浅析Web3内容分发赛道发展现状

原文作者:Todd

原文来源:A&T Capital

本文仅做行业学习交流之用,不构成任何投资建议。

之前行业里有很多对Web3整体的定义,为了能够把自己的框架做的细化,我尝试着对web3产品相较于web2产品而言应有的特征进行归纳:

- 去中心化的网络基础

足够分散、尽可能少的信任需求、强大的基础设施

开放的、可组合的、公共的后端

能够自主管理的身份

对所产生数据的所有权

原生的数字支付

想要特别说明的是,抛出上述的特征并不意味着web3所有的东西都需要‘on-chain’,这不仅是出于对当前技术瓶颈的考量,更是“不是每个web3的所有信息都需要on-chain”,即web3时代的信息一定是on-chain和off-chain的完美结合。

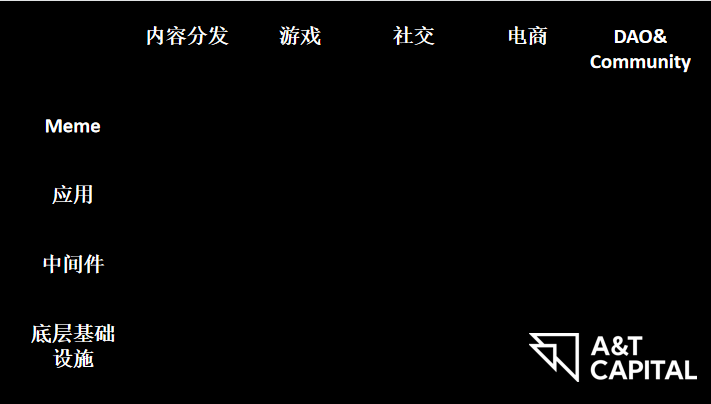

通用框架

纵轴的逻辑:对于任何行业架构,应用/中间件/底层基础的三层式分法都是屡试不爽的;而加入Meme则是考虑到其作为现实文化在crypto世界的里的一种非具象化表现,对于传统三层式存在着可能的指导意义,以及潜在的自成一个新层的可能性。

横轴的逻辑:内容分发/游戏/社交/电商是目前web 2时代最主流的子赛道,考虑到这四项满足着人们十分基础的需求,所以web3时代大概率会继续存在,只是换一种表现方式罢了;而加入DAO则是考虑到DAO在Web2时代并没有得到很好的发展,而在Web3时代成为重要内容已是板上钉钉。

P.S. DAO作为crypto思想的集大成者(可称之为终极目标),自然不会很快就成熟,但其发展过程中的一举一动,对于内容分发/游戏/社交/电商这四项的Web3发展路径一定会有深远的影响,是优秀的参考指标。

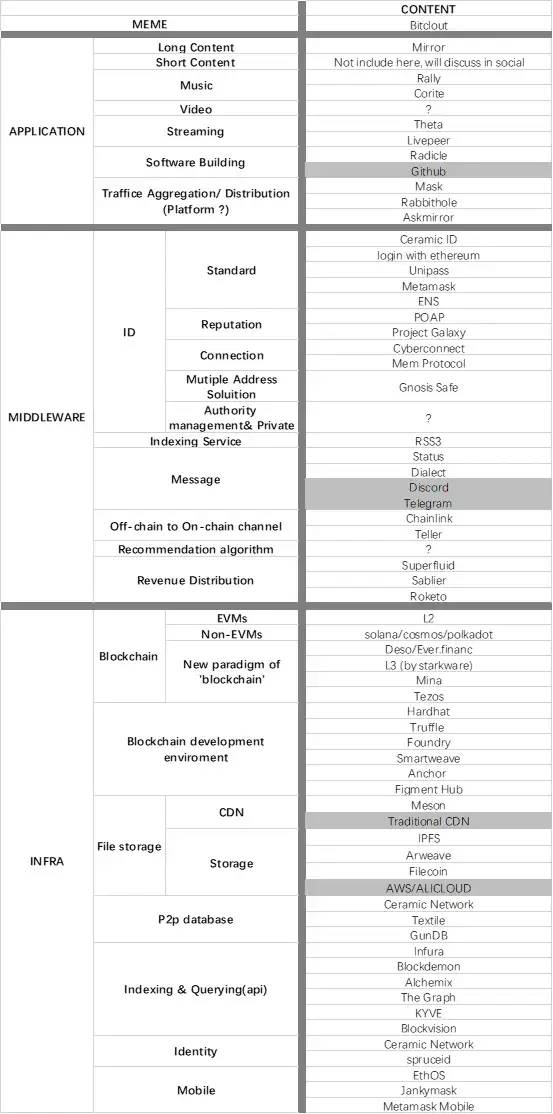

内容分发赛道

选择从内容分发赛道开始,更多的是参照Web2的发展规律,个人主页/黄页早于FB等社交产物,这因为内容分发的业务逻辑简单,对支撑技术要求偏低;

当前的Web3市场实际情况也一定程度上支持了我的猜想:相较于社交产品,内容分发的应用已经部分小有成绩。

灰色栏均始于Web2,但我认为他们暂时不需要“完全Web3化”

这张表能发掘的东西很多(当然需要补充的也很多),我们先聊两点,两点我从自身需求出发遇到的问题:

1.

对于内容消费者,内容发现体验差,简单推送+多账户体系会是阶段性的优质解决方案。

作为一个内容消费者,我大部分时间只会考虑三个步骤:

怎么触及内容

在哪儿看内容

怎么付费

当前,mirror+ethereum+arweave较好的满足②在哪看内容的问题。

Blockchain native payment + NFT + ENS + Revenue Distribution也很好的服务了③。

①是缺口最大的:作为一名Mirror上的阅读者,相较于Web2的主动搜索&被动推送体验,我寻找优质内容是不太容易的,目前只能通过①在twitter等其他渠道碰到好文章,就记下作者的mirror地址(mirror甚至没有给我follow优质创作者的功能);

②通过类AskMirror的引擎搜关键词(搜索引擎以一种奇怪的逻辑对内容进行了排序,效果不佳)。

那能不能加个follow功能(如果Mirror要保持纯净,那Askmirror是不是可以加一下,或者在Web3Pass/Cyberconnect.me上做内容推送),进而依照follow而生成的社交图谱帮我推荐,如果信息池太小不足以支撑算法,至少提供下按照相关性的简单排序;

上述想法对于那些希望不再被类似Web2大数据支配的用户可能是不喜欢的,那可以: A 单独开个地址来用于Mirror阅读,交易等其他操作使用其他账户即可;B 给到用户是否同意对外共享自己信息的权利,从而选择是否开启推送功能;

上述方案B提出了权限管理的要求,而这是在当前Ethereum/Arweave这样的链上信息必公开的框架下所无法实现的,即对存储提出了①不公开;②可验证所有权 的存储新要求,所对应的解决方案已经不再局限于链式结构,链下存储或是优质,只需对存储进行签名即可。

对于内容创作者,创作者经济运转并不完整,亟待所有权&使用权的分离与落地。

2.

而对于内容创作者,无非就是关心:内容形态支持,内容分发,流量(粉丝)积累,变现手段;在当下被谈及最多、与Web2区别最大的的Web3新特性当属变现手段,但缺口也十分显著:

预先众筹+事后版权收入分成的模式是存在已久的链上内容创作者经济模型,但至今仍未有一家平台将此方案很好的执行,究其原因①当前区块链体系能够很好的定义数据所有权,但对数据使用权的定义是缺失的;②传统的解决方案涉及到法律以及执法机关,而链上这两部分都是暂时缺失的;

链上有法律环境,是显而易见的优质方案,但事实是我们还需要等很久;在那之前,预staking+ DAO的模式可以在一定程度上解决问题②,当然不可否认的是如果作恶的收益高于staking,则会失效。

更丰富的预言机以及权限管理或是解决问题①的必要条件,但市场上需要一个更加优质的方案!

AMA

Q:流量聚合层应该归属于应用层还是中间件层?

A:都可能会有,会是完全不同的两种表现形态,早期大概率会是应用层的聚合先出现;

逻辑是早期单个应用流量都不多,所以能够分发流量的聚合层(e.g. 自带流量的团队来做)的价值会很直接;中后期可能会沉淀出一些Protocol/Standard的中间件形态。

(观点来自于来自于潘老师 @nake13)

Q:如何看待钱包与Web3时代用户入口的关系?

A:钱包其实可以拆分成Signer(秘钥管理逻辑)/ Provider(Signer 到 dApp 的中间件,比如 MetaMask 对 dApp 之间的一整套 RPC 调用规则)/ 转账逻辑三层;

Web3时代的用户入口应该在Signer层做的更好,e.g. 更丰富的功能(e.g. 身份验证、加解密)、更好的UX。

(观点来自于来自于知县 @frank_lay2)

Q:对去中心化主义的严格追求与阶段性的退让以迎合用户,该如何抉择?

A:Mirror没有follow&推送功能可以理解为项目方不想沾染大数据控制用户的web2痛点,但UX的确不佳;Opensea作为一个聚合平台,难免会出现ipo上市这种背离Web3初心的抉择(借潘老师的观点:Opensea现在就是个换皮Web2平台),但Opensea的优质UX的确吸引到了用户。

所以只有UX的提升才能促使crypto逐步进入大众的习惯,而大众越多的接触crypto事物则会慢慢改变提高其对去中心化主义的接纳程度;我认为整个过程是长期的、曲线救国的,直到去中心化主义真正被大众接纳。所以crypto产物在短期的、少量的平台化是有助于行业发展的,也是值得行业支持的。

(有感于Moxie的My first impressions of web3)

Q:Message需要on-chain么?

A:不需要,即便资源消耗(e.g. gas fee)不是问题,大家也不会想要自己微信的每条信息都on-chain;message只需在被查询时能①保真;②验证签名 即可。

Discord/TG给出链上地址关联功能,应该就很足够了。

Q:做Web3产品,大而全还是小而精?

A:行业早期变化万千,小而精的试错成本更低;即便到了中后期,参考‘尽可能少的信任需求的’以及‘可组合的后端’两项原则,小而精仍是最优选项,如果你一定想做很多,那多做几个再来组合也能满足。

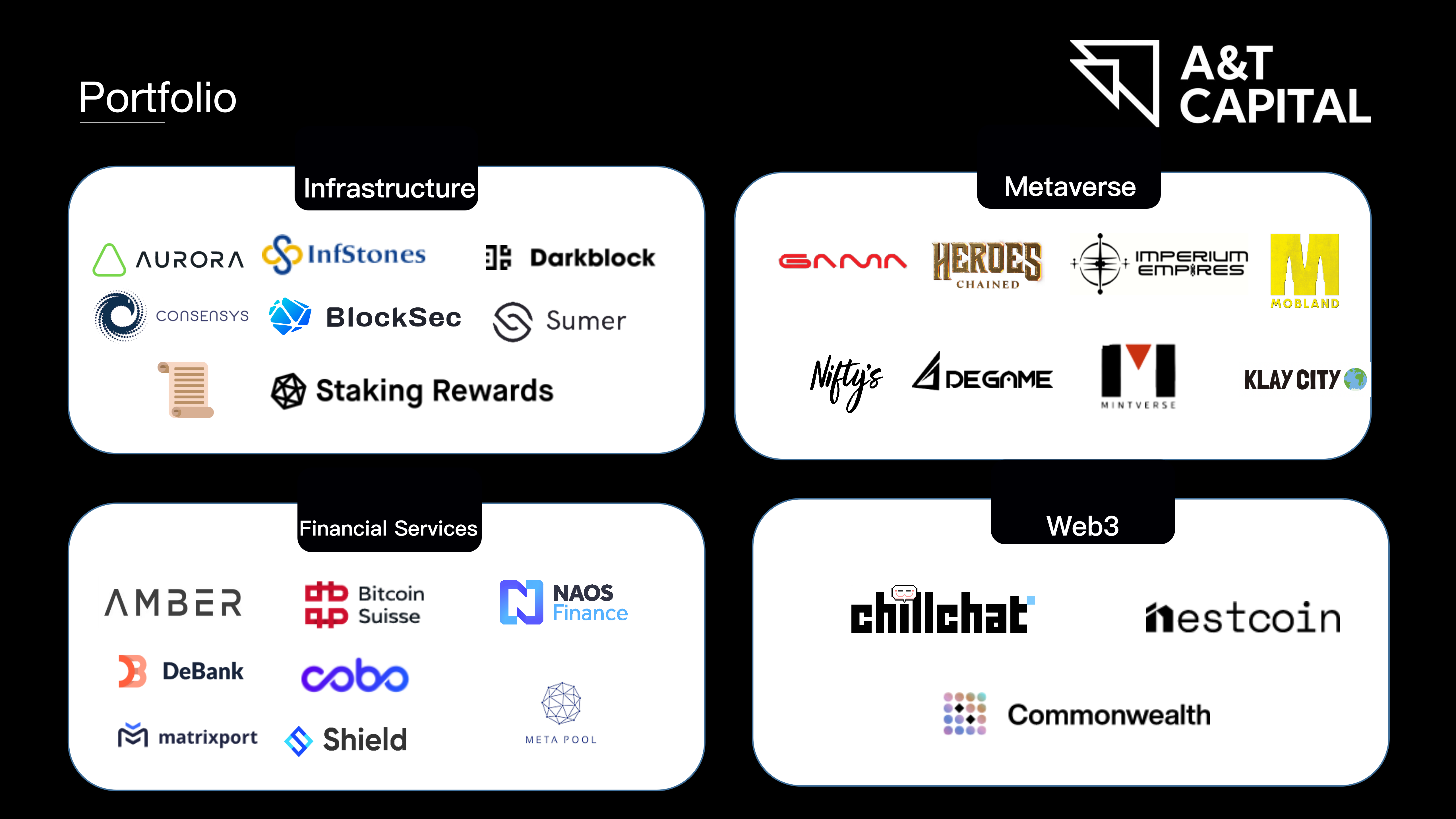

关于 A&T Capital

A&T Capital是一家针对新兴颠覆性技术的风投基金。基金专注于支持早期到成长阶段的初创公司。背靠5家金融技术Decacorn(100亿美元以上的估值),分布式记账技术早期支持者以及一批经验丰富产品负责人,A&T Capital在推动下一代去中心化数字时代的初创企业进行大规模落地上具有独特的优势。