灰度推出专注于加密相关公司的新ETF

本文来自 Decrypt,原文作者:Jeff John Roberts

Odaily 星球日报译者 | 念银思唐

摘要:

- 灰度推出新 ETF,包含一篮子 22 家加密货币相关公司。

- 这只 ETF 已在纽约证交所开启交易,交易代码为 GFOF。

加密资产管理巨头 Grayscale Investments(灰度)正在向传统股票市场拓展。

周三,Grayscale 宣布推出“Grayscale Future of Finance ETF”,该 ETF 将持有一篮子股票,由 22 家在加密货币行业“深耕”的上市公司组成。这些公司包括支付和科技公司,如 PayPal 和 Block(前身为 Square),以及像 Coinbase 这样的纯加密公司和 Silvergate Capital 这样的投资机构,因此更类似于传统 ETF。

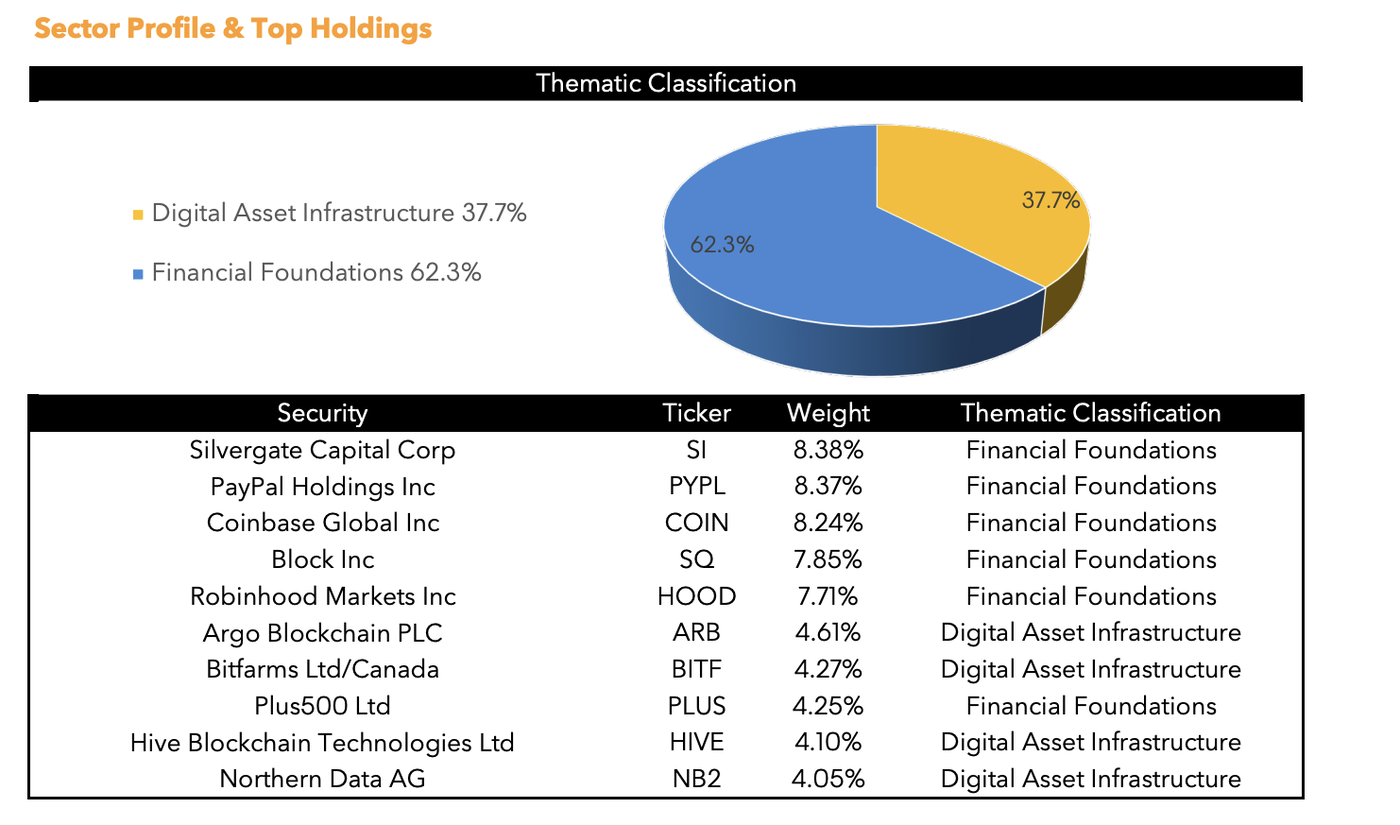

以下是该 ETF 最大的持仓情况:

据 Grayscale 的一位发言人表示,该基金并不包含特斯拉或 MicroStrategy 等公司的股票,因为这些公司只是在资产负债表上持有比特币,或者是接受比特币作为支付手段。

ETF 是“交易所交易基金”的简称,是一种很受欢迎的投资类型,它允许人们以股票的形式购买大宗商品或一篮子股票(如标普 500 指数),管理费用相对较低。因此,新的 Grayscale ETF 对于投资者而言是购买单一股票的一种方式,以押注大量致力于加密经济的各种公司的业绩。

“虽然 Grayscale 已努力将自身打造为数字货币投资的全球领导者,但金融的未来需要更广泛的授权。”Grayscale Investments 首席执行官 Michael Sonnenshein 表示。

这只新的 Grayscale ETF 已在纽约证券交易所(New York Stock Exchange)开启交易,股票代码为 GFOF。一家名为 Volt Equity 的公司在去年 10 月推出了一款类似的产品。

Grayscale此前已经在为推出新的ETF做准备。今年 1 月下旬,彭博(Bloomberg)和 Grayscale Investments 合作推出了一个新的基于数字资产的指数“BGFOF”(Bloomberg Grayscale Future of Finance Index)。该指数追踪了 22 家与数字资产、金融科技相关的公司,这些公司预计将在未来两年内为数字经济的增长做出重大贡献,其中代表“金融未来”的公司按三个关键支柱分类:金融基础、数字资产基础设施和技术解决方案,这涵盖了支付、交易、资产管理、硬件、区块链/技术或矿业公司等细分市场。

这只专注于加密相关公司的新 ETF 推出之际,Grayscale 正就美国 SEC 拒绝批准其比特币现货市场 ETF 的申请展开一场激烈的斗争。Grayscale 表示,该公司可能会就这一拒绝提起诉讼,并称这是一种武断的做法,尤其是在美国 SEC 批准了一种与衍生品市场挂钩的更复杂版本的比特币 ETF 的情况下。

这一切都对 Grayscale 核心产品 GBTC 的价格造成了影响。理论上,该信托基金应该紧跟比特币的价格,但最近几周,GBTC 已经出现了超过 25% 的折价——美国 SEC 的强硬态度加剧了这种情况。如果该机构改变方针,预计 GBTC 价格将出现反弹。

除了 Grayscale 自身的努力,加密领域的另一巨头 Coinbase 也在去年 12 月致信美国 SEC,敦促其批准资产管理公司 NYSE Arca 将 GBTC 转换为 ETF 的申请。

Coinbase 首席法律官 Paul Grewal 在一系列推文中强调该公司的立场:“SEC 允许基于期货的 ETP 是好事。但是,在允许基于期货的 ETP 的同时不允许基于现货的 ETP,并没有合理的依据,两者都依赖于比特币的基础价格。”

此外 Blockchain Association 也发文称,认为 SEC 在评估比特币期货 ETP 和现货 ETP 时用了双重标准。该组织表示,他们致信美国 SEC,强烈敦促其批准 NYSE Arca 将 GBTC 转换为 ETF 的申请。

而 Grayscale 乐观地认为,随着不断探索加密交易所交易基金领域,比特币 ETF 的批准只是时间问题。