加密暴雷潮中,链上无抵押借贷协议的表现如何?

在下行市场中,Aave、Compound等超额抵押借贷平台因为抵押品价值始终高于债务,平台与用户资金始终是安全的。而多个中心化借贷平台则因为将资产无抵押地出借给三箭资本等机构,遭到毁灭性的打击,如曾经管理上百亿美元的Celsius,已传出申请破产保护。

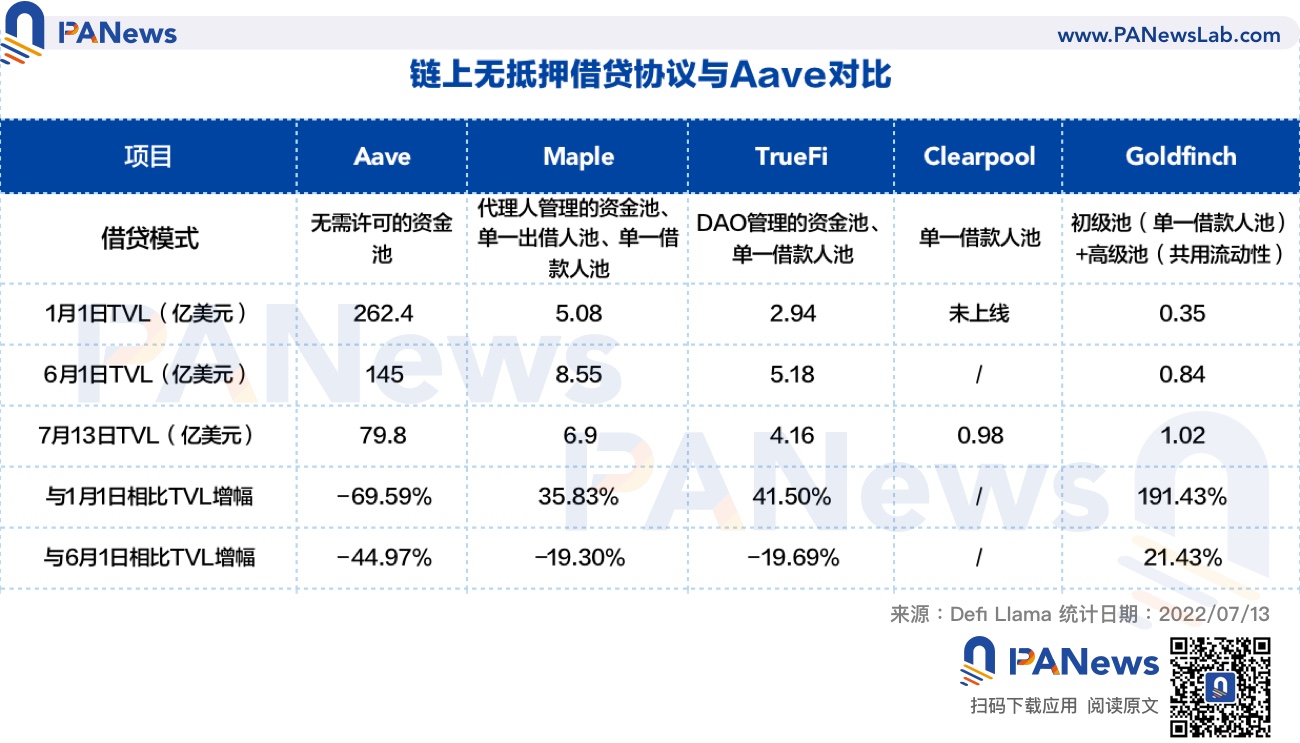

这让一些圈内人士开始质疑无抵押借贷的模式,认为其安全性似乎被证伪,但据PANews梳理发现,链上无抵押借贷协议在本次冲击中受到的影响并不大,且主要协议的数据在今年均有所提升。截至7月13日,Maple、TrueFi、Goldfinch的TVL相比年初分别上升35.8%、41.5%、191%,而超额抵押借贷协议的代表Aave的TVL同期下降69.6%。

Maple:向Babel借款1000万美元,已进行清算

Maple目前已占据了无抵押借贷市场的大多数份额,它通过代理人和资金池的方式运行,每个代理人管理一个资金池。代理人决定可以将资金借给哪一些机构,以及借款利率等详细条款。这种方式相对比较中心化,但代理人的专业知识可以规避掉部分风险。现在,Maple中也增加了面向单一出借人和单一借款人的私有池,但参与者需要先完成KYC。

Maple在6月13日~6月21日期间,多次就Three Arrows Capital(3AC,三箭资本)、Celsius、Babel的风险进行更新,要点总结如下:

1、3AC并未使用过Maple进行借贷;Celsius在Maple上运营有一个2000万美元的WETH池,但Celsius是唯一出借人,即Celsius通过Maple向其它机构放贷;Maple的Orthogonal池曾向Babel借出1000万美元。

2、Maple的借款人没有与UST/Luna相关的风险敞口,与3AC、Celsius相关的风险敞口较小,接下来将继续通过一对一谈话实时监控。

3、Maple中的借款主要用于做市、Delta中性策略或高频套利,通常不会持有方向性的头寸。

4、所有贷款都可以在链上查看,和借款人签订了具有法律追索权的贷款协议。

由此可见,Maple对Babel、3AC、Celsius的直接风险暴露为1000万美元。在官网上,这笔借款显示为“已清算”。Maple与借款机构签署有具备法律效应的合同,只要这些机构不至于破产,就需要足额偿还对Maple的债务。但是,目前并不能确认Maple的借款人中是否有向3AC或Celsius提供借款,若Maple的借款人将资金存放在3AC或Celsius处而无法赎回,这也有可能导致这些借款人无法按时偿还Maple的借款。但这种情况对所有的无抵押借贷平台都适用。

即便是直接的风险敞口较小,流动性的短缺和恐慌确实也给Maple带来了不利影响。截至7月13日,Maple最大的两个流动性池Orthogonal Trading - USDC 01和Maven 11 - USDC 01的流动性均已耗尽,剩余的现金数量为零,存款人的赎回操作需要等待借款人还款。由于这两个池的最后一笔借款操作均发生在6月上旬,可以推测是存款用户的集中赎回导致流动性耗尽。

Maple的公告称,在现金不足的情况下,出借人必须等待借款人还款。随着贷款在接下来的几周内到期,借款人的还款将增加资金池中的可用资金,然后出借人可以赎回资金。

从今年4月开始,Maple在Solana上发起了借贷业务,而Solana上的两个资金池X-Margin USDC和Genesis USDC分别有106万美元和61万美元的流动性,能够满足普通用户的赎回需求。

截至7月13日,Maple中的总存款为6.9亿美元,与今年年初相比增加35.8%,与6月1日相比减少19.3%。目前整体资金利用率在97%左右。

TrueFi:TPS/3AC有借款,于6月21日提前还款

TrueFi是稳定币TUSD团队在2020年推出的项目,现在有两种借贷模式。一种是从项目早期一直持续到现在的,每一种稳定币为一个资金池,任何人都可以进行存款,通过质押TRU代币、评估借款人的信誉来决定是否同意放贷申请;另一种是后期推出的TrueFi Capital Markets,每一个借款人对应一个资金池,向对应的资金池存款则代表仅将资金出借给该借款人。

TrueFi的借款记录可在链上进行查询,在近期3AC、Celsius的风险事件中,Celsius并未从TrueFi进行过借款,3AC有两次从TrueFi借款的记录,第一次为2022年2月25日开始的一笔171万TUSD的60天借款,到期后归还;第二次为2022年5月21日开始的一笔约199万USDT的90天借款。显示的借款人均为“TPS Capital/Three Arrows Capital”,在第二次借款发起后不到一个月内,3AC被传出资金短缺,但是即便在TrueFi中的借款并未到期的情况下,3AC也在借款发起后一个月时完成了还款。因此,TrueFi也并未直接在3AC和Celsius的暴雷中遭遇资金损失。

截至7月13日,TrueFi中总存款达到4.16亿美元,与今年年初相比增加41.5%,与6月1日相比减少19.7%。资金利用率为96.06%,各种稳定币池中都仍有部分流动性,方便用户退出。

Clearpool:6月9日通过TPS的借款申请,6月19日关闭

Clearpool则是按照“单一借款人池”(Single Borrower Pools)的方式运行。首先,Clearpool合作的第三方数据平台X-Margin会对借款人进行评级并给出借款上限;然后Clearpool在前端新增借款人;用户可以自由选择将资金出借给哪些借款人。

Clearpool曾允许TPS Capital在自己的平台上向用户募集资金。

6月9日,Clearpool宣布增加TPS Capital(TPS Capital当时被称为“三箭资本的OTC部门“)的借款人池,允许TPS Capital从Claerpool的用户处最多借贷1730万美元的资金。

6月19日,Nansen创始人Alex Svanevik在推特上质疑TPS Capital的借款人评级为A,此时三箭资本的风险已经暴露。

6月19日,X-Margin迅速作出回应,取消了TPS Capital的借款资格,并从Clearpool平台上删除了TPS Capital。X-Margin称,“确保TPS归还了贷款,Clearpool的出借人没有资金损失”。

由此可知,TPS在已经出现问题的情况下,才寻求从Clearpool进行借贷,并获得了通过。随后风险暴露,在发现问题后,X-Margin和Clearpool的反应迅速,暂停了TPS的借款额度。

截至7月13日,Clearpool的总存款为9788万美元,公共池的资金利用率在80%左右。只有5个机构被允许从公共池中借款,分别为Amber Group、Auros、FBG Capital、Folkvang、Wintermute,大多数机构也同时是Maple和TrueFi的借款人。

Goldfinch:向现实世界的企业提供贷款,与加密市场波动相关性较小

Goldfinch采用初级池和高级池结合的方式运行,初级池是单一借款人池,投入的资金将获得更高收益,但也需要承受更大风险;高级池的流动性将分配给各个单一借款人池,收益较低,但借款人的还款将优先归还高级池的本金和利息。借款申请是否通过需要审计员(通过质押GFI参与)进行评估,审计员由协议随机选择。

由于Goldfinch的借款人通常并非加密机构,获得的USDC贷款通常兑换为法币,因此Goldfinch基本不受加密市场波动的影响。

截至7月13日,Goldfinch的总存款为1.02亿美元,资金利用率约为98%,与今年年初相比,总存款上升191.4%,与6月1日相比上升21.4%。这些借款人来自超过20个国家,Goldfinch称已为超过100万人的企业提供借款。

小结

各个无抵押借贷项目开展的业务越来越接近,如一开始选择一种稳定币只有一个资金池的TrueFi,增加了对应单一借款人的资金池;Maple则从每个代理人运营一个资金池的模式,增加了允许单一借款人或单一出借人运营一个资金池。越来越多的业务需要KYC才能参与。Maple、TrueFi、Clearpool三者的借款人有很大程度的重合,增加了系统性风险。

无抵押借贷项目在下行市场中受到的影响低于DeFi的超额抵押借贷和中心化借贷,说明这一套信用评估和风险管理方案的有效性。当然,部分原因是因为无抵押借贷通常仅支持稳定币的借贷,而Aave等协议中包含ETH、WBTC甚至stETH等波动性较大的资产。

部分无抵押借贷协议同样面临流动性问题,如Maple的Orthogonal Trading和Maven 11池,流动性完全耗尽,需要等待借款到期还款后才能赎回。资金利用率高也带来流动性少的问题。