为什么说2022年将会是社区DAO之年?

原文来源:p.mirror.xyz

原文翻译:dave lin

本文来自The SeeDAO。

在加密世界,2020年,是 DeFi 的时代。

到目前为止,2021年,是 NFT 的时代。

大家都知道火热的 jpeg 之夏吧?

2022年,将是社区 DAO 的时代。

社区 DAO = DeFi 的基础设施+ NFT 的商业模型 + 富有创意的人。

Crypto(加密)不仅仅是一种技术,它是一种互联网原生经济。使用 ETH 跟踪收入;关键决策是通过社区治理做出的;交易是通过链上的智能合约执行的;资金库是通过多重签名机制控制的;价值是由代币捕获的。

DAO 就是加密经济体的原生组织结构。

DAO 是建立在 Discord 服务器和区块链上,而不是建立在特拉华州或者是开曼群岛。DAO 提供了一种互联网原生方式来汇集资金、做出集体决策和获取价值。

DAO 的组织结构看起来像现代合作社,但是在接下来的十年里,我相信它们的规模和影响将可以与世界上一些最大的上市公司相媲美。

最近以来,DAO 无处不在:收集 NFT、社交、构建软件、电子竞技、音乐人、媒体、教育、资助公共物品。

但是,到底是什么让 "DAO" 之所以为 DAO?

尽管 DAO 的目标、规模和复杂程度各不相同,但大多数都包含相同的核心组件:

群聊(Group chat)

DAO 通常从有人开始说"如果……会不会很酷"开始,然后添加一些朋友到 Telegram 的小组或 Discord 的服务器上。

资金库(Treasury)

最常见的社区 DAO 的类型就是收集蓝筹 NFT 并将它们储存在多重签名系统中。正如我们在 Party Bid 中看到的那样,人们喜欢和朋友一起无脑入 NFT。这是一种体验。社区 DAO 还可以通过代币众筹来取得初始资金。这使得 DAO 可以用 ETH 填充资金库,以用于运营和增长。

代币(Token)

随着关于你的社区 DAO 很有趣的消息的扩撒,人们就会开始狂发私信给你要求加入你的 DAO。此时,很多社区 DAO 就会发行 ERC-20 代币作为加入会员的门槛。根据社区 DAO 的排外性,会员资格费从价值几美元到几百万美元的 ETH 不等。

治理(Governance)

拥有宝贵资金和数百名成员的社区 DAO 需要一种方式来做出集体决策。通常,会在群聊里达成初步共识 (使用 emoji 符号等),而治理投票只是一种形式。但是有趣的是去看谁投票了,他们有多少投票权,以及他们投票支持什么。此外,大多数社区 DAO 会为对有5-10名组员的专注团队赋能,帮助他们获得专属的工作流,而不是要求每个小决定都要通过决策的治理提案才能完成。

链上现金流(On-chain cash flow)

这是社区 DAO 中最新生的组件,也是最有趣的组件。链上现金流使你和朋友有趣的群聊变成一个可持续的事情。到目前为止,产生链上现金流的主要方式是通过 NFT 空投。

那么,这些社区 DAO 真的可以运行吗?

在过去的几个月里,像 Fingeprints 和 Flamingo 这样的 DAO 已经积累了五到六位数的 NFT 藏品。

像 Bright Moments 这样的 DAO 在几分钟内就卖出了价值几百万的 NFT。

Rabbithole、Seed Club、Forefront 和 FWB 正在成为下一波在加密世界里活跃贡献者的主要入口。

一些 DAO,比如 NounsDAO,会让你思考"什么鬼?"(WTF)。

甚至不用让我提 Loot ……

多家顶级风险投资基金投资了这些 DAO,我认为它们当中的一些会成为未来十年投资组合中表现最好的投资标的。

在后文,我们将仔细研究社区 DAO。DAO 如何成为可持续的组织,有什么风险,以及它们在未来会是什么样子。

一、发展社区DAO

与传统的初创公司不同,大多数社区 DAO 的最初目标不是最大化股东价值,而是形成有共鸣的氛围。人们希望被志同道合的人包围,做出集体决定,并推动社区的目标向前发展。

但鉴于更广泛的加密市场的增长,许多社区 DAO 发现自己持有价值百万美元的资金和市值超过1亿美元的 ERC-20 代币。仅在过去的几个月里,他们已经从群聊发展成了真正的企业。

发展这些社区 DAO 的关键之一将是经常性的链上现金流。还有其他一些重要的因素,如社区参与、社区治理、代币组学等。但产生链上现金流为社区 DAO 提供资金来奖励贡献者,雇佣全职员工和增加他们的资金。

我在大学期间读金融,学到的最无聊的东西之一是如何分析资产负债表,但事实证明这真的挺有用。

社区DAO的资产负债表上有两种资产:

股权(蓝筹NFT、社区DAO代币、加密协议代币)

现金(ETH、USDC、DAI)*

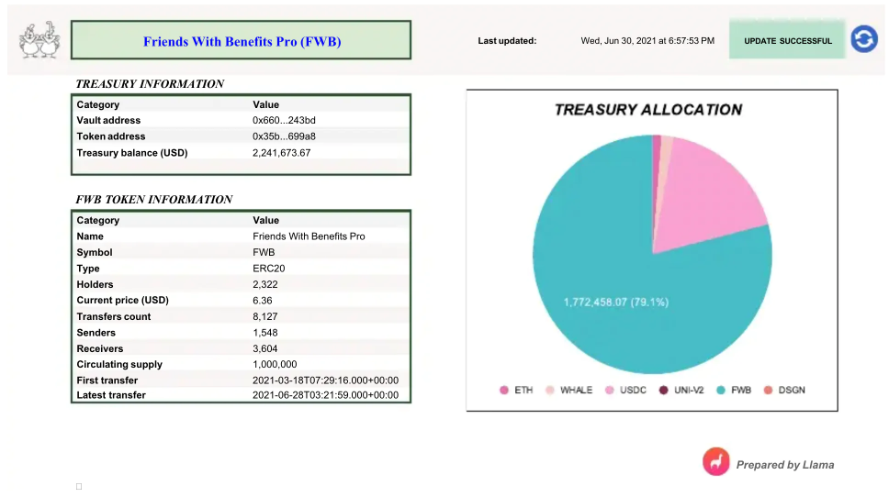

FWB June 2021 Financials by Llama. Source

从技术上讲,ETH 可以视为以太坊网络中的股权,但是为了简单起见,让我们将 ETH 归类到资产负债表的现金里,因为它对 DAO 来说是主要的交换媒介。

那么,社区 DAO 可以如何处理他们资产负债表上的现金和股权呢?对于许多 DAO 来说,加密世界感觉就像一个大型多人在线游戏。

对于社区 DAO 来说,这个游戏就是增加资金库的价值,同时保持最初推动社区发展的强大氛围。

社区 DAO 可以通过以下几种方式,让自己赢得这场比赛:

收集蓝筹 NFT;

赚取会员费;

发行 NFT 空投;

启动一个代币化的 NFT 展廊;

建立媒体公司;

销售 SaaS 工具;

投资代币 (DeFi 协议、NFT 协议和其他 DAO)。

让我们来逐个分析。

01 收集蓝筹 NFT

这是社区 DAO 最常见的启动方式。

一群发烧友想要收集诸如 Punks、Autolyphs、DEAFBEEF、Fidenzas、Ringers 的蓝筹 NFT,但不想自己投入所有的资金。相反,他们会集中资金去买一个蓝筹 NFT 投资组合。

然而,在实践中,将这些 NFT 储存在保险柜是缺乏流动性的。这样做不会直接产生收入。因此,一些 DAO 通过发行 ERC-20 代币的方式,让人们可以对这些NFT的潜在价值进行投机,赚取交易费,并决定何时出售。PleasrDAO 是最大的 NFT 收集 DAO 之一,最近宣布了一项近似的针对其1/1的 Doge NFT 的流动性策略。

这有点像将黄金存放在资金库里并基于黄金发行纸质的凭证 (是不是听起来很熟悉?)。你可以将纸质凭证兑换成标的资产,但你需要相信当你想要兑换时,该资产是可用的并且是有价值的。不过我们有的是蓝筹 NFT 和 ERC-20 代币,而不是黄金和纸质凭证。

公平地说,其中一些资金库是极其有价值的,而且有很大机会在某天价值数十亿美元。因此,与其说像是把黄金存放在资金库里,不如说更像是拥有标志性互联网文化和世界上一些最有价值 IP 的股权。但现实情况是,在短期内,只靠这些资金库无法产生经常性的链上现金流。

这些蓝筹 NFT 不是短期现金流,而且作为顶级收藏家、艺术家、创始人、投资者和运营商参与到社区中的聚焦点 (或是加密世界里人们说的 schelling point)。

正如我们在接下来几节中看到的那样,这些装满蓝筹 NFT 的资金库最有价值的方面,是它们吸引了人力资本,把非流动的 jpeg 图片转化成资产负债表上的现金。

02 收取会员费

我不知道你怎么看,但 "追随者 (follower)" 和 "订阅者 (subscriber)" 这两个词对我来说有点奇怪。它们暗示了一种单方面的关系。我跟随 (follow) 你,你订阅 (subscribe) 了我。

但"会员 (member)" 和 "所有者 (owner)" 就不同了。

我们是会员。

我们是所有者。

在 Web3 里,成员资格和所有权被封装在代币中。余额被存储在区块链上。你的资产由你自己的私钥控制。

如果社区中的氛围不佳,或者你在另一个衰退的流动性挖矿中被打击了、需要流动性的时候,你可以在 AMM 上出售你的代币或者前往 Discord 的 #otc 频道去协商一个合理的价格,无需任何解释。

但随着社区 DAO 增加资金库的价值和对会员身份的需求增加,会员代币的潜在价值也随之增加。

如果你是社区的早期成员或者通过你的贡献挣得了大笔分配,这可以变成很大一笔财富。

在过去的一个月里,$FWB的会员价值从1,000美元增加到12,000美元。

然而,会员代币不仅仅是"数量增加" (nUmBeR gO uP),在更深层次上,代币是一种帮助在线社区创造、捕获和重新分配 价值的协调机制。

由于代币持有者也是社区成员,除非他们想要这么做,否则不需要动用 Excel 表格并根据 DCF 分析来做资源分配的决策。

社区 DAO 投资于任何他们想要的地方。有时是捐赠给慈善机构,有时是在巴黎搞喝酒 party。

03 NFT 空投

这是社区 DAO 产生链上现金流的最主要方式。有一些空投数量巨大。去年,无聊猿 (BAYC) 在一小时内售出了价值 9200万美元的 Mutant Ape NFT。

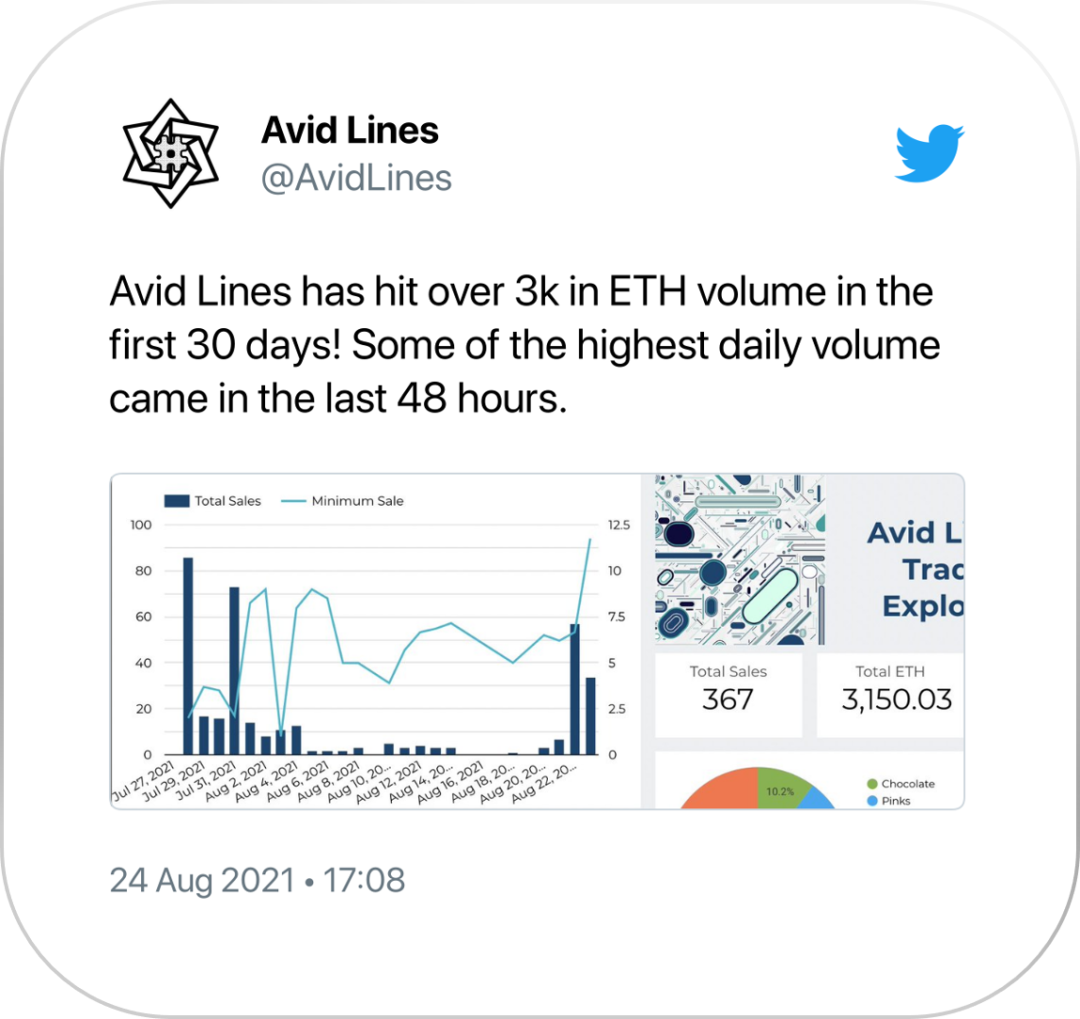

最近,我最喜欢的另一个空投是 Arihz(匿名巴西计算机科学家/NFT艺术家)和 FingerprintsDAO (将智能合约作为艺术品收藏的主要收藏家 DAO 之一) 之间的合作。这个空投被称作 Avid Lines,在前30天,它的交易量接近1000万美元。

更重要的是,这个空投是一个很好的例子,说明了如何以一种有趣的方式重新混合 NFT IP。它是 Autoglyphs 的衍生品,也是 FingerprintsDAO 资金库里最有价值的藏品。

它的原理是这样的:

铸造者选择一个 Autoglyph 作为生成算法的基本输入;

Autoglyph 的持有者可以把他们的 Autoglyph 放在白名单上,并获得以他们的 Autoglyph 作为基础输入的 NFT 首发销售收入的10%;

生成算法会将基础的 Autoglyph 输入和 Arihz 的随机代码相结合,然后输出一个名为 Avid Lines 的混合版 NFT(它们巨好看)。

一些最受欢迎的 NFT 空投是采用蓝筹 NFT IP,并混制成有趣、类似游戏且具有视觉吸引力的衍生品。这些衍生项目很有趣,因为它们将存储在保险柜里那些非流动的 jpeg 图片变成了生产性资产。一些 Autoglyph 的持有者只是靠调用智能合约上的白名单功能就挣取了价值 4 万美元的 ETH。

随着 DAO 在寻找增加其资金库里 NFT 价值的新办法,我们将继续看到更多的类似这样的衍生品空投,这些衍生品可以提高核心 IP 的价值,同时也将 NFT 变成生产性资产。

04 代币化的 NFT 展廊

大多数的社区 DAO 还没有自己的代币化 NFT 展廊。但在不久的将来,我认为它将成为社区 DAO 产生链上现金流的最流行的方式之一。

基本理念是:

成员使用社区 DAO 代币来投票决定哪些艺术家/空投可以在他们的网站上铸造;

通过让开发者在 DAO 的 NFT 库注册表中注册智能合约,支持多种空投机制(预留拍卖、减价拍卖、版本售卖、抽奖销售、空投、生成销售等);

来自一级和二级销售的收入由艺术家、开发团队和 DAO 的资金库共享;

艺术家、收藏家、开发团队和其他贡献者收到社区 DAO 代币;

代币持有者获得仅限会员的特色功能比如专属空投、NFT 徽章、折扣、实物铸造、商品等等。

这使得社区 DAO 可以建立自己的 NFT 市场,同时以现金和股权的形式奖励代币持有者、艺术家、收藏者和开发团队。顶级社区 DAO 的策展能力将最终将这些 NFT 展廊变成新兴艺术家的孵化器。

举个例子,如果你是一名生成艺术家,经投票后, FingerprintsDAO 将你选入他们的展廊,这基本上就像是一名时装设计师能够将自己最新的时装系列放在 Vogue 杂志上。这种方式创造了一个本能的反馈循环,顶级社区 DAO 通过策展高质量 NFT 展品建立地位,然后帮助新一代艺术家获得艺术品的发行同时赚取费用。

这有点像 CAA (Creative Artists Agency) 或是互联网文化的唱片公司。但现在代理商是粉丝、建设者和创意人员。

05 建立媒体公司

构建媒体公司不像代币展廊那么性感,但确实有效。建立一个播客和/或定期简讯,找到一些赞助者,然后就是蓬勃发展了。

顶级的社区 DAO 应该很容易找到赞助商,因为他们的社区里充满了新潮的人,他们有现金可以随意花在像数字宠物石的物品上。

Club Top Shot 是我最喜欢的围绕 NFT 藏品的媒体公司之一。

UTA 是好莱坞首屈一指的人才机构之一,在去年9月和 Larva Labs (CryptoPunks、Autoglyph 和 Meebits 的创造者) 签约,将会在电影、电视、电子游戏、出版和特许方面体现它们。想象一下 Kevin Hart 在 Netflix 的节目中为 CryptoPunk 或 Meebits 配音就能把我乐死。我会立刻就看。

06 SaaS 工具

大多数社区 DAO 几乎每周都要经历以下循环:

出现一个需要解决的问题;

有人基于现有工具进行研究;

结果发现现有工具没法满足社区所需;

啊😫。

FWB 是为其社区构建定制工具最活跃的 DAO 之一。当他们需要一个工具来标记 (token-gate) IRL 事件时,他们自己做了。当他们需要一个能显示社区关键信息的仪表盘时,他们就做了一个(而且很有活力)。

FWB 早期做对的一个关键是选择了高质量的种子会员。然后,入门会员通过工作量证明 (proof of work) 来确保只有那些最投入的人才能加入社区并在每一季重新计算。这就创造了一个积极的反馈循环,使有才华的人才进入。这些人开始构建和交付产品,更多有才华的人才会感兴趣并加入,更多问题浮现出来,更多问题也得到解决。

随着社区 DAO 成为加密世界中顶尖人才的聚合器,我们将会看到更多的用于服务更广大社区的定制工具。与 YC 初创公司通常获得与其同一批次的初创公司的初始分配类似,社区 DAO 将会从其他 DAO 和他们社区的项目中获得初始分配。

07 代币 (DeFi 协议、NFT 协议和其他DAO)

有趣的是,DAO 通过相互投资来调整激励措施。

去年,FWB 和 WHALE 进行了代币交换 (token swap),其中 $FWB 的股份价值为10万美元。今天,这些股份已经价值150万美元了。

鉴于这些 DAO 中人力资本的数量,大多数加密协议将可能会有一些 DAO 作为战略投资者来帮助他们发行、连接和专业领域支持。随着加密市场的增长,这些"DAO2DAO"的股权最终可能会变得非常非常大。这些股权也会创造一种我们在激烈竞争的商业世界中从未见过的新型的相互结盟。

二、风险

与其它任何可投资资产一样,社区 DAO 也遵循风险回报谱。

社区 DAO 的主要风险包括:

糟糕的 OpSec

DAO 的资产 (NFT、ETH 和 ERC-20) 存储在区块链的智能合约中。通常,该合约是由可被信任的一组社区成员通过多重签名的钱包控制的。要取出资产,需要多个成员使用自己的加密钱包签名确认,达到一定的阈值才可以实现。这样的做法可以防止其中一位签名者耍无赖和破坏社区。或者是防止某个签名者无法访问自己的私钥,系统中应有足够的冗余来保证交易仍然可以被签名和提交。

理想情况下,我们消除了对任何受信方的需求,并通过类似 SafeSnap 之类的工具将治理和去信任交易的执行整合起来。但是在实践中,大多数社区需要对选定的社区成员群体有一定程度的信任,以确保安全地存储和管理资产。

潜在的 ETH / NFT 崩盘

NFT 是否存在泡沫?可能是的。最近的价格上涨和下跌模拟了大多数科技周期的繁荣和萧条的本质。如果 ETH 的价格暴跌,社区 DAO 在资产负债表上的现金将会减少,而且需要对 NFT 的账面价值进行减计。

这是一个真正的风险。许多 DAO 都在 Llama 等领域专家的帮助下实施资金多元化策略,以确保他们可以度过熊市。DAO 可以将 ETH 转换成 USDC 或 DAI 等稳定币来抵御 ETH 的波动风险。最好的 DAO 将拥有经常性的链上现金流和高效的成本结构,使他们能够度过熊市。

缺乏社区参与

人是任何社区的中心,无论是 DAO 还是其他。最好的社区 DAO 拥有的使命比单纯的人数增加 (nUmBeR gO uP) 要深得多。为实现这一使命的集体行动就是确保核心贡献者和活跃的社区成员每天都回来。但是当人们被代币价格分心的时候,或是核心团队失去兴趣的时候,文化就恶化了。

这些社区 DAO 的魔力在于人。通宵达旦地在 Discord 群组里回答问题的 mod;在写帮助文档以帮助新进成员的志愿者。很多社区中最有价值的工作都是不引人注意和没有回报的。社区成员需要内在动力来推动社区向前。否则,社区将会慢慢退化为另一个不活跃的群聊。

设计不佳的代币经济

代币经济两个最大的风险是:

1)核心团队没有足够大的股权来激励他们;

2)对手大户累积来大量代币,并使用它们通过治理或负面价格来操纵网络。

我们仍处于了解社区 DAO 代币经济最佳实践的早期阶段。许多社区聘请了像 Fire Eyez、Delphi Digital 和 Gauntlet 等专家来帮助他们制定稳健的代币策略。

三、社区DAO的未来

以下是对社区 DAO 未来的一些预测:

将会有很多数十亿美元价值的社区 DAO

这在加密世界原住民当中可能不存在争议,但如果你花时间考虑一下,这是非常疯狂的。在线社区存在于 Discord 服务器、Telegram 聊天群、Twitter DM、FB 群、Patreon 等平台上。

DAO 的组织结构使得这些在线社区有能力协调资本、做出集体决定,并通过互联网原生货币获得价值。可以使用此功能的社区典型案例是 GME 空头挤压期间的 r/wallstreetbets。除了投资以外,我认为在游戏、出版、音乐、教育、艺术、软件开发等领域将会出现十亿美元级的社区 DAO。

社区代币 > 社交代币

在过去的几年里,社交代币是讨论加密原生消费应用程序未来时的热门话题。想法是"你像投资股票一样投资于人不是很酷吗?" Bitclout最初的吸引力就是人们对于这种产品需求的标志。但专注于某一个人的社交货币可能会导致倦怠、心理健康问题和监管风险。因此,与专注于个人的社交代币不同,我认为专注于一群人集体努力的社区代币将会成为主导模式。

投资 Beat 代币很无聊,但是成为 Mr.Beat 社区的一员是有趣的。社交代币感觉像是一种自上而下的方式。创作者和管理团队保留对创意决策和IP的完全控制权。但正如我们在 BAYC 和 Loot 中看到的那样,具有正确激励措施,自下而上的去中心化社区将会比集中协调型社区创造出更多的价值。在之前的时代,像 Android 和 Linux 这样的开源项目并没有原生的商业模式。但是现在 ERC-20 代币和 NFT 给开源软件提供了一种商业模式。而且还不仅仅是开源软件,还有开源 IP。

对我来说,社交代币意味着自上而下的中心化的协调努力,而社区代币意味着自下而上的去中心化社区,对于社区的底层 IP 具有完全的访问权限。后者更加加密原生,并为我们前所未见的组合创造力铺平了道路。

服务型 DAO 将在扩张社区 DAO 方面发挥重用

在加密世界,建立一个成功的项目需要一套全新的专业技能。诸如代币组学、资金库管理、社区管理、入职、治理、智能合约开发、数据科学、协议安全和 OpSec 等。因为在这些领域专家还不多,我们已经看到加密原生机构(即"服务型 DAO")聚集最优秀的人才并为其他 DAO 提供服务。Llama 提供资金库管理服务,Fire Eyez 提供代币组学服务,Vector 提供设计加密 app 的服务。

服务型 DAO 结合了自由职业者的灵活性和初创公司的优势。大多数通过 ETH 和 ERC-20 代币的组合获得报酬,这样是利益共享,风险共担的。随着这些服务型 DAO 构建他们的流程、雇佣更多的人才并构建软件来自动化他们的服务,社区 DAO 将会更容易解决一些棘手问题并帮助他们扩大社区。

四、结语

社区 DAO 是在线社区下一步的进化。

这就像 reddit 论坛里,不同 subreddit 有一个共享的银行账户、一种代币和治理机制一样。它们将成为新的社交网络。最好的学习方式就是积极贡献。

以下是我通常和有兴趣为社区 DAO 做贡献的朋友分享的的内容:

加入3到5个 Discord 服务器,感受不同的氛围;

在 #introduction 频道介绍自己,并阅读其他人的介绍,看看是什么样的人在社区里;

找到2到3个跟你最相关的频道,一天多看几次。提问、回答问题、送上鼓励;

阅读治理论坛,了解社区首要任务和他们如何做出决策;

通过参与语音聊天与最活跃的贡献者建立联系;

在这个最初研究阶段之后,选择一到两个和你相合的社区 DAO,加倍地关注他们;

找到一个你可以帮忙的委员会并参与一个项目。随着你感觉更好的时候,承担一些领导角色;

试着获得社区代币的奖励来对齐激励,真正变成社区的所有者;

迭代和重复。

DAO 大师 Coopahtroopa 本人最近发表了一篇文章,其中包含了一些你可以贡献的 DAO 和关注的人员列表。

这一领域对于人才的需求远超供应,因此,如果你感兴趣,不要犹豫,抓紧加入并开始做出贡献吧!