ETH周报 | 以太坊基金会再次在顶部套现;单个以太坊矿工赢得170.65 ETH的区块奖励(1.17~1.23)

作者 | 秦晓峰

编辑 | 郝方舟

出品 | Odaily星球日报

一、整体概述

加密交易员和分析师Edward Morra发推称,以太坊基金会(再次)成功在顶部卖出ETH套现。自那以后,ETH下跌了40%以上。上述交易发生在去年11月11日下午2点56分(UTC时间)。当时以太坊基金会在Kraken上卖出了9000万美元的ETH,ETH成交价为4810美元。该分析师强调,这不是以太坊基金会第一次在以太坊行情的顶部或附近套现。(U.Today)

二级市场方面,目前 ETH 价格短时可能小幅回调,支撑位 2300 美元、2000 美元,阻力位 2500 美元。

二、二级市场

1.现货市场

OKX 行情数据显示,上周 ETH 价格一度跌至 2300 美元以下,周内收于 2432 美元,环比下跌 27.5%。

(ETH 日线图,图片来自OKEx)

日线图上显示,价格目前站上布林带下轨,短期内价格可能继续下探 2000 美元关口;下方支撑位是 2300 美元、2000 美元以及 1700 美元,上方阻力位是 2500 美元,以及 2660 美元(MA5)。

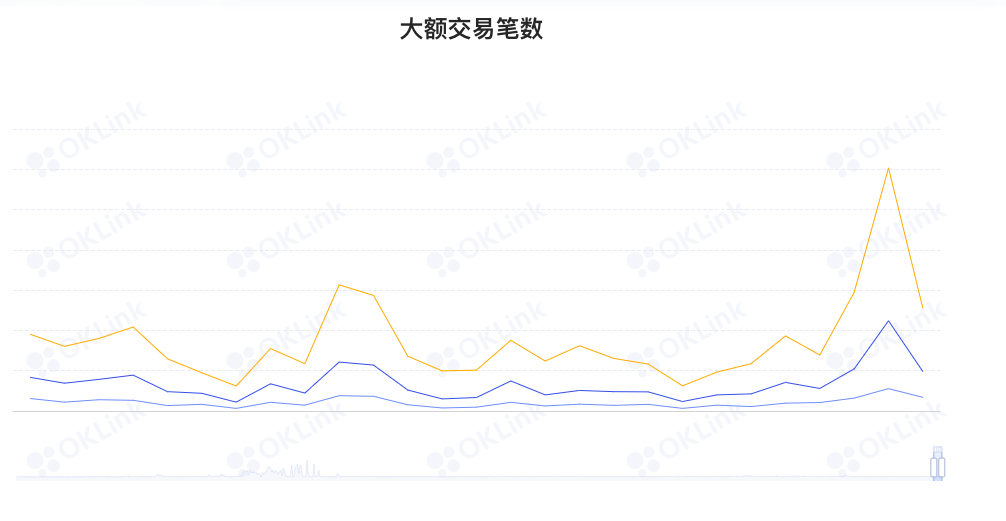

2.大额异动

欧科云链OKlink数据显示,链上转账次数上周大幅上涨,“1000 ETH 以上”、“2000 ETH 以上”以及“5000 ETH 以上”分别环比上涨 86%、96% 以及 90%,大额巨鲸交易热情明显增加。

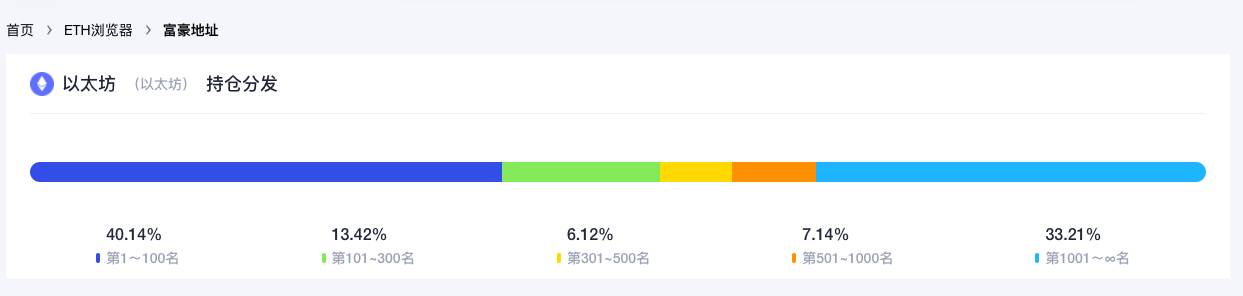

3.富豪榜地址

欧科云链OKlink数据显示,目前 ETH 持仓前 300 名,掌握了总计 53.56% 的 ETH,环比上涨 0.07%;此外,整个持仓分布呈现椭圆形结构,各个部分占比分别是:第 1~100 名,占比 40.14% ,环比上涨 0.18%;第 101 ~ 300 名,占比 13.42% ,环比下降 0.11%;第 301 ~ 500 名占比 6.12% ,基本保持一致;第 501 ~ 1000 名,占比 7.14%,环比上涨 0.04%;第 1001 名后,占比 33.21%,环比下降 0.09%。

三、生态与技术

1.社区之声

Vitalik:有研究证明EIP 1559大大减少了交易平均等待时间

1 月 18 日,Vitalik在推特上转发了北京大学和杜克大学共同研究关于EIP 1559的论文《EIP-1559的实证分析:交易费用、等待时间和共识安全》,并表示,此篇论文特别提到EIP 1559大大减少了交易的平均等待时间的确认。 据了解,这篇论文研究证明,EIP-1559通过简化费用估算、缓解区块内已付gas价格差异以及减少用户等待时间,大大改善了用户体验。然而,EIP-1559对gas费波动和普遍安全性的影响很小。此外,研究还发现,当以太坊的价格波动较大时,等待时间明显较长,研究还验证了较大规模的区块会增加兄弟区块的存在。

3.项目动向

(1)OpenSea(以太坊)1月交易额超34.8亿美元,创新的月度交易额最高记录

据Dune Analytics数据显示,截至目前 OpenSea(以太坊)1月交易额已超过34.8亿美元,打破去年8月创造的月交易额最高记录34.2亿美元。

(2)以太坊交易协调协议Aelin Protocol与以太坊智能合约自动执行工具Gelato Network达成合作

官方消息,以太坊交易协调协议Aelin Protocol与以太坊智能合约自动执行工具Gelato Network达成合作,以在Optimistic Ethereum上启用Uniswap v3的流动性挖矿。44 AELIN将每月分发给流动性提供者作为奖励。按照目前的价格,这大约是每月3,000,000美元。

(3)Snapshot拟在二季度推出链上投票框架Snapshot X

1月18日,Snapshot官方宣布计划在2022年第二季度发布Snapshot X,这是一个基于StarkNet(即Layer 2 ZK-Rollup)的投票框架,允许任何DAO在Layer 2上运行链上治理并在以太坊上执行交易。据Snapshot官方透露,Snapshot X进行投票的成本约为1,000个gas,或者比以太坊便宜约50到100倍。据悉,Snapshot X会在2022 年第三季度晚些时候对所有DAO开放,最初仅支持ERC- 20 和委托投票策略,之后将添加对ERC-721和多链的支持。

(4)以太坊NFT徽章应用程序POAP宣布完成1000万美元融资,Archetype和Sapphire Sport LLC领投

以太坊NFT徽章应用程序POAP宣布完成1000万美元融资,Archetype和Sapphire Sport LLC领投,Collab Currency、1KX、Libertus Capital、Red Beard Ventures、6th Man Ventures、Delphi Digital、A Capital、Sound Ventures、Advancit Capital和The Chernin Group等参投。(Decrypt)

(5)Radicle推出流支付协议Drips,允许通过订阅和NFT会员产生经常性收入

Radicle推出流支付协议Drips,其是一种新的以太坊协议和社交网络,它允许任何人产生持续的收入,而无需依赖银行账户或提取平台。Drips允许任何以太坊用户定期向任何其他以太坊用户流式传输资金,同时还可以通过一次交易从多个流中收集资金。

此外,创作者和开发者还可以发行和出售NFT会员资格,可能会给粉丝带来独特的好处,以换取经常性的财务支持。使用以太坊的无许可金融基础设施,Drips会员资格由NFT代表。这些会员资格可供任何人使用,并且可以在支持以太坊的网络上的任何应用程序(Discord、Telegram、Reddit、Snapshot、Radicle Upstream等)中获得好处。

(6)Optimistic找到一种方法可以将平均交易费用再降低30%

官方消息,以太坊二层扩容方案Optimistic表示,找到一种方法可以将平均交易费用再降低30%,可能会在稍后部署。

据桌游爆炸猫咪(Exploding Kittens)透露,该公司已经与3D打印公司Glowforge合作,为其最新推出的棋盘游戏Happy Salmon在以太坊区块链上发行10枚NFT。根据Exploding Kittens的联合创始人兼首席执行官透露,NFT所有者可以使用Glowforge 3D打印机将他们的NFT打印到Happy Salmon盒子上,或者在二级市场上出售。(TheBlock)

(8)去中心化索引协议The Graph融资5000万美元,Tiger Global领投

去中心化索引协议The Graph宣布通过出售代币完成5000万美元融资,Tiger Global领投,FinTech Collective、Fenbushi Capital、Reciprocal Ventures以及Blockwall Digital Assets Fund参投。据彭博社报道,新融资将用于收购其他开发商,并在亚洲和欧洲进行扩张。(CoinDesk)

(9)Lido Finance:41.5%的bETH仓位面临清算

以太坊2.0质押协议Lido Finance发推提醒Anchor Protocol用户称,其内部警告显示,41.5%的bETH仓位面临清算,当前价位距离清算价格已经不到20%。据悉,bETH是stETH在Terra生态的映射代币,由DeFi固定利率协议Anchor Protocol与Lido Finance合作推出。

(10)以太坊二层隐私解决方案Aztec Network启动赠款计划

以太坊二层隐私解决方案Aztec Network宣布启动赠款计划。首期赠款计划将奖励与Aztec Network进行集成的协议。得益于Aztec Network此前发布的桥接方案Aztec Connect,社区中的任何人都可编写桥接合约,Aztec Network将承担审计和部署的全部成本,部署桥梁的开发者将获得2000美元的奖金。

3.借贷

Defipulse 数据显示,上周链上锁仓抵押品价值从 960 亿美元下跌至 923.6 亿美元,一周下跌 3%;前一周净增 37.72 亿美元,上周净减 27.4 亿美元,环比下降 172%。具体来看,上周 ETH 抵押量从 894 万个下降至 881 万个,跌幅1.5%;BTC 抵押量从 230853 个上涨至 231741 个,涨幅 1%。

从单个项目来看,锁仓价值前三名分别是:Maker 164.8 亿美元;Curve 144.1 亿美元;Convex Finance 119.5 亿美元。

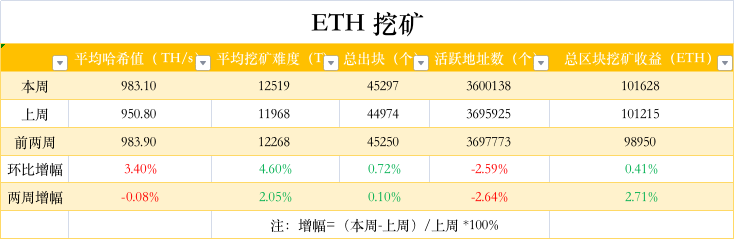

4.挖矿

(数据来自etherchain.org)

etherchain.org 数据显示,上周平均算力环比上涨 3.4%,暂报 983TH/s;平均挖矿难度环比上涨 4.6%,暂报 12519T;链上活跃度环比下降 2.5%,挖矿总收入环比微涨 0.5%。

四、消息面

链上数据显示,1月17日,单个ETH矿工(2Miners: SOLO)挖出一个区块,并赢得超过170.65 ETH的区块奖励,价值约54万美元,区块高度是14020509。这对于矿工来说是非常幸运的事,尽管比特币矿工此前发生过类似情况,这种情况极为罕见。

据此前报道,1月11日,一个算力仅有126 TH的个体矿工赢得6.25 BTC的区块奖励,价值超26万美元,该比特币区块的区块高度是718124。(Beincrypto)

(2)摩根大通:以太坊在NFT领域的主导地位正在被Solana“吞食”

摩根大通在报告中表示,由于拥堵和高额Gas费,以太坊在NFT领域的主导地位正在下降。

Nikolaos Panigirtzoglou等分析师在上周发布的报告中写道,以太坊网络在NFT领域的市场份额已从2021年初的约95%降至约80%。

摩根大通表示,自去年8月份以来,Solana一直在从以太坊获取最多的NFT交易量份额,并指出这是NFT市场开始大规模扩张的时候。与此同时,以太坊的市值份额也正逐渐被Solana所“吞食”。

根据该报告,由于NFT是“加密生态系统中增长最快的领域”,以太坊在NFT市场中的份额可能比其DeFi份额更重要。本月早些时候,该行警告称,以太坊在DeFI领域的主导地位也面临风险,因为维持其主导地位所需的网络规模可能实现得太慢。

摩根大通警告称,如果以太坊在2022年继续失去NFT市场份额,其估值可能会面临更大的问题。(CoinDesk)

根据加密交易员和分析师Edward Morra发推称,以太坊基金会(再次)成功在顶部卖出ETH套现。自那以后,ETH下跌了40%以上。上述交易发生在去年11月11日下午2点56分(UTC时间)。当时以太坊基金会在Kraken上卖出了9000万美元的ETH,ETH成交价为4810美元。该分析师强调,这不是以太坊基金会第一次在以太坊行情的顶部或附近套现。(U.Today)[原文链接]