Pantera Capital:新一轮「加密投资热潮」即将到来

本文来自 Pantera Capital,原文作者:Pantera Capital 创始人 Dan Morehead

Odaily 星球日报译者 | Moni

一个多世纪前,经济学家、传奇记者白哲特(Walter Bagehot)曾说过这样一句“名言”——

“为避免恐慌,央行应尽早、自由地(即无限制地)用高利率贷款给有偿付能力的公司,尤其是那些能提供良好抵押的公司。”

而一百多年过后,美联储依然没有意识到真正的问题所在,仍在积极放大债券、股票、房地产等领域的泡沫,这又将需要更大规模的政策掉头来抵消相关风险。释放大量流动性的最终结果是致使资产市场混乱。那么,规模这一政策风险的最佳选择是什么呢?我们认为是:加密资产。

同时,美联储忽略了“低利率”的问题。实际上,美联储一直在操纵美国国债和抵押债券,并将利率推至历史低点。纵观美国历史,从来没有出现过“年通胀率达 7.5%,但联邦基金为零”的时期 (由于美联储更新速度缓慢,年通胀率实际数据可能是 8.6%)。如果我们关注实际利率(也就是通胀后的利率),会发现这一数字已经达到“-5.52%”,创下近 50 年来的最低点。稍微有点理性的投资者,还会选择美国国债和债券吗?

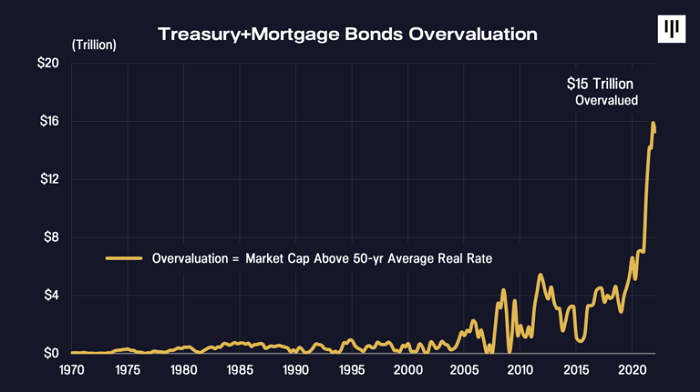

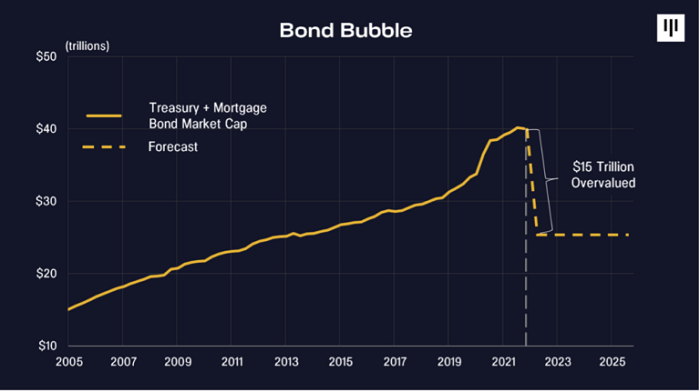

毫无疑问,美联储的政策组合并不正确,五周后是否加息也有很多争论。(难道不应该五个月前或者现在就立刻加息吗?)正是美联储极度的操纵,让当前市场被高估了 15 万亿美元。

我们在 2021 年 12 月预测了市场泡沫可能会破裂。从那以后,美国 10 年期票据利率下跌了 5 个基点,利率上涨了 70 个基点。由此判断,新一波“交易潮”已经开始了。但问题是,大多市场参与者还没充分意识到政策与加密货币价格间的关系。

美联储政策对比特币到底有多大影响?

当美国债券泡沫破裂、美联储开始加息时,将会迎来转折点,最终对应两个结局:

1、我错了,市场变化对加密资产没有产生任何影响;

2、市场错了,市场变化对加密资产产生了巨大影响。

在此,我们分享一些 2 月 1 日 Pantera Capital 投资者电话会议上的内容:

Dan Morehead: “自从我们上次投资者电话会议以来,市场显然发生了巨大的变化。就像我们在 11 月和 12 月所预测的那样,美国债券泡沫将会破裂,美联储将不得不扩大加息力度。投资者也需要相应地采取行动。但当时,我们并没有预测到加密货币市场会出现如此严重的衰退,这意味着交易者会出现疑虑,究竟是自己分析判断的不对,还是加息和数字货币市场走低就没有关联。在这种情况下,我坚信市场真的错了,而且利率上升(我认为这很明显,它将会发生并将继续发生)对加密货币市场的影响并没有那么糟糕,相对于其他资产类别,加密资产价格表示其实非常不错。”

Joey Krug:“我们提出一个宏观观点是,加密货币肯定受到了美联储计划加息的打击。但同时,我也认为加密市场对美联储有点敏感。到目前为止,加密货币市场经历过大约五次加息,其中几次的影响其实都被夸大了。在以太坊跌至约 2,200 美元低点的时候,市场出现了巨大恐慌,可如果你看一下美国 10 年期国债利率,会发现其峰值约为 1.9%,目前大约为 1.8%,但在去年底曾一度跌至 1.35%,然后迅速上升到 1.9%,波动也是非常明显,所以我认为这对市场来说是一个警钟。

但是,如果你关注一下加密货币市场变化就会发现:当传统的宏观市场下跌时,加密货币关联变化往往会发生在大约 70 天时间左右,也就是两个月多一些。我觉得,加密货币仍然是一个相对较小的市场,因此联邦基金利率就算从 1.25% 跌至 0%,对于加密货币市场来说并不会带来太大差异,毕竟这个市场每年增长也就四到五倍,就算是某些 DeFi 资产能够带来 10-40 倍的市盈率,如果与高达 400-500 倍的科技股市盈率相比,真的是小巫见大巫。我们的观点是,加密市场可能会在接下来的几周内与传统金融市场脱钩,并再次开启新一波交易,我个人认为 ETH 的底部也许是 2,200 美元。”

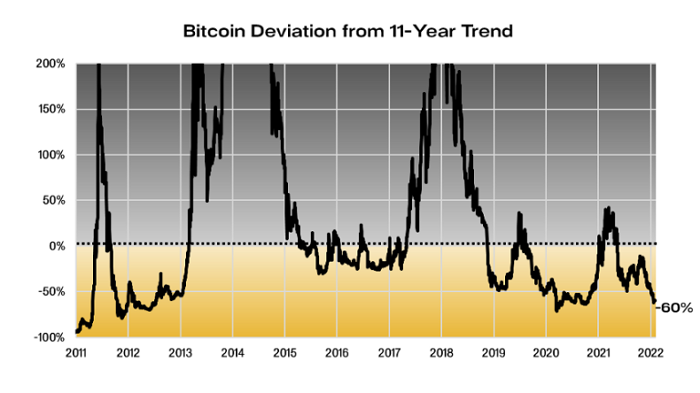

Dan Morehead:“我完全同意 Joey Krug,标准普尔指数和加密货币之间的相关性可能不会维持太久。自 2010 年有比特币交易以来,标准普尔指数出现过六次下跌,但是比特币都在几个月后(大约 71 天)内反弹。我认为,这种情况今年会再次发生,然后加密市场会与传统金融市场脱钩。一旦人们愿意花点时间思考这个问题,就会意识到加密资产与其他资产类别完全不同,在利率上升环境中,加密资产其实是相对表现最好的。因为区块链不以现金流为导向,类似于黄金,因此价格变化和以利率为导向的产品截然不同。我认为,投资者会进行选择:他们必须投资一些东西,如果利率上升,加密资产无疑是最具吸引力的投资标的。我们快速回顾一下当前市场位置,在过去十年中,我们多次使用下面这张图,非常重要。你会发现,现在比特币的交易价格其实比整体趋势低了大约 60%。

但是,这并不能保证比特币下周就肯定会上涨,也不能保证下个月或任何时候都不会进一步下跌。当市场处于极端状态的时候,比特币相对较快反弹的可能性非常高。我们在区块链投资领域里已经摸爬滚打了 9 年时间,也不得不承认,有时市场暴跌,我也会非常紧张,但我相信市场会快速反弹。我认为我们需要几周或几个月的时间才能非常强劲地反弹,也非常看好市场大趋势,同时认为目前价格依然处于相对便宜的状态。你可以看到,大约一年前,美联储把利率推高了,真的很疯狂。我认为美联储的行动完全是一个政策错误,他们也许很快会开始加息。所以,如果你现在还没有把你的债券卖给美联储,请抓紧。也许到下个月,债券就找不到买家了,到时候应该会有更多人进入加密货币市场。”

根据上图,比特币的 4 年同比回报率处于其历史范围的最低端,所以比特币并没有被高估,实际上,现在似乎依然“非常便宜”

根据上图,比特币的 4 年同比回报率处于其历史范围的最低端,所以比特币并没有被高估,实际上,现在似乎依然“非常便宜”

Joey Krug、Paul Veradittakit,以及 Dan Morehead 都觉得,当市场下跌,大多数人都会感到恐慌,这可能是因为人类有一种与生俱来的从众本能。

当市场飙升时——FOMO 魔鬼在我们耳边窃窃私语,每个人都想跟风追涨,这是人性。

当市场崩盘时——周围每个人都在吐槽,我们想要逃离……我们想要停止痛苦,这也是人性。

为什么 Web3 很重要?

去年年底 Elon Musk 和 Jack Dorsey 对 Web3 进行了抨击,之后引发了加密行业的激烈辩论,为此,我们决定举办一场“为什么 Web3 很重要”主题投资者电话会议,期间邀请了 DeSo 基金会的 Nader Al-Naji 和 Audius 的 Roneil Rumburg 参加,以下是本次讨论的一些内容亮点。

问:如何定义“Web3”?

Nader Al-Naji:“我个人认为 Web3 是在区块链上构建的东西,如果你使用的是区块链,对我来说那就是 Web3。你可能会问,这有什么意义?为什么基于区块链的应用如此有趣且与众不同?我认为,Web3 之所以有趣,最大原因是——所有链上资产和内容都是共享的,这使开发人员能够相互引用并进行创新,这个概念被称为可组合性,这种方式在 Web2 中无法实现。举一个具体的例子,使用 DeSo 区块链,基于它构建的应用程序实际上都共享同一个内容池,当您在一个应用中发帖,实际上会出现在所有其他应用中。如果您在一个应用程序中建立了关注者,然后您想转移到另一个应用程序,那么您的所有关注者也可以在该新应用程序上访问。正如我所提到的,在所有应用程序之间共享数据的概念称为可组合性,我认为这是区分 Web2 和 Web3 应用程序的关键。”

问:最近在 Twitter 上,Jack Dorsey 和 Elon Musk 公开质疑 Web3 的现实和愿景,Elon Musk 在 Twitter 上说 Web 3更像是营销流行语,他说的对吗?

Nader Al-Naji:“放弃 Web3 的人可能不了解可组合性的力量——资产和内容的力量被共享并真正由用户拥有。当具有可组合性时,出现完全支持它的平台(Layer 1 或是其他类似的东西)是不可避免的,因为基于 Web 3构建的单个杀手级应用程序会共享所有这些用户和数据,有利于更多应用程序建设,并创造一个良性循环。我们在以太坊上看到了可组合性,我认为当 Web 3发生时,它是不可能被忽视的。 ”

问:Jack Dorsey 对 Web3 所有权持批评态度,他说:“没有人拥有‘Web3’”,并且“最终会出现一个带有不同标签的中心化实体。”你同意这种看法吗?

Roneil Rumburg:“我既同意又不同意。当今大多数加密网络都处于初期阶段,通常这意味着在更广泛的社区中代币所有权的分配并不是去中心化的。但是,当您考虑将其与现有的 Web2 产品进行比较时,这些公司正在积极地向处于生命周期中如此年轻的用户提供所有权,但更重要的是,这些产品实际上的设计方式是,它们不断地将自身的所有权分配给使它们变得有价值的用户。”

元宇宙和“边玩边赚”游戏模式

从一开始,定义“元宇宙”就是一项不可能完成的任务。我们认为,目前给出最好定义的人是 Matthew Ball,作为一位投资人,他给出的定义是:

“元宇宙是一个大规模且可互操作的实时渲染 3D 虚拟世界网络,可以由具有个人存在感和数据连续性(例如身份、历史、权利、对象、通信和支付)。”

那么,谁在构建元宇宙呢?到目前为止,主要分为两个阵营:非加密行业和加密行业。但有趣的是,这两个阵营并没有拼的你死我活,而是在彼此合作。

1、非加密行业:科技巨头的元宇宙

2022 年,两家大型科技公司—— Meta 和微软——对元宇宙的未来下了很大的赌注,将其直接纳入他们的近期路线图。Meta 推出了 Horizon Workrooms 产品,不过他们似乎有更大的野心。扎克伯格似乎“明白”了为什么互操作性和开放性很重要,并且由于他认为这是公司的一个新时代,因此声称正在朝着这个方向发展。

2、加密行业:社区拥有的元宇宙

使用区块链技术创建的一些虚拟世界主要包括:The Sandbox、Decentraland 和 Cryptovoxels,虽然它们每个都有不同的元素和世界经济,但区块链和 NFT 的力量允许真正的数字土地所有权,因此开辟了全新的活动类型,比如你可以出租自己的土地,也可以为他人定制建造房屋。例如,在 Decentraland 上,几乎每天都有用户可以参与和体验的活动。 Dominos、Atari 和其他大牌品牌也购买了虚拟地块来宣传他们的商品、举办活动并在虚拟世界中建立知名度。

现阶段,距离元宇宙走向“主流”还有很长的路要走。坦率地说,我们可能只触及到这一领域的边缘而已。但是,随着企业和游戏的逐渐深入,开放、去中心化和社区拥有的元宇宙将击败封闭的传统系统。

互联网 VS. 区块链

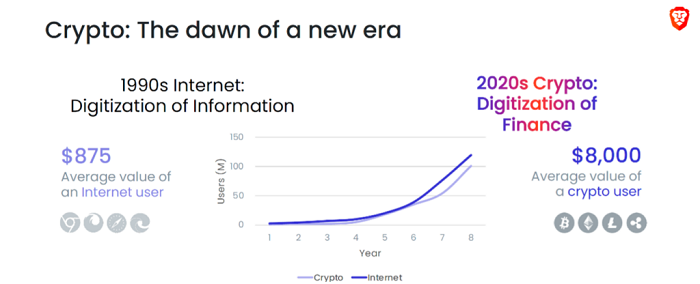

Brave 发布了这张图表很酷(如下图所示),在上世纪 90 年代,互联网行业用了八年时间才达到 1 亿用户,这种情况和加密行业非常相似。

正如 Pantera Capital 联合首席信息官 Joey Krug 所说:

“加密货币和区块链技术是新金融基础设施的基础,类似于互联网是新信息基础设施的基础。”

与上一代信息数字化相比,金融数字化创造的价值要大得多。如今一个加密用户的平均价值为 8,000 美元,而 90 年代一个互联网用户价值仅为 875 美元。

总结:债券泡沫破灭,新一波“加密交易潮”即将来临

据 Pantera Capital 创始人 Dan Morehead 透露,自 2013 年以来,他没有投资过加密资产外的任何东西。因为自那时以来,债券泡沫开始形成,也导致出现不对称性的交易,因此 Dan Morehead 做出了一个决定:做空 10 年期票据和抵押贷款支持的证券,然后选择加密货币。

新一波“加密交易潮”即将来临。