NFT交易失败也要给钱?一文探讨如何合理优化gas费用

原文作者:老雅痞

本文来自老雅痞(微信公众号 ID:laoyapi),Odaily星球日报经授权转载发布。

2021年,NFT收藏品爆发为一个数十亿美元的资产类别。然而,这种成功带来了一些问题。

大多数NFTdrop使用先到先得(FCFS)机制,其固定价格远远低于市场清算价格(供应与需求匹配的价格)。这样做的问题是什么?低价和过度的需求有效地创造了竞赛条件。在高度期待的drop期间,只有最早的买家才有机会铸造NFT。因此,对下一个区块中的铸币交易的需求上升,而gas费用大幅增加。

如果你不熟悉 "gas费 "这个术语,它是用户为使用以太坊区块链所支付的费用。具体来说,"gas"是成功进行区块链交易所需的费用。用户用以太币支付费用,以太币是以太坊区块链上使用的加密货币。网络根据对区块空间的需求,计算出用户需要支付的gas数量。通常情况下,费用是由用户的钱包自动设定的。gas的计量单位是gwei,也就是10^(-9)ETH。

在高峰期,你会参与所谓的 "gas战争"。这是一个短语,当有一个巨大的gas价格飙升,因为无数用户试图在一个小的时间窗口得到交易确认。

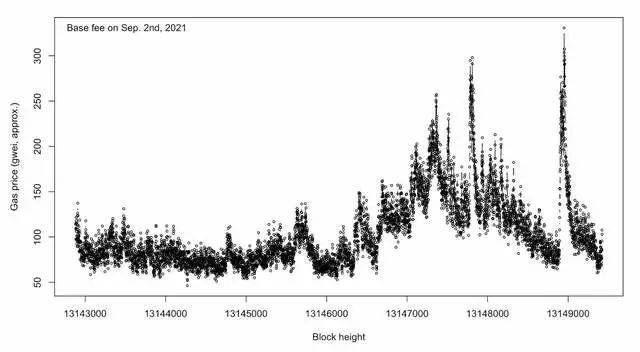

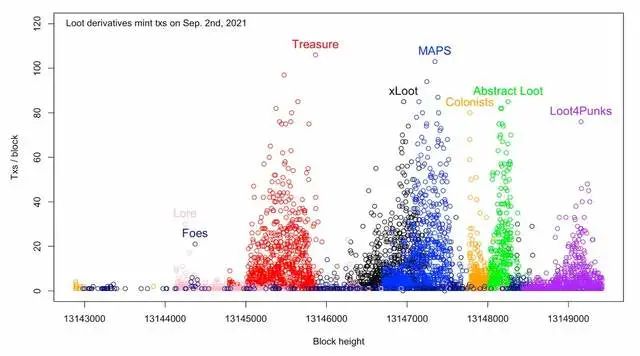

在高需求的NFT下跌期间发生的gas战,为该区块链上的所有用户创造了可怕的体验。例如,在Loot项目取得突破性成功后,急于铸造和上市Loot衍生品,造成了几次gas费用的飙升,提高了整个以太坊网络的交易价格。下面的图表显示了在9月2日,每当Loot衍生品被铸造时,gas费用是如何急剧上升的。

本文将探讨一些关于FCFS drop如何对用户产生负面影响的案例研究。我们还就收藏品创作者如何缓解这些问题提供了建议。

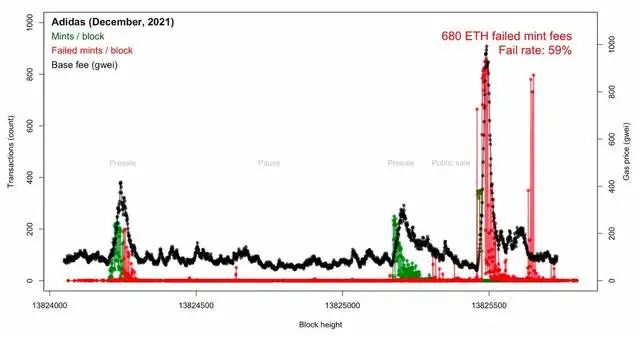

进入Metaverse:阿迪达斯drop的问题

Into the Metaverse是阿迪达斯、Gmoney、Bored Ape Yacht Club(BAYC)和PUNKS Comic之间的一个合作NFT项目。它于2021年12月发布。拥有3万个NFT中的一个,持有者就可以获得限量版的阿迪达斯商品和未来的虚拟体验。有一个预售活动,只有拥有合作项目之一的NFT的收藏家可以参加,然后是任何人都可以参加的公开销售。

有两个主要问题困扰着公开拍卖。首先是高额的gas费用。执行铸币交易以获得阿迪达斯NFT的需求大大超过了以太坊网络在一个区块中可以处理的交易数量。因此,处理一笔以太坊交易的成本急剧上升。

上面的图表通过绘制跨区块的铸币交易图来说明这些动态变化。绿色点表示成功的铸造nft,红色点表示失败。

35000个钱包尝试了39000次铸造交易,其中59%的铸造失败。成功的铸币交易的中位数是0.16 ETH的gas。价值680ETH的gas被浪费在失败的铸币上。根据当时的ETH价格,这就是260万美元。

公开发售的第二个问题是,每个钱包被允许最多铸造两个NFT。然而,一些参与者使用机器人来规避规则。例如,一个投机者在一次交易中铸造了330个阿迪达斯NFTs。这个人写了一个定制的智能合约,部署了许多子合约。所有的子合同都参与了铸币,并将NFTs发送到一个钱包里。

有一个系统可以缓解困扰阿迪达斯NFT销售的问题,那就是平行NFT项目所开发的drop机制。使用这个系统,Into the Metaverse项目将允许用户在链外预订NFT。按照最初的计划,每个用户最多可以预售两个NFT。在进行一次预订后,用户必须等待5分钟才能预订另一个。这样一来,机器人就无法在反应速度正常的人类进行购买之前抢走所有的库存。

预售期将持续直到所有的NFT被预订。一旦所有的NFT被预定后,将有24小时的时间,用户可以在链上为他们预订的NFT付款。这意味着用户将不必急于在短时间内进行交易,也不会有gas战争。它也会给核心团队时间来识别和剔除任何参与第一阶段的机器人。

最后,NFT将被铸造并分批发送给买家。阿迪达斯将从drop收入中支付与铸造和转移NFT有关的gas成本。请注意,使用这种方法,买家只需要在链上进行一次支付交易,与铸币交易相比,其gas成本相对较低。

这种方法的缺点是,用户将不得不相信中心化的、链外的预售系统--以及将机器人列入黑名单的团队成员,在不影响去中心化的前提下,证明用户是一个独特的人而不是一个机器人,这在web3领域仍然是一个发展中的领域。

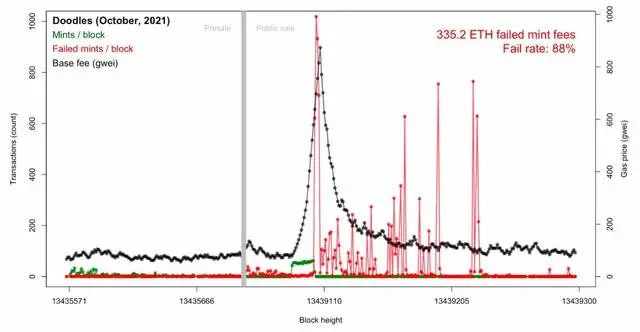

与Doodles一起出现的那些问题

Doodles是2021年10月推出的10k pfp NFT的集合。

Doodles的投放有两个阶段:只有白名单的FCFS铸造阶段和公开FCFS铸造阶段。在白名单阶段,用户可以随意铸造,基础gas保持合理稳定,很少有失败的交易。一旦公开销售开始,对区块空间的需求上升,因为人们急于铸造剩余的Doodles,gas费用急剧上升。

在预售期间(灰色竖线之前),失败的交易仅占0.2ETH的费用。

在公开发售期间(灰线之后),有1万个钱包尝试了1万3千次mint交易。其中12000次尝试失败,代表90%以上的失败率。成功的铸币交易的中位数为4.0ETH的gas。

由于交易失败,浪费了价值335.2ETH的气体。根据当时的ETH价格,这相当于126万美元。区块13,439,104的Etherscan条目是大屠杀的一个完美缩影--它有超过1000个失败的Doodles交易,仅失败的交易费用就造成了近100个ETH。

实施MultiRaffle方法可以提高gas效率和Doodles drop的失败率。来自Paradigm加密货币投资公司的研究人员Anish和Hasu开发了这种drop机制。它涉及用户通过在智能合约中锁定资金来购买抽奖券。彩票的成本等于NFT的成本,如果该彩票没有中奖,这一成本将被退还。

购票期应持续多天,以确保没有影响gas价格。一旦购票期结束,就用Chainlink VRF选择获胜者,以提供稳健的随机性。每张票都有同样随机的机会被选中。最后,用户可以随时claim他们的NFT或退款。

只有在这个时候,项目组才能够按照代码的规定从合同中提取资金。

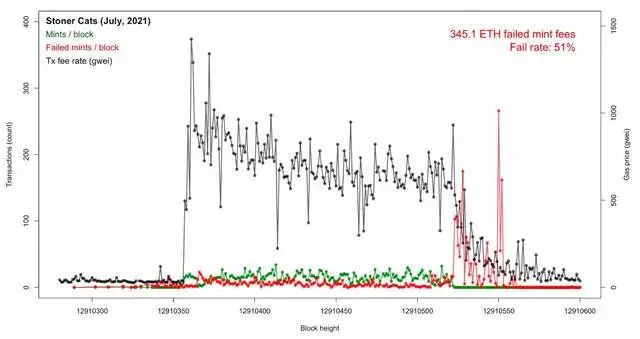

Stoner Cats的drop

Stoner Cats是一部由全明星阵容制作的动画短片,包括 Mila Kunis and Ashton Kutcher,购买10,420个NFT中的一个,持有者可以获得各种剧集和福利,例如与创作者一起构思和幕后内容。

在投放期间,3.5万个钱包进行了5千次铸造。51%的铸币尝试失败。每个成功的铸币需要花费0.22ETH的气体。价值345ETH的gas被浪费在失败的铸币上。根据当时的以太坊价格,这相当于794,000美元。

随着铸造Stoner Cats 开始,gas费用飙升。除此以外,铸币合同的编写效率低下,导致gas限额计算不足。因此,没有在他们的钱包中手动调整气体限额的用户更有可能遭遇交易失败。

值得庆幸的是,Stoner Cats 团队在事件发生后决定报销参与者的gas费。

除了改进合同外,有一种方法可以帮助提高gas效率,那就是在一系列以Stoner Cats 为主题的游戏和谜题背后为mint选项设限。这些挑战的性质将是多样化的,并出现在许多不同的平台上,使寻宝活动对机器人来说不可行,即使用户知道所有的步骤。这种方法的一个很好的例子是TempleDAO的开幕式,其中包括多个步骤的Discord命令,Cryptovoxels谜题室,以及在一个定制网站上回答问题。

这种方法将有助于错开铸币的时间,那些在所有NFT被铸造时还没有完成一系列挑战的人将没有机会提交铸币交易。

使用谜题和游戏来为铸造NFT把关,是一种有趣的方式来过滤参与者,选择那些对项目最投入和最感兴趣的人--而不是无意中过滤那些拥有最大钱包和最高技能的人,这是目前的运作方式。从长远来看,这可能会对社区产生积极影响。

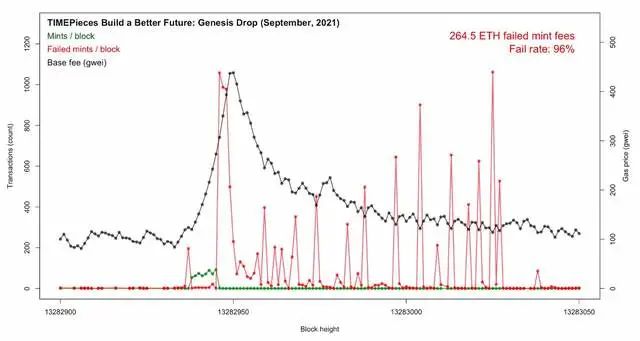

TIMEPieces可以如何改进

2021年9月,时代公司drop了一个名为TIMEPieces的NFT项目。该系列包括4,676个NFT,有40多位艺术家的作品。持有者的福利包括在2023年之前无限制地访问时间网站,并获得未来个人活动的独家邀请。

11000个钱包进行了13.5k的铸造,其中96%的钱包铸造失败。成功的铸币交易的gas费用中位数为2.3ETH。由于交易失败,价值265个ETH的gas被浪费了。根据当时的ETH价格,浪费的gas价值为836000美元。在13,283,025区块中,失败的TIMEPieces交易约占整个区块的90%!

TIMEPieces drop的失败率达到了可怕的96%。由于“科学家“提前发现了合约并提前部署好了机器人,NFTs在短短的2-3分钟内就卖光了。

该团队可以用来防止这种结果的一种方法是智能分批拍卖。使用这种方法,用户向智能合约提交竞标,指定他们想要的代币数量和他们希望购买的价格。一旦竞价期结束,就会计算出一个清算价格,以匹配需求和供应。出价高于该价格的用户随时可以claimNFT,加上出价和结算价之间的ETH差额。出价低于该价格的用户,其ETH将由合约退还。

解决NFT drop问题的其他方法

除了上面探讨的投放机制外,NFT项目还可以探索在投放过程中通过Flashbots RPC路由铸币交易。这带来了两个主要的好处。

如果交易失败,用户将不必为其支付gas。

机器人不会在公共mempool中看到用户的mint交易。

一个项目可以利用Flashbots RPC的一个方法是在drop网站上添加一个信息弹窗,向用户解释如何使用Flashbots RPC来造币。

另一种方法是设计投放网站来检测那些没有使用Flashbots RPC的用户,并提示他们在铸币前将其添加到Metamask。

在这篇文章中,我们已经探讨了FCFS收藏品投放如何导致糟糕的用户体验的案例研究,并提出了一些可行的替代方案。

我们希望看到社区联合起来,推动反对FCFS模式。作为用户,我们有能力用我们的钱包投票,决定什么项目能成功。如果我们明确表示,我们不会支持那些不愿改进技术的项目团队,开发团队就会设计出提供更好用户体验的drop。