财富杂志:明星风投人凯蒂豪恩为什么离开a16z?

原文作者:老雅痞

本文来自微信公众号老雅痞(ID:laoyapi),Odaily星球日报经授权转载发布。

这位a16z的老兵因在Coinbase和OpenSea上投下大笔赌注而成名。她的新企业有望成为Web3由女性风险投资家独自筹集的规模最大的基金。

豪恩表示,她的七人公司已经在超负荷运转了。

凯蒂·豪恩带我浏览她的艺术收藏。方便的是,这次参观不需要去画廊,甚至不需要去她家--豪恩的首选媒介是NFT,所以我们正在浏览她手机上完整的数字图像目录。这些数字收藏品存储在区块链上,就像加密货币一样,目前是豪恩所在的科技行业的热门产品。

她滚动浏览郁郁葱葱的花卉图像和前卫的赛博朋克风格头像(“我的收藏家品味非常多样化,”豪恩承认),寻找她的最爱之一。虽然在火爆的NFT市场上,一些最热门的作品已经卖出了数千万的价格,但这幅像素化的、扎着粉红色小辫子的女孩图案,并没有花费她一分钱,而是一份生日礼物。去年年底,她从朋友埃琳娜·西勒诺克那里收到了它。值得注意的是,西勒诺克是安德森•霍洛维茨基金的克里斯•迪克森的妻子。自从霍恩离开司法部的工作,投身于风险投资领域以来,他一直是该公司加密货币基金的合伙人。

但是,虽然这个粉色头发的女孩可能会永远刻在区块链里,但现实人类之间的联系更有可塑性。举个例子:我和霍恩在这里的原因是谈论她宣布要离开迪克森和强大的安德森公司,推出自己的基金这一重磅消息。

虽然普通美国人可能不知道她,但她却出人意料地成为了加密货币和更广泛的Web3领域的摇滚明星。Web3不仅包括NFT和比特币、以太坊等货币,还包括支持这些货币的底层区块链基础设施。2013年,她涉及该领域时,对加密货币根本不感兴趣——事实上,她是旧金山的一名联邦检察官,负责调查加密货币是如何被用于犯罪活动的。

“我没有选择这项任务,”豪恩说,她之前的法律工作还包括起诉白领罪犯、监狱帮派和腐败的联邦特工。"然而,我确实选择了留在这个领域。"

安德森•霍洛维茨也被称为a16z,是硅谷最大、最知名的风险投资公司之一。创始人马克•安德森和本•霍洛维茨是Web3的早期信徒,当时许多风投还对投资加密货币犹豫不决。他们在霍恩身上看到了他们所需要、但很少有人具备的专业知识:有能力驾驭与当时刚刚起步的加密货币行业一起发展的复杂监管环境。

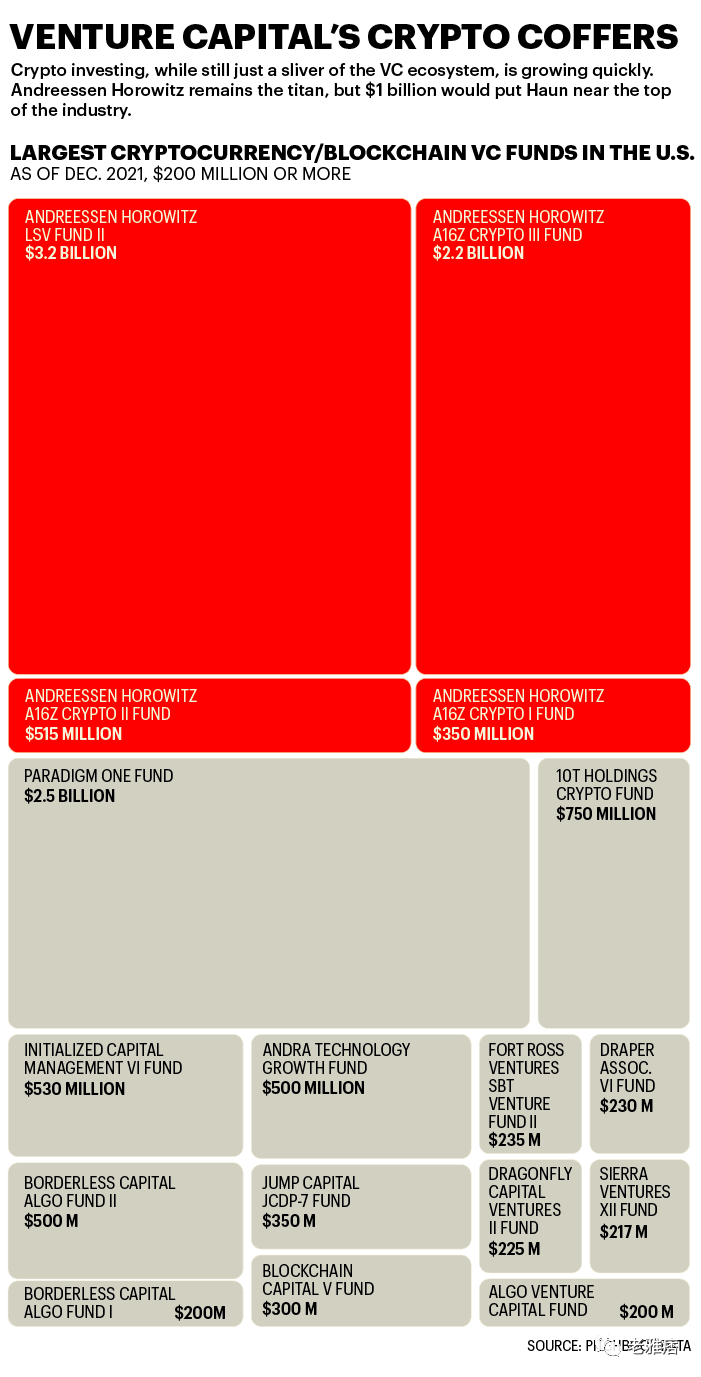

这位前检察官签约成为该公司的第一位女性投资合伙人。她与a16z合伙人迪克森一起,共同创建并领导了一个由约50人组成的加密货币团队,该团队的上一支基金总额达到了惊人的22亿美元。不久之后,这位前行业外行就成为了a16z最知名的合作伙伴之一,对加密货币交易所Coinbase和NFT市场OpenSea等热门公司进行了投资。

12月中旬,她宣布将离开a16z创建一家全新的公司,这一消息发出一连串的信号——庆祝、感叹和提问。这是一件大事,有消息称,豪恩正计划成立一只10亿美元的基金。如果她成功了,这将是迄今为止由女性风险投资家独自筹集的最大的加密货币基金。FTX创投的负责人Amy Wu说:“加密领域的女性并不多。”她自己也刚刚被请来投资该加密货币交易所在1月推出的20亿美元基金。事实上,开风险投资支票的女性并不多;在美国,女性风险投资人仅占普通合伙人职位的15.4%

现在,这位前检察官面临着新的挑战。在结束了在a16z的四年工作后,她的形象一路高升,人脉丰富,投资业绩强劲。但她也留下了这家拥有300多人的公司的雄厚资金、令人羡慕的资源和威望。豪恩和她的六人团队向创始人提出了一个截然不同的建议。她的新公司将进入一个在轻率的淘金热和令人反胃的修正之间摇摆的世界——就像我们现在所处的世界。豪恩2.0是否有能力在这种动荡中生存下来,并让创始人签下合同?

豪恩和我第一次坐下来是在一月的一个清晨,在门罗公园的紫檀酒店,离她在a16z的老办公室只有几步之遥。我们坐在一个户外露台上,眼前是圣克鲁斯山脉的壮丽景色。我们是这家通常熙熙攘攘的酒店的唯一顾客,这里是许多在该地区工作的风险投资家的聚会场所。这很合理:奥密克戎感染者在湾区和其他地方激增。即使这个地方像通常那样挤满了风险投资人,豪恩也会脱颖而出。她有一头金色的头发和深邃的蓝眼睛,我从未见过她穿任何带有Arc'teryx或Patagonia标志的衣服——这是沙山路人选择的标志性伪休闲品牌。今天,豪恩穿着黑白波点连衣裙抵达。我最后一次见到她时,她穿的是一身淡粉色系腰带的华伦天奴套装。

她有那种难以捉摸的品质,能够与任何人交谈,无论是在会议室还是法庭上。她可以很有说服力,而且很有毅力。但她也很有魅力,在谈到她的新公司时,甚至带着兴奋和眩晕感。

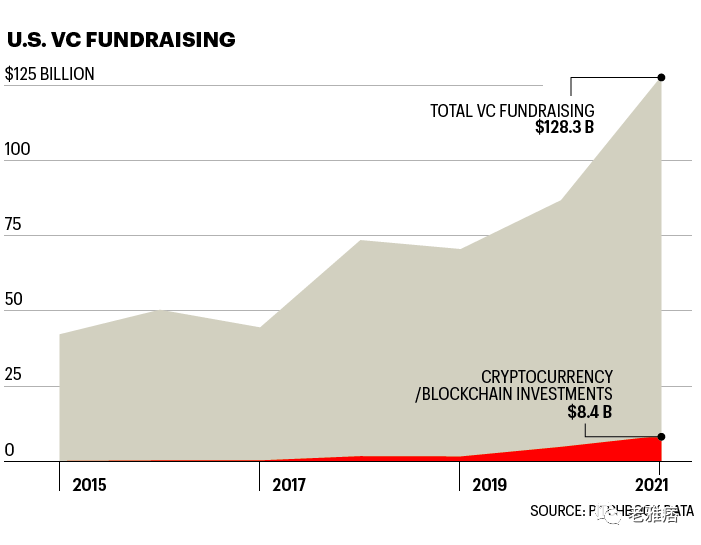

与她的新企业关系密切的人士说,豪恩正在为她的首期基金筹集至少10亿美元。豪恩不愿证实这一数字,称她因“法律和监管原因”而被禁止发表评论,这是VC筹集资金的标准回应,他们担心会激怒美国证券交易委员会。但考虑到大量资金涌入加密货币,10亿美元似乎是一个可行甚至保守的数字。根据PitchBook的最新数据,去年美国的风险融资达到了创纪录的1283亿美元。而这些钱中流向加密货币基金的份额正在快速增长,从2017年的不到0.5%到去年的近7%。风投们一出钱,他们自己的投资者,也就是有限合伙人,就会猛扑过来补充他们的金库。再加上豪恩已经证明有能力参与最热门的加密货币交易,这对她来说是个好兆头。她从小做起,只专注于加密货币的事实?这也可能对她有利。

在过去四年里,我在公司学到的东西之一是我实际上是一个企业家。现在是我走出去的时候了。就这么简单。——凯蒂·豪恩

"风险投资公司Kleiner Perkins的合伙人Ilya Fushman说:"真正的加密原生基金对LP有很大吸引力。"这是因为这些投资者能够吸引令人兴奋的新创始人。"

豪恩正在把握时机。她的新企业已经进行了七项投资,其中包括未披露金额的Autograph,这是一家位于洛杉矶的初创公司,帮助运动员和艺人推出和营销NFT。Fushman的公司共同领导了这一轮投资,他和豪恩都将在Autograph的董事会任职。(有趣的是:这家创业公司还得到了坦帕湾海盗队四分卫汤姆-布雷迪的支持)。但你猜猜还有哪家风险投资公司共同领导了这一轮1.7亿美元的融资?A16z的迪克森也加入了董事会。尽管这可能很难让人相信--任何分手都会有一定程度的紧张,但双方都坚持认为豪恩与她的前雇主的分手是友好的。她说,她在a16z的工作是富有成效的。她认为公司的创始人给了她一个机会。"没有多少人会想到,'哦,她会成为一个优秀的风险投资人',”豪恩说。

但豪恩说,她与创始人合作的经历改变了她对自己想要什么的看法。“过去四年我在公司学到的一件事是,我实际上是一名企业家,”她说。去年,当 a16z 的第三个专用加密基金完全部署时,这是一个继续前进的自然时刻。“鉴于我们正处于这个转折点,这让我进行了大量的反省,”她说。“是时候自己走出去了。就这么简单。”

豪恩指着我们坐的地方附近的一个天井。她说,就在上个月,她和迪克森在那里讨论了她离开的细节,比如她可以带多少人一起离开。(一位内部人士将这些谈判称为 "换马会议"。)最终,各方一致同意,霍恩将带着6名a16z成员离开,其中包括她的首席营销官蕾切尔•霍维茨,以及她新公司的全球政策主管托米卡•蒂勒曼。公司还决定,a16z将成为她新基金的早期投资者。毫无疑问,霍恩的公司将与a16z竞争一些交易,但作为她的新企业的投资者,她的前雇主肯定会受益,无论谁赢。除此之外,豪恩和a16z都表示,他们计划继续合作,就像他们刚刚与Autograph合作一样。

迪克森在向《财富》杂志提供的一份书面声明中表示:“我们经常就该领域有前途的项目和团队进行交谈,并继续在几个董事会共事。”、“所以我们将继续密切合作。”

尽管多次请求,迪克森还是不愿意和我直接对话,这表明a16z策略和豪恩所采用的策略之间存在分歧。正如你可能对前检察官所期望的那样——这项工作通常需要试图利用媒体来推进你的案件——豪恩已经成为了聚光灯下的焦点,接受采访,并成为技术会议的常客(她曾在《财富》杂志的三次活动上发言)。与此同时,A16z对媒体的态度变得更加冷淡——联合创始人马克•安德森因在社交媒体平台上屏蔽记者而臭名昭著,他甚至开始自己的内部内容运营,完全回避记者。

你知道还有谁最讨厌媒体吗?名人。(在媒体行业混迹多年的老雅痞本人波澜不惊地敲下这行字)

但这并没有阻止明迪·卡灵对记者总结她对肖恩的第一印象:"她是一个我很想和她一起度假的风险投资家。"卡灵通过电子邮件告诉我,她是一位演员、作家和制片人,可能最出名的是她在《办公室》中的角色。

去年秋天,卡灵在洛杉矶的一次晚宴上认识了豪恩,当时有一群娱乐界的女性参加。这次聚会的目的之一是让豪恩与这群人分享她对加密货币世界的了解,其中一些人对涉足Web3感兴趣。(据知情人士透露,格温妮丝·帕特洛当晚也出席了会议,她后来宣布了对比特币矿商TeraWulf的投资。)

2004年与最高法院大法官安东尼·肯尼迪在一起。她从那年年底到2005年为这位大法官做书记员。

豪恩计划将自己与竞争对手区分开来的方法之一是专注于“垂直领域”,为每个领域都引入专家顾问。她任命谷歌前高管贾里德•科恩和同为检察官的威廉•弗伦岑分别代表技术和政府政策。当她需要一个娱乐顾问时,她打电话给卡灵。

卡灵说:“我想我在她问完问题之前就答应了。”“她是加密货币社区的传奇人物,谁不想和她在一起呢?”

豪恩的计划还包括对她在a16z共同管理的基金进行一些显著的改变。她说,与这家公司的庞大规模相比,“我们希望保持灵活,所以我们的团队规模较小。”虽然a16z以向其投资组合中的公司提供从营销到法律等一系列服务而闻名,但豪恩表示,她计划采取一种更有针对性的方式来确立她的公司能为创始人做什么和不做什么。

对豪恩而言,小而有针对性的做法与全球化并不矛盾。她说,她计划寻找远离硅谷等典型中心的初创公司。豪恩表示:“我认为,一些最优秀的加密货币创始人将遍布全球。”“所以我认为这是我的公司要做的事情之一,就是越来越关注全球。(A16z表示,它的大多数加密货币投资组合公司都 "定居 "在美国,但其中许多公司的员工分布在世界各地。)

当然,还有名字。到目前为止,霍恩将她的新企业命名为 "KRH",意思是Kathryn Rose Haun。但这位投资者说,这只是法律文件的一个占位符。“我不想排除任何可能性,但我不相信我会以自己的名字命名,"豪恩告诉我。"我正在建立一个特许经营权,我相信,有一天,其他人会接手。"

作为一名风险投资家,很难量化豪恩的成功。这在一定程度上是由于该行业的工作性质——许多投资都没有成功,而那些成功的投资通常需要10年以上的时间才能“退出”,也就是上市或被收购。在过去的四年里,豪恩和a16z的加密团队进行了60多笔投资。到目前为止,只有一家加密货币交易平台Coinbase退出了市场,该平台去年通过直接上市而上市,估值接近1000亿美元。虽然Coinbase是豪恩作为加密货币内部人士的第一份工作——这家初创公司在她2017年离开美国司法部后邀请她加入他们的董事会——但实际上,早在豪恩加入该公司之前,a16z早在2013年就对该公司进行了初始投资。

也就是说,她所支持的公司的估值已经出现了惊人的增长,在初创公司退出之前,估值可能是最常被引用的衡量成功的指标。例如,OpenSea 已成为 NFT 的主要市场;仅在去年,它的价值就达到15亿美元,而现在它的价值已经超过了130亿美元。

“她是一枚热追踪导弹,”前a16z投资者杰西•瓦尔登说,他在2020年也离开了公司,成立了自己的加密货币基金。“她知道空间的走向,也知道如果你要去那里,你需要认识哪些人。作为投资者,这是一种超能力。"

她是一枚热追踪导弹。她知道空间的去向,也知道如果你要去那里,你需要认识哪些人。

杰西•瓦尔登,前a16z投资者和VARIANT FUND创始人

事实上,找到合适的人,并让他们答应,似乎是迄今为止豪恩成就的一个重要部分。在她的新公司,她计划运用这种能力,建立自己的团队,帮助她的投资组合公司建立他们的团队,寻找交易,当然,还有完成交易。

“这就是我十多年来的工作,”她说,指的是她之前作为联邦检察官的职业生涯。“我做交易,我谈判,我与桌子另一边的人相对而坐,我必须迅速弄清楚。"

“凯蒂是OG,”Royal的联合创始人兼首席执行官贾斯汀·布劳说。Royal是一家让音乐家向粉丝出售版税所有权的服务公司,豪恩在a16z的时候投资了这家公司。“因为她在这个领域如此活跃了这么长时间,她的关系不仅涵盖了加密货币公司的范围,而且还远远超出了加密社区。”

在迪克森宣布她要离开的消息后,豪恩和迪克森在a16z团队的晚宴上。

Coinbase的首席运营官艾米丽·崔回忆道,当另一位潜在的董事会成员考虑在另一家公司任职时,豪恩是如何介入的。据崔说,豪恩带那个人出去吃午饭,让他们坐下来,告诉他们如果不加入Coinbase就是疯了。这很有效。"她知道该说些什么才能真正起到作用,"Choi说。"而且她不遗余力。"

在a16z,豪恩参与了加密货币团队的建设,该团队在四年时间里从两名成员增长到大约50人。她说,多年来,她招募了团队中的“大多数”成员。(迪克森在电子邮件中表示:“招聘是一个团队的努力,凯蒂是团队的一个重要组成部分。”)

豪恩需要不断引进顶尖人才,以应对竞争日益激烈的加密投资市场。但她也需要利用当初让她引起硅谷关注的监管和法律知识。加密货币可能不再是a16z第一次敲门时的未知数,但它仍然同样令人担忧。

随着加密货币在全球范围内的扩张,它面临的挑战和争议也在扩大。去年,中国禁止加密货币的做法引起了轩然大波,其他国家也因担心它们可能破坏国家对现有货币体系的控制而限制了加密货币的使用。此外,还有另一个担忧正在酝酿之中:一些数字货币是出了名的能源密集型产品,会留下巨大的碳足迹。在1月20日举行的美国众议院能源和商业小组委员会听证会上,这个问题成为了焦点,国会成员讨论了如何让加密货币更环保。

“监管合规是今年加密货币领域最重要的话题,”FTX Ventures的吴表示。

除了外部威胁,加密货币的迅猛增长也招致了更大的科技生态系统的批评。Box的亚伦•列维和Airbnb的布莱恩•切斯基等初创公司创始人都对Web3的采用和影响表示怀疑。加密社区内部越来越多的人担心,权力正在被少数精英,特别是那些从风投那里获得大量现金的最大的初创公司集中在一起。对于那些支持Web3承诺“去中心化”信息控制的人来说,这是一种诅咒。理论上,Web3以一种传统网络从未出现过的方式传播权力。

Coinbase在2021年首次公开募股时的场景。

豪恩的前公司a16z对反对者进行了严厉批评,称Web3还很年轻,但最终会兑现承诺。安德森还一如既往地屏蔽了另一位技术专家——推特创始人杰克•多尔西。此前,两人就加密公司到底是去中心化还是中心化的问题公开争吵。

豪恩正在采取更外交的方式。“我认为看到像Moxie Marlinspike(一位对 Web3 表示怀疑的技术内部人士)和Jack Dorsey这样的人进入这个领域并提供细致入微的批评是非常令人兴奋的,”豪恩说。“我对此表示欢迎。”

但是,尽管她与批评人士接触过,但豪恩·表示,她对加密货币的炒作并不感到不安。是的,基础设施还没有完全到位,但它已经在路上了。与此同时,她说,这项技术的潜力已经爆发式增长。当她在2018年进入投资领域时,大多数人认为加密货币唯一真正有意义的领域是金融应用,豪恩说:“我所了解的是,使用案例比我们当时想象的要多得多。”

与此同时,还有更紧迫的问题。今年1月,在豪恩的筹款活动中,加密货币市场遭遇崩盘,市值蒸发1.4万亿美元。一些人称之为“大屠杀”,另一些人称之为“修正”。豪恩并不担心,她指出,波动对这个领域来说并不新鲜:“运营加密货币基金的本质就是承担风险。”

许多加密货币交易的结构——包括豪恩说她将与她的新公司进行的交易——都可能具有极高的风险。与以股权换取现金的传统风险投资不同,许多加密货币投资者将所谓的代币作为其股权的一部分。这些代币本质上是存储在区块链上的数字证券,与更广泛的加密货币市场一样面临着剧烈的波动。

不过,对豪恩来说,重要的是要把风险和不确定性区分开来,因为风险和不确定性在她的字典里并不存在。

“就像我职业生涯中的许多事情一样,我认为事情要么是‘hell yes’,要么是‘no’。当安德森•霍洛维茨公司给我提供了一份工作,是‘hell yes’,当我决定独立出来的时候也是‘hell yes’,在那之前,我的法律生涯中还有很多其他的时刻也一样。我一直都是一个遵循直觉的人,我的直觉,同时也是我的兴趣所在,这之间真的没什么不同。在过去几周里,我是否有过觉得自己到底在做什么的时刻?“是的,当然。然而,我非常投入。我知道这是一个正确的决定。”

杰西卡•马修斯补充报道

编者:这个故事的前一个版本误报了Elena Silenok的姓氏。《财富》对这一错误表示抱歉。

区块链的赌注

豪恩投资了加密货币领域一些发展最快、最有前途的初创公司。但是,这个行业是如此年轻,以至于它还没有给许多赢家加冕,也没有把输家赶下台。以下是豪恩迄今为止最引人注目的一些投资和董事会席位。

Arweave

这家位于柏林的公司表示,它是利用区块链技术“储存”信息的新数据存储形式的先驱。豪恩在2019年领投了500万美元的融资,这轮融资完全基于代币,这意味着投资者购买了记录在区块链上的数字证券,而不是传统的股票。

Autograph

由足球明星汤姆·布拉迪联合创办的NFT公司于今年1月筹集了1.7亿美元。豪恩的新公司(以及她的前雇主安德森-霍洛维茨)参与了这轮融资,现在豪恩已经加入了Autograph的董事会。

Coinbase

2017年,豪恩成为这家初创公司的首位独立董事。这一举动最终导致她加入了a16z,后者是加密货币交易平台的早期投资者。去年4月,Coinbase以近1000亿美元的估值上市,这在加密行业是罕见的。

OpenSea

OpenSea是快速增长的NFT市场上最热门的初创公司之一,目前市值超过130亿美元。在a16z的时候,豪恩领导了两轮融资,并加入了OpenSea董事会。她通过自己的新公司再次进行投资,在今年1月的C轮融资中为该拍卖平台贡献了3亿美元的巨额资金。

Royal

另一项豪恩在a16z的投资是Royal,它允许音乐家向他们的粉丝出售版税所有权,这是一个新的NFT应用。在其他风险投资公司中,像Chainsmokers和Nas等艺术家也加入了Royal去年5500万美元的A轮融资。