Foresight Ventures市场周报:Aurora生态TVL增量迅猛,Moonbirds交易依旧火爆

市场观点

宏观流动性

货币流动性更趋紧张。周四美联储主席鲍威尔称5月会议将加息50BP,并确认了市场多次加息50BP的预期。回顾上轮缩表周期,美联储从17年10月一直持续到19年9月;本轮月度缩表规模上限或是上轮的两倍。BTC市场仍然与传统的股票市场密切相关,而后者本身很难获得持续的买入,市场遇到了多个宏观上的阻力。宏观流动性决定行情涨跌幅度。

链上筹码指标

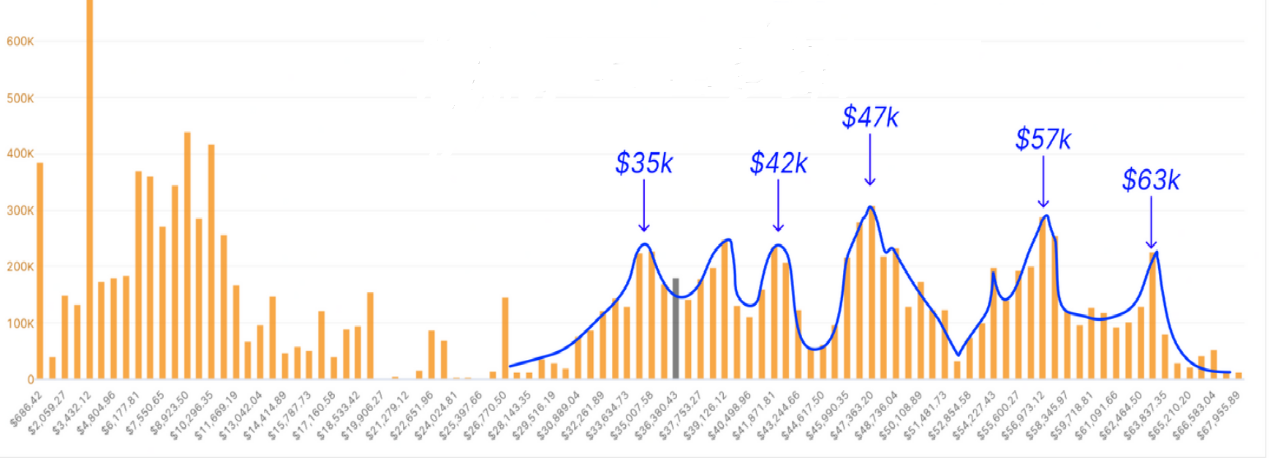

链上数据显示,BTC大量筹码成本集中在35000到42000价格区间,这是过去3个月市场主要震荡范围。

长期投资者短期有所减持。1年以上未动的BTC在60%以上,仍处于历史高位。这周部分的长期持有者开始了获利抛售,他们减持了30000多个BTC,或是他们的行为造成了价格波动。

BTC长期市场指标

长期趋势指标MVRV-ZScore以市场总成本作为依据,反映市场总体盈利状态。当指标大于6时,是顶部区间;当指标小于2时,是底部区间。当前指标为1.1,处于底部区间。

BTC短期市场指标

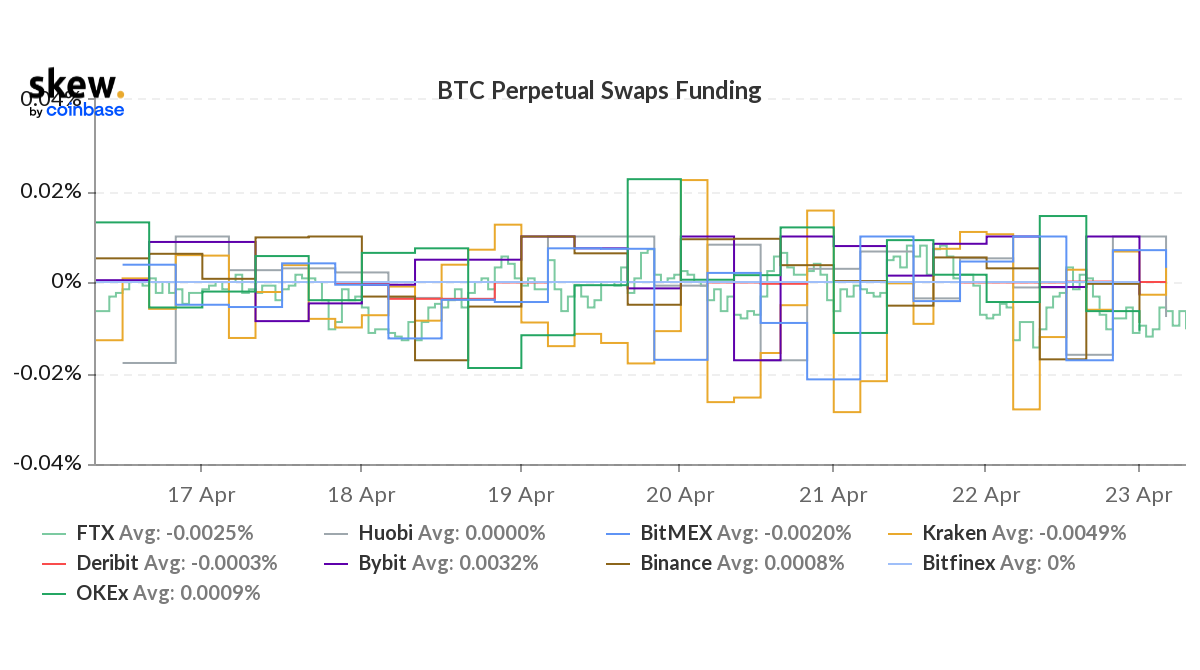

期货资金费率:正常水平。费率0.05-0.1%,多头杠杆较多,是市场短期顶部;费率-0.1-0%,空头杠杆较多,是市场短期底部。当前平均费率接近0,结合多空比分析,说明目前市场多数散户做多,少数大户做空。

期货多空比:1.7。预示多头人数较多,短期市场风险积累。

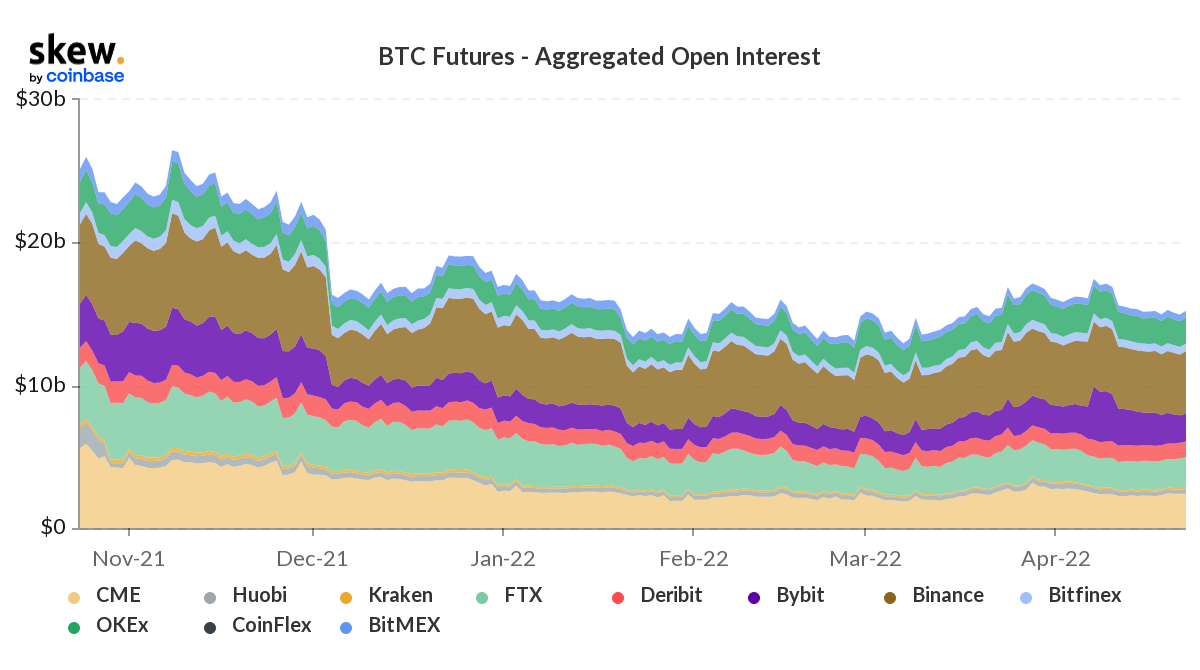

合约持仓量:持仓量处于相对高位。高持仓量预示市场波动率变大。

BTC走势分析

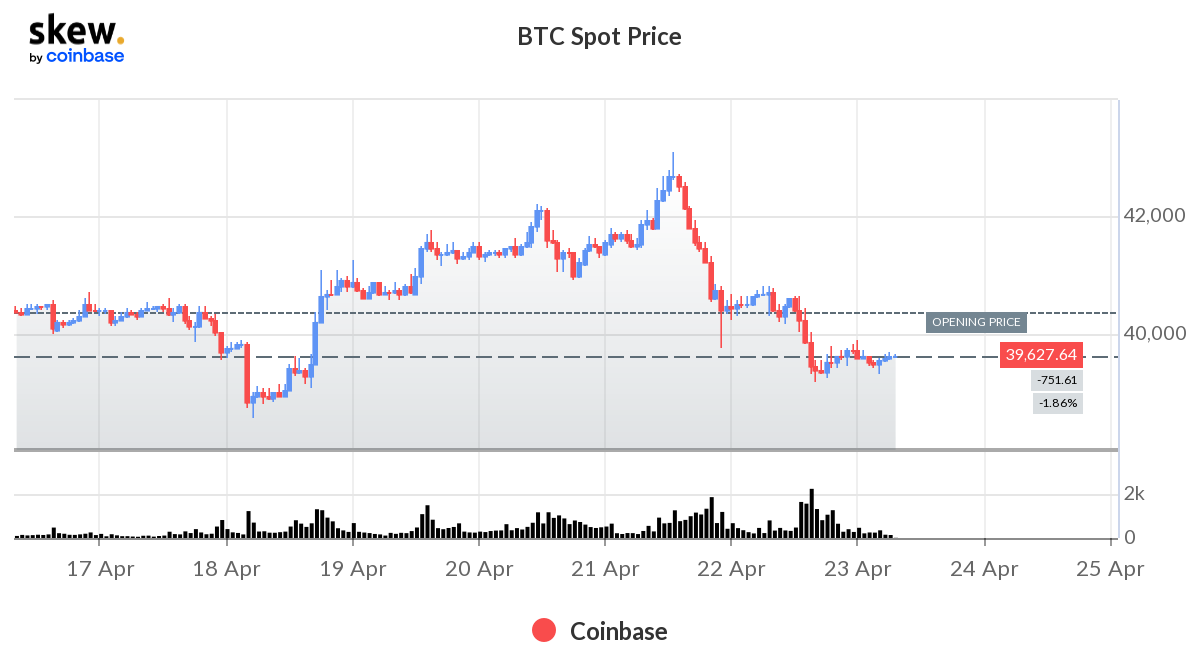

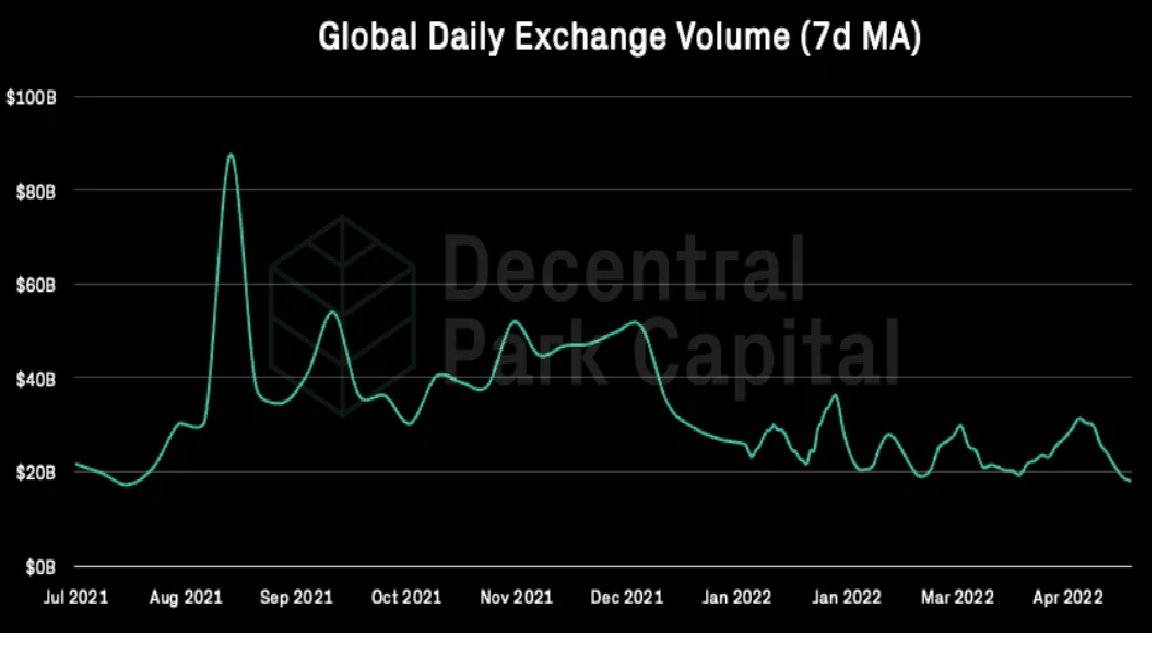

BTC价格回落到40000以下,走势疲软。市场流动性缺失,交易所日成交量下滑到21年7月水平。BTC从11月的历史前高持续下跌了3个月,在33000暂停了下来,然后在35000-42000之间宽幅震荡。BTC现在处于牛熊分界线上,43000和39000分别是牛熊的关键点位,一旦超过市场将会有大波动。

板块涨跌幅Top 100

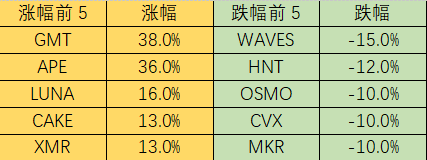

BTC下跌2.4%,市场同步下跌。与上周结构相似,链游、NFT等板块继续领涨;defi、稳定币等板块跟随市场下跌。

市场数据

公链总锁仓量情况

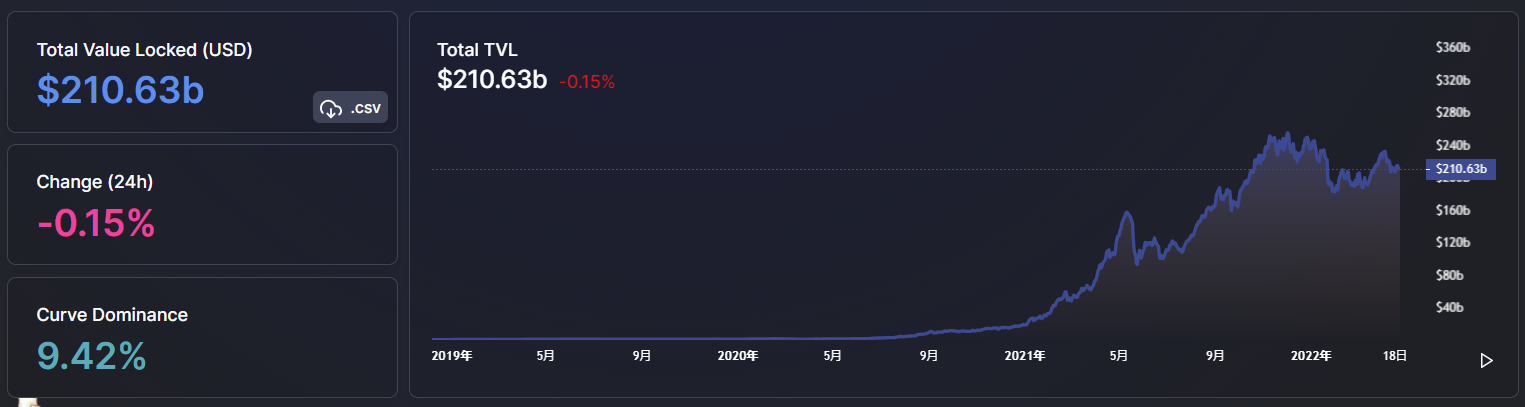

本周TVL出现0.45B的下降,下跌幅度为0.21%,整体表现略强于同期BTC。

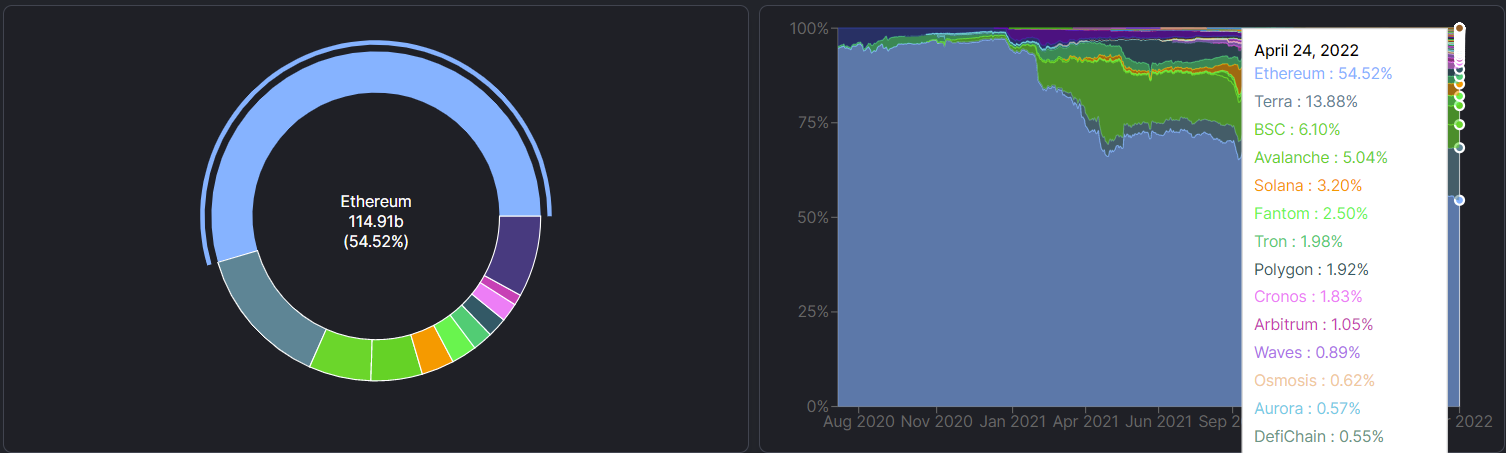

各公链TVL占比情况

本周ETH链TVL占比继续出现下降,由55.37%下降至54.52%,下降0.85%,而Terra链占比在上周出现轻微下跌后继续增长,占比增长1.16%,到达13.88%;本周NEAR生态的EVM兼容层Aurora,出现了较高增长,由0.43%上升至0.57%,上涨幅度达32.5%,已是NEAR生态TVL的2.5倍,而本周同期Aurora代币上涨不超过3%。

各链协议锁仓量情况

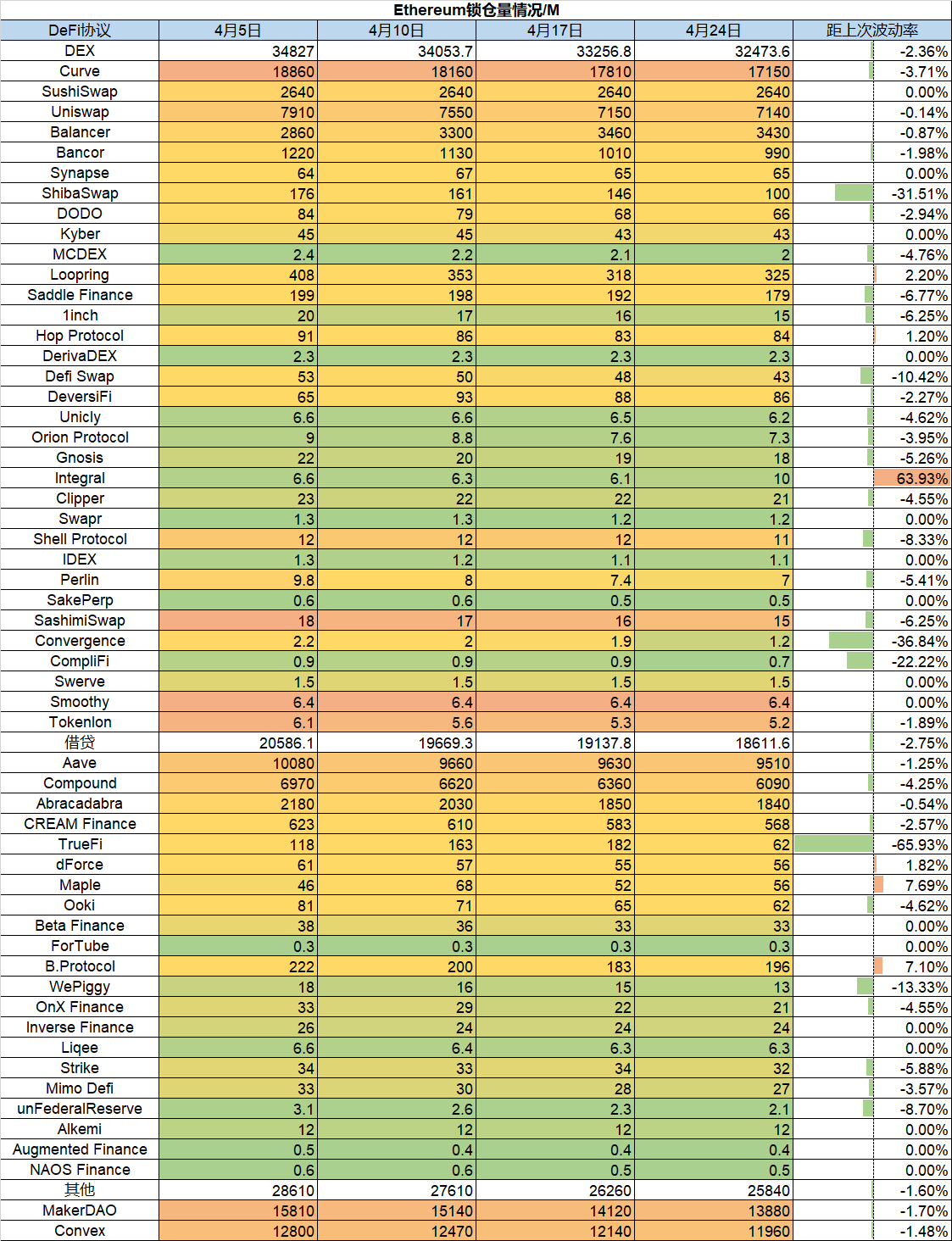

1、ETH锁仓量情况

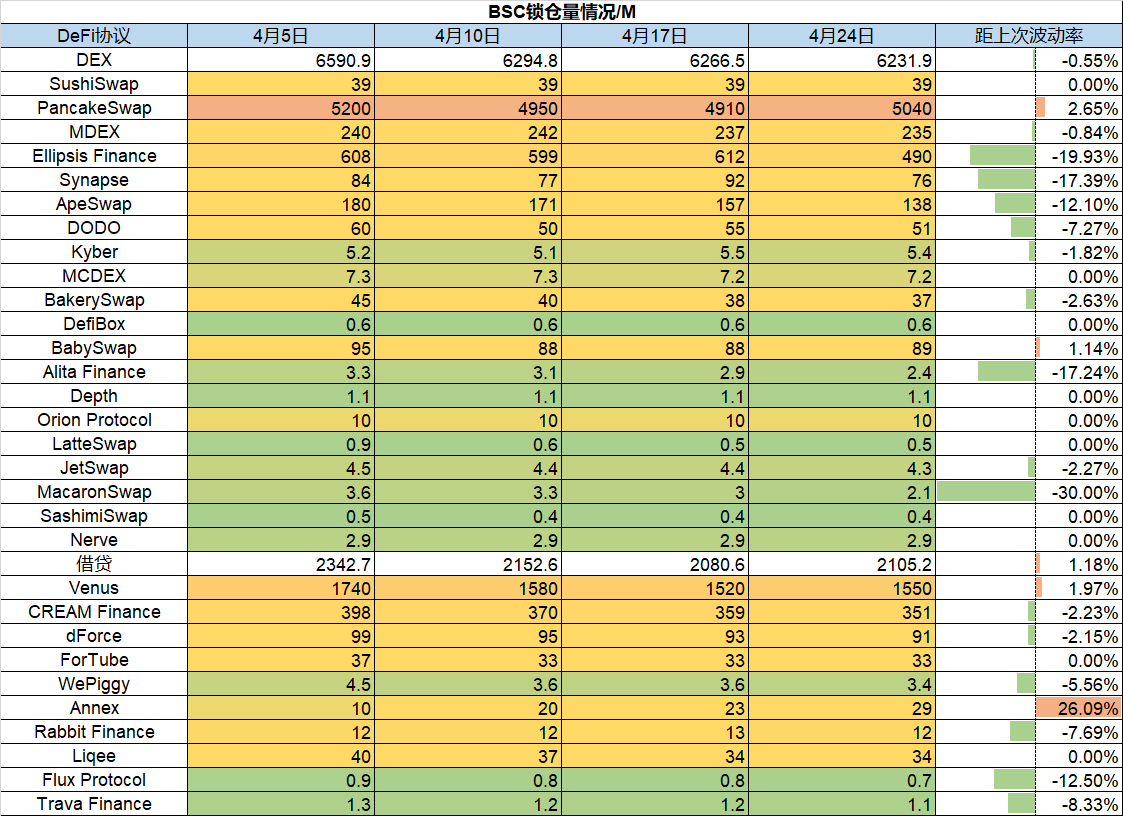

2、BSC锁仓量情况

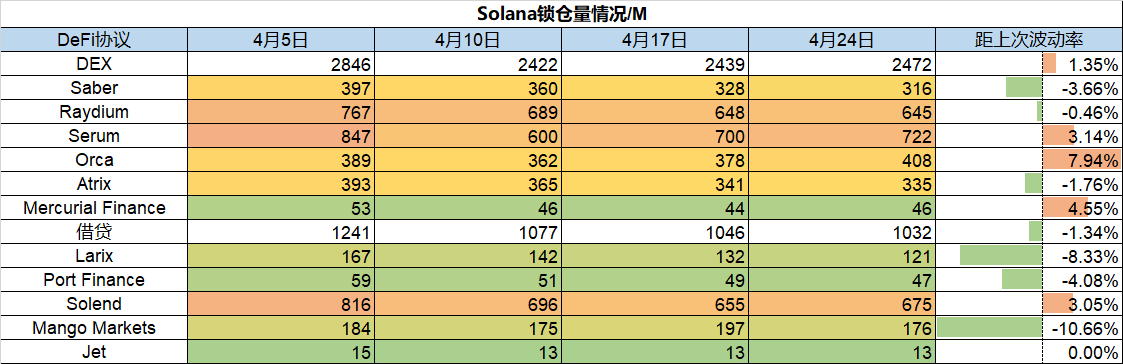

3、Solana锁仓量情况

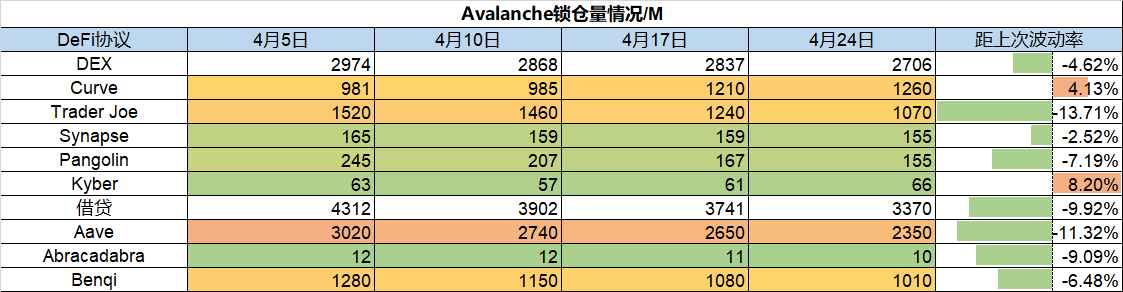

4、Avalanche锁仓量情况

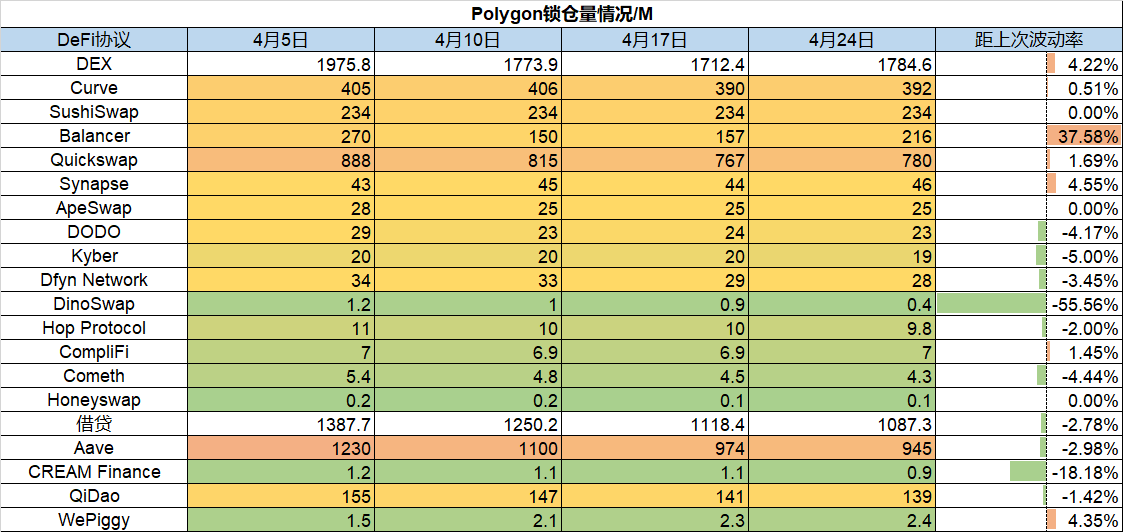

5、Polygon锁仓量情况

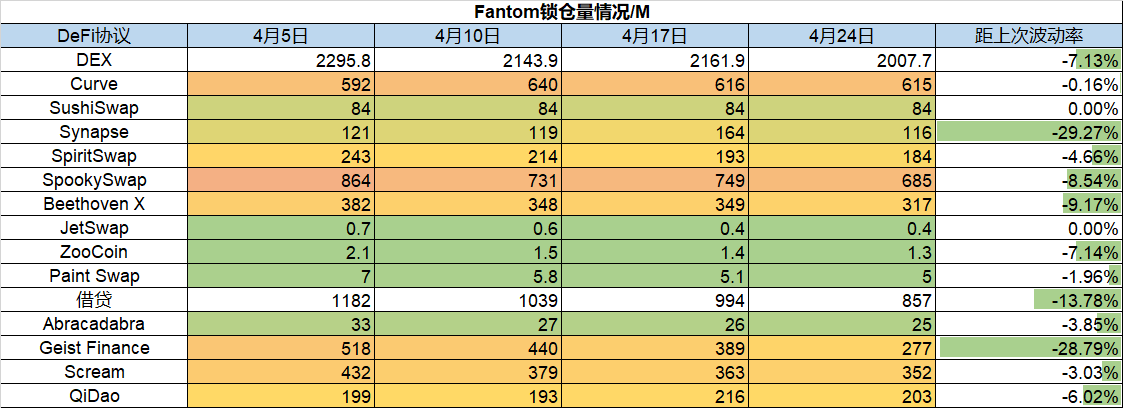

6、Fantom锁仓量情况

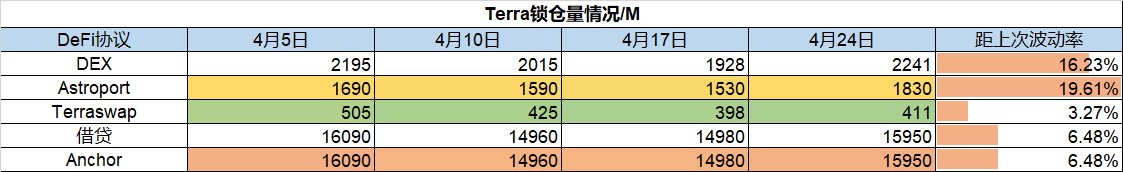

7、Terra锁仓量情况

8、本周协议情况总结

Terra链下的Anchor协议依旧增量稳定,已达到历史新高;除此之外值得关注的协议是Annex,主要是稳定币借贷协议,涵盖的内容包括代币交易、储蓄、智能合约拍卖和NFT交易市场等。短期内TVL出现了剧烈拉升,行情端对应出现了一倍的涨幅。

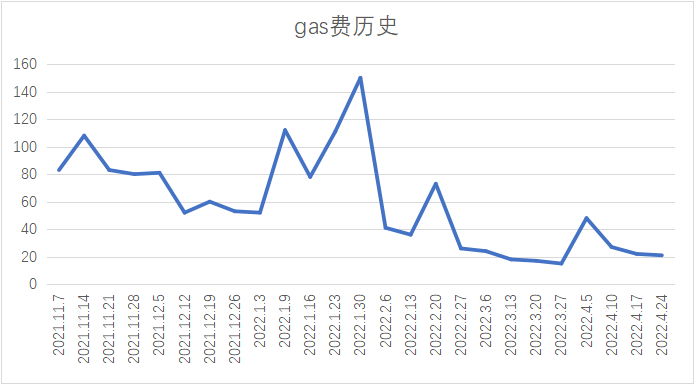

ETH Gas fee历史情况

当前链上转账费用约为$3.35,Uniswap交易费用约为$11.42,Opensea的交易费用约为$12.53,在行情出现大幅增长的21日Gas曾达到70,行情端大幅下跌后,继续趋于较低状态。

NFT市场数据变化

1、NFT指数市值

2、NFT市场交易概览

3、NFT"聪明的钱"购买排序

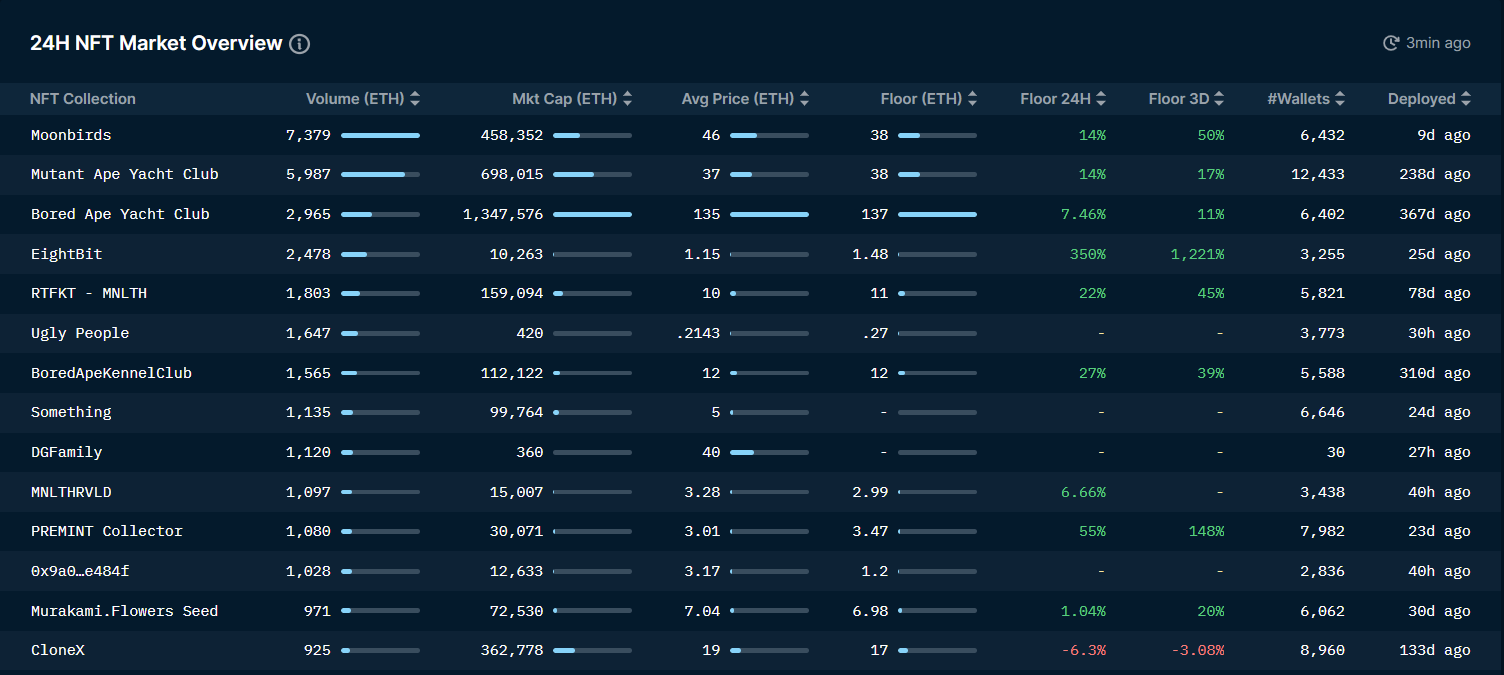

短期内Moonbirds的交易量依旧维持在极高水准,已连续三日获得交易量排行榜第一名,紧随其后的是APE的两个系列,值得注意的是EightBit,该团队在2010年推出了最初的头像创建器,2022年3月31日起开始公开发售EightBit,Mint成本为0.05ETH,曾在4月4日出现过一次疑似建仓,在4月22日起开始出现大规模交易,一路将地板价拉升至2.4ETH。

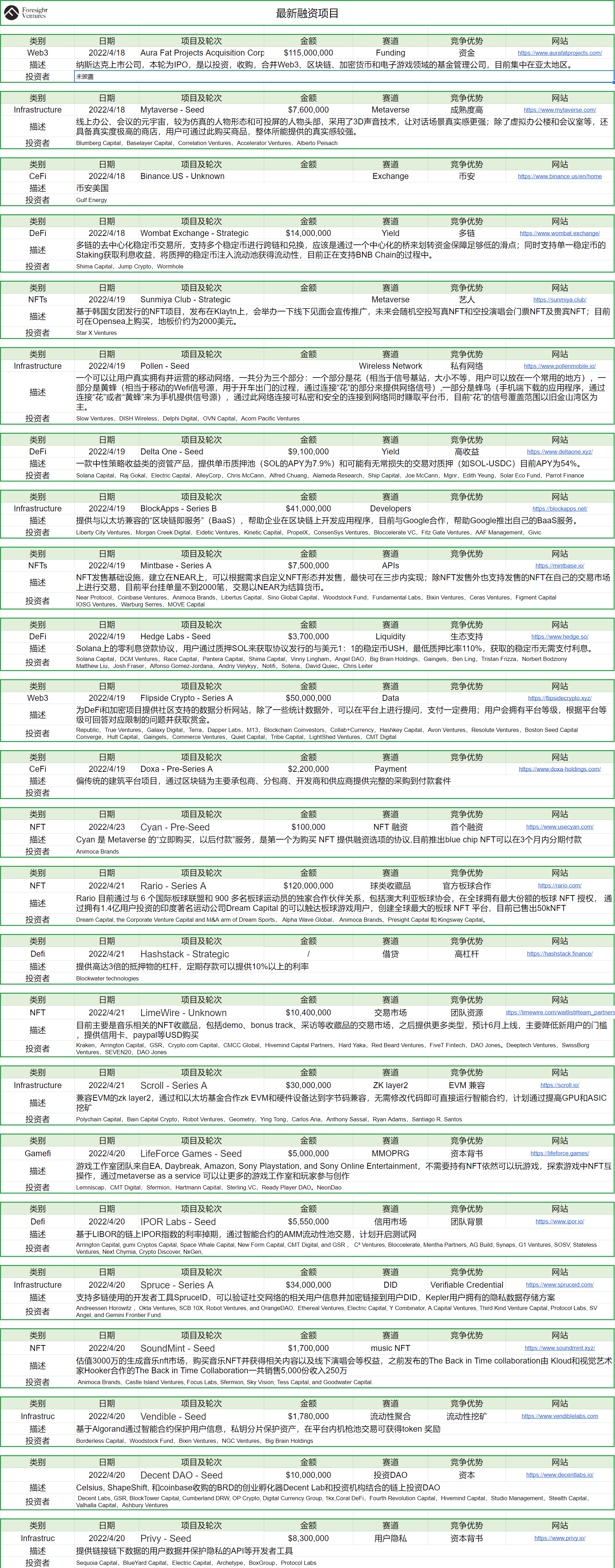

项目最新融资情况