ระดับสีเทา: เก้าแผนภูมิดูกฎหมายของวงจรตลาดการเข้ารหัส

บทความนี้มาจาก Grayscaleผู้เขียนต้นฉบับ: Matt Maximo และ Michael Zhao รวบรวมโดยนักแปล Odaily Katie Ku

ชื่อเรื่องรอง

ตลาด Crypto สี่รอบ

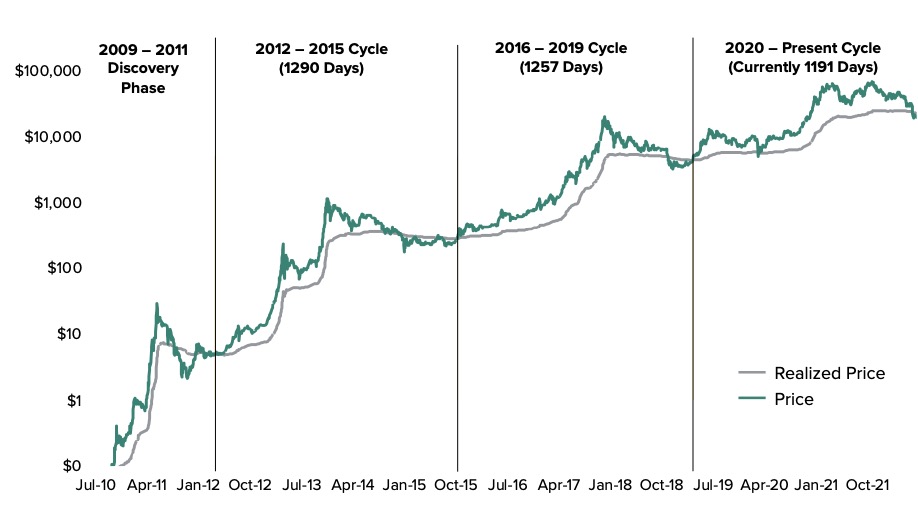

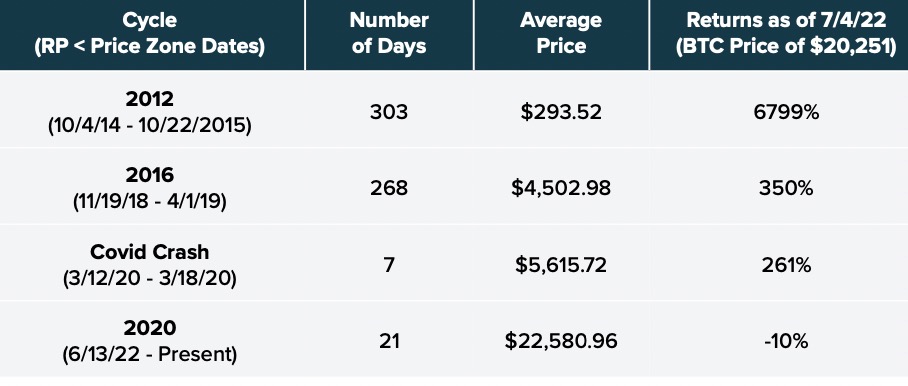

เช่นเดียวกับตลาดเศรษฐกิจและการเงินแบบดั้งเดิม crypto มีวัฏจักรขึ้นและลง โดยเฉลี่ยแล้ว วงจรของตลาด crypto จะใช้เวลาประมาณ 4 ปี หรือประมาณ 1275 วัน เราสามารถใช้ราคา bitcoin เป็นพารามิเตอร์เพื่อกำหนดระยะเวลาในเชิงปริมาณโดยตระหนักว่าราคานั้นต่ำกว่าราคาตลาด (ราคาซื้อขายปัจจุบันของสินทรัพย์) จากมุมมองเชิงคุณภาพ แต่ละรอบแสดงถึงความก้าวหน้าในผลิตภัณฑ์และการยอมรับ ซึ่งเป็นจุดเริ่มต้นสำหรับรอบถัดไป

ต่อไปนี้สรุปสถานการณ์ตั้งแต่เริ่มวัฏจักรตลาด crypto ในปี 2012:

2555-2558: ยุคแฮ็ค + การเริ่มต้น Ethereum

ธีมหลักของวัฏจักรนี้คือการขยายตัวของการแลกเปลี่ยน crypto และกระเป๋าเงินใหม่

2016-2019: ยุคแห่งการทดลอง ICO & กำเนิด DeFi

ราคาลดลงอย่างรวดเร็วมากขึ้น แต่การเทขายไม่ได้ทำลายตลาดทั้งหมด เงินทุนได้หันไปใช้เหรียญ Stablecoins และโทเค็น ICO แทน วางรากฐานของ DeFi Summer

ธีมของวัฏจักรตลาดปี 2020 คือเลเวอเรจเมื่อนักลงทุนเริ่มเลเวอเรจขึ้น

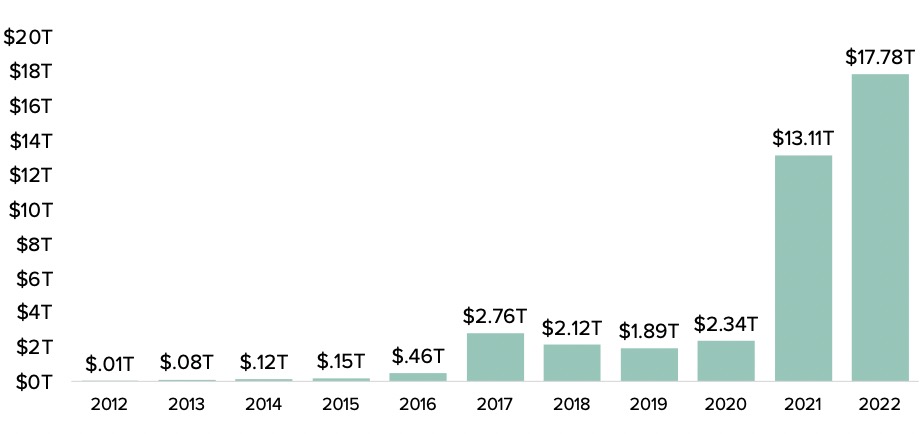

ชื่อเรื่องรอง

ราคาของสินทรัพย์ดิจิทัลเป็นเพียงส่วนหนึ่งของระบบนิเวศที่กว้างขึ้นซึ่งกำลังพัฒนาในอุตสาหกรรมการเข้ารหัสลับ ในขณะที่ราคาของ Bitcoin ผันผวนควบคู่ไปกับสินทรัพย์ทางการเงินแบบดั้งเดิมในช่วงเวลาที่ตลาดไม่แน่นอน เครือข่ายพื้นฐานยังคงทำงานตามที่ออกแบบไว้ และกำลังดำเนินการประมวลผลสินทรัพย์มูลค่าเกือบ 18 ล้านล้านดอลลาร์ในปีนี้ เพิ่มขึ้นจาก 13 ล้านล้านดอลลาร์ในปี 2564 ดังที่แสดงในรูป ด้านล่าง. เม็กซิโกเป็นผู้รับเงินโอนรายใหญ่อันดับสามและเป็นหนึ่งในหลายประเทศที่หันมาใช้เทคโนโลยีนี้ Bitso บริษัทแลกเปลี่ยนสกุลเงินดิจิทัลในเม็กซิโกได้เห็นการโอนเงินข้ามพรมแดนเพิ่มขึ้น 4 เท่าระหว่างไตรมาสแรกของปี 2021 ถึงไตรมาสแรกของปี 2022

คำอธิบายภาพ

การโอนมูลค่าเครือข่าย Bitcoin (USD)

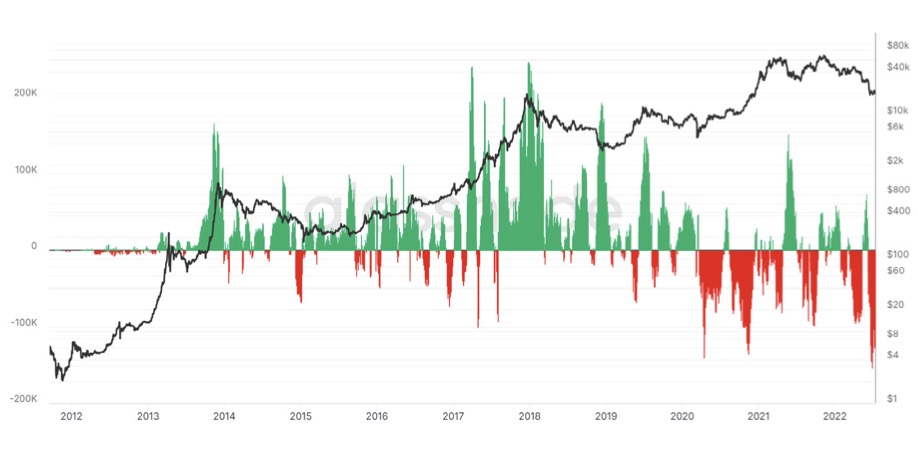

การเปลี่ยนแปลงตำแหน่งสุทธิของการแลกเปลี่ยนใน 30 วัน (การวัดปริมาณของ bitcoin ในการแลกเปลี่ยนแบบรวมศูนย์) ประสบกับการไหลออกที่ใหญ่ที่สุดเป็นประวัติการณ์ในเดือนมิถุนายน 2022 ซึ่งบ่งชี้ว่าผู้ถือกำลังย้าย bitcoins จากการแลกเปลี่ยนและการถ่ายโอนแพลตฟอร์มการให้ยืมแบบรวมศูนย์ สิ่งนี้ชี้ให้เห็นว่านักลงทุนอาจระวังการวางเงินในแพลตฟอร์มการให้กู้ยืมแบบรวมศูนย์ ซึ่งใช้กลยุทธ์ที่มีความเสี่ยงมากขึ้นเมื่อใช้เงินทุนของผู้ใช้ซึ่งอาจนำไปสู่ปัญหาสภาพคล่อง ผู้ใช้ดูเหมือนจะเลือกที่จะถือสินทรัพย์ดิจิทัลของตนไว้เฉยๆ

คำอธิบายภาพ

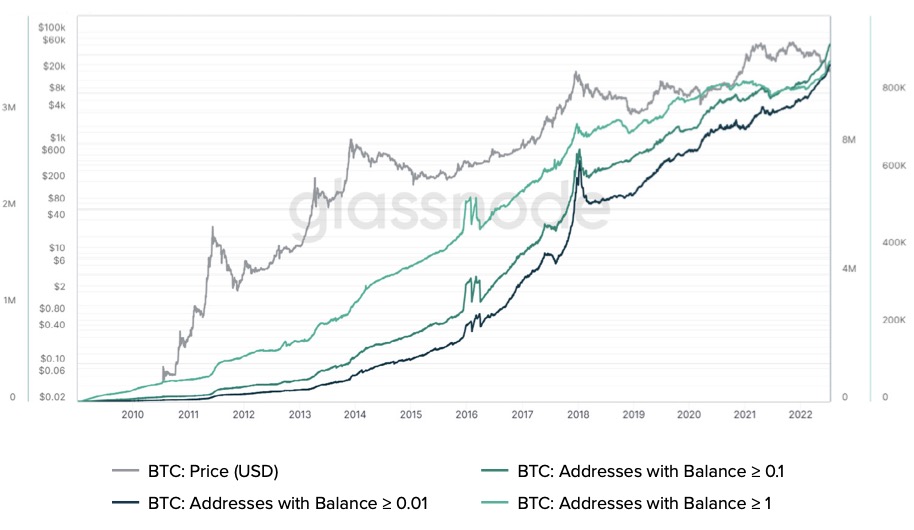

การไหลออกจำนวนมากเหล่านี้อาจเกิดจากนักลงทุนใช้ประโยชน์จากโอกาสในการเพิ่มสถานะด้วยส่วนลด จำนวนที่อยู่กระเป๋าเงินที่ถือ BTC เพิ่มขึ้นอย่างรวดเร็ว ถึงจุดสูงสุดเป็นประวัติการณ์ นี่เป็นการเปลี่ยนแปลงที่น่าสนใจในอารมณ์ของตลาด เนื่องจากนักลงทุนที่มีเงินทุนขนาดเล็กได้ลดขนาดสถานะลงเมื่อมีความไม่แน่นอนเกี่ยวกับสภาวะตลาด โดยเฉพาะอย่างยิ่งในปี 2018 เมื่อราคา bitcoin ลดลงจากประมาณ 20,000 ดอลลาร์

คำอธิบายภาพ

Bitcoin: ยอดคงเหลือของผู้ถือเล็กน้อย

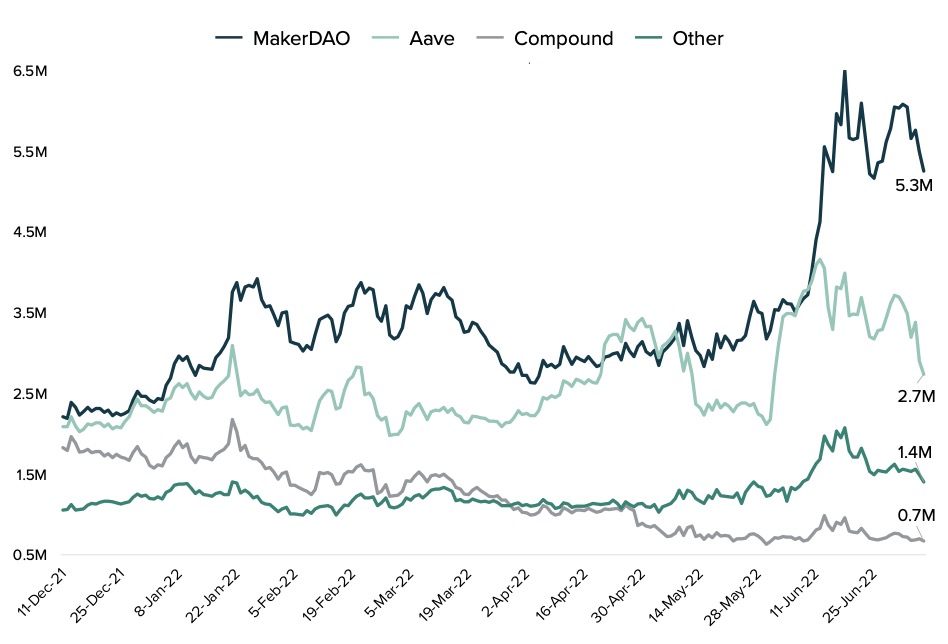

ความโปร่งใสของกิจกรรมบนเครือข่ายยังช่วยให้ผู้เข้าร่วมตลาดเข้าใจสถานะของสถาบันเหล่านี้ ซึ่งตลาดแบบดั้งเดิมอาจมีความทึบมากกว่า ทำให้ตลาดมีเวลาเตรียมตัวและปรับตัวสำหรับการชำระบัญชีที่อาจเกิดขึ้น แม้จะมีเงินทุนไหลออกเนื่องจากผู้ใช้ลดภาระหนี้ลง แต่การกู้ยืมทั้งหมดบนแพลตฟอร์มให้ยืมเช่น Aave และ MakerDAO ยังคงสูงกว่าในช่วงต้นปี 2565

คำอธิบายภาพ

ยอดรวมการยืมแพลตฟอร์มกระจายอำนาจ (ETH)

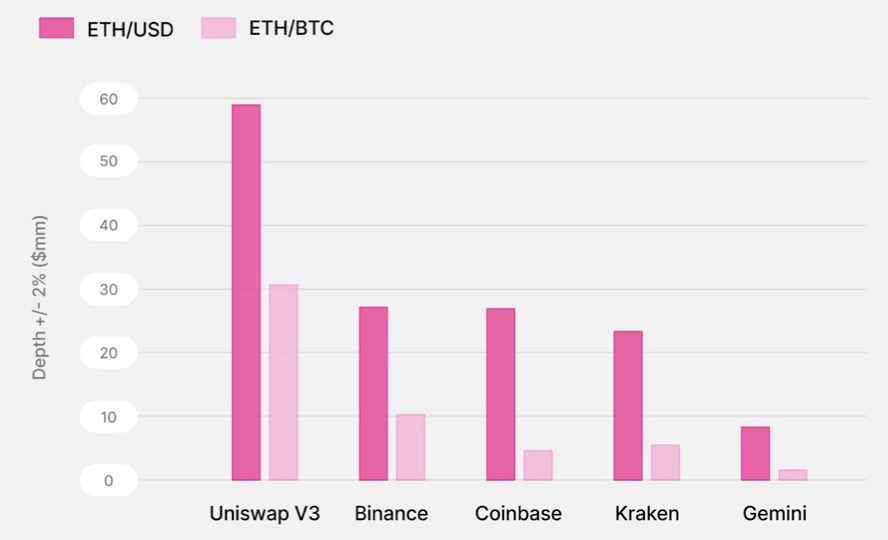

ในหมู่พวกเขา สภาพคล่องของคู่การซื้อขาย Stablecoin ยังสูงกว่าการแลกเปลี่ยนแบบรวมศูนย์ สภาพคล่องของ Uniswap ในคู่การซื้อขาย USDC/USDT นั้นเกือบ 5.5 เท่าของ Binance

คำอธิบายภาพ

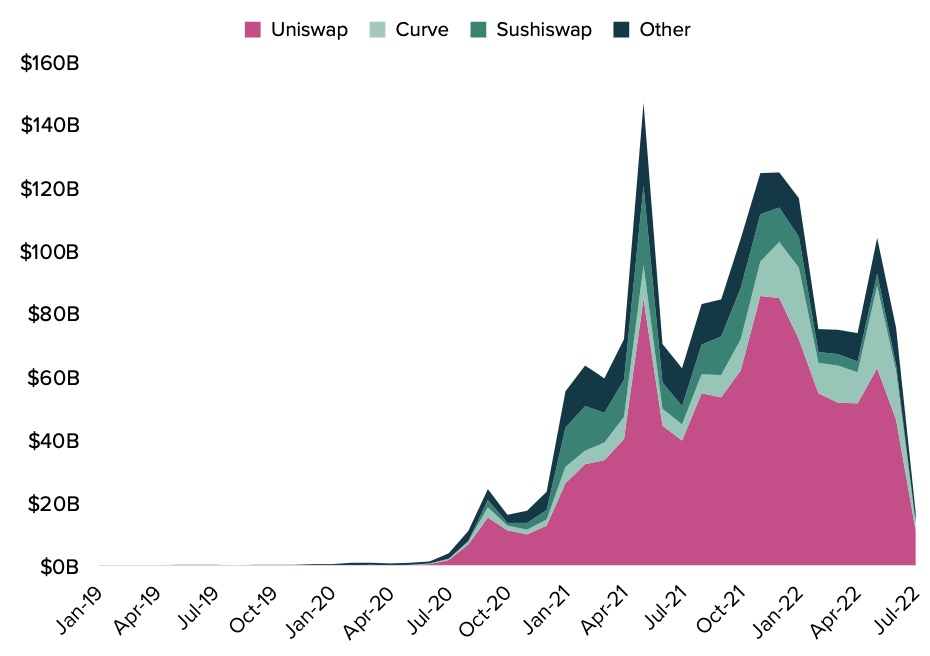

เมื่อเผชิญกับความผันผวนของตลาด ปริมาณการซื้อขายรายเดือนของ DEX ก็ยังคงทรงตัวเช่นกัน ในเดือนมิถุนายน 2564 DeFi เกือบสูญเสียสถานะ ขณะที่ DEX ดำเนินการธุรกรรมมูลค่าหลายพันล้านดอลลาร์ ณ เดือนมิถุนายน 2565 DEX บน Ethereum มีปริมาณการซื้อขายเท่ากับ Uniswap โดยมีมูลค่าประมาณ 75 พันล้านดอลลาร์ ปริมาณการซื้อขาย DEX ในเดือนกรกฎาคม 2022 ยังอยู่ในระดับเดียวกับเดือนกุมภาพันธ์ 2022 เมื่อราคาของ Ethereum สูงขึ้นประมาณ 2.5 เท่า โดยอยู่ที่ประมาณ 2,800 ดอลลาร์และ 1,100 ดอลลาร์ตามลำดับ

คำอธิบายภาพ

ปริมาณการทำธุรกรรมแบบกระจายอำนาจของ Ethereum (USD)

Metaverse เป็นหนึ่งในหมวดหมู่ที่เติบโตเร็วที่สุดใน crypto โดยมีสินทรัพย์มากกว่า 230 รายการที่มีมูลค่ามากกว่า 11 พันล้านดอลลาร์ ตามข้อมูลของ CoinMarketCap Axie Infinity เกมบล็อกเชนที่สร้างขึ้นบน Ethereum มีที่อยู่ที่ใช้งานอยู่มากกว่า 778,000 แห่งที่เล่นเกมในช่วง 30 วันที่ผ่านมา ผู้ครอบครองตลาดเริ่มให้ความสนใจในปฏิสัมพันธ์ระหว่างการเข้ารหัสลับและความบันเทิงในการเล่นเกม Gala Games ผู้พัฒนาเกม Blockchain ได้ร่วมมือกับ Fortnite studio Epic Games ความร่วมมือระหว่าง Gala และ Epic Games จะช่วยให้เข้าถึงผู้ใช้กว่า 194 ล้านคนได้อย่างง่ายดาย ซึ่งอาจจะเป็นวิดีโอเกมที่ใช้บล็อกเชนเกมแรกของพวกเขา ซึ่งถือเป็นก้าวสำคัญของอุตสาหกรรม

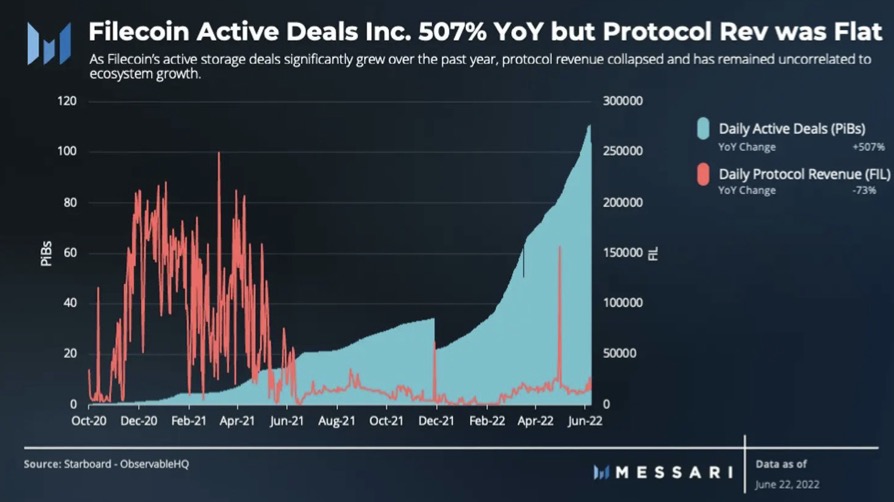

ดังแผนภูมิด้านล่าง แม้ว่าการใช้งานเครือข่ายจะมีการเติบโตแบบทวีคูณ แต่รายได้ของโปรโตคอลก็ทรงตัว (ธุรกรรมที่ใช้งานรายวัน) หลังจากการอัปเกรดเครือข่าย แม้ว่ารายได้จากโปรโตคอลจะมีความสำคัญ แต่การพัฒนาก็ไม่ได้ขึ้นอยู่กับสิ่งนั้นเสมอไป ยกตัวอย่าง Filecoin การอัปเกรดนี้ขยายเครือข่ายและให้บริการพื้นที่จัดเก็บไฟล์อย่างต่อเนื่องโดยมีค่าใช้จ่ายเพียง 0.001% ของต้นทุนพื้นที่จัดเก็บไฟล์พื้นที่จัดเก็บบนคลาวด์ Amazon S3

ชื่อเรื่องรอง

สรุป

สรุป

ทุกวัฏจักรของตลาดที่อุตสาหกรรม crypto ดำเนินการทำให้ระบบนิเวศนี้แข็งแกร่งขึ้น วัฏจักรของตลาดนี้ทำให้เราได้รับ DeFi ที่ “ผ่านการทดสอบความเครียด” โปรโตคอลโครงสร้างพื้นฐาน นวัตกรรมในโซลูชันตามขนาด และอุตสาหกรรม Metaverse ที่กำลังเติบโต และอื่นๆ แม้จะมีการลดราคา การชำระบัญชี และความผันผวน อุตสาหกรรม crypto ยังคงสร้างและสร้างสรรค์สิ่งใหม่ๆ อย่างต่อเนื่อง ผลักดันขอบเขตของอุตสาหกรรม

ชื่อเรื่องรอง

https://cointelegraph.com/news/crypto-winter-has-250-days-left-if-the-market-cycle-repeats-grayscale