史上「第二大DeFi黑客攻击」Wormhole损失约3.2亿美元

原文来源:BitpushNews

原文作者:Amy Liu

作为区块链之间最大的桥梁之一,Wormhole 遭黑客攻击被盗取约 3.2 亿美元,即 120,000 ETH——使其成为迄今为止第二大 DeFi 黑客攻击。

Wormhole在今天早些时候表示,网络因维护而停机,其官方网站上写着:“门户网站暂时不可用。”

据《比推》此前报道,专攻跨链技术的Poly Network宣布主网被黑客攻击,其用户在BSC、以太坊、Polygon三条区块链上的资产总计被转移6.1亿美金,该金额超越此前DeFi的安全事故,成为迄今金额最大的DeFi安全事件。

上周,黑客从去中心化金融协议 Qubit Finance 窃取了 8000 万美元。

Wormhole是一种允许用户跨区块链桥接资产的协议。它锁定的总价值超过 10 亿美元,并支持六个区块链:Terra、Solana、Ethereum、Binance Smart Chain、Avalanche 和 Polygon。

一位名为d231d的Wormhole管理员在其Telegram群中写道:“据我们所知,目前只有wETH受到影响,没有其他代币受到影响。”

这位管理员补充说,门户网桥已经关闭,并要求成员不要发起进一步的交易。

一些用户报告了交易卡顿,但管理员表示“一旦网络恢复正常,您就可以兑换您发送到网桥的代币。”

根据 Etherscan 的数据,虽然尚不清楚黑客是如何利用该网络的,但它发生在美国东部时间周三下午2点左右的三笔不同交易中。

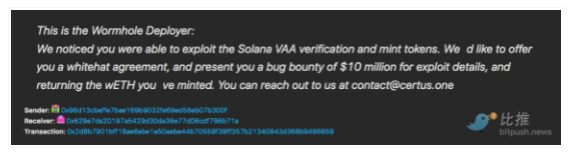

Wormhole 在漏洞攻击大约一小时后向黑客发送了一条链上消息,悬赏归还代币。

消息中写道:“我们注意到你能够利用Solana VAA验证和铸造代币。我们愿意向你提供一份白帽协议,并向您提供 1000 万美元的漏洞赏金,以获取漏洞攻击细节,并返还你铸造的wETH。”

跨区块链网桥的工作方式通常是获取一项资产(如ETH),并将其锁定在合约中,以便在桥接链上发布并行资产。

跨区块链网桥的工作方式通常是获取一项资产(如ETH),并将其锁定在合约中,以便在桥接链上发布并行资产。

目前尚不清楚如果 Wormhole 发行的 ETH 无法桥接到以太坊主链并且现在毫无价值,可能会对Solana贷款市场和其他协议产生什么影响。

Solana DeFi 平台 Step Finance 的创始人 George Harrap 在接受 CoinDesk 采访时表示,他预计 2021 年 8 月收购 Wormhole 开发商 Certus One 的 Jump Capital 将介入以支持被黑客入侵的 ETH。他补充说,如果不是这样,许多接受 ETH 作为抵押品的基于 Solana 的平台现在可能部分资不抵债。

他说:“如果没有人支持它并且代币真的消失了,那么 Wormhole ETH 的价值为 0,而持有余额的每个人都变得一文不值,DeFi 协议、用户、每个人。”

在随后的推文中,Wormhole 确认总共损失了 120,000 ETH,并表示将向桥接器添加资金以支持 Solana 上的wETH,但该团队没有具体说明谁将提供资金。

今年1月,以太坊联合创始人Vitalik Buterin在Reddit的一篇帖子中颇具先见之明,他认为,桥接未来不会流行,部分原因是桥接资产的支持存在风险。