一文概览Rollup生态系统的发展现状

原文作者:Alex Beckett

原文编译:DeFi 之道

自 2019 年出世以来,Rollups 已经走过了漫长的道路。我们已经看到形成了两个主要竞争者阵营,以及包含许多混合演化的其他各种有前途的 Rollup 理论设计。2022 年已经过半,我们现在来看看 Rollup 生态系统的发展现状。

Optimistic Rollup

由于通用 Optimistic Rollup 的主网上线使用时间明显长于其 zk-rollup 同行,因此它们获得了绝大多数 rollup 应用程序。两个领先的 Optimistic Rollup 应用是 Arbitrum 和 Optimism,一段时间以来一直如此。

根据 TVL 衡量,Arbitrum 排名最高,达到 24 亿美元。尽管在主网上运行了一年的大部分时间,但系统上仍处于训练测试阶段。目前,开发 Arbitrum 的实体 Offchain Labs 运营着一个单一的中心化排序器。虽然交互式欺诈证明是实时的,但单个排序器是唯一可以提交争议以生成欺诈证明的白名单实体。从用户的角度来看,他们仍然必须对系统有很大的信任,尽管预计会逐步走向去中心化。

Arbitrum 下一个协议升级 Nitro 已在开发网络上运行,并将彻底改革现有架构,用 WASM-Geth 组合替换自定义的 Arbitrum 虚拟机。Arbitrum 的交互式欺诈证明将在 WASM 上运行,并且节点软件将具有与 Geth 等效的代码库,以及一些特定于 Rollup 的优化。总而言之,Nitro 将带来显着的优化、更高的性能和更好的 EVM 兼容性。

Optimism 是第二大 Optimistic Rollup,在所有 Rollup 的 TVL 排名中位居第三,为 4.69 亿美元。Optimism PBC 的情况与 Arbitrum 的情况类似,只有一个中心化排序器。然而,Optimism PBC 找到了一种方法,通过使用从排序器获得的利润来追溯资助公共产品,从而为网络提供积极的利益。第一轮共向 58 个公益项目捐款 100 万美元。如果有任何方法可以在中心化排序的情况下产生积极影响,那么这不失为一条可以走的道路。

目前,Optimism 缺乏欺诈证明,但预计会逐步去中心化和必要的安全升级——这也是标准。但是,几乎所有 Rollup 都具有即时或延迟升级能力,因此 Rollup 的安全性最终取决于升级多重签名。

即将到来的 Bedrock 升级将把 Optimism 的架构转变为类似于 Arbitrium 的架构。当前的 Optimism 虚拟机将被 MIPS-Geth 组合取代,其中节点软件等同于常规的以太坊 Geth 节点——这被称为以太坊等效。交互式欺诈证明也将作为附加功能,这是对原始非交互式欺诈证明的升级。一般来说,Bedrock 将是 Optimism 的重要一步,为系统添加了许多功能和增强功能。

顺便说一句,Optimism 也向非富豪治理实验迈出了一大步。决策将在两个屋子之间进行,即代币屋和公民屋。代币屋将采用通用代币投票,而公民屋将采用一个公民一票制。由此看来,这样一个系统中最困难的障碍可能是找到为用户分配公民身份的最佳方法,同时最大限度地减少女巫攻击的可能性。如果用户可以获得多个公民身份,那么他们可以有效地对治理施加比普通公民更大的影响力。Optimism 指出,他们将使用不可转让的 NFT 来代表公民身份,但是个人交换私钥以获得更多选票的威胁仍然存在。

Fuel 是 Optimsitic Rollup 领域的另一个著名参与者,它采取了与 Arbitrum 和 Optimism 截然不同的方法。Fuel Labs 正在使用基于 rust 的编程语言为 Fuel V2 构建自定义 VM。虽然与 EVM 兼容的 Rollup 对于将以太坊开发生态系统加入 Rollup 特别有用,但自定义 VM 是可以获得最大性能提升的地方,因为它们不必遵守现有的标准。

Fuel V2 中我最喜欢的部分可能是并行事务处理,主要是因为一旦出现足够的数据容量,吞吐量瓶颈就会变成执行。一旦吞吐量瓶颈转移到执行,实现并行处理的 Rollup 将比没有它的 Rollup 有优势。值得注意的是,Fuel V1 是第一个在以太坊上上线的主网 Optimistic Rollup,并且仍然是唯一一个存在无需许可的排序器和欺诈纠纷以及没有升级多重签名的 Rollup。

以目前的形式,Optimistic Rollup 远远优于 zk-rollups。两个主要考虑围绕着:

完全、无限制的可组合性:zk-rollups 在 zk 电路上组合智能合约方面存在固有的困难。唯一具有一般可组合性的 zk-rollup 是 StarkNet,它目前已获得许可的智能合约部署,并对桥可以支持的 TVL 数量设置了上限。所有其他 zk-rollup 都是特定于应用程序的,或者只进行代币转账。

EVM 兼容性:zk 电路与 EVM 中标准的某些类型的密码学存在固有的兼容性问题,这使得 zkEVM 成为一项极具挑战性的任务。具有 EVM 兼容性的主网上已经存在了一段时间的 Optimistic Rollup,预计升级将进一步实现等效。

Zk-rollup

一段时间以来,以太坊社区已经达成共识,即 zk-rollups 是可扩展 rollup 的最终状态。因此,与 Optimistic Rollup 相比,正在积极开发的 zk-rollup 项目似乎更多,其中许多计划在未来两年内推出。

Starknet 目前是已上线主网的唯一的通用、可组合的 zk-rollup。但是,该系统仍处于早期的 alpha 模式,具有多种限制。StarkNet 和以太坊之间的桥梁被限制在一定数量的 TVL,自推出以来逐渐增加。StarkNet 上的智能合约部署也被列入白名单。我认为这主要是为了降低发生智能联系错误的风险,因为可能没有足够的(任何?)审计员来审计开发人员想要部署的所有 Cairo 合约——StarkWare 将暂时担任这个角色是有道理的。可审计性是新的自定义语言的普遍缺点之一,而 zk 系统的复杂性只会加剧这种情况。最终,StarkNet 目前处于领先地位。

ZkSync 是另一个主要的“zk-rollup”竞争者,一段时间以来一直在使用 zkSync 2.0 构建通用 zk-rollup。最近的测试网标志着 zkEVM 在实时测试网上的第一个实例。然而,随着 zkPorter 的加入,zkSync 2.0 不仅仅是一个 Rollup。这将是一种 Volition,使用户能够在 zkPorter 和以太坊之间进行选择以发布他们的交易数据。虽然以太坊正在升级使用 danksharding 的数据吞吐量,但 Volition 是一个很好的中间地带,它为用户提供了在交易成本安全范围内的选择。

虽然大多数 zk-rollups 都优先考虑可扩展性,但隐私是 zk-rollups 可以启用的另一个重要方面。Aztec 目前凭借其私人代币传输 zk-rollup (zk.money) 在隐私领域处于领先地位——它们是我所知道的唯一一个以隐私为重点的以太坊 rollup。Aztec 还将在大约下周推出其下一次迭代 Aztec connect,使用户能够私下访问以太坊 DeFi。与使用 Tornado Cash 之类的东西相比,这是一个很大的改进,其中隐私只能通过混淆而不是直接屏蔽交易来实现——但愿没有人链接你的 Tornado 钱包,否则你的隐私就消失了。

Zk-rollups 已经非常复杂,增加隐私使问题更加复杂。zk-rollups 有可能永远不会达到私有可组合智能合约的状态。正因为如此,隐私可能会通过特定于应用程序的链出现,无论是通过 zk-rollup 还是 zk-rollup 之上的验证(validium)。

其他各种 zk-rollup 也存在于生产中,包括 Scroll 和 Polygon 的各种项目。zk-rollups 的一大区别在于使用自定义 VM 或 zkEVM 执行环境。其优点和缺点类似于 Optimistic Rollup。但是,zk-rollups 在实现 zkEVM 时具有更多固有的复杂性。因此,可以为使用自定义 VM 和语言(如 StarkNet 和 Cairo)的路线提供非常有力的案例。

主权 Rollup

Rollup 类别中的最后两个目前是理论上的,尽管正在积极开发中。主权 Rollup 与典型的 Rollup 不同,因为它有一个分叉选择规则,允许它独立于其基础层分叉。相反,常规 Rollup 将其分叉选择委托给其结算层——它必须是结算层,因为它需要确保 Rollup 的正确性。

主权 rollups 将在 Celestia 等数据可用性(DA)层上最为突出,其中 DA 层无法确保 Rollup 事务的正确性。正因为如此,像 Celestia 这样的东西的 Rollup 默认是主权的,因为它们必须通过欺诈/有效性证明和分叉选择来确保自己的交易正确性。这不应被误认为是 Celestia 提供的共识,用于就交易排序达成一致。

对于一个乐观的主权 Rollup,假设交易是正确的,因此 Rollup 节点只需要从 Celestia 下载区块数据。Zk - 主权 rollup 通过有效性证明确保正确性,该证明将通过 p2 p 网络分布在 rollup 节点之间。

对我来说,主权 Rollup 的重要性在于它们的分叉能力,这使这些 Rollup 能够真正独立于其基础层。从本质上讲,主权 Rollup 重新获得了社会追索机制。

结算 Rollup

结算 Rollup 是一种专为结算而构建的主权 Rollup。重要的是,结算层是任何具有双向信任最小化桥梁和 Rollup 的区块链。该桥使代币能够在 Rollup 层和结算层之间双向传输。信任最小化是桥梁的一个属性,其中通信仅依赖于通过验证数据可用性和欺诈/有效性证明的诚实少数假设。

与任何结算层一样,结算 Rollup 的目的是为“Rollup”提供一个环境,以验证证明、解决争议和桥接代币。不过,从技术上讲,结算之上的“Rollup”是混合的,因为它们通过结算 Rollup 所在的数据可用性层使用链下 DA——使它们成为一种 validum 或一种 Optimistic validium。

混合 Rollup

Validum

说到混合,validium 就是一种混合 zk-rollup,其中交易数据发布在链下,这可能需要除用于验证有效性证明的结算层之外的任何环境。StarkEx 是唯一的有效实例。特别是,StarkEx 是一个特定于应用程序的验证,目前支持三个应用程序;Immutable X、Sorare 和 DeversiFi。StarkEx 还支持 DyDx 使用的 zk-rollup 模式,这是 TVL 第二大的 Rollup。

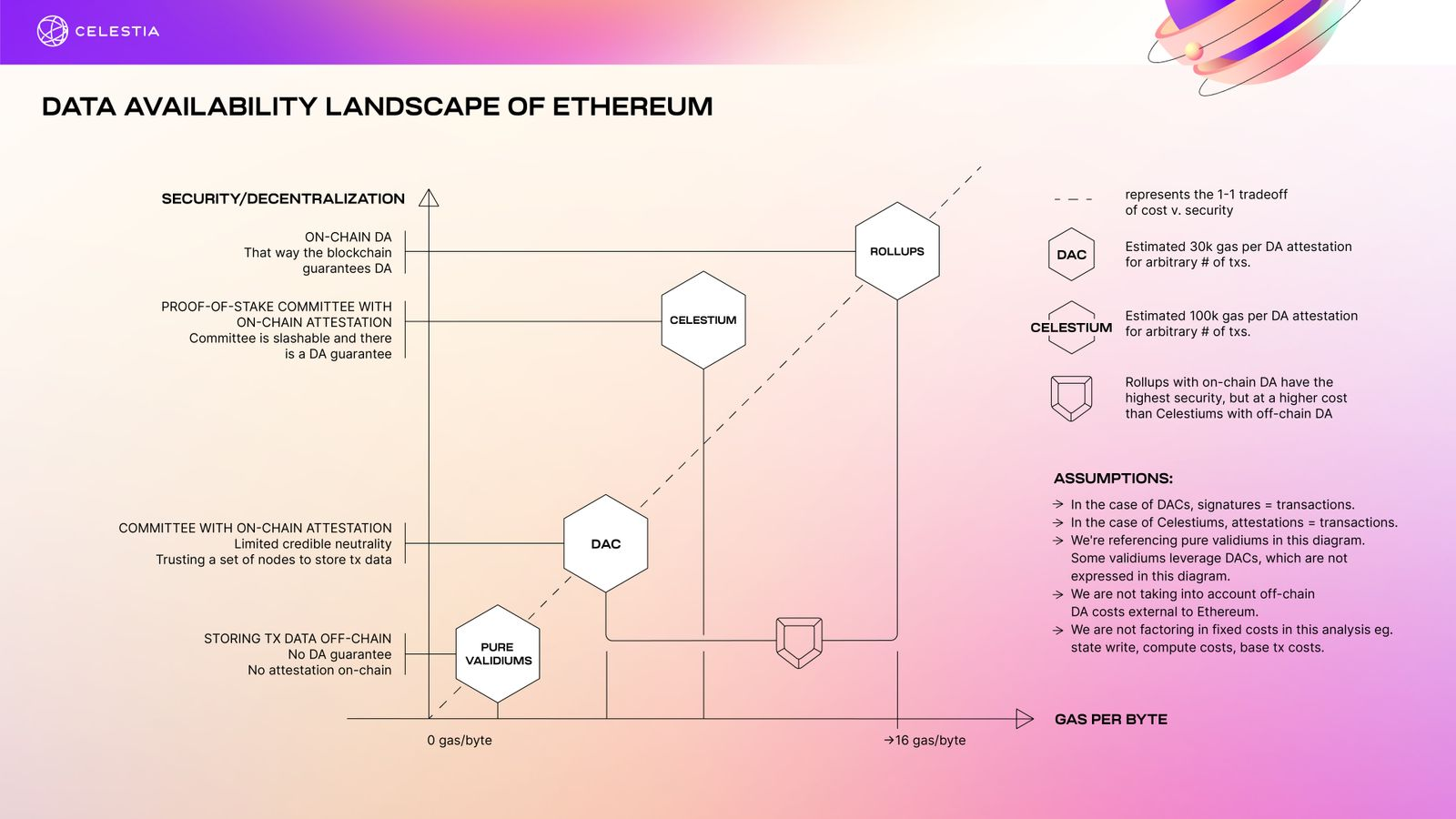

StarkEx 使用由一组受信任方组成的数据可用性委员会 (DAC) 为 StarkEx 验证提供数据可用性。虽然将数据可用性委托给获得许可的委员会会降低安全性,但它使 StarkEx 验证能够提供比 zk-rollups 更便宜的交易。成本降低是可能的,因为将数据发布到以太坊是昂贵的——它也是导致 Rollup 交易费用的主要可变成本。

使用外部数据可用性层可以减少带有 DAC 的验证的一些安全考虑。安全性的主要增加来自区块链提供的加密经济安全性,节点可能因不诚实活动而被监禁和惩罚。该实施的一种 Validium 是对“Rollup”范围内成本安全权衡的一个有趣的补充。

图片来自 Celestia

Optimistic Validium

与验证一样,一种 Optimistic validium 是一种混合 Optimistic Rollup,其中交易数据发布在链下。关于这个特定的混合体应该被称为什么并没有普遍的共识,所以这就是我要说的。

Metis 是目前唯一的 Optimistic validium,它从一种 Optimistic Rollup 模型转变为以安全为代价降低交易费用。Optimistic validium 对其 validium 对手的安全保证较弱,因为需要数据可用性来生成欺诈证明并成功解决争议。如果发生争议并且相关状态转换的数据不可用,则欺诈证明无法证明欺诈。因此,如果链下数据可用性提供者未能提供数据,资金可能会从 Optimistic validium 中被盗。

Volition

通过结合 zk-rollup 和 validium,Volition 是一种混合体,让用户可以选择链上或链下数据可用性。选择是在个人交易层面做出的,其中链下数据代表更便宜的费用和更低的安全性,而链上数据导致更高的费用和更高的安全性。这为用户提供了由单个系统提供的选择自由,而不是明确地寻找适合用户成本安全偏好的链。

目前,zkSync 2.0 是唯一公开宣布的正在开发的 Volition。在 zkSync 2.0 中,链上数据由以太坊提供,链下数据由他们自己的专用 PoS 链 zkPorter 提供。关于 zkPorter 的细节并没有太多细节,我猜主要是因为它仍在积极的开发和测试中。StarkWare 可能会为 StarkEx 或 StarkNet 实施一种 Volition 选项,尽管这纯粹是猜测。

Adamantium

adamantium 是一种验证,其中每个人都亲自向网络提供自己的数据可用性。个人的交易数据由他们亲自存储(链下),他们必须保持在线以证明每个区块的数据可用性。如果用户不在线或未能证明,那么他们的资金会自动在链上撤回到结算层。虽然 StarkWare 提出了 adamantium 设计,但没有任何明确的迹象表明 StarkWare 或任何团队正在从事这项工作。最终,如果确实得到了开发,它可能会成为希望对其安全进行更多个人控制的用户或实体的利基选择,这就是为什么 adamantium 用户被称为“高级用户”的原因。

Enshrined rollup

最后值得一提的是,Enshrined rollup 是一种直接作为现有区块链一部分的 rollup。简而言之,它是一个执行分片。正如在以太坊 2.0 提案和其他类似分片的区块链中看到的那样,Enshrined rollup 和执行分片之间的区别在于,执行分片被提议为单体。全局验证者集将被拆分为委员会并分配给特定的分片以充当验证者集。执行分片将充当另一个拥有自己的执行、共识和数据可用性的区块链,但它会检查点回到“信标链”——类似于侧链检查点返回到他们选择的链的方式。理论上,以太坊 enshrined rollup 只会进行执行,并使用信标链来验证数据可用性和欺诈/有效性证明。