Comprehensive interpretation of sudoswap: team, features and currency planning

Originally written by Karen, Foresight News

After Uniswap acquired Genie, an NFT aggregation market, it announced that it will realize NFT transactions through sudoswap. Just half a month before Uniswap officially announced the partnership, sudoswap, which was originally an NFT OTC trading platform, launched an NFT on-chain market protocol sudoAMM.

AMM agreement

sudoswap development and team

sudoswap by anonymous developer@0xmonsConstruction, the Alpha version of the peer-to-peer trading platform designed for NFT will be launched as early as the second quarter of 2021. This version is supported by 0x V2, allowing users to exchange freely among ERC-20, ERC-721 and ERC-1155 assets. Assets are transferred only when exchanged. To put it simply, user A creates a redemption request, then sends the redemption link to designated user B (or allows anyone to purchase), then user B accepts the transaction, and the assets are transferred at the same time.

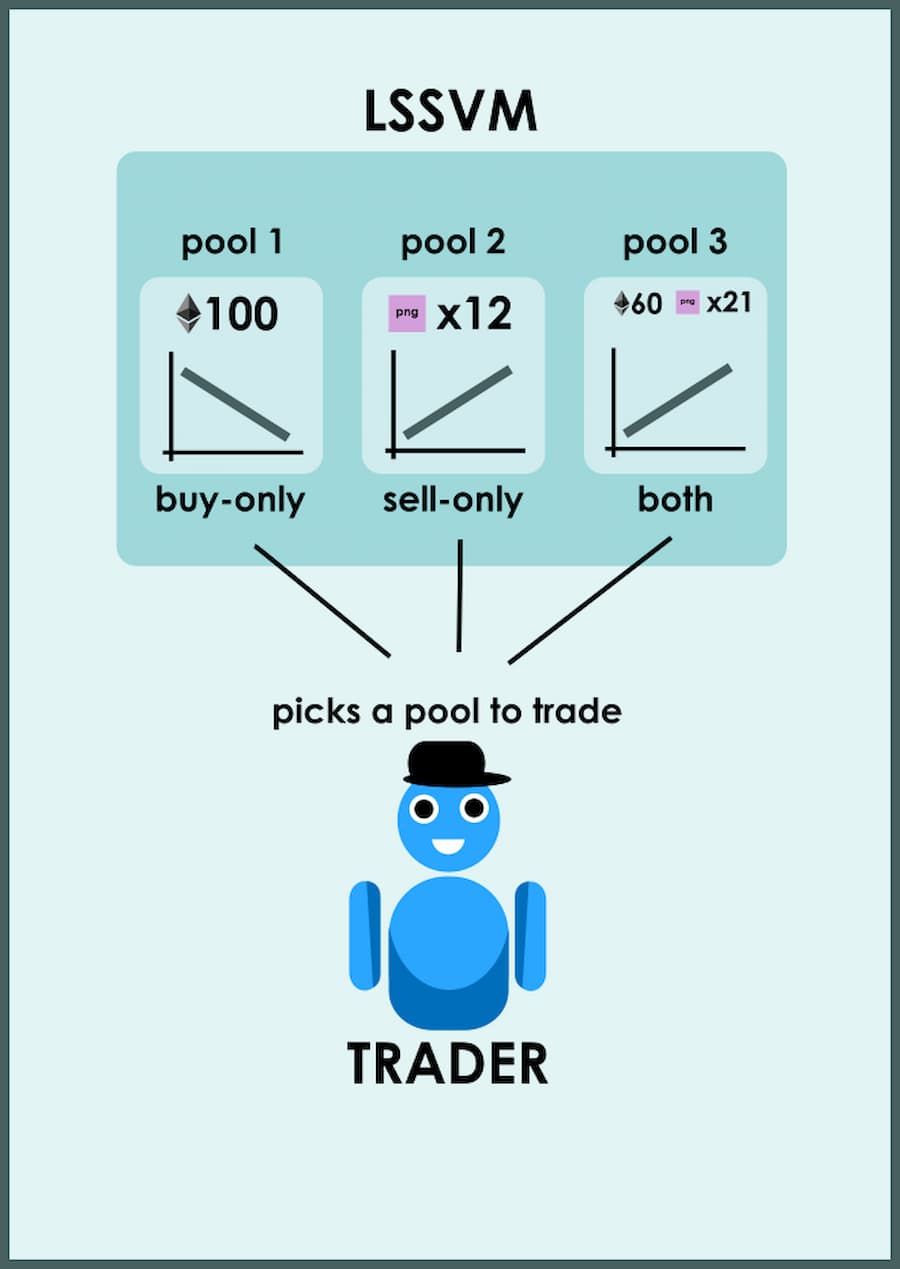

The latest sudoAMM launched by sudoswap is actually0xmonsNFT conceived from the beginningAMM agreement(i.e. LSSVM) and a major upgrade of sudoswap. The LSSVM prototype consists of many individual NFT pools, each pool is managed by a liquidity provider and parameterized by a custom bonding curve, and traders can then trade within a single NFT pool or across multiple pools.

In addition to 0xmons, the initial development team of sudoAMM also includes BoredGenius, the person in charge of smart contracts, and 0xhamachi, the back-end developer. BoredGenius is also the builder of protocols such as Timeless Finance, 88mph, and Astrodrop.

In addition to 0xmons, the initial development team of sudoAMM also includes BoredGenius, the person in charge of smart contracts, and 0xhamachi, the back-end developer. BoredGenius is also the builder of protocols such as Timeless Finance, 88mph, and Astrodrop.expressexpress

What are the features of sudoAMM?

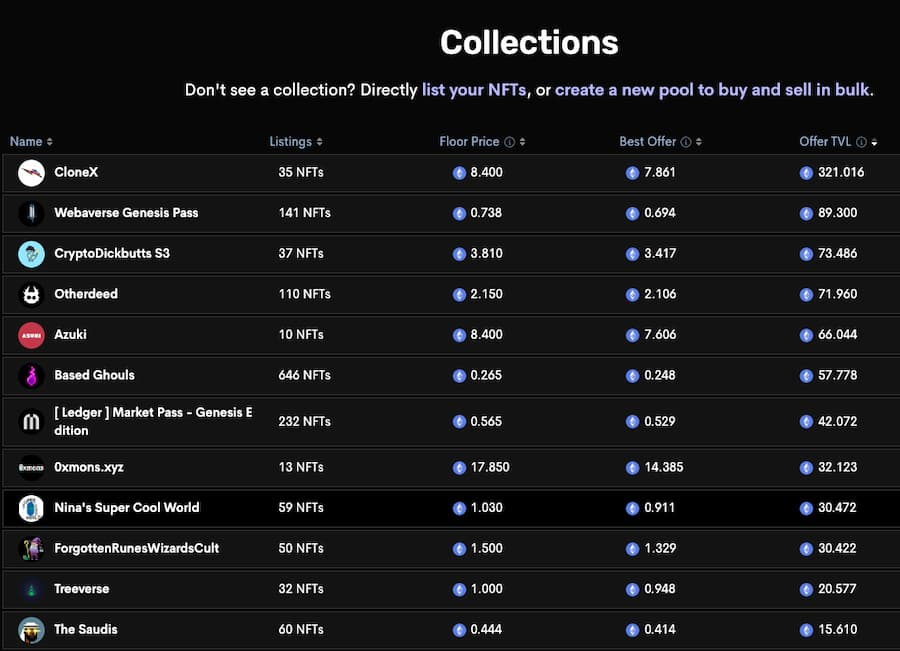

sudoAMM currently only supports ERC-721 NFT, and will release support for ERC1155 and ERC20 token routing later. It currently provides the creation of NFT unilateral pools (pools for buying or selling NFTs) and ETH and NFT bilateral pools, but only bilateral pools flow Sex providers can earn transaction fees. The main features of sudoAMM are low platform transaction fees (only 0.5%), on-chain liquidity pools, no royalties and low Gas. In addition, sudoAMM has also made further optimizations in terms of user experience, including series quotations, shopping carts, and floor price sweeping functions.

sudoswap express, the logic and code of sudoAMM have been optimized in order to save gas fees for traders. When trading NFT in batches, sudoAMM can save up to 40% of Gas fees.

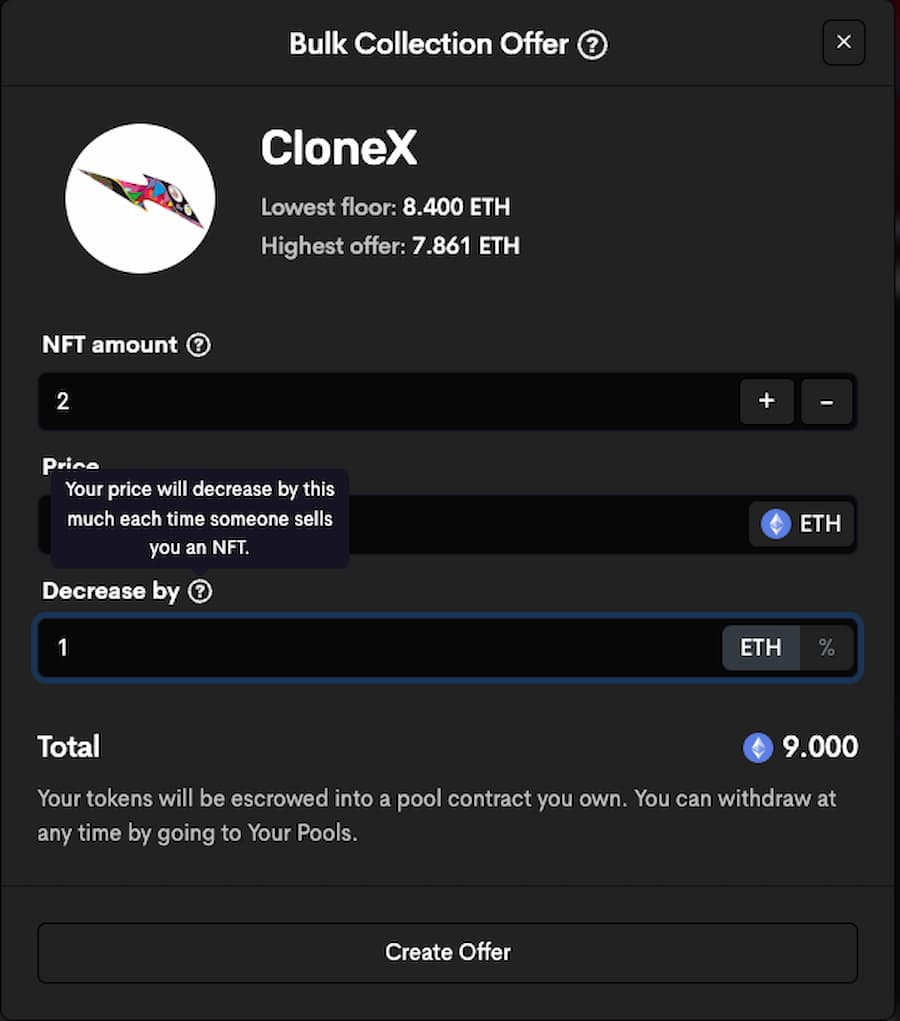

Here we focus on the price setting of sudoAMM. Users can choose one of the linear curve or exponential curve, and then set the Delta value, which can also be 0. After the pool is created, the user can also choose to continue to deposit NFT or change the price data.

Source: https://blog.0xmons.xyz/83017366310

Here we focus on the price setting of sudoAMM. Users can choose one of the linear curve or exponential curve, and then set the Delta value, which can also be 0. After the pool is created, the user can also choose to continue to deposit NFT or change the price data.

For example, when creating a pool for selling 5 NFTs, set the starting price to 2 ETH. If you choose a linear curve and set the Delta value to 0.5, then the price of the first NFT is 2 ETH, the second is 2.5 ETH, and the second is 2.5 ETH. Three are 3 ETH, and so on; if the exponential curve is selected and the Delta value is set to 50%, the price of the second NFT is 3 ETH, and the third is 4.5 ETH.

SudoAMM's series of quotations is actually equivalent to creating an NFT purchase pool. You can choose a linear curve or an exponential curve. Unlike OpenSea, etc., since sudoAMM is an on-chain liquidity protocol, the tokens used for quotations will be entrusted to users. In the pool contract of , of course, you can also withdraw funds from this contract at any time.

SudoAMM's series of quotations is actually equivalent to creating an NFT purchase pool. You can choose a linear curve or an exponential curve. Unlike OpenSea, etc., since sudoAMM is an on-chain liquidity protocol, the tokens used for quotations will be entrusted to users. In the pool contract of , of course, you can also withdraw funds from this contract at any time.

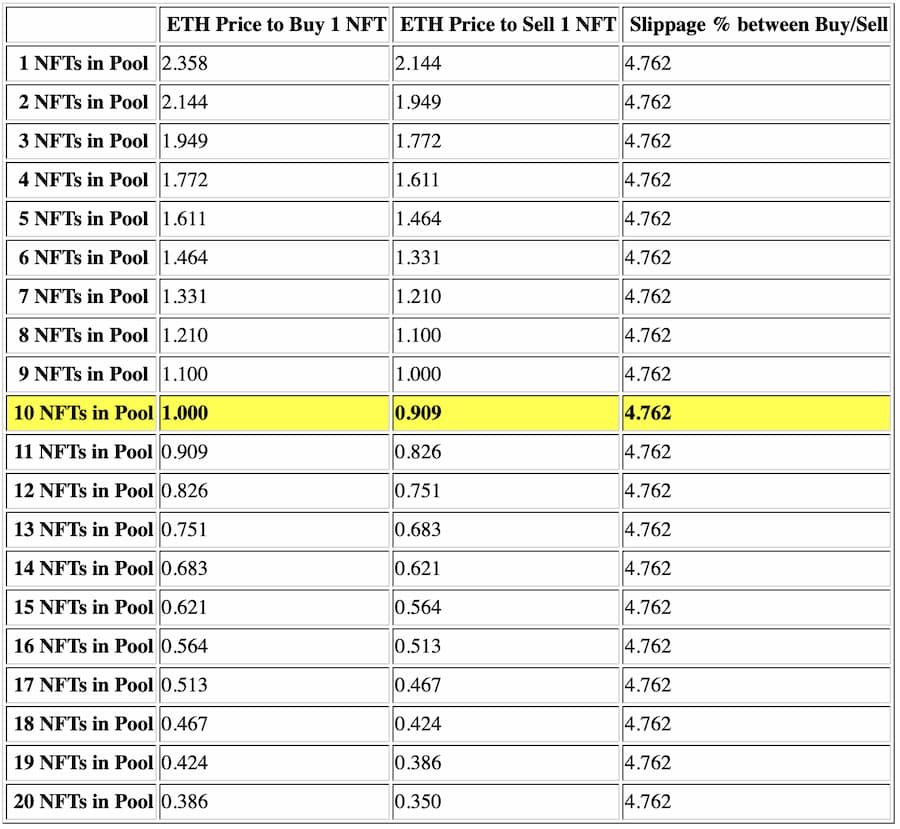

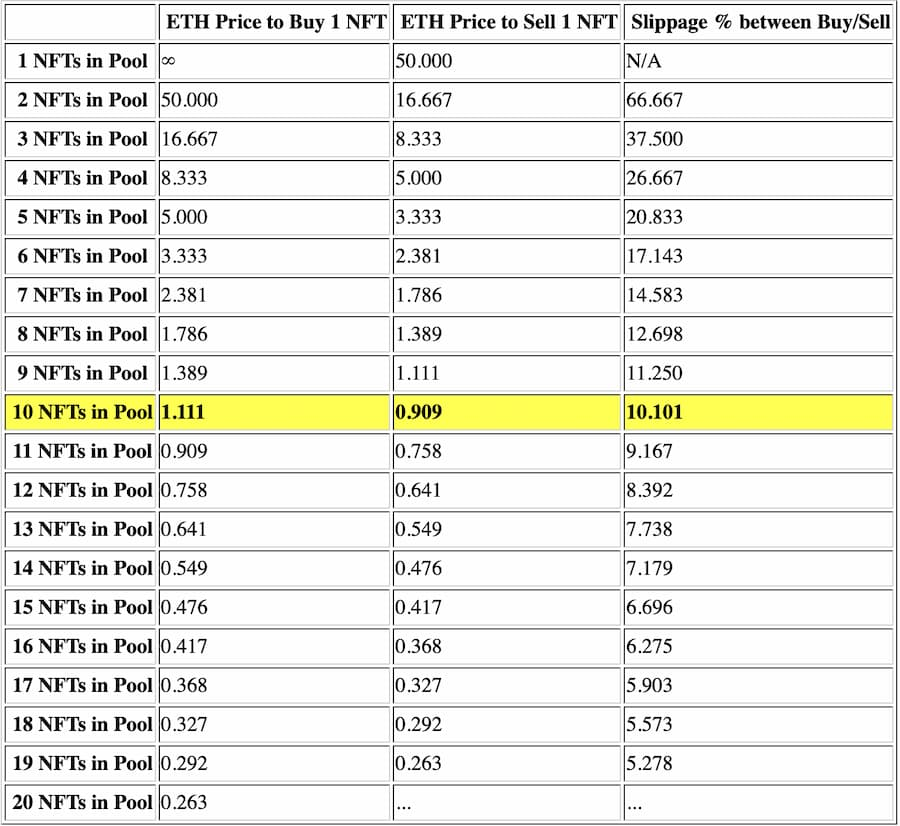

In addition, the slippage in sudo AMM is also fixed. Since the price change is relatively narrow, if you buy or sell multiple NFTs at once, the average price of the transaction will also be lower. For details, please refer to

x*y=k In the pool, the ETH required for each trader to buy or sell an NFT

In addition, the slippage in sudo AMM is also fixed. Since the price change is relatively narrow, if you buy or sell multiple NFTs at once, the average price of the transaction will also be lower. For details, please refer to0xmonsComparison of previously published sudoAMM and constant product (x*y=k).

From a smart contract perspective, when new pools are created, tokens representing liquidity positions are also not received as each liquidity pool has a unique smart contract associated with and owned by the creator.

From a smart contract perspective, when new pools are created, tokens representing liquidity positions are also not received as each liquidity pool has a unique smart contract associated with and owned by the creator.

Perhaps the most critical question, will sudoswap issue coins?

expressexpress, "SUDO tokens will be released. After the NFT AMM is released, it will gradually turn to DAO and put the tokens on the agenda. Since there is no VC, it should allocate more generous airdrops to the team and the community. The community mainly considers XMON holdings holders and 0xmons NFT holders." When sudoAMM was officially announced, sudoswap also emphasized that the sudoAMM protocol will be managed by SUDO governance tokens, and the distribution details of SUDO tokens and their utility for XMON holders will be announced later.

At the end of 2020, 0xmons released the digital collection series 0xmons, which was inspired by Pokemon, SCP and Lovecraft. The maximum supply of the currency XMON is 10,000, and the current quotation is as high as 34,000 US dollars. It has risen nearly 5 times in the past month and more than 15 times in a year. The valuation of the fully diluted token is 340 million US dollars.

In summary, it can be found that sudoAMM has made significant improvements in terms of liquidity provision, flexibility and efficiency during transactions, such as allowing the provision of unilateral liquidity pools for NFT or ETH, pairing NFT and ETH, and adjusting liquidity at any time Pool parameters, two-sided pool creators can set their own fees, optional pricing curves, etc.

summary

In summary, it can be found that sudoAMM has made significant improvements in terms of liquidity provision, flexibility and efficiency during transactions, such as allowing the provision of unilateral liquidity pools for NFT or ETH, pairing NFT and ETH, and adjusting liquidity at any time Pool parameters, two-sided pool creators can set their own fees, optional pricing curves, etc.

However, since sudoAMM is completely on the chain, operations such as listing or unlisting NFTs, bidding, and receiving quotations require payment of Gas fees. Although sudoswap claims to be able to effectively reduce the required Gas fees, but for frequently operated NFT Degen Or it is not a small expense when the Ethereum network is congested.

In addition, in sudoAMM, the corresponding ETH and NFT when listing or bidding for NFT must be stored in escrow, regardless of security issues, especially for some NFTs with additional utility (such as governance, potential airdrops, service access and even display) It is not very attractive, and the capital efficiency of sudoAMM is much lower than that of OpenSea for NFT buyers. More importantly, most of the current popular NFT series have rare attributes, and driving reasonable pricing is also a considerable challenge for sudoAMM.

In addition, in sudoAMM, the corresponding ETH and NFT when listing or bidding for NFT must be stored in escrow, regardless of security issues, especially for some NFTs with additional utility (such as governance, potential airdrops, service access and even display) It is not very attractive, and the capital efficiency of sudoAMM is much lower than that of OpenSea for NFT buyers. More importantly, most of the current popular NFT series have rare attributes, and driving reasonable pricing is also a considerable challenge for sudoAMM.

refer to:

https://blog.sudoswap.xyz/announcing-sudoamm.html

https://blog.sudoswap.xyz/deep-dive-1-sudoamm-vs-the-other-amms-they-told-u-not-to-worry-about.html