对于当前加密市场走势,50个KOL这样说

编者按:本文整合自 Twitter 大 V 对当前加密市场行情的观点言论,由 Odaily星球日报译者 Katie 辜编译,其中有苦水、有鸡汤、也有强心剂,仅供参考,请各位读者切勿作为交易依据,DYOR(尤其是在极端行情和大幅波动下)。

1. 币安创始人 CZ:

如果你认为只有加密货币波动性很大,那就看看股票吧。-84%、-72%。这并不是说它让加密货币的情况更好,了解风险管理挺重要的。

我们需要尊重市场,剩下的留给市场和时间。最终,我们需要回到基本面。创造真正的产品,不是依靠短期激励或促销,而是人们使用的内在价值。市场在循环中上下波动。

记住,有卖家,就有买家。

2. FTX 创始人 SBF:

市场不会因为通货膨胀加剧而下跌。不久前就发生了通货膨胀。

世界“意识到”通货膨胀已经发生了——>利率上升——>通胀下降——>市场下跌。

3. Digital Currency Group 创始人 Barry Silbert:

在这个市场上,我宁愿拥有比特币,不愿意拥有其它。

4. 三箭资本联合创始人 Zhu Su:

本周对我们行业的多个方面进行了压力测试。我也看到了跟 2020 年 3 月类似的感觉。虽然现在感觉很残酷,但总会好起来的。

5. ARKinvest 创始人 Cathie Wood:

科技/电信泡沫破灭后,股票遭到抛售,因为“梦想”在 20-25 年内都不会成为现实。基因组测序、自适应机器人、能源存储、人工智能和区块链技术都是现实,它们的股票似乎处于深度价值领域。

6. 1Confirmantion 普通合伙人 Richard Chen:

去年,许多唯利是图的创始人从风投那里获得了错误的信息(以太坊 NFT 对环境不利,DeFi 的竞争对手有 XX 问题,等等)。

在熊市中,当大潮退去,才知道谁在裸泳,留下真正的创始人和真正被使用的产品。

7. Bankless 创始人 David Hoffman:

这是市场循环的一部分,在这里,新人要么学会了去中心化和抵制审查制度的价值。或者他们离开,然后再回来,进入下一个牛市。

8. Nansen 创始人 Alex Svanevik:

有时很容易陷入二元思维:“我应该全部卖掉还是持有?”重要的是要记住你还有选择的权利。通常比什么都不做要好。

9. OpenSea 联合创始人 Alex Atallah:

微观悲观,宏观乐观。

10. Paradigm 联合创始人 Fred Ehrsam:

其 2018 年发表的《surviving crypto cycles》文章:“周期没有好坏之分,它们是自然的。高峰期的兴奋为世界提供了梦想成真的机会。最低点的绝望催生实用性和清晰性。市场在短期内是非理性的,但从长期来看并非如此。”

11. Pantera Capital 创始人 Dan Morhead:

我认为比特币可能很快与其它风险资产脱钩。比特币经历了许多繁荣和萧条的周期。

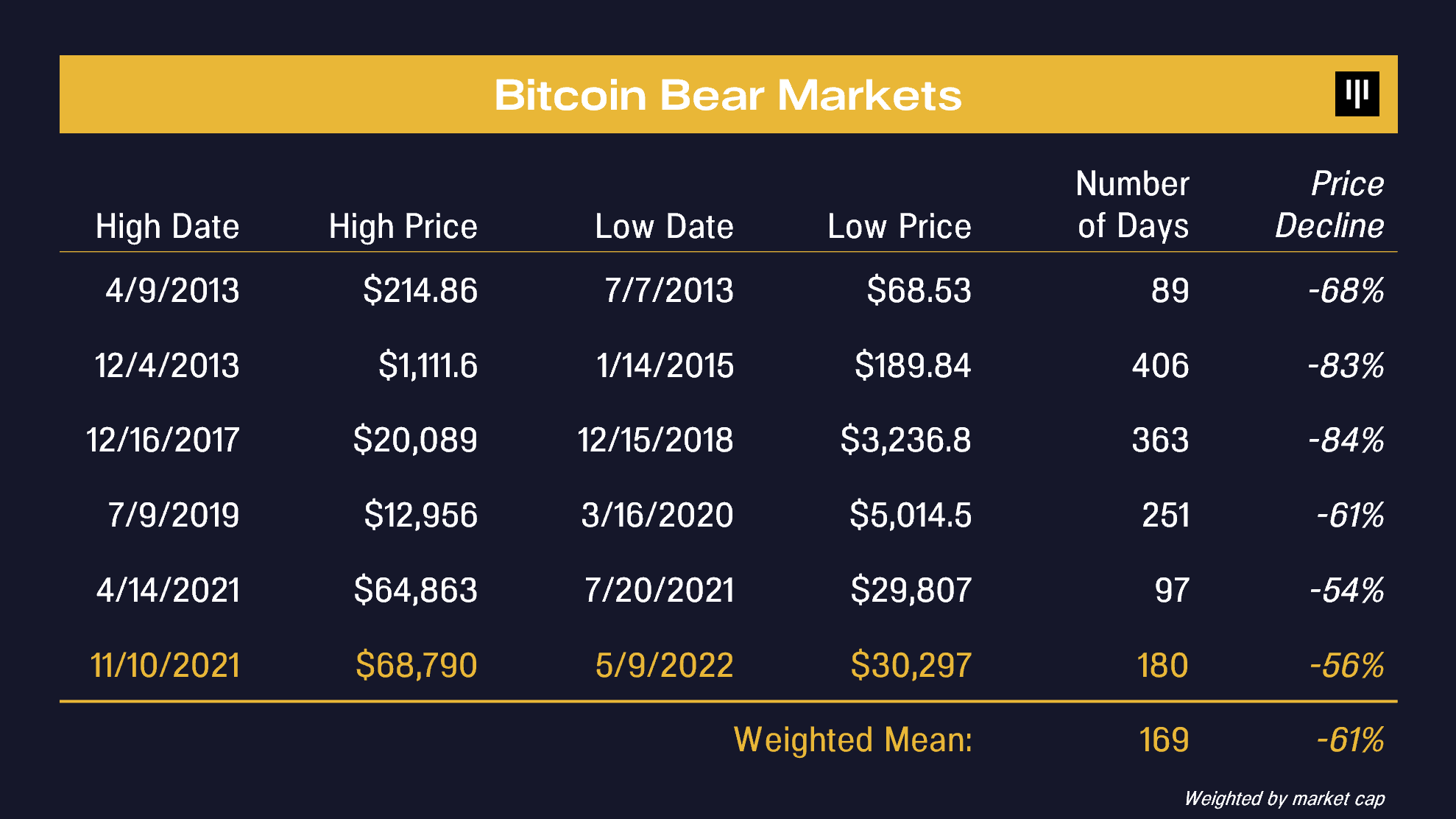

以下是过去 5 个周期的平均跌幅(按市值加权):-61%,169 天。

当前的熊市:-56% 超过 180 天。

12. Axie Infinity 联合创始人 The Jiho.eth:

今天对加密界来说是绝对残酷的一天。作为一个行业,我们还有很长的路要走,还有很多要做。我并不是说这次熊市会像上一次一样,甚至也不是说我们正处于熊市。

我想让你知道这种波动在加密货币中是很正常的。它是未来生长的肥料。它很臭,但它是必要的。这是过程的一部分。

回头看,最后一只熊是我们需要的:这让我们变得坚强,它让我们走到了一起,给了我们新的视角。我们有资金继续建设 10 年。我们准备好了。

许多项目将会夭折,而我们将活下来。

13. Messari 创始人 Ryan Selkis:

我们刚刚损失了 400 亿美元的资产,并不是“大而不倒”。我宁愿选择一个无情的、抗脆弱的系统,而不是一个“安全的”、“规范的”系统。

你可能有几个月的时间在目前这个价格附近买入,假设它们还能保值的话。

14. Compound Finance 创始人 Robert Leshner:

加密搏击俱乐部 Rule NO.1——先活下去。

15. Dragonfly Capital 管理合伙人 Hassedb Qureshi:

从一个输了很多钱的人那里学到的 4 个教训(不是我):

(1)人类是有弹性的。我们习惯的速度惊人的快。

当你失去了一切,第一个晚上感觉绝望。第二天感觉很郁闷。接下来的一周感觉是可控的。下个月,你忘记了你甚至失去了它。

(2)天下没有免费的午餐。每当你认为自己找到了一种轻松赚钱的方法时,你很可能遗漏了一些东西。

(3)当你输了钱,你剩下的是你的技能和知识,这些只会增长。

我的许多知识和经验都来自于我过去的失败。第一次失败的人根本没有机会。

(4)你通过做你喜欢的事情来积累真正的财富。因为如果你不爱它,你会放弃得太早。

加密货币已经死亡了太多次,无法计算。我认识很多人,他们很早就进场,但失去了信心,然后离开了。

16. dYdX 创始人 Antonio:

市场会影响我们。我们不能忽视它,这将是痛苦的,它可能会迫使我们改变我们的心态一段时间。但杀不死我们的终将使我们更强大。

市场会卷土重来,尽管有噪音和不确定性,我们会留下来继续建设。

17. The Block 创始人 Frank Chaparro:

人们仍在处理这个问题,但这是加密货币的“雷曼时刻”。听说有很多基金可能因为 LUNA 的崩溃而破产。

18. Penguin 新老板 Luca Netz:

胖企鹅撑住!我们是最胖的!

19. Yield Guild 联合创始人 Gabby Dizon:

如果你现在在赔钱,退一步,保留你的资金,保持清醒的头脑。心理健康是第一位的。不要投资超过你所能承受的损失,而是将你的时间和精力用于协议,赚取加密货币。

20. Delphi Digital 总顾问 Gabriel Shapiro:

悲极生乐。

我也将加入痛苦的队伍。是的,我在 Terra 的税后净资产为负。

奇怪的是,虽然我是一个非常悲观和容易抑郁的人,但我似乎就是不会为此感到沮丧。不知道为什么,但我想这是个好兆头。

21. Bitfinex CTO,Paolo Ardoino:

如果你想继续 HOLD,还有很长的路要走。

22. The Block 首席研究员 Steven:

我不在乎你的 Crypto。

23. Bankless 作者 Ryan Sean Adams:

UST 试图渗透到 DeFi 的各个角落。幸运的是,我们切除了“癌症”。如果照这样的传播速度,可能已经是晚期了。

24. 《2022 年第一份财富密码》作者 Adam Cochran:

市场内爆最糟糕的部分是,无论是骗局还是杠杆导致的下跌,最终只会因为绝望而发生。

传统经济是如此的糟糕,以至于大多数人觉得唯一的“成功”的方法就是把所有的东西都放在数字资产和杠杆上。

除非修复根本性破损的社会经济体系,否则他们总是会回来追逐风险级别高达 11 级的东西。

如果监管机构真的想保护公众不受快速致富计划的影响,最好的办法是专注于改善我们经济中的所有公平和准入,这样人们就能真正致富。

我们也要问问自己,为什么这么多人觉得有必要赌得这么狠,以至于他们会对每一个警告都视而不见。

25. 数字资产算法做市商 Wintermute CEO 致全体员工内部邮件:

准备好迎接冬天吧。

26. BitMEX 联合创始人兼前 CEO,Arthur Hayes:

在他最新的文章中指出,“预计 6 月加息 50 个基点,并将继续削弱长期风险资产……我将在比特币 20,000 美元和以太坊 1,300 美元时介入。”

27. a16z Web3 顾问,Not Boring Capital 创始人 Packy McCormick:

VC 告诉投过的创始人要勒紧裤腰带。

28. FXT 投资人 High Stakes Capital:

看多。

2 号持有现货,现在上杠杠了。

29. Ever New Capital 合伙人、168 Club 合伙人 Woody:

老手死于抄底,麻了,继续躺平。

30. Placeholder Venture Capital 合伙人 Chris Burniske:

30% 概率:BTC 25K & ETH 2K6

25% 概率:BTC 30-33K & ETH 2K-2200

35% 概率:BTC 27-29K & ETH 1700-1900

30% 概率:BTC ~22K & ETH 1400

31. Castle Island Venture 合伙人 Nic Carter:

这下真完犊子了。

32. The Syndicate 天使投资人 jason@calacanis.com:

加密货币将进入冬天。骗子和无能的人没法赚快钱了,温州皮革厂老板要带着他的小姨子跑了。

现在 Web3 只有 1% 的合法创始人才能从灰烬中创造出真正的价值,类似于网络泡沫破灭后的情况。

33. Rari Capital 创始人 JAI BHAVNANI:

过去一周对市场上的每个人来说都是疯狂的,尤其是加密货币。情绪很低。

这是真正的建设者活跃起来的时候。这是它们茁壮成长的时候。加密市场建设者从 2018 年到 2019 年的付出使 20-21 年加密之夏成为可能。

34. 前高盛投行员工 Degentraland:

我 16 岁的时候,和学校里的一个女孩勾搭上了,结果她告诉了学校里的每个人。对比下,这次市场对我的伤害更大。

35. First Star Venture VC,Drew Volpe:

长时间内,BTC 才是稳定币。

36. DeFiance Capital 投资人 Arthur:

如果再出现牛市,我们就别再只说“UP”了。

37. LedgerPrime 数字资产公司领导人 Joel John:

Mt Gox (出事)的时候我也在。当时 Crypto 市值 ±10%,但恐慌要慢得多。从 2013 年 12 月到 2014 年 2 月,故事才成为现实。显然,这将反弹,但相当有趣。

38. LedgArt NFT 项目联合创始人 KALEO:

一旦 FUD 最终得到缓解,应该有望为本周结束时的小幅反弹打开大门。

39. Chartered Financial 分析师 freshjiva:

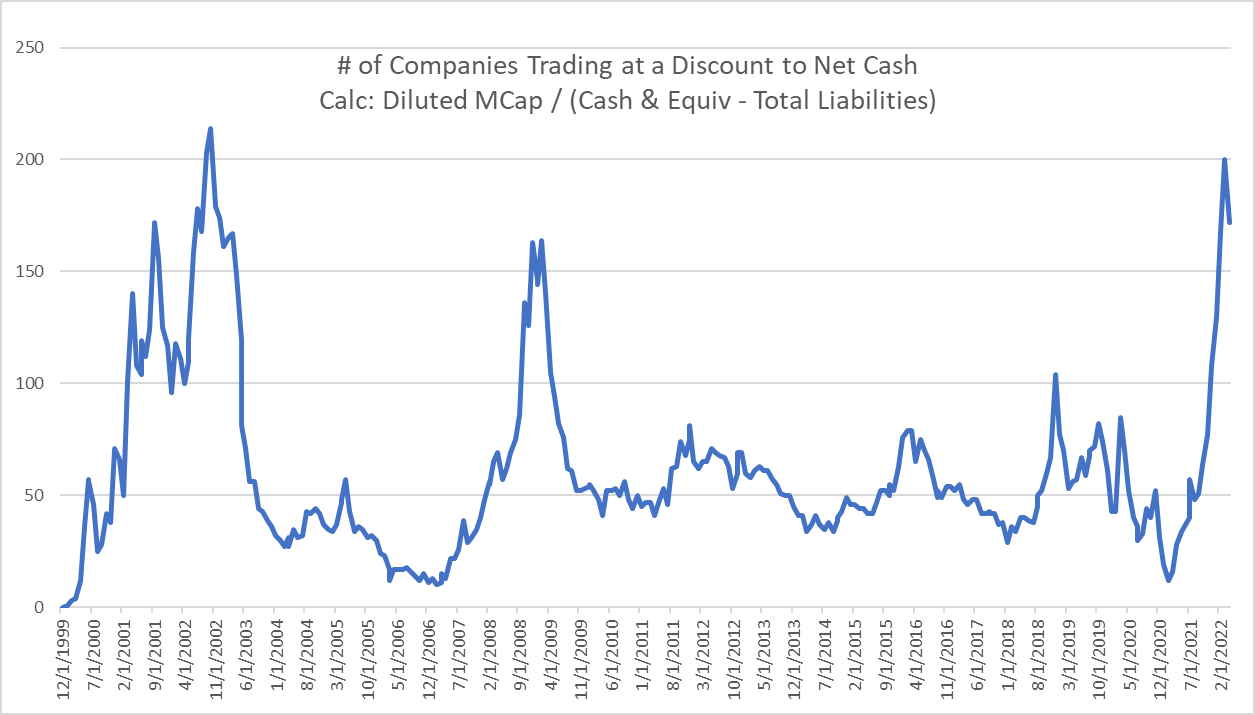

现在以低于净现金的价格交易的公司数量,已达到 2000 年泡沫破裂后的高点。

我使用的是最严格的计算方式:(稀释股份✖️价格)/(现金和等价物-总负债)。

我们越来越接近了……

40. 加密市场分析师 Onchain Wizard:

我就直说了吧,短期投资选择是:

(1)持有现金的,正面临 10% +通货膨胀;

(2)每天的股票下降 10%;

(3)自己的代币下降 20%;

(4)持有不稳定的稳定币,可以在一天内下跌了 40%。

41. 知名加密货币交易员 Moon:

我现在在任何情况下都可能看多,也许我们反弹只是因为抛售压力现在已经结束,但总的来说,市场看起来很糟糕,这种内爆将会产生几周、几个月的连锁反应。

42. 电报群 Benson’s Trading 交易员 DeskBenson:

抄底了 15%,剩下的等强劲反弹再抄。

43. 信息安全工程师、ratwell0x NFT 艺术创作者 Tetranode:

21k 开始买。

其他 Crypto KOL

44. Cobie:

像是 2014-2015 的熊市。

我认为以太坊和比特币未来会达到新的历史高点。但其它币就不能这么说了,我认为很多还会再跌 95%,被锁定的估值仍然高得离谱。

保留尽可能多的火力,抛开你头脑中的“峰值净资产”,为未来制定一个计划。如果你不赌就赢不了,如果你输光了所有的钱就不能赌了。系好安全带。

45. 0xSoro:

顺应趋势。

回顾 22 年和 21 年,折腾不断,而结果是大小受挫。亏亏赚赚,胜似有无。吃的全都是 DeFi 老本。慢慢让我相信一切赚钱都是时势使然。在保障和改善自己和家人生活条件的基础之上再去折腾,因为折腾很容易返贫。这应该是好多 DeFi 玩家普遍的状态。殊不知命运馈赠的礼物,早已在暗中标好价格。

46. Fiskantes:

失去所有的钱并不是世界末日。甚至失去的比你拥有的还要多。别做傻事。

47. Merit Circle DAO 爱好者 Pentoshi:

转为看空。6 月份 BTC 可能在 19-24k 区间。

48. NFT 思想家、知名 NFT 收藏者 Punk6529:

现在我们要找出哪些资金是“为了科技而投资”,哪些资金实际上是“FOMO 动量交易员”。

49. YouTube 频道“MMCrypto”主持人:

稳定币可以不稳定,但比特币坚不可摧。

每次比特币下跌,我都会做多 9 倍。一旦交易失败,我以 9x 重新打开一个新的交易。三笔失败的交易让我们跌破两万美元。

这是一个时间的问题,抓住底部 to da moon!

50. 电报群 EmperorBTC Channel 交易主讲人 Emperor:

如果给你一个建议,那就是不要试图抄底。