比特币跌破3万美元,加密熊市还会持续多久?

作者 | 秦晓峰

编辑 | 郝方舟

出品 | Odaily星球日报(ID:o-daily)

随着各国央行加息、抑制通胀,全球金融市场在过去几个月持续下行,加密金融也难以独善其身。

北京时间 5 月 10 日上午 8 点,BTC 最终跌破 3 万美元心理关口,创下近 10 个月新低,24 小时跌幅 11%,其他加密货币最高跌幅普遍在 20% 以上。币 Coin 数据显示,过去 24 小时共造成 10.5 亿美元的爆仓。

NFT 市场也惨遭波及,热门蓝筹 BAYC、Azuki 等 NFT 地板价 24 小时跌幅均超 20%,并且流动性降低,交易量暴跌。

此外,加密上市公司股价也呈瀑布式下跌,普遍在 10% 以上。其中 Coinabse 股价 48 小时最高下跌 32%,创下历史新低 70.19 美元,目前维持在 73 美元附近,较 IPO 发行价(250 美元)下跌 70.8%;最大比特币持仓上市公司 MicroStrategy 股票 24 小时最高下跌 25.55%,暂报 225.52 美元。

市场一片哀嚎,有人高呼「加密熊市已至」,选择割肉离场;也有人逆市抄底,坚持做多 Web3。加密市场真的进入至暗时刻了吗?Web3 短期内还有机会回血吗?

一、市场复盘:比特币跌破3万大关

与 「312」、「519」的两次急跌不同,比特币这一轮周期性下跌,着实是「钝刀子割肉」,前后历时近两月。

3 月 28 日,比特币创下年内新高 48200 美元,并且即将突破「牛熊分界线」——200 日移动平均线(MA200)。彼时,在俄乌紧张局势下,全球金融市场普遍表现不佳,外界对比特币充满期待,并认为其能走出独立行情,甚至在年内突破 10 万美元关口。

然而,盛极必衰,这种期待很快就被现实打脸。

在创下年内新高后,比特币在 45000 美元附近盘整了近一周时间,直到 4 月 5 日,正式确立了下行方向,开启了长达 1 个多个月的阴跌。整个四月,比特币单日最高跌幅只有 6%,绝大多数时间跌幅只有 2% 左右,多空势力围绕 4 万美元关口展开争夺,但反弹时间较少,似乎也预示着多头今日的溃败。

5 月 5 日,比特币开始加速下行,接连跌破重要支撑位,并于 5 月 9 日空头势力达到顶峰;过去 24 小时,比特币从 34000 美元跌破 3 万美元大关,最低跌至 29725 美元,最大跌幅 12.5%;5 月以来,比特币累计最大跌幅 25.6%;截至发稿前,BTC 反弹至 31000 美元一线。

除了比特币,以太坊等其他加密货币也遭遇重创。其中 ETH 24 小时最大跌幅 13%,跌破 2200 美元,年内累计最大跌幅 43.4%;BNB 、SOL、XRP、ADA 等市场前十的加密货币,普遍跌幅在 15% 以上;受 UST 脱锚影响(价格一度跌至 0.66 美元),LUNA 价格在过去 24 小时之内腰斩,最高跌幅 63%,目前位于 16 美元左右。

受此影响,整个加密市场市值,也在过去 48 小时缩水 1300 亿美元,暂报 1.5 万亿美元,下跌 8%;从年初以来,加密总市值缩水 8300 亿美元,下跌 36%。

根据币 Coin 数据,过去 24 小时全网共计爆仓 10.5 亿美元,共有 28.94 万人成为爆仓受害者,最大单笔爆仓 2326 万美元;过去 30 天,全网共计爆仓 70 亿美元。对比「519」爆仓数据(69.1 亿美元,约 58 万人爆仓),也可以看出衍生品市场发展走向成熟。

实际上,早在这次大跌一个月前,衍生品用户就已经主动降杠杆。根据 The Block 发布的四月加密市场分析数据显示,BTC/ETH 期货未平仓量和期权持仓量出现双降,比特币期货合约和以太坊期货合约交易额同样也在走低,其中比特币期货月度交易额下跌至 1.03 万亿美元,跌幅达到 20.2%。

链上交易方面,根据欧科云链链上大师数据,全网 DeFi 抵押借贷 24 小时清算量达 7000 万美元,创近 90 天新高;全网 DeFi 锁仓量连续 6 日下降,较 2022 年最高点跌幅超 35%。

此外,用户交易热情大大降低,今日恐慌与贪婪指数为 10(昨日为 11),恐慌程度较昨日有所上升,等级仍为极度恐慌。

受行情暴跌影响,NFT 市场也开始遇冷。在昨日的下跌中,BAYC 挂单量激增,但成交量较低,为了尽快套现,一些用户选择低价出售 NFT,导致地板价不断下移。NFTGo.io 数据显示,BAYC、Azuki 等蓝筹 NFT 系列地板价过去 24 小时跌幅均超 20%。其中 BAYC 系列 NFT 地板价一度跌至 89.9 ETH,过去一周交易量下跌 50%;MAYC 系列 NFT 地板价跌至 17.98 ETH,Azuki 系列 NFT 地板价跌至 10.5 ETH。

加密相关上市企业也被下跌行情波及,股价普遍跌幅在 10% 以上。矿机第一股嘉楠科技(NASDAQ: CAN)暂报 3.18 美元,48 小时最高下跌 25.3%;加密平台 Coinabse 股价 48 小时最高下跌 32%,创下历史新低 70.19 美元,目前维持在 73 美元附近,较 IPO 发行价(250 美元)下跌 70.8%;最大比特币持仓上市公司 MicroStrategy 股票 48 小时最高下跌 25.55%,暂报 225.52 美元;特斯拉股价下跌 9%,Robinhood 股价 48小时最高下跌 11.3%。

另据 Coindesk 消息,以加密货币为重点的金融服务公司 Galaxy Digital (GLXY) 在一季度亏损 1.117 亿美元,而去年同期(一季度)有 8.582 亿美元的收益。

二、通胀加息背景下,Crypto与美股同频下跌

每一次加密行情下行,市场都要探究成因。而这次,算法稳定币 UST「生逢其时」,成为一个「背锅侠」。

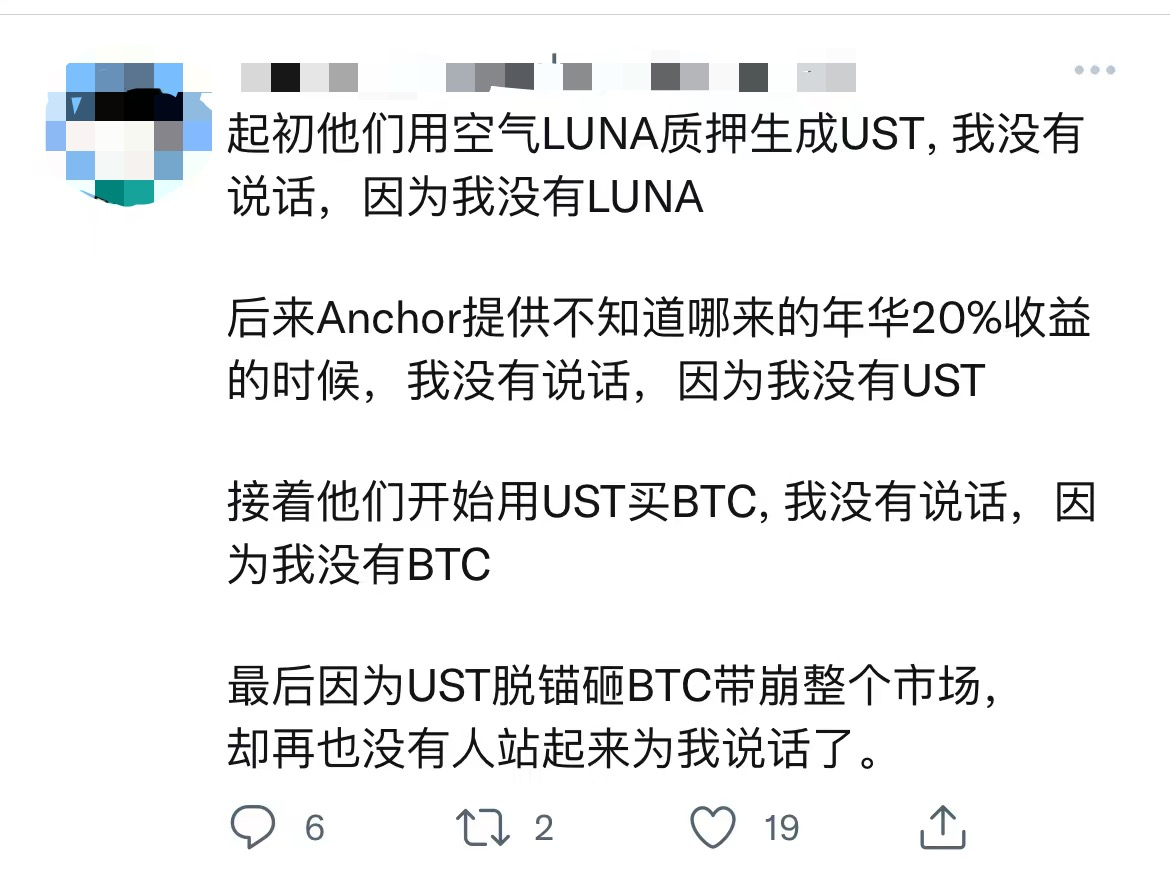

这两天,加密社区广泛流传着一张图,调侃 UST 脱锚带崩了整个加密市场:起初,他们用空气 LUNA 质押生成 UST,我没说话,因为我没 LUNA……最后因为 UST 脱锚砸 BTC 带崩了整个市场,却再也没人站起来为我说话。

据欧科云链链上天眼数据监测,被标记为 Terra 生态非营利组织的 Luna Foundation Guard(LFG)的地址于 10 号上午再次转出 28,205.5 枚比特币,截至发文该地址余额清零,似乎做实了砸盘的传言。但随后 LFG 表示,将发行 15 亿美元贷款,以帮助稳定 UST 价格,并有传言称 Jump、Alameda 等公司提供 20 亿美元拯救 UST。推荐阅读《开启死亡螺旋or压力测试结束?UST能被拯救吗》

在我看来,UST 这次的脱锚只是加密行情下行的一次黑天鹅事件,远远构不成推动整个市场暴跌的条件。正如前文所言,比特币这一轮下行始于 3 月下旬,很大程度上是由于外部宏观经济政策变化导致:随着各国央行,特别是美联储加息,全球金融资产进入恐慌性抛售阶段,加密金融难以独善。

为了抑制不断上涨的通胀压力,各国央行纷纷收紧货币政策,加息成为过去几个月全球金融市场最为关注的重大事件,其中尤以美联储加息关注度最高。

今年 1 月议息会议以来,美联储的加息预期持续扰动美股市场;2 月,美国劳工部公布美国消费者价格指数(CPI)创 40 年以来新高,再次增加外界对加息的预期;然而,直到 3 月中旬,靴子才最终落地。

3 月 17 日,美联储宣布加息 25 个基点(即 0.25%),将联邦基金利率目标区间提高至0.25%—0.5%,这是 2018 年以来美联储首次加息。不仅如此,美联储还透露更激进的措施,预计将在今年加息六次政策会议上,以加大努力减缓处在 40 年来最高水平的通货膨胀,此外 5 月将宣布缩减 9 万亿美元资产负债表的进程。

由于担心美联储控制通胀的措施可能导致经济衰退以及流动性危机,美股投资者为了避险纷纷开始抛售手中的金融资产,美股三大股指在过去几个月集体重挫:道指从 36800 历史高点下跌至目前的 32120 点,最大跌幅 12.7%;纳指从年初的 15832 点下跌至目前的 11688 点,最大跌幅 26.1%;标普 500 指数从近 5000 点高点下跌至 3,988 点,跌破 4000 点大关,最大跌幅 20.1%。

特别是 5 月 5 日,美联储再次公布利率决议,将基准利率上调 50 个基点至 0.75%-1.00% 区间,为 2000 年 5 月以来最大幅度加息,同时公布了 6 月份开始的缩表计划。这次加息,更是引发新一轮恐慌性抛售,美股齐创 52 周新低,加密市场也惨遭波及。

过去两年来,比特币与美股,特别是标普 500 的相关性进一步加强。根本原因在于,疫情下量化宽松政策的实施,更多的传统资金开始关注并投资比特币,将其视为新兴资产类别以求获得资产升值,这也促成了加密市场过去两年的牛市。然而,随着全球加息收紧货币,传统资金开始抛售高波动性的资产,具有良好流动性的 Crypto 与美股此时都成为了「弃子」,同频共震,双双开启下跌行情。

实际上,Crypto 的抛售,也在链上数据分析中得到验证。欧科云链数据显示,自 5 月初以来,包括 Coinbase 在内的多个加密平台持续流入大额比特币,目前比特币交易所的资金流入创 5 个月高点;根据链上分析平台 Santiment 的数据,大量以太坊代币正在流入交易所,在过去两周内,330000 ETH(价值近 8.25 亿美元)已被转移到加密货币交易所钱包中,流入的增加可能表明需求减少导致抛售压力增加。

除了全球金融市场的宏观环境不稳定,加密金融自身也进入发展瓶颈,存量资金被抽干,少有增量入场。

2021 年,NFT 市场获得蓬勃发展,交易量屡创新高。根据 L'Atelier 报告,2021 年 NFT 销售额达到 176 亿美元,环比增长约 210 倍,NFT 买家数量从 7.5 万增加到 230 万。与此同时,NFT 交易也为投资者创造了不错的利润,投资者通过 NFT 获利 54 亿美元。

NFT 持续高涨的交易热情,也延续到了今年二季度,多个蓝筹项目地板价不断创下新高,并且新项目层出不穷,源源不断地从市场抽取存量资金。根据区块链分析公司 Nansen 的数据,自四月初以来,专业投资人(smart money)地址已在 NFT 上投资了 4864 ETH,并获得了17581 ETH 的回报,在 NFT 交易中净赚了 12717 ETH。

实际上,不只是 NFT,GameFi、元宇宙、X To Earn 等各种新项目陆续涌现,用各种山寨币、空气币换走了大量的价值币(BTC、ETH、稳定币)。在牛市中,这种玩法助推泡沫形成,所有人都在赚钱;到了熊市,泡沫迅速破灭,最终导致整个市场崩盘。

三、何时走出加密熊市?

比特币价格已经触及近 10 个月新低,大有跌破「519」低位的趋势。关于加密金融后市走势,目前市场上观点分歧较大。

悲观派认为,加密市场已经步入熊市,市场可能进一步下跌。

区块链分析公司 Glassnode 近期研究称,根据梅耶乘数(Meyer Multiple)指标分析,目前仍处于加密熊市之中。这个指标表明,当前可能已经度过了熊市晚期的初始阶段,并且已经进入了熊市的下半场。然而,根据以前的周期,它也表明可能还需要煎熬一段时间,市场尚未提供足够的需求和价格升值,以实现可持续的获利和资本流入。(注:梅耶乘数是最知名的比特币指标之一,该指标为价格和 200 日移动均线之间的简单比率,它为比特币周期提供了一个强大而可靠的长期底部和顶部形成指标。)

基于算法的加密货币投资平台 Mudrex 首席执行官 Edul Patel 表示,利率上升让个人和机构投资者暂停思考加密市场前景。他说:“这种下跌趋势可能会在未来几天持续下去。比特币可能会继续测试 3 万美元的水平。”

加密货币交易平台 Luno Pte 发展和国际事务副总裁 Vijay Ayyar 表示,整体市场仍处于通胀和增长担忧的压力之下,如果比特币跌破 30000 美元,恐进一步跌至 25000 美元,然后才会出现任何“重大”反弹。

毫无疑问,3 万美元是众多机构投资者以及加密投资者的心理关口,同时也是不少上市公司比特币持仓成本线。Odaily 星球日报去年曾统计了八家上市公司持仓情况(点击阅读),平均比特币持仓成本为 26029 美元,与去年的市场低点 28800 美元相距不远;而 5 月 10 日比特币价格一度跌穿 MicroStrategy 成本价(30700 美元)后也迅速反弹,似乎也预示着该点位的支撑性较强。

另外,考虑到加密金融受美股影响,二者未来可能同频联动反弹。Galaxy Digital 首席执行官 Mike Novogratz 在最近的财报电话会议上预测,加密市场还会有继续下跌,他认为加密复苏不会在未来两个月内发生。他补充说,加密货币将与纳斯达克 100 指数保持高度相关,他表示“非常有信心”,一旦股市找到“某种底部”,比特币将会反弹。

那么,美股何时到底反弹?根据美银最新报告,过去 140 年里美国股市共经历了 19 次熊市,平均下跌 37.3%,平均持续时间为 289 天。虽然过去的表现并不能完全代表未来的表现,但如果以历史表现作为参考,美银团队测算出的结果是,本轮熊市将在今年 10 月 19 日结束,届时标普 500 指数将达到 3000 点,纳斯达克综合指数将达到 10000 点。美银带来的一个“好消息”是,目前美股很多股票已经跌至熊市区域。换言之,比特币以及整个加密金融在未来几个月内,可能并不会有较大的利好反转。

不过,乐观派却认为比特币价格已经严重低估,熊市即将结束。

加密资管机构 Amber 在最新的分析报告中指出:“从链上的数据分析来看,连续下跌的价格让一些长期持有者止损,并将比特币重新分配给新的购买者。虽然我们看到已实现亏损占市场的主导地位,但目前价格低于 200 日移动均线的 80%,在比特币被交易的历史上只有不到 15% 的时间处于或者低于 200 日移动均线的 80% 价位,这是个值得注意的表明比特币目前被低估的指标。”

方舟基金(ARK Invest)创始人 Cathie Wood(木头姐)认为,表示,加密货币与传统资产之间的相关性越来越大,这表明熊市很快就会结束。“加密货币作为一种新的资产类别,不应该看起来像纳斯达克,但它确实像。它现在高度相关。你知道你正处于熊市,也许当一切都开始变得相似时,就接近尾声了,我们正看到一个又一个市场的投降。”

尽管目前市场低迷,她仍然对加密货币保持长期信心,因为与 ARK 的其他投资类别一样,她认为加密货币会随着巅峰市场和社会而呈指数级增长。根据Wood的说法,区块链是提供指数级增长机会的行业之一,她认为这些行业(人工智能和区块链技术等)在未来 7 到 8 年内总估值将增长 21 倍。

分析师 PlanB 发推称,BTC 月线 RSI 低于 50,预示着短期内价格可能测试 26000 美元;不过,根据其 2019 年 3 月发布 S2F 模型,PlanB 相信 BTC 价格仍将在未来几年内继续增长。

四、BTC永存,Web3不死

在过去十余年中,比特币不止经历过一次暴跌,市场恐慌也在意料之中,但最终比特币依然顽强地存活了下来,因此投资者不必过度悲观。我们更应该思考的是,如何真正将 Web3 做大,吸引更多的增量(用户、资金)入场。

从比特币来看,虽然持有者包含散户交易者、高净值交易者、一些对冲基金和专业基金,但基本盘仍不够大。配置了比特币作为资产储备的上市公司比例相较于整个传统金融市场而言非常小,资产体量甚至不到 1%;此外,也没有主权财富基金持有 BTC。这意味着当加密货币下跌时,没有足够的购买者可以支撑市场。只有当比特币的基本盘足够大,才能真正抵御风险。

从全球市场分布来看,Web3 在欧、美、亚地区发展渐趋成熟,而在其他欠发达地区依然具有很高的发展潜力可以挖掘。

以非洲地区为例,由于极度欠缺银行服务,加密货币成为跨境支付重要替代项。数据显示,2020 年非洲大陆已发展成为加密 P2P 交易的第二大地区,尼日利亚、肯尼亚和南非成为非洲加密交易活跃地区;2021 年,非洲继续占据了中心地位,加密货币的采用率激增了 1200%,肯尼亚连续第二年在 P2P 交易量方面排名世界领先。美国 Insights 公司报告显示,加密货币在非洲的底层人群中的采用率也是世界上最高的。

虽然现货市场下跌,但从近期的融资来看,Web3 依然是机构重仓的重要赛道。The Block 统计数据显示,加密行业 4 月份共有 244 笔投融资交易,创历史新高。此外,多个新的风险投资基金推出,包括 Dragonfly Capital、Union Square Ventures 和 Framework Ventures 的新基金。

总而言之,在全球金融市场普遍不景气的当下,Web3 依然是最具活力的行业,并且也是未来十年的最重要风口。正如老牌风投红杉资本喊出的口号所言,将持续有人「All in Crypto」。