去了 Uniswap,有些去了 Aave,有些去了 OpenSea、NFT 铸造厂、DEX 聚合器、桥接器、代币转移等。

但雨滴(交易)落在以太坊的哪个位置并不重要。它终将汇聚到同一个地方并通过相同的过程到达那里。每一滴雨滴都是独特的,落在一个独一无二的地方,但自然法则很快就会接管,水滴会汇聚成涓涓细流,细流汇聚成小溪,小溪变成河流,而河流最终汇集在流域的最深处。

ETH Stakers(质押者)。

我把这个称之为……以太坊流域。

术语汇编

对于处于加密之旅早期阶段的人而言,这个术语表可以帮助你更好地理解本文的其余内容。

优先费用(Priority Fee):以太坊上的所有交易都收取优先费用。从用户的角度来看,这基本上是 gas 费的代名词。你支付的费用越高,你的交易就越快被纳入区块链,因为你增加了交易被选中的动力。

内存池(Mempool):内存池是一个较小的数据库,其中包含每个节点保留的未确认或待处理事务。当一个交易通过被纳入区块而被确认时,它就会从内存池中删除。内存池不是一个规范的东西。每个区块链节点都有自己的内存池版本。有时,交易仅广播给特定实体,使得内存池与其他实体不一致。

MEV:最大可提取价值(Maximal extractable value,MEV)是指在标准的区块奖励和 gas 费用之外,通过包含、排除和改变一个区块中的交易顺序,可以从区块生产中提取的最大价值。任何有权在区块中进行交易的人都能以对自己有利的方式进行交易,确保他们的交易抓住所有可用的套利机会。

MEV 搜索器:MEV 搜索器(MEV Searcher)是一种自动化且高度优化的算法,可扫描区块链和内存池以寻找潜在的套利机会,并在发现该机会时提交尝试捕捉该机会的交易。

交易捆绑包(Transaction Bundle):MEV 搜索器生成“交易捆绑包”,它们是一组被捆绑到一个包中的复杂交易,它整体是一个单一的交易,但其中包含许多交易。就像普通交易一样,它也带有优先费用或贿赂,以纳入一个区块中。

区块构建者(Block Builder):区块构建者将所有的交易捆绑在一起,以及最高优先级的内存池交易,并构建一个符合纳入条件的区块。

区块提议者:你可能知道区块提议者的另一个名字:ETH Staker(质押者)。验证节点,区块提议者提议将区块纳入区块链中。这是正常 ETH 质押过程的一部分,也是交易供应链的最后一步。

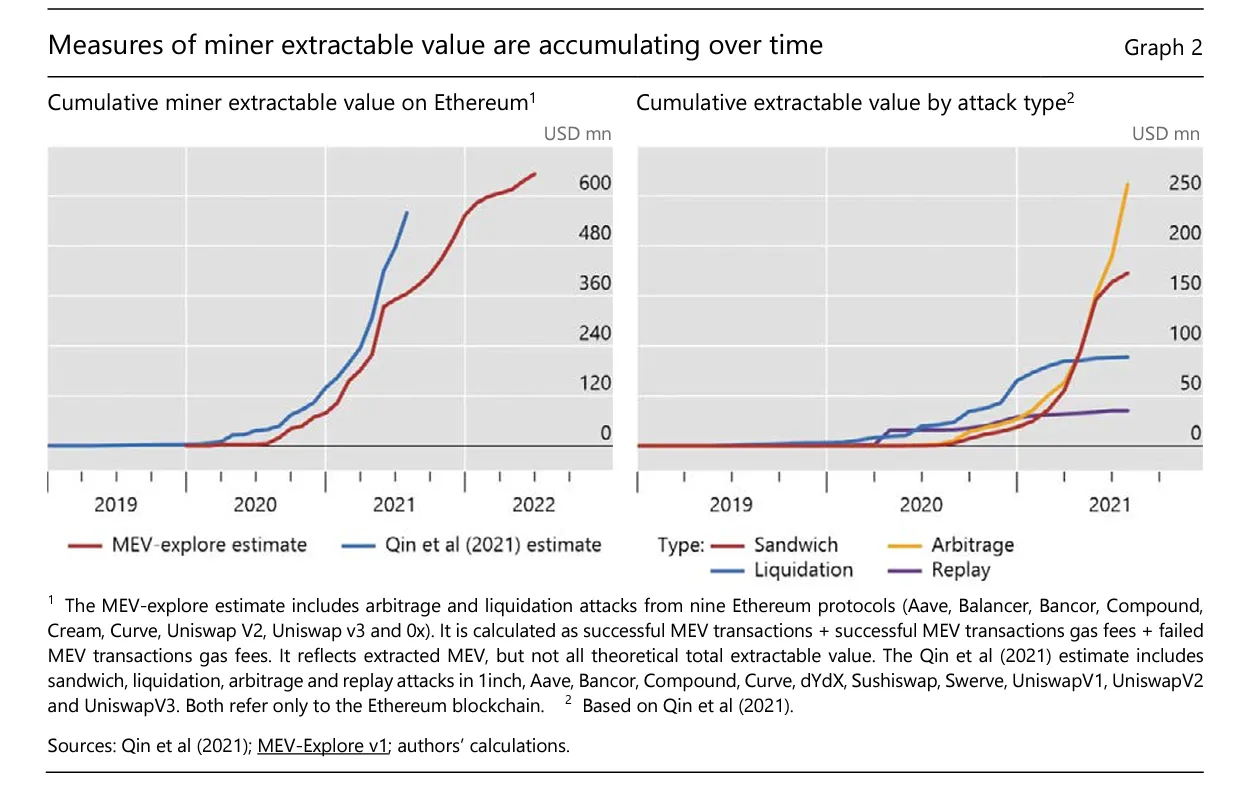

MEV:有多大?

以太坊上的每笔交易都有某种与之相关的价值。如果没有,那么发送者就不会支付 gas 费。有人愿意付出一些代价来改变以太坊的状态。人们付费以改变 Uniswap 上的价格,或提高或降低 Aave 的清算水平,又或是参与某种改变以太坊价格和价值的金融交易。

以太坊上的每笔交易都会产生套利痕迹。当有人在 Uniswap 上购买 ETH 时,他们会将其价格与其他所有市场相混淆,并为套利者创造一个重新平衡的小型机会。所有的金融交易都会为套利机器人留下大量的小型机会。

当你扰乱 Uniswap 池的平衡时,套利机器人会出现,消耗套利,并输出一个更加平衡和健康的生态系统。以太坊的使用率越高,存在的套利总量就越多。套利机器人类似于 TradFi 中的高频交易者,有数以百万计的算法在寻找最微小的差异,而它们都在竞相捕捉这个微小的机会。

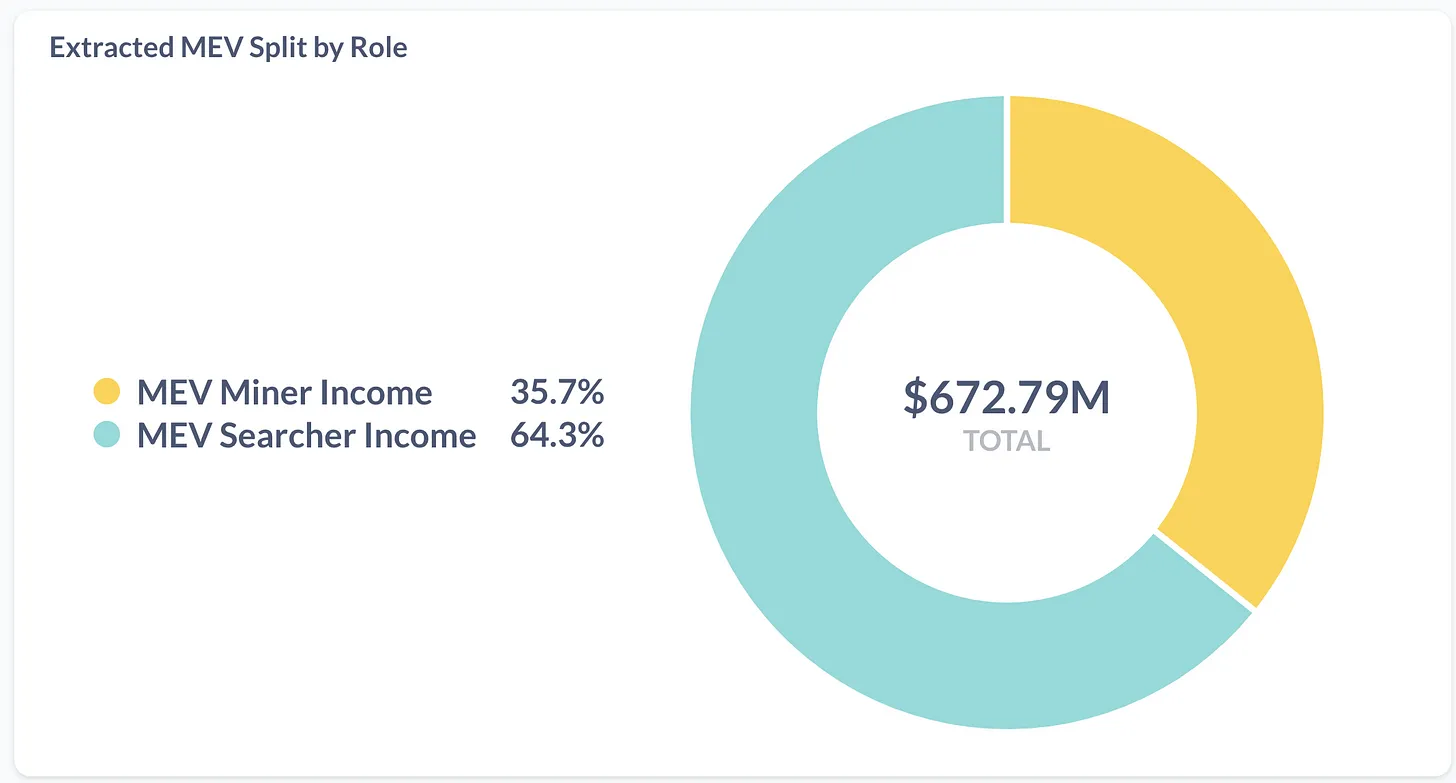

如果用美元定义,MEV 的价值非常大,达到了 6.72 亿美元。下图:

而这仅仅是 MEV 的早期阶段。MEV 价值获取是一个非常有利可图的领域,它必然会迅速地以数量级增长。没有人认为它不会,特别是当人们普遍认为 MEV 不是一个“可解决的问题”时。

往好了说,它可以被利用。但往坏了说,它会把你的区块链变成寡头统治的地狱。

但是不必害怕!以太坊开发人员正在处理这个问题。他们开发了一个系统,利用 MEV 并使其流向下游,然后分发给最广泛的市场参与者:ETH 质押者。

以太坊交易供应链

步骤 0丨交易起源:“内存池”

在交易嵌入到以太坊区块链之前,它们存在于这种称为“内存池(Mempool)”的“未出生”状态。正如上文提及,内存池基本上是所有尚未包含在区块链中的用户交易。

当你在 Metamask 上进行交易时,你会将其广播到以太坊节点网络。这些节点下载这些数据,并将其保存在计算机内存中。

优先费用最高的交易会从交易的海洋中被拖出来,并被添加到一个区块中纳入区块链网络。本文将在下面的剩余步骤中描述如何选择交易以包含在内,因为除了“哪笔交易支付了最高优先费用”之外,还有更多变量需要考虑。

需要注意的是:内存池是一个巨大的交易海洋。每笔交易都有一个与其包含相关的出价,并且它们都在以太坊上做一些事情。

所有交易都有两个与之相关的潜在价值来源:

优先费用:用户可以选择支付明确的贿赂,以获得纳入

MEV :对以太坊状态产生套利机会的二阶效应

交易最终如何成为以太坊区块链的一部分,取决于优先费用的大小和交易的所有相关 MEV。

例如,可以创建一笔费用为 0 美元的交易,基本上是要求矿工免费包含该交易。矿工或验证者通常会忽略此交易。但如果该交易类似于“支付 1,000,000 DAI 以获得 1 ETH”或“出售 Cryptopunk #1118 以换取 1 ETH ”,则该交易将立即被第一个发现它的 MEV 机器人所带走。

简单地说,所有的交易都是有奖励的,要么是明确的优先费,要么是隐含的 MEV 价值。每笔交易的价值都被供应链中的下一个参与者获取:MEV Searchers。

步骤 1丨MEV 搜索器:“微型套利者(Arbitrager)”

MEV 搜索器是高度优化的套利机器人。

每个 MEV 搜索机器人都针对一种特定类型的 MEV 进行了优化,其创建者花费大量时间和人力来改进机器人,以便产生更好的套利并赚取更多利润。

例如,会有一些搜索器被高度优化,以套利 DeFi 中各种 AMM(自动做市商;又名“去中心化交易所”)的不平衡现象。如果 ETH 在 Uniswap 上的价格是 1998 美元,而在 Sushiswap 上的价格是 2002 美元,一个为 DEX 套利而优化的 MEV 机器人将创建一个交易,抓住这个价差并获得一些 gwei。

同样的竞争也发生在 Aave、Maker 或 Compound 等借贷应用程序内部。大量的价值支付给了清算机器人,它们都竞相清算 DeFi 贷款。随着时间的推移,我们已经看到这些 DeFi 清算机器人在较小的利差上展开竞争,确保贷款以市场允许的最优惠利率清算,最大限度地提高贷款保留的价值。

有成千上万的 MEV 搜索机器人在内存池中搜寻,与其他 MEV 搜索机器人争夺价值极小的套利。

随着这些 MEV 搜索器变得更好、更节能,它们将能够争取越来越小的套利,有机地确保 DeFi 是一个高效的市场。

捆绑

这些 MEV 搜索机器人创建“捆绑”交易,因为它通常是一组交易,需要充分捕获可用的套利。机器人需要将所有这些交易按特定顺序包含在他们的操作中,因此他们将它们捆绑在一个整齐的小包裹中,然后将其运送给游戏中的下一个玩家:区块构建者(Block Builders)。

就像普通的交易者一样,每个 MEV 搜索机器人都会为他们创建的每个交易包提交一个“出价”。这是机器人愿意支付给区块构建者以包含他们的捆绑包的价格。由于这种 MEV 套利游戏竞争激烈,利润变得极其微薄。

由于这些 MEV 机器人处于一个快速的竞价升级游戏中,为争取纳入区块而战,MEV 搜索者支付给区块构建者的出价几乎接近它们提取的套利的全部价值,这意味着区块构建者捕获的价值量自然接近 MEV 搜索者所能提取的 99.99%。

步骤 2丨区块构建者:“宏观套利者”

“区块构建”的作用很直白。区块构建者尽可能建造最有价值的区块,然后出价让区块提议者(ETH 质押者)接受他们的区块。

这听起来很简单,但为了尽可能地盈利,构建者必须具有高度的竞争力。

区块构建竞争有两个向量:

硬件和网络

订单流(Order Flow)

硬件和网络

区块构建者必须经历一个计算密集型的交易模拟过程。

构建者不能不考虑其内容就盲目地包含每一个交易捆绑包。搜索者提交的许多交易捆绑包将追求相同的套利机会,如果一个懒惰的构建者包括冲突的交易捆绑包,那么第二个交易捆绑包将被拒绝,并且构建者将丧失其相关的投标。

糟糕的是,区块空间是宝贵的,构建者必须对它包含在一个区块中的交易进行超级优化。

因此,区块构建者会经历一个密集的交易模拟过程,在这个过程中,他们会播放每笔交易,以检查是否存在冲突。他们将运行所有可能的交易捆绑包,以找到最有利可图的组合,然后用基本的内存池交易填充剩余的区块,并向区块提议者竞标,将其纳入。

所有这些都在12秒内完成。

订单流

回到上文提到的关于以太坊内存池的内容……

内存池不是一个规范的东西。“规范的东西”和“唯一的事实来源”是以太坊区块链。在交易“进入区块链”之前,它处于一种不确定的状态。

每个以太坊节点都有自己的内存池版本。当你通过 Metamask(或任何钱包)进行交易时,你正在将你的交易广播给每一个愿意倾听的以太坊节点。毕竟,你只希望交易包含在区块内……但不关心谁去做。

然而,这并不是对每个行为者都是如此。广播交易其实就是“展示你的卡片”,是在告诉世界你想做什么。如果“你在做什么”代表着“我有一堆市场不知道的 alpha”,那么向所有愿意倾听的节点广播该交易,肯定会让你失去你正试图获得的 alpha 的每一分钱。

观看一个非常古老的 Bankless 剧集:“以太坊是一片黑暗的森林”

好的,所以你在以太坊上看到了一堆 alpha……但如果你广播你的交易,你就会把这些 alpha 透露给一些 MEV 机器人,它们肯定会先发制人,因为这就是它们的工作。

那么应该怎么做?私人订单流。

你无需向所有人广播此交易,而是与同意处理你的交易而不向其他所有人广播的矿池达成链下协议。

例如 Flashbots,已经开发了“Flashbots Protect”,以民主化访问这种权力。你可以在这里查看。

这里要吸取的教训:并非所有的内存池都是平等的。具有更好的内存池愿景和访问私人交易订单流的实体将能够利用市场其他部分的套利机会

这些是区块构建者竞争的载体:无论是通过改进的硬件和网络,还是用于订单流的私有链下协议。

竞价区块

区块构建者通过收集来自 MEV 搜索者所有交易捆绑包的出价,以及来自单个交易的所有优先费用来赚钱。例如,这将变成一个可以为他们提供 2.2 ETH 的区块。然后,他们将对区块提议者提出的该区块进行 1.9 ETH 的出价,以试图获得 0.3 ETH 的差价。

就像 MEV 搜索者一样,区块构建者将是高度竞争的。一个真正优秀的区块构建者可以生成一个有 3 ETH 价值的区块,并为其出价 2.2 ETH。但另一个区块构建者可以构建一个只有 2.4 ETH 价值的区块,并为其出价 2.3 ETH。

自然,理性的区块提议者会接受 2.3 ETH 的竞价区块,而接受较小差价的构建者则将现金收入囊中。

利润率下降得非常快。

步骤 3丨区块提议者:“ETH Stakers”

最后一步是将区块实际添加到区块链上。

运行验证节点的 ETH 质押者,只需选择与之相关的出价最高的区块。

他们甚至不需要做任何工作,只需选择最有利可图的区块头并签署一个信息,表示他们以 32 ETH 债券的完全信任和信用来批准这个区块。

要点:通过机制设计实现平等

以太坊开发者花费了大量的时间和研发来使 ETH 质押尽可能容易和民主,使 ETH 可以在基本的消费硬件上进行质押,并使用尽可能少的 ETH( 32 ETH,阅读此线程以了解为什么它是当前理论上的最低数字)。

这些是以太坊的价值观:使家庭验证和参与共识尽可能民主和可访问。不管你的背景是什么,你只需要基本的消费硬件和一些 ETH,就可以参与以太坊的质押。像 Rocket Pool 和 Lido 这样的应用层创新有助于降低 32 ETH 的门槛,并且在未来,对于单独质押者而言,32 ETH 有可能降低到 16 甚至 8 个。

我们已经发现 MEV 是以太坊中的一个大问题,它有可能将 ETH 的供应集中到少数特权方,这些特权方可以比其他任何人更好地提取 MEV。这一现实威胁着保持以太坊去中心化和民主化的所有努力。

那么,开发者做了什么?他们利用机制设计来利用 MEV,并将其置于 ETH 持有者的手中。

作为 ETH 质押者,你知道如何运行 MEV 搜索机器人吗?你知道如何构建最优化的区块吗?通过上述过程,你就不需要这样做。整个供应链受制于堆栈中最去中心化和可访问的部分:ETH 持有者(holders)。

MEV 搜索器机器人的利润率,在被区块构建者争取纳入的过程中得到了最大限度的压缩。而区块构建者的利润,则在区块提议者争取纳入的竞争被最大限度地压缩了。

区块提议者就是 ETH 质押者。最好的 MEV 搜索机器人的所有潜在中心化威胁都会向传递给区块构建者,然后再传递给 ETH 质押者。

而这对 ETH 来说,非常利好。

那么,它真的会在 ETH 质押者这里结束吗?

不一定。

Blocknative 的 Matt Culter 认为,这种竞争实际上会回到交易起源点:钱包。

由于每笔交易都有相关的价值,因此钱包成为消费者互动的一个非常活跃的场所。钱包成为专有交易流的来源。而区块构建者可以利用交易流。

因此,区块构建者可能会为他们的交易流支付钱包费用。例如,一个专门的区块构建者可以向 Metamask 支付很多钱,只将交易路由给他们,而不是向全世界广播。

这听起来很糟糕!Metamask 用户的交易将像 Citadel 和 Robinhood 一样被欺骗。

但我不认为会是这样。相反,我认为它会产生诸如信用卡积分或航空里程之类的东西……而不是像 ETH 或 DAI 这样的实际货币奖励。

钱包会付钱让你去使用它们。从逻辑上讲,通过这个过程提取的所有利润可能都归结于交易发起者(也就是你),你的钱包服务提供商会给你回扣。

这就是以太坊交易流域的循环周期。

在交易的价值汇聚到一个中心池之后:ETH 质押者就会蒸发到空气中,它蒸发到空气中,凝结成云,再次降雨到山上,回到漏斗的顶部,并为以太坊生态系统提供源源不断的养分。

对此,建立了一个自我延续的生态系统,并让一千个 dapps 绽放。