流动性不是全部,整体视角来分析10个稳定币项目

引言

五月,Luna 崩盘,UST 大幅脱锚,冲击着本就低靡的市场。无数协议遭到清算,稳定币市场遭受短期冲击。据 Coingecko 和 Defillama数据,稳定币总市值在 Luna 崩盘后跌去 5.34%,DeFi TVL 下降 43%。市场剧烈波动,等到硝烟散去,人们才意识到,稳定币项目的资产端原来如此重要。

回过头看,人们发现先前一往无前的算稳项目几乎都是跛脚的巨人,建立在不可持续的信用扩张之上。稳定币项目的整体性被人们选择性忽视,毕竟彼时的人们认为,资产可以借预期凭空创造,极端的流动性危机只存在于假设之中,人们沉浸于信用扩张带来的高杠杆中。然而血淋淋的现实敲醒了人们,挤兑开始发生, 资产不足兑付。

TL;DR

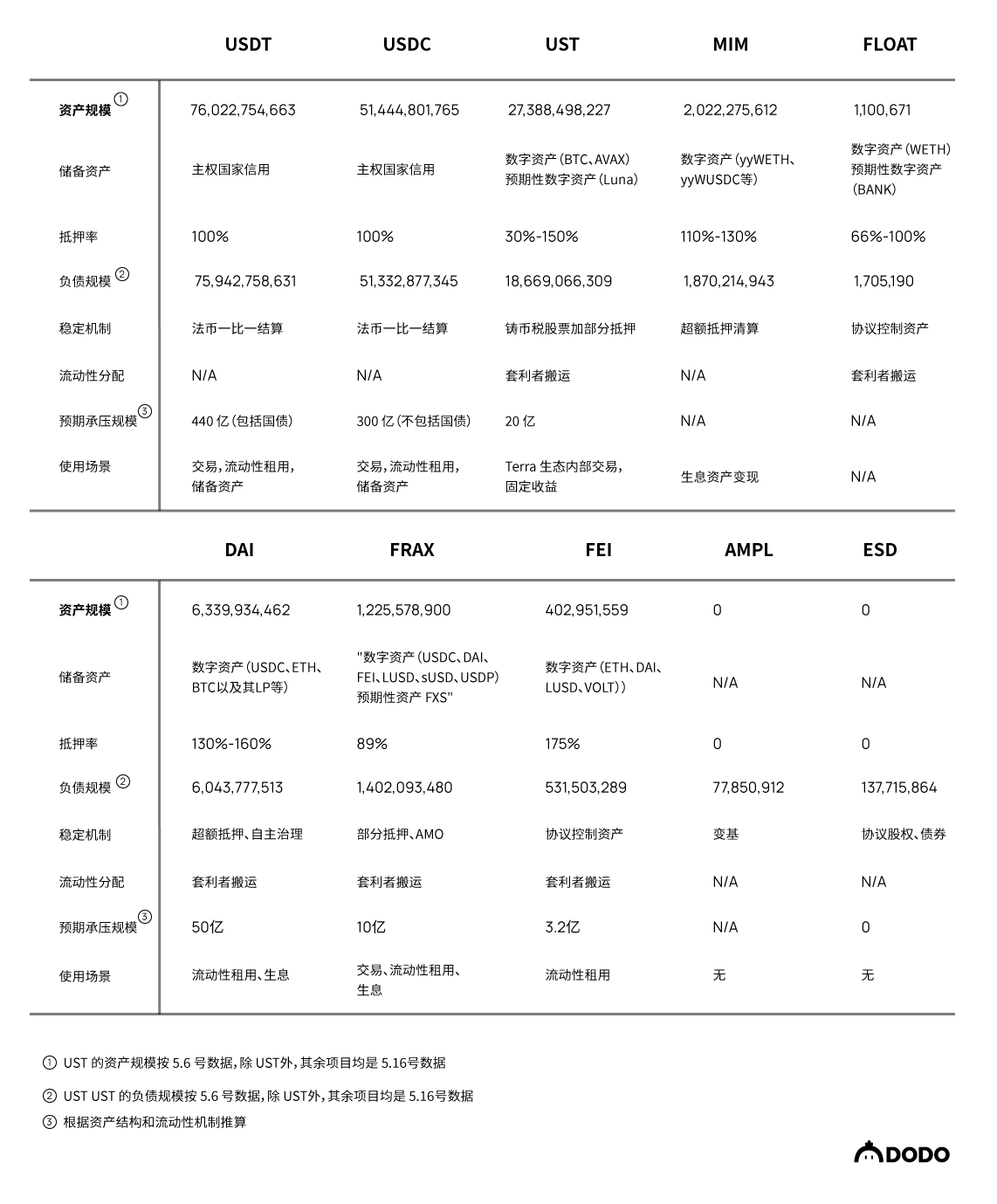

要以整体视角审视稳定币项目,从资产、负债、流动性、使用场景四个方面分析。资产结构决定了稳定币项目的偿付能力,负债结构决定了稳定币项目的偿付结构,流动性机制体现了短期稳定如何实现,而使用场景是人们对稳定币的需求根源所在。

USDT 和 USDC 都有在短时间内承受数百亿美元兑换的能力,但是相比之下,USDC 的资产结构更为稳定,应对极端流动性危机的能力更强。

UST 崩盘的深度原因在于预期性资产(Luna)的市值不能反映真实兑现价值,资产结构严重失衡,同时,负债结构畸形,75% 的负债由 Anchor 吸收,使用场景局限在生态内部。

DAI 的储备资产十分稳定且多样化,目前仍以最安全的去中心化稳定币自居,但其作为交易对结算资产离 USDC 仍有较大差距。而 MakerDAO 为用户提供的存款利率也常被人诟病,用户持有 DAI 的主观能动性也不足。

FRAX 的资产结构相比 UST 十分稳定,且未来将转向足额抵押。而 FRAX 目前已陆续成为多链资产的计价方式,其 DeFi 生态的使用场景已经悄然超越了 DAI。

资产的选择对稳定币项目至关重要,且越高波动率的资产应该对应越高的抵押率,在资本效率和稳定之间,应该优先保证稳定。

依靠市场套利维持稳定的项目,极端行情下套利机制有可能失效,依靠协议本身管理流动性效率低。

无抵押的稳定币已经被证明无法长期支撑其债务发行,最终都将转向足额抵押的稳定币。

稳定币项目需要以整体视角审视

稳定币从来都不能只看流动性上的创新,而要以整体视角审视。资产保证了兑付,负债决定了偿付结构,流动性管理确保稳定币能经受短期冲击,而使用场景是扩张的源头。某一方面的极端突出可能会带来短期上的迅速扩张,但只要有一个方面的短板就宣告了长期上的灭亡。

稳定币项目要通盘考虑资产,负债,流动性和使用场景。设计上的高瞻远瞩才能让稳定币项目走的更远。看似简单的资产和负债端,恰是人们所忽略的,而资产和负债端的设计复杂度和设计选择范围都非常的深和宽,流动性管理上的设计也不能局限于变相加杠杆,更应考虑到偿付期现,而使用场景是项目的出发点,要综合考虑团队自身的资源禀赋和历史条件,努力抓住历史机遇。

本文将从资产、负债、流动性和使用场景这四个维度,对具有代表性的 10 个稳定币项目进行分析。在具体分析之前,分别对资产、负债、流动性和使用场景进行归纳,厘清一些概念和框架。

资产

资产端是稳定币项目关键一点。在资产端,需要关注储备资产的选择,各资产的比例,以及抵押率。这些要素构成了稳定币项目的资产结构。

储备资产是指项目用来支撑稳定币兑付的具有价值的资产。Multicoin Capital 在 2018 年的稳定币概述中提到,稳定币的储备资产有法币,铸币税股票和数字资产。Dimitrios Koutsoupakis 在2020 年的论文中认为,储备资产有主权国家信用,生态内代币资产和生态外代币资产。结合多种文献,我们认为储备资产有四大类:

主权国家信用:主权国家发行的信用货币即法币,以及法币计价的传统金融资产,如货币市场基金,商业票据,公司贷款,国债,大额存单等。USDT、USDC 等法币抵押的数字资产视作主权国家信用。

实物资产:贵金属和可以进行交割的实物商品,如黄金,白银,石油,天然气等。

数字资产:**运行在区块链上,去中心化的,具有一定市值和流动性的数字货币,以及可以兑换数字货币的衍生 Token 和生息资产等,如 BTC,ETH,WETH 等。

预期性数字资产:**项目的原生代币或铸币税股票(Seigniorage Share),由市场形成交易价格,受预期影响大,如 Luna,FXS

由于各种资产的波动性和流动性不同,所以不同的资产比例有不同的偿付能力。而抵押率需要适应资产的选择和比例,整体上来看,高波动性资产抵押率高,低波动性资产抵押率低。由于大部分稳定币项目不是单一资产,所以如何调整资产比例,选择合适的抵押率就是非常重要的。资本结构至关重要,它能反映出项目的偿付能力,在极端行情下的承压能力,以及对预期的支撑。

负债

负债端是稳定币项目发行的所有未偿付的购买力,是所有流通中的稳定币价值之和。负债结构包括负债规模,流通分布。

负债是流通中的稳定币,对于一个稳定币项目来说,如何扩张负债,哪些协议是可以接入的,风险几何,如何平衡负债的偿付结构,如何稳定负债扩张的速度和负债端的结构,都是需要考虑的。

负债规模易查。而链上数据可追可查,可以准确看到稳定币的分布情况。但是,由于 DeFi 发展尚出于早期,大量的筹码交换依旧集中于中心化交易所,一些中心化的协议也会吸纳稳定币,所以,在现阶段准确刻画负债结构是不可能的,只能判断大致的分布情况。

在现阶段,负债结构上的分析上的意义在于识别异常值和极端不平衡情况。虽然不能精确得到流通分布,但是某一协议的异常变化和极端不平衡的比例结构是可以捕捉到的,通过提前警示,可以预知风险来源,及时调整可以规避风险。

流动性

流动性是指稳定币兑现的难易程度。流动性管理包括稳定机制,流动性分配。而极端承压测试可以预测在极端情况下一个稳定币项目能够承受的挤兑规模。

流动性上的创新是上一时期稳定币项目发力的重点,各种各样的算稳机制被开发出来,并投入实验之中。这些项目为后来者提供了宝贵的经验和数据,尤其是 Luna 的崩盘。我们认为,在稳定机制上,可以分为两大类:

法币一比一结算:理论上是用户在出入金时自动铸造和销毁 Token,实践上都会采用缓冲的方式分批铸造和销毁 Token。USDT、USDC 等法币抵押项目使用这种方式。

算稳机制:算稳机制层出不穷,在实践中主流的有以下几类:

铸币税股票机制:协议中稳定币的价值是固定的,可以兑换等值项目的原生代币。通过套利者来稳定市场价格。

协议控制资产:智能合约控制资产,直接调控市场上的交易池。

超额抵押清算:将抵押品按照超额抵押率存入协议,触及一定的比率时清算。

流动性分配主要有两种,分配给套利者或协议直接与交易池交互,依靠套利者市场行为可以提高效率,但是面临极端行情下失控的风险,由协议直接增发会面临安全风险和效率问题。

使用场景

使用场景是当前所有稳定币的症结所在,是稳定币项目扩张的源泉。稳定币的需求根本上来源于使用场景。目前对传统支付场景的渗透率低,不过我们可以着眼于未来。

主权国家发行货币自带使用场景,一个国家内部的商品交易,结算,信用扩张等都靠法律强制力和政府强制力保证。而 web3 的世界没人规定你使用什么协议,也没有一个实体大到能垄断绝大多数用户,更没有一个协议能打通一个主权国家级别的线下使用场景,因此选择什么样的使用场景,很大程度上决定了一个稳定币项目的增长空间。

我们认为稳定币项目可以先接入某一细分场景,再进行拓展,而未来大的历史机遇在于虚拟世界的价值交换,随着 DID,Gamefi,元宇宙的发展,稳定币的使用场景将会爆发,而这些场景对于法币来说是陌生的战场。

接下来,我们将以整体视角分析 10 个稳定币项目,先从法币抵押的 USDT 和 USDC 开始。

USDT

💡 USDT 市值曾超过 800 亿美元,是最大的稳定币项目,不过其资产结构一直被许多公司抨击。究竟其资产结构是怎样的,又能否承受住挤兑呢?

资产

资产结构

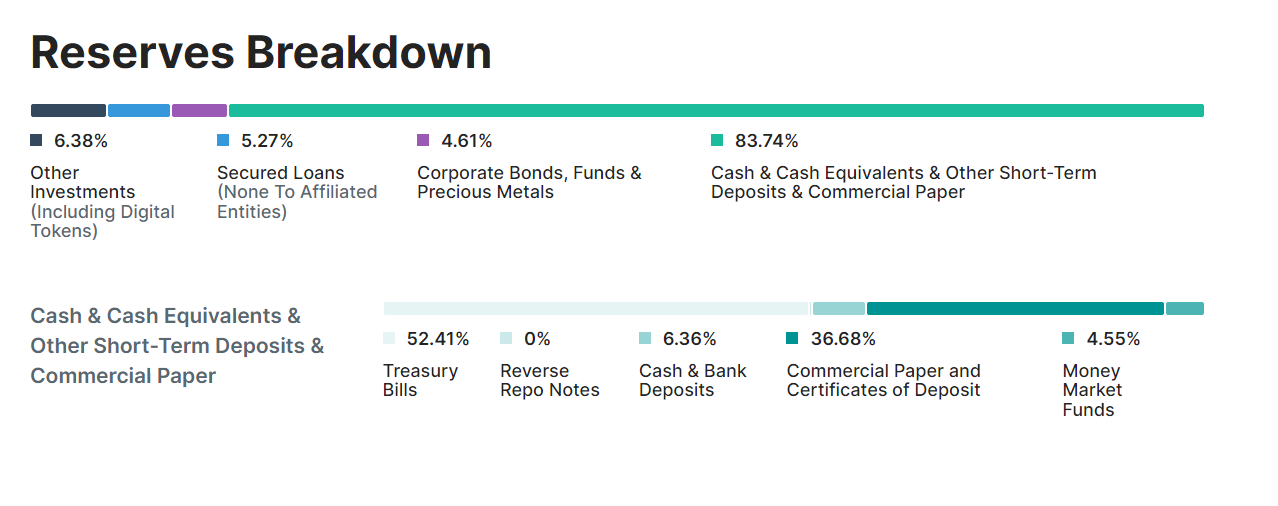

数据来源:Tether Transparency May 10 2022

特点

整体上来看,USDT 的资产几乎都是以法币计价的,而法币代表了主权国家信用。但是从结构上来看,细分资产,流动性,质量等都是有所区别的。美国国债、现金、货币市场基金是其中流动性最高的部分,这部分占总资产的比例大概是 50% 左右,收益率比较低,但是质量最高。其他部分是 Tether 公司用来盈利的部分,流动性和安全性稍低。整体资产中,风险最大的是商业票据。结构与商业银行的资产结构很像,Tether 的盈利很大一部分来自于持有美国国债,商业票据,发放贷款和投资带来的收益。

Tether 的资产结构较 21 年已经发生了很大变化,最大的变化就是商业票据占比大幅下降,从 60% 降到现在的 30% 左右,而更多的换成了国债和货币市场基金。

USDT 的抵押率是百分百法币抵押,属于全额抵押的稳定币。

资产分析

USDT 是中心化的稳定币项目,资产上最大的优势在于,其持有的是传统金融中比较优质的资产,在保持资产流动性的同时,能够借助传统金融成熟的市场,持续带来收益,这部分完全可以支撑整个团队。但 Tether 最大的风险也在于其中心化的管理和资产的暴雷,我们可以看到,商业票据,投资,贷款,公司债券,这几个风险较高的资产,总计占总资产的 47.14%,在发生流动性危机和局部信用危机的时候,无法偿付的风险变高。而且 Tether 并没有披露过其高风险资产的坏账率等,存在一定的不透明。

负债

负债结构

Tether 的负债主要是流通中的 USDT,其中,发行在 TRON 和 ETH 上的 USDT 最多,占总额的 90% 左右,这些负债,以各种形式存在于交易所,智能合约和个人钱包中。

负债分析

Tether 的负债在 DeFi 里并不多,Tether 在 DeFi 场景中的使用率低于 USDC,因此很大部分的负债集中于交易场景,因此,这样的负债结构就要求 Tether 做好充分的流动性管理,提供充足的流动性。

流动性

流动性管理

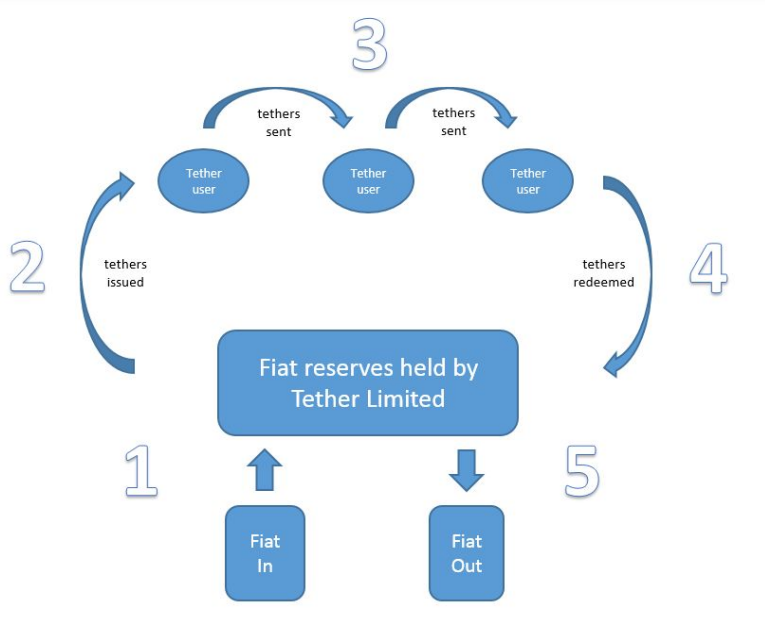

USDT 的稳定机制是法币一比一结算,如下图所示。但在具体操作上,Tether 不是连续发 USDT,即 Tether 在收款后到新发 USDT 是有时间差的,铸造 USDT 通常是一次铸造大量 USDT,在发行上也需要经过授权流程。

来源:Tether 白皮书

USDT 赎回法币的过程,对于 Tether 来说,是应对用户提现的过程。Tether 应对提现,首先是通过其流动性最高的资产,银行存款和货币基金,这部分大概是 10%,能够应付短期大量提现需求,其次,美国国债的流动性稍差,这部分占 40% 左右,在极端行情下有面临市场流动性危机而资产贬值的风险,其他资产流动性较差,短期变现较困难。其次,Tether 还设立了股东资本缓冲以应对短期大量提现需求,有 1.6 亿左右。

在流动性分配方面,Tether 是直接把流动性分配给通过其合约入金的用户,新 token 以这种形式发放到市场上,Tether 有 USDT 缓冲,当 USDT 不足时,会铸造新的 USDT 投放到市场上。

流动性极端承压测试

我们来考虑一下,USDT 在极端市场行情下,能承受的挤兑极限,USDT 的资产,能立即兑付的,10%,大概 80 亿。美国国债市场现货交易额在 5000 亿美元以上,在市场流动性不出现大问题的情况下(美国国债在过去只闪崩过 3 次),我们可以假设 Tether 的美国国债可以迅速变现,这部分资金大概在 380 亿左右,加上前面的 80 亿现金,基本上可以在短期内应付 440 亿美元的兑现规模。叠加恐慌因素,在历史上也没有出现过超过 50% 的挤兑,因此可以认为 USDT 在极端行情下是可以保持流动性充足的。

使用场景

USDT 最大的使用场景是数字货币交易。根据数据分析平台 Nansen 的数据,ETH 上持币前十的地址有七个是交易所地址,包括六个中心化交易所和一个 DEX(Curve),而 USDT 在数字货币交易外的其他场景上,表现乏力,尤其是在 DeFi 应用上的占比,显著低于 USDC。USDT 也是其他稳定币流动性的接入对象,即其他稳定币的一个锚定物,同时也成为了一部分稳定币项目的储备资产。

USDC

💡 Luna 的冲击之后,USDC 是为数不多市值增加的稳定币,吸收了大量 USDT 的兑换,到底其资产结构与 USDT 有何不同,会使人们对其稳定性没有怀疑呢?

资产

资产结构

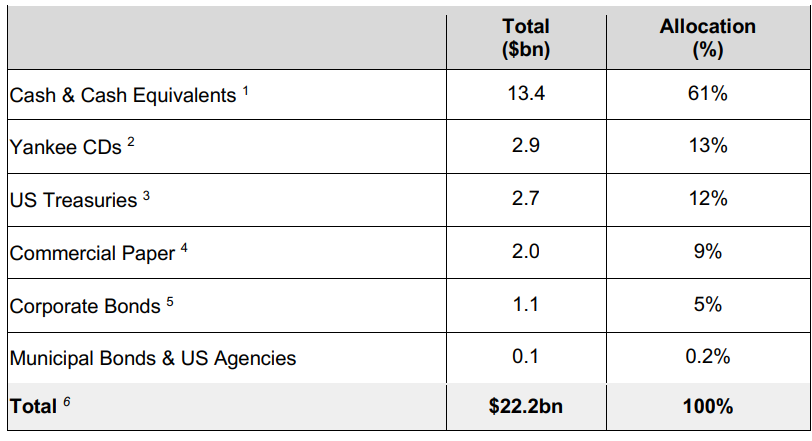

数据来源:Circle Management Assertion Report May 2021

USDC 最后一次披露资产结构是在 2021 年五月,如上图所示,可以看出,Circle 的资产结构和 Tether 有着明显的区别。Circle 对现金及其等价物的计算并没有包含美国国债,大额存单和商业票据,只包含银行存款和货币市场基金,均能即时兑付。Circle 现金资产的比例高达 61%,而 Tether 银行存款加货币市场基金仅有不到 10%。大额存单占比为 13%,美国国债占比 12%,商业票据和公司债券合计占比 14%,其他资产仅占比 0.2%。

特点

USDC 的资产特点就是高流动性的现金资产占比很高,高风险的公司债券和商业票据占比仅 14%。Circle 的投资业务一部分由其控股的 SeedInvest 实施,用 USDC 投资项目。

USDC 的抵押率是百分百法币抵押,属于全额抵押的稳定币。

资产分析

USDC 高现金资产占比使得其能应对短期大量的提现需求,有助于稳定预期防止挤兑,资产结构比较合理。USDC 发生流动性危机的可能很少,因为他的现金占比商业银行还要高很多,能够应对短时间的大量提现需求。但是同时,Circle 的资产结构不是定期披露,在透明度上依旧面临着问题,这也是中心化稳定币项目无法避免的。

负债

负债结构

USDC 现在的流通量是 500 亿美元左右,以各种形式存在于交易所,智能合约和个人钱包中,不过,USDC 和 USDT 在结构上是有差别的,USDC 在各大 DEX 中的锁仓量大概在 20 亿左右,是 USDT 的 1.5 倍,而在如 AAVE,Compound 主流借贷协议中,USDC 的流通量在 40 亿以上,是 USDT 的两倍多。

负债分析

USDC 的负债更多的在 DeFi 内部流动,这会使 USDC 兑现其负债的压力更小。流动性管理的压力也更小。

流动性

流动性管理

USDC 的稳定机制是法币一比一结算。跟 USDT 类似,USDC 也有缓冲机制,新的 USDC 会间隔发行。

USDC 应对提现会首先动用流动性最高的现金资产,这部分占比 60% 左右,大概 300 亿美元,美国国债和大额存单的流动性稍差,这部分占比 25%。

流动性极端承压测试

USDC 应对极端行情的能力是很强的,可以在短期内承受超过 300亿美元的抛压,而在历史上从来没有出现过这种情况,可以认为 USDC 的流动性承压能力是很强的。而 USDC 的主要风险来源于,资产结构变化未披露,存在现金资产比例减少的可能,审计造假,极端性的全球金融危机。

使用场景

USDC 把握住了历史机遇,在交易性场景上有广泛应用。也广泛应用于 DeFi 协议中,采用率是 USDT 的一倍多。USDC 同时与提供了最强的法币流动性,成为了其他稳定币的锚定物,也成为了一部分稳定币项目的储备资产。

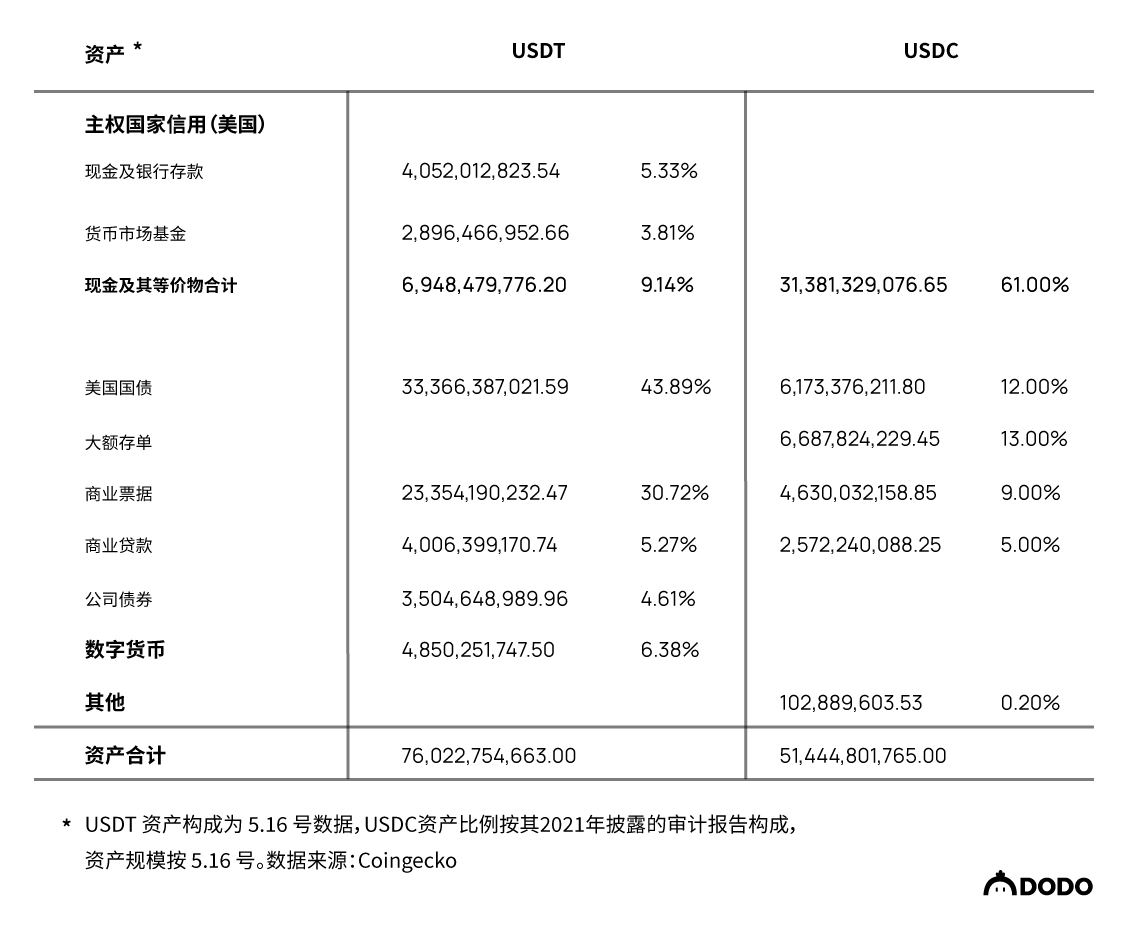

USDT、USDC资产结构对比表

UST

💡 短期的冲击使 Luna 在短短两天内归零,短期的冲击固然有可能是有备而来,市面上的猜测也数不胜数,但是其不合理的资产负债结构是其完全无法阻挡冲击的根本原因。UST 崩盘证明了储备资产不能完全由预期性资产构成,且信用扩张速度需要控制。

资产

资产结构

UST 的储备资产是 Luna,在 2022 年初,Terra 开始购买 $BTC 和 $AVAX 作为自己的储备资产。但是与 Luna 和 UST 的市值相比,BTC 和 AVAX 的市值并不高。UST 的储备资产主要还是 Luna。

因为 UST 在近期遭遇了脱锚,Luna 也已经归零,我们以 5 月 6 号 Terra 的资产状况为例,来分析 UST 的储备资产。

彼时,Luna 的价格在 80 美元左右,市值 270 亿左右,UST 的市值在 180 亿左右,LFG 持有价值 30 亿左右的 BTC,1 亿 左右的 AVAX,以及一些零散的其他资产。总储备资产 300 亿左右,其中 Luna 占比 90%。

特点

Terra 的资产很有特点,其 UST 市值基本上是由 Luna 这一预期性资产来支撑的,Luna 的交易价格由市场形成的,波动较大,在上一轮牛市中,Luna 的市值始终超过 UST,反映出人们对 Luna 的预期形成了溢价。

资产分析

Luna 的市值是由预期支撑的,不可否认的是,Luna 在之前扩张的过程中,也经历过短暂的 UST 脱锚和下跌,但是最终靠套利机制回归锚定,建立了一定的市场信心,更是走出了大幅溢价 UST 的行情。但是风险在于,储备资产受预期影响太大,波动性大,虽然团队意识到了这一点开始引入 BTC 等储备,但是在 Luna 的比例还未降下来的情况下,极端行情就已然发生。在极端行情下,Luna 会发生流动性危机,面临市值大幅缩水的风险,进而发生死亡螺旋。

因此,在真正发生挤兑风险的时候,Terra 的储备资产并不是纸面上的 300 亿美元,而是真实兑现出来的价值,但是这个价值不得而知,从这次崩盘上看,Luna 短期全部变现(两天)能真实能兑现出来的价值不足 20 亿美元。

负债

负债结构

大部分流通的 UST 都在自己的生态里面,其中,Anchor 协议吸收了大量的 UST,在 5.6 号时,高达 140 亿美元。而一月份这个数字只有 50 多亿。Anchor 承诺了接近 20% 的固定收益率,每天产生大量的利息,滚动增加。其余 UST 有 10 亿左右在跨链桥上,有 10 左右在非 Terra 链的 DeFi 协议中,剩下的 20 亿美元,在交易所,Terra 生态的其他协议以及个人钱包中。

负债分析

Terra 的负债结构不合理,除了 Anchor 之外,Terra 生态上其他的协议并没有吸收多少 UST,这样的结构导致 Terra 的负债增长压力要大很多,接近 75% 的负债都是由这个固定收益率协议所吸收,因此极端情况下的清算和抛压是巨大的风险。不过,Terra 的负债全是 UST 计价的,只要不发生极端行情,是可以滚动续作的,但是在极端行情下,这部分负债的规模和清算点位就值得注意了。

流动性

流动性管理

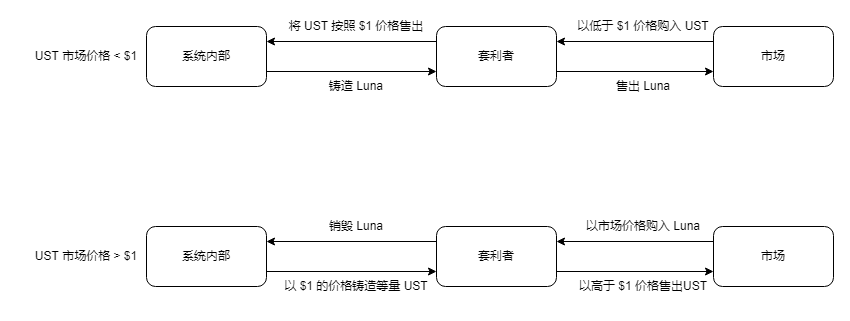

Terra 的稳定机制如下图所示。Terra 通过其内部的预言机系统提供报价,在预言机内部,UST 的价格恒定为 $1 不变,当市场上的 UST 过多时,UST 的市场价格小于 $1,套利者会在市场上购入 UST,在协议中以 $1 的价格售出,同时协议按照 Luna 的市场价格铸造出等值的 Luna,套利者在市场中售出 Luna,完成套利。在这个过程中,UST 的流通量会通过套利机制逐渐减少,Luna 的价格会暂时下降。反之同理。

据 Terra 白皮书整理

可以看到,在整个的过程中,Terra 实际上是把流动性分配给了套利者,依靠套利者吸收和释放 UST,而 Terra 每日的套利上限是 3亿美金,也就是说,Terra 每日最多吸收或释放 3 亿美元的流动性。Terra 的机制可以使得原生代币 Luna 吸收 UST 的发行价值,也就是铸币税收益。理论上来说,市场上的货币需求变高,UST 的流通量通过套利者释放变高,Luna 的价值随之变高,当市场上的货币需求变少时,UST 的流通量通过套利者回收减少,Luna 的价值随之减少。

但是 Luna 是预期性资产,价格是市场交易形成的,受预期影响很大,在极端行情下,UST 和 Luna 都被抛出,市值下降,Luna 受预期叠加套利抛压的影响,有可能市值低于 UST,而进一步刺激市场恐慌而抛出 UST,形成死亡螺旋。

流动性极端承压测试

在极端行情下,从资产端看,Terra 能动用的资产有,Luna(LFG 持有的Luna),BTC 等,还有市场上的套利者。极端行情下,套利者会疯狂抛卖 Luna,从 5.9 号开始的行情来看,短期抛压太多的 Luna,会造成流动性危机,市值迅速下降,也就是说,高出 UST 市值 50% 的 Luna,短期内真实兑付价值并没有多少,实际上,只支撑了不到 20 亿的 UST 兑换。

使用场景

UST 的使用场景集中在 Terra 生态内部,其中最大的使用场景是 Anchor 协议。

MIM

💡 跟 UST 不同,MIM 的资产结构较为合理,储备资产完全是原生的数字货币资产,是 crypto native 的稳定币,但抵押率选择偏低,受限于 DeFi 市场不成熟,还存在一些风险因素。

资产

资产结构

MIM 是以生息资产作为抵押的稳定币。Abracadabra 会更新一个抵押资产的白名单,比如 Yearn 中的 yvWETH、yvWUSDC 等。而这些资产的背后就是 ETH,USDC 这种资产。资产规模在 18 亿左右。

特点

MIM 的储备资产有个很明显的特点就是长尾资产占比高,MIM 就是为这些资产提供流动性的一个稳定币,本质上是一个借贷协议。而 MIM 通过 Curve 中的池子,可以把 MIM 换成流动性更好的稳定币,以实现其购买力。

资产分析

MIM 的资产选择是生息资产,为这些资产提供流动性。这些资产是 Defi 原生资产,与 USDC 和 USDT 等借助传统金融市场生息不同。Abracadabra 在为这些资产提供流动性的同时,会抽取一部分利息,作为协议收入,这是一个可持续的商业模式,随着 DeFi 市场的逐渐成熟,这些资产的贴现规模将会越来越大,但是目前规模较小,且面临着极端行情波动的风险。MIM 中,不同资产的抵押率不同,用户抵押这些资产,根据资产的不同,能拿到资产价值 75% 到 90% 的 MIM,因此,抵押率大概是 110% 到 130% 的水平,抵押率比较低,大幅波动可能造成脱锚。

负债

负债结构

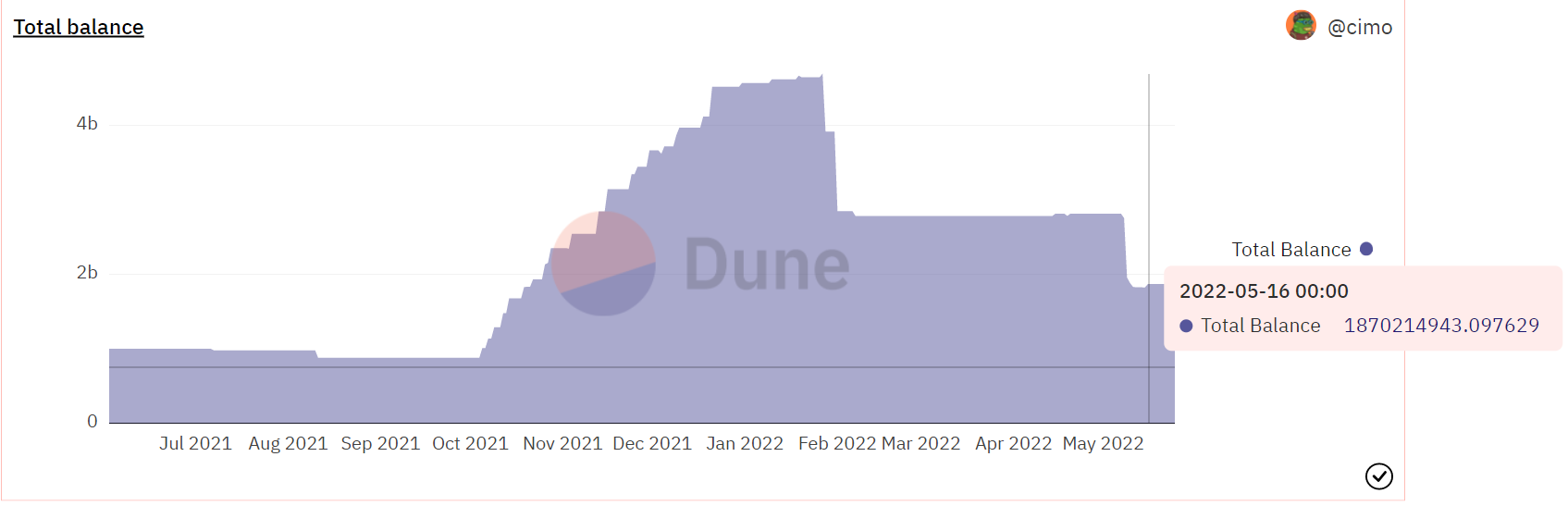

MIM 的总流通量在 18 亿左右,其中有 2.3 亿在 Curve 的 MIM+3 池里,还有 4.2 亿在 Uni V3的池子里,10 亿在跨链合约上。这三个合约占了总流通量的 80% 以上,负债结构较为简单。MIM 完全运行在链上,数据可查可追溯,公开透明。

数据来源:Dune Analytics

负债分析

Curve 上的池子有 2.3 亿的流动性,占总流通量的 10% 左右,该池子 30 日的交易量是 112 亿美元,几乎全部反映了 MIM 的流动情况。

流动性

流动性管理

MIM 最基本的流动性管理手段就是赎回抵押资产。但是 MIM 的抵押率较低,在极端行情下,用户有可能会放弃赎回抵押资产,而直接卖出 MIM。MIM 有自己的国库,使用了多签机制,用来应对极端情况,该地址拥有 323 万的 USDT,832 万的 CRV 以及 595 万的 MIM。考虑到极端行情下 MIM 的持仓不会抛出,因此剔除 MIM,其缓冲总值在 1500 万美元左右。规模较小。

流动性极端承压测试

MIM 风险在于,极端行情下,抵押资产价值大幅缩减,而 MIM 的抵押率又比较低,且国库的资金相对于流通量来说只有不到 1%,所以在极端行情下,面临着脱锚风险。

使用场景

MIM 是为生息资产提供流动性的,使用场景有限,用户如果有使用上的需求,一般会选择把 MIM 换成更普适的 USDC、USDT、DAI 等。

Float

💡 Float 跨越了美元锚定,想要直接实现在购买力上的稳定,是很有意思的想法,但其资产结构不合理,储备资产不断流失,使用场景匮乏。

资产

资产结构

Float Protocol 是链上协议,资产和代币分布都是可查的。目前,其储备资产的集合 Basket 地址有价值 114 万美元的 WETH,这些资产是由协议持有的,用于稳定价格,类似于抵押资产,但是并不可以拿 Float 来赎回,所以不完全是抵押资产。

特点

Float 储备资产的特点是只有两种资产组成,WETH 和 Bank,这两种资产的比例是可以通过协议来进行调节的,目前储备资产的地址中有价值 114 万美元的 WETH,通缩时会增发 Bank 来吸收抛压。

资产分析

Float 的资产总值在 114 万美元左右,抵押率大概是 65%,属于不足额抵押,但 Float 在通缩时会增发 BANK,所以抵押率要高于这个数字,另外,由于 Float 的资产比较单一,波动率也是很高的。

负债结构

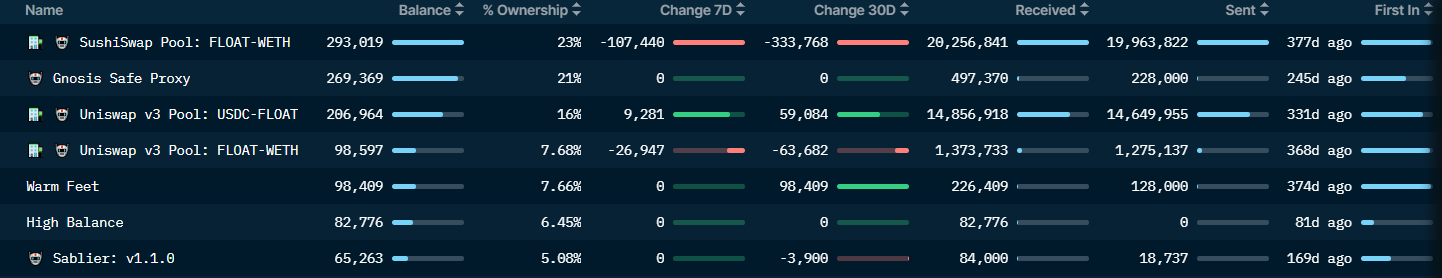

流通在外的 Float 总计 127 万左右,市值大概是 178 万美元,而超过 65% 的 Float 在 Sushi,Gnosis 和 Uni 的池子中。

数据来源:Nansen

负债分析

Float 的负债结构显示出,其并没有多少的使用场景,流动性也比较差。

流动性

流动性管理

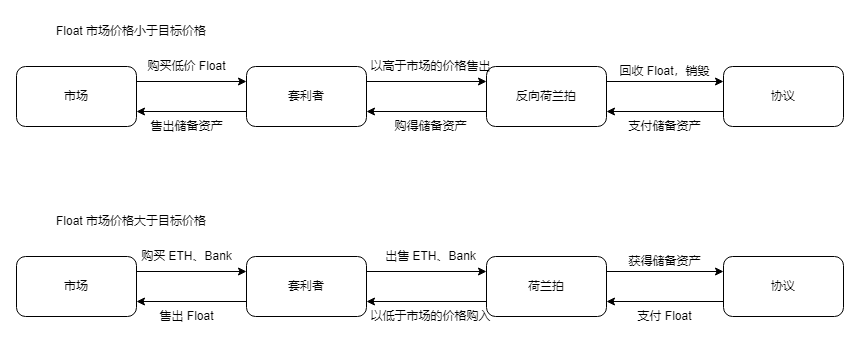

Float 最核心的创新就是稳定机制,Float 的构想如下图所示。首先,Float 锚定的不是美元,而是目标价格,目标价格受 ETH 价格影响。Float 的稳定机制依靠套利者,Float 市场价格变低时,套利者可以在市场上购买 Float,然后在协议内售出套利,反向同理。

来源:Float Protocol 官方文档

Float 的流动性管理方面,有几个风险点,一个是目标价格的确定,Float 的锚定价格追踪数字货币市场,也即 ETH,但市场行情走弱时,目标价格随之降低,用户手中的 Float 价值减少,这样并没有实现其保证用户购买力不变的目标,反而不如锚定美元来得实在。一个是,Float 的抵押率会在市场行情变化的时候降低,因为 Float 铸造的时候抵押率是 100%,非超额抵押的选择会降低人们的预期。不过,Float 的资产是通过协议来控制的,流动性分配也是由协议来实现。

流动性极端承压测试

Float 目前的金库有 114 万美元的 WETH,已经低于 178 万美元的 Float,不过由于 Float 的规模并不是很大,并没有严重的抛压,反而人们会预期市场回升。如果 ETH 的价格继续大幅走低,有可能会导致 Float 挤兑。

使用场景

Float 使用场景匮乏。

DAI

💡 DAI 一直被人们称为“最稳定的去中心化稳定币”,是什么样的资产结构与多样性让 DAI 的价格一直维持锚定?

资产

资产结构

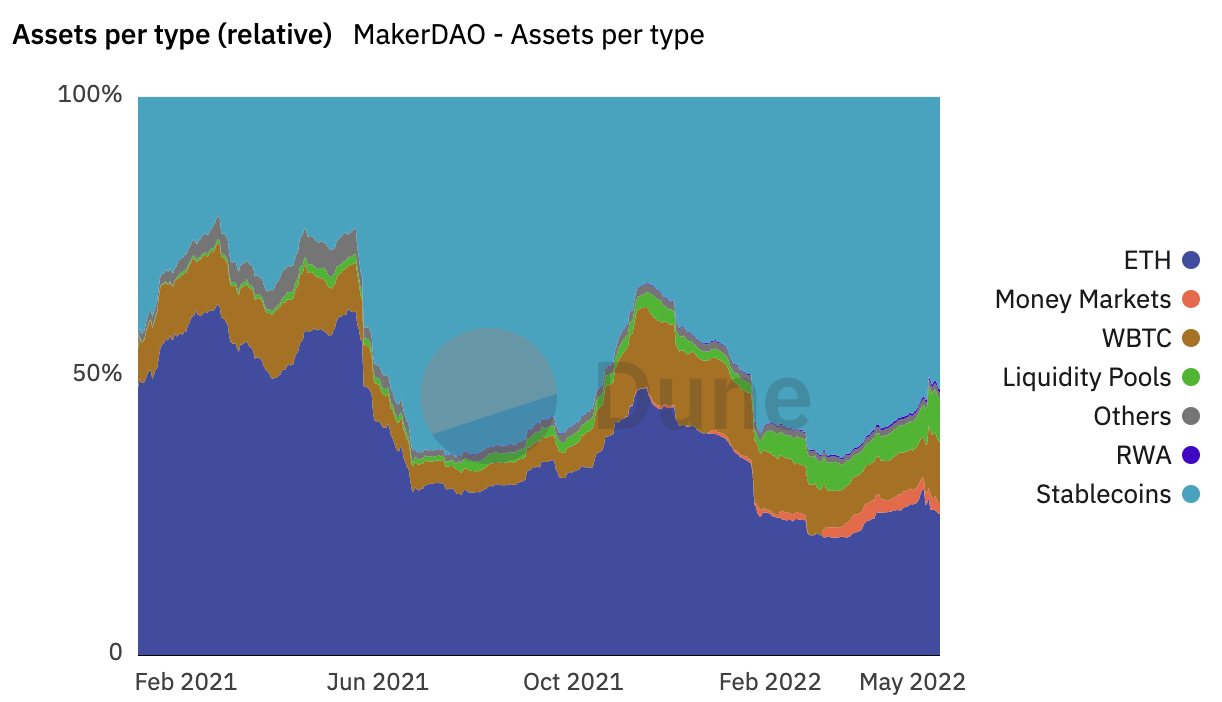

DAI 是以主流资产且超额抵押作为支持的稳定币。其支持的抵押品包括稳定币USDC、ETH、BTC、LINK、UNI、YFI、MANA、MATIC 以及部分高流动性资产的 Uni-V3 与 Curve LP 和链下资产 RWA,目前资产规模在 100 亿美元左右,ATH 超过 200 亿美元。

数据来源:Dune Analytics

特点

DAI 通过外部市场因素,如抵押债仓 CDP、自主反应机制和外部经济激励来保持稳定,以实现去中心化。而 MakerDAO 通过一套包括执行投票(Executive Voting)和治理投票(Governance Polling)在内的科学治理系统,让 MKR 持有者可以对协议以及 DAI 的财务风险进行管理,例如稳定费用、担保类型、担保率等,以确保其稳定性、透明度和效率。目前,DAI 的储备资产都以高流动性、相对低波动率作为主要特点,在不牺牲主流资产敞口的前提下为其释放流动性。

资产分析

DAI 背后的抵押品都是由资产多样性、平均数百万美元的日交易量和每个代币的相对稳定性进行选择的,以ETH、BTC为主,抵押率在 150% 左右。直到 Curve 3pool 部署后,DAI 的波动率才真正得到有效管理,持有者也拥有更多流动性选择。

负债

负债结构

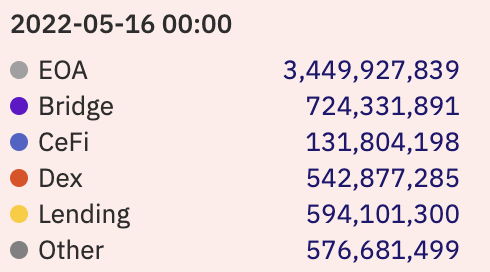

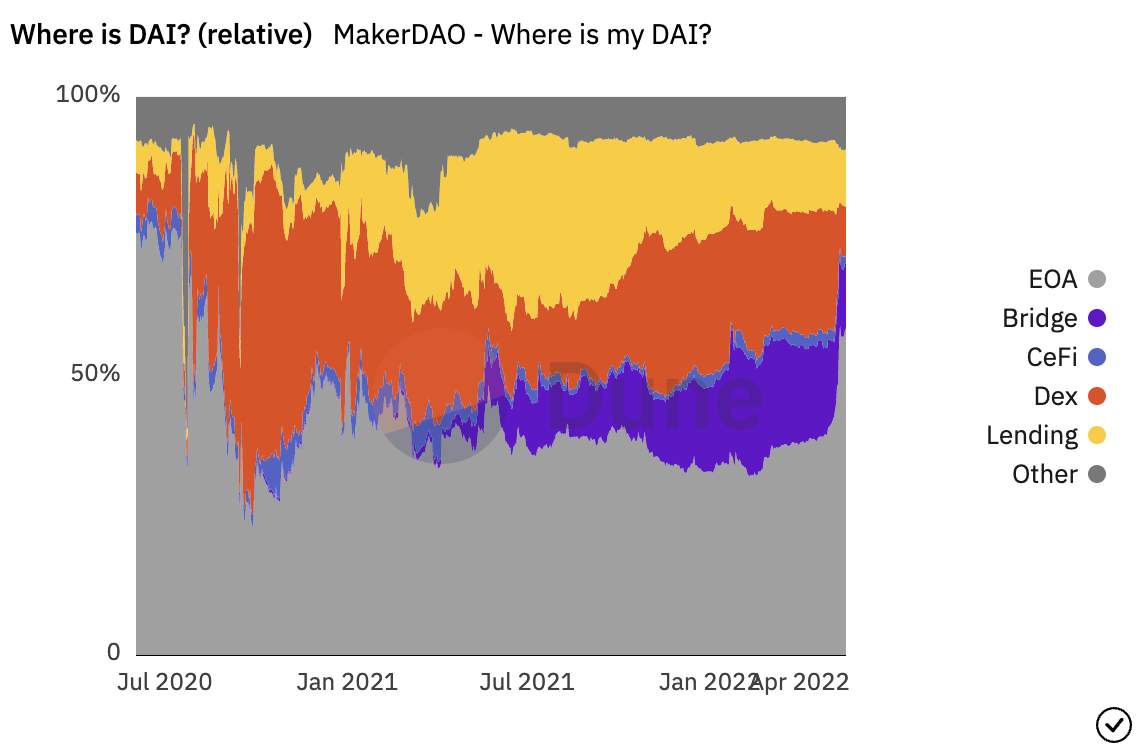

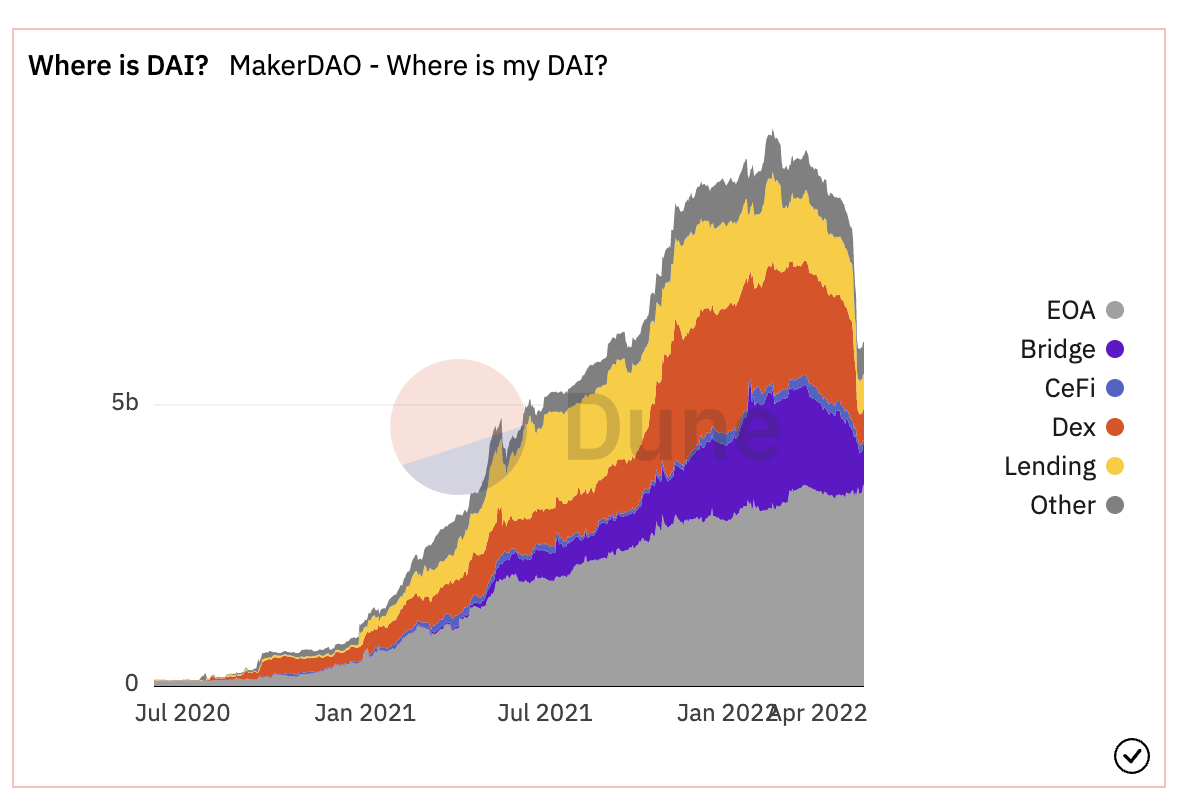

目前,DAI 的总流通约 60 亿,其中有约 35 亿在外部地址中(EOA),7.2 亿锁定在跨链桥内,5.5 亿在 DEX 中,5.9 亿在借贷协议中。

数据来源:Dune Analytics

负债分析

Coingecko 数据显示,DAI 的 24 小时交易量约为 3.5亿 美金,结合其大于 50% 的流通量位于外部钱包地址当中可以看出,DAI是较受欢迎的稳定币。其在借贷协议与跨链桥锁定的比例也说明了 DAI 目前已是 多链 DeFi 乐高中 不可或缺的一部分。

数据来源:Dune Analytics

流动性

流动性管理

DAI 作为多抵押品且超额抵押支持的稳定币,其多为流动性高的主流储备资产足以支撑用户赎回抵押品,避免因行情剧烈波动导致的挤兑以及清算。

数据来源:Dune Analytics

流动性极端测试

我们可以推测,在极端行情下,当抵押资产价值大幅缩水后,DAI 依然拥有 Peg Stability Module(PSM)以及 Curve 3pool 作为其保障锚定价值的核心。

使用场景

目前,DAI 仍以最安全的去中心化稳定币自居,被人们称为 “Wrapped USDC”,作为交易对结算资产离 USDC 仍有较大差距。而 MakerDAO 为用户提供的存款利率也常被人诟病,用户持有 DAI 的主观能动性也不足。

FRAX

💡 相比 UST,同为“算稳”的 FRAX 的成长却相对稳定、健康。由小比例 FXS 吸收波动性的飞轮设计目前看来十分有效,且 FRAX 也正在为多链计价拓展做了充分的准备。

资产

资产结构

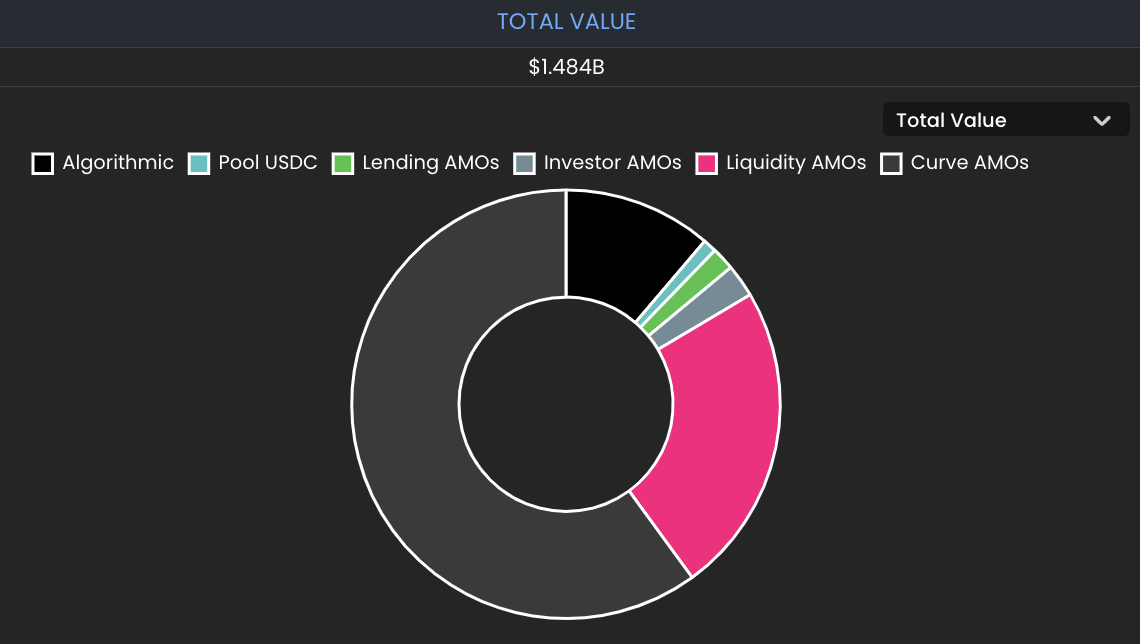

最初,FRAX 是由以 USDC(现已接受包括 DAI、FEI、LUSD、sUSD、USDP) 和 FXS 两种抵押品同时作为支撑的稳定币,两种资产的抵押比例(CR)由协议 AMO 算法控制,因此 FRAX 也称为部分抵押的算法稳定币。CR 决定了铸造或赎回 FRAX 所需的外置和内置抵押品的比例。未来,FRAX 的非足额抵押部分将接受链下资产 RWA。目前,FRAX的非 FXS 抵押品规模约 12 亿美金(当前稳定币抵押品比率为 89%)。

来源:Frax.finance 官网

特点

FRAX 所接受的资产选择基本为超额抵押或足额抵押的稳定币,以及吸收其与美元锚定波动性的原生代币 FXS。抵押品稳定币也在不降低抵押率的前提下被不同的 AMO 用于赚取协议收入。

资产分析

Frax Finance 通过其原生代币 FXS 吸收与美元锚定的波动性,实现了飞轮效应。稳定币抵押品和 FXS 都被 AMO 用于积累协议收入,其收入也被用于支撑非足额抵押部分与反哺 FXS 持有者。此外,FRAX 利用如 Curve AMO不仅可以赚取收入,还大幅增加了FRAX的流动性并加强其与美元的锚定,达到了类似央行干预市场以维持价格锚定的效果。

负债

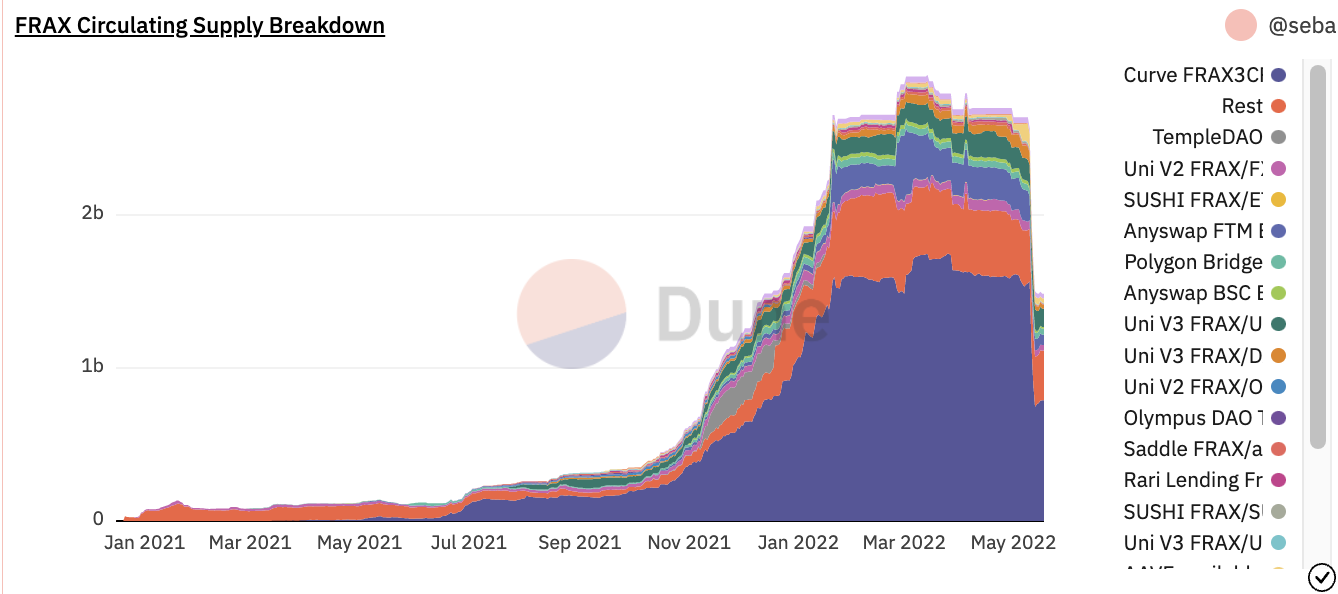

负债结构

目前,FRAX 总流通量约为 11.8 亿,其中有超过 50% 被用于 Curve 3CRV pool 赚取收入,有约 20% 成为了 DEX 中的稳定币计价交易对。

来源:Dune Analytics

负债分析

FRAX 在 Curve 上拥有约 1b 的流动性,占流通量的 70% 以上,30 日交易量近千亿美元,具有较高的流动性与需求量。以目前 89% 的 CR 计算,当前的负债结构基本健康。

流动性

首先,FRAX 使用双向套利机制维持其锚定,例如,如果 CR 为85%,那么铸造1 FRAX需要存入 0.85 美元的 USDC 以及价值 0.15 美元的 FXS。随着增长率的增加,意味着 FXS 的流动性相对于 FRAX 的供应量有所增加,可以赎回更多的 FRAX,而对 FXS 供应量的百分比影响较小。因此,该系统可以吸收更多来自 FRAX 赎回的 FXS 卖压,而不会面临负反馈循环的风险,并且 CR 也会降低。

其次,Frax AMO 所存入的协议都是可以立即赎回资产的协议,以保证稳定币抵押品与 FRAX 的兑付。国库积累的收入也将用于不时之需。

流动性极端测试

同样,极端行情下,FXS 市值将暴跌,CR 将从一个较低的百分比迅速飙升到较高的百分比,从而引发挤兑。然后,一定比例的 FRAX 持有人可能会通过赎回从系统中抽走所有抵押品,剩下的持有人将持有不足额抵押的 FRAX。但 FRAX 的 CR 并非旨在快速波动,所以不会出现 CR 大大超过系统中抵押品的实际百分比的情况。此外,这种差异通常发生在FRAX需求持续增长期间,并且 FRAX 仍拥有足够支持直接退出 FRAX 头寸的流动性。

使用场景

目前,FRAX 已陆续成为多链资产的计价方式,其 DeFi 生态的使用场景正在已经悄然超越了 DAI。

FEI

💡 FEI 的内核与 DAI 十分相似,但资产结构相对单一,使用场景更加匮乏。

资产

资产结构

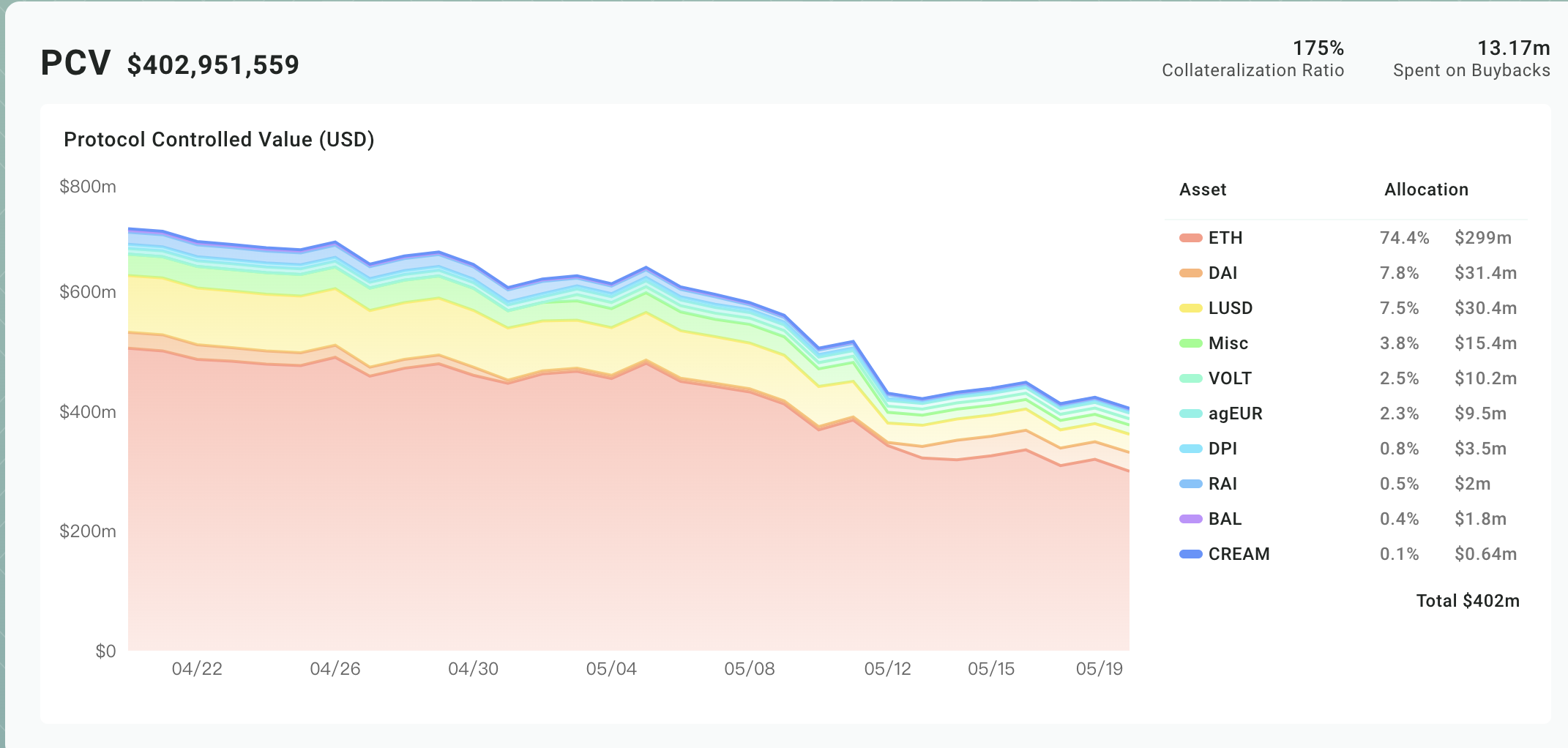

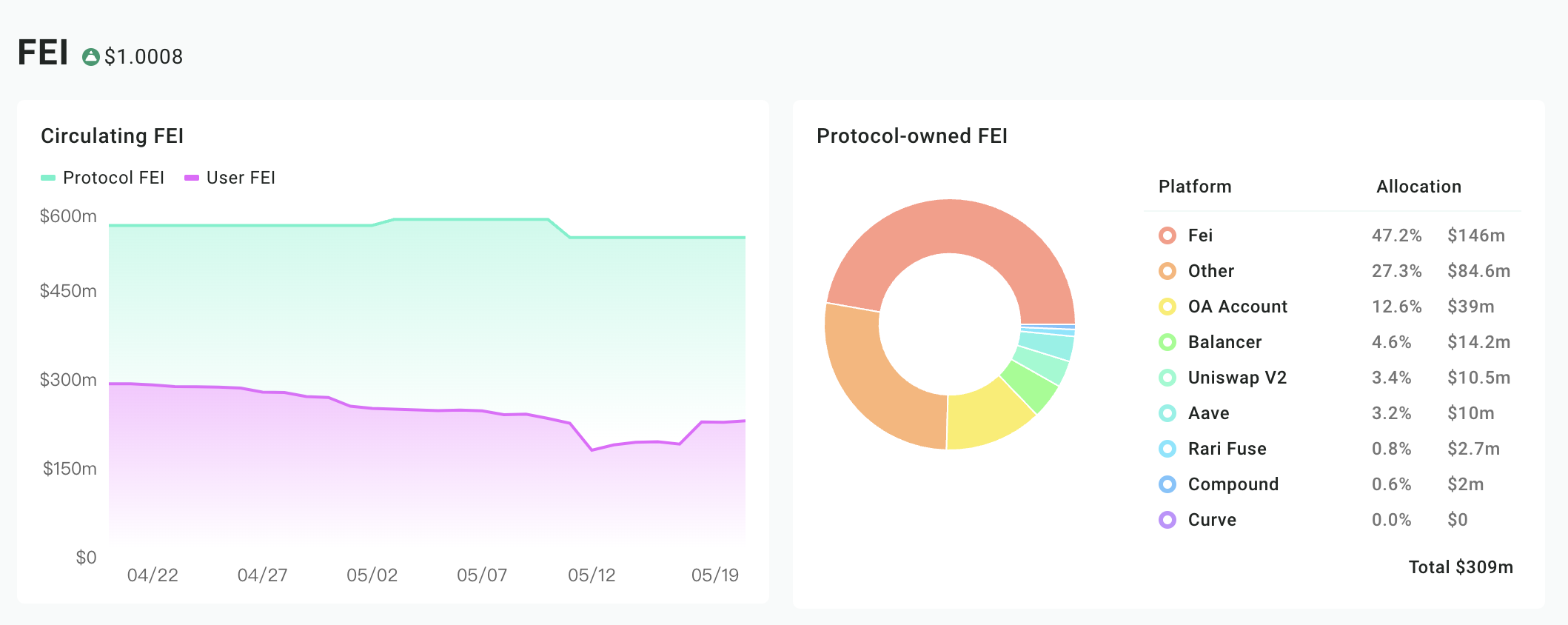

FEI 是以算法管理 PCV 以维持美元价值锚定的稳定币,实则超额抵押。目前 PCV 中有约 75% 为 ETH,7.8% 为 DAI, 7.5% 为 LUSD,2.5% 为 VOLT。PCV 也被用于收益策略增加国库收入。

来源:Fei Protocol 官网

特点

FEI 实则是超额抵押生成的稳定币,由其维持锚定模块 Peg Stability Module (PSM) 支持, 也由 PSM 赚取协议收入。

资产分析

目前 FEI 的系统抵押率为 175%,相比 MakerDAO更高。

负债

负债结构

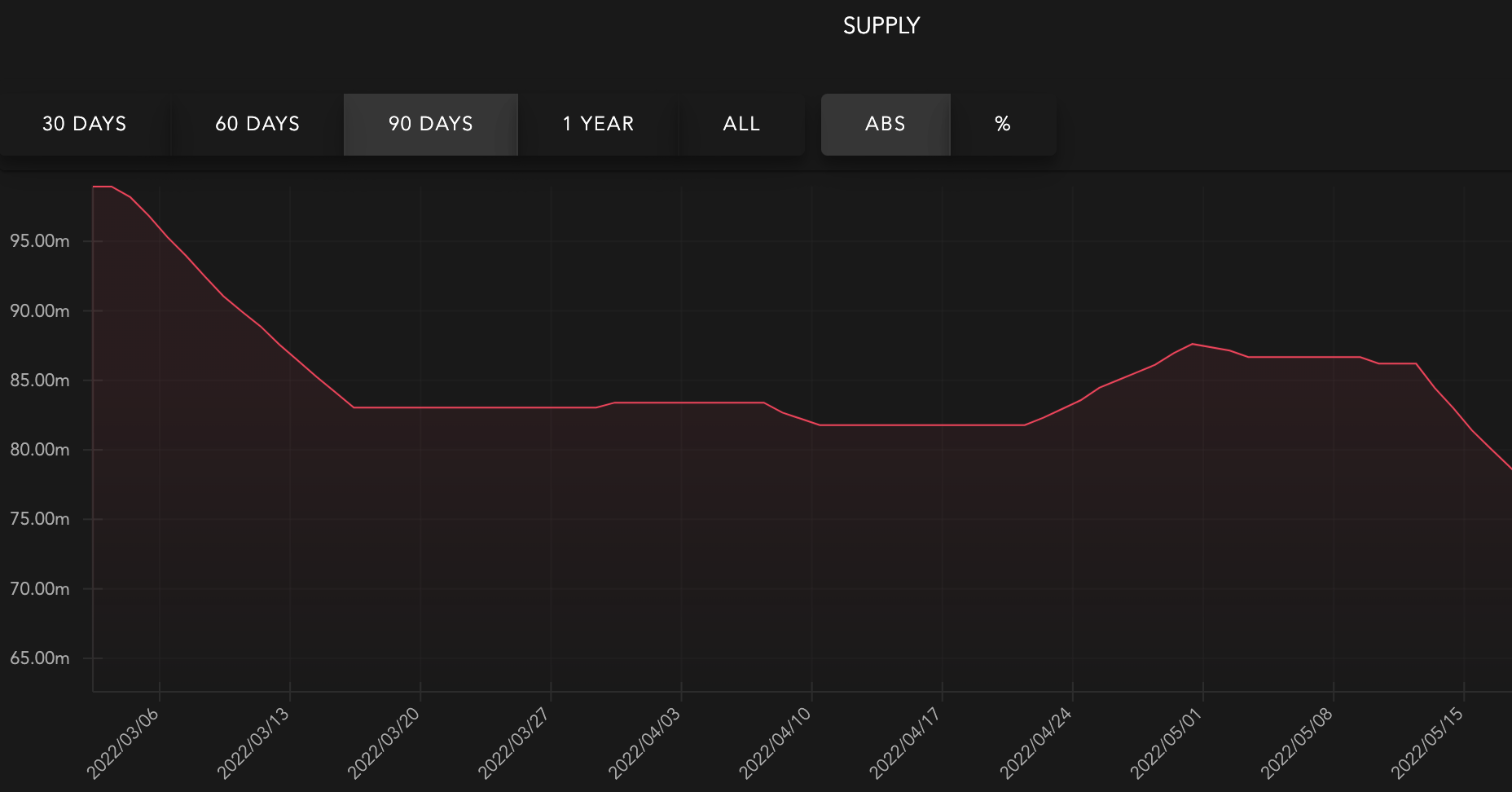

目前,FEI 流通约 5.3 亿。其中,有近 60% 为协议所有,40% 为外部流通。

来源:Fei Protocol 官网

负债分析

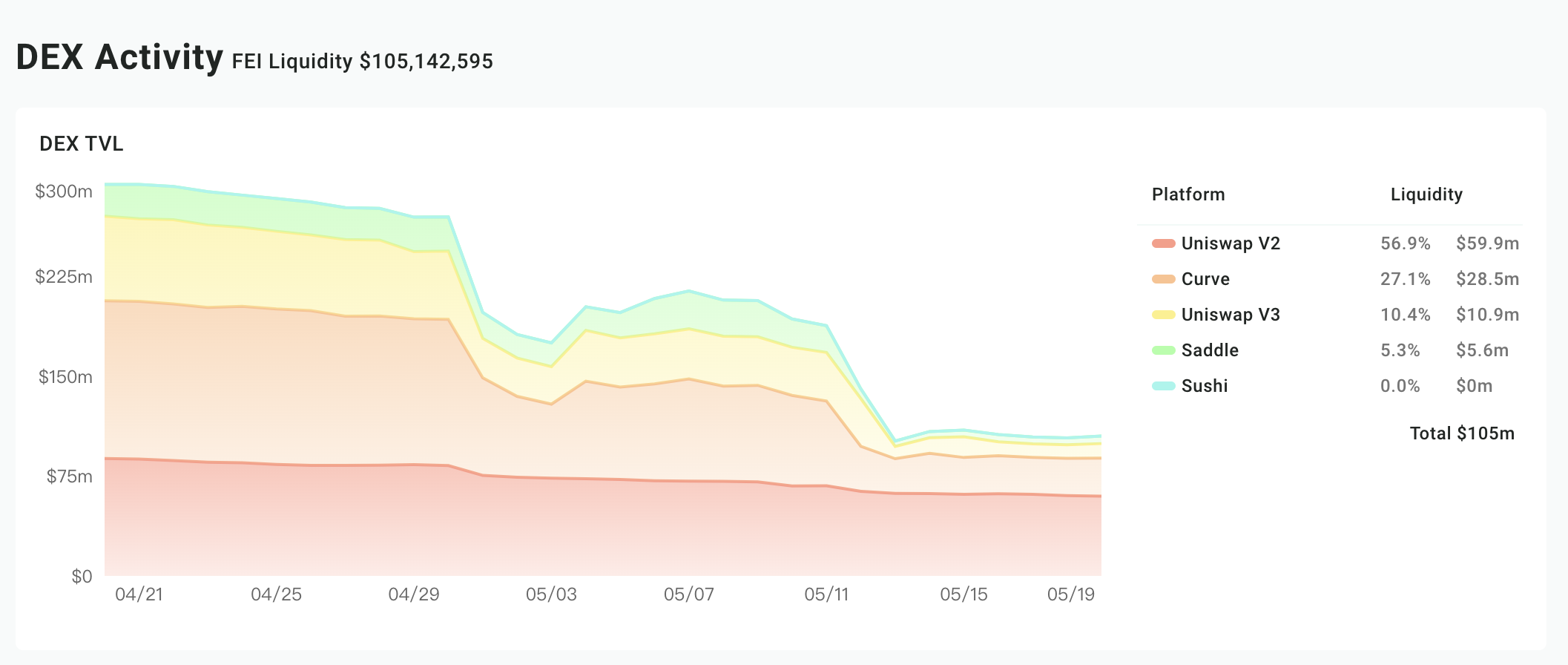

FEI 目前在 DEX 上拥有 100m 的流动性,其中 Uni-V2 拥有 60m 流动性,Curve 中拥有近 30m 流动性,整体 30 日交易量约 5 亿美元。但 FEI 的负债结构并不合理,从 ATH 的 PCV 腰斩来看,FEI 并未被外部生态所接纳吸收。

来源:Fei Protocol 官网

流动性

流动性管理

FEI 通过套利维持锚定:当 FEI 的价格长期低于 1 美元时,任何人都可以触发挂钩复权来使价格回升。协议会撤回所有拥有的流动性,用取回的 ETH 买入 FEI 至挂钩价,剩余的 ETH 加上的 FEI 重新提供流动性,销毁剩余的 FEI。除了协议的主动操作之外,还有一些机制促使用户的自发行为来锚定价格。当价格低于挂钩价格时,卖出的用户将有 4% 的额外损失,买入的用户将额外获得 2% 的奖励。

流动性极端测试

国库不退出 FEI 头寸的情况下,FEI 在 DEX 拥有 100m 的流动性以应对挤兑,加上175% 的抵押率足以维持 FEI 的抵押品兑付,FEI 不会长时间脱锚。

使用场景

FEI 的本质与 DAI 类似,因此目前 FEI 只有相关的衍生协议 Volt 使用其作为国库储备资产,场景很有限。

AMPL

💡 Ample Forth 是首批引入 Rebase 机制的算稳,使用供需关系调控货币发行量,然后依赖套利者的套利行为来驱使货币价格向着 1 美元的方向波动,但方式过于简单粗暴,当下行压力过大,流动性短时间被榨干。

资产

没有储备资产。

负债

负债结构

目前流通 77m,凭空创造。

来源:Ample Forth 官网

负债分析

进入水下的死亡螺旋后,市值与流通量同时下行,持有人权益被无限稀释。

流动性

流动性管理

AMPL 使用 Rebase 的方式维持价格锚定。当稳定币的市场价格小于目标价格 (2019 年的 1 美元),协议就会同比减少系统中所有用户手中的稳定币数量;反之,当稳定币的市场价格大于目标价格, 协议就会同比增加系统中所有用户手中的稳定币数量。

其最大的价值在于它首次大胆地设计了 Rebase 机制来调控货币发行量,然后依赖套利者的套利行为来驱使货币价格向着设计者希望的方向波动。在 AMPL 之后的所有关于算法稳定币的改良都或多或少都在围绕 Rebase 来开展,无论是智能合约全局调控还是发行协议债券、股票激励用户来完成供应量的调控。

流动性极端测试

当所有持币人抛售后会榨干流动性。供应量的调控手段偏直接粗暴,忽略了更复杂因素,如市场环境、心理因素等的影响。

使用场景

唯一拥有的场景是 Aave V2 的借贷。据团队称,未来还将推出基于AMPL 的抗通胀稳定币和基于 AMPL 的高波动性和低波动性代币。

ESD

💡 ESD 最重要的创新就是引入了协议股权、债券两个重要的宏观调控手段,但系统由于缺乏抵押物的支撑,预期的净现值无法长期支撑协议股份的价值。

资产

没有储备资产。

负债

目前流通 137,715,864,凭空创造。

负债分析

ESD 目前价格已经归零,因此负债也为零。

流动性

相比 AMPL,ESD 最重要的创新就是引入了协议股权、债券这两个重要的宏观调控手段。尽管第二代 Rebase 依然会智能合约全局调整总供应量,但只会用在通缩时,而且增发出来的稳定币会分给协议股票持有者享受铸币权。在面临通胀时,协议是通过优惠出售股票奖励用户主动销毁手中的稳定币形成套利机会,与 AMPL 的用户被动接受稳定币供应量增减有着巨大差异。

使用场景

无抵押支持者认为人们对系统的乐观预期,如系统能够稳健发展、价格稳定、供应体量稳步增长等并不足以支撑起一个稳定币系统。尽管以 ESD 为代表的项目引入了协议股票分享铸币税的设计,但是目前我们从稳定币价格稳定上看它们的表现要远糟糕于有抵押品的项目。由于系统缺乏抵押物的支撑,而这些预期的净现值就是支撑协议股票的价值。对比 UST 以及其他无抵押稳定币项目的发展情况来看,都是在稳定币价格下跌时用户都在离场抛售股票导致单靠协议股票调控失灵,系统崩溃的局面。

横向对比

结论

如何选择储备资产至关重要:对于一个稳定币项目来说,首先要考虑的问题是如何选择储备资产,稳定币新项目似乎很排斥以主权国家信用做背书的主权货币作为储备资产,但不选择法币,并不代表着去中心化,去中心化的表现之一应当是没有一个主体能随意挪用项目本身的储备资产。所以在当下,选择法币作为储备资产,是一个好选择,原因是,法币可以轻松的接入传统的金融市场,集聚起来的资金可以很容易的找到低风险的收益来源。在数字货币市场中寻找储备资产,还是要选择,流动性高,市值高,波动小的资产,MIM 提供了一个方向,以生息资产作为储备,但目前生息资产还不成熟。

抵押率的选择同样重要,UST 的崩盘给我们说明,以预期性资产作为储备资产的稳定币项目,原生代币的市值至少要高过稳定币的 10 倍,才能应对极端市场波动,越高波动率的资产应该对应越高的抵押率,在资本效率和稳定之间,应该优先保证稳定。

流动性管理方面,应该考虑是选择依靠套利还是协议本身控制,新发货币应该如何分配。依靠套利的项目,极端行情下套利机制有可能失效,依靠协议本身管理流动性效率低。结合资产端,哪些资产用来应对兑现的,选择多大的比例。当下稳定币项目在稳定机制上的设计大同小异,本质上都是在时间和空间上通过某种形式在市场上回收和投放货币。

使用场景的突破是值得期待的,不管是 FTX 提出的,期货市场结算采用智能合约还是在第三世界国家逐渐推广的各种支付应用,都具有极大的潜力。但是,更应注意到的是,数字货币天生适合的应用场景是虚拟消费场景,随着 NFT,Gamefi,元宇宙等消费场景的涌现,稳定币面前摆着巨大的历史机遇,而虚拟场景的支付,数字货币是有天然优势的。数字货币交易的一历史机遇支撑了 USDT 和 USDC,DeFi 的历史机遇支撑了 DAI,下一个历史机遇会催化出什么样的稳定币项目,值得期待。

无抵押的稳定币已经被证明无法长期支撑其债务发行,最终都将转向足额抵押的稳定币。而目前已有很多足额抵押稳定币,而最终能依靠其高流动性且拓展其生态与计价场景的稳定币将胜出。

Reference:

https://assets.ctfassets.net/vyse88cgwfbl/5UWgHMvz071t2Cq5yTw5vi/c9798ea8db99311bf90ebe0810938b01/TetherWhitePaper.pdf

https://www.centre.io/hubfs/pdfs/attestation/Grant-Thorton_circle_usdc_reserves_07162021.pdf

https://f.hubspotusercontent30.net/hubfs/9304636/PDF/centre-whitepaper.pdf

https://assets.website-files.com/611153e7af981472d8da199c/618b02d13e938ae1f8ad1e45_Terra_White_paper.pdf

https://pro.nansen.ai/token-god-mode?token_address=0xdac17f958d2ee523a2206206994597c13d831ec7

https://pro.nansen.ai/token-god-mode?token_address=0xa0b86991c6218b36c1d19d4a2e9eb0ce3606eb48

https://pro.nansen.ai/token-god-mode?token_address=0x99d8a9c45b2eca8864373a26d1459e3dff1e17f3

https://pro.nansen.ai/token-god-mode?token_address=0xb05097849bca421a3f51b249ba6cca4af4b97cb9

https://pro.nansen.ai/wallet-profiler?address=0xf3B29CeaD29CBeB35CF9371504DA2fF4770c59eC

https://mirror.xyz/0x43930805dEBbF779fB8EDC8E43f988A8448Aad63/XuF96k6vrQdE5zuDs6jeubJOSr07JwHaOH1Ai16UkI0

https://www.federalreserve.gov/econres/ifdp/files/ifdp1334.pdf