a16z协议专家:浅谈未来的代币经济模型设计

原文作者:a16z协议专家Porter Smith

原文编译:DeFi之道

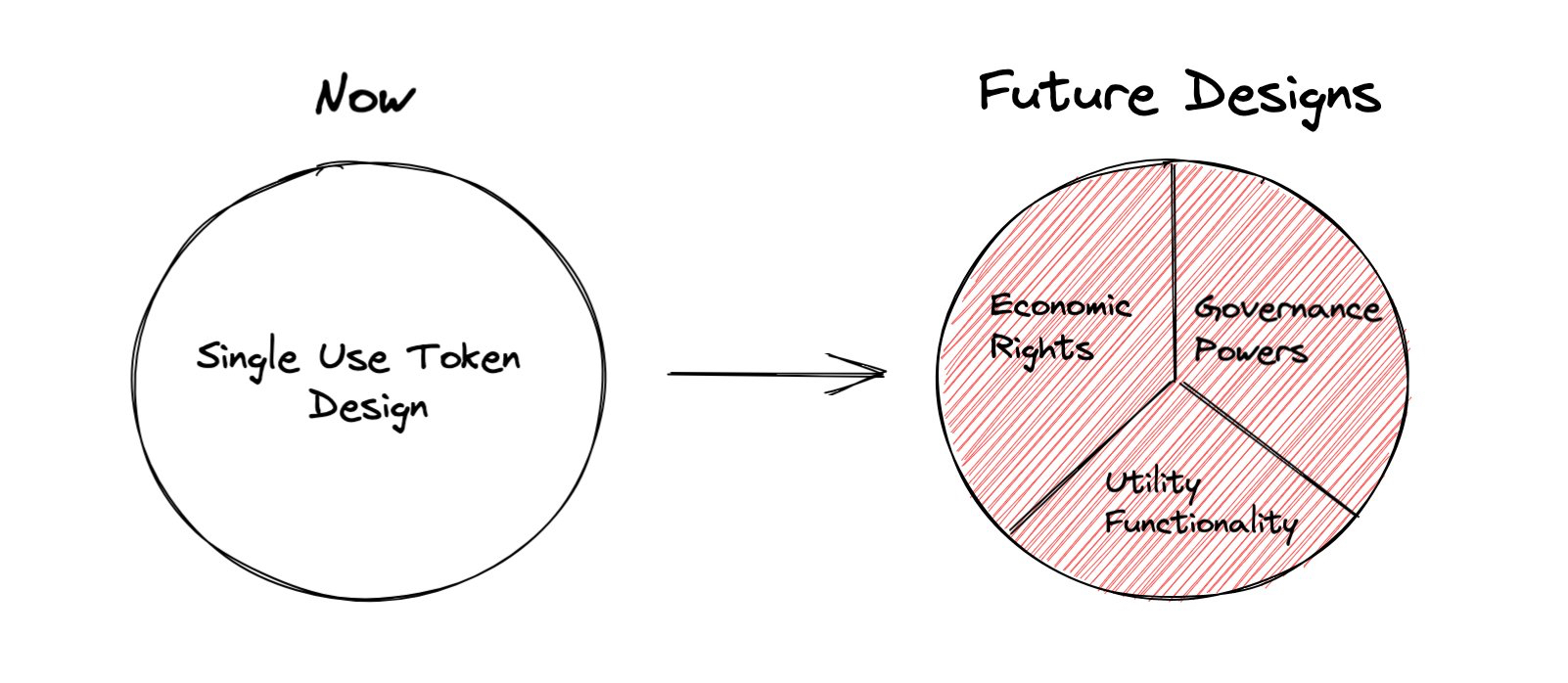

通常情况下,代币模型包含一个单一用途的代币设计,即一个治理代币传递投票权。

这种情况会改变吗?

未来的代币设计可能会选择融合经济、治理和实用权利,从而开辟一个新的设计空间。这如何做到?

对于许多代币,一开始就嵌入了特定的经济权利。但并非所有的代币都具备这个功能(包括许多NFT也没有)。展望未来,代币持有者可能希望可以直接获得他们的经济利益份额。

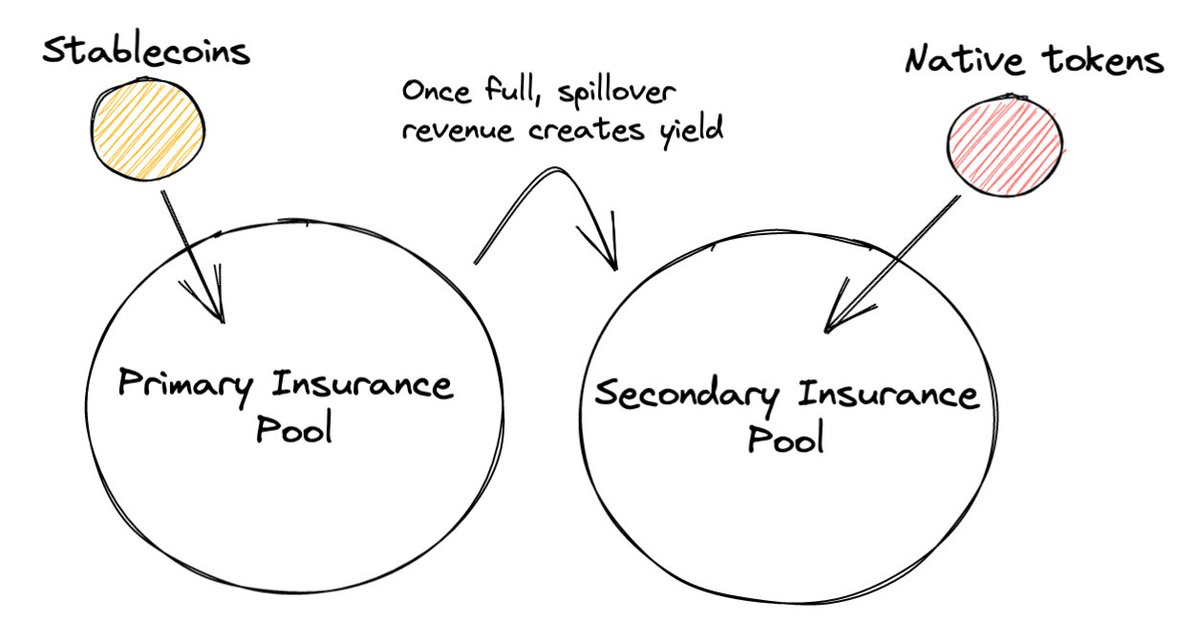

有不同的方法可以做到这一点。一种是创建一个二级保险池(secondary insurance pool),支持以稳定币计价的主要保险池(primary insurance pool)背后的协议。

主要保险池以稳定币为基础,二级保险池则基于原生代币。

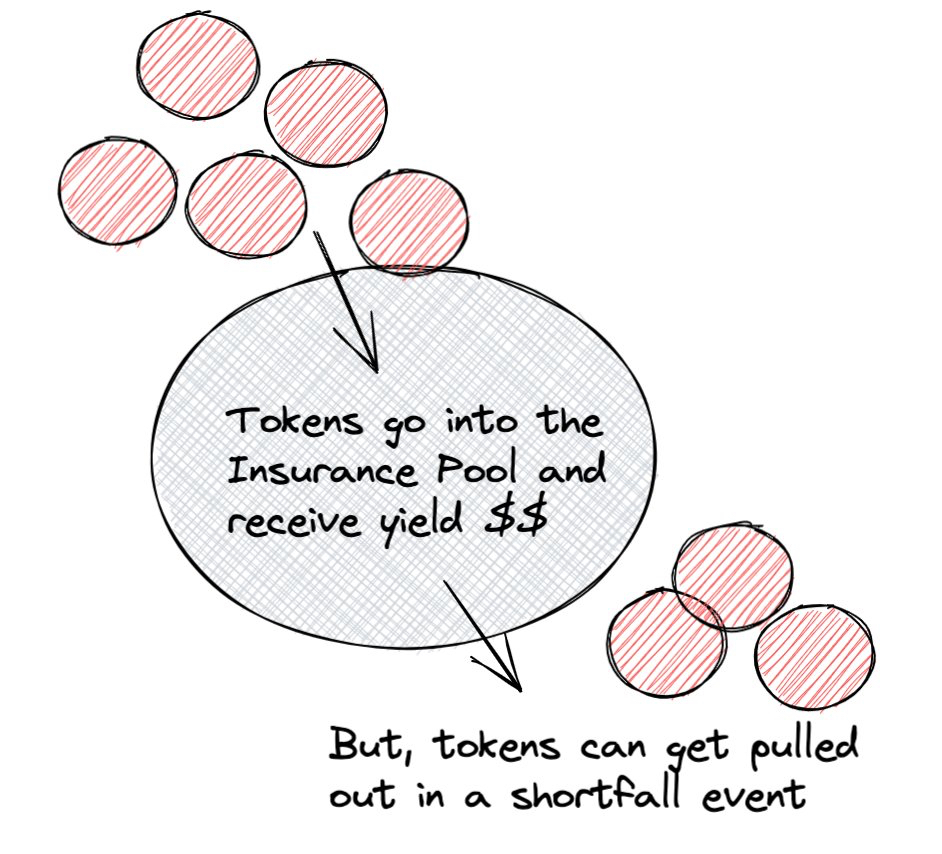

用户可以将他们的代币质押到二级池中,并获得稳定币收益作为回报。如果发生任何亏空事件,这些代币将被用于对协议进行资本重组,使其超出主要保险池无法覆盖的范围。

你也可以添加特定于协议的实用程序功能。这里可能有无限的表现方式,唯一的实际限制是社区的创造力和用例的实用性。

DeFi的一个示例可能是在债务拍卖中使用原生代币来调整激励机制,持有原生代币的参与者会在他们的中标价上获得折扣。

第二个例子涉及将NFT权利的各个方面整合到传统的可替换代币中:考虑对新社区倡议的访问优先级、为某些行为提供更好的经济激励,等等。

NFT社区已经在做相反的事情了。以@BoredApeYC APE空投为例,它赋予NFT持有人新的权利。这不也可以反过来发生吗?NFT空投 -> 代币持有者。

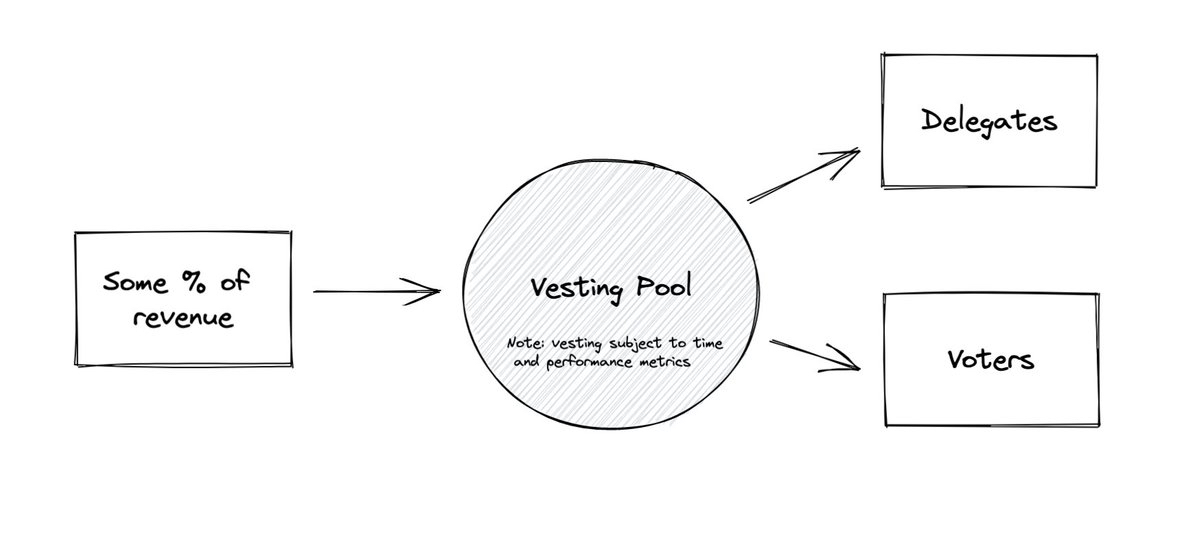

一个不同的设计途径是为活跃的投票者和代表设立归属池(vesting pools)。我们经常忘记,普通的代币持有者和代表是两类新的利益相关者,他们应该像其他贡献者一样在经济上激励他们做出贡献。

另外,代币持有者可能希望动态治理权也能给予他们经济回报。除了通过全民公投对每个提案进行投票外,代币持有者还可以根据协议24个月的财务表现,委托并获得既得代币。

这就激励了授权。代币的授予可以基于投票活动、跟踪性能的特定协议指标等。而为了促进长期参与,代币在一定期限内不能被认领,用户必须在该归属期限内继续投票。

简而言之,代币提供了一个空白的画布,可以结合经济、治理和实用功能,并且在未来几个月内会积极改变。我们正处于发现可以嵌入以创建新功能的最初阶段。

特别感谢@milesjennings和@sriramk在这个帖子上的帮助。那么,你有新的代币设计想法吗?