原文作者:Sally,IOSG Ventures

原文编辑:Olivia,IOSG Ventures

tl;dr:

NFT如何定价一直是一个有趣的话题。因为定价是一个不可避免的中间操作,包含着可计算和不可计算的两部分问题,在任何NFT Fi的应用场景下都需要解决。想要将NFT普遍应用到DeFi中,彻底激活NFT的流动性,首先我们需要对NFT这一资产价值做出尽可能真实且能被广泛接受的估值判断。

然而NFT由于以下三个方面,难以像传统金融资产一样被简单进行评估计算:

NFT非同质化属性所导致其内生的主观性和非流动性

NFT的稀有度相对模煳,并且稀有度和价格水平不完全正相关

NFT价格波动剧烈(受团队和政策问题影响经常发生暴拉和暴跌)

而如果定价机制无法得到很好的解决,那么NFT贷款交易等行为往往会因高风险而难以赢得市场信任,进而导致两个问题:

缺乏支撑交易池深度的充足流动性

难以构建NFT形式的多样化金融衍生品

为了解决这一问题,市场上越来越多NFT定价平台和新兴方法正在涌现。在这里我们可以简单将这些定价解决方案分为两类:

同行定价类: 又可细分为 (a)主体评估定价和(b)流动池博弈定价

预言机定价类:又可细分为 (a)TWAP定价和(b)链下计算定价

Peer同行定价

a.Crowds主体评估定价

主体评估定价是目前主观性较强的一种定价形式。以Taker V1为代表的流动性借贷协议,可以通过将DAO的利益与贷款人的利益相结合,以主体评估和投票决策的形式对NFT进行白名单划分和定价,从而在一定程度上对贷款人所面临的风险敞口进行缩减。同时,这种方式对NFT资产的质量要求没有限制,可以被广泛应用于长尾和新兴NFT藏品的价格发现。然而这种方式对curator的判断能力依赖严重,并且其无法提供实时更新的NFT价格,整体效率较低。

Taker V1

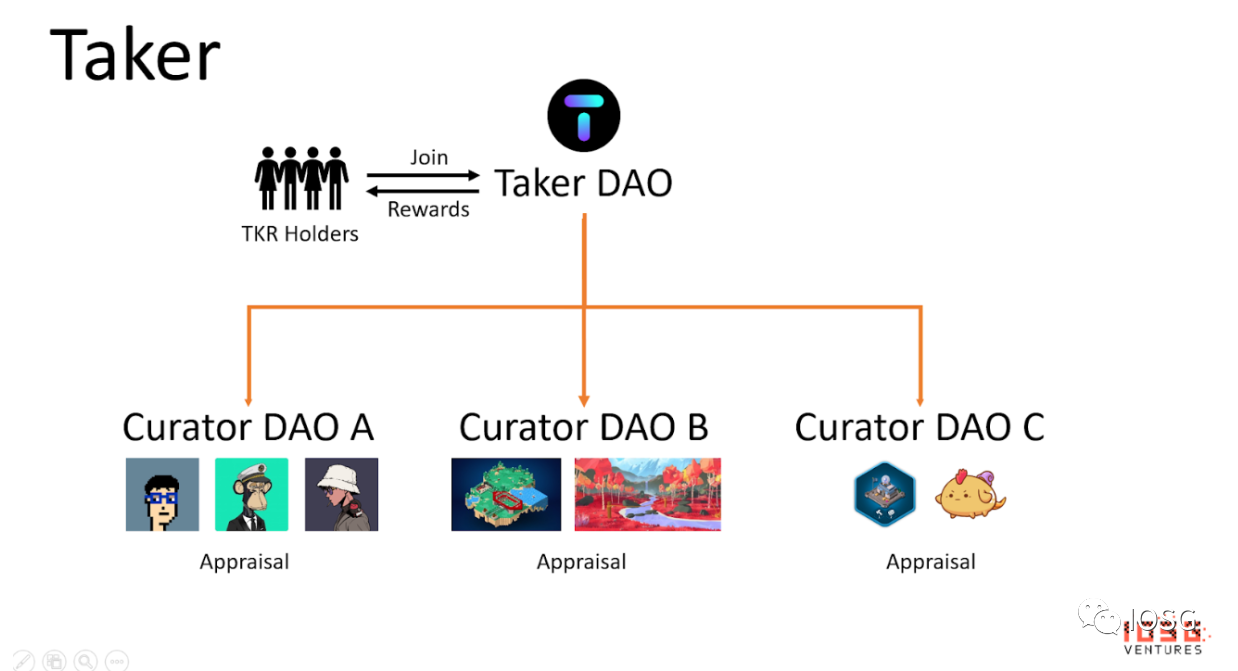

Taker是一个NFT资产的流动性协议,主要通过DAO的形式来为NFT借贷提供流动性,支持包括NFT,证券,合成资产等在内的多种形式的资产。持有TKR代币后可获得DAO成员资格,参与决策借贷利率和公平定价等设计。同时,持有TKR也能通过质押获得额外收益。

Taker DAO内部设有多个curator DAO(sub-DAO), 每个sub-DAO可以自行管控自己的白名单及白名单上任何NFT的地板价以防借款人违约。此外,sub-DAO的成员通过集体投票,决定将自有国库的资金投入特定类型的NFT资产上。比如有些sub-DAO可以只关注Metaverse土地类资产,有些sub-DAO可以只关注pfp艺术类资产。

在Taker群体定价的模式下,完整的借贷流程如下:

Taker社区成员(贷款人)向DAO存入资金。

DAO铸造DAO代币(TKR)以代表成员的股份

Curator(发起人)对所发起的DAO中NFT藏品进行主观定价

借款人以NFT为抵押,根据Curator的评估价格进行贷款

借款人用利息偿还贷款

DAO成员获取奖励(根据利息收益率)

随着DAO的发展壮大,DAO成员获chi得的收益累增

b. Spot流动池博弈

流动池博弈定价机制和defi类似,主要是通过乐观的质押凭证机制,即由流动性提供者根据自己对价格的预期进行质押,从而将NFT的估值和流动池内的资产价格进行绑定。这也是一种很大程度上依赖于LP主观决策的定价方式,优势是其可以实现NFT的实时估值,将交易价值与真实价值挂钩,释放出更大的流动性。但其也存在定价机制复杂,不适用于对低价值的长尾NFT进行大量快速定价等问题。

Abacus

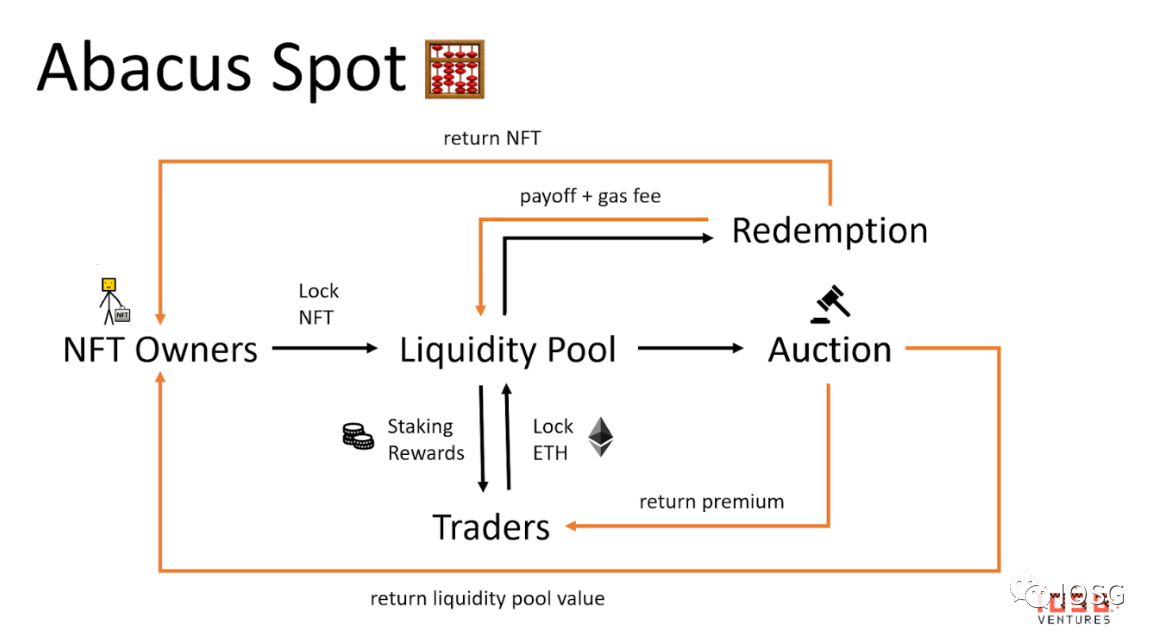

Abacus是一个简单清晰的NFT估值系统,主要利用乐观PoS来创建一个以流动池为基础的NFT估值方法。Abacus的估值方法分为两种,一种是我们上述提到的群体定价,另一种就是我们这里所讨论的流动性定价。其流动池内的价值折算成ETH就相当于是开池NFT的价值。在这种机制下,相当于制定了一套ETH/NFT的交易对,可以像Opensea一样对NFT价格进行实时反映。

基于其流动池定价方法,完整的借贷流程如下所示:

1.开启池子:

NFT非托管,所有者需要在池子上签名作为凭证(proof of life)

所有者将收到一个NFT(ERC721)代币来代表他们的财产并赚取交易费

2.交易者将ETH锁在池中

决定锁定的ETH的数量:如果资金池是2eth,但交易者认为NFT价值2.5eth,交易者可以把0.5eth放入资金池,现在资金池价值2.5eth。

决定锁定时间:如果交易者认为价格只会在当前价进行短暂停留,可以只锁定2周。相反,如果交易者对底价有信心,可以锁定更长的时间,从而获得更多的奖励。

3.NFT所有者开启释放

4.NFT所有者发送贷款请求

5.所有权被转让给借贷平台

6.借贷平台检查现货规模和锁定时间

7.借贷平台发放贷款

8一旦借款人未执行还款,NFT将被立即拍卖

Oracle预言机定价

a.TWAP

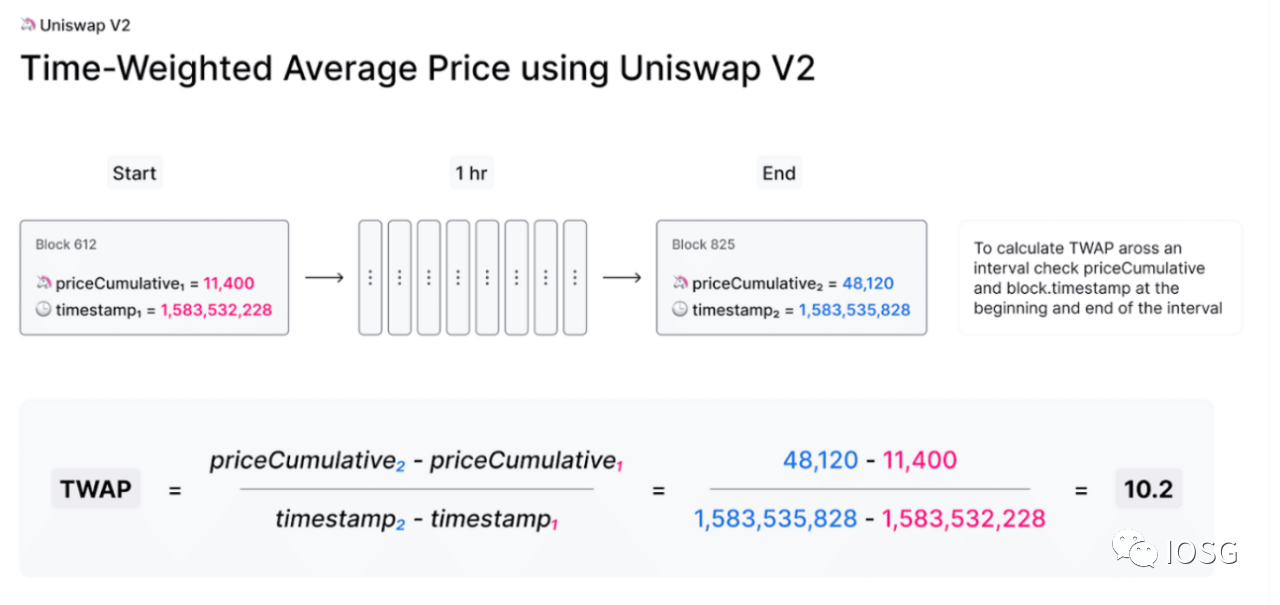

预言机对NFT进行定价评估的典型方式就是基于简单的传统算法交易策略,在对NFT销售价格和底价进行加权平均计算,从而综合得到一个TWAP(Time Weighted Average Price)。举一个简单的例子,如果我们想计算时间间隔为1个小时的TWAP价格,就可以取开始和结束的累计价格P1和P2的差值,以及开始时间T1和结束时间T2的差值,将两者相除,从而算出这1小时内的TWAP。最为人所熟知的TWAP预言机包括Chainlink和Uniswap的V2。

实际上TWAP定价是最容易实现和最高效的一种方式,只要通过集成、爬取和清洗NFT交易平台的价格数据,在设定的时间序列内选取多个价格取均值就可以降低恶意操纵的可能,提供一个能被接受的、相对准确的NFT价格。

然而TWAP并不是一个完美的解决方案,因为在极端市场环境下,当价格出现剧烈波动时,TWAP预言机就很容易受到影响而变得不准确。因此TWAP被认为只适用于对市场活跃度较高,流动性较好,价格相对稳定的蓝筹NFT进行定价。

BendDAO

BendDAO是解决NFT流动性问题的借贷协议,借款人可以通过抵押NFT借出ETH套现。目前BendDAO可以支持包括BAYC、Cryptopunks、Azuki、MAYC、CloneX、World Of Women、Coolcats、CyberKongz和Doodles在内的9种蓝筹NFT的借贷。

BendDAO采取的NFT定价方式就是典型的TWAP定价。其通过和chainlink合作,调用多节点采集所抵押的NFT在Opensea和LooksRare两个交易平台的地板价,调用合约接口将地板价喂到链上后计算出对应的TWAP,从而过滤掉交易平台价格波动的影响。由下图可见对cryptopunk这一藏品,预言机提供的地板价和成交均价、TWAP是保持一致的。

与BendDAO类似,运用TWAP预言机进行定价的协议还包括JPEG’d, DeFrag, DropsDAO,Pine等。

b. Off-chain computation链下计算

基于AI和机器学习的链下计算也逐渐成为一种新兴的NFT预言机定价方式。由于NFT的非同质性,其主要的属性分类、稀有特征、历史销售数据等价值信息可以通过元数据分解用作模型指标。协议进而可以基于这一系列指标和数据集进行建模处理,从而给出一个相对可靠和准确的定价或定价区间。

这类估值方式具备极高的技术壁垒,对于长尾NFT资产相对友好,可以被认为是最具备大规模应用可能性的解决方案。但问题在于这种方法对算力和元数据要求较高,由于算法未公开我们也无法确定训练和拟合结果是否有效。并且NFT一旦属性特征发生变化,模型很可能就会失效,因此需要不断迭代。

Banksea

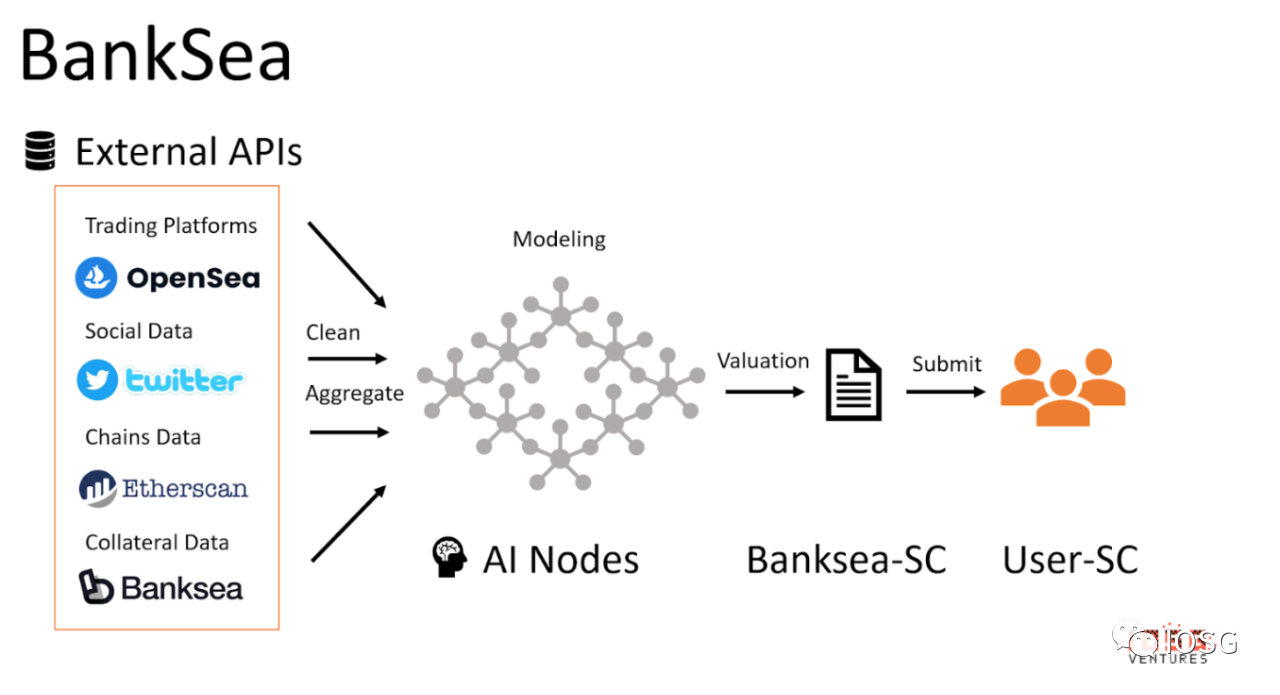

以Banksea为代表的预言机协议主要采用 AI 模型来训练 NFT 的数据集,从而针对不同NFT资产生成准确、高效的预测价格。其整体主要由采b层和NFT层的两个模组构成。

在采集层上,Banksea会收集链上的NFT交易和上架记录实时计算出三类价格:市场地板价、AI地板价和24小时均价。AI地板价代表的是所有AI估值中的最低价,在市场出现剧烈波动或遭遇预言机攻击时起到一个风控和维稳的作用。

在NFT层上,Banksea会通过提取NFT的多维度特征,基于时间序列进行AI模型训练,定期生成标准估值和估值范围两个结果。此外,其会将AI模型计算得出的估值,与实时交易价格进行拟合和回归验证,从而优化最终结果并缩小误差区间。

Banksea基于AI模型的链下定价流程可见如下:

外部API查询:监控和抓取综合NFT数据,来源包括交易平台、社交平台、公链和抵押平台等

数据聚合:将收集得到的NFT数据进行清洗,提取特征属性,输入到AI节点

AI建模:AI节点集群根据输入的数据集进行模型训练和部署,计算出预测价格和风险分数,并将结果返回Banksea智能合约

数据提交:链上智能合约去除异常值后,提取出在合理区间内的数据提交给第三方程序

除了Banksea以外,Upshot和NFTBank等也提供基于AI中更细分的机器学习(ML)方法对NFT进行精准定价的预言机解决方案。此外如Defi Kingdom、Axie Infinity等都集成AI链下算法进行定价的社区工具。

总结 One More Thing

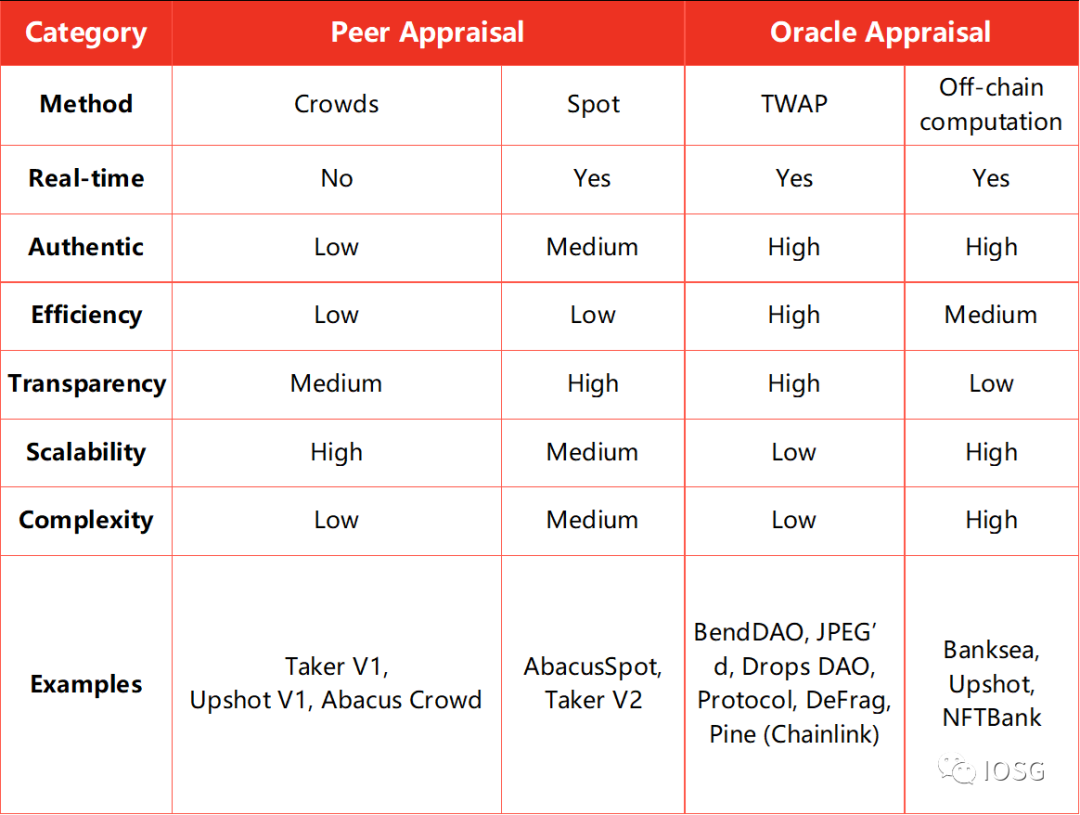

最后,我们可以将目前市面上NFT定价两大范式中的四种具体解决策略通过下述几个维度进行概括梳理:

可以看到,目前不管是哪种估值方式,都存在一定的优缺点。我们期待着在不远的将来更多新兴的NFT定价方式被挖掘和完善。尤其是对于链下计算的预言机定价方式,我们相信随着技术进步和更多优质项目方的参与,更多的AI算法技术如深度神经网络(DNN)等可以被投入到拟合评估函数中,使定价决策树得到更准确和快速的修剪。

NFT定价仿若围棋棋局,是看上去简单的复杂游戏,是一个由一连串决策构成的问题。我们可以用同行直觉判断范围,也可以用预言机算法预测未来。

而如果一定要追问什么才是好的定价范式?我认为问题的关键也许就像吴清源说的,不在于目算几遍、目算多远,而在于目算多广、多快和多准。